Americans plan to spend over $1,000 on holiday finances this season, according to a recent Gallup poll. The common advice recommends spending just 1% of household income on holiday gifts. However, many families end up spending substantially more.

My 13 years as a financial advisor have shown how unexpected expenses create stress during the holidays, even for people with well-planned budgets. Breaking down your holiday budget into specific categories works best: 50% for gifts, 30% for parties and dining, 10% for decorations, and 10% for miscellaneous expenses.

These 12 practical holiday budgeting tips extend beyond conventional advice. My clients have used these strategies to manage their holiday spending while preserving the season’s joy. You can take charge of your holiday finances in 2025 with these proven techniques that help control cash flow and boost savings.

Create a Strategic Holiday Investment Plan

Image Source: First Financial Federal Credit Union

“The biggest risk of all is not taking one.” — Mellody Hobson, President and co-CEO of Ariel Investments

Smart holiday financial planning begins when you understand investment strategies that line up with your festive goals. My years as a financial advisor have shown how good investment planning makes holiday budgeting easier to handle.

Setting Smart Financial Goals

Your holiday financial goals should be specific and measurable. The total holiday budget needs categories: gifts, travel, decorations, and entertainment. You’ll need to calculate monthly savings to hit your target49. The Deloitte’s 2023 Holiday Retail Sales Consumer Survey50 shows average spending of $1,652 on holidays. This means setting aside about $138 each month.

Investment-Based Savings Strategy

A dedicated holiday savings account with competitive interest rates could work well. High-yield savings accounts currently offer interest rates upward of 4%, while traditional savings accounts average just 0.46%22. On top of that, it helps to know the math: starting with $200 and saving $200 monthly for 10 months at a 4.5% interest rate builds up to $2,240.8722.

Risk Assessment and Management

A careful assessment of your risk tolerance should come before any investment strategy. Yes, it is true that risks affect asset classes in different ways51. Short-term holiday savings should focus on:

- Liquidity risk management through an appropriate mix of liquid and non-liquid investments

- Market risk mitigation through staggered investments

- Interest rate risk consideration for debt instruments

Tax-Efficient Holiday Planning

Tax benefits can grow through smart holiday planning. The 26 U.S. Code §170 lets you claim charitable contributions as itemized deductions to reduce taxable income52. Cash donations to charities can be deducted up to 60% of your adjusted gross income52.

If you want education-focused gifts, a 529 account might be right. New rules let you roll over unused assets from these accounts into a Roth IRA without tax implications, up to $35,00052. Traditional IRA contributions give tax deductions too, with 2024 limits at $7,000 if you’re under 50 and $8,000 if you’re 50 or older52.

Starting these strategies early builds a reliable foundation for holiday spending. All the same, you should watch and adjust your investment approach as market conditions and personal circumstances change53.

Leverage Digital Tools for Budget Automation

Image Source: Landmark National Bank

Technology has become a game-changer to manage seasonal expenses. My experience with clients shows how digital tools make financial planning easier and help automate savings.

AI-Powered Budgeting Apps

AI-driven apps now work like your personal financial assistants. They analyze spending patterns and give custom advice. Wally, a fully automated finance app, tracks spending and cash flow while WallyGPT provides custom suggestions54. The AI in Cleo figures out the best weekly savings amounts and gives live feedback on spending decisions54.

Smart Banking Features

Banks now offer sophisticated tools to boost holiday budgeting. Money Scout® gets into spending habits, income, and upcoming expenses to find unused funds—ranging from $5 to $50—and moves them to savings automatically55. This feature runs up to three times weekly. The system needs at least 4 months of account activity to understand your spending patterns55.

Automated Savings Tools

Automatic transfers really shine to save for holidays. These tools ensure steady savings instead of manual transfers through:

- Predictive Analysis: Apps forecast monthly expenses and create custom savings plans based on your financial situation54

- Smart Transfers: Systems like Money Scout analyze transaction patterns to find the best times to save, unlike traditional round-ups that work only when you spend55

- Flexible Control: Most platforms let you pause transfers or change amounts until midnight on scheduled transfer days55

PocketGuard works out your remaining spendable money after bills and savings56. Goodbudget uses a virtual envelope system that works great for families managing holiday finances together56.

Your chosen platform works best when you connect all your financial accounts. This setup helps track expenses automatically, categorize them, and predict monthly cash flow57. You should be careful when picking apps—download only from verified sources and look into security features58.

My advisory practice shows clients who use these digital tools keep better control of holiday spending. The secret is picking tools that match your money habits and tech comfort level. Many banks now include these features free of charge, making them available options to manage your holiday budget55.

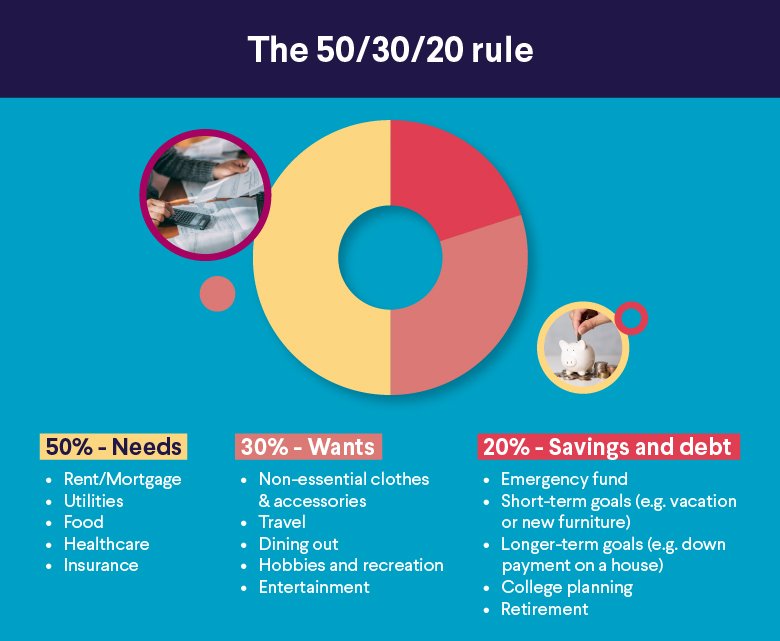

Implement the 50-30-20 Holiday Rule

Image Source: SoFi

The 50-30-20 rule helps you take control of your holiday spending. My years as a financial advisor have shown me how this simple method gives clients better control over their holiday finances.

Essential Holiday Expenses

This all-encompassing approach puts 50% of your holiday budget into essential expenses59. These must-have costs include:

- Travel costs including airfare, accommodations, and transportation

- Simple holiday meals and gatherings

- Mandatory gift exchanges

- Essential decorations

To name just one example, see how an average family spends approximately $6,000 for a week-long stay at premium destinations60. Smart planning is vital to handle these big expenses well.

Flexible Spending Categories

Your holiday budget’s next 30% goes to discretionary spending59. This part lets you enhance your holiday experience without hurting your financial stability. My client’s spending patterns show these flexible expenses typically include:

- Additional gifts beyond essential exchanges

- Premium decorations and entertainment

- Dining out during the holiday season

- Charitable donations

Most Americans spend more than they have during holidays61. You can avoid overspending by tracking purchases and using budgeting tools that sort expenses automatically.

Long-term Savings Allocation

The final 20% should go toward savings, even during holidays59. This money will give you financial security beyond the festivities. Here are smart ways to handle it:

- Emergency Fund Buffer: Keep money ready for surprise holiday expenses62

- Post-Holiday Recovery: Save for January bills and financial obligations63

- Future Holiday Planning: Start saving for next year right away

Consumers might lose $3 billion in unused FSA funds because of the December 31 deadline64. Adding FSA-eligible expenses to your holiday budget helps you get tax benefits while meeting savings goals.

Opening a dedicated holiday savings account early in the year works best63. Automatic transfers help you stay disciplined, though you might need to adjust amounts based on your situation65. My clients who stick to this method feel less stressed about money while enjoying their holidays fully.

Maximize Credit Card Rewards Strategically

Image Source: YouTube

Credit card rewards give great value during holiday spending. Three-quarters of credit card accounts offered rewards in 20226. As a financial advisor, I’ve helped many clients get the most from these benefits through smart planning.

Points Optimization Strategy

Smart point collection starts when you time your credit card applications right. You should open new accounts when you plan big holiday expenses. Welcome bonuses usually need you to spend specific amounts13. These welcome bonuses are a big deal as it means that they can top 100,000 points14. This creates a great chance to save during holidays.

Getting the most points means matching the right cards with your purchases. Travel cards give extra points for specific spending categories13. Each quarter brings rotating bonus categories that might line up with holiday expenses. This gives you boosted cash back on gas or dining13.

Cashback Maximization

You can multiply your earnings by double-dipping rewards. Credit card portals let you earn regular rewards plus extra points or miles13. Right now, some cards give up to 6% cash back when you combine eligible purchases with select retailers15.

For regular spending, cards with steady returns work best. The Citi Double Cash gives 2% on purchases – 1% on buying and 1% on paying15. Some cards also offer bonus rewards up to 20% through shopping portals. You can stack these with regular card earnings15.

Travel Rewards Planning

Book your trips about 60 days ahead to get the best deals with reward points5. Your points’ value increases when you transfer them to airline or hotel partners. Most transfers work at a 1:1 ratio, but some can reach 1:2. This doubles your points’ worth1.

Here are some smart approaches:

- Book travel through card issuer portals to get bonus value

- Transfer points to partner programs for more redemption options

- Watch for seasonal promotions that boost travel rewards

Credit Score Management

Holiday spending needs careful credit management. High credit utilization can hurt your score2. Here’s how to protect your credit profile:

- Keep track of your credit utilization ratio

- Stay within credit limits to avoid fees and higher interest rates16

- Pay full balances monthly so interest charges don’t eat up your rewards1

Good management of credit card rewards helps cut holiday costs. Average holiday spending reaches $1,048. Using cards strategically can earn about $21 in rewards when you pay balances on time17.

Use Tax-Advantaged Accounts for Holiday Savings

Image Source: LinkedIn

Tax-advantaged accounts can boost your holiday savings power through pre-tax contributions. My years as a financial advisor have shown these accounts pack many more benefits beyond their basic healthcare purpose.

HSA Benefits

Health Savings Accounts give you amazing triple tax advantages you can use for holiday planning. Your contributions stay tax-deductible, with 2025 limits reaching $4,300 if you have individual plans and $8,550 for families18. HSA funds roll over year after year, which lets you build up savings for future expenses7. People aged 65 and above can use these funds for non-medical expenses without penalties7.

FSA Strategic Usage

Flexible Spending Accounts need careful planning since all but one of these account holders face the December 31 deadline19. FSA funds cover many eligible expenses though. Here are some smart ways to use them:

- Buy FSA-eligible items like sunscreen and first-aid supplies for holiday travel

- Schedule medical appointments and procedures before year-end

- Take advantage of grace period extensions that typically last until March 15 of the following year19

Tax Deduction Opportunities

My advisory practice has revealed several ways to optimize taxes with these accounts. Your contributions to tax-deferred accounts directly lower your taxable income18. This decreased adjusted gross income might qualify you for extra tax benefits18.

FSA contributions in 2024 let you roll over up to $640 to the following year19. Your employer might also offer a 2.5-month grace period that extends until March 15, 202519. These options are vital since 37% of people with grace period deadlines lose their funds because they don’t know about them19.

Smart holiday planning works well when you link your cash-back rewards card to these accounts20. This helps your money grow throughout the year while keeping tax advantages. HSA investments can also generate tax-free earnings, giving you extra funds for holiday expenses7.

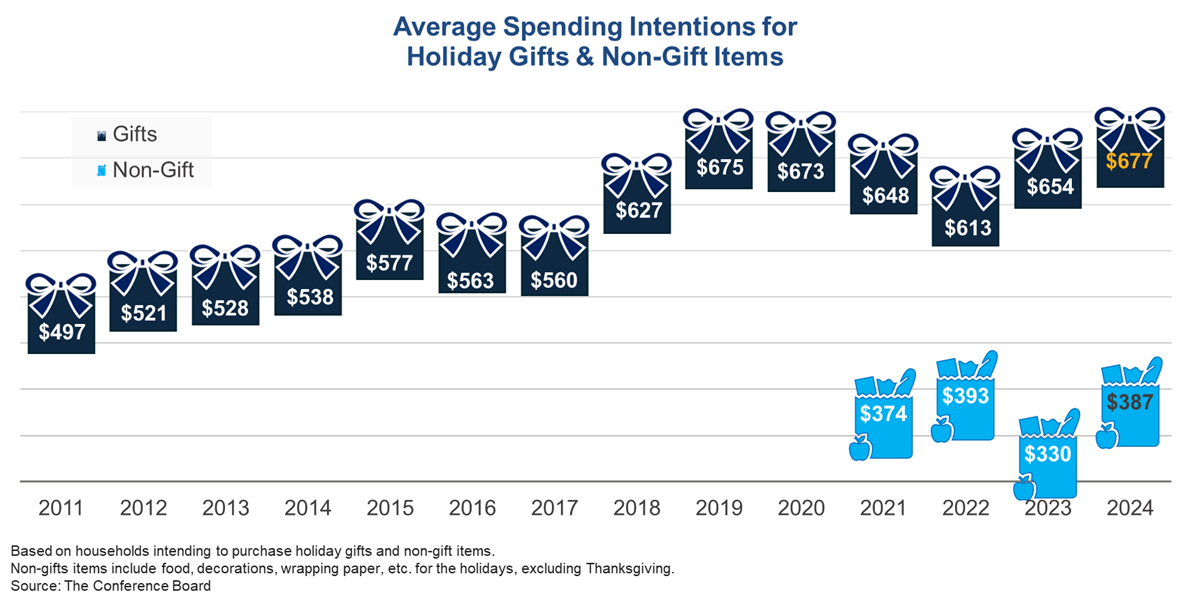

Apply Dollar-Cost Averaging to Holiday Spending

Image Source: The Conference Board

Holiday expenses become more manageable when you break them down into smaller, regular contributions throughout the year. My experience as a financial advisor shows how dollar-cost averaging principles help people manage their holiday spending better.

Monthly Savings Distribution

A sinking fund approach splits your holiday expenses into monthly portions you can handle. You can make smaller contributions regularly when you start early, usually through automated transfers21. Recent data shows that a high-yield savings account earning 4% interest with $200 monthly deposits grows to $2,240.87 in ten months22.

Investment Timeline Planning

The right timing helps you succeed with holiday savings. Setting up automated contributions in January spreads your costs across twelve months23. Here are some key timing strategies:

- Shop early to avoid competition and get better deals

- Browse secondhand marketplaces year-round for quality items at lower prices

- Earn extra interest income by using high-yield savings accounts21

Risk Mitigation Strategies

Dollar-cost averaging helps you handle market changes by making smaller, steady purchases instead of big one-time investments24. This method gives you several benefits:

- You make fewer emotional spending decisions

- Your purchases are better timed

- You pay less per transaction through systematic buying25

Set up a separate holiday savings account to make this strategy work best21. Right now, high-yield savings accounts offer rates above 4%, which beats traditional savings accounts that average 0.46%22. Short-term certificates of deposit (CDs) that mature before the holidays might give you better returns22.

My clients avoid last-minute holiday shopping by using dollar-cost averaging principles consistently. This prevents overspending and stress during the holiday season. Their regular contributions throughout the year build a solid holiday fund while earning interest26.

Create a Holiday Emergency Fund Buffer

Image Source: Chegg India

A dedicated emergency buffer protects your holiday finances from unexpected costs. My years of advisory experience show how good emergency planning keeps holiday debt at bay.

Risk Assessment

Financial risk evaluation is vital for holiday planning. Recent data shows that nearly a quarter of Americans see emergency savings as their main wealth-building goal27. Your buffer size should account for these key factors:

- Income stability and employment status

- Medical needs and insurance coverage

- Number of financial dependents

Fund Allocation Strategy

Emergency funds should cover three to six months of essential expenses8. Some situations need bigger buffers:

- Freelancers or people with variable income need nine to twelve months of coverage

- Families with dependents require extra reserves

- People with specific medical needs should add extra padding

Your emergency fund works best in a dedicated high-yield savings account away from regular spending accounts8. These accounts now offer rates exceeding 4%, and this is a big deal as it means that they beat traditional savings rates of 0.46%11.

Emergency Coverage Calculation

Your monthly essentials determine the right coverage amount. A simple example: $3,000 in basic expenses means a three-month buffer needs $9,0008. Break this goal into smaller chunks – even $20 weekly adds up to good protection27.

Automatic transfers help build your buffer steadily. Move 5% of each paycheck to your emergency fund on paydays8. Review your buffer needs when you face:

- Changes in income or expenses

- New financial dependents

- Higher medical costs

After reaching your target buffer, shift your focus to other long-term financial plans8. Note that steady small contributions work better than occasional large deposits. My clients maintain financial stability through proper emergency fund management and enjoy their holidays without worrying about security.

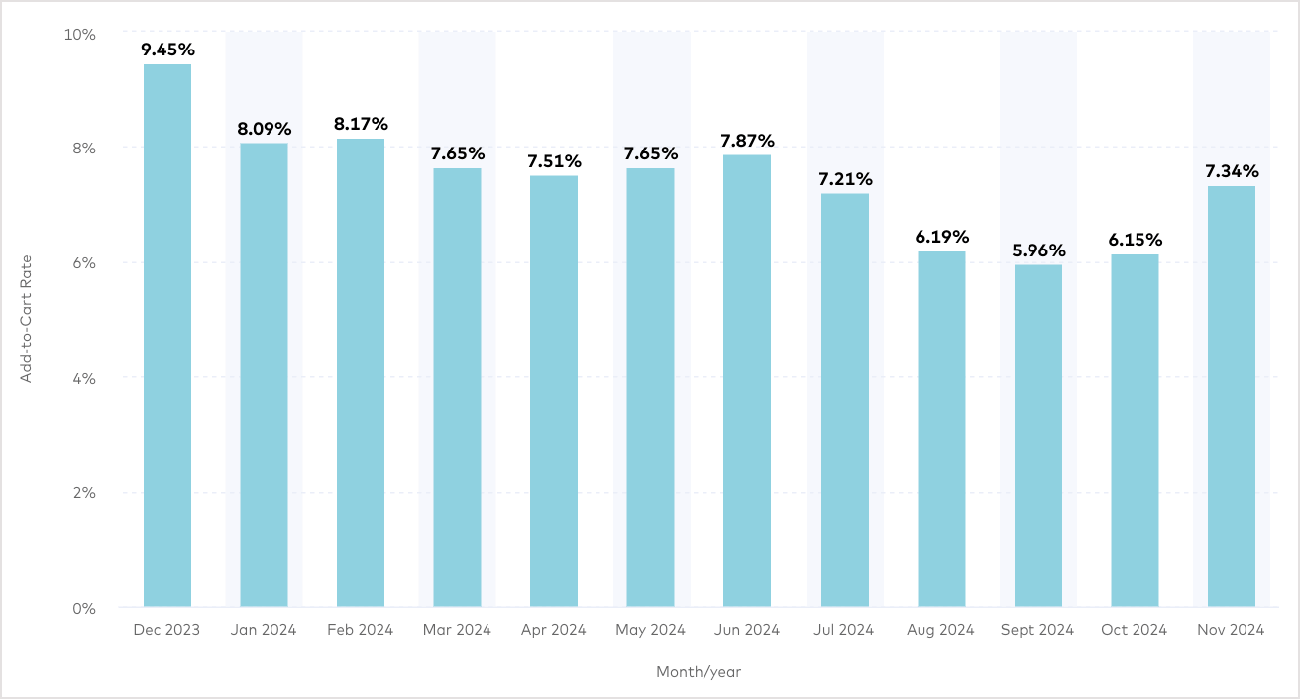

Optimize Online Shopping with Price Analytics

Image Source: Smart Insights

Smart price analytics tools help shoppers make better holiday purchase decisions. My unique experience in financial advising shows how the right timing and price monitoring can lead to big savings.

Price Tracking Tools

Several powerful tools help you watch price changes at online stores. CamelCamelCamel works specifically with Amazon prices and shows current rates along with past highs and lows28. Capital One Shopping checks prices from multiple sellers and lets you know when items are cheaper elsewhere29. Similarly, Karma keeps an eye on thousands of online stores and applies coupon codes to help you save more29.

Historical Price Analysis

Recent holiday seasons show deep discounts made shoppers spend more. Electronics saw price cuts up to 30.1%, toys reached 28%, and TVs dropped to 24.2%30. These patterns show the best times to buy. To name just one example, see how toy prices change a lot in the months before holidays9. Winter clothes get cheaper later in the season, while electronics hit their lowest prices during Black Friday31.

Timing Purchase Decisions

The right timing is a vital part of saving money. Right now, 65% of shoppers wait for holiday sales before buying32. Free shipping plays a big role too – 61% of buyers say it’s their main reason for choosing where to shop online32.

Here’s how to save more during holidays:

- Use multiple price tracking tools at once

- Create price alerts for items you want

- Look at past price patterns before buying

- Keep track of seasonal sales

My clients get better deals on holiday shopping by following these steps. Price tracking shows that prices dropping by 1% led to a 1% increase in buying compared to previous seasons30. Electronics, clothes, and furniture made up about 54% of what people bought online30, so these items deserve extra attention when tracking prices.

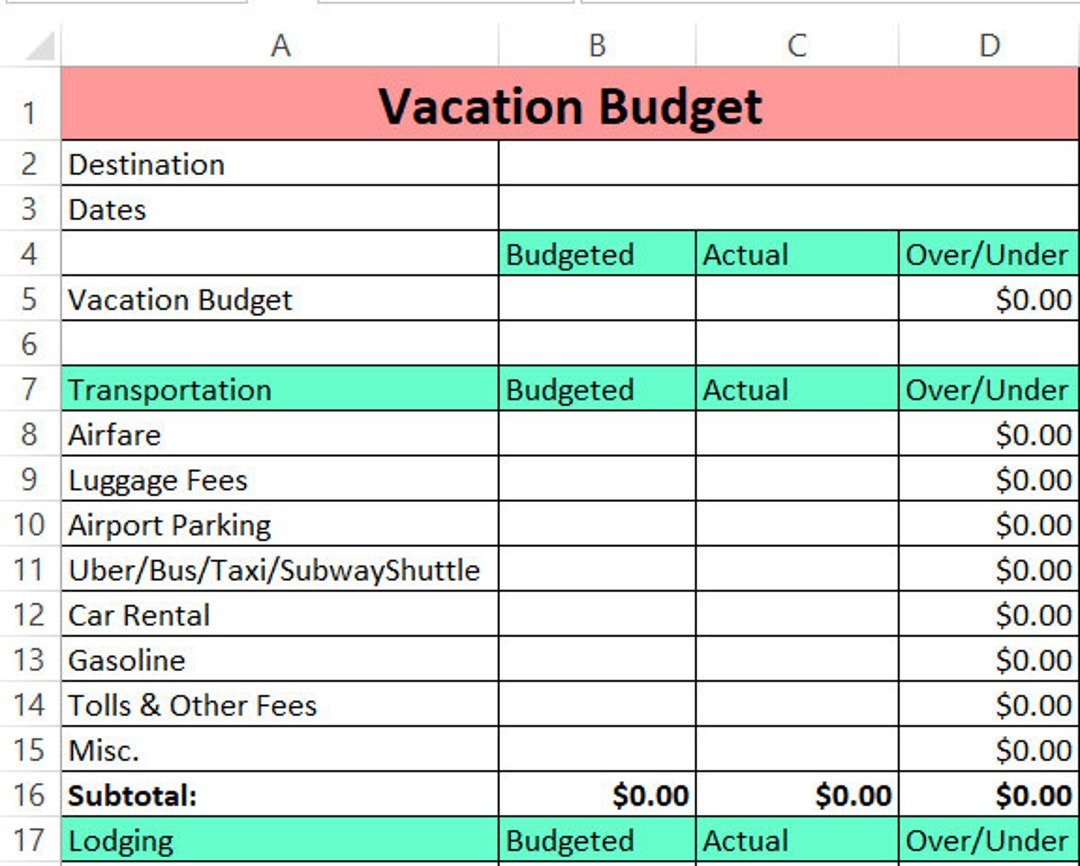

Implement Zero-Based Holiday Budgeting

Image Source: Etsy

Zero-based budgeting revolutionizes holiday financial planning because you assign every dollar a specific purpose. My years helping clients manage money show this is the quickest way to handle seasonal expenses.

Income Allocation Strategy

You need your income minus expenses to equal zero. This ensures every dollar has a purpose33. Look at your bank statements to understand your spending patterns and available funds3. Your holiday budget should spread across key categories until you hit zero. Make adjustments throughout the season as needed.

Expense Categorization

Smart categorization is the foundation of zero-based holiday budgeting. Start with a list of predicted holiday expenses21:

- Essential purchases (gifts, travel, meals)

- Flexible spending (decorations, entertainment)

- Savings and emergency funds

Your expenses should never exceed income. Cut spending or boost income right away to keep things balanced33. People with irregular income should plan conservatively and adjust upward when extra money comes in33.

Budget Tracking Methods

You’ll need to track every expense carefully to make this work. Record transactions as they happen. High-yield savings accounts offer rates above 4% right now34. Here are some proven ways to stay on track:

- Use banking apps to watch transactions

- Write down expenses right after purchases

- Check and adjust your allocations monthly

This system gives you flexibility while you retain control. To name just one example, if you budget $25 for a gift but find it for $15, you can move that extra $10 to another category that needs more funds33. Clear rules about reimbursable expenses and spending limits help too35.

Zero-based budgeting takes the guesswork out of holiday spending. Check your budget monthly and adjust it as your situation changes34. This works great if you want to cut debt or save more money36. Detailed records and regular spending reviews create a reliable path to holiday financial success.

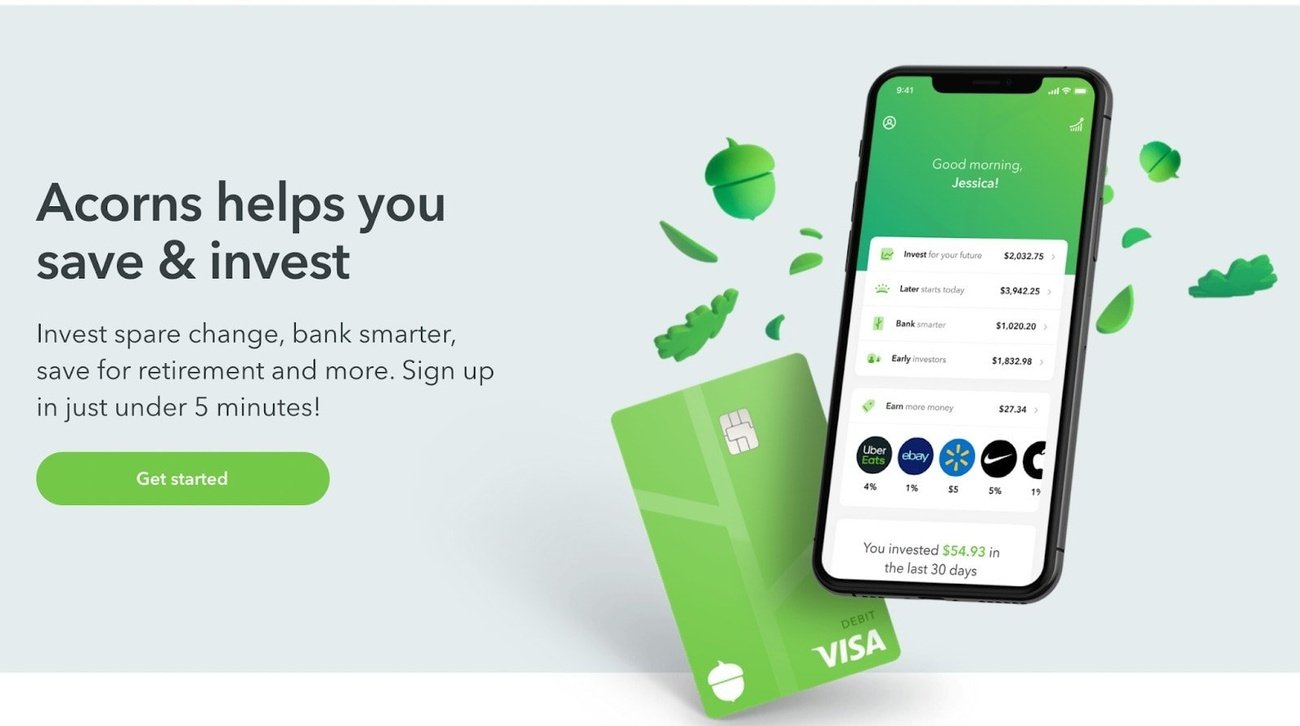

Use Micro-Investing for Holiday Savings

Image Source: The Ways To Wealth

Micro-investing platforms give you a smart way to build holiday savings through small, regular deposits. My experience as a financial advisor shows these tools help people create substantial holiday funds without stretching their monthly budgets too thin.

Automated Investment Apps

Today’s investment platforms make it easy to get started with just a few dollars. Acorns leads the pack with its all-in-one service at USD 3.00 monthly37. The platform handles everything from automatic transfers to retirement accounts. Betterment Investing helps you set up dedicated holiday savings goals. They also give you options to invest in cryptocurrency portfolios and take advantage of tax-loss harvesting37.

Roundup Savings Strategy

The roundup feature turns your everyday purchases into tiny investments. A coffee purchase of USD 4.65 gets rounded to USD 5.00, and those 35 cents go straight into your investment account38. Your weekly transactions, around 30 of them, could add up to USD 10.00 in savings. That’s over USD 520.00 each year38.

Sarah’s story shows how this works. Her daily roundups average USD 1.50, adding up to USD 45.00 monthly. In 20 years, with 7% returns, these small amounts could grow into USD 23,500.0039. Some providers sweeten the deal – SouthState’s program matches 2% of your savings, up to USD 250.00 yearly10.

Portfolio Diversification

Smart diversification is a vital part of holiday savings success. The main goal isn’t chasing big returns but protecting your portfolio from market swings40. These key elements work well:

- Put your money in different types of assets

- Add fixed-income investments to lower volatility

- Keep investing steadily whatever the market does

Short-term holiday goals under three years need low-risk investments11. High-yield savings accounts now pay between 2% to 5%11. These accounts are the foundations of a solid holiday fund. Regular micro-investing and proper diversification can turn small contributions into a nice holiday savings buffer over time.

Apply the 24-Hour Purchase Rule

Image Source: LinkedIn

“If you buy things you do not need, soon you will have to sell things you need.” — Warren Buffet, CEO of Berkshire Hathaway, legendary investor

You need to keep holiday spending in check by controlling impulse purchases. My experience as a financial advisor shows that the 24-hour rule works well to stop unnecessary holiday shopping.

Impulse Control Strategy

A 24-hour cooling-off period acts as a shield against unplanned holiday spending. Research shows that when you put unplanned purchases on hold, you get time to assess if they fit your budget41. This simple approach helps you decide if an item is worth buying or just satisfies a passing whim.

Value Assessment Method

Your decision-making gets better when you assess purchases with practical measures. The quickest way is to calculate an item’s cost in work hours – a $200 item at $15 per hour equals 13 hours of work42. You should also think about:

- How it lines up with your holiday budget

- Whether it brings lasting value or just quick satisfaction

- Other ways you could use the money

Decision Making Framework

A well-laid-out process makes your purchasing choices stronger. Studies show that people who talk about planned purchases with others make smarter decisions42. You should ask these questions before buying:

- Why you need this item

- What emotions drive your decision

- Where you’ll keep the item

- How you’ll pay for it

The 24-hour rule often saves you money because many shoppers lose interest after waiting41. You can use this time to compare online prices and find the best deals41. Today’s shoppers look deeper into their buying decisions to ensure they get lasting value12.

Without doubt, holiday shopping brings temptations, but staying disciplined through careful assessment stops you from making purchases you’ll regret. Set aside a small amount for impulse buys43 – this acknowledges human nature while you retain control of your finances. True value means more than just price tags in today’s digital world12.

Create a Post-Holiday Financial Recovery Plan

Image Source: First Exchange Bank

Your holiday spending might have left you in a tight spot, and you need a solid plan to bounce back. My years of helping clients have shown that a well-laid-out recovery plan helps people get back on their feet after the seasonal splurge.

Debt Management Strategy

Holiday debt needs quick action. Start by checking your recent account statements and separate your holiday purchases from regular expenses44. The 50-30-20-10 budget rule works best: put 50% of extra money toward debt, 30% for necessities, keep 20% for reasonable lifestyle costs, and save 10% for next holiday season45.

If you have multiple credit cards, a debt consolidation plan might help. Cards with 0% APR for up to 21 months let you pay down the principal balance directly45. Personal loans could be another option, as they usually come with lower fixed rates than credit cards with variable rates46.

Savings Replenishment

Getting your savings back on track should be your next priority. High-yield savings accounts now give you interest rates above 4%, which is a big deal as it means that they beat traditional savings accounts at 0.46%47. Schedule automatic transfers around your payday to keep your recovery on track48.

Try a “no-spend” week for things you don’t really need. Pick one category each week – eating out, fun activities, or new clothes – and pause spending there45. On top of that, take a look at your monthly bills to find savings:

- Get rid of subscriptions you don’t use

- Lower your mobile data plans

- Choose higher insurance deductibles

Investment Rebalancing

Tax-loss harvesting helps offset gains in other parts of your portfolio4. You might want to sell underperforming investments by December to lock in tax losses. The start of the year is also a great time to rebalance your portfolio, as buying opportunities often emerge4.

To recover quickly, algorithmic trading platforms help you spot price differences efficiently4. These days, decimalization lets stock prices move in $0.01 steps, which cuts trading costs4. Remember to focus on steady investments in diverse, low-cost portfolios instead of chasing quick wins4.

Comparison Table

| Budget Tip | Main Benefit | Implementation Strategy | Recommended Tools/Methods | Expected Savings/Returns |

|---|---|---|---|---|

| Design a Holiday Investment Plan | Long-term financial growth | Split budget into categories (50% gifts, 30% parties, 10% decorations, 10% misc) | High-yield savings accounts | 4%+ interest on savings |

| Use Digital Tools for Budget Automation | Efficient expense tracking | Link all financial accounts to one platform | Wally, Cleo, PocketGuard, Money Scout | Varies based on spending patterns |

| Follow the 50-30-20 Holiday Rule | Better spending control | 50% essentials, 30% flexible, 20% savings | Dedicated holiday savings account | N/A |

| Use Credit Card Rewards Wisely | Extra savings through points | Match applications with major expenses | Credit card portals, shopping portals | Up to 6% cashback |

| Set Up Tax-Advantaged Accounts | Tax savings and flexibility | Use HSA and FSA accounts wisely | HSA ($4,300 individual limit), FSA ($640 rollover) | Tax-free growth on contributions |

| Start Dollar-Cost Averaging | Less financial strain | Monthly contributions | High-yield savings accounts | 4% interest on $200 monthly deposits |

| Build a Holiday Emergency Fund | Financial security | Save 3-6 months of essential expenses | Dedicated high-yield savings account | 4%+ on emergency savings |

| Shop Online with Price Analytics | Better purchase deals | Track prices across retailers | CamelCamelCamel, Capital One Shopping, Karma | Up to 30.1% on electronics |

| Try Zero-Based Holiday Budgeting | Full budget control | Give every dollar a purpose | Banking apps, expense tracking tools | N/A |

| Start Micro-Investing | Steady savings growth | Round-up transactions | Acorns, Betterment | $520+ annually from roundups |

| Practice the 24-Hour Purchase Rule | Less impulse spending | Wait 24 hours before buying | Value assessment framework | Varies by spending habits |

| Make a Post-Holiday Recovery Plan | Quick financial recovery | Use 50-30-20-10 debt management method | Balance transfer cards, high-yield savings | Up to 21 months 0% APR |

Closing remarks

My twelve holiday budget strategies come from years of helping clients manage their finances better. Smart holiday planning works best when you break down expenses into smaller chunks and stay disciplined through automated savings and strategic credit card use.

Clients see amazing results when they mix different approaches together. They might use tax-advantaged accounts among micro-investing options, or combine zero-based budgeting with price analysis tools. Their success stories show these methods complement each other perfectly.

The numbers speak for themselves. High-yield savings accounts now offer 4%+ returns. Credit card rewards can reach 6% cashback. Strategic purchase timing can save you up to 30%. But numbers aren’t everything. Financial success comes from applying these principles consistently throughout the year.

To learn how these strategies can fit your situation, reach out to us at support@trendnovaworld.com.

Note that holiday budgeting doesn’t require perfection – you just need thoughtful planning and steady progress toward your goals. Start using these techniques today and adjust them to fit your life. Your future self will appreciate the financial stability and peace of mind these strategies bring during the holidays.

Access more info at

13 Wealth Building Strategies Self-Made Millionaires Use in 2025

FAQs

Q1. What are some effective strategies for saving money during the holidays in 2025? Create a strategic holiday investment plan, leverage digital budgeting tools, implement the 50-30-20 rule for holiday spending, and maximize credit card rewards. Also, consider using tax-advantaged accounts and applying dollar-cost averaging to your holiday savings.

Q2. How can I control my holiday spending without sacrificing the joy of the season? Apply the 24-hour purchase rule to avoid impulse buying, optimize online shopping with price analytics tools, and implement zero-based holiday budgeting. These strategies help you make thoughtful purchasing decisions while still enjoying the festivities.

Q3. What’s a smart way to build up holiday savings throughout the year? Use micro-investing apps and automated savings tools to consistently set aside small amounts. Consider creating a dedicated holiday emergency fund buffer and applying dollar-cost averaging principles to your savings plan.

Q4. How can I make the most of credit card rewards for holiday shopping? Strategically time credit card applications to coincide with major holiday expenses, utilize shopping portals for additional points, and consider cards with rotating bonus categories that align with holiday spending. Always pay balances in full to avoid interest charges negating rewards value.

Q5. What should I do to recover financially after the holiday season? Create a post-holiday financial recovery plan that includes a debt management strategy, savings replenishment, and investment rebalancing. Consider implementing a “no-spend” period for non-essential categories and evaluate monthly bills to identify areas for reduction.

References

[1] – https://www.nerdwallet.com/article/travel/nerdwallets-beginners-guide-to-credit-cards-points-miles

[2] – https://blog.harvardfcu.org/financial-impact-of-the-holidays-on-your-credit-score

[3] – https://www.ramseysolutions.com/budgeting/how-to-make-a-zero-based-budget?srsltid=AfmBOoqMaTEekqLvVaOCuMspdybStehtW8R7J684Oh-ALgHv906eD1cL

[4] – https://poole.ncsu.edu/thought-leadership/article/does-the-stock-market-feel-the-holiday-spirit/

[5] – https://www.americanexpress.com/en-gb/business/trends-and-insights/articles/5-simple-ways-to-plan-a-holiday-using-rewards/

[6] – https://www.nerdwallet.com/article/travel/maximize-credit-card-points

[7] – https://www.fidelity.com/learning-center/smart-money/hsa-benefits

[8] – https://www.chase.com/personal/banking/education/budgeting-saving/cash-buffer

[9] – https://www.nerdwallet.com/article/finance/best-way-to-save-on-holiday-shopping

[10] – https://www.southstatebank.com/personal/stories-and-insights/get-ahead-on-your-holiday-savings

[11] – https://www.investopedia.com/articles/investing/030217/best-strategy-shortterm-savings-goals.asp

[12] – https://www.marketingdive.com/news/why-marketers-should-focus-on-value-holiday-shopping/729008/

[13] – https://www.cardratings.com/travel/how-to-maximize-travel-credit-card-rewards.html

[14] – https://thepointsguy.com/credit-cards/maximizing-cards-earn-without-high-spending/

[15] – https://awardwallet.com/blog/maximize-cash-back-holidays/

[16] – https://www.alliantcreditunion.org/money-mentor/how-holiday-shopping-can-impact-your-credit-score

[17] – https://www.cnbc.com/select/how-to-earn-and-use-credit-card-rewards-for-holiday-shopping-purchases/

[18] – https://turbotax.intuit.com/tax-tips/investments-and-taxes/tax-advantaged-accounts-how-they-can-boost-your-savings/c4fKPc6Tf

[19] – https://hrexecutive.com/the-fsa-spending-deadline-is-coming-soon-3-ways-to-help-prepare-employees/

[20] – https://www.cnbc.com/select/why-open-holiday-savings-account/

[21] – https://www.nerdwallet.com/article/finance/how-to-build-a-holiday-budget-that-works-every-year

[22] – https://www.experian.com/blogs/ask-experian/where-to-put-holiday-savings/

[23] – https://www.lakeridge.bank/blog/holiday-budgeting–saving–and-spending–plan-ahead-for-a-joyful-season

[24] – https://www.fidelity.com/learning-center/personal-finance/guide-to-dollar-cost-averaging

[25] – https://www.americancentury.com/insights/holiday-spending-put-a-budget-on-your-list/

[26] – https://www.nationwide.com/lc/resources/personal-finance/articles/holiday-savings

[27] – https://americasaves.org/resource-center/insights/reduce-holiday-stress-by-keeping-your-finances-in-check/

[28] – https://lifehacker.com/best-price-tracking-tools

[29] – https://thepointsguy.com/travel-gear/shopping-price-trackers/

[30] – https://www.cnbc.com/2025/01/07/online-holiday-spending-rises-with-discounts-ai-chatbots-adobe-says.html

[31] – https://www.bankrate.com/banking/savings/the-best-time-of-year-to-buy-everything/

[32] – https://www.adweek.com/adweek-wire/wunderkind-holiday-shopping-survey-finds-timing-price-lead-ecommerce-purchase-decisions/

[33] – https://www.ramseysolutions.com/budgeting/create-a-christmas-budget?srsltid=AfmBOoodFHHfXyiWG1Avl-DBEAiNz1Rk0filbcq7k-jk_IqloYy3dKWk

[34] – https://www.citizensbank.com/learning/what-is-zero-based-budgeting.aspx

[35] – https://www.texasbaycu.org/articles/the-ultimate-guide-to-smart-holiday-budgeting

[36] – https://www.bankrate.com/banking/how-to-make-a-zero-based-budget/

[37] – https://www.businessinsider.com/personal-finance/investing/best-investment-apps-for-beginners

[38] – https://www.sofi.com/learn/content/what-are-round-up-savings/

[39] – https://www.nerdwallet.com/article/investing/micro-investing

[40] – https://www.fidelity.com/learning-center/investment-products/mutual-funds/diversification

[41] – https://www.masscpas.org/news/10000000-0000-0000-0000-0000000003c1:curb-impulse-holiday-spending-with-these-5-tips

[42] – https://lifeskillsadvocate.com/blog/impulsive-spending-and-adhd-17-ways-to-keep-it-in-check/

[43] – https://www.launchcu.com/blog/how-to-overcome-holiday-impulse-purchases/

[44] – https://www.agfed.org/blogs/moneydig/debt-detox-recovering-from-holiday-spending/

[45] – https://money.usnews.com/money/personal-finance/spending/articles/spent-too-much-on-the-holidays-heres-how-to-manage-a-holiday-debt-hangover

[46] – https://www.experian.com/blogs/ask-experian/how-recover-from-holiday-spending/

[47] – https://www.citizensbank.com/learning/get-back-on-track-financially.aspx

[48] – https://www.paypal.com/us/money-hub/article/rebuilding-savings-after-holiday-spending

[49] – https://www.cnbc.com/select/how-to-build-a-holiday-budget/

[50] – https://feea.org/2023/12/holiday-budgeting-tips/

[51] – https://www.livemint.com/money/personal-finance/risk-assessment-in-financial-planning-what-you-need-to-know-151676535367247.html

[52] – https://llklaw.com/legal-blog/your-tax-smart-holiday-gift-guide-to-strengthen-your-estate-plan

[53] – https://www.mutualofomaha.com/advice/financial-planning/financial-planning-basics/mitigating-financial-risk-strategies-for-a-more-stable-future

[54] – https://www.bankrate.com/banking/savings/ai-apps-to-help-you-save-money/

[55] – https://www.huntington.com/Personal/online-banking/money-scout

[56] – https://www.brandvm.com/post/holiday-spending-hangover-budgeting-tools-apps

[57] – https://money.usnews.com/money/personal-finance/saving-and-budgeting/articles/simple-and-free-budgeting-tools

[58] – https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/simple-saving-tools

[59] – https://www.ramseysolutions.com/budgeting/50-20-30-budget-rule?srsltid=AfmBOorMLGigipuOmB6YXl-Q1IKlFgqqsampUvrnW5j_ktToBzWPw3ov

[60] – https://www.tiaa.org/public/learn/balancing-vacation-expenses-and-saving-for-retirement

[61] – https://www.amerantbank.com/ofinterest/staying-financially-healthy-tracking-holiday-spending/

[62] – https://hrss.cpa/budgeting-for-the-holidays-guide-to-keeping-your-finances/

[63] – https://americasaves.org/resource-center/insights/creating-a-holiday-spending-savings-plan/

[64] – https://www.prweb.com/releases/5-ways-to-use-flexible-spending-account-fsa-funds-to-maintain-good-health-and-save-money-during-the-holiday-season-from-fsa-store-302308194.html

[65] – https://www.citizensbank.com/learning/50-30-20-budget.aspx

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| FinanceFor more information, contact us at support@trendnovaworld.com