Healthcare costs are climbing steadily in 2025. Saving money on healthcare without sacrificing quality care has become a real challenge.

My 13 years as a financial advisor have shown me how healthcare expenses can wreck personal finances. But there’s good news – the right cost-cutting strategies can lead to major savings. Some health systems have saved over $6.6 million](https://www.opm.gov/healthcare-insurance/healthcare/plan-information/compare-plans/) just by improving how doctors participate in cost management.

You can cut healthcare spending in many proven ways. Using generic medications, getting free preventive screenings, and choosing in-network providers with better rates all help reduce costs. The Inflation Reduction Act of 2022 creates new ways to save money, especially when you have Medicare coverage through drug price negotiations.

I’ve put together 12 tested strategies to help you manage your healthcare costs in 2025. These practical tips focus on both quick wins and lasting savings, so you get quality care at prices you can afford.

Choose the Right Health Insurance Plan

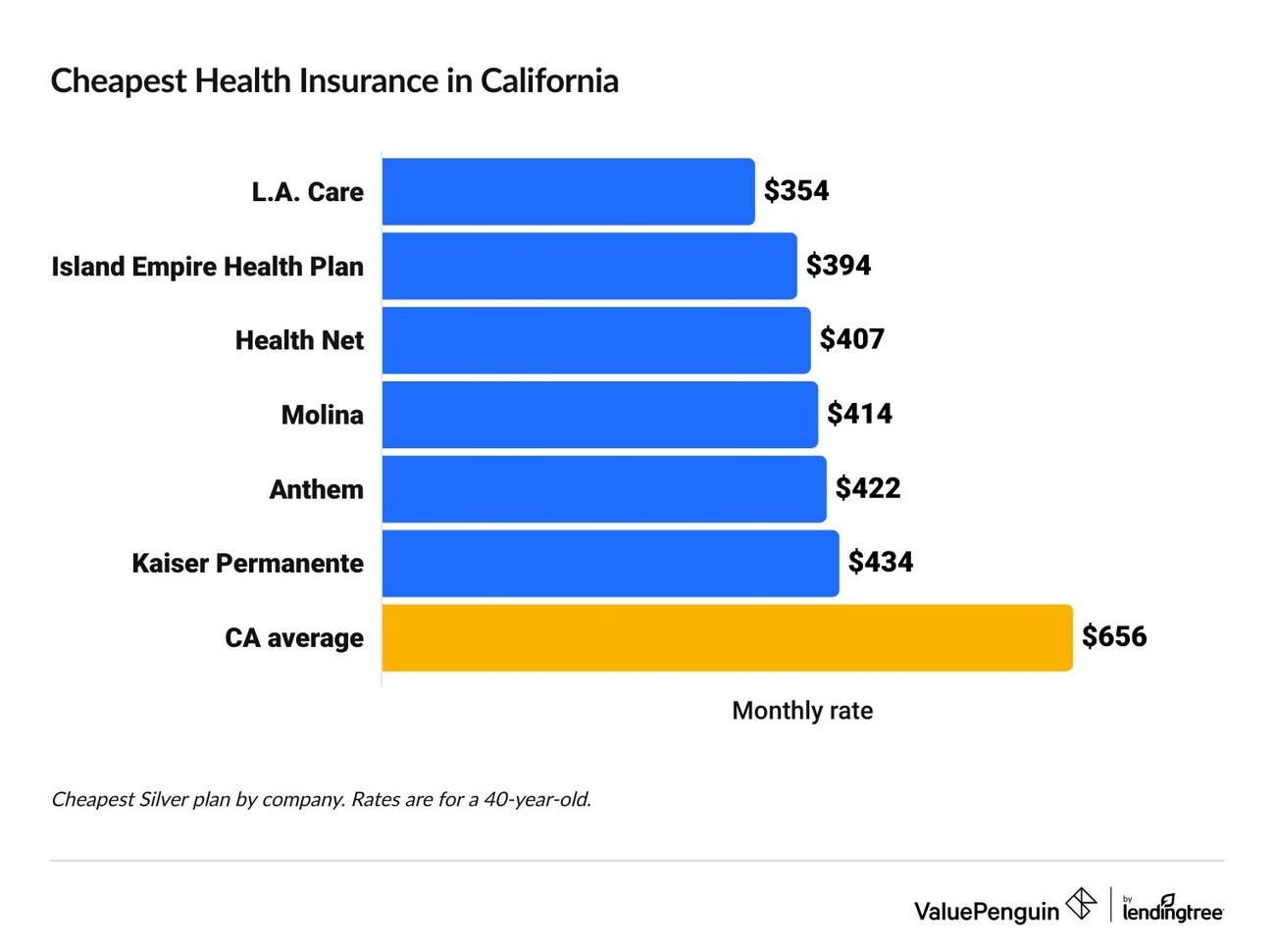

Image Source: ValuePenguin

Choosing the right health insurance plan is the life-blood of managing healthcare costs. A clear grasp of different plan types and their cost implications can help you save money throughout the year.

Understanding Different Plan Types Health Maintenance Organizations (HMOs) typically offer lower premiums among other higher out-of-pocket costs for out-of-network care52. Preferred Provider Organizations (PPOs) give you more flexibility with out-of-network coverage but charge higher premiums52. Exclusive Provider Organizations (EPOs) combine HMO and PPO features. They usually cost less than PPOs and let you visit specialists without referrals52.

Comparing Deductibles vs Premiums Premiums and deductibles have an inverse relationship – lower costs in one area mean higher expenses in the other53. A plan with a $2,000 deductible means you pay this amount before your insurance kicks in53. Healthy people who rarely need medical care benefit from high-deductible plans. People with chronic conditions might do better with plans that have higher premiums but lower deductibles54.

Network Coverage Analysis The average marketplace enrollee can access 40% of doctors near their home through their plan’s network55. About 27% of actively practicing physicians don’t join any marketplace plan network55. Marketplace enrollees typically have access to:

- 43% of primary care doctors

- 52% of medical specialists

- 53% of surgical specialists

- 37% of psychiatrists55

Hidden Cost Considerations You need to look beyond simple premiums and deductibles. Watch out for copayments and coinsurance4. Some plans list providers as in-network even when they’re unavailable – these are called “phantom providers“55. On top of that, 20% of consumers with marketplace plans say their needed providers weren’t covered, and 23% struggled to get appointments with covered providers55.

My work as a financial advisor shows that knowing these elements helps create a detailed strategy to reduce healthcare costs. Note that you should check provider directories and verify network participation before you commit to a plan.

Maximize Health Savings Accounts (HSAs)

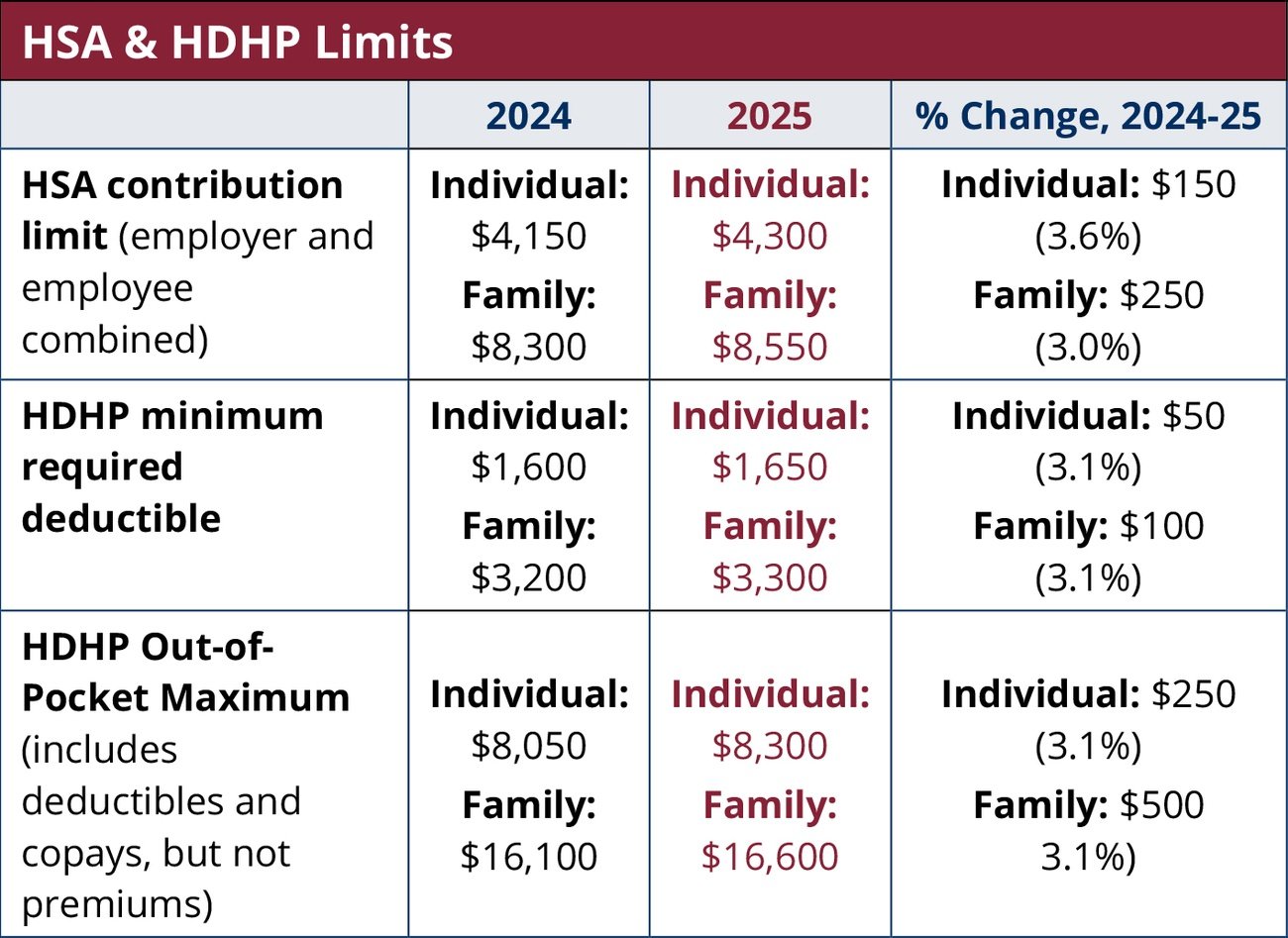

Image Source: MedBen

HSAs are great tools that help manage healthcare costs through tax planning and investment opportunities. My experience as a financial advisor shows how these accounts can substantially cut healthcare costs while building wealth over time.

HSA Contribution Strategies

The 2025 contribution limits let you put in up to $4,300 for self-only coverage and $8,550 for family coverage56. More importantly, people 55 and older can add an extra $1,000 as a catch-up contribution57. You should think over contributing enough to cover your expected medical costs plus some extra for future savings.

Investment Options

HSA funds don’t expire like Flexible Spending Accounts do – they roll over each year and create room for investment growth. Most providers let you invest once your account hits certain levels. Here’s what’s surprising: only 12% of HSA account holders invest their balances58. This is a big deal as it means that most people miss out on growth potential.

Tax Benefits

The triple tax advantages of HSAs make them incredibly valuable to reduce healthcare costs:

- Pre-tax Contributions: Your contributions lower taxable income. Payroll deductions even skip Social Security and Medicare taxes59.

- Tax-free Growth: Investment earnings grow without taxes59.

- Tax-free Withdrawals: You pay no taxes when using funds for qualified medical expenses59.

These 2025 requirements must be met by your health plan to qualify:

- Individual deductibles start at $1,650; family deductibles at $3,30056

- Out-of-pocket costs can’t exceed $8,300 for individuals or $16,600 for families56

The “last-month rule” lets you contribute the full yearly amount if you’re HSA-eligible on December 1st60. All the same, you must stay eligible through December 31st of the next year to avoid penalties60.

Note that your employer’s contributions count toward yearly limits61. A $1,000 employer contribution means you’ll need to adjust your personal contribution down. HSAs work well as both immediate healthcare solutions and long-term savings tools when you plan carefully and contribute regularly.

Leverage Preventive Care Services

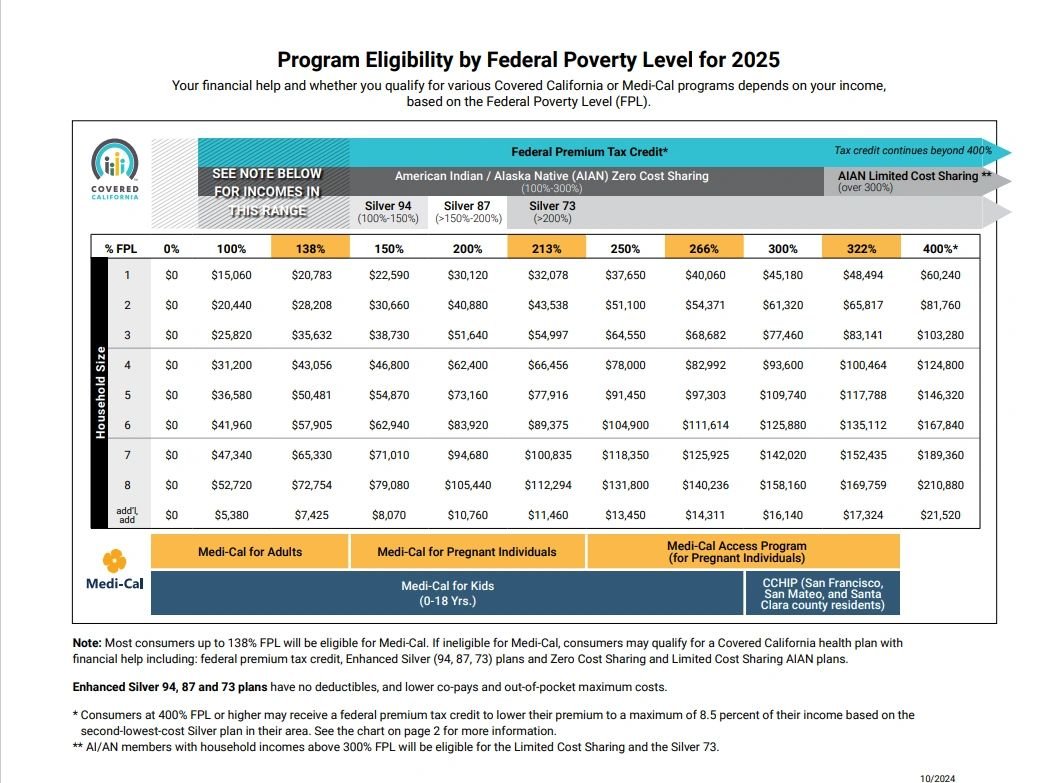

Image Source: Insurance

Preventive care is the life-blood of reducing long-term healthcare expenses. Early detection and intervention help people decrease their medical costs because treating conditions early needs less intensive and expensive care.

Free Screenings and Vaccinations

Public health centers provide many no-cost immunizations and health screenings, whatever your immigration status62. These services include detailed vaccinations for adults, such as COVID-19, flu, hepatitis, and pneumococcal vaccines62. Many hospitals also provide health screenings at minimal or no cost to check for chronic conditions like asthma, cancer, diabetes, and heart disease63.

Early Detection Benefits

Finding diseases early makes treatment outcomes better by starting care right away64. Research showed that delayed or unavailable cancer care results in:

- Lower survival rates

- Increased treatment complications

- Higher care costs64

Primary care doctors are crucial for early detection through regular screenings based on each patient’s age and risk factors65. Finding diseases early means treatments work better with less invasion, which helps reduce healthcare costs65.

Wellness Program Participation

Corporate wellness programs have proven they can cut healthcare costs. A major corporation’s data since 1995 showed that when employees joined wellness programs:

- Smoking rates dropped by two-thirds

- High blood pressure cases fell by more than 50%

- Physical inactivity went down by half66

The company’s wellness initiatives saved about $250 million in healthcare costs over ten years, earning $2.71 for every dollar spent66. Another healthcare organization’s program did even better – they saved $4.90 for every dollar invested over five years67.

Today, 64% of large companies employ health risk assessments or biometric screenings in their wellness programs68. These programs typically include yearly wellness visits, proven screening tools, and better health access through telemedicine options65. Taking part in these preventive services helps people manage their healthcare costs while staying healthy.

Optimize Prescription Drug Costs

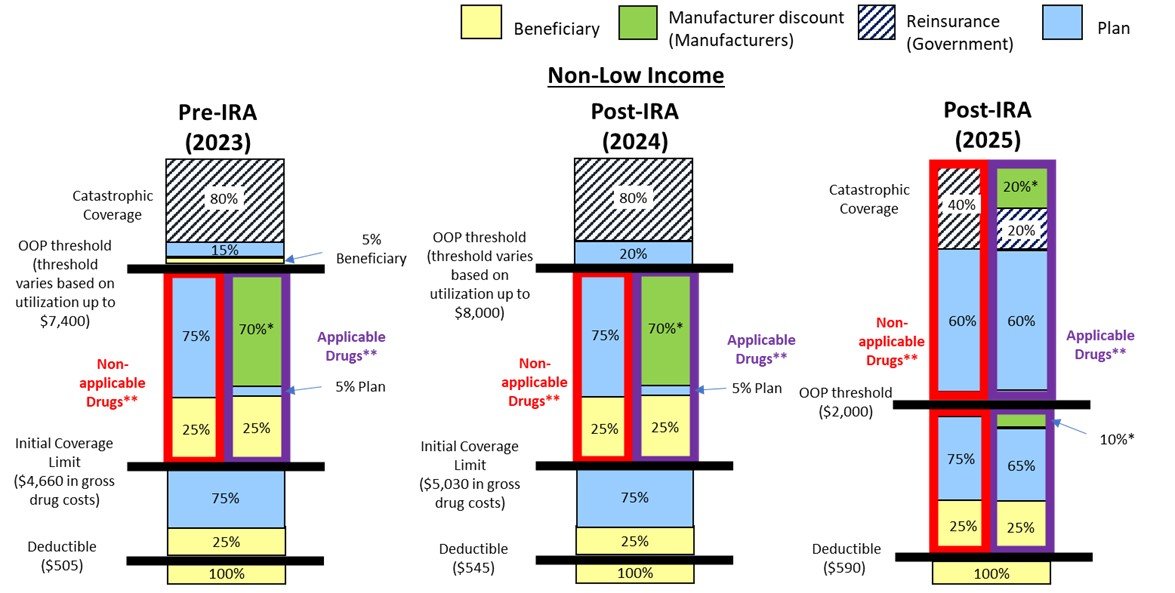

Image Source: CMS

Prescription drug costs make up much of healthcare expenses, and prices are rising faster than most other healthcare services69. My experience as a financial advisor has shown several proven ways to cut medication costs while maintaining quality care.

Generic vs Brand Name Medications

Generic drugs account for nine out of ten prescriptions filled in the U.S.70. These medications cost 80-85% less than brand-name options71, yet brand-name drugs still make up nearly 75% of total prescription costs70. The FDA rigorously tests generic drugs to match brand-name medications’ safety, quality, and effectiveness70. Drug prices drop when patents expire after 17 years because other companies can produce generic versions71.

Mail-Order Pharmacy Benefits

Mail-order pharmacies save money through bulk purchases directly from manufacturers72. You can get 90-day supplies with better discounts than retail stores, which saves 4-7 percentage points compared to traditional pharmacies72. These services are 23 times more accurate when filling prescriptions72 and usually provide round-the-clock access to pharmacist consultations73.

Prescription Discount Programs

These discount programs help lower medication costs:

- SingleCare offers savings up to 80% at over 35,000 participating pharmacies74

- Optum Perks provides discounts at nationwide pharmacies without membership fees74

- ScriptSave WellRx delivers average savings of 65% across 65,000 pharmacies74

Patient Assistance Programs

Pharmaceutical companies’ Patient Assistance Programs (PAPs) give financial support or free medications to people who qualify16. These programs work independently from insurance and can cut out-of-pocket expenses substantially16. RxAssist maintains a complete database of these programs17, which helps people who need brand-name medications without generic options.

Regular price comparisons between pharmacies and careful review of these options can minimize your prescription costs. Working with healthcare providers to find generic alternatives and learning about assistance programs are great ways to maximize savings75.

Use Telemedicine Services

Image Source: Shortlister

Telemedicine has become a budget-friendly alternative to traditional healthcare delivery. It offers huge savings to patients and providers alike. My years of advising clients on healthcare costs have shown me how virtual care reduces financial burden while maintaining quality care.

Virtual Visit Cost Savings

Virtual medical consultations cost much less than visiting a doctor’s office. Data shows virtual visits average $112.80 per encounter compared to $161.40 for traditional office visits8. Patients save money too – telehealth costs $23.80 versus $32.70 for in-person visits8. Health systems report even better results, with telemedicine visits costing 23% less than traditional encounters – $380 versus $49318.

Remote Monitoring Benefits

Remote patient monitoring (RPM) cuts costs by:

- Catching health problems early19

- Reducing unnecessary clinic visits19

- Lowering emergency room visits20

- Cutting hospital readmission rates20

Studies show RPM helps doctors and patients communicate better, which leads to better self-care and patient confidence19. Doctors can spot problems quickly and step in sooner when they monitor patients continuously19.

Digital Health Platform Options

Modern digital health platforms combine several features to maximize telemedicine’s benefits:

- Real-time Vital Sign Tracking: Platforms work with wearable devices to monitor health continuously21

- Secure Video Consultations: HIPAA-compliant systems let you talk privately with doctors21

- Medication Management: Automatic reminders help you take medicine on time21

- Electronic Health Record Integration: Smooth data sharing keeps care coordinated21

Telemedicine saves more than just medical costs. Patients avoid travel expenses and spend less time away from work22. Research shows patients save money on parking, transportation, and hotels22. Rural patients benefit the most since they can access specialist care without traveling long distances19.

Smart use of these services helps you manage healthcare costs while getting excellent care. Healthcare costs keep rising, but telemedicine offers a practical way to save money without losing access to medical expertise.

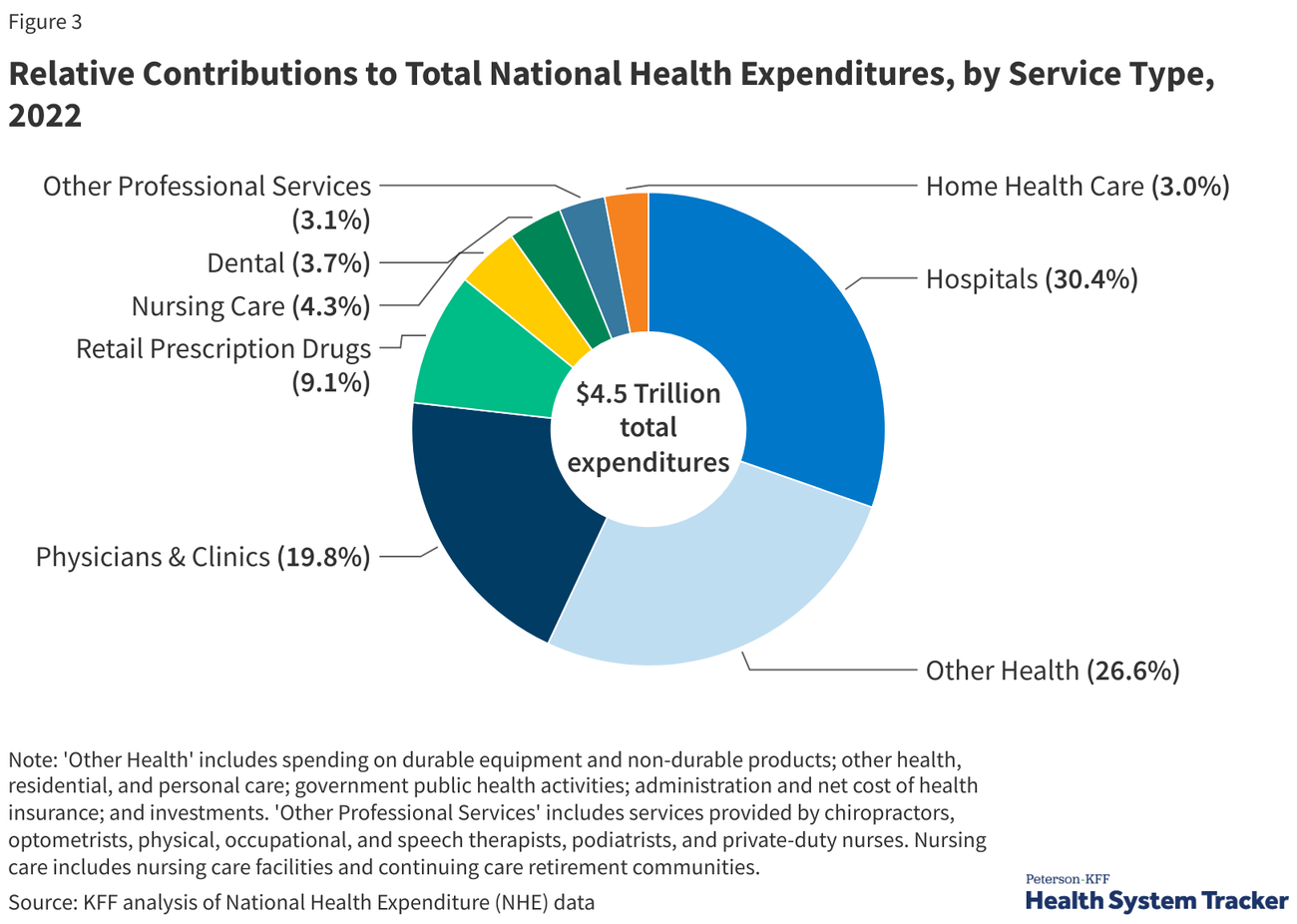

Compare Healthcare Providers

Image Source: KFF

Comparing healthcare providers is a vital strategy to reduce medical expenses. By looking at costs and quality metrics, patients can make smart decisions that lead to big savings.

Price Transparency Tools

Starting January 2021, hospitals must provide clear pricing information online in two formats: a complete machine-readable file and a consumer-friendly display of shoppable services23. The Centers for Medicare and Medicaid Services (CMS) offers tools that help hospitals meet these requirements. Patients can now confirm pricing data more easily24. These transparency measures help estimate care costs beforehand and compare prices between facilities.

Quality Metrics Assessment

Quality measures fall into three main categories to review healthcare providers:

- Structural Measures: Assess provider capacity and systems

- Process Measures: Check clinical practices and guideline compliance

- Outcome Measures: Track actual effects on patient health25

CMS puts quality initiatives into action through accountability and public disclosure5. These measures help track healthcare processes, outcomes, and patient experiences to ensure safe and quick care delivery.

Cost Negotiation Strategies

Medical bills often offer chances for major reductions through smart negotiation. Studies show approximately $195 billion in medical debt exists in America7. The good news is you have several proven ways to negotiate:

- Ask for detailed itemized bills to spot potential errors

- Look for settlement amounts with upfront payments that can save 30-50%

- Set up payment plans with lower interest rates than credit cards7

The best approach is to contact providers before bills reach collection agencies to protect your credit score26. Nonprofit hospitals must give you 240 days from initial billing for financial assistance applications, though they might send bills to collection earlier26.

Smart provider comparison and strategic negotiation can help you manage healthcare expenses effectively. Note that physician services in health systems cost 12-26% more than independent practices, while system-based hospital services cost 31% more on average27. These price differences help you make informed choices when picking healthcare providers.

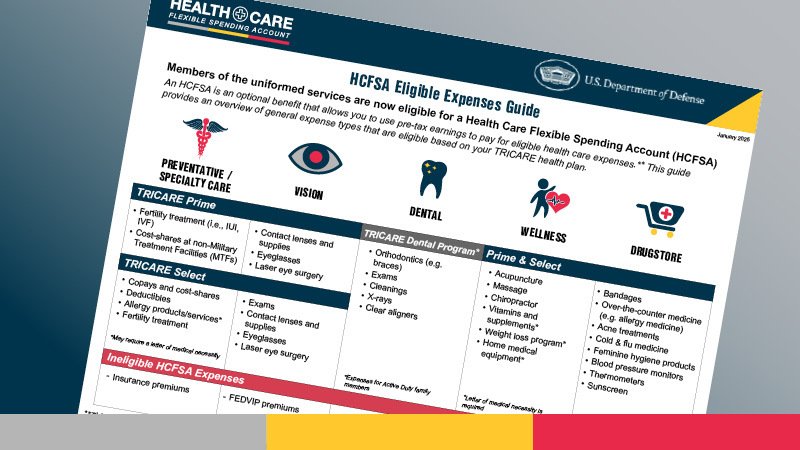

Take Advantage of Flexible Spending Accounts

Image Source: FINRED – USALearning

Flexible Spending Accounts (FSAs) help you cut down healthcare costs through tax-advantaged savings. I’m a financial advisor, and I want you to get the most out of these accounts to save money on healthcare.

FSA Planning

Your FSA contributions lower your taxable income with pre-tax payroll deductions28. You can contribute up to $3,050 annually in 202529. Most employers let you access your full annual contribution right from day one6. This means you can handle big medical expenses early in the year. Just watch your spending carefully because unused funds usually go back to your employer6.

Eligible Expenses

You can use FSAs for many healthcare costs:

- Medical copayments and deductibles

- Prescription medications and over-the-counter drugs

- Vision care expenses like eyeglasses and contact lenses

- Dental procedures and orthodontia30

You can use FSA funds for alternative treatments like acupuncture too28. Your claims will go through smoothly if you keep records with these five vital details:

- Patient name

- Provider name

- Service date

- Type of service

- Cost6

Timing Your Claims

You need to know FSA deadlines to get the most benefits. Your employer will likely give you one of two options:

- A grace period up to 2.5 months after the plan year ends28

- A carryover option that lets you roll up to $610 into next year28

Claims during the grace period first use last year’s leftover money before touching current year funds28. Calendar year plans typically run this period from January 1 through March 1528. Your employer might also give you a “run-out” period, usually 90 days, to submit last year’s claims31.

FSAs are a great way to cut healthcare costs if you time things right and plan ahead. Set up a monthly or quarterly schedule to submit claims instead of waiting until year-end31. This way, you’ll make the most of your tax-advantaged healthcare dollars and keep your reimbursement paperwork in order.

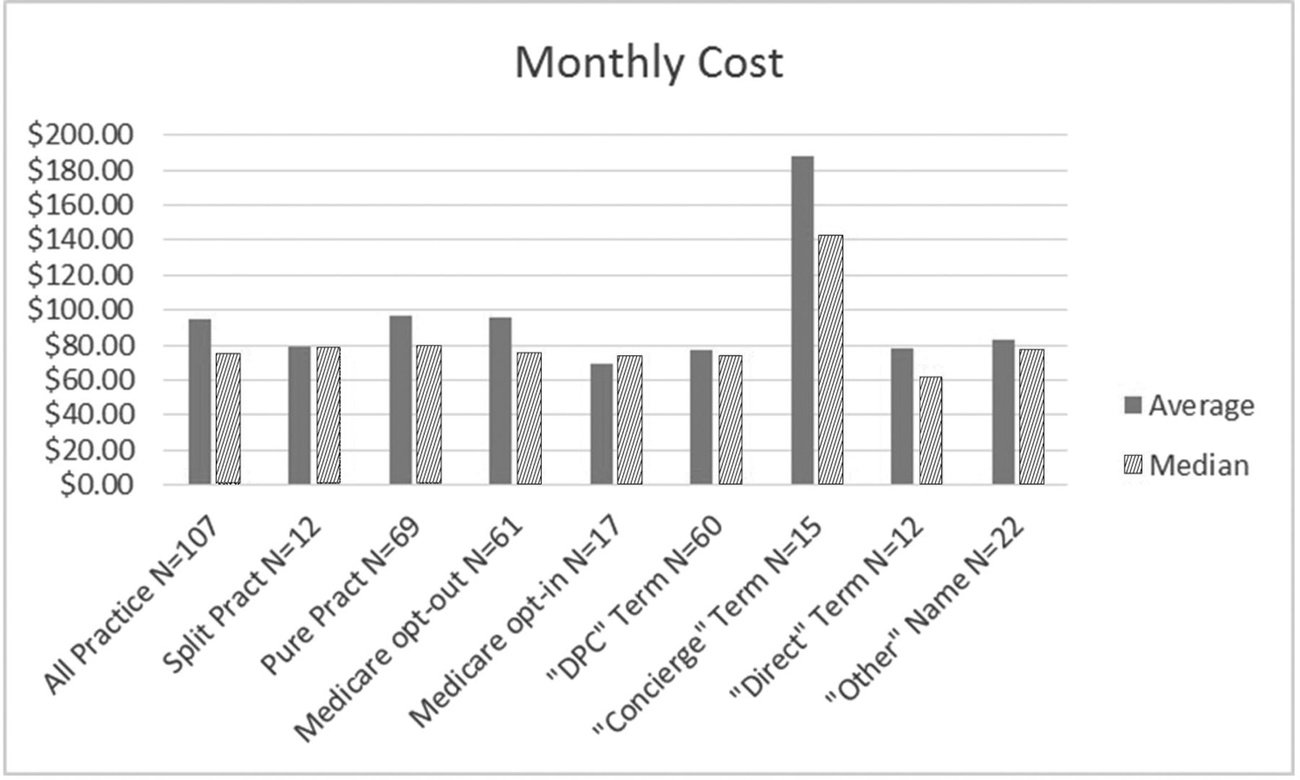

Consider Direct Primary Care

Image Source: Journal of the American Board of Family Medicine

Direct Primary Care (DPC) offers a compelling way to cut healthcare costs with a simpler payment model. You pay a membership fee that creates a direct financial connection between you and your physician, without insurance companies in between.

Membership Model Benefits

DPC practices work with straightforward monthly fees that usually range from $50-$1003. Your membership gets you better access to physicians who take care of fewer patients to give you customized attention9. The results speak for themselves – DPC physicians report 40% fewer emergency room visits32 and their patients show 25.54% lower hospital admission rates32.

Cost Comparison with Traditional Care

Real examples show how DPC saves you money. Take routine laboratory tests – blood sugar, CBC, metabolic profiles, and thyroid labs cost just $5-10 per test with DPC33. These prices beat traditional insurance deductibles hands down. A detailed breakdown shows:

- A 55-year-old pays $67 monthly for DPC membership33

- You pay nothing extra for complicated respiratory infections33

- You can get prescription medications at wholesale prices right from practices34

- Many patients save $399 yearly33

Service Coverage

Your DPC membership includes extensive primary care services:

- Clinical and laboratory services

- Consultative services

- Care coordination

- Detailed care management9

DPC practices cover more than 85% of typical healthcare needs without deductibles or coinsurance costs10. Members get discounted rates on laboratory work, radiology services, and various procedures through wholesale pricing deals10. Companies that use DPC programs see impressive results – 54% reduction in emergency claims and 13% lower total claim costs10.

These benefits aside, you should keep catastrophic insurance coverage for specialized care and emergencies3. Using DPC with high-deductible health plans typically saves 20-30% on overall healthcare costs10. This smart combination helps you handle routine medical expenses while staying protected against major health events.

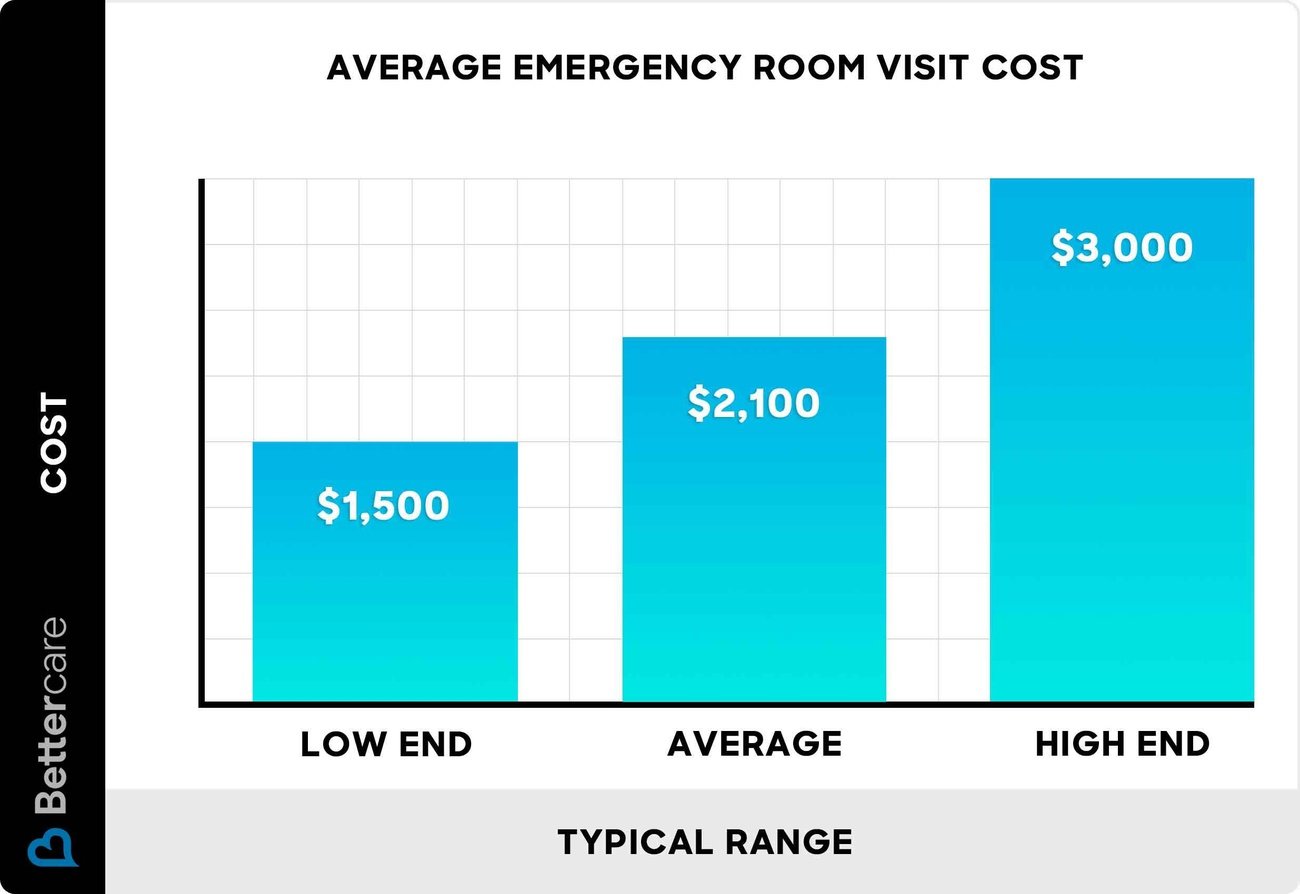

Navigate Emergency Care Wisely

Image Source: BetterCare

Your healthcare expenses can vary dramatically based on where you seek emergency care. Over the years, I’ve helped many clients navigate emergency care costs as a financial advisor. My guidance has helped them save thousands of dollars while getting quality treatment.

Urgent Care vs ER Costs

The price gap between urgent care and emergency rooms is nowhere near close. A typical urgent care visit costs $165, while an ER visit runs around $1,70035. Research shows that urgent care centers in local areas reduce ER visits by 17%36. These centers provide the same level of care at substantially lower costs for common issues like minor burns, cuts that need stitches, or simple broken bones37.

In-Network Emergency Facilities

Insurance companies must cover emergency care during medical emergencies, whatever the network status – it’s federal law37. Choosing in-network facilities is a vital part of managing costs. The Emergency Medical Treatment and Labor Act (EMTALA) requires Medicare-participating hospitals to:

- Provide appropriate medical screening examinations

- Offer necessary stabilizing treatment

- Arrange appropriate transfers when needed38

Understanding Coverage Rules

Federal protection sets specific guidelines for emergency care coverage. The No Surprises Act, which took effect in January 2022, protects patients from unexpected out-of-network charges for:

- Emergency room services

- Post-stabilization care

- Air ambulance services11

Hospitals can’t delay emergency screening or treatment to check insurance coverage39. Your insurance must treat true emergencies at the nearest ER as in-network care12. Be careful when choosing emergency care locations – freestanding ERs often charge more than hospital-based facilities13.

Smart choices about care facilities and knowledge of coverage rules will help you manage emergency healthcare costs better. Urgent care centers can handle about 89% of cases that people take to emergency rooms. This offers great savings without compromising care quality36.

Bundle Medical Procedures

Image Source: Penn LDI – University of Pennsylvania

Healthcare providers now use bundled payment programs as a new way to save costs. These programs set fixed prices for specific types of care. Data analysis shows they can cut expenses while keeping quality high.

Package Pricing Benefits

Bundled payments help reduce costs for medical procedures of all types. Studies show an average saving of $4,229 per surgery – a 10.7% drop in total costs40. Patients save money too, with their out-of-pocket costs dropping by $498 – that’s 27.7% less40. Joint replacements, spinal fusion, and bariatric procedures work well with these programs. Spinal fusion surgeries show the biggest savings40.

Negotiation Techniques

Smart planning and risk management make bundled payment negotiations work better. Here’s what matters:

- Clear rules about risk factors and health conditions41

- Stop-loss provisions in reinsurance agreements41

- Well-defined timeframes that protect against unrelated medical costs41

- Quick and simple claims submission41

Both patients and providers get better results as they learn the system40. Companies save $7 for each $1 they waive in patient copayments40.

Quality Assurance

Quality measures play a big role in bundled payment programs. Healthcare providers usually:

- Add care navigators to help guide patients42

- Create better ways for providers to talk to each other42

- Let healthcare teams share patient data42

Research shows these payment arrangements help providers work together better42. Teams think more carefully about service efficiency, which leads to better patient outcomes at lower costs42. Quality scorecards paired with bundled payments push teams to improve their care43.

My experience as a financial advisor shows that organizations using bundled payments cut unplanned readmissions by 10%43. Teams can remove unnecessary services while keeping care quality high through good coordination43. Bundled payments offer a practical way to save money in healthcare.

Maintain Healthy Lifestyle Habits

Image Source: Blue Cross NC

A healthy lifestyle can significantly reduce your long-term healthcare costs. Smart lifestyle choices help you save money on medical expenses and lead a better life.

Preventive Health Strategies

Studies show that good health during your working years directly associates with steady employment and lower disease risks14. A 45-year-old woman with high blood pressure can cut her yearly pre-retirement healthcare costs by $3,65144. Strong relationships with family, friends, and support networks boost both physical and mental health44.

Fitness Program Discounts

Insurance companies now provide great fitness program benefits as economical wellness solutions. Kaiser Permanente gives its members discounted rates on ClassPass monthly memberships, which lets them access thousands of fitness studios across the country45. Blue Shield members can use nationwide fitness centers for just $19 monthly and join virtual classes46. Members of Anthem can get gym reimbursements when they meet minimum visit requirements47.

Long-term Cost Benefits

Healthy lifestyle choices create significant financial rewards over time. Research shows that losing 10% of body weight can cut lifetime medical costs by $2,200 to $5,300 for overweight people1. Cutting out a $10 daily junk food habit saves $3,650 each year1. Employer wellness programs show remarkable results:

- 54% reduction in emergency claims14

- 13% decrease in total claim costs14

- $4 saved in lost productivity for every $1 spent on healthcare48

Organizations report savings of more than $500 billion yearly through complete wellness programs that target changeable risk factors48. Community-based health programs generate $5 in savings for every $1 invested, according to The Trust for America’s Health48. Good health proves just as valuable as traditional financial investments, as it affects both current healthcare costs and long-term financial security1.

Review Medical Bills Carefully

Image Source: PeopleKeep

A close look at medical bills is a vital step to manage healthcare costs. Research shows that medical bills contain errors 80% of the time15, which makes a full picture absolutely necessary.

Common Billing Errors

Medical bills often include several types of mistakes that can get pricey:

- Duplicate Charges: Bills show up multiple times for similar procedures15

- Incorrect Billing: Charges appear for services patients never received15

- Upcoding: Higher diagnosis codes lead to increased charges15

- Unbundled Charges: Services that should be grouped together get billed separately15

Negotiation Tips

Timing plays a significant role in disputing medical bills. Patients have the right to challenge charges within 120 days of receiving the original bill if they exceed $400 above the good faith estimate2. During negotiations, providers cannot:

- Send bills to collections

- Add late fees

- Take any retaliatory actions2

Most providers give settlement options and often reduce bills by 30-50% for upfront payments49. Nonprofit hospitals must also provide a 240-day grace period from the original billing date for financial assistance applications49.

Payment Plan Options

Healthcare providers usually offer several ways to help manage medical expenses:

- Interest-Free Plans: Many hospitals and clinics let patients pay without interest15

- Administrative Fee Reduction: Providers must cut bills by at least $12.50 during payment settlements2

- Financial Assistance: Nonprofit hospitals must help eligible patients financially50

Uninsured patients should receive good faith estimates within these timeframes:

- One business day for services scheduled 3 business days ahead

- Three business days for services scheduled 10 business days ahead51

Patients can reduce their healthcare expenses through smart bill review and negotiation. It’s worth mentioning that you should ask for detailed, itemized bills that show every service and charge15. Quick action on billing concerns helps maintain a strong negotiating position and protects your credit score49.

Comparison Table

| Strategy | Primary Cost Benefit | Average Savings | Key Features | Implementation Requirements |

|---|---|---|---|---|

| Choose the Right Health Insurance Plan | Lower premium or out-of-pocket costs | Varies by plan type | Access to 40% of local doctors; Multiple plan types (HMO, PPO, EPO) | Annual plan review and network analysis |

| Maximize HSAs | Triple tax advantage | Up to $4,300 (individual) or $8,550 (family) annually | Tax-free contributions, growth, and withdrawals; Investment options | High-deductible health plan enrollment |

| Utilize Preventive Care | Reduced long-term treatment costs | $250 million over 10 years (corporate example) | Free screenings; Early detection; Wellness programs | Regular preventive visits and screenings |

| Cut Prescription Drug Costs | 80-85% savings on generic drugs | Varies by medication | Generic alternatives; Mail-order options; Discount programs | Price comparison; Provider consultation |

| Use Telemedicine Services | Lower per-visit costs | $48.60 per visit average savings | Remote monitoring; Digital health platforms; Reduced travel costs | Internet access; Compatible devices |

| Compare Healthcare Providers | Reduced service costs | 12-26% for physician services | Price transparency tools; Quality metrics; Cost negotiation | Research and comparison shopping |

| Take Advantage of FSAs | Pre-tax savings on medical expenses | Up to $3,050 annually | Immediate fund access; Broad expense coverage | Employer-sponsored plan enrollment |

| Explore Direct Primary Care | Reduced routine care costs | $399 annually average | Monthly membership model; Complete primary care; Wholesale pricing | DPC provider availability |

| Guide Emergency Care Choices | Lower acute care costs | $1,535 per visit (urgent care vs ER) | Network coverage protection; Facility options | Understanding coverage rules |

| Bundle Medical Procedures | Fixed pricing for care episodes | $4,229 per surgery average | Package pricing; Quality assurance measures | Provider participation |

| Maintain Healthy Lifestyle | Reduced lifetime medical costs | $2,200-$5,300 (weight management example) | Fitness program discounts; Preventive strategies | Consistent health maintenance |

| Review Medical Bills Carefully | Error correction savings | 30-50% through negotiation | Dispute rights; Payment plans; Financial assistance | Detailed bill review; Timely action |

Final thoughts

My 13 years as a financial advisor have shown me how healthcare costs can deeply affect personal finances. These 12 strategies provide practical ways to cut medical expenses while keeping quality care. The best results come from using several approaches together.

A strong foundation for healthcare savings starts with choosing the right insurance and optimizing HSA or FSA accounts. You can minimize long-term costs by focusing on preventive care and using telemedicine services. Smart prescription drug management and careful provider selection help cut expenses even further.

The numbers back up these strategies. Healthcare systems have saved $6.6 million by improving physician involvement. Patients using Direct Primary Care visit emergency rooms 40% less often. Telemedicine visits cost 30% less than going to the office. Medical bills often contain errors, so a detailed review gives you the full picture.

Everyone’s healthcare needs are different, but these approaches can adapt to your situation. You can make sustainable changes without feeling overwhelmed by starting with one or two strategies and adding more over time. My clients report big savings when they follow these recommendations.

Your strategy needs regular review and updates as healthcare needs and market conditions change. We can help you put these cost-saving approaches into action – just reach out to us at support@trendnovaworld.com. Taking charge of your healthcare now protects your health and financial future.

To learn more visit:

17 Clever Back to School Shopping on a Budget Hacks (Save Up to 70%)

FAQs

Q1. What are some effective ways to control rising healthcare costs? Some effective strategies include using generic medications, leveraging preventive care services, utilizing telemedicine, comparing healthcare providers, and carefully reviewing medical bills for errors. Implementing multiple approaches often yields the best results in reducing overall healthcare expenses.

Q2. How can I save money on prescription drugs? You can save on prescription drugs by opting for generic alternatives when available, using mail-order pharmacy services, participating in prescription discount programs, and exploring patient assistance programs offered by pharmaceutical companies. These methods can lead to significant cost reductions, with generic drugs costing 80-85% less than brand-name alternatives.

Q3. What are the benefits of using telemedicine services? Telemedicine offers several benefits, including lower per-visit costs (averaging $48.60 less than in-person visits), convenience, reduced travel expenses, and access to remote monitoring. It’s particularly beneficial for routine consultations and follow-ups, making healthcare more accessible and cost-effective.

Q4. How can I maximize the benefits of my Health Savings Account (HSA)? To maximize your HSA, contribute the maximum allowed amount annually ($4,300 for individuals or $8,550 for families in 2025), use it for qualified medical expenses, and consider investing unused funds for long-term growth. HSAs offer triple tax advantages: tax-free contributions, growth, and withdrawals for medical expenses.

Q5. Why is it important to review medical bills carefully? Reviewing medical bills is crucial because approximately 80% contain errors that can inflate charges unnecessarily. Common mistakes include duplicate charges, incorrect billing, and upcoding. By carefully examining bills, you can identify and dispute errors, potentially saving 30-50% through negotiation with healthcare providers.

References

[1] – https://njaes.rutgers.edu/health-finance/health-behaviors.php

[2] – https://www.cms.gov/medical-bill-rights/help/dispute-a-bill

[3] – https://www.elationhealth.com/resources/blogs/the-cost-savings-for-direct-primary-care-patients

[4] – https://www.aetna.com/health-guide/explaining-premiums-deductibles-coinsurance-and-copays.html

[5] – https://www.cms.gov/medicare/quality/measures

[6] – https://www.healthequity.com/library/8-things-to-know

[7] – https://www.npr.org/2023/03/24/1165953653/medical-bills-debt-negotiation-forgiveness

[8] – https://www.ahajournals.org/doi/10.1161/JAHA.122.028713

[9] – https://www.aafp.org/family-physician/practice-and-career/delivery-payment-models/direct-primary-care.html

[10] – https://pmc.ncbi.nlm.nih.gov/articles/PMC8504342/

[11] – https://www.cms.gov/medical-bill-rights/know-your-rights/using-insurance

[12] – https://www.bcbstx.com/find-care/where-you-go-matters/know-your-network

[13] – https://healthselect.bcbstx.com/find-a-doctor-hospital/options-for-care

[14] – https://pmc.ncbi.nlm.nih.gov/articles/PMC8299921/

[15] – https://www.peoplekeep.com/blog/the-secret-to-negotiating-lower-medical-bills

[16] – https://www.cms.gov/medicare/coverage/prescription-drug-coverage/patient-assistance-program

[17] – https://www.rxassist.org/

[18] – https://www.pennmedicine.org/news/news-releases/2023/june/employee-telemed-visits-25-percent-less-costly-for-health-system

[19] – https://pmc.ncbi.nlm.nih.gov/articles/PMC10730976/

[20] – https://www.healthrecoverysolutions.com/blog/the-top-13-benefits-of-remote-patient-monitoring

[21] – https://www.mahalo.health/insights/top-digital-health-platforms

[22] – https://pmc.ncbi.nlm.nih.gov/articles/PMC8852313/

[23] – https://www.cms.gov/priorities/key-initiatives/hospital-price-transparency

[24] – https://cmsgov.github.io/hpt-tool/

[25] – https://www.ahrq.gov/talkingquality/measures/types.html

[26] – https://www.myhealthcarefinances.com/medical-bills/negotiating-and-paying-medical-bills

[27] – https://hcp.hms.harvard.edu/news/care-costs-more-consolidated-health-systems

[28] – https://www.investopedia.com/ask/answers/111314/how-does-grace-period-work-my-flexible-spending-account-fsa.asp

[29] – https://www.usatoday.com/story/money/personalfinance/2023/03/03/flexible-spending-account-deadlines-expenses/11389674002/

[30] – https://www.cigna.com/individuals-families/member-guide/eligible-expenses

[31] – https://fsastore.com/articles/learn-fsa-run-period.html?srsltid=AfmBOopVZYF_ckKveN0viTmsMrefXjXWDdH6p4r5XlWuRSR1Qsh0Zsla

[32] – https://www.phprimarycare.com/direct-primary-care/direct-primary-care-vs-traditional-primary-care/

[33] – https://tablehealth.com/direct-primary-care-saves-you-money/

[34] – https://dpcnation.org/faq/dpc-saves-you-money/

[35] – https://www.uhc.com/member-resources/where-to-go-for-medical-care/care-options-and-costs

[36] – https://academyhealth.org/blog/2021-07/research-suggests-urgent-care-centers-reduce-health-care-costs-providing-alternative-emergency-department

[37] – https://www.webmd.com/health-insurance/insurance-tips-for-er

[38] – https://www.cms.gov/priorities/your-patient-rights/emergency-room-rights

[39] – https://www.acep.org/life-as-a-physician/ethics–legal/emtala/emtala-fact-sheet

[40] – https://www.rand.org/news/press/2021/03/01/index1.html

[41] – https://healthexec.com/topics/healthcare-management/healthcare-economics/5-things-know-about-negotiating-bundled-payments

[42] – https://www.cms.gov/priorities/innovation/key-concepts/bundled-payments

[43] – https://www.healthcarevaluehub.org/advocate-resources/publications/bundled-payments

[44] – https://www.protectedincome.org/the-lifelong-connection-of-health-wellness-and-finances-signature-series/

[45] – https://healthy.kaiserpermanente.org/georgia/health-wellness/fitness-deals

[46] – https://www.blueshieldca.com/en/home/be-well/live-healthy/fitness-exercise-physical-therapy

[47] – https://www.anthem.com/member-resources/wellness-programs

[48] – https://www.ncbi.nlm.nih.gov/books/NBK53914/

[49] – https://time.com/7208964/how-to-negotiate-medical-bills/

[50] – https://www.cms.gov/medical-bill-rights/help/plan/no-insurance-cannot-pay-bill

[51] – https://www.dfs.ny.gov/consumers/health_insurance/surprise_medical_bills

[52] – https://www.anthem.com/individual-and-family/insurance-basics/health-insurance/choosing-a-plan

[53] – https://www.healthpartners.com/blog/premium-vs-deductible-understanding-the-difference/

[54] – https://www.usbank.com/financialiq/plan-your-future/health-and-wellness/steps-to-choosing-a-health-insurance-plan.html

[55] – https://www.kff.org/private-insurance/report/how-narrow-or-broad-are-aca-marketplace-physician-networks/

[56] – https://www.irs.gov/pub/irs-drop/rp-24-25.pdf

[57] – https://www.irs.gov/publications/p969

[58] – https://www.edwardjones.com/us-en/market-news-insights/guidance-perspective/maximize-hsa

[59] – https://www.hsacentral.net/consumers/tax-benefits-health-savings-account/

[60] – https://www.fidelity.com/learning-center/smart-money/hsa-contribution-limits

[61] – https://www.forbes.com/sites/davidrae/2024/12/02/the-new-2025-health-savings-accounts-hsa-limits-explained/

[62] – https://www.nyc.gov/site/doh/services/immunization-clinics.page

[63] – https://portal.311.nyc.gov/article/?kanumber=KA-02769

[64] – https://www.who.int/activities/promoting-cancer-early-diagnosis

[65] – https://www.chenmed.com/blog/role-primary-care-early-detection-and-intervention-seniors

[66] – https://hbr.org/2010/12/whats-the-hard-return-on-employee-wellness-programs

[67] – https://pmc.ncbi.nlm.nih.gov/articles/PMC11640894/

[68] – https://www.healthcarevaluehub.org/advocate-resources/publications/wellness-programs-and-incentives-review-evidence

[69] – https://www.buzzrx.com/blog/best-prescription-discounts-of-2024

[70] – https://www.uhhospitals.org/blog/articles/2022/07/generic-vs-brand-name-drugs-is-there-a-difference

[71] – https://consumer.ftc.gov/articles/generic-drugs-low-cost-prescriptions

[72] – https://www.pcmanet.org/mail-service-pharmacy/

[73] – https://www.bluecrossnc.com/blog/insurance-basics/tools-services/mail-order-pharmacy-prescription-drugs

[74] – https://www.healthline.com/health/best-prescription-discounts

[75] – https://perks.optum.com/blog/compare-prescription-discount-cards

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| FinanceFor more information, contact us at support@trendnovaworld.com