Want to save $6,000 in the next 12 months? The average user does exactly that with one of the best budget apps we’ll cover in this piece.

Money management might feel overwhelming, but the right budgeting tool can change your financial situation completely. These apps are either free or cost just a few dollars each month. They provide solid security features and connect directly to your accounts for live tracking.

My 15 years of testing and reviewing personal finance apps have taught me which ones actually work. We’ll explore 10 proven apps that help you spend less and save more, from zero-based budgeting tools to envelope systems.

Let’s take a closer look at the options that could change your financial future, starting with each app’s most powerful money-saving features.

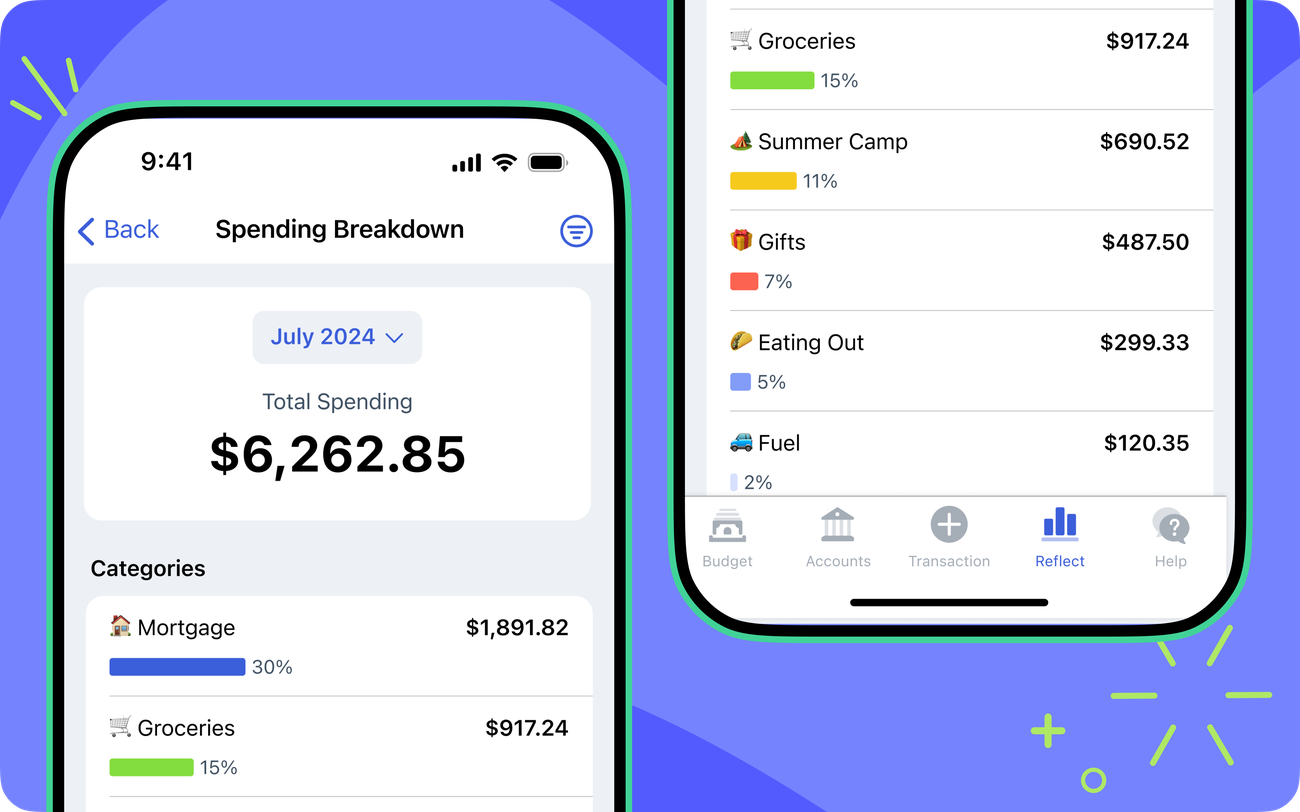

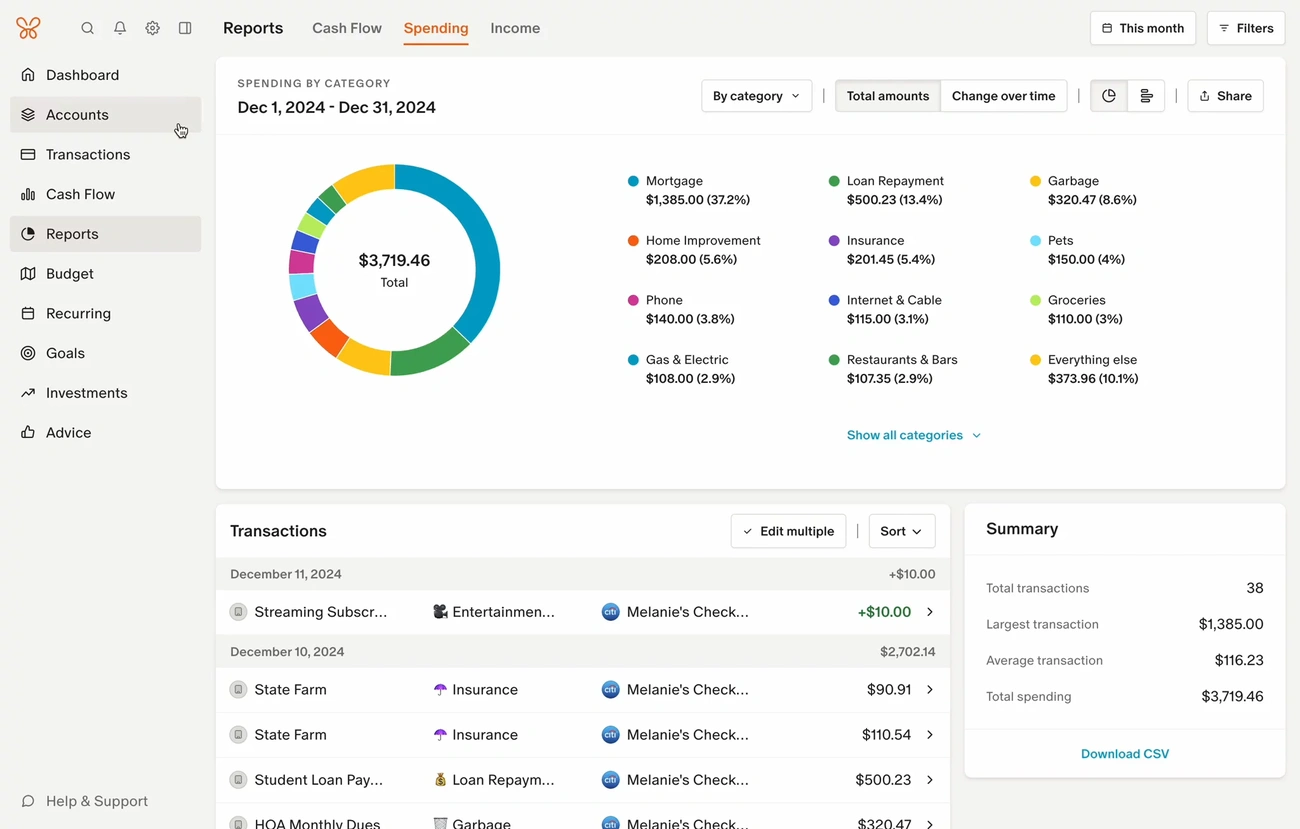

YNAB (You Need A Budget)

Image Source: YNAB

YNAB stands out from other budget apps because it uses a unique zero-based budgeting approach that gives every dollar a specific job. The platform helps users break free from living paycheck-to-paycheck through smart money management50.

YNAB Key Money-Saving Features

The app excels with its bank-grade security and smooth integration with major financial institutions through Plaid, MX, and TrueLayer50. Users can link their accounts securely, get automatic transaction imports, and check their budget on any device51. The platform also provides an ad-free experience and detailed loan planning tools that calculate interest savings51.

Real User Savings Data

YNAB makes a real difference in users’ financial health. New users save an average of $600 in their first two months and $6,000 in their first year52. The app has helped 91% of users change their money mindset positively52. About 70% of users now have enough savings to cover three months of expenses53.

Free vs Premium Cost Analysis

| Plan | Cost | Features |

|---|---|---|

| Monthly | $14.99 | Full access |

| Annual | $109.00 | Best value |

| Trial | 34 days | No credit card required |

Best Practices for Maximum Savings

The platform works on four basic rules: give every dollar a job, plan for true expenses, roll with the punches, and age your money54. Users should treat irregular expenses as “true expenses” and save monthly for them. A good example is setting aside $100 each month for a $600 car insurance bill that comes due every six months55.

PocketGuard

Image Source: pocketguard.com

PocketGuard’s intelligent algorithms have helped users save over $680 million and reduce bills by more than $20 million since 20156.

Smart Savings Algorithms

The app uses the SMART framework (Specific, Measurable, Achievable, Relevant, and Timely) to set goals56. The platform tracks spending patterns and suggests realistic monthly contributions based on your budget through automated calculations. The system also monitors progress through external or manual goals, and users can link savings directly to bank accounts56.

Bill Negotiation Success Rate

The platform works with Billshark to analyze and negotiate bills, with an impressive 80% success rate for cell phone, WiFi, and cable services6. Users receive customized recommendations about potential savings on their recurring expenses. The system flags services you pay for regularly to help identify unused subscriptions8.

Monthly Savings Potential

PocketGuard’s complete approach to expense tracking and bill management has helped users pay off over $43 million in debts6. The platform calculates safe-to-spend amounts after considering bills, goals, and necessities9. Users can stay within budget limits with live updates on category spending10.

| Feature | Savings Impact |

|---|---|

| Bill Negotiation | Average 12.48% monthly reduction10 |

| Subscription Management | Identifies unused services |

| Automated Tracking | Live budget updates |

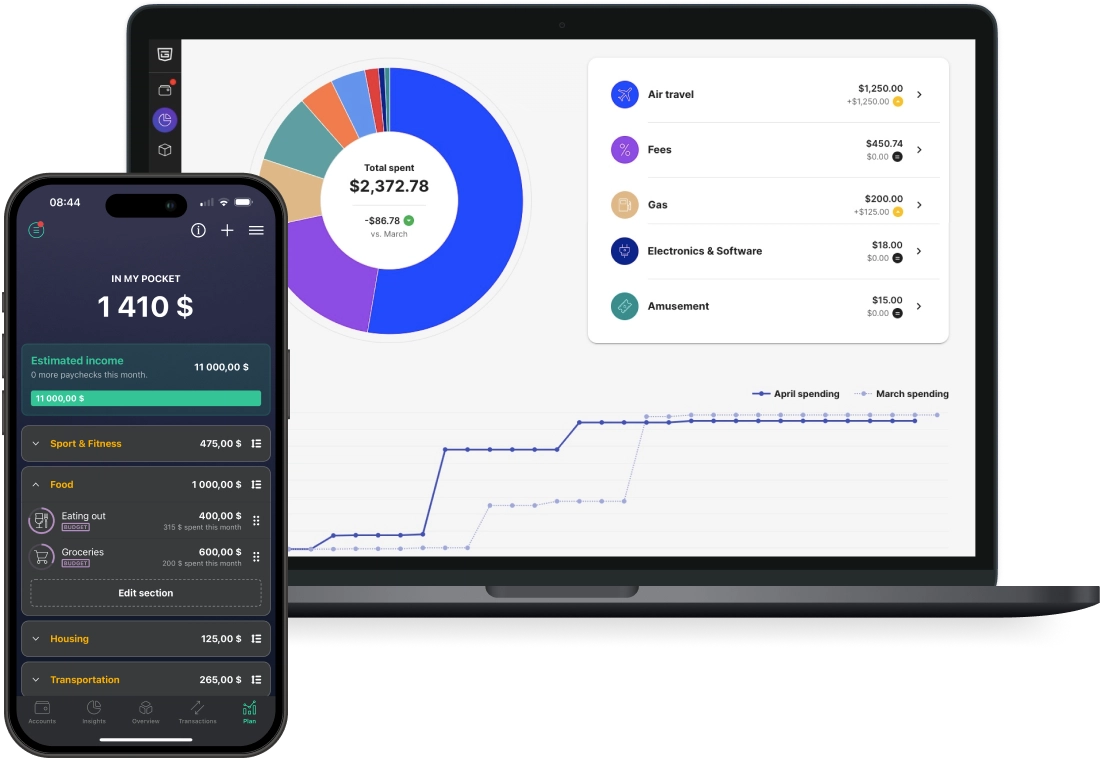

Rocket Money

Image Source: www.rocketmoney.com

Rocket Money stands out as CNET’s 2024 Editors’ Choice for best budget apps11. The app helps users spot and cut unnecessary expenses effectively.

Subscription Management Features

The platform’s subscription tracking system scans connected accounts and displays all recurring charges on a single dashboard. Users can spot and cancel unwanted subscriptions quickly, usually within 30 minutes12. A dedicated concierge team handles cancelations directly for premium subscribers. The team’s efforts have helped users save over $490 million in unused subscription fees13.

Average User Savings

More than 5 million members have saved over $1 billion since the platform’s launch13. The app’s bill negotiation service succeeds 85% of the time with major service providers13. Members who actively review their subscriptions save $387.84 on average each year by removing unnecessary services14.

Premium ROI Analysis

Premium membership costs between $6 and $12 monthly11 and provides:

- Unlimited budget customization

- Automated savings tools

- Credit score monitoring

- Net worth tracking

The bill negotiation service takes 30-60% of your first year’s savings11. A $20 monthly bill reduction saves $240 yearly, with Rocket Money’s fee ranging from $72 to $14413. The platform’s smart balance checking system proves highly effective by cutting operational costs 50% while maintaining strong collection rates15.

Goodbudget

Image Source: Goodbudget

Goodbudget brings the envelope budgeting method into the digital age and turns traditional cash-based budgeting into a modern money management solution16.

Envelope System Benefits

The digital envelope system in Goodbudget helps you plan your spending rather than just track it17. Monthly income gets split into virtual envelopes for different categories like groceries, rent, and entertainment18. You can only spend what’s in each envelope, which stops overspending and helps you manage money better19.

Free Version Capabilities

The free version comes packed with features at no cost20:

- 10 regular and 10 annual/goal envelopes

- Single account access on two devices

- One year of transaction history

- Community support

- Debt tracking capabilities

Success Stories

Users have achieved amazing financial goals with Goodbudget. One user cleared a $180,000 tax bill while keeping emergency savings intact21. A couple managed to save enough money for fertility treatments and bought their home too21. The app’s ratings show its popularity – 4.6 stars in the App Store and 4.2 stars in Google Play18.

The platform works as a hands-on budgeting tool that needs manual transaction entry instead of automatic bank syncing22. This design choice helps you stay more aware of your spending patterns and make smarter money decisions23.

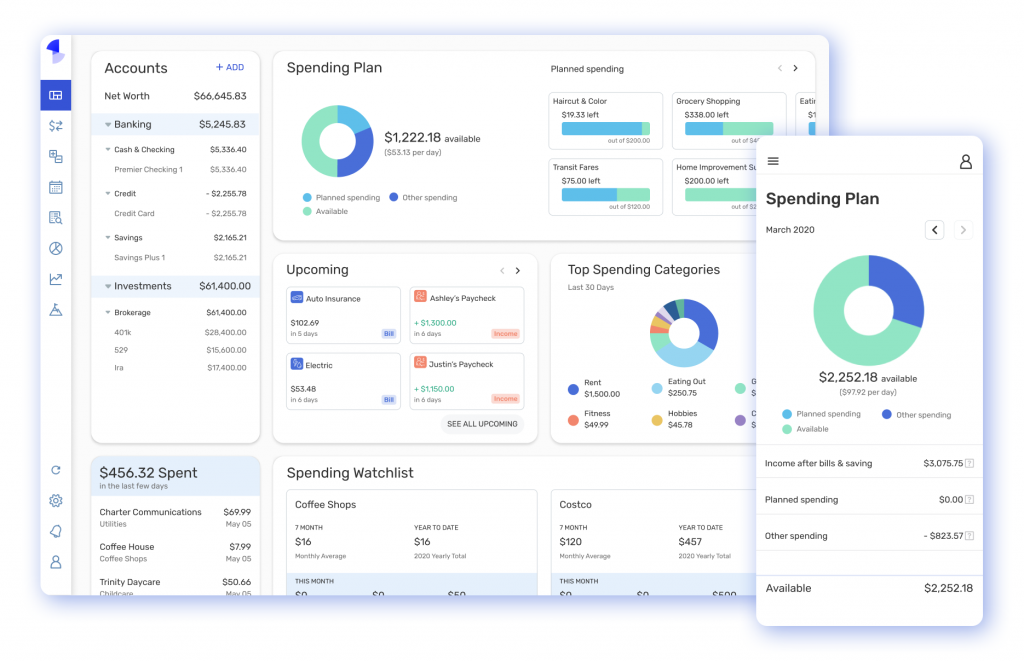

Monarch Money

Image Source: www.monarchmoney.com

Monarch Money made its debut in 2018. The platform combines smart investment tracking with detailed budgeting tools24.

Investment Tracking Features

Monarch’s investment tracker helps you monitor ETFs, stocks, and cryptocurrency in multiple accounts24. The platform works with Plaid, Finicity, and MX to connect to over 13,000 financial institutions2. Interactive charts help users analyze their portfolio’s performance. The system automatically categorizes transactions2. Users can upload CSV files manually in the beta investment tracking feature to analyze historical data25.

Net Worth Growth Tools

The platform’s net worth tracker shows daily updates through an interactive chart that sorts assets by type26. Zillow integration lets users track their property values27. The customizable dashboard shows how you spend and how your investments match up2. Users can visualize their financial journey through area charts for net worth trends. Sankey diagrams map out where the money flows28.

Premium Features Worth Paying For

Premium access runs at $14.99 monthly or $99.99 annually. New users get a 7-day trial28. Premium members enjoy:

| Feature | Benefit |

|---|---|

| Unlimited Account Syncing | Up-to-the-minute transaction updates |

| Partner Access | Joint financial management at no extra cost |

| Custom Categories | Tailored expense tracking |

| Investment Analytics | Portfolio performance metrics |

The platform’s auto-categorization gets smarter over time29. AI-powered transaction cleaning and custom rules for merchant names and categories make this possible29. Users can set up unlimited savings goals and watch their progress through visual indicators28.

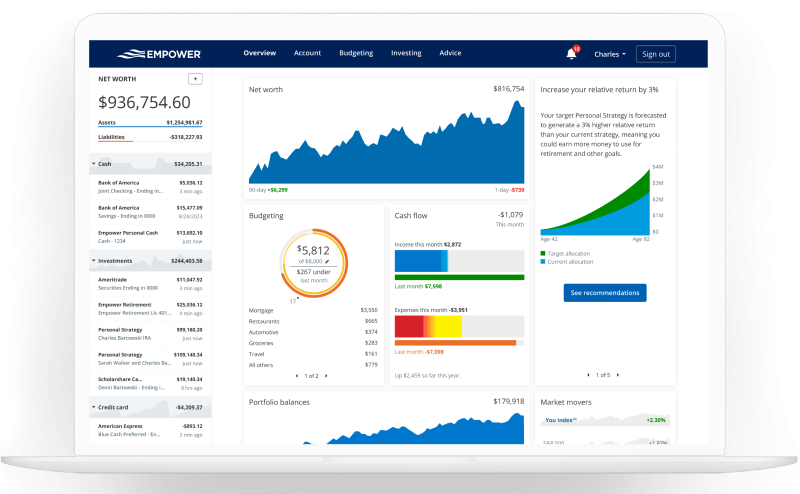

Empower

Image Source: Empower

Empower started as a wealth management platform and evolved into a sophisticated system with money-saving features and investment tools. The platform caters to both newcomers and seasoned investors.

Automated Savings Technology

The platform’s AutoSave feature analyzes your income patterns and spending habits to find the best saving amounts30. You can pick between weekly transfers (up to four times per week) or savings tied to your paycheck30. The system aims to stimulate steady growth and checks account balances before making transfers. This ensures you have enough money for your regular expenses30.

Investment Fee Analysis

Empower’s fee analyzer spots hidden costs in investment portfolios31. The detailed analysis reveals expense ratios, administrative fees, and unpublished fund charges that affect your long-term returns31. The service costs an annual fee of 0.89% for accounts over $100,00032. Larger portfolios exceeding $1 million qualify for better rates ranging from 0.79% to 0.49%32.

Wealth Building Tools

The investment checkup feature uses Morningstar’s forward-looking forecasts to assess your portfolio’s growth potential33. You get customized asset allocation recommendations based on your risk tolerance and financial goals3. The retirement planner tests your finances against various scenarios, including recessions, to help you pick the right time to retire33. The platform protects your data with AES-256 encryption and multi-factor authentication33.

| Investment Tier | Asset Range | Annual Fee |

|---|---|---|

| Investment Services | $100K-$250K | 0.89% |

| Wealth Management | $250K-$1M | 0.89% |

| Private Client | Over $1M | 0.79%-0.49% |

Simplifi by Quicken

Image Source: Quicken

Simplifi by Quicken brings precision to personal finance with its accessible interface and up-to-the-minute tracking capabilities.

Up-to-the-Minute Budget Tracking

The platform’s spending plan adjusts automatically when transactions happen and provides daily spending limits based on income and expenses4. Users get instant updates about their available funds and retain better control over their finances. Monthly expenses split into income, bills, subscriptions, and planned spending, with projections available up to 12 months ahead34.

Customizable Savings Goals

Simplifi’s savings goals feature lets users contribute from any connected account and tracks progress through visual indicators35. The platform keeps contributed amounts separate from available balances to help users avoid spending allocated savings36. This system has helped users save $5,000 in emergency funds within five months37.

Premium Features Analysis

Users can access the platform for $47.88 annually, with a discounted rate of $35.884. Premium features include:

| Feature | Benefit |

|---|---|

| Investment Dashboard | Up-to-the-minute portfolio tracking |

| Credit Score Monitoring | Monthly VantageScore updates |

| Customizable Reports | Detailed financial analysis |

| Refund Tracking | Automated payment verification |

The platform protects user data through advanced encryption technology and multi-factor authentication38. Users have discovered around $20 monthly in unused subscription services through automated categorization and instant notifications37.

EveryDollar

Image Source: Ramsey Solutions

EveryDollar with over 10 million active users helps people save an extra $395 in their first month and cut monthly expenses by 9%39.

Zero-Based Budgeting Benefits

The platform makes sure every dollar has a purpose through a simple three-step system. Users enter their income, plan expenses, and balance to zero5. People who track their transactions actively find an average of $790 in extra money during their first two months5. The system tracks both savings goals and spending patterns to give users better control of their finances.

Dave Ramsey Money-Saving Principles

EveryDollar merges with Dave Ramsey’s Baby Steps framework, which makes it perfect for users who follow this proven wealth-building approach5. The platform focuses on debt elimination and emergency fund building with customizable budget categories. Users can create sinking funds for irregular expenses and save monthly for yearly costs like car insurance or property taxes40.

Free vs Paid Features

Premium access costs $79.99 annually or $17.99 monthly41 and includes:

| Feature | Free | Premium |

|---|---|---|

| Monthly Budgets | ✓ | ✓ |

| Transaction Tracking | Manual | Automatic |

| Bank Connection | – | Multiple Accounts |

| Custom Reports | – | ✓ |

| Bill Reminders | – | ✓ |

| Financial Coaching | – | Unlimited |

The free version includes everything you need like unlimited budget categories, manual transaction tracking, and dedicated customer support5. Premium users get access to paycheck planning tools that help coordinate spending with income timing42.

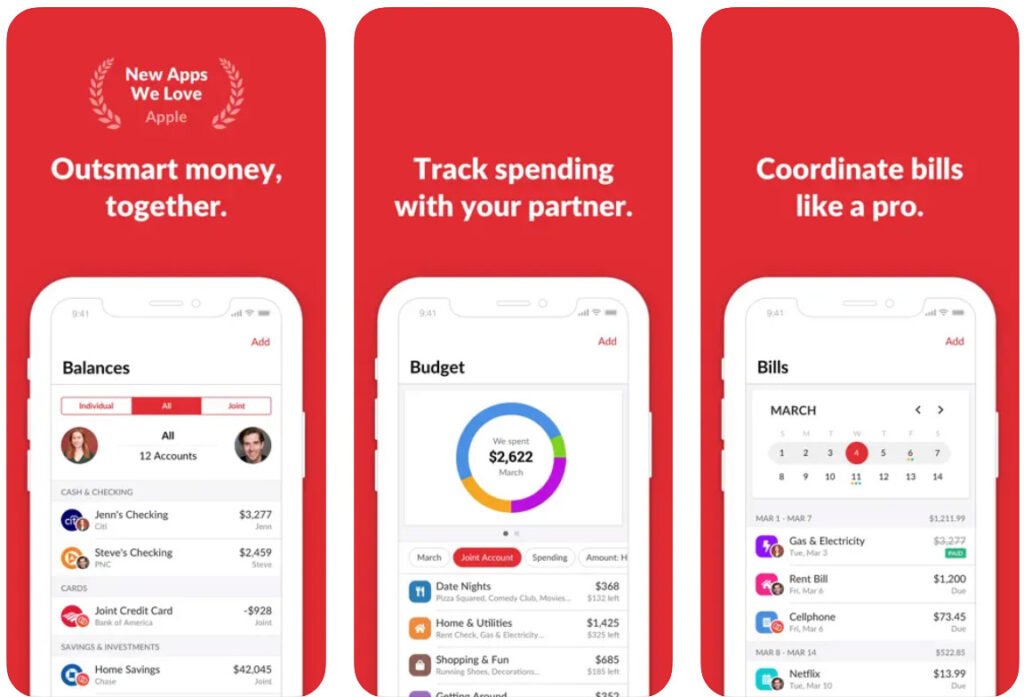

Honeydue

Image Source: Homeowner.com

Honeydue makes shared financial management easier for couples through its smart approach to collaborative budgeting.

Couple Money Management

The platform connects to more than 20,000 financial institutions across five countries43. We focused on making financial details transparent between partners. Users can choose what they want to share – from complete transaction details to simple balance information1. The app’s built-in chat feature lets partners discuss specific transactions with emojis and comments44. This creates a space dedicated to financial conversations.

Shared Savings Goals

Honeydue now provides a joint checking account through Sutton Bank with FDIC insurance1. Both partners get a linked Visa debit card without monthly fees or minimum balance requirements1. The platform sorts transactions automatically to help couples track their spending patterns together45. Partners can customize expense categories to stay better organized.

Bill Split Features

The app stands out in managing shared expenses through:

| Feature | Benefit |

|---|---|

| Bill Reminders | Automated alerts for upcoming payments |

| Expense Tracking | Immediate transaction monitoring |

| Split Calculator | Easy division of shared costs |

| Chat Integration | Direct communication about bills |

Partners can mark transactions as shared expenses45 or keep individual purchases separate. The platform imports and sorts transactions automatically46. This helps couples see their combined financial picture clearly. Both partners receive alerts when approaching monthly budget limits1. This ensures better control over their joint expenses.

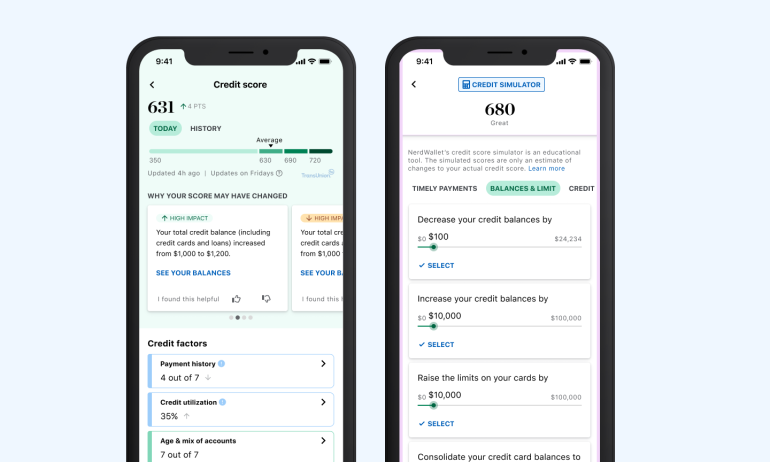

NerdWallet

Image Source: NerdWallet

NerdWallet goes beyond regular budgeting tools to give you a complete financial platform that combines credit monitoring with educational resources. The platform’s free credit score service updates weekly through TransUnion®47. We focused on VantageScore® 3.0 monitoring.

Credit Score Monitoring

Users can learn how different actions might affect their scores with the platform’s credit simulator47. The system sends notifications about changes in credit profiles through detailed alerts48. Your payment history, credit utilization, and account age are tracked47. These factors help create a clear picture of creditworthiness.

Financial Education Resources

NerdWallet shines in financial education with its self-guided online courses7. You’ll find podcasts and well-researched articles that cover everything from simple budgeting to advanced investing7. The platform includes:

| Resource Type | Features |

|---|---|

| Interactive Tools | Credit simulator, budget calculator |

| Educational Content | Online courses, podcasts |

| Financial Guidance | Customized insights, alerts |

Money-Saving Recommendations

The platform uses the 50/30/20 budget rule – 50% for needs, 30% for wants, and 20% for savings7. Users can track cash flow and monitor net worth through the dashboard49. The free NerdWallet app stands out by giving you complete expense tracking tools without subscription fees49. Premium features from other budget apps might give you more specialized functions.

Comparison Table

| App Name | Monthly Cost | Key Features | Average User Savings | Integration/Security | Special Focus |

|---|---|---|---|---|---|

| YNAB | $14.99 | Zero-based budgeting, Loan planning tools | $6,000 first year, $600 first two months | Bank-grade security, Plaid/MX/TrueLayer integration | Four-rule system to manage money proactively |

| PocketGuard | Not mentioned | Bill negotiation, Smart savings algorithms, Subscription tracking | 12.48% monthly bill reduction | SMART framework implementation | Bill reduction and subscription management |

| Rocket Money | $6-$12 | Subscription management, Bill negotiation, Credit score monitoring | $387.84 annual subscription savings | 85% success rate with service providers | Subscription cancelation and bill reduction |

| Goodbudget | Free tier available | Digital envelope system, Debt tracking, 10 regular envelopes | Not mentioned | Manual transaction entry | Traditional envelope budgeting method |

| Monarch Money | $14.99 | Investment tracking, Net worth monitoring, Portfolio analysis | Not mentioned | 13,000+ financial institutions, Plaid/Finicity/MX | Investment and net worth tracking |

| Empower | 0.89% (assets >$100k) | AutoSave feature, Investment fee analysis, Retirement planning | Not mentioned | AES-256 encryption, Multi-factor authentication | Wealth management and investment optimization |

| Simplifi | $3.99 ($47.88/year) | Immediate tracking, Investment dashboard, Spending plan | $20/month subscription savings | Advanced encryption, Multi-factor authentication | Precise spending planning |

| EveryDollar | $17.99 | Zero-based budgeting, Baby Steps integration, Custom reports | $395 first month, 9% expense reduction | Multiple bank connections (premium) | Dave Ramsey principles integration |

| Honeydue | Free | Joint account management, Bill splitting, Shared expense tracking | Not mentioned | 20,000+ financial institutions | Couple-focused financial management |

| NerdWallet | Free | Credit monitoring, Financial education, Budget tracking | Not mentioned | TransUnion integration, Weekly updates | Credit score monitoring and education |

Epilogue

The right budget app can transform your financial journey. You don’t need to struggle with spreadsheets or paper tracking anymore – these tools come with automated features that deliver real results. My tests revealed that YNAB users save around $6,000 in their first year. PocketGuard members have saved more than $680 million together.

Your specific needs should guide your choice of app. YNAB works great for zero-based budgeting, and Monarch Money stands out with investment tracking. Couples who manage shared finances will find Honeydue perfect for their needs. Beginners can start with free options like NerdWallet that offer good features. Premium services are worth considering as they give you automated tracking and deeper insights.

These platforms take security seriously. Your sensitive data stays protected with bank-grade encryption and multi-factor authentication. Most apps connect naturally with thousands of financial institutions, which makes tracking your transactions a breeze.

A quality budget app is worth the small monthly cost. You’ll spend less, cut unnecessary subscriptions, and develop better spending habits. Try your chosen app’s free trial today – your future self will thank you for this step toward financial freedom.

To learn more visit:

15 Simple Frugal Habits That Save $500+ Every Month (2025 Guide)

FAQs

Q1. What is the most effective budgeting app for saving money? YNAB (You Need A Budget) stands out as one of the most effective budgeting apps for saving money. Users report saving an average of $6,000 in their first year, with the app’s zero-based budgeting approach helping break the paycheck-to-paycheck cycle.

Q2. How do budget apps help couples manage their finances together? Apps like Honeydue are specifically designed for couples to manage shared finances. They offer features such as joint account management, bill splitting, and shared expense tracking. These apps allow partners to choose what financial information to share and provide a platform for discussing transactions and financial goals.

Q3. Are there any free budget apps that offer comprehensive features? Yes, NerdWallet offers a free comprehensive financial platform that combines budgeting tools with credit monitoring and educational resources. It provides weekly credit score updates, expense tracking, and financial guidance without subscription fees, making it a solid option for beginners.

Q4. How do investment tracking features in budget apps benefit users? Investment tracking features, like those found in Monarch Money, allow users to monitor their portfolio performance across multiple accounts. These tools provide analytics on asset allocation, track net worth growth, and offer insights to help users make informed investment decisions, contributing to overall financial health.

Q5. Can budget apps help reduce monthly expenses? Yes, many budget apps are designed to help reduce monthly expenses. For example, Rocket Money’s subscription management feature helps users identify and cancel unwanted subscriptions, saving an average of $387.84 annually. Additionally, apps like PocketGuard offer bill negotiation services that can lead to an average 12.48% reduction in monthly bills.

References

[1] – https://www.cnbc.com/select/honeydue-budgeting-app-review/

[2] – https://www.zdnet.com/article/this-is-the-best-money-management-app-ive-tested-and-right-now-its-50-off/

[3] – https://www.empower.com/tools

[4] – https://www.pcmag.com/reviews/simplifi-by-quicken

[5] – https://www.ramseysolutions.com/budgeting/everydollar-a-faster-easier-way-to-budget?srsltid=AfmBOoow4AVW48wbO0kz72z5iEi-_yD0Vu6cTx74mFMTe-S62QdGZajE

[6] – https://financebuzz.com/pocketguard-review

[7] – https://www.pcmag.com/reviews/nerdwallet

[8] – https://www.getrichslowly.org/pocketguard-review/

[9] – https://clark.com/personal-finance-credit/budgeting-saving/pocketguard/

[10] – https://www.cnn.com/2022/01/19/cnn-underscored/best-budget-apps/index.html

[11] – https://www.cnet.com/personal-finance/banking/rocket-money/

[12] – https://www.thequalityedit.com/articles/rocket-money-review

[13] – https://moneywise.com/managing-money/budgeting/rocket-money

[14] – https://www.cnet.com/personal-finance/banking/can-rocket-money-save-you-as-much-on-subscriptions-as-it-claims/

[15] – https://amplitude.com/blog/rocket-money-revenue-customer-journeys

[16] – https://goodbudget.com/

[17] – https://goodbudget.com/what-you-get/

[18] – https://www.nerdwallet.com/article/finance/goodbudget-app-review

[19] – https://goodbudget.com/envelope-budgeting/

[20] – https://goodbudget.com/help/billing/

[21] – https://goodbudget.com/blog/2019/11/celebrating-your-budgeting-victories/

[22] – https://www.cnet.com/personal-finance/banking/best-budgeting-apps-to-get-control-of-your-money-in-2025/

[23] – https://www.experian.com/blogs/ask-experian/goodbudget-budgeting-app-review/

[24] – https://clark.com/save-money/monarch-money-review/

[25] – https://help.monarchmoney.com/hc/en-us/articles/22373197208212-Investment-Transactions-Beta

[26] – https://www.monarchmoney.com/new-net-worth-chart-investment-transactions-and-more

[27] – https://www.adhdmoneytalk.com/exploring-monarch-money-the-ultimate-budgeting-tool/

[28] – https://www.businessinsider.com/personal-finance/banking/monarch-money-review

[29] – https://www.monarchmoney.com/

[30] – https://support.empower.me/hc/en-us/articles/360038663434-How-AutoSave-works

[31] – https://support-personalwealth.empower.com/hc/en-us/articles/201169600-Retirement-Fee-Analyzer-Calculations-Overview

[32] – https://www.cnbc.com/select/empower-review/

[33] – https://www.pcmag.com/reviews/empower

[34] – https://support.simplifi.quicken.com/en/articles/4212702-understanding-your-spending-plan

[35] – https://support.simplifi.quicken.com/en/articles/3676756-using-quicken-simplifi-s-savings-goals

[36] – https://www.quicken.com/blog/simplifi-savings-goals/

[37] – https://financebuzz.com/simplifi-review

[38] – https://familymoneyadventure.com/simplifi-by-quicken-review/

[39] – https://www.ramseysolutions.com/ramseyplus/everydollar?srsltid=AfmBOoqGtVvNPeFCSW4nehDK18-g9wAojFsvm3JtdqOBlQjyXJtoMh7G

[40] – https://www.ramseysolutions.com/budgeting/how-to-create-a-monthly-budget?srsltid=AfmBOopv68fp3uynegW1rMUVGD37CJ0izAN1ZR9f_PXCUcx6Y8fgDo24

[41] – https://everydollar.help.ramseysolutions.com/hc/en-us/articles/28947175238669-Difference-Between-Ramsey-Plus-and-EveryDollar-Premium-Membership

[42] – https://www.ramseysolutions.com/budgeting/everydollar-a-faster-easier-way-to-budget?srsltid=AfmBOoqD4znXMfK2_jsnslVU0ITmUZhW7b3RYUrnJKfvN6A1lmDoxCM1

[43] – https://www.honeydue.com/how-it-works

[44] – https://www.honeydue.com/

[45] – https://thecollegeinvestor.com/35477/honeydue-review/?srsltid=AfmBOoocF5bM5ovzVTQMQPmsihGwJRRxRSKiOGX9CD-85y7G2RSO562n

[46] – https://clark.com/personal-finance-credit/budgeting-saving/honeydue/

[47] – https://www.nerdwallet.com/p/free-credit-score

[48] – https://www.nerdwallet.com/p/free-credit-report

[49] – https://www.nerdwallet.com/article/finance/best-budget-apps

[50] – https://www.joinkudos.com/blog/ynab-review-2025-a-comprehensive-look-at-you-need-a-budget

[51] – https://www.ynab.com/features

[52] – https://www.ynab.com/pricing

[53] – https://www.ynab.com/

[54] – https://clark.com/save-money/ynab/

[55] – https://www.ynab.com/guide/how-to-save-money

[56] – https://help.pocketguard.com/hc/en-us/articles/360002196559-Goals

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com