Car insurance rates have reached their highest peak since 1976, surging an astounding 19% in the last year. The average American pays $2,014 each year for car insurance, which takes about 3% of their income just for premiums.

My 13 years as a financial advisor have shown me how these rising costs affect families. I’ve found many ways to save money on insurance that deliver results. Smart changes can reduce your premium by 15-30% when you adjust your deductible. You could save over $2,000 by keeping good credit. These proven methods help cut costs while keeping your coverage intact.

The premiums keep climbing, and you need to optimize your insurance spending. I’ve put together 15 tested strategies to help you save money on insurance in 2025. These strategies work – good drivers earn up to 22% off with certain providers. You can even cut your premiums by 23% by adding anti-theft devices to your vehicle.

Leverage Smart Home Technology for Premium Discounts

Image Source: NerdWallet

“Many insurance companies now offer reduced premiums for installing smart security systems, leak detectors, and other devices that help prevent costly damages.” — Grit Insurance, Insurance company providing expert insights

Smart home technology helps cut insurance costs and improves home protection. Homeowners can get substantial premium discounts by installing smart devices that monitor and detect issues early. My research into insurance trends confirms this.

Best Smart Devices for Insurance Savings

Water leak detectors stand out as the most valuable smart devices to save on insurance. This makes sense since water damage accounts for nearly 25% of all homeowners insurance claims59. Smart water sensors like Flo by Moen or Honeywell systems can spot leaks early. These systems prevent costly damage that typically runs about $11,000 per incident60.

Smart security systems with professional monitoring can lower premiums by up to 13% with certain insurers61. On top of that, smoke and carbon monoxide detectors that send smartphone alerts provide better protection. These qualify you for extra discounts, especially when you combine them with other smart devices.

Installation and Setup Guide

You’ll need proper documentation to prove device installation and functionality to your insurance provider. To get the best savings:

- Get professional help installing complex systems like water shutoff valves

- Install simple devices like smart thermostats and doorbell cameras yourself

- Check devices regularly to keep getting discounts

Average Premium Reductions

Device type and insurance provider affect discount amounts. Smart home technology can save homeowners 10% to 15% on their premiums62. Insurance companies often give specific discounts:

- Up to 5% for smart security systems59

- Another 4% for water sensors62

- Up to 20% total savings with multiple smart devices59

ROI Analysis

Smart devices need upfront investment, but they pay off beyond just insurance savings. A good example is early leak detection that prevents $11,000 in average water damage costs60. Multiple smart devices often result in higher total discounts. Some insurers give up to 13% off for systems with professional monitoring61.

Talk to your insurance provider before buying smart devices. Check which devices qualify and what you need to get discounts. Keep records of all installations and update your devices regularly to maintain your premium reductions.

Optimize Your Credit Score Strategically

Image Source: Bankrate

“Getting insurance quotes doesn’t hurt your credit-based insurance score or other credit scores.” — Experian, Major credit reporting agency

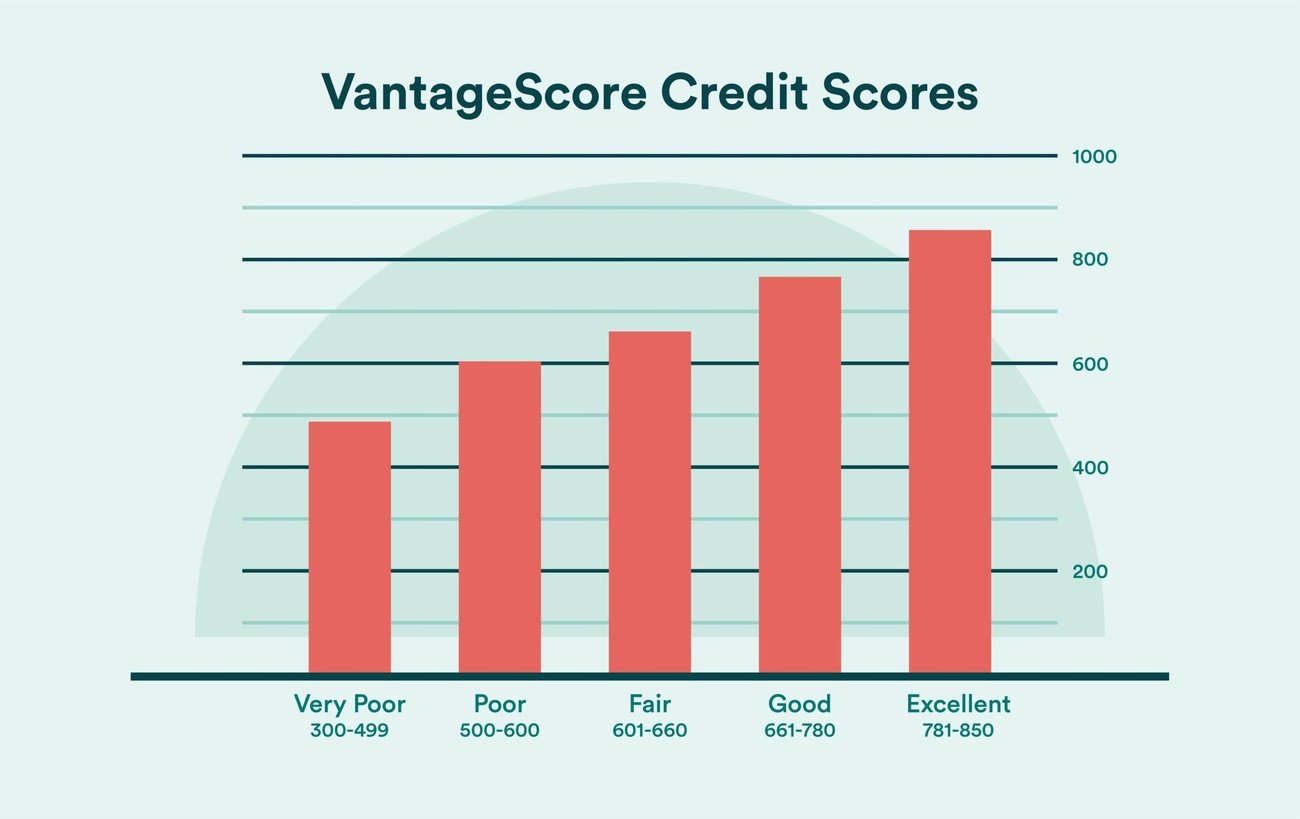

Credit scores play a significant part in setting insurance premiums in most states. The largest study of insurance data shows drivers with poor credit (below 580) pay nearly double for their car insurance compared to those with exceptional credit (above 800)63.

Credit Score’s Effect on Insurance Rates

Insurance companies use credit-based insurance scores to review risk by looking at payment history and credit utilization. Recent data confirms that drivers with poor credit pay $166 more monthly for full coverage than those with good credit64. This means in twelve states including Texas, Georgia, and New York, poor credit more than doubles insurance rates64.

Quick Credit Improvement Tactics

You can reduce your insurance costs through these credit improvement steps:

- Bills need consistent on-time payments – payment history carries the highest weight in credit scoring formulas65

- Credit utilization should stay below 30% by requesting higher credit limits or paying balances more often63

- Old credit accounts need to remain active with small charges now and then65

- Credit reports should be checked for errors – in 2021, over one-third of Americans found mistakes on their reports63

Timeline for Premium Adjustments

Insurance rates usually reflect credit score improvements within 30-45 days after positive changes to your credit report65. The effect varies by state and insurer. California, Hawaii, Massachusetts, and Michigan are the only states that ban using credit scores for insurance pricing64.

Your insurance rates can’t increase mid-policy term due to credit changes63. Insurance companies must tell you within 30 days if they deny coverage or charge more based on your credit report66. You can ask for an exception from higher rates if major illness, temporary job loss, divorce, or identity theft affected your credit score66.

A single credit tier improvement can save you money. Moving from poor to average credit can reduce insurance costs by approximately $600 annually63. Regular credit checks and smart improvement strategies often result in lower insurance premiums as time goes by.

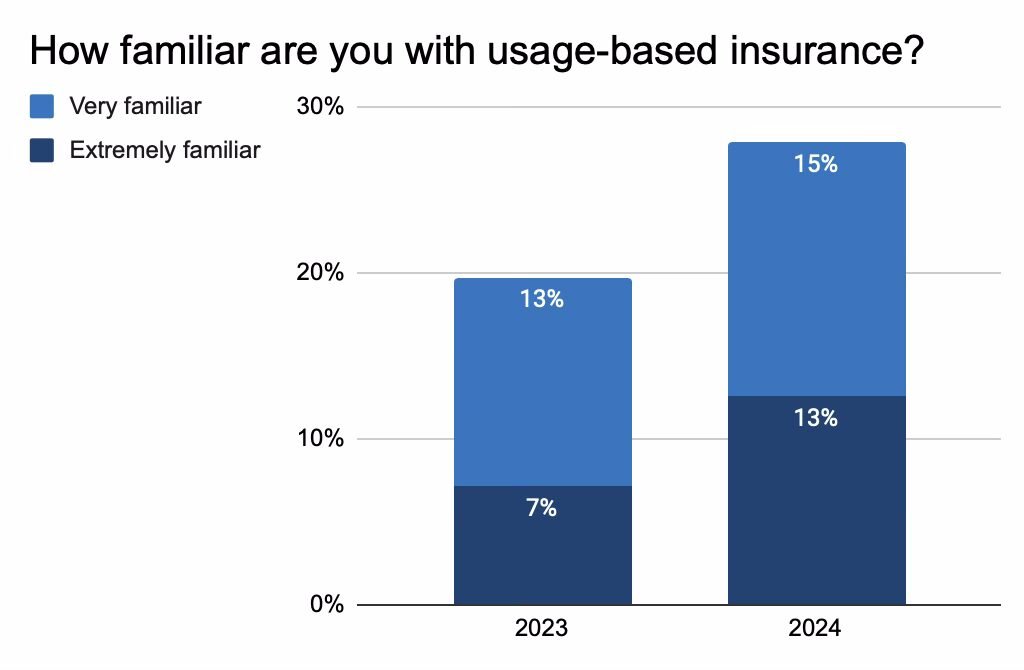

Master Usage-Based Insurance Programs

Image Source: Cambridge Mobile Telematics

Usage-based insurance programs help reduce premiums by tracking your driving habits in real time. My experience as a financial advisor has shown how these programs have evolved into sophisticated tools that help cost-conscious drivers get tailored rates.

Top Telematics Programs Comparison

Major insurers now give drivers unique telematics options. State Farm’s Drive Safe & Save provides rates 30% below average premiums67. Nationwide’s SmartRide gives you a 10% discount when you sign up and you can save up to 40%68. Liberty Mutual’s RightTrack program lets you save up to 30% without any long-term location tracking68.

Driving Habits That Lower Premiums

Telematics devices track these specific behaviors that affect your insurance costs:

- Smooth acceleration and braking patterns

- Following posted speed limits

- Staying off roads late at night

- Limited phone use while driving

- Reasonable mileage limits

Privacy Considerations

While telematics can save you money, privacy is a vital concern. Most programs need constant access to your smartphone’s location69. Research shows 68% of drivers worry about data privacy70. You should review your insurer’s privacy policy about:

- Data collection methods

- Information sharing practices

- Duration of data retention

- Third-party access restrictions

Potential Savings Analysis

Your potential savings through telematics programs vary based on demographics. Recent data reveals:

- Overall median savings: $120 annually71

- Drivers under 45: $145 yearly71

- Policies with multiple drivers get higher average discounts71

- Sign-up bonuses: 5-10% immediate discount72

Demographics play a role in savings potential. Black policyholders save about $186 annually, Latino policyholders $174, white policyholders $98, and Asian policyholders $10971. While insurers advertise maximum discounts of 25-40%, typical savings hover around 10%71.

Note that savings show up after several months of monitoring because insurers need enough data to calculate your risk profile. The biggest discounts go to drivers who travel during off-peak hours and show consistent, safe driving habits71.

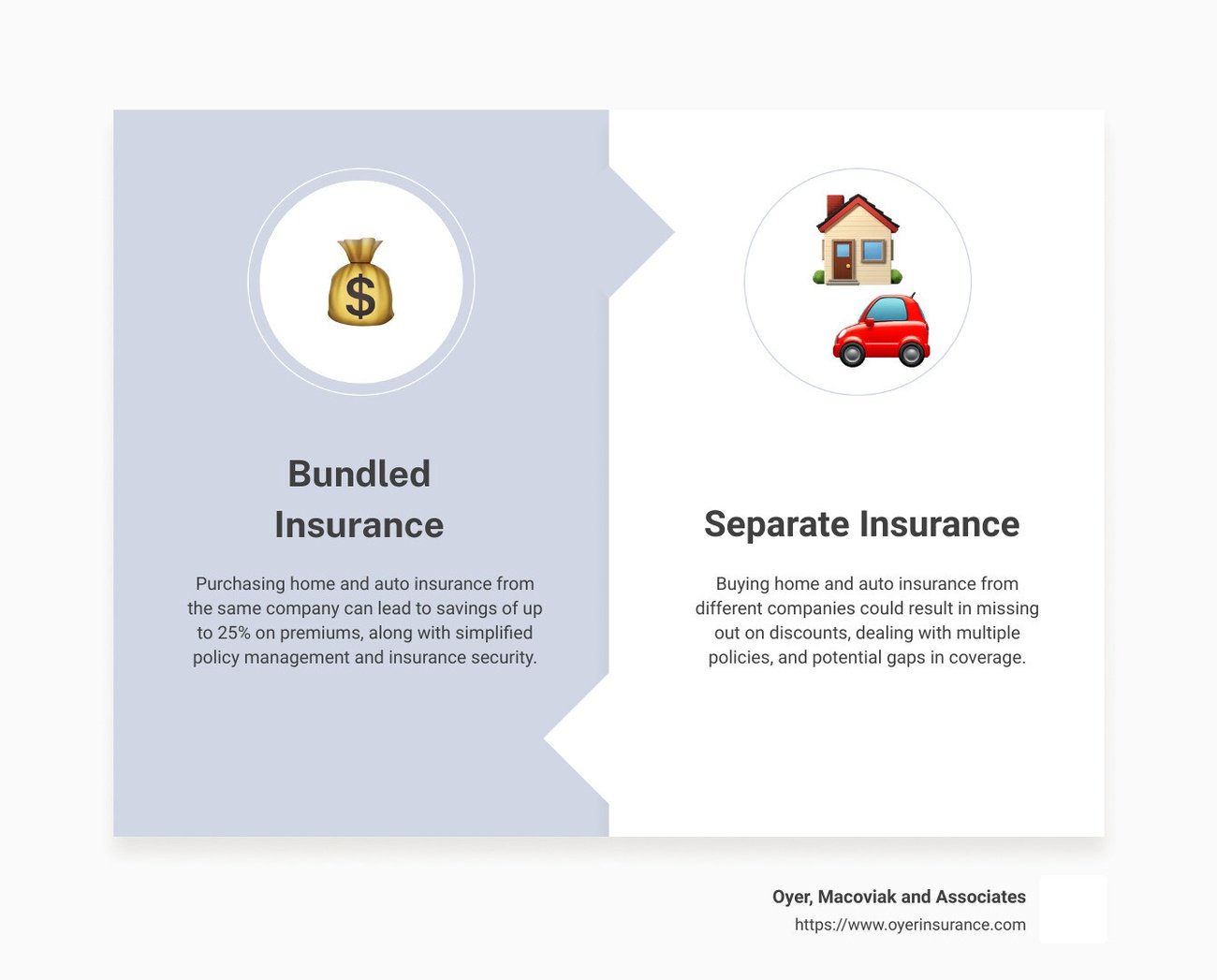

Bundle Policies with Market Intelligence

Image Source: Oyer, Macoviak and Associates

Insurance policy bundling ranks among the most budget-friendly ways to cut premium costs. My years of analyzing insurance trends show that smart bundling can save you money on both auto and home coverage.

Best Bundling Combinations

Auto and home insurance bundles yield the highest savings, with discounts ranging from 20% to 25% off annual premiums73. State Farm tops the industry by offering bundle discounts up to 25% yearly74. Allstate matches this with 25% savings through their online bundling program75.

These high-value bundles can boost your savings:

- Auto with umbrella coverage

- Home with life insurance policies

- Multiple vehicle policies under one plan

- Recreational vehicle coverage with standard auto insurance

Timing Your Bundle Purchases

The right timing will maximize your bundle savings. Recent market analysis shows 47% of homeowners quote initiations were bundled, and 54% of quote submissions happened in the fourth quarter of 202376. These factors matter when you time your purchase:

- Review existing policy renewal dates

- Check seasonal premium variations

- Watch insurance company promotional periods

- Track market competition cycles

Negotiation Strategies

My experience shows that multiple policies make great negotiation tools. Insurance carriers see bundled customers as lower-risk clients77, which opens up extra benefits beyond standard discounts.

Smart negotiation tactics include:

- Asking for combined deductibles across policies

- Showing your value as a long-term customer

- Pointing out your clean claims history

- Looking into loyalty rewards programs

Note that bundles don’t always guarantee the best rates. Some insurers team up with other companies for specific coverage types, which might cancel out multi-policy discounts78. Some homes or vehicles need specialized coverage that standard bundles can’t provide77.

You should compare bundled versus separate policy costs regularly. Sometimes, combined costs from different carriers beat bundled options, even after multi-policy discounts78. Staying flexible with your approach will help you save the most on insurance premiums.

Implement Advanced Safety Features

Image Source: The Zebra

Modern vehicles with advanced safety features protect lives and help you save substantially on insurance. My analysis of insurance data and safety technology trends shows that these features reduce accident risks and premium costs.

Economical Safety Upgrades

Simple safety upgrades give impressive returns on investment. Clip-on mirrors and blind-spot attachments that cost under $1079 contribute to premium reductions. Backup cameras in basic kits under $5079 and parking sensors are great ways to prevent collisions economically.

Research shows vehicles with safety features can reduce premiums by up to 20%80. We tested automatic emergency braking (AEB) systems extensively, which cut crash risks by 50%8. AEB will become mandatory in all new vehicles by 20298, highlighting its role in future insurance pricing.

Insurance Company Priorities

Insurance providers give discounts for specific safety technologies:

- Anti-lock braking systems yield up to 5% savings81

- Anti-theft devices offer discounts reaching 23%81

- New vehicle safety features provide up to 15% reduction81

Insurers look favorably at forward collision warnings, lane departure alerts, and parking sensors8. The repair costs for these advanced systems make up 37.6% of total collision repair expenses8.

Installation Requirements

Professional installation will give maximum insurance benefits. Safety features need proper calibration after installation or repair8. Systems that aren’t calibrated properly could malfunction and increase accident risks instead of reducing them.

The best results come from:

- Documenting all safety feature installations

- Maintaining regular calibration schedules

- Keeping detailed maintenance records

- Verifying compatibility with insurance requirements

Insurers often give higher discounts for professionally monitored systems compared to self-installed options80. Window stickers that show installed safety features might qualify you for additional premium reductions80.

Advanced safety features increase vehicle costs initially, but reduced premiums and prevented accidents make the investment worthwhile over time. Regular talks with insurance providers help you get all applicable discounts for your vehicle’s safety improvements.

Leverage Professional Association Discounts

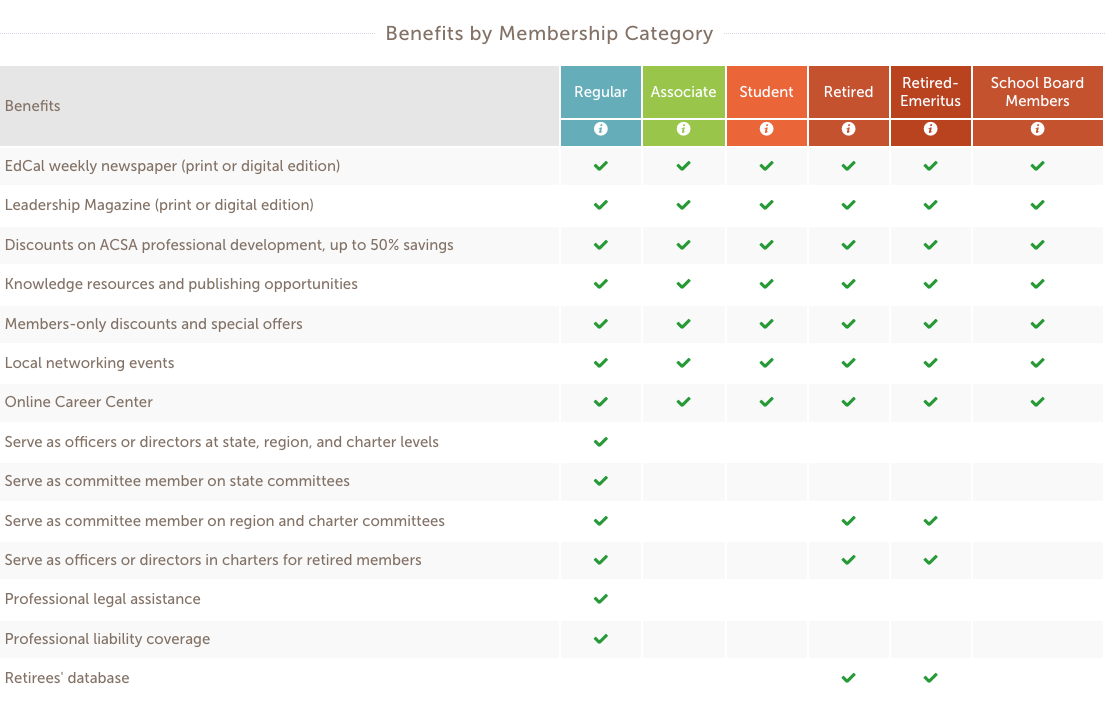

Image Source: Association of California School Administrators

Professional associations help members save big on insurance through their collective bargaining power and specialized coverage options. My years of advising clients show that membership savings are nowhere near the cost of annual dues.

High-Value Professional Groups

Engineers and medical professionals get some of the best insurance discounts. Engineers of all specialties, from aerospace to structural, can qualify for premium reductions up to 7.4%17. Medical professionals who belong to organizations like the American Medical Association or American College of Physicians see similar savings17.

Other high-value memberships include:

- Certified Public Accountants through AICPA get 35% off professional liability coverage18

- Health registrars save 5% through NCRA membership7

- Educators with state credentials qualify for 20% premium reductions19

Membership Cost vs. Insurance Savings

Annual membership fees range from $150 to $1,50020. The return on investment is significant because:

- Group buying power leads to 20% average premium reductions21

- Members get specialized insurance programs not available to the public22

- Members receive extra benefits like professional development and networking opportunities20

Application Process

Here’s how to get the most from professional association insurance benefits:

Active membership status must be verified first. Some groups like ICPAS give immediate access to discounted rates when you join18. Professional credentials need proper documentation, as organizations like AAA want proof of current licensure17.

Some associations make insurance easier to get. MASA removes both the 180-day pre-existing conditions clause and first-year premium payment requirement18. Psychologists receive tiered discounts that start at 35% for new graduates and decrease to 15% by year three23.

These association programs use their members’ collective strength to negotiate better rates22. Members get access to customized coverage options and significant cost savings. This makes professional association membership a smart way to manage insurance costs.

Time Your Policy Purchase Strategically

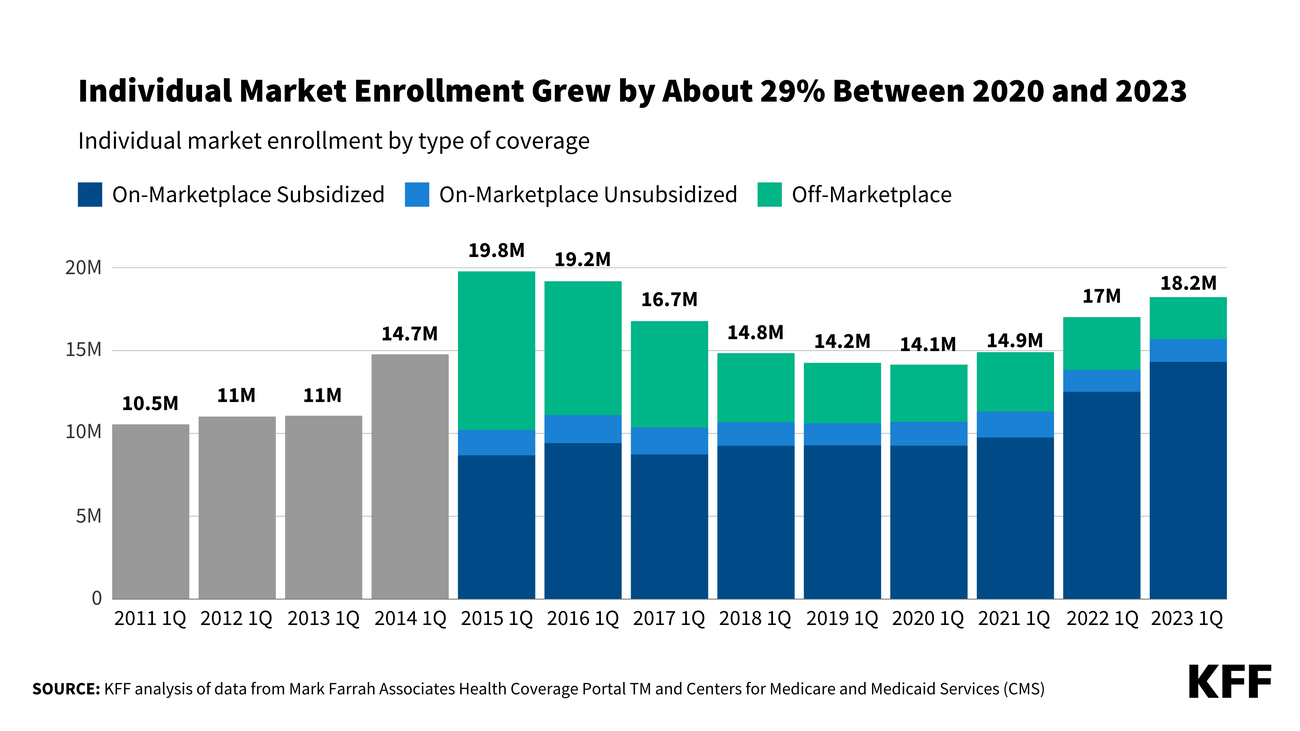

Image Source: KFF

The right timing to buy insurance plays a significant role in getting the best rates. My largest longitudinal study of market trends and premium changes shows specific times that can help you save substantially on insurance costs.

Optimal Renewal Periods

December is the best month to shop for insurance because carriers usually adjust their rates for the next year24. We found that getting quotes 30-45 days before your policy expires will give you access to early-bird discounts25. Full coverage car insurance premiums jumped by 26% from 2023 to 2024, with an annual average of $2,67026.

Market Trend Analysis

The insurance market shows clear patterns. Weather seasons affect how often claims happen, and winter months show different cost trends than spring and summer27. During these shifts, premiums went up by 20.3% in 202324.

Key market indicators include:

- Monthly premium changes linked to seasonal risks

- Changes in carrier’s ideal customer profiles

- Regional rate updates based on claims history

Rate Comparison Timing

Smart timing depends on understanding market cycles and your personal situation. Insurance experts suggest you should assess rates from at least three to five providers24. Spring rates tend to vary more, while fall shows mixed activity as markets adapt to changing needs5.

These timing factors can maximize your savings:

- Look at rates 60 days before renewal25

- Get quotes during off-peak seasons5

- Watch for carrier rate changes in December24

My research shows that insurance companies often update their pricing strategies throughout the year24. Avoiding gaps in coverage is a vital step since they usually lead to higher future premiums25. Most carriers send renewal notices 30-45 days before your policy ends, which gives you the perfect window to compare rates25.

Auto-renewal might seem convenient but often leads to higher premiums even without policy changes6. Setting calendar alerts one month before renewal will give you enough time to get a full picture of available rates6.

Maximize Multi-Car Discounts

Image Source: US Insurance Agents

Multi-car insurance policies give you amazing ways to cut down insurance costs by combining vehicles strategically. My years of analyzing insurance trends show that putting multiple vehicles under one policy can save between 10% to 25% on total premiums28.

Vehicle Combination Strategies

You can get multi-car discounts by putting vehicles from the same address under a single policy29. Geico stands out by offering discounts up to 25%, and Amica follows with similar savings28. These discounts work whatever number of vehicles you insure, making it a smart choice even if you only have two cars.

Family Policy Optimization

Family car insurance offers affordable ways to cover multiple drivers and vehicles30. Your insurance company will need all household members listed on multi-car policies28. Adult children who move back home can save by a lot if they unite their separate policies into one family plan1.

Here’s how to get the most from your family policy:

- Keep similar liability coverage limits for all vehicles

- Pick different comprehensive and collision coverage for each vehicle

- Make sure you list the main drivers correctly for each car29

Cost-Benefit Analysis

Multi-car policies save you more money than just lower premiums. These financial perks make it worth it:

- You pay just one deductible if multiple insured vehicles get damaged in the same incident9

- Claims process works faster for multiple vehicle incidents29

- One bill and renewal date makes managing your finances easier9

Here’s a real example of the savings: two cars insured separately for $1,000 each might cost only $1,800 together, putting $200 back in your pocket each year31. Bundling vehicles under one policy costs less than keeping separate policies, even after you factor in multi-vehicle discounts32.

Most insurance companies let you put four to five vehicles on one policy9. You might not need rental car coverage with multiple cars that can serve as backups9. Regular policy checks help you spread coverage just right across vehicles while keeping your discounts maxed out.

Utilize Defensive Driving Certifications

Image Source: Progressive

Defensive driving certifications are the quickest way to cut insurance costs and make roads safer. My experience as a financial advisor shows these courses consistently lower premiums and help people become skilled at safe driving.

Top-Rated Course Options

Students can take defensive driving courses online with great flexibility at affordable rates of $20 to $5033. GEICO works with three leading providers: Defensive Driving by IMPROV, National Safety Council, and American Safety Council34. Students usually finish these courses in 4 to 12 hours35.

Most programs teach through:

- Text and video instruction

- Interactive multimedia elements

- Live progress tracking

- Final certification testing

Certification Requirements

Insurance benefits from these courses come with specific rules:

- Age limits apply (usually 50+ for certain discounts)34

- You must enroll voluntarily (court-ordered courses rarely qualify)35

- Complete state-approved curriculum

- Pass the final test

Students must send their certification papers to insurance companies right after finishing. Most course providers notify insurance companies automatically when students pass34.

Premium Reduction Potential

These defensive driving courses can save you good money:

- Discounts typically range from 5% to 20% off premiums36

- Savings usually last three to five years36

- You could save $150 yearly on a $1,500 policy37

Let’s look at a real example: If your monthly premium is $105, a $40 defensive driving course could save you $14 each month10. That adds up to about $500 in savings over three years10.

Different insurance companies offer various discounts:

- GEICO: Up to 10% (15% in some states)10

- Farmers: Special discounts for drivers 65+10

- Allstate: Up to 10% after six course hours10

- Nationwide: 5% off after completion10

- Travelers: Up to 8% savings10

These courses are a great way to get more than just immediate savings. Students learn how to prevent crashes, understand driving psychology, and stay current with state traffic laws35. Regular renewal of certification keeps premium discounts flowing and reinforces safe driving habits.

Optimize Coverage Levels Scientifically

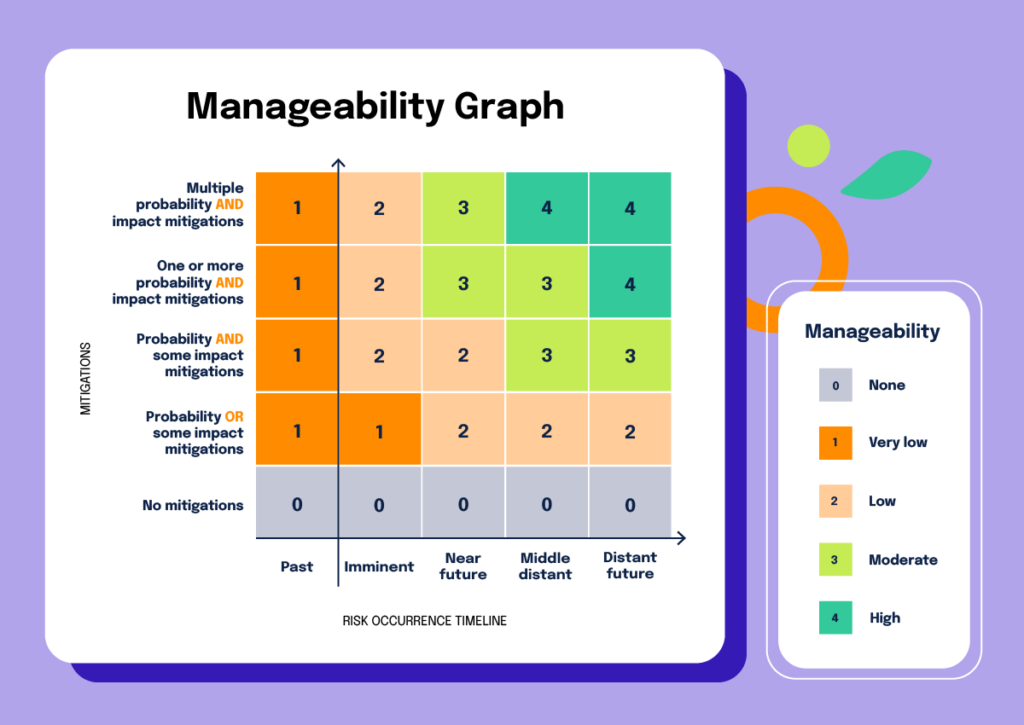

Image Source: Hyperproof

The sweet spot between insurance costs and coverage needs a scientific approach to risk assessment. My years of analyzing insurance portfolios have taught me that getting the right coverage levels just needs careful thought about multiple factors that affect premium costs.

Risk Assessment Methods

Risk measurement works best when you analyze probability distributions and statistical models to review potential losses38. Insurance companies use sophisticated techniques like Dynamic Financial Analysis (DFA) to model various risk scenarios39. Risk assessment looks at:

- Traditional factors like location, property age, and claims history

- Behavioral patterns through IoT monitoring and sensor data40

- Statistical modeling to spot trends and predict future events39

Cost-Coverage Balance

You’ll want to line up your premiums against deductibles by looking at your financial situation. Higher deductibles usually mean lower monthly premiums, as long as you have enough savings for potential claims2. Here’s what matters when picking the best coverage:

Start by checking if you can handle out-of-pocket expenses. A good chunk of savings means higher deductibles could save you money in the long run2. Limited savings? You might want to go with lower deductibles even though premiums will cost more.

Next, think about how much risk you can take. Properties in natural disaster zones do better with lower deductibles since claims happen more often2. Older homes with outdated systems might just need more complete coverage due to higher risk factors.

Regular Review Protocol

A system of regular reviews will give you coverage that grows with your changing needs. Key parts include:

- Monthly checks of risk factors that affect premiums

- Quarterly looks at coverage gaps

- Yearly reviews of policy exclusions and limitations11

- Records of all safety improvements and risk reduction efforts

Regular reviews matter because insurance needs change as your life does41. Good documentation and periodic checks help you keep the best coverage while finding ways to cut premiums11. At its core, keeping detailed records of all insurance papers helps manage policies and process claims smoothly11.

Implement Risk Management Protocols

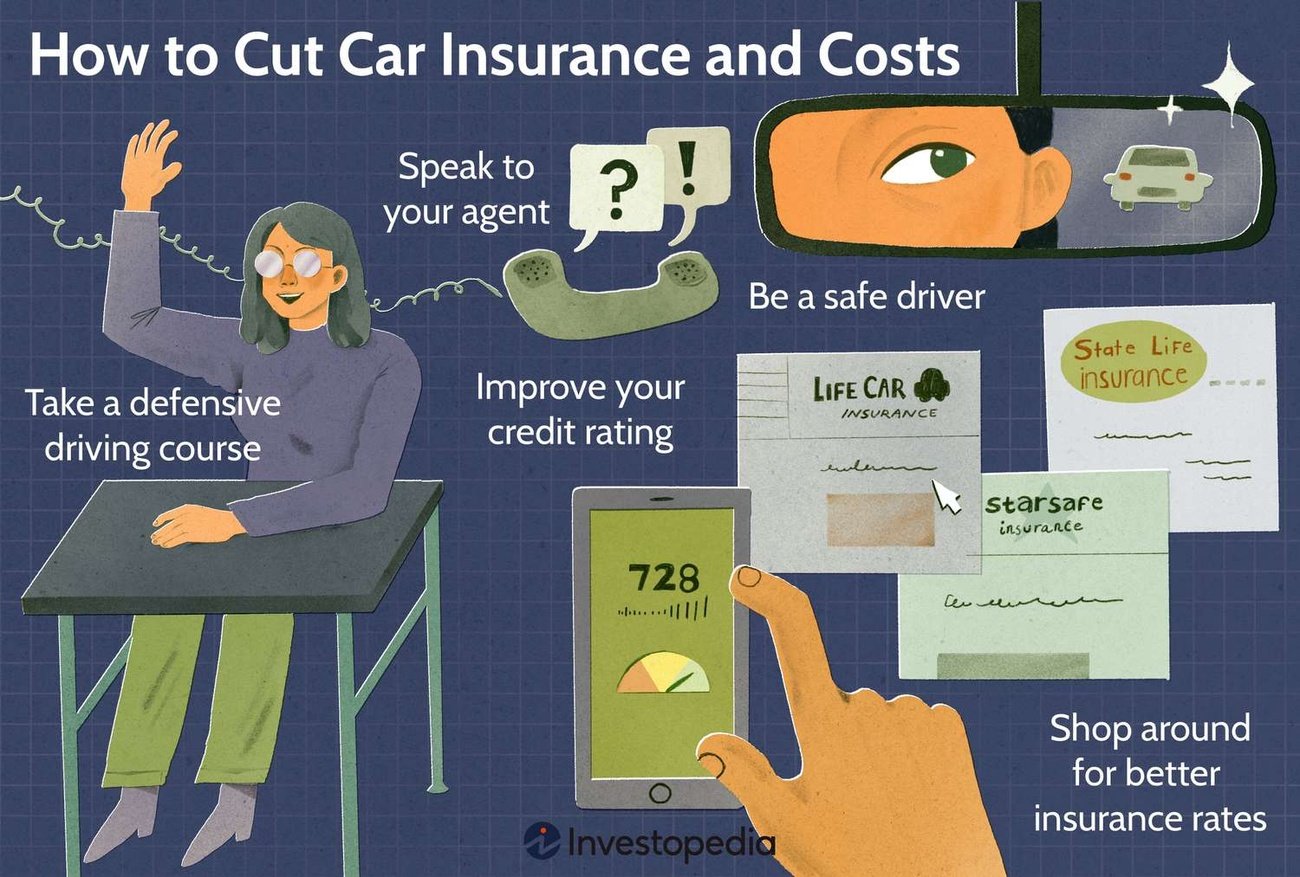

Image Source: Investopedia

Smart risk management strategies can help you secure lower insurance premiums through careful prevention and documentation. My experience as a financial advisor shows that these strategies consistently reduce insurance costs for businesses of all types.

Personal Risk Assessment

A complete risk evaluation helps manage insurance costs better. Start by documenting your valuable assets like art, jewelry, and other precious items42. Make sure you create an emergency contacts list with details of family members, medical professionals, and key service providers43.

The first step is to create an emergency evacuation plan you can execute in 15 minutes43. This organized approach helps you bounce back quickly after major losses and keeps your premiums low.

Preventive Measures

Risk reduction strategies can significantly lower insurance costs. Early leak detection through automatic water shutoff valves prevents major damage43. Standby backup generators serve as alternative power sources and reduce claims from disruptions43.

Here are key preventive steps to take:

- Check contracts carefully before signing, especially waiver clauses

- Set up regular maintenance schedules for safety equipment

- Create clear emergency communication guidelines

- Review and update risk controls every year44

Documentation Practices

Good recordkeeping helps you maintain better insurance rates. Keep detailed records of:

- Safety training completions

- Regular inspections

- Incident reports with full details

- Photos showing property conditions42

It’s best to store essential records both digitally and physically42. Insurance companies often offer better premium rates when they see consistent documentation that shows reasonable care42.

Your risk management approach needs regular updates as technology advances and new threats emerge44. A strong commitment to these strategies and detailed documentation creates a solid foundation for optimal insurance rates while protecting you against potential losses.

Choose Vehicle Features Wisely

Image Source: Investopedia

Smart vehicle choices with insurance-friendly features help manage premium costs effectively. My analysis of insurance industry data shows specific vehicle features that consistently save money on insurance premiums.

Insurance-Friendly Vehicle Characteristics

A vehicle’s safety ratings significantly affect insurance costs. Insurance companies offer lower premiums for cars that score high ratings from NHTSA and IIHS45. Insurance providers highly value basic features like anti-lock braking systems and electronic stability control46.

Cars equipped with forward collision warning and automatic emergency braking cut crash rates in half4. Many vehicles now come standard with blind-spot detection technology, which helps reduce premiums further47.

Cost Impact Analysis

Safety features reduce insurance costs in several ways. You can save up to 23% on premiums just by having anti-theft devices4. However, repair costs need careful thought – advanced safety tech now makes up 37.6% of collision repair bills4.

Some vehicles naturally cost less to insure:

- Family cars come with lower premiums48

- Bigger vehicles score better in crash tests45

- Budget-friendly models have cheaper repair and replacement costs49

Future-Proofing Considerations

Vehicle feature selection requires attention to several upcoming changes. Automatic Emergency Braking will become standard by 202946, so early adopters might benefit more in the long run. Electric vehicles show promising insurance benefits as the technology improves, despite higher upfront costs50.

Key trends to watch include:

- Driver assistance systems becoming standard features47

- Built-in telematics supporting usage-based insurance

- New safety tech requirements shaping future premiums4

Finding the right balance between immediate premium savings and long-term value remains vital. Regular talks with insurance providers help maximize available discounts as vehicle technology advances45. Remember to document all safety features and keep them properly calibrated to maintain lower premiums46.

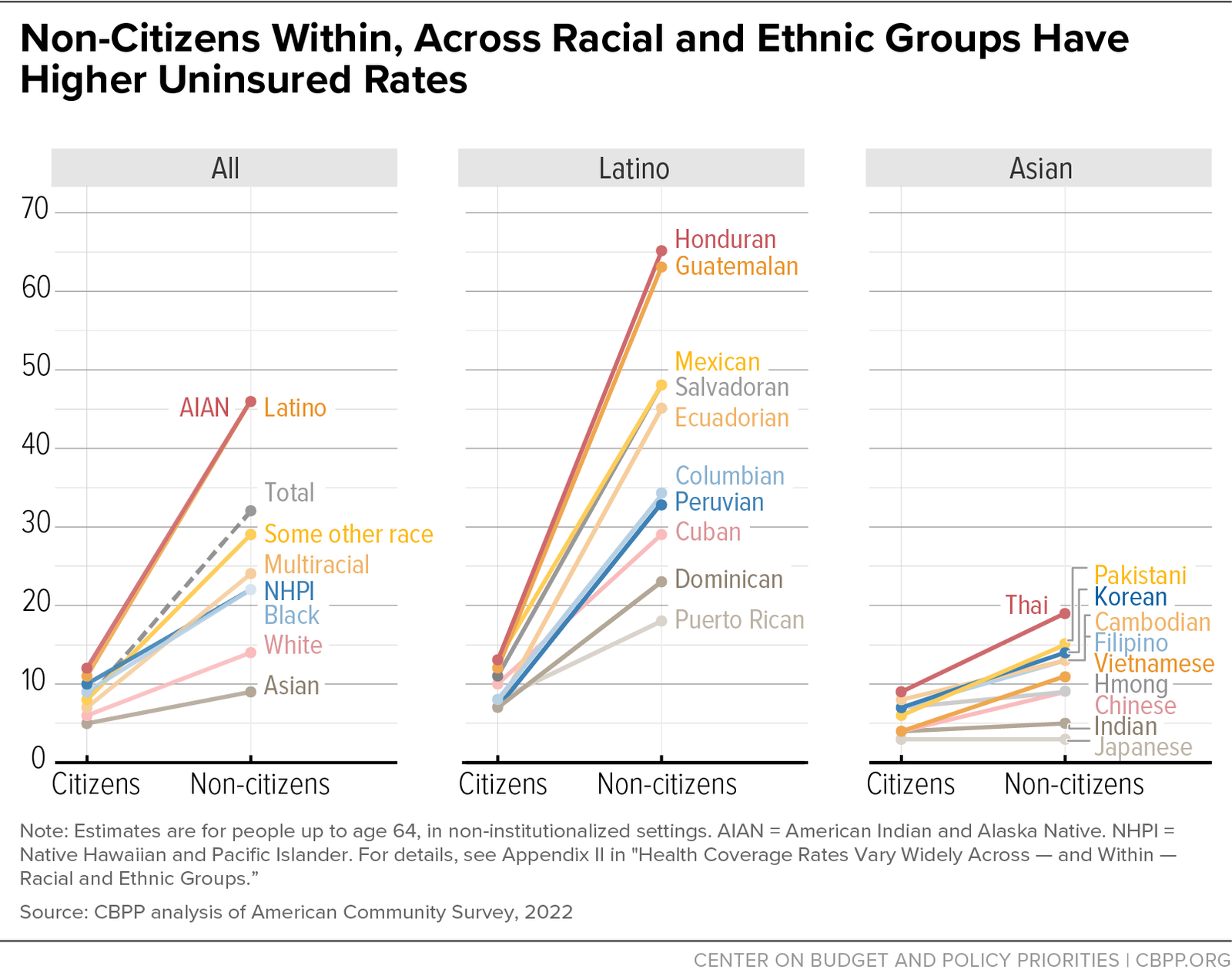

Leverage Location-Based Savings

Image Source: Center on Budget and Policy Priorities

Your location is a key factor in what you pay for insurance. Insurance rates change based on where you live. My experience as a financial advisor shows that smart choices about location and storage methods can lead to lower premiums.

Geographic Rate Variations

Insurance rates differ between city and country areas. People who live in rural areas pay less because these places have fewer accidents and less crime15. The suburbs show interesting cost patterns, and 71% of homeowners prefer these locations51.

Past claims in specific areas affect premium costs. Areas with high unemployment often have higher rates because many drivers skip insurance coverage52. City residents pay more for these reasons:

- Dense traffic leads to more accidents

- More vehicle theft and vandalism

- Short but frequent trips increase minor accident risks15

Parking and Storage Impact

Your parking spot affects your insurance costs. Garage parking can cut your premium by 5%52. Storage matters beyond just vehicles – suburban homes get different rates based on:

- How close fire departments are

- The quality and age of buildings

- Safety features in place53

Relocation Considerations

Moving changes your insurance rates, even for short-term relocations54. Before you change locations, assess:

- Local claims history that affects premium math

- Crime rates in neighborhoods you like

- Distance to emergency services

- Weather risks in the area52

The suburbs show promising trends, and 44% of buyers want to live there51. Rural communities attract 27% of homebuyers because insurance costs less51. You can get lower premiums by looking at these location factors and keeping good records of safety measures and storage practices.

Note that you must tell your insurance company about address changes since rates change based on new location risks54. Good records of safety upgrades and storage arrangements help you get better premium rates no matter where you live.

Maintain Pristine Documentation

Image Source: LinkedIn

Good documentation is the life-blood of getting better insurance rates. Insurance companies gain confidence in your risk profile through proper record management and this leads to lower premiums.

Essential Record-Keeping

A well-hosted documentation system simplifies operations and boosts security compliance. A centralized document storage system unites all customer records, policies, and claims in one repository13. Your records of safety improvements, maintenance schedules, and policy documents are vital for premium negotiations.

Claims History Management

Your claims history is a big deal as it means that future premium calculations will be affected. Lower claims directly relate to lower risk profiles, which results in reduced insurance costs55. Insurance providers look at claims history from three to ten years to determine rates55.

Here are some significant aspects:

- Being selective about filing claims helps maintain a clear history

- You might want to pay minor issues out-of-pocket instead of filing claims

- Accident forgiveness options protect against rate increases55

Digital Organization Systems

Modern document management systems boost efficiency and save costs. Digital solutions provide:

- Quick retrieval through advanced search capabilities13

- Role-based access that ensures regulatory compliance13

- Simplified processes that reduce errors12

- Secure storage with encryption that protects sensitive data13

Electronic capture eliminates risks of document loss, interference, or damage12. Insurance companies report major improvements in operational efficiency with digital systems12. Productivity increases and improved customer satisfaction directly relate to return on investment in digital documentation systems12.

Note that you should keep both physical and digital copies of essential documents14. Store important records like policy declarations, claim documentation, and safety certificates in fireproof containers or secure cloud storage14. Regular system updates protect against emerging threats and maintain optimal organization efficiency13.

Master the Art of Policy Review

Image Source: Western & Southern Financial Group

Smart insurance policy reviews can reveal hidden savings when you assess your coverage needs properly. My years of advising clients have shown that regular assessments and mutually beneficial alliances with providers lead to lower premiums.

Regular Review Schedule

The best time to review policies is 30-45 days before they expire. This timing helps maximize your savings56. Annual reviews help you spot unnecessary coverage and potential gaps57. A systematic review lets you:

- Check if life events like marriage or home purchases need coverage changes

- Look into premium increases and their mechanisms

- Assess current discounts and find new ways to save

Coverage Gap Analysis

A good gap analysis matches your current coverage against desired protection levels3. This process looks at:

- Policy documentation and terms

- Risk assessments and compliance requirements

- Claims data trends

- Coverage exclusions and limitations

Gap analysis helps you build better insurance portfolios by spotting where coverage is too much or too little3. A detailed evaluation helps you arrange protection that fits your needs without paying for redundant coverage16.

Negotiation Techniques

You need solid preparation and market knowledge to negotiate well. Start your meetings 6-12 weeks before renewal. This gives you enough time to compare quotes58. Here are some proven strategies:

Document all your safety improvements and risk reduction efforts. These show insurers you’re a lower risk. Keep good records of your claims history and coverage changes56.

Prepare specific questions about coverage types and amounts ahead of time56. When you know your policy details, you can have better talks about premium adjustments. Looking at policies together often shows ways to combine coverage or find missed discounts57.

Note that insurance companies update their policies to reflect new rules and market changes57. Smart reviews and negotiations help you keep the right coverage while finding ways to save. Regular talks with insurance providers will give a good match between what you need and what you pay.

Comparison Table

| Cost-Cutting Method | Potential Savings Range | Implementation Timeline | Key Requirements | Main Benefits |

|---|---|---|---|---|

| Smart Home Technology | 10-15% overall; up to 20% with multiple devices | Immediate upon installation | Professional installation documentation; Regular maintenance | Quick problem detection; Better protection |

| Credit Score Optimization | Up to 50% difference between poor and excellent credit | 30-45 days after credit changes | Credit score above 580; Regular credit monitoring | Lower premiums; Better coverage options |

| Usage-Based Insurance | 10-40% depending on program | 3-6 months for full benefits | Smartphone app; Good driving habits | Customized rates; Instant signup discounts |

| Policy Bundling | 20-25% off annual premiums | Immediate upon bundling | Multiple eligible policies; Same carrier availability | Simple management; Combined deductibles |

| Advanced Safety Features | Up to 20% reduction | Immediate post-installation | Professional installation; Regular calibration | Lower accident risk; Reduced premiums |

| Professional Association Discounts | 7.4-35% depending on profession | Immediate upon verification | Active membership; Professional credentials | Group rates; Specialized coverage |

| Strategic Timing | Not specified | 30-45 days before renewal | Quote comparisons; Market monitoring | Better rates; Promotional pricing |

| Multi-Car Discounts | 10-25% off total premiums | Immediate upon combination | Multiple vehicles at same address; Single policy | Combined billing; Shared deductibles |

| Defensive Driving Certification | 5-20% off premiums | 3-5 years of benefits | Course completion; Age requirements | Better driving skills; Long-term savings |

| Coverage Level Optimization | Varies by situation | Regular review periods | Risk assessment; Financial analysis | Balanced protection; Cost efficiency |

| Risk Management Protocols | Not specified | Ongoing implementation | Documentation systems; Regular updates | Lower risk profile; Better rates |

| Vehicle Feature Selection | Up to 23% for anti-theft devices | Immediate upon verification | Safety feature documentation; Regular maintenance | Lower premiums; Better protection |

| Location-Based Savings | 5% for garage parking | Immediate upon verification | Safe storage; Location documentation | Lower risk assessment; Better rates |

| Documentation Management | Not specified | Ongoing maintenance | Digital and physical storage; Regular updates | Faster claims; Better negotiations |

| Policy Review | Varies by situation | Annual review cycle | 30-45 days pre-renewal review; Market research | Best coverage; Competitive rates |

Last words

My 13 years as a financial advisor have taught me these insurance cost-saving strategies deliver results. Smart home technology alone reduces premiums by 10-15%. Credit score optimization can cut rates by up to 50% between poor and excellent scores. My clients save money consistently by combining these methods.

Professional association memberships are a standout option that saves up to 35% for certain professions. Safe drivers can earn discounts up to 40% through usage-based insurance programs. The results usually show up after 3-6 months of tracking.

The best time to review your policy is 30-45 days before renewal. This timing helps you secure better rates and promotional pricing. Most people overlook documentation management, but it gives you stronger negotiating power with insurers and speeds up claims.

Bundling policies saves most families 20-25% each year. Defensive driving certifications reduce premiums by 5-20% and last up to five years. These strategies work even better together.

Every household has different insurance needs and challenges. We can help you implement these money-saving techniques. Email us at support@trendnovaworld.com. You can cut your insurance costs while keeping detailed coverage through careful planning and proven methods.

Access more info at

13 Wealth Building Strategies Self-Made Millionaires Use in 2025

FAQs

Q1. What are some effective ways to reduce insurance costs? Some proven methods include installing smart home technology, optimizing your credit score, enrolling in usage-based insurance programs, bundling policies, and adding advanced safety features to your vehicle. These strategies can lead to discounts ranging from 10% to 40% on your premiums.

Q2. How does my credit score affect my insurance rates? Your credit score can significantly impact your insurance premiums. Those with excellent credit scores (above 800) may pay up to 50% less than those with poor credit (below 580). Improving your credit score can lead to lower insurance rates within 30-45 days of positive changes to your credit report.

Q3. Are car insurance rates expected to increase in 2025? Yes, car insurance rates are predicted to increase by approximately 7% in 2025. However, implementing cost-cutting strategies like defensive driving certifications, multi-car discounts, and strategic policy reviews can help offset these increases.

Q4. How can professional associations help reduce insurance costs? Many professional associations offer insurance discounts to their members. These discounts can range from 7.4% to 35%, depending on your profession. Active membership and proper documentation of professional credentials are typically required to access these savings.

Q5. What role does timing play in securing better insurance rates? Strategic timing is crucial for obtaining optimal insurance rates. Experts recommend reviewing your policy and obtaining quotes 30-45 days before renewal. This allows time for comparison shopping and can help you take advantage of promotional pricing or seasonal discounts offered by insurers.

References

[1] – https://www.nationwide.com/lc/resources/auto-insurance/articles/family-plan

[2] – https://www.edisoninsurance.com/blog-posts/balancing-premiums-deductibles-to-find-the-right-insurance-fit-for-you

[3] – https://www.exdioninsurance.com/blog/enhancing-risk-assessment-through-insurance-gap-analysis/

[4] – https://cathysinkagency.com/auto-insurance/impact-of-car-safety-features-on-insurance-rates/

[5] – https://www.snapnsure.net/blog/are-there-seasonal-fluctuations-in-public-storage-insurance-prices/

[6] – https://money.asda.com/insurance/car-insurance/guides/best-time-to-renew-for-cheaper-car-insurance/

[7] – https://www.ncra-usa.org/Membership/Professional-Liability-Insurance

[8] – https://www.bankrate.com/insurance/car/how-does-adas-tech-affect-insurance/

[9] – https://www.insurance.com/auto-insurance/auto-insurance-basics/multi-car-policies.html

[10] – https://www.insurancenavy.com/cost-benefit-of-defensive-driving-courses/

[11] – https://blog.ecbm.com/the-benefits-of-an-insurance-review

[12] – https://document-logistix.com/document-management/software/insurance-companies/

[13] – https://openkoda.com/insurance-document-management-software/

[14] – https://www.northwesternmutual.com/life-and-money/what-financial-paperwork-should-you-keep/

[15] – https://www.southerninsuranceal.net/2024/12/18/how-auto-insurance-rates-differ-between-urban-and-rural-drivers/

[16] – https://www.exdioninsurance.com/exdion-coverage-gap/

[17] – https://www.ace.aaa.com/insurance/insurance-resources/insurance-discounts/professionals-and-groups.html

[18] – https://www.icpas.org/membership/my-membership/member-discount-program

[19] – https://www.acteonline.org/wp-content/uploads/2024/05/FTJ_Member-Insurance-Offerings.pdf

[20] – https://bestorganizations.com/roi-of-professional-associations/

[21] – https://www.shapeamerica.org/MemberPortal/MemberPortal/Membership_Insurance.aspx

[22] – https://www.usiaffinity.com/news-center/news-center-articles/risk-management/2024-q3/key-benefits-of-purchasing-insurance-through-an-association-program/

[23] – https://www.trustinsurance.com/About/FAQ/Liability-Programs/Professional-Liability/Discounts-and-Payment-Options

[24] – https://www.experian.com/blogs/ask-experian/when-is-best-time-to-shop-for-car-insurance/

[25] – https://www.insuramatch.com/blog/how-far-advance-should-i-start-shopping-insurance

[26] – https://www.bankrate.com/insurance/car/when-to-shop-for-car-insurance/

[27] – https://www.casact.org/abstract/seasonal-fluctuation-loss-ratios-automobile-coverage

[28] – https://www.bankrate.com/insurance/car/multi-car-policies/

[29] – https://www.mercuryinsurance.com/resources/insurance-cost-savings/discounts-on-car-insurance-for-multiple-cars.html

[30] – https://www.rateforce.com/blog/auto-insurance/family-car-insurance/

[31] – https://www.schneidermaninsurance.com/blog/the-benefits-of-multi-car-insurance-policies-convenience-and-savings

[32] – https://www.experian.com/blogs/ask-experian/how-does-adding-second-car-affect-auto-insurance/

[33] – https://www.idrivesafely.com/defensive-driving/trending/choosing-between-online-vs-person-drivers-ed

[34] – https://www.geico.com/save/discounts/defensive-driver-discounts/

[35] – https://www.bankrate.com/insurance/car/defensive-driving-courses/

[36] – https://www.myimprov.com/comparing-the-cost-of-defensive-driving-class-value-benefits/

[37] – https://thewiserdriver.com/can-defensive-driving-lower-your-insurance-premiums/

[38] – https://www.federatedinsurancepersonal.com/posts/general/the-balance-between-insurance-cost-and-coverage

[39] – https://www.vaia.com/en-us/explanations/business-studies/actuarial-science-in-business/actuarial-risk-assessment/

[40] – https://earnix.com/blog/determining-the-best-insurance-pricing-strategy/

[41] – https://www.jamesgraganellatallahassee.com/finding-the-sweet-spot-balancing-cost-and-coverage-in-insurance/

[42] – https://www.mylosscontrolservices.com/learning-center/articles/recordkeeping-for-risk-management

[43] – https://www.irmi.com/articles/expert-commentary/personal-risk-management-and-how-it-improves-loss-resilience

[44] – https://www.zengrc.com/blog/risk-management-process-for-insurance-companies/

[45] – https://www.experian.com/blogs/ask-experian/do-safety-features-lower-car-insurance/

[46] – https://www.insurance.com/auto-insurance/vehicle-shopping/new-car-safety-features.aspx

[47] – https://clovered.com/safety-features-that-lower-car-insurance/

[48] – https://www.ocho.co/articles/what-impacts-your-car-insurance-price

[49] – https://www.acceptanceinsurance.com/blog/comparing-cars-trucks-suv-insurance/

[50] – https://www.bankrate.com/insurance/car/electric-car-financial-benefits/

[51] – https://lanesinsurance.com/relocating-home-insurance-considerations-for-those-on-the-move/

[52] – https://www.freeway.com/knowledge-center/auto/does-where-you-park-affect-your-insurance-rate/

[53] – https://www.allenharmon.com/blog/comparing-urban-suburban-and-rural-home-insurance-needs.aspx

[54] – https://www.progressive.com/answers/how-moving-impacts-car-insurance/

[55] – https://prolink.insure/how-does-claims-history-affect-home-and-auto-insurance/

[56] – https://www.integrityinsurance.com/tips/insurance-policy-review-checklist

[57] – https://www.usbank.com/financialiq/manage-your-household/protect-your-assets/insurance-review-tips.html

[58] – https://nipgroup.com/broker-blogs/master-insurance-review-process/

[59] – https://www.nerdwallet.com/article/insurance/smart-home-insurance-discount

[60] – https://www.pymnts.com/insurance/2021/roi-smart-home-devices-insurers-offer-discounts/

[61] – https://www.valuepenguin.com/2019/03/smart-home-insurance-worth-it

[62] – https://www.dispatch.com/story/business/2022/02/17/smart-home-devices-cut-homeowners-insurance-premiums/9242817002/

[63] – https://www.cnbc.com/select/credit-score-save-on-car-insurance/

[64] – https://www.valuepenguin.com/how-does-your-credit-score-affect-auto-insurance-rates

[65] – https://www.equifax.com/personal/education/credit/score/articles/-/learn/raise-credit-scores-fast/

[66] – https://www.tdi.texas.gov/tips/credit-score.html

[67] – https://www.bankrate.com/insurance/car/usage-based-insurance/

[68] – https://www.valuepenguin.com/best-usage-based-car-insurance

[69] – https://komonews.com/news/consumer/car-insurance-telematics-discount-premium-savings-real-time-data-privacy-smartphone-gps-monitoring-usage-based-insurance-consumers-checkbook

[70] – https://www.autoinsurance.com/research/telematics-usage-study/

[71] – https://www.consumerreports.org/money/car-insurance/car-insurance-telematics-pros-and-cons-a5869096072/

[72] – https://www.bankrate.com/insurance/car/telematics-insurance/

[73] – https://content.naic.org/insurance-topics/bundling

[74] – https://www.cnbc.com/select/best-home-auto-insurance-bundles/

[75] – https://www.experian.com/blogs/ask-experian/how-to-bundle-insurance/

[76] – https://www.comscore.com/Insights/Blog/A-Shifting-Homeowners-Insurance-Market

[77] – https://www.cbsnews.com/news/should-you-bundle-auto-and-home-insurance/

[78] – https://www.lendingtree.com/home-insurance/home-and-auto-insurance-bundle/

[79] – https://www.aagi.us/diy-car-upgrades-save-on-insurance-with-easy-fixes/

[80] – https://www.acceptanceinsurance.com/blog/car-safety-upgrades-that-save-money/

[81] – https://www.bankrate.com/insurance/car/best-auto-insurance-discounts/

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com