A harsh truth faces many Americans today: Half of those retiring at 65 can’t keep up their previous lifestyle. My 13 years of experience as a financial advisor has shown me why retirement strategies are more vital than ever.

The reality hits hard with numbers. A 65-year-old couple needs $315,000 just for healthcare expenses. The chances that one partner will live past 90 stands at 70%. Retirement planning must create a green financial framework that spans decades – it’s not just about saving money.

I’ve helped numerous clients plan their retirement path. Through this experience, I’ve developed 12 proven strategies that deliver results. These methods move beyond simple retirement savings approaches. They help maintain your lifestyle while navigating healthcare costs, tax changes, and longer lifespans in 2025 and beyond.

Start Early with Strategic Retirement Planning

Image Source: Investopedia

You need careful planning and steadfast dedication to achieve financial security in retirement. My experience helping clients plan for retirement shows that people who start early gain a substantial edge in building a reliable financial future.

Understanding Your Retirement Number

Financial experts say you’ll need 70% to 90% of your pre-retirement income to keep your lifestyle in retirement61. The average American spends about 20 years in retirement61, which makes calculating your retirement number vital. Right now, only half of Americans know how much they should save61.

Here’s how to calculate your retirement number effectively:

- Review your current monthly expenses

- Add healthcare costs, which can reach $315,000 for a typical 65-year-old couple

- Plan for inflation, which runs about 3% each year62

Setting Clear Financial Goals

You retain control by creating multiple income streams instead of just relying on savings. Social Security only replaces 40% of pre-retirement income61, so you need additional sources of income.

These proven strategies deliver the best results:

- Get the most from employer-sponsored retirement plans, especially those with matching contributions

- Broaden investments across different asset classes to lower risk

- Use catch-up contributions after age 50

- Set up automated savings to keep contributions consistent

Creating a Retirement Timeline

Your retirement timeline substantially affects your investment strategy. Younger investors can take more calculated risks with stocks and then move to safer assets as retirement gets closer63.

A strategic timeline looks like this:

- Early Career (20s-30s): Target aggressive growth and maximize employer matches

- Mid-Career (40s-50s): Mix growth with preservation while saving more

- Pre-Retirement (5-10 years before): Adjust investments to protect your wealth

- Retirement Phase: Use withdrawal strategies that match your needs

Note that compound interest drives long-term growth. To cite an instance, see how starting retirement savings at 25 and putting in $2,000 yearly for 40 years could grow to about $560,000 at 8% annual growth. Starting at 35 might only give you $245,000 under similar conditions64.

Your retirement strategy should stay flexible and adapt to life changes like marriage, career moves, or market swings65. Regular reviews and rebalancing help your retirement plan stay in sync with your financial goals and risk comfort level.

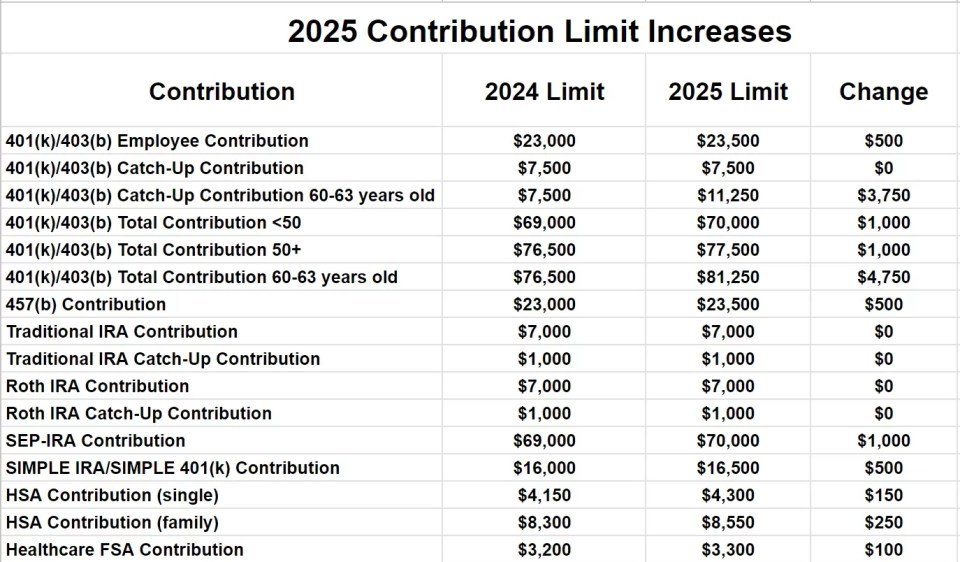

Maximize Tax-Advantaged Retirement Accounts

Image Source: The Neighborhood Finance Guy

Tax-advantaged retirement accounts help build a secure financial future. My years of advising clients have shown how these accounts can substantially boost retirement savings when used strategically.

401(k) Contribution Strategies

Employees can contribute up to $23,500 to their 401(k) plans in 202566. Many employers match these contributions, which means free money toward retirement. The smart move is to contribute enough to get the full employer match and maximize your retirement savings.

After-tax contributions beyond standard limits create another powerful strategy. The combined employer and employee contribution limit reaches $70,000 in 202567. This strategy, known as the mega backdoor Roth IRA, lets you save substantial amounts with tax advantages.

IRA Investment Options

Individual Retirement Accounts give you flexibility in retirement planning. Traditional IRAs grow tax-deferred, which might reduce your current tax bill. The withdrawals get taxed during retirement60. Roth IRAs work differently – you pay taxes upfront but get tax-free qualified withdrawals after age 59½, provided you’ve held the account for five years60.

HSA Benefits for Retirement

Health Savings Accounts shine with their triple tax advantage. The 2025 contribution limits are $4,300 for self-only coverage and $8,550 for family coverage67. Your contributions are tax-deductible and grow tax-free. The withdrawals stay tax-free when used for qualified medical expenses34.

The math speaks for itself. A $1,000 HSA investment growing at 7% annually becomes $7,612 in 30 years. The same investment in a traditional IRA would only reach $5,937 after paying 22% in taxes34. Once you turn 65, you can use HSA funds tax-free for Medicare premiums and other healthcare costs34.

Catch-up Contribution Opportunities

Age 50 opens doors to catch-up contributions. The 401(k) participants can add $7,500 more beyond the standard limit in 202568. People aged 60-63 get an even better deal with $11,250 in catch-up contributions69.

IRA holders over 50 can put in an extra $1,000 yearly above the regular limit68. HSA rules let those 55 and older add $1,000 more each year70.

A new rule kicks in for 2026. High-income earners (making over $145,000) must put their catch-up contributions into Roth accounts71. This change shows why staying current with retirement savings rules matters.

Develop Multiple Income Streams

Image Source: Rentec Direct

A resilient retirement strategy’s life-blood is building multiple income streams. My experience as a financial advisor shows how different income sources protect retirees from market volatility and inflation risks.

Dividend Investment Strategy

Dividend-paying stocks provide a reliable income stream without selling your investments. Companies distribute dividends quarterly13, which creates predictable cash flow. In spite of that, focusing on companies with consistent dividend-paying histories is significant because payouts can vary or even stop13.

Dividend yields have become more attractive than diversified bond portfolios in today’s market13. Investors should watch out for unusually high dividend yields that might signal company problems. The best results come from stocks with reliable histories of steady or increasing dividend payouts13.

Real Estate Income Planning

Rental properties create another strong income stream through real estate investments. A USD 300,000 property that generates USD 1,500 monthly rent could yield 6% annual returns before expenses14. REITs give investors a more hands-off approach and access to various property portfolios without direct management duties14.

Success in real estate investment depends on:

- Property type selection (residential vs. commercial)

- Location assessment

- Market condition analysis

- Professional property management evaluation14

Side Business Development

Starting a business after retirement opens up exciting ways to earn extra income. Recent data shows substitute teachers earn about USD 21.00 per hour or USD 43,500 yearly15. Platforms like Tutor.com and Skooli help retirees find tutoring work without marketing hassles15.

FlexJobs, Upwork, and PeoplePerHour help professionals utilize their expertise through flexible freelance work15. Retirees should remember tax implications – self-employment income over USD 400 yearly needs tax reporting15.

Virtual assistance has become a popular option. Assistants help manage emails, scheduling, and organizational tasks for small businesses3. Event planning and freelance writing let retirees use their existing skills while keeping flexible schedules3.

Retirees can build a strong financial foundation that handles market changes and inflation pressures by implementing these income streams strategically. Success comes from choosing opportunities that match your skills, available time, and financial goals.

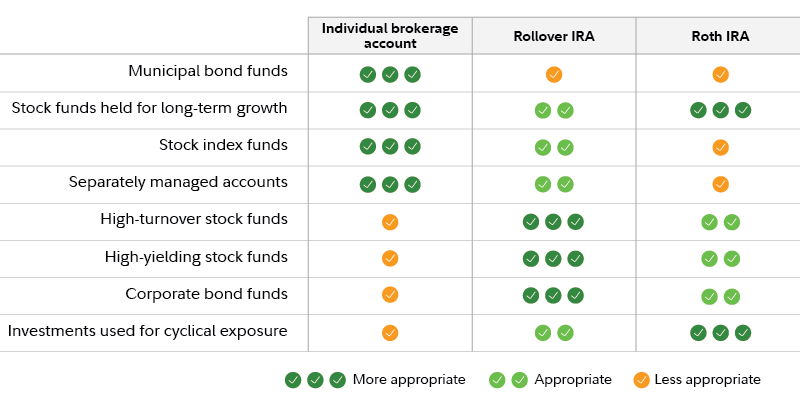

Create a Tax-Efficient Investment Strategy

Image Source: Fidelity Investments

Smart tax planning is the foundation of preserving wealth throughout retirement. My years as a financial advisor specializing in tax optimization have shown me how smart tax decisions can affect retirement savings by a lot.

Asset Location Optimization

The right asset placement in different account types can boost after-tax returns between 0.05% and 0.3% annually16. This strategy matches investments with accounts that offer the best tax advantages. Here’s what works best:

- Place bonds and high-yield investments in tax-deferred accounts like traditional IRAs

- Hold tax-efficient investments like index funds in taxable accounts

- Use Roth accounts for investments with high growth potential

A retired couple with a $2 million portfolio could save between $2,800 and $8,200 annually in taxes through careful asset location, depending on their tax bracket17.

Tax-Loss Harvesting Techniques

Tax-loss harvesting lets you offset capital gains while repositioning your portfolio. Here’s a practical example: offsetting a $20,000 short-term capital gain with a $25,000 loss could save about $8,050 in taxes at a 35% marginal rate18.

Key points to remember:

- Losses first apply to gains of the same type (short-term or long-term)

- Up to $3,000 in excess losses can offset ordinary income annually

- Remaining losses carry forward to future tax years18

The wash-sale rule requires waiting 30 days before buying similar securities18.

Roth Conversion Planning

Smart Roth conversions help minimize future tax burdens. The best time for conversion happens during “trough years” – after retirement but before Social Security benefits start19. This timing gives you better control over taxable income.

These factors matter when planning conversions:

- Current versus expected future tax rates

- Available funds outside retirement accounts to pay conversion taxes

- Time horizon before needing the converted funds

The strategy works best when you:

- Convert during lower tax bracket years

- Pick investments with higher appreciation potential

- Pay conversion taxes with non-retirement assets20

Retirees can save thousands in retirement savings by implementing these tax-efficient approaches. Reinvesting $900 in annual tax savings at 6% could grow to approximately $35,000 over 20 years18.

Implement Risk Management Protocols

Image Source: 7th Street Financial

Retirement savings need an all-encompassing approach to risk management. My years of client advisory experience have taught me several key strategies that help protect retirement assets from unexpected challenges.

Insurance Coverage Assessment

Your life insurance policies should give you enough coverage to:

- Pay off existing liabilities

- Replace lost income

- Cover caregiving expenses

- Handle final expenses

- Fund children’s education (if desired)21

‘Own occupation’ long-term disability insurance is a vital safety net. It replaces your after-tax income until age 65, even when you find different work21.

Emergency Fund Planning

A strong emergency fund protects you from financial shocks. Retirees need more than the standard three to six months of expenses. Here’s what you should aim for:

- Two-income households: 3-6 months of expenses

- Single-income households: 6+ months of expenses

- Investment-dependent retirees: 18-24 months of expenses22

Separate emergency savings protect your retirement accounts during market downturns. This strategy helps you avoid tax penalties and gives your investments time to bounce back21.

Long-term Care Considerations

The numbers tell a clear story: approximately 70% of Americans who turn 65 today will need some type of long-term care services23. Current costs show the reality:

- Home healthcare aide: $61,776 annually

- Assisted living facility: $54,000 annually

- Private nursing home room: $108,405 annually24

You have three main options to fund long-term care:

- Personal savings

- Government assistance

- Insurance products24

Regular health insurance and Medicare don’t typically cover long-term care expenses23. Long-term care insurance becomes a significant consideration. You should think over buying it in your 50s before health conditions might limit your eligibility25.

These risk management strategies help retirees shield their savings from unexpected financial challenges. Success comes from detailed coverage that tackles both immediate emergencies and long-term care needs.

Optimize Social Security Benefits

Image Source: Kiplinger

Social Security benefits are the foundations of retirement income. Smart planning helps you get the most from these benefits. My experience with clients shows that claim timing and coordination substantially affect lifetime benefits.

Timing Your Claims

Your monthly payments depend heavily on when you start collecting Social Security. The maximum benefit in 2025 will be $2,831 if you claim at age 62, but this amount grows to $5,108 if you wait until age 7026. Your payment grows by about 8% for each year you delay benefits after reaching full retirement age27.

Spousal Benefit Strategies

Married couples can use special strategies to maximize their combined benefits. You can receive up to 50% of your partner’s primary insurance amount if you wait until full retirement age28. Surviving spouses who reach full retirement age can get 100% of their deceased partner’s benefit29.

Working While Collecting Benefits

People under full retirement age can earn up to $23,400 in 2025 without affecting their benefits30. Social Security takes $1 for every $2 earned above this limit30. The earnings limit jumps to $62,160 during the year you reach full retirement age, with $1 taken for every $3 earned above this amount30.

These earnings don’t count toward the limits:

- Pensions and annuities

- Investment earnings

- Interest income

- Veterans or government retirement benefits30

The good news is that reduced benefits from excess earnings aren’t gone forever. Social Security recalculates your benefit amount once you reach full retirement age. This gives you credit for months when benefits were withheld31. Your monthly benefit might even increase if your current earnings replace lower-earning years in your benefit calculation32.

Smart timing and understanding these rules help retirees get the most from their Social Security benefits while maintaining their lifestyle. Each person’s situation differs greatly. A qualified financial advisor can help you create the best claiming strategy for your needs.

Build a Healthcare Cost Strategy

Image Source: U.S. Bank

Healthcare costs rank among the biggest financial hurdles retirees face. My years of working with retirees show that a well-laid-out healthcare strategy plays a vital role in financial stability.

Medicare Planning

Your Medicare enrollment timing will affect your long-term costs. A seven-month Initial Enrollment Period starts when you turn 65. This period spans three months before your birth month, your birth month, and three months after2. Late enrollment often leads to permanent penalties.

Original Medicare pays about two-thirds of healthcare costs6. A typical 65-year-old couple will need $330,000 in 2025 [link_1] to cover medical expenses throughout retirement. This amount doesn’t include long-term care costs33. The right Medicare planning helps protect your retirement savings.

Healthcare Savings Options

Health Savings Accounts (HSAs) are a great way to get tax advantages while funding retirement healthcare. The 2025 contribution limits are $4,300 for self-only coverage and $8,550 for family coverage34. People over 55 can add $1,000 more each year35.

HSAs provide three distinct tax benefits:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses34

Your existing HSA funds remain available for healthcare expenses after Medicare enrollment, including Medicare premiums36. However, you can’t make new contributions at this point.

Supplemental Insurance Considerations

Supplemental insurance fills Medicare’s coverage gaps. Medigap policies help pay deductibles, copayments, and coinsurance costs37. The six months after Medicare Part B enrollment guarantee your acceptance for Medigap coverage, whatever your pre-existing conditions38.

Medicare Advantage plans bundle Part A, Part B, and usually Part D coverage as another option5. These plans often add dental and vision care benefits but limit provider networks6.

Today, 94% of Medicare beneficiaries say they’re satisfied with their healthcare quality4. However, insufficient supplemental coverage could strain your finances since medical costs rise 1.5 to 2 times faster than inflation6.

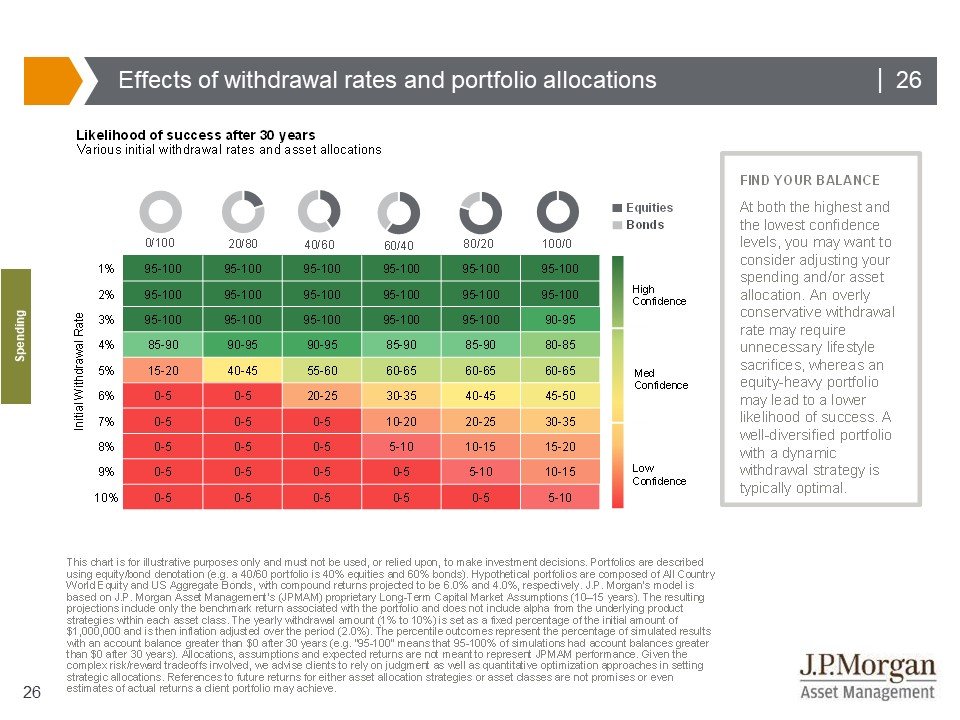

Design a Sustainable Withdrawal Plan

Image Source: Approach Financial

A well-planned withdrawal strategy is the life-blood of keeping your retirement wealth intact. My years of working with retirees have shown that you need to balance your current needs with long-term stability. This means looking at several ways to withdraw your money.

The 4% Rule Assessment

The traditional 4% rule tells you to take out 4% of your retirement savings in year one and adjust that number each year based on inflation39. Today’s market conditions make this approach trickier than before. Studies show a 4.6% withdrawal rate worked well 90% of the time when looking at a 30-year retirement period40. People who retire at 60 might want to stick to a lower 4.4% rate since they could need their money for 35 years or more40.

Dynamic Spending Strategies

Dynamic spending lets you be more flexible by changing your withdrawals based on how the market performs. You set upper and lower limits that let you spend more when markets are strong and pull back when they’re not41. A real-world example shows that using dynamic spending with a -1.5% floor and 5% ceiling lets you start with a 5% withdrawal rate. This works with 85% confidence over 35 years if you have a 50/50 mix of stocks and bonds41.

Required Minimum Distribution Planning

Most retirement accounts need you to start taking required minimum distributions (RMDs) at age 737. Your RMD amount comes from dividing your account balance by a life expectancy number from the IRS’s Uniform Lifetime Table7. You must take your first RMD by April 1 of the year after you turn 73. After that, you need to withdraw by December 31 each year8.

Key things to know about RMDs:

- Roth IRAs don’t need RMDs during your lifetime7

- You’ll face a 25% penalty if you withdraw too little or too late42

- You can use Qualified Charitable Distributions up to $105,000 yearly to meet RMD requirements8

Smart use of these withdrawal methods helps retirees live the way they want while keeping money for later. The best approach often mixes different methods and changes with market conditions and your personal needs throughout retirement.

Create an Estate Planning Framework

Image Source: Esther Schwartz Zelmanovitz, PLLC

Estate planning is a vital part of your retirement strategy that helps your hard-earned wealth support your legacy goals. My experience as an advisor has taught me how to balance asset preservation with your future wishes.

Legacy Planning Strategies

Your legacy plan needs clear documentation of your financial assets and wishes. A detailed road map helps your family members find investment accounts, significant documents, and specific instructions43. Today’s digital world requires special attention to digital assets like cryptocurrencies and intellectual property in modern legacy management44.

Trust Considerations

Revocable trusts give you distinct advantages, especially in avoiding probate and keeping your privacy. These trusts are particularly valuable if you own properties in multiple states – a revocable trust eliminates the need for multiple probate proceedings45.

Here are four great reasons to think over trusts:

- You avoid probate and reduce costs

- You get better control over asset distribution

- Your financial matters stay private

- You get simpler management during incapacity45

Beneficiary Designation Review

Your beneficiary designations need regular review since they override will provisions46. Old designations could accidentally send assets to ex-spouses or deceased individuals47. Retirement accounts without proper beneficiary designations might trigger faster distributions and bigger tax burdens46.

Remember to review these key points:

- Retirement account designations

- Life insurance policies

- Transfer-on-death accounts

- Trust beneficiaries48

Note that some trusts can protect your assets from creditors while giving you tax advantages49. Generation-skipping trusts let you transfer wealth straight to your grandchildren and optimize estate tax management across generations44.

A strategic approach to these estate planning elements ensures your wealth serves its intended purposes. Recent data shows that well-structured trusts have 94% beneficiary satisfaction rates48, which proves how well they preserve legacies.

Develop a Debt Elimination Strategy

Image Source: Investopedia

A secure retirement starts with smart debt management. My years as a financial advisor have shown me how the right debt strategies can make or break retirement plans.

Mortgage Planning

Most people call mortgages “good debt,” but you still need to review them carefully. The numbers tell an interesting story – 46% of homeowners aged 65-79 now have mortgages, which is twice as many as in 199050. The 28/36 rule makes good sense: keep mortgage payments under 28% of your pretax income, and all debt payments should stay below 36%50.

Smart mortgage management boils down to these points:

- Look into refinancing when rates drop or to shorten your term

- Check if you can still deduct the interest on your taxes

- See how your mortgage affects your retirement savings access

High-Interest Debt Management

Credit cards need your attention right now because they come with the steepest interest rates. The numbers paint a clear picture – people aged 50-64 carry about $7,200 in credit card debt. Seniors 65 and up have less but still owe $4,700 on average51.

Two methods work well to cut down debt:

- The Snowball Method: Pay the smallest debts first while keeping up minimum payments on others

- The Avalanche Method: Tackle your highest-interest debts first but don’t skip other minimum payments

Student Loan Considerations

Student loan debt has become a big deal for retirees. The last 15 years saw a massive jump to $126 billion for people over 6052. You should know that if you default on federal student loans, the government can take up to 15% of your Social Security benefits53.

These strategies help manage student loans:

- Ask about income-driven repayment plans

- Look into loan forgiveness options

- Think about consolidating your loans

- Check if your employer helps with student loan payments9

The quickest way to tackle debt starts with paying off high-interest credit cards. Then focus on student loans, and leave mortgage debt for last12. This approach helps retirees keep their options open while protecting their nest egg for what matters most.

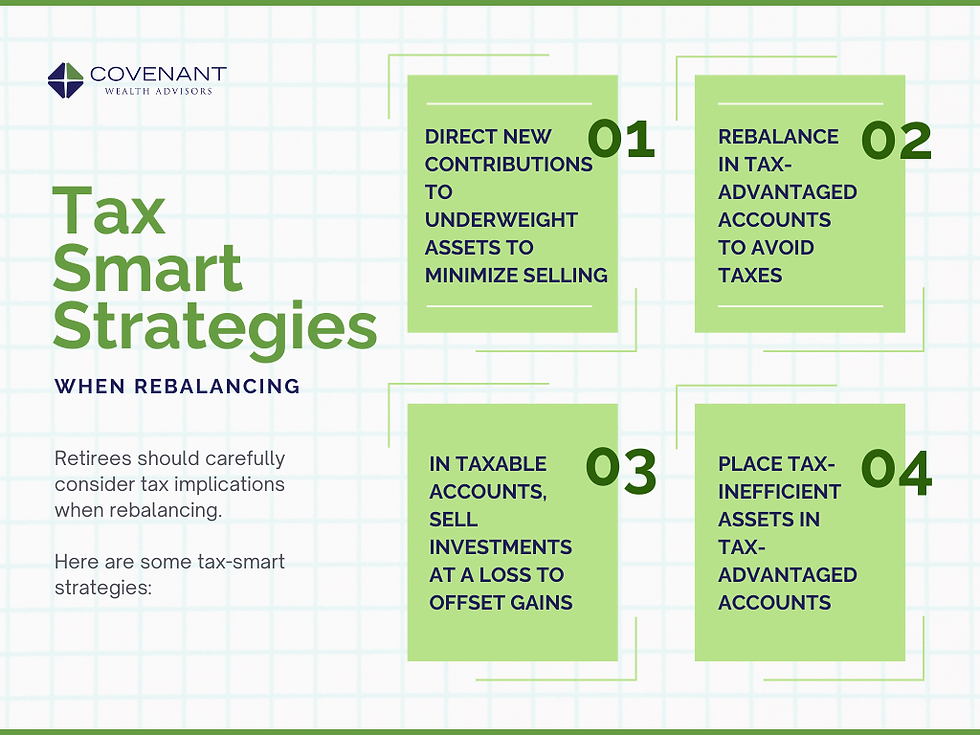

Implement Portfolio Rebalancing Protocols

Image Source: Covenant Wealth Advisors

Portfolio rebalancing plays a key role in keeping retirement stable. My years of managing retirement portfolios show that regular rebalancing helps preserve wealth and adapts to market changes.

Asset Allocation Strategy

Data from the past century shows portfolios with 91% stocks and 9% bonds gave the best returns in multiple markets54. Market conditions differ by region though. U.S. markets did well with 100% stock allocation, while Spain showed better results with 70% stocks and 30% bonds54.

The bucket strategy gives you a great way to get the right asset mix:

- Short-term bucket: Cash and low-risk investments that cover 1-3 years of expenses

- Medium-term bucket: Moderate investments for 3-10 years

- Long-term bucket: Growth-focused investments for 10+ years ahead55

Risk Tolerance Assessment

Risk tolerance depends on how much market volatility you can handle and afford. The ‘Rule of 110’ works as a starting point – subtract your age from 110 to find the right stock allocation55. So a 65-year-old investor might want to keep 45% in stocks.

Regular risk checks become crucial as life changes. Research shows retirees should keep enough growth potential, since people now live to 82 for men and 85 for women on average55.

Market Timing Considerations

Research shows the best time to rebalance is when portfolios drift substantially from target allocations10. You can pick between two main approaches:

- Fixed band: Rebalance at specific percentage deviations

- Relative band: Set triggers based on percentage of allocation targets10

Studies confirm that wider rebalancing bands need fewer adjustments and can exploit positive market momentum10. This effect shows up most in portfolios with 60% equity allocation, followed by those with 90% stocks10.

Smart use of these methods helps retirees keep their portfolios on track as markets change. Monthly checks combined with threshold-based rebalancing strike the right balance between hands-on management and long-term stability56.

Plan for Lifestyle Maintenance

Image Source: Finance Strategists

You need careful financial planning to keep your desired lifestyle in retirement. My experience with clients shows that good planning leads to stable finances through decades of retirement.

Budget Optimization

Smart retirement budgeting begins when you understand how you spend money. Households under age 55 spend about $58,000 yearly11. Spending patterns change when retirement begins. Food, entertainment, and transportation costs stay stable, while housing costs usually go down57.

Inflation Protection Strategies

Inflation threatens retirement savings at 3.4% yearly as of May 202411. Here are proven ways to protect against inflation:

- Long-term stock investments work well since the S&P 500 has returned about 10% yearly, beating inflation’s 3% average11

- Put some fixed-income investments in Treasury Inflation-Protected Securities (TIPS) that adjust with inflation11

- Broad-based commodities ETFs often do well during inflationary times11

Lifestyle Goal Setting

Realistic lifestyle goals lead to retirement satisfaction. Healthcare costs rise faster than general inflation11. A solid plan includes:

- Looking at monthly expenses now and what you’ll need later

- Adding healthcare costs that might reach $330,000 for a typical 65-year-old couple1

- Adapting your lifestyle as retirement goes on

Most people need 80-90% of their pre-retirement income to maintain their standard of living58. Smart planning helps you adjust spending while keeping your quality of life. Housing costs drop naturally as retirees choose smaller homes or move to cheaper areas57. Travel costs might go up early in retirement as you check off bucket list destinations59.

Your retirement plan should stay flexible. Regular money checkups and spending adjustments help your savings last throughout retirement1.

Comparison Table

| Strategy | Main Goal | Core Elements | Best Time to Start | Important Numbers |

|---|---|---|---|---|

| Begin Retirement Planning Early | Build a reliable financial future through early planning | – Retirement number calculation – Clear financial goals – Investment timeline | Your 20s-30s | 70-90% of pre-retirement income needed for retirement |

| Get the Most from Tax-Advantaged Accounts | Save more through tax benefits | – 401(k) strategies – IRA investments – HSA utilization | Age 50+ for catch-up contributions | 2025 401(k) limit: $23,500 Combined limit: $70,000 |

| Build Multiple Income Sources | Create varied revenue streams | – Dividend investments – Real estate income – Side businesses | Throughout retirement | $300,000 property can yield 6% annual return |

| Design a Tax-Smart Investment Plan | Lower taxes on retirement savings | – Asset location – Tax-loss harvesting – Roth conversions | Pre-retirement planning | Can save 0.05-0.3% annually through proper asset location |

| Set Up Risk Protection | Safeguard retirement assets | – Insurance coverage – Emergency fund – Long-term care planning | 50s for long-term care insurance | 70% of 65-year-olds will need long-term care |

| Make the Most of Social Security | Get maximum lifetime benefits | – Timing strategies – Spousal benefits – Work considerations | Age 62-70 | Maximum benefit at 70: $5,108 (2025) |

| Plan for Healthcare Costs | Prepare for medical expenses | – Medicare planning – HSA optimization – Supplemental insurance | Age 65 for Medicare | $330,000 needed for retirement healthcare |

| Create a Smart Withdrawal Plan | Keep income steady | – 4% rule assessment – Dynamic spending – RMD planning | Start at age 73 for RMDs | 4.6% withdrawal rate sustainable 90% of time |

| Set Up Estate Planning | Pass on wealth effectively | – Legacy planning – Trust considerations – Beneficiary reviews | Throughout retirement | 94% beneficiary satisfaction with trusts |

| Clear All Debts | Reduce money owed | – Mortgage planning – High-interest debt – Student loan management | Pre-retirement | 46% of 65-79 year-olds carry mortgages |

| Balance Your Portfolio | Keep investments on track | – Asset allocation – Risk assessment – Market timing | Regular monitoring | Rule of 110 for stock allocation |

| Maintain Your Lifestyle | Keep your standard of living | – Budget optimization – Inflation protection – Goal setting | Throughout retirement | 80-90% of pre-retirement income needed |

Ultimate point

My 13 years as a financial advisor have shown me countless success stories from clients who used these proven retirement strategies. Each approach – from early planning to lifestyle maintenance – creates lasting financial security.

The research is clear: proper retirement planning makes a real difference. Half of Americans struggle to keep their pre-retirement lifestyle. Those who follow detailed strategies have better chances of financial stability. My ground experience proves that using multiple approaches gives the best results.

These 12 strategies create an integrated system. Early planning builds the foundation. Tax-advantaged accounts grow wealth. Multiple income streams add stability. Risk management keeps assets safe. Social Security optimization, healthcare planning, and sustainable withdrawal strategies create steady income. Estate planning, debt elimination, and portfolio rebalancing round out the framework for long-term success.

The numbers paint a clear picture. A typical 65-year-old couple needs $330,000 for healthcare alone. This makes proper planning crucial. Smart Social Security timing can boost monthly benefits from $2,831 at age 62 to $5,108 at age 70. The 4.6% withdrawal rule shows 90% success rates over 30-year retirement periods.

As your financial advisor, I help you put these strategies to work. Each person’s retirement experience is unique and needs individual-specific approaches with regular updates. To learn more, reach out to us at support@trendnovaworld.com to see how these strategies line up with your retirement goals.

Note that successful retirement planning just needs action today. The path might look complex, but small steps toward each strategy build a secure financial future. Start using these proven approaches now to keep your desired lifestyle throughout retirement.

For more information, visit

13 Money-Saving Financial Tips for New Parents in 2025 (Tested by Real Families)

FAQs

Q1. What major retirement changes are coming in 2025? In 2025, workers ages 60-63 will be eligible for higher 401(k) catch-up contributions. There will also be new rules for inherited IRAs and increased Social Security benefits for certain public sector employees.

Q2. How much savings do I need to maintain my lifestyle in retirement? A general guideline is to have 25 times your desired annual retirement income saved. For example, if you want $40,000 per year, aim for $1 million in savings. However, this can vary based on factors like inflation and unexpected expenses.

Q3. What is the recommended withdrawal rate for retirement savings? While the traditional 4% rule is well-known, some experts now suggest a 4.6% withdrawal rate as being sustainable 90% of the time over a 30-year retirement period. However, the ideal rate can vary based on individual circumstances and market conditions.

Q4. How can I create multiple income streams for retirement? Diversifying your income sources can include dividend-paying stocks, rental properties, and part-time work or consulting. For example, a $300,000 rental property could potentially yield a 6% annual return before expenses.

Q5. How should I plan for healthcare costs in retirement? Healthcare is a significant expense in retirement. As of 2025, a typical 65-year-old couple needs about $330,000 to cover medical expenses throughout retirement. Consider maximizing Health Savings Accounts, purchasing supplemental insurance, and factoring these costs into your overall retirement budget.

References

[1] – https://www.usbank.com/retirement-planning/financial-perspectives/maintain-lifestyle-in-retirement.html

[2] – https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/working-past-65/retiree-insurance

[3] – https://money.usnews.com/money/retirement/second-careers/articles/great-side-hustles-for-retirees

[4] – https://www.schwab.com/learn/story/demystifying-medicare-retirement

[5] – https://www.securian.com/insights-tools/articles/medicare-tips-in-retirement.html

[6] – https://www.ml.com/articles/healthcare-in-retirement.html

[7] – https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

[8] – https://www.fidelity.com/learning-center/personal-finance/retirement/required-minimum-distributions

[9] – https://www.irs.gov/newsroom/irs-issues-important-interim-guidance-on-employer-matching-contributions-made-to-retirement-plans-related-to-employee-student-loan-payments

[10] – https://www.troweprice.com/personal-investing/resources/insights/whats-the-best-approach-for-portfolio-rebalancing.html

[11] – https://www.bankrate.com/retirement/how-to-keep-inflation-from-wrecking-retirement/

[12] – https://blog.massmutual.com/retiring-investing/debt-retirement-prevent

[13] – https://www.usbank.com/retirement-planning/financial-perspectives/investment-options-to-generate-retirement-income.html

[14] – https://smartasset.com/retirement/investing-in-real-estate-for-retirement

[15] – https://www.bankrate.com/retirement/best-side-hustles-for-retirees/

[16] – https://investor.vanguard.com/investor-resources-education/article/asset-location-can-lead-to-lower-taxes

[17] – https://www.schwab.com/learn/story/how-asset-location-can-help-save-on-taxes

[18] – https://www.schwab.com/learn/story/how-to-cut-your-tax-bill-with-tax-loss-harvesting

[19] – https://www.bairdwealth.com/insights/wealth-management-perspectives/2023/09/the-three-tests-before-a-roth-conversion/

[20] – https://www.fidelity.com/learning-center/personal-finance/retirement/roth-iras-roth-ira-conversion/focused-roth-conversion

[21] – https://www.edwardjones.com/us-en/market-news-insights/guidance-perspective/retirement-protection-strategies

[22] – https://finance.yahoo.com/news/much-retirees-keep-emergency-fund-130123665.html

[23] – https://www.kiplinger.com/retirement/ways-to-prepare-for-long-term-care-expenses-in-retirement

[24] – https://www.pnc.com/insights/personal-finance/protect/planning-for-long-term-care.html

[25] – https://www.ml.com/articles/big-retirement-risks-and-how-to-prepare-for-them.html

[26] – https://www.ssa.gov/faqs/en/questions/KA-01897.html

[27] – https://www.ncoa.org/article/get-more-money-from-social-security-7-tips-to-max-out-your-benefits/

[28] – https://www.ssa.gov/oact/quickcalc/spouse.html

[29] – https://www.aarp.org/social-security/claiming-strategies-for-couples/

[30] – https://www.ssa.gov/benefits/retirement/planner/whileworking.html

[31] – https://www.ssa.gov/faqs/en/questions/KA-01921.html

[32] – https://www.ssa.gov/pubs/EN-05-10069.pdf

[33] – https://institutional.fidelity.com/advisors/insights/spotlights/retirement-income-planning/retirement-planning-health-care-costs

[34] – https://www.fidelity.com/viewpoints/wealth-management/hsas-and-your-retirement

[35] – https://www.morganstanley.com/atwork/employees/learning-center/articles/hsa-retirement-savings

[36] – https://www.optumbank.com/investments/hsa-saving-retirement.html

[37] – https://www.westernsouthern.com/retirement/do-i-need-supplemental-insurance-if-i-have-medicare

[38] – https://www.ehealthinsurance.com/medicare/parts/do-i-need-medicare-supplement-plan-when-i-retire/

[39] – https://www.investopedia.com/terms/f/four-percent-rule.asp

[40] – https://www.fidelity.com/viewpoints/retirement/how-long-will-savings-last

[41] – https://investor.vanguard.com/investor-resources-education/article/retirement-withdrawal-strategies

[42] – https://www.schwab.com/ira/traditional-ira/withdrawal-rules/required-minimum-distributions

[43] – https://www.franklintempleton.com/articles-us/retirement/year-end-estate-planning-strategies-for-maximizing-tax-benefits-and-legacy-planning

[44] – https://www.wqcorp.com/blog/preparing-for-the-unexpected-estate-planning-considerations-for-retirees

[45] – https://www.kiplinger.com/retirement/reasons-retirees-need-a-revocable-trust

[46] – https://www.americanbar.org/groups/real_property_trust_estate/resources/estate-planning/planning-retirement-benefits/

[47] – https://www.investopedia.com/retirement/importance-updating-retirement-account-beneficiaries/

[48] – https://www.westernsouthern.com/retirement/beneficiary-designation

[49] – https://www.forbes.com/councils/forbesfinancecouncil/2024/12/02/essential-asset-protection-strategies-for-retirement-savers/

[50] – https://content.schwab.com/web/retail/public/book/excerpt-single-5.html

[51] – http://equitable.com/perspectives/life-planning/2024/debt-and-retirement-planning-a-guide-for-gaining-peace-of-mind

[52] – https://www.nextavenue.org/how-we-are-going-into-retirement-debt-free/

[53] – https://www.urban.org/urban-wire/ensuring-americans-can-retire-free-student-loan-debt

[54] – https://www.iese.edu/insight/articles/best-asset-allocation-retirees/

[55] – https://smartasset.com/investing/asset-allocation-in-retirement-guide

[56] – https://investor.vanguard.com/investor-resources-education/portfolio-management/rebalancing-your-portfolio

[57] – https://www.fidelity.com/viewpoints/retirement/spending-in-retirement

[58] – https://www.calstrs.com/how-to-fill-the-gap-maintain-your-standard-of-living-in-retirement

[59] – https://www.securian.com/insights-tools/articles/retirement-budget-tips.html

[60] – https://turbotax.intuit.com/tax-tips/investments-and-taxes/tax-advantaged-accounts-how-they-can-boost-your-savings/c4fKPc6Tf

[61] – https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/dol-top-10-ways-to-prepare-for-retirement-booklet-2023.pdf

[62] – https://www.nerdwallet.com/calculator/retirement-calculator

[63] – http://equitable.com/perspectives/life-planning/2024/plan-your-retirement-early-why-starting-now-matters

[64] – https://www.adp.com/spark/articles/2024/11/the-long-term-benefits-of-early-retirement-planning-for-employees.aspx

[65] – https://www.nerdwallet.com/article/investing/retirement-planning-an-introduction

[66] – https://money.usnews.com/money/retirement/401ks/articles/strategies-to-maximize-your-401-k-balance

[67] – https://www.fidelity.com/learning-center/personal-finance/retirement/how-to-max-out-your-retirement

[68] – https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-catch-up-contributions

[69] – https://investor.vanguard.com/investor-resources-education/iras/catch-up-contributions

[70] – https://www.bankrate.com/retirement/using-your-hsa-as-a-retirement-plan/

[71] – https://www.schwab.com/learn/story/what-to-know-about-catch-up-contributions

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com