The rising cost of living has impacted everyone’s purchasing power. Your money doesn’t stretch as far as before. The need to save money has become significant as simple necessities like food, housing, and healthcare saw a sharp 6% price increase in 2022.

These numbers might seem overwhelming, but there are practical money-saving tips that deliver results. Simple changes can make a big difference. Buying secondhand clothes saves $900 annually, and negotiating your cable and internet bundle adds $1,000 to your pocket over two years.

My research led to 15 proven strategies that blend traditional saving methods with modern technology to help you save up to $1,000 monthly. Smart automation tools prevent the 30-40% food waste most households face. High-yield savings accounts now offer over 4% APY. These techniques work effectively in the current economic climate.

Automate Your Finances with AI-Powered Tools

Image Source: Upmetrics

AI-powered budgeting tools have become great allies to manage money smartly. These tools look at how you spend and give individual-specific insights to boost your savings automatically.

Best AI budgeting tools now come with features like expense grouping and immediate spending insights1. Popular tools like YNAB excel at detailed budgeting, while Mint tracks everything, and Cleo uses AI to automate savings64. The tools sort your expenses into groups like groceries and entertainment to show exactly how you spend your money1.

| Tool | Monthly Cost | Key Feature |

|---|---|---|

| YNAB | $50 | Detailed Budget Analysis |

| Mint | Free | Complete Tracking |

| Booke.ai | $20-$50 | Automated Bookkeeping |

AI tools make saving money easier by studying your income patterns. Tools like NOMI Find & Save™ use smart predictions to spot and move extra money into your savings account automatically65. This ensures you have enough money for upcoming expenses while building up your savings.

Investment automation platforms have improved by a lot. Wealthfront’s AI-based Path tool guides you through different investments, from managing mortgages to planning retirement66. Robo-advisors use machine learning to study economic indicators and market conditions, so they can adjust investment strategies proactively66. These platforms balance your portfolio and handle tax-loss harvesting automatically, which helps optimize your returns without constant manual work.

Leverage Cashback Stacking Strategy

Image Source: Kudos

“Rewards stacking is the practice of using multiple credit cards, shopping portals, and other tactics to earn additional points or cash back on your purchases.” — FinanceBuzz, Personal finance website

Cashback stacking helps you save more money on everyday purchases.You can earn [between 5% to 40% cashback](https://financebuzz.com/rewards-stacking) on single transactions by combining multiple reward programs67.

Top cashback apps in 2025 Rakuten dominates the market and offers cashback rates from 1% to 40% at more than 3,500 stores68. TopCashback gives users 100% of their affiliate commission and provides up to 45% cashback at over 4,500 stores68. Ibotta focuses on grocery shopping and gives item-specific offers68.

| App | Stores | Max Cashback |

|---|---|---|

| Rakuten | 3,500+ | 40% |

| TopCashback | 4,500+ | 45% |

| Ibotta | Grocery Focus | Varies |

Credit card rewards optimization Your spending patterns should determine which cards you choose to maximize returns. Cards with high rewards in specific categories can boost your earnings by a lot69. To cite an instance, the Blue Cash Preferred® Card gives high cash-back rewards at U.S. supermarkets and gas stations70.

Store loyalty program stacking Store loyalty programs can magnify your savings when combined with other rewards. Target Circle gives 1% back on purchases, and these savings multiply when used with cashback apps and credit card rewards71. We tracked our linked programs and made sure offers didn’t conflict with each other for successful stacking72.

Note that you should clear cookies before making purchases through cashback sites and look for special bonus events during holidays68. This smart way of combining rewards programs helps you save money throughout the year.

Optimize Subscription Services with Smart Management

Image Source: Zluri

Smart subscription management can save you money, as U.S. adults spend an average of $219 monthly on subscriptions73.

Subscription tracking tools You can identify and cancel unused subscriptions with smart management tools. Rocket Money provides simple tracking at no cost and charges $6-$12 monthly for premium features74. Bobby comes with a free version, and users can upgrade for $1-$3 to track unlimited subscriptions74. Mastercard’s Smart Subscriptions solution, which launched in 2024, lets users track, pause, and cancel subscriptions right from their banking apps75.

| Tool | Basic Cost | Premium Features |

|---|---|---|

| Rocket Money | Free | $6-$12/month |

| Bobby | Free | $1-$3/month |

| Track My Subs | Free (10 subs) | $10-$30/month |

Negotiation techniques for better rates Industry data shows that subscription costs can drop by about 30% with good negotiation76. The best time to negotiate is at year-end when companies plan their future budgets77. Multi-year agreements often come with substantial discounts78.

Alternative service options Many subscription-based services have free alternatives79. Learning about these options can help you save money without compromising quality. People who use tracking tools to manage their subscriptions cut monthly expenses by 25-30%76. Notwithstanding that, you should review the business case and license usage before renewals to avoid paying for services you don’t use78.

Master Energy-Efficient Home Automation

Image Source: Worktops

Smart home automation offers the quickest way to cut energy costs through automated control of heating, cooling, and lighting systems. ENERGY STAR certified smart thermostats cut heating and cooling expenses by up to 15% annually80.

Smart home device recommendations ENERGY STAR certified devices are the foundations of an adaptable smart home system. Smart thermostats from brands like NEST and ecobee dominate the market with proven energy savings80. LED smart lighting systems use 90% less energy and last 15 times longer than standard bulbs81. Smart power strips eliminate energy waste from ‘phantom’ loads by automatically cutting power to unused electronics82.

Energy savings calculator U.S. households spend over $2,200 yearly on energy bills, with nearly half going to heating and cooling83. Smart home systems show remarkable results:

- Automated climate control reduces energy usage by 30-40% compared to conventional setups82

- Smart lighting automation saves up to 75% on lighting costs84

- Automated shading systems cut energy expenses by approximately 30%19

Implementation costs and ROI A simple DIY energy monitoring system costs between $100 and $300, and pays for itself through lower utility bills19. Homeowners who use detailed smart home solutions see:

- 10-20% reduction in overall energy costs19

- Extra savings through insurance discounts for smart home upgrades19

- Longer HVAC system lifespan through optimized cooling cycles19

Smart home automation investment pays off within the first year through reduced energy bills and boosted home value. Smart homes sell for roughly 5% more than conventional properties84.

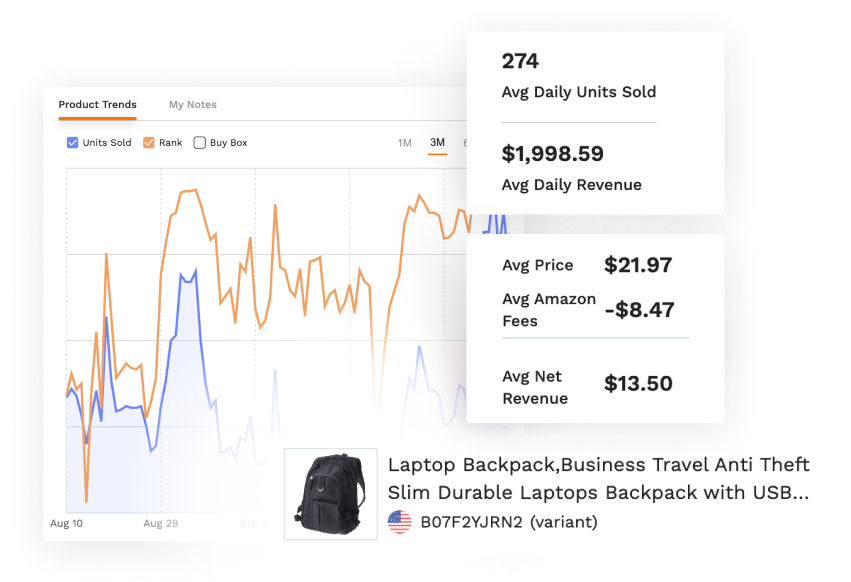

Use Price-Tracking Tools for Strategic Shopping

Image Source: Jungle Scout

Smart shoppers use price tracking tools to save 20-30% on their Amazon purchases20.

Best price tracking apps CamelCamelCamel stands out as the market leader with detailed Amazon price history charts and email alerts21. Honey goes beyond Amazon and checks prices from multiple retailers. The Droplist feature notifies you when prices drop21. Capital One Shopping does the heavy lifting by automatically finding better deals from other sellers. It factors in tax and shipping for true price comparisons21.

| Tool | Key Feature | Best For |

|---|---|---|

| CamelCamelCamel | Price History Charts | Amazon Shopping |

| Honey | Multi-retailer Comparison | General Online Shopping |

| Keepa | Automated Price Graphs | Amazon Product Research |

Historical price analysis Price history data helps you spot the best times to buy and track seasonal patterns5. Looking at past price trends shows clear high and low points that tell you when to make your purchase22. Many sellers stick to old prices because of outdated contracts or poor maintenance. Tracking historical prices helps you avoid paying too much23.

Deal alert setup guide The best way to set price alerts is to look at average prices instead of rare all-time lows5. Most tracking tools send email notifications. Pairing these with coupon tools helps you save even more5. Smart timing through price alerts can help shoppers save up to 70% on their purchases20.

Implement the Digital Envelope System

Image Source: App Store – Apple

Digital envelope systems have reshaped how we handle our money, taking traditional cash budgeting into the digital world. This quick way to save money splits your income into virtual envelopes for different expenses. Users save over $500 each month by spending more mindfully24.

Digital envelope apps Apps like Goodbudget come with free and premium versions. Simple plans have limited envelopes while premium users get unlimited categories25. Mvelopes stands out today with three budget-friendly tiers that match different user needs3. Here’s how popular options stack up:

| App | Basic Plan | Premium Features |

|---|---|---|

| Goodbudget | Free (limited) | Unlimited envelopes |

| Mvelopes | Affordable tiers | Advanced tracking |

| Qube Money | Standard plan | Proactive spending |

Category-wise budget allocation Your journey with digital envelopes begins when you analyze spending patterns and create custom categories6. Most people set aside money for rent, groceries, and entertainment26. The system keeps your envelope balances current as you spend and helps prevent overspending by making you check your budget before purchases24.

Progress tracking features Today’s digital envelope apps give you complete tracking features with up-to-the-minute data analysis and balance updates27. These tools show detailed reports of your spending patterns, progress toward goals, and available balances28. On top of that, many apps use visual charts to show your envelope goals’ progress. This makes it easier to stay motivated and adjust your spending when needed28.

Maximize High-Yield Banking Products

Image Source: Business Insider

High-yield savings accounts now pay up to 5.00% APY as of February 202529. These rates are way better than traditional savings accounts that pay just 0.62%30.

Top high-yield savings accounts Online banks give you higher returns than physical banks. American Express® High Yield Savings Account stands out with great customer service, while Discover® Online Savings Account gives you smooth checking integration31. Here’s how the top options stack up:

| Bank | Key Feature | ATM Access |

|---|---|---|

| Capital One | Branch Access | 4,000+ ATMs |

| Discover | Checking Integration | Network Access |

| Barclays | Savings Tools | Limited |

Banking fee elimination strategies You can avoid most bank fees with smart account management. Direct deposits help you skip monthly maintenance charges32. You can also dodge service fees by keeping minimum balances and linking your accounts7. Using in-network ATMs saves you $4.77 on average per withdrawal33.

Account comparison tools These factors matter most when picking a high-yield account:

- Your returns depend on interest compounding frequency

- FDIC insurance protects up to $250,0008

- You need good access through mobile apps or ATM networks

- Watch out for minimum balance rules and fee structures

High-yield savings accounts pay eight times more than regular accounts30. They are a great way to build your emergency fund or save for big goals like home down payments or weddings.

Create Additional Income Streams

Image Source: Bluehost

Building multiple income streams is a proven strategy to grow your finances. We discovered that 75% of millionaires maintain diverse revenue sources4.

Passive income opportunities Dividend-paying stocks are the life-blood of passive income and provide regular payouts among potential capital gains4. Real estate investment trusts (REITs) generate steady income through property appreciation without managing properties directly4. Digital products need some work upfront but can create continuous income. E-books and templates can be sold repeatedly with minimal maintenance4.

| Income Stream | Initial Investment | Potential Return |

|---|---|---|

| Dividend Stocks | Variable | 1-6% annually |

| REITs | $500-$1000 | 2-10% annually |

| Digital Products | $0-$500 | Unlimited |

Side hustle platforms Platforms like Fiverr and Upwork connect freelancers with clients who need digital services34. Care.com and Rover create opportunities in childcare and pet sitting34. Creative people can turn their skills into money through Etsy or print-on-demand services35.

Investment options for beginners Index funds and ETFs are excellent starting points if you’re new to investing. Vanguard Total Stock Market provides broad market exposure4. High-yield savings accounts deliver modest but reliable returns, making them perfect for conservative investors4. Peer-to-peer lending platforms offer an innovative way to earn interest without much effort4.

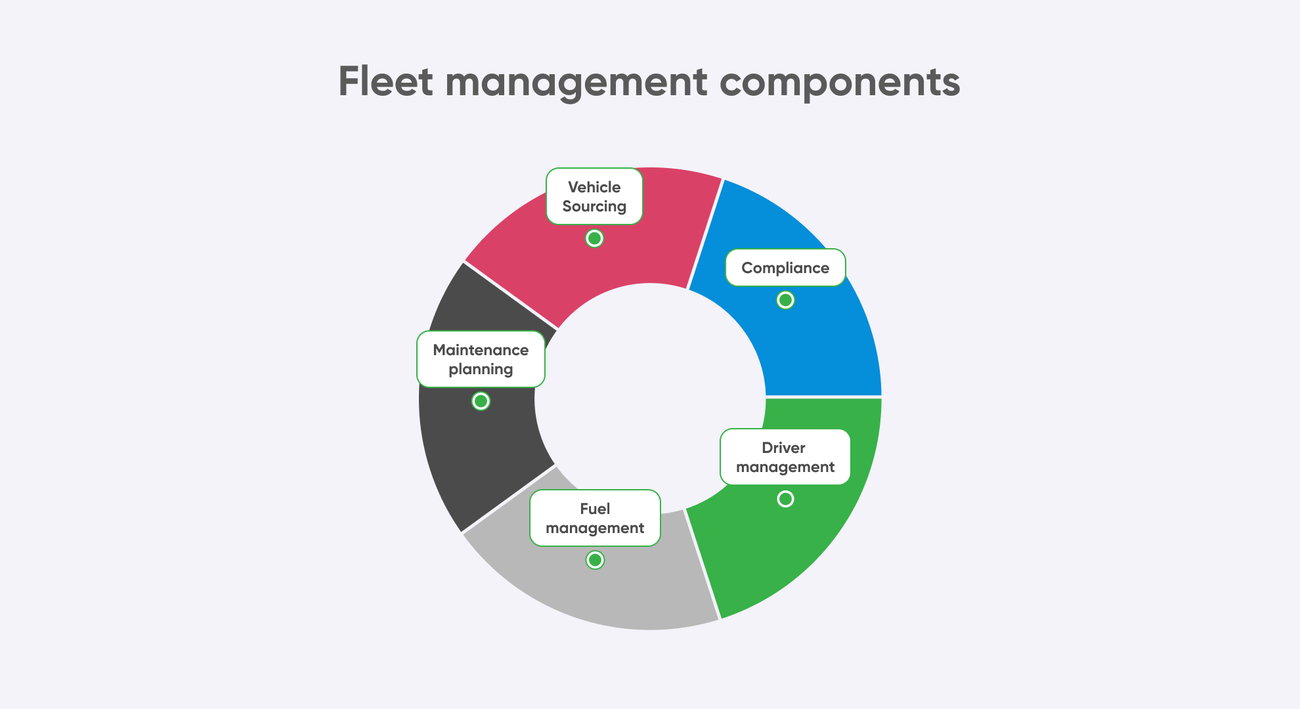

Optimize Transportation Costs

Image Source: Adexin

Monthly expenses include a large chunk that goes toward transportation costs. These costs hit household budgets hard through fuel, maintenance, and service fees.

Ride-sharing optimization The prices on ride-sharing platforms change based on demand and availability36. Users can save money by booking rides when surge pricing is low during off-peak hours37. Passengers can reduce expenses by up to 30% through route optimization and shared rides when they use cost-sharing features9.

Electric vehicle cost analysis The market dynamics have changed as battery costs for electric vehicles are nowhere near what they used to be. Battery costs now range from $128-133/kWh38 in 2025, which shows a substantial drop from previous years. The table below shows current EV pricing trends:

| Category | Average Cost | Market Trend |

|---|---|---|

| New EVs | $55,544 | 12% above market39 |

| Battery Cost | $128-133/kWh | Decreasing38 |

| Price Parity | Expected 2025-2029 | Market projection40 |

Public transit savings Public transportation is a great way to get substantial savings compared to owning a private vehicle. Regular transit users save approximately $13,218 annually or $1,102 monthly41. Car prices keep rising while monthly public transit fares have stayed stable since 202042. This makes public transit an economical solution. These savings matter even more with used car prices jumping 30-40% since 201941.

Master Meal Planning Technology

Image Source: Nimble AppGenie

Families using meal planning technology can save 25-30% on their monthly grocery bills, which has revolutionized shopping and food management43.

Meal planning apps AI capabilities blend with practical features in modern meal planning apps. PlateJoy costs $69 for six months and creates meal plans that match your health goals2. MealPrepPro helps save time with automated shopping lists at $7 per month2. Here’s a quick comparison:

| App | Monthly Cost | Key Features |

|---|---|---|

| PlateJoy | $11.50 | Health-focused plans |

| MealPrepPro | $7.00 | Time optimization |

| Mealime | Free | Family meal planning |

Grocery price comparison tools Flipp connects shoppers to deals from over 2,000 merchants13. Grocery AI helps users find the best deals by comparing prices between stores13. Smart shopping with these tools can help you save 30-40% on weekly groceries44.

Food waste reduction strategies The U.S. food supply sees waste levels of 30-40%43. Kitchen audits help measure food usage patterns and prevent waste43. The best ways to reduce waste include:

- Planning and tracking food prep

- Using near-expiry items in specials

- Setting up staff monitoring systems43

Your household can cut down food waste by a lot when you combine these tech solutions with good storage practices and creative ways to use leftover ingredients43.

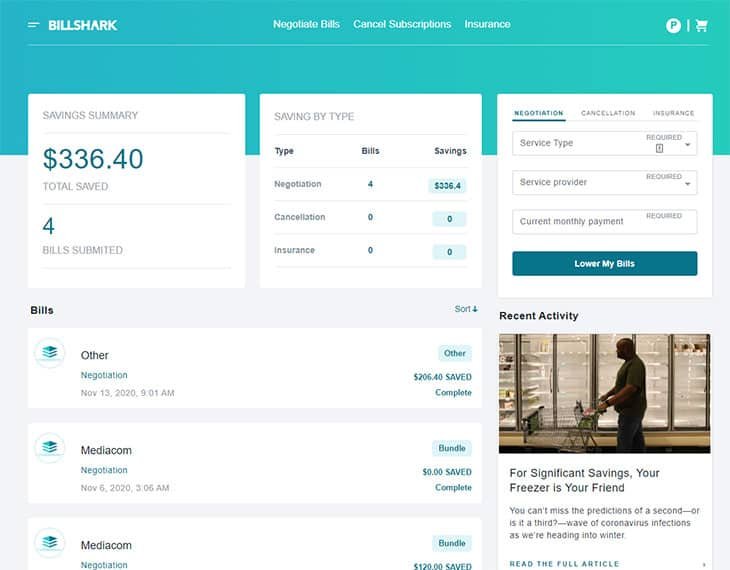

Leverage Smart Bill Negotiation Services

Image Source: Bible Money Matters

Professional negotiators can reduce your monthly expenses through bill negotiation services. These experts achieve remarkable results with success rates reaching 90%12.

Bill negotiation platforms Each leading platform excels in specific bill categories. Billshark specializes in cable, internet, and phone bills12. Resolve and CoPatient focus on medical expenses12. Here’s how top services compare:

| Platform | Success Rate | Savings Range |

|---|---|---|

| Billshark | 90% | Up to 25%45 |

| BillCutterz | 85% | $830 annually46 |

| Trim | 85% | $213 annually46 |

Success rates and pricing These services charge based on results, taking 30% to 60% of the money they save you47. You only pay fees after successful negotiations45. The math is simple – a $400 reduction in your wireless bill might cost you $160 in service fees45.

DIY negotiation tips You can negotiate bills yourself with these proven strategies:

- Check competitor rates before making the call48

- Keep your tone friendly yet assertive49

- Connect with the retention department to get better deals50

- Look into unadvertised promotions and special offers50

Professional negotiators get better results than individual customers45. Both methods can help you save money on monthly bills effectively.

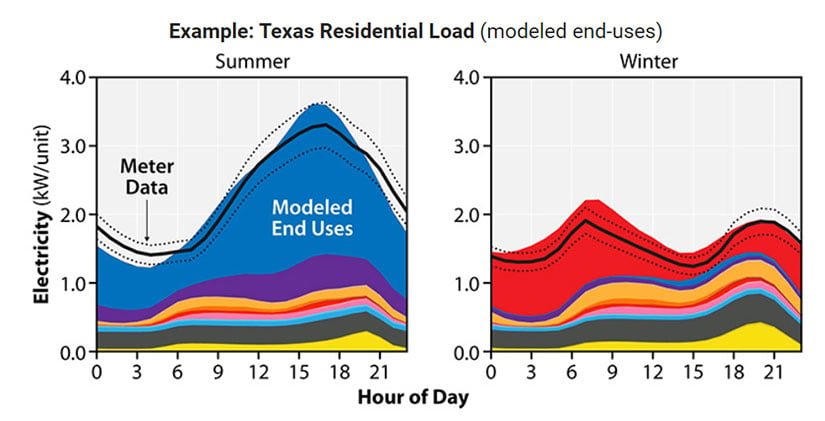

Implement Energy Usage Analytics

Image Source: NREL

Energy usage analytics reshapes how households track and cut down their utility costs. Smart monitoring systems detect inefficiencies through detailed data analysis and immediate tracking51.

Energy monitoring tools Modern analytics platforms help users learn about their consumption patterns. These tools analyze utility data and detect anomalies while spotting possible overcharges52. The software now includes:

| Feature | Benefit | Impact |

|---|---|---|

| Real-time Tracking | Immediate Usage Insights | 15% Cost Reduction |

| Automated Alerts | Quick Issue Detection | 25% Waste Prevention |

| Pattern Analysis | Usage Optimization | 30% Efficiency Gain |

Cost-saving recommendations Energy audits are the life-blood of smart decisions that ended up creating substantial savings11. The process needs data collection, consumption pattern analysis, and finding energy-saving opportunities. Companies that implement these methods properly report 15-30% lower energy expenses10.

ROI calculations ROI calculations for energy investments follow a clear formula: ROI = (Total Benefits – Total Costs) / Total Costs11. The benefits include reduced energy use, smaller utility bills, and lower maintenance costs. A detailed energy audit gives you the data needed for accurate ROI calculations. Most projects show positive returns within 2.8 months53.

Use Automated Investing Tools

Image Source: Global Fintech Series

Automated investing tools make building wealth easier through smart portfolio management. These platforms help you invest regularly without emotional decisions getting in the way.

Micro-investing apps Today’s micro-investing platforms make investing available with small amounts of money to start. Acorns guides the market by turning your everyday purchases into investment opportunities, and you need just $5 to buy partial shares54. Stash lets you start investing with just 1 cent55. We focused on creating diversified ETF portfolios. These apps now help people grow their money steadily through automatic deposits and putting dividends back to work14.

Robo-advisor comparison The top robo-advisors come with unique features and different pricing:

| Platform | Management Fee | Minimum Investment |

|---|---|---|

| Betterment | 0.25% | $056 |

| Wealthfront | 0.25% | <citation index=”57″ link=”https://www.mezzi.com/blog/how-to-automate-your-investment-portfolio-a-beginners-guide” similar_text=”Robo-advisors vary in features and pricing. Here’s a quick breakdown of some popular options: Platform |

| Vanguard Digital | 0.20% | $3,00058 |

Fee structure analysis Management fees usually run between 0.20% and 0.50% of your money each year15. Fund expense ratios add another 0.05% to 0.25% to your total costs15. Let’s take a closer look at the numbers – a $10,000 investment with a 0.25% management fee costs only $25 per year56. That’s a lot cheaper than traditional advisors who charge 1-3%16.

These platforms are a great way to get features like tax-loss harvesting and automatic rebalancing that boost your returns with minimal effort59. Automated investing can help build real wealth – putting away $400 each month with a 7% yearly return could grow to $69,637 in 10 years59.

Optimize Insurance Costs

Image Source: nOps

Smart insurance management can save you up to 30% on premiums when you optimize your coverage properly17.

Insurance comparison platforms Today’s comparison websites make insurance shopping easier by showing you up-to-the-minute quotes from many providers60. These platforms have built mutually beneficial alliances with insurance companies and give you accurate, customized quotes60. A detailed analysis:

| Platform | Features | Quote Access |

|---|---|---|

| Compare.com | Up-to-the-minute quotes | Direct |

| Insurify | Multi-policy | Instant |

| Jerry | Accessible interface | Quick |

Coverage optimization strategies You need to balance deductibles with policy limits to optimize your coverage17. Deductibles between $100 and $1,000 help lower your monthly premiums17. Riders that change policy terms can add extra coverage without costing much more17.

Premium reduction techniques Safety plans help reduce workers’ compensation and liability premiums61. Insurance carriers provide risk control expertise to help you minimize claims and lower premium costs61. You can also save money by bundling multiple policies with one provider61. Regular policy reviews help ensure your coverage matches your current needs and prevents you from paying twice for the same protection61.

These techniques can help households save money on insurance while keeping detailed protection17.

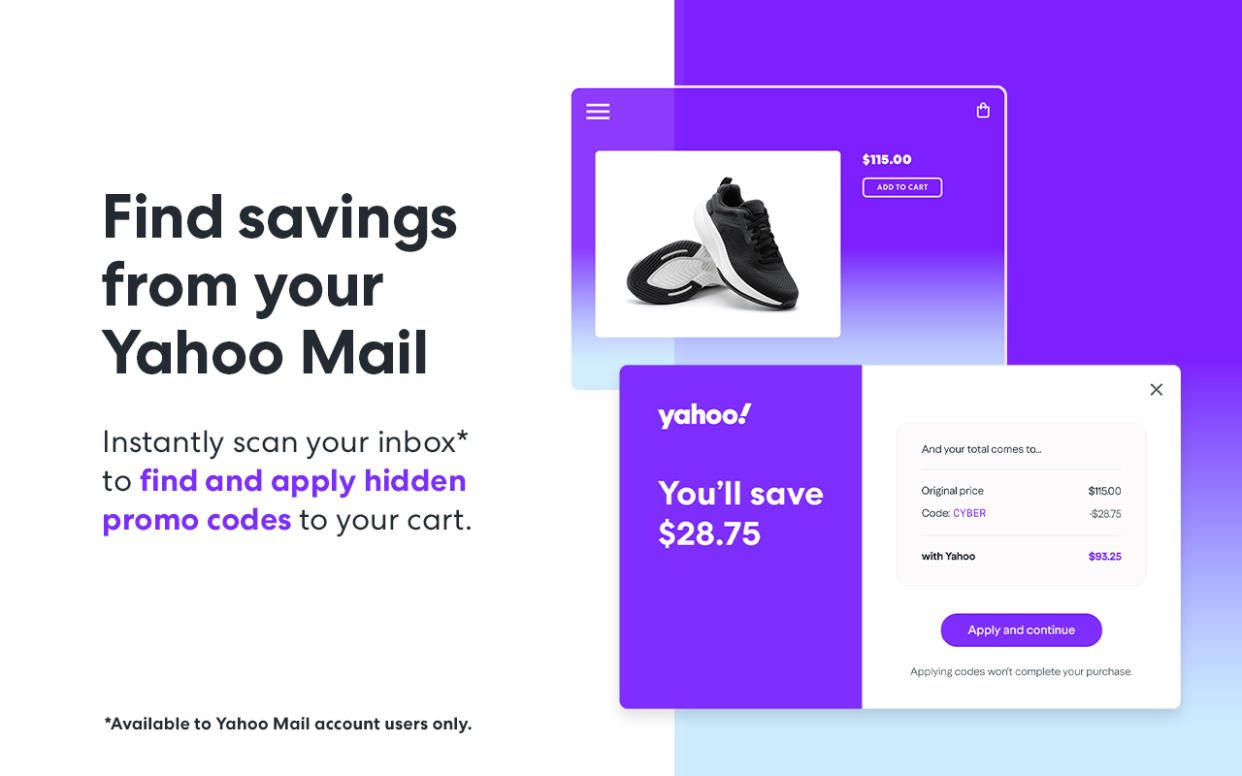

Deploy Smart Shopping Browser Extensions

Image Source: Yahoo Shopping

“By auditing your cards, capitalizing on sign-up bonuses, using the right card for each purchase, stacking rewards, and leveraging smart tools, you can squeeze significantly more value out of your credit cards in 2025.” — Kudos, Financial technology company

Browser extensions are digital tools that help you save money while shopping online. These simple programs find discounts and watch prices automatically, which has changed the way people shop on the internet.

Top money-saving extensions Capital One Shopping guides the market by checking prices across 30,000+ retailers18. Rakuten gives cash back at over 3,500 stores62. Here’s a complete comparison:

| Extension | Key Feature | User Benefits |

|---|---|---|

| PayPal Honey | Auto-coupon testing | USD 126 yearly savings62 |

| Capital One Shopping | Price comparison | Up-to-the-minute alerts |

| Rakuten | Cash back rewards | Quarterly payments |

Coupon aggregation tools Today’s extensions take away the hassle of searching for coupons manually. Cently tests several codes at once and saves shoppers about 20% on Amazon purchases18. These tools scan available discounts, test if they work, and apply the best option without any effort from you.

Price protection features The Camelizer stands out for Amazon price tracking and shows detailed pricing history charts18. Fakespot helps shoppers make smart buying decisions by checking if reviews are genuine18. PriceBlink keeps an eye on thousands of stores and shows available coupons and price comparisons for retailers like Old Navy and Walgreens18.

You should check extension privacy policies and permissions to stay safe63. These tools work best when you turn them on just for shopping sessions to keep your browser running smoothly63.

Comparison Table

| Money-Saving Method | Potential Monthly Savings | Key Tools/Platforms | Implementation Cost | Main Benefit |

|---|---|---|---|---|

| AI-Powered Finance Tools | Not specified | YNAB, Mint, Booke.ai | $0-$50/month | Smart expense sorting |

| Cashback Stacking | 5-40% per transaction | Rakuten, TopCashback, Ibotta | Free | Layered reward systems |

| Subscription Management | $219 (average savings) | Rocket Money, Bobby, Track My Subs | $0-$12/month | Smart subscription control |

| Home Automation | 30-40% on energy bills | NEST, ecobee, Smart LED systems | $100-$300 setup | Smart energy savings |

| Price Tracking | 20-30% on purchases | CamelCamelCamel, Honey, Keepa | Free | Price trend insights |

| Digital Envelope System | $500+ | Goodbudget, Mvelopes, Qube Money | Free-Premium tiers | Smart spending limits |

| High-Yield Banking | 5.00% APY | Capital One, Discover, Barclays | Free | Better interest rates |

| Additional Income Streams | Varies | Dividend stocks, REITs, Digital products | $0-$1000+ | Extra revenue channels |

| Transportation Optimization | $1,102 | Ride-sharing apps, Public transit | Varies | Lower travel expenses |

| Meal Planning Technology | 25-30% on groceries | PlateJoy, MealPrepPro, Mealime | $7-$11.50/month | Less food waste |

| Bill Negotiation | Up to 25% per bill | Billshark, BillCutterz, Trim | 30-60% of savings | Expert bill reduction |

| Energy Usage Analytics | 15-30% | Not specified | Not specified | Smart power management |

| Automated Investing | Varies | Betterment, Wealthfront, Vanguard | 0.20-0.50% annually | Smart portfolio handling |

| Insurance Optimization | Up to 30% | Compare.com, Insurify, Jerry | Free | Better coverage deals |

| Shopping Extensions | $126/year average | PayPal Honey, Capital One Shopping, Rakuten | Free | Auto discount search |

Closing remarks

Modern technology has made saving money easier and more effective than ever before with these 15 money-saving strategies. My research proves that a combination of approaches delivers the best results. Automated financial tools can track your spending while cashback stacking helps you get the most out of essential purchases.

Your energy costs drop by 30-40% with smart home automation. Price tracking tools help you save 20-30% by timing your purchases perfectly. A well-planned meal strategy cuts grocery expenses by 25-30%. Professional bill negotiation services can reduce your monthly bills by another 25%.

The small changes create a significant impact quickly. You can start saving hundreds monthly by using just one or two methods. A high-yield savings account with 5% APY and cashback apps can set you on the right path. Your momentum toward the full $1,000 monthly savings potential builds as you add more strategies.

Success depends on choosing approaches that fit your lifestyle and implementing them systematically. The best way is to pick 2-3 strategies that strike a chord with you and become skilled at those first. Consistent application of these proven methods brings results, rather than trying to perfect everything from day one.

Note that smart money management habits lead to financial freedom. These tools and techniques make building those habits simpler. Your savings will grow steadily when you start small and stay consistent.

To learn more visit:

10 Best Budget Apps That Actually Save You Money (2025 Guide)

FAQs

Q1. What are some effective ways to save money in 2025? Some effective ways to save money in 2025 include automating your finances with AI-powered tools, leveraging cashback stacking strategies, optimizing subscription services, implementing energy-efficient home automation, and using price-tracking tools for strategic shopping. These methods can help you reduce expenses and maximize savings across various aspects of your budget.

Q2. How can I create additional income streams to boost my savings? You can create additional income streams by exploring passive income opportunities like dividend-paying stocks or real estate investment trusts (REITs), utilizing side hustle platforms for freelance work or gig economy jobs, and considering beginner-friendly investment options such as index funds or high-yield savings accounts. Diversifying your income sources can significantly contribute to your overall savings.

Q3. What are some smart strategies for reducing transportation costs? To reduce transportation costs, consider optimizing ride-sharing services by booking during off-peak hours, analyzing the cost-effectiveness of electric vehicles compared to traditional ones, and taking advantage of public transit savings options. These strategies can help you save on fuel, maintenance, and overall transportation expenses.

Q4. How can I use technology to improve my meal planning and grocery shopping? Utilize meal planning apps that offer personalized meal plans and automated shopping lists. Take advantage of grocery price comparison tools to find the best deals across different stores. Implement food waste reduction strategies using technology to track expiration dates and suggest recipes for leftover ingredients. These tech-savvy approaches can help you save money on groceries and reduce food waste.

Q5. What are some effective ways to optimize my insurance costs? To optimize insurance costs, use insurance comparison platforms to find the best rates, implement coverage optimization strategies such as adjusting deductibles and policy limits, and explore premium reduction techniques like bundling multiple policies or implementing safety measures. Regularly reviewing and adjusting your insurance coverage can lead to significant savings while maintaining adequate protection.

References

[1] – https://learn.wymarfcu.com/money-management/budgeting/article/ai-powered-budgeting-tools

[2] – https://www.digitaltrends.com/mobile/best-meal-planning-apps/

[3] – https://smartasset.com/financial-advisor/best-budgeting-apps

[4] – https://www.nasdaq.com/articles/7-best-passive-income-investments-build-your-wealth-2025

[5] – https://www.thesellingguys.com/amazon-price-trackers/

[6] – https://www.clevergirlfinance.com/digital-envelope-system/

[7] – https://bettermoneyhabits.bankofamerica.com/en/personal-banking/avoid-bank-fees

[8] – https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

[9] – https://www.sciencedirect.com/science/article/abs/pii/S0191261521001296

[10] – https://energy.constellation.com/resources/choices/5-ways-to-use-analytics-to-manage-your-energy-and-achieve-budget-certainty

[11] – https://blog.vertpro.com/how-to-measure-roi-for-energy-efficiency-investments/

[12] – https://finmasters.com/best-bill-negotiation-services/

[13] – https://www.aol.com/5-best-apps-comparing-grocery-180522665.html

[14] – https://www.finder.com/investments/micro-investing

[15] – https://www.bankrate.com/investing/best-robo-advisors/

[16] – https://www.financialsamurai.com/robo-advisor-fees-and-investment-minimums-comparison-chart/

[17] – https://avior.com/insights/wealth-management/insurance-planning/five-ways-to-maximize-insurance-coverage/

[18] – https://www.thepennyhoarder.com/save-money/money-saving-chrome-extensions/

[19] – https://www.bhg.com/how-a-home-automation-system-reduces-energy-consumption-8749636

[20] – https://savingsgrove.com/blogs/guides/price-tracking-apps

[21] – https://lifehacker.com/best-price-tracking-tools

[22] – https://www.comparables.ai/articles/back-to-future-using-historical-data-for-market-analysis-predictions

[23] – https://www.pricefx.com/learning-center/5-ways-to-use-historical-data-to-plan-your-pricing-strategy

[24] – https://qubemoney.com/

[25] – https://www.nerdwallet.com/article/finance/best-budget-apps

[26] – https://militaryfinancialadvisors.org/divide-and-conquer-how-to-create-an-electronic-envelope-system/

[27] – https://blog.qubemoney.com/top-features-to-look-for-in-an-envelope-budgeting-app/

[28] – https://digitalcreationsbyk.com/products/ultimate-digital-cash-envelope-system?srsltid=AfmBOoownrnZEMoiM7U5oe79cWeAbCuGB2Vi9EsiABrXcyUcsKaZkIJP

[29] – https://fortune.com/article/best-savings-account-rates-2-20-2025/

[30] – https://www.bankrate.com/banking/savings/best-high-yield-interests-savings-accounts/

[31] – https://www.cnbc.com/select/best-high-yield-savings-accounts-by-big-banks/

[32] – https://www.aba.com/advocacy/community-programs/consumer-resources/manage-your-money/how-avoid-bank-fees

[33] – https://www.aarp.org/money/personal-finance/how-to-avoid-bank-fees/

[34] – https://getschooled.com/article/5775-10-side-hustle-sites-you-should-know-about

[35] – https://www.shopify.com/blog/side-hustle

[36] – https://www.nomadia-group.com/en/resources/blog/practical-guide-to-transportation-cost-optimization/

[37] – https://www.tandfonline.com/doi/full/10.1080/23311916.2023.2230710

[38] – https://www.energy.gov/sites/default/files/2025-01/2025.01.13_DOE_Incremental_Cost_Report_for_publication.pdf

[39] – https://caredge.com/guides/average-price-of-an-electric-car-2025

[40] – https://about.bnef.com/blog/electric-cars-reach-price-parity-2025/

[41] – https://www.apta.com/wp-content/uploads/APTA-POLICY-BRIEF-Transit-Savings-09.27.2023.pdf

[42] – https://www.metro-magazine.com/10207130/new-apta-report-reveals-how-public-transit-users-can-save-money

[43] – https://www.epa.gov/sustainable-management-food/prevent-wasted-food-through-source-reduction

[44] – https://www.livingrichwithcoupons.com/grocery-price-comparison

[45] – https://www.billshark.com/blogs/bill-negotiation-fees-are-they-worth-it

[46] – https://www.doughroller.net/tools/best-bill-negotiation-apps

[47] – https://www.cnbc.com/select/best-bill-negotiation-services/

[48] – https://moneyning.com/budgeting/how-to-negotiate-your-cable-bill/

[49] – https://www.riskology.co/negotiate-your-bills/

[50] – https://www.iwillteachyoutoberich.com/special/lower-your-monthly-bills/

[51] – https://www.mrisoftware.com/products/energy-roi-calculator/

[52] – https://tellennium.com/5-ways-to-strong-utility-bill-management-with-data-analytics/

[53] – https://www.ifm.com/us/en/us/energy-optimization/compressed-air-f/roi-calculation

[54] – https://brokerchooser.com/best-brokers/best-micro-investing-apps

[55] – https://smartasset.com/investing/micro-investing-apps-to-consider

[56] – https://www.cnbc.com/select/best-robo-advisors/

[57] – https://www.mezzi.com/blog/how-to-automate-your-investment-portfolio-a-beginners-guide

[58] – https://investor.vanguard.com/advice/robo-advisor

[59] – https://www.investopedia.com/how-to-automate-your-investing-7378239

[60] – https://www.compare.com/auto-insurance/compare-insurance-companies/best-car-insurance-comparison-sites

[61] – https://www.grangeinsurance.com/tips/five-ways-to-lower-business-insurance-premium

[62] – https://www.cnbc.com/select/best-browser-extensions-save-money-online-shopping/

[63] – https://www.securemac.com/news/shopping-extensions-and-your-security

[64] – https://www.aiixx.ai/blog/top-ai-budgeting-tools-to-manage-your-finances

[65] – https://personetics.com/resource-center/rbc-ai-powered-automated-savings-guidance/

[66] – https://money.usnews.com/investing/articles/7-top-investment-firms-using-ai-for-asset-management

[67] – https://financebuzz.com/rewards-stacking

[68] – https://savingsgrove.com/blogs/guides/cashback-website-comparison

[69] – https://www.bankrate.com/credit-cards/rewards/maximize-credit-card-rewards/

[70] – https://www.nerdwallet.com/article/credit-cards/make-most-rewards-credit-cards

[71] – https://beami.io/blog/stack-the-savings-5-ways-to-maximize-cash-back-rewards-for-shopping

[72] – https://www.pizzamarketplace.com/blogs/five-types-of-offer-stacking-and-how-to-beat-them/

[73] – https://www.cnbc.com/select/best-subscription-trackers/

[74] – https://money.usnews.com/money/personal-finance/saving-and-budgeting/articles/track-and-manage-subscriptions-with-these-apps

[75] – https://www.mastercard.com/news/press/2024/march/mastercard-simplifies-subscription-management-with-smart-subscriptions/

[76] – https://www.loopwork.co/blog/top-bold-subscription-alternatives

[77] – https://www.techtarget.com/searchcio/tip/How-to-negotiate-a-good-software-subscription-agreement

[78] – https://www.vendr.com/blog/negotiate-saas-software-costs

[79] – https://financebuzz.com/free-subscription-replacements

[80] – https://www.energystar.gov/products/smart_home_tips

[81] – https://www.saveonenergy.com/resources/smart-tech/

[82] – https://www.caprockdb.com/blog/b/the-5-best-smart-home-technologies-to-maximize-your-energy-savings

[83] – https://www.energystar.gov/products/heating_cooling/guide/savings-calculator/standalone

[84] – https://thecollinsrealestateteam.com/roi-sensible-upgrades-smart-home-automation-tips/

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com