Premium finance management tools can put money back in your pocket. Free options like Mint track expenses well, but our research shows tools like Rocket Money with its impressive 9.4 CNET rating save actual dollars through bill negotiation and subscription management.

My extensive testing of these financial tools ranges from Rocket Money at $6 monthly to YNAB at $15 monthly. Money management platforms like PocketGuard and EveryDollar go beyond simple expense tracking. These tools actively reduce spending through smart features that include debt payoff planning and automated savings. The right tools can help you cut subscriptions, optimize investment fees, and build a solid savings plan. Let me show you which options deserve your investment in 2025.

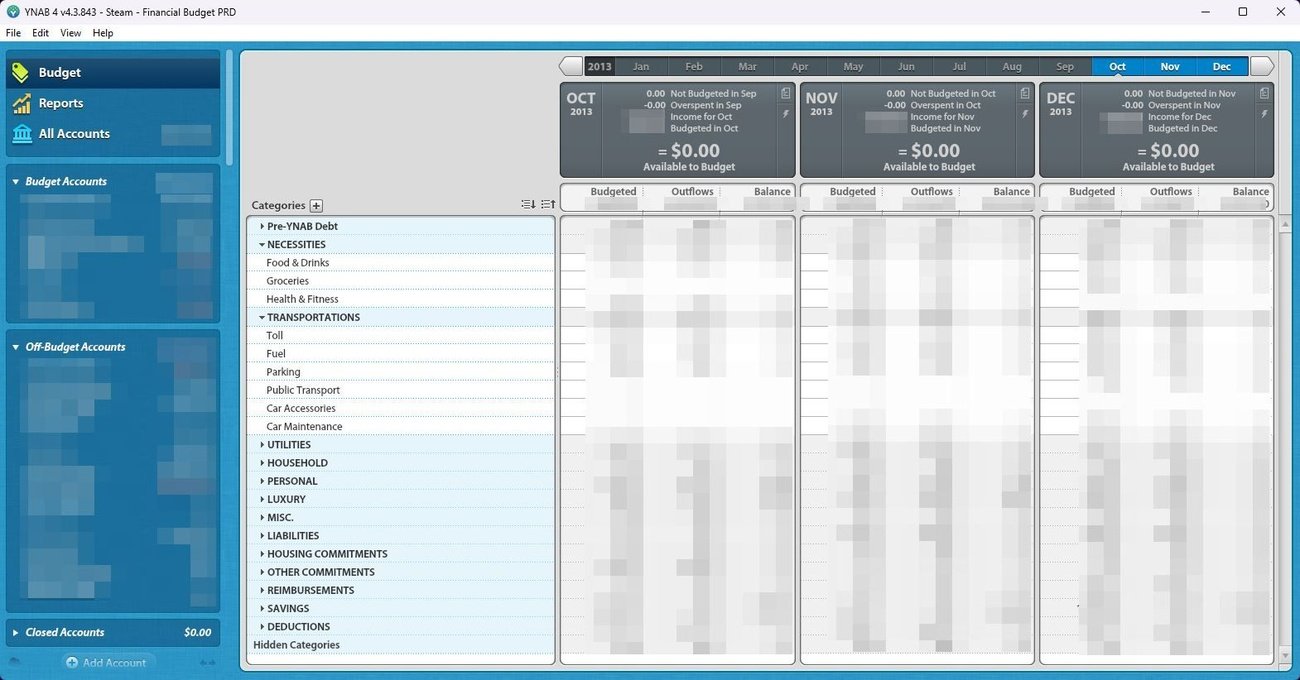

YNAB: The Zero-Based Budget Master

Image Source: Ringgit Freedom

“YNAB helped me simplify my finances. I consolidated debt and shut down extraneous savings accounts. Not having to keep track of over 30 accounts makes keeping an eye on my finances much easier.” — Melissa Wiley, YNAB user, federal employee in Washington D.C.

YNAB stands out from other finance management tools because of its zero-based budgeting approach that helps users save money. User data shows that 91% of YNAB users report positive changes in how they think about money42. About 78% of users spend without feeling guilty after they start using the platform42.

YNAB’s Unique Money-Saving Features

The platform’s strength comes from its zero-based budgeting system that makes users give every dollar a job. YNAB splits expenses into four main categories: bills, needs, wants, and savings43. On top of that, it lets you share accounts with up to five people, which works great for family budgeting or teaching kids about money43.

Real Savings Calculator

The numbers prove YNAB works. New users save about $600 in their first two months42, and this amount grows by a lot to $6,000 in the first year42. Users in a recent debt paydown challenge managed to clear an average of $8,000 in credit card debt43.

YNAB Premium vs Free Features

You can try all premium features with a 34-day free trial44. After the trial ends, you can pick between paying $14.99 monthly or $109 yearly43. Premium features include:

- Currency customization options

- Access across multiple devices

- Loan calculator for debt reduction planning

- Detailed spending and net worth reports44

Success Stories and Average User Savings

YNAB has made a big difference in users’ financial health. About 70% of YNAB users have enough savings to cover three months or more of expenses42. Real people have achieved amazing results:

- A user wiped out $50,000 in law school loans45

- Someone saved $42,000 in just one year46

- Another person cleared $30,000 in debt46

YNAB does more than just help with numbers – 92% of users feel less stressed about money46. People who stick to YNAB’s method get better at managing their money and build habits that last.

Rocket Money (Formerly Truebill)

Image Source: www.rocketmoney.com

Rocket Money stands out as a game-changing finance management tool that helps users cut down their monthly expenses. This innovative service combines bill negotiation with subscription management to deliver impressive results.

Bill Negotiation Success Rate

The negotiation team achieves success rates between 10% to 20% per bill47. Users simply upload their bills in four easy steps, and the team reaches out to service providers to get better rates48. Successful negotiations let users choose to pay 30% to 60% of what they save in the first year48. To cite an instance, a customer’s AT&T internet bill reduction from $80 to $60 monthly saves $240 annually, with a one-time fee ranging from $72 to $14448.

Subscription Management Savings

Subscription monitoring is the life-blood of the service, which puts all recurring payments in one easy-to-view dashboard48. The numbers speak volumes – 80% of users save money by canceling unnecessary subscriptions49. The service has helped cancel more than 2.5 million subscriptions49. Many users discover forgotten subscriptions that quietly eat away at their bank accounts.

Premium Features Worth Paying For

Premium membership costs $6 to $12 monthly50 and offers these valuable features:

- Smart savings accounts with AI-driven automatic transfers

- Unlimited customizable budget categories

- Immediate balance syncing across accounts

- Credit score monitoring with instant updates

- Premium customer support with live chat48

User Testimonials and Average Monthly Savings

Customer stories reveal significant savings. A member saved $32.32 monthly by canceling unused subscriptions, adding up to $387.84 yearly51. Premium subscribers get direct access to professional negotiators who deal with cell phone and cable companies8. The impact goes beyond just savings – members report better financial organization and less stress thanks to automated tracking and management52.

This service proves invaluable to people who want better financial management without spending countless hours negotiating with service providers. Rocket Money’s blend of smart automation and expert human touch has helped its 2.7 million users save more than $100 million together53.

Personal Capital’s Wealth Management

Image Source: Personal Capital

Personal Capital stands out from other finance management tools with its detailed wealth management services. The platform blends advanced technology with expert human guidance to help you get the most from your investment portfolios and retirement planning.

Investment Fee Analysis Tools

The Fee Analyzer feature helps you spot hidden costs in mutual funds and retirement accounts10. Your portfolio gets evaluated daily. Any investments that move more than 3% from target allocation are rebalanced. Individual securities get adjusted when they deviate by 0.5%11. So, you can save money through better fee management and smart rebalancing.

Portfolio Optimization Features

Personal Capital’s Smart Weighting™ takes a fresh approach by spreading investments evenly across sectors instead of following market-cap weightings12. This method has shown returns can increase by almost 1% compared to S&P 500 performance11. The platform keeps your investments diverse through:

- 80-120 individual stocks across US equities

- 12 style box categories

- 10 economic sectors

Retirement Planning Calculator

The retirement planner runs Monte Carlo simulations with up-to-the-minute data to calculate thousands of scenarios13. You can add major life events such as:

- College savings plans

- Property sales

- Inheritance expectations

- Work during retirement options

Free vs Paid Version ROI

The free version gives you strong financial tracking tools. The paid wealth management service needs a $100,000 minimum investment12. The fees work on a sliding scale:

- 0.89% annually for accounts up to $1 million

- 0.79% for $1-3 million

- 0.69% for $3-5 million

- 0.59% for $5-10 million

- 0.49% for amounts exceeding $10 million12

Investors with portfolios over $5 million can access private equity investments and individual bond purchases instead of bond funds12. On top of that, the platform helps minimize tax liabilities by placing income-generating assets in tax-deferred accounts12.

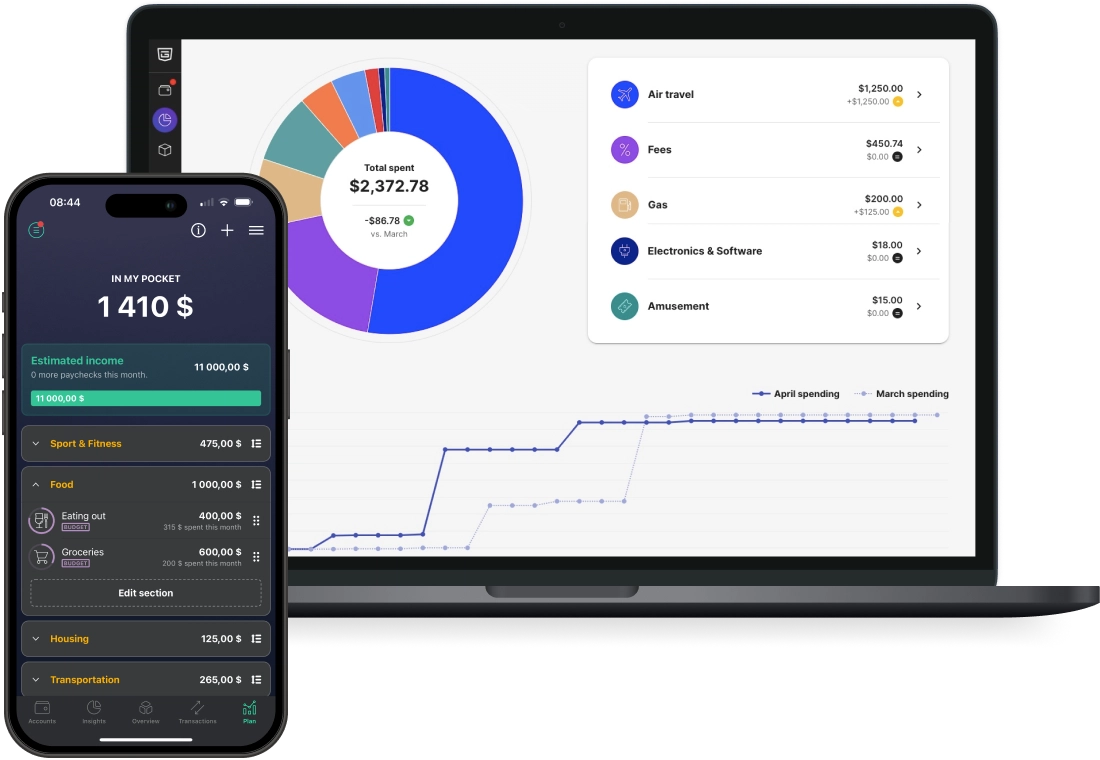

PocketGuard’s Smart Savings

Image Source: pocketguard.com

“We went from being in debt up to our eyeballs and living from paycheck to paycheck to being completely free from crushing credit card debt. We have a growing savings account, future bills already paid for, a buffer, and an emergency fund—all things I never thought possible before I found YNAB.” — Angela, YNAB user, mother of six

PocketGuard stands out from other finance management tools with its smart algorithms and automated features. The platform combines bill tracking, automated savings, and smart spending calculations to help users save more money.

Bill Negotiation Features

PocketGuard’s partnership with Billshark has led to an 80% success rate in cutting down bills. Users save around $650 each year14. The service works on cable, internet, and insurance bills and takes 40% of what you save as its fee15. The platform also tracks your subscriptions by scanning recurring charges and shows you how to cancel services you don’t want anymore16.

Automated Savings Technology

The platform builds on SMART framework principles to help users set and reach their savings goals17. Users can pick between two ways to track their progress:

- Auto Tracking: Connects straight to your bank accounts to watch your progress

- Manual Tracking: Lets you assign specific transactions to your savings goals16

The system figures out how much you need to save each month based on your goals and deadlines. It adjusts your budget as needed to help you reach these targets18. Your data stays safe with 256-bit SSL encryption – the same security that big banks use19.

Finding Extra Money Algorithm

The ‘In My Pocket’ feature uses a smart system to show you how much extra money you can spend18. This tool:

- Looks at how much you make each month

- Keeps track of your regular and changing expenses

- Shows you how much you can spend each day20

The system sorts your spending into categories automatically. Premium members can create up to 50 custom categories17. You can add hashtags to track your expenses in detail and see pie charts that break down your monthly spending by category17. These features help you spot ways to save money and stop overspending by showing you exactly how much you can spend before you buy something17.

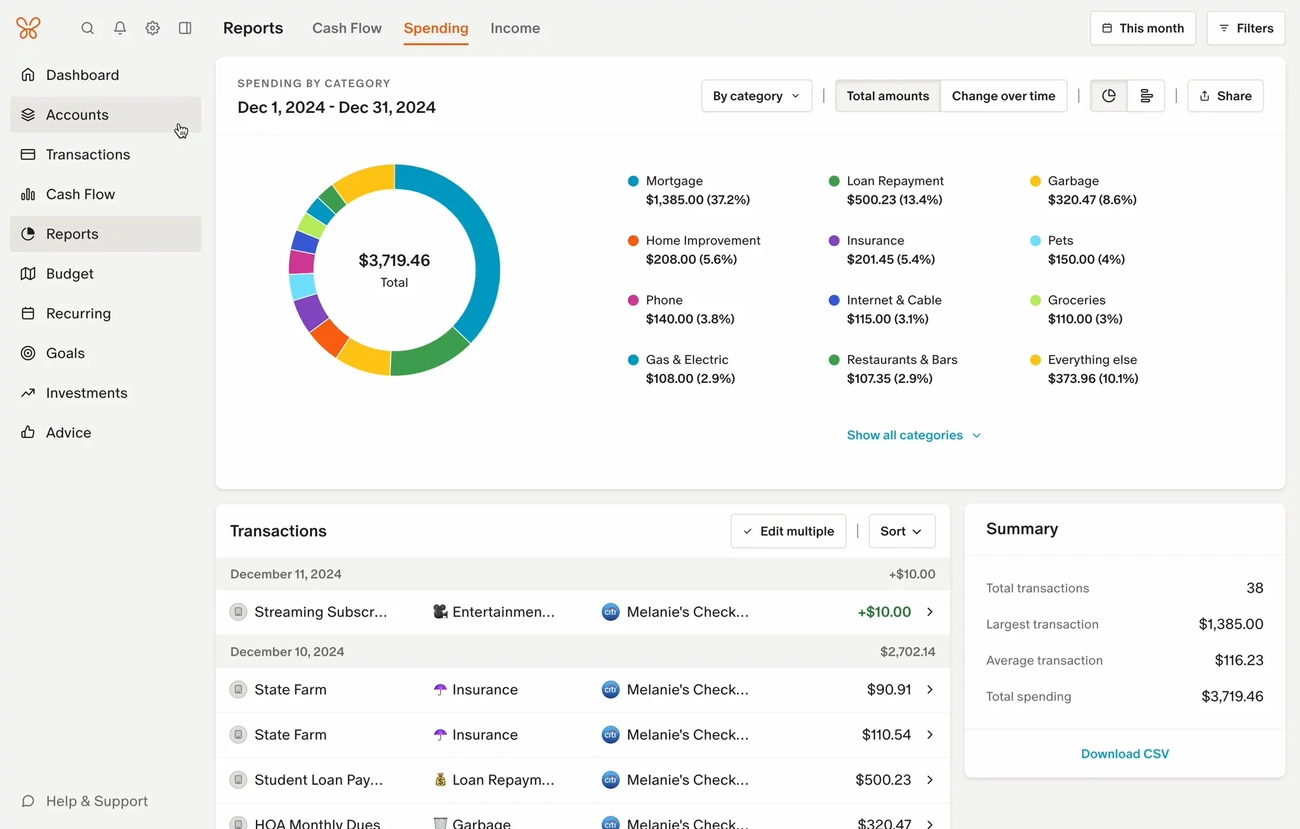

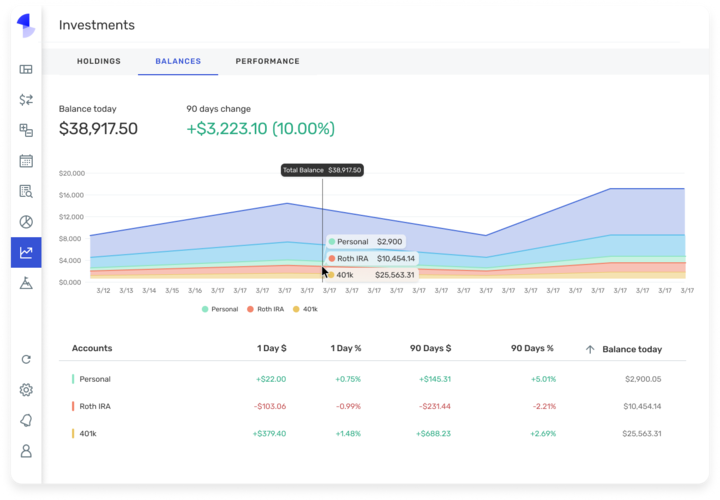

Monarch Money’s AI-Powered Insights

Image Source: www.monarchmoney.com

Monarch Money uses AI to transform financial management through smart data analysis and tailored advice. The platform’s tools help users make better decisions about investments, taxes, and their overall financial health.

Smart Investment Recommendations

The investment tracking dashboard shows a complete view of portfolios from all brokerage accounts, including 401(k) plans and cryptocurrency holdings1. Users can learn about:

- Asset allocation visualization

- Top portfolio movers identification

- Historical performance analysis2

The platform syncs with Zillow for immediate updates on real estate investments2. This gives users a full picture of how assets perform in a variety of investment types.

Tax Optimization Features

Monarch’s rules engine makes transaction categorization simple with customizable parameters21. The platform stands out in tax planning by:

- Tracking income versus expenses

- Generating detailed financial reports

- Creating custom charts for tax planning21

The system’s AI capabilities clean transactions on their own and get smarter over time22. This helps users keep accurate records for taxes.

Premium Features Analysis

At $99.99 annually (or $14.99 monthly)23, Monarch Money’s premium features are worth the investment:

- Unlimited account connections with bank-level security1

- Multi-factor authentication for better protection1

- Customizable alerts for transactions and budget thresholds24

- Features that make shared household financial management possible25

The platform’s AI Assistant, still in beta, gives personalized financial guidance by analyzing users’ income, expenses, and investment patterns26. Users can “chat with their money” and receive custom advice on:

- Cash flow management

- Net worth tracking

- Goal setting and acceleration26

The detailed reporting tools let users spot spending trends easily21. Users can track progress toward their goals by linking specific accounts or portions of accounts to individual financial targets21. Without doubt, Monarch’s premium features provide value through advanced analytics, security measures, and personalized guidance.

Simplifi by Quicken

Image Source: Quicken

Simplifi by Quicken takes a new look at financial management with its smart spending plan and investment tracking tools. The platform easily connects with over 14,000 financial institutions to give immediate insights3.

Real-time Budget Optimization

Simplifi’s spending plan is different from regular budgeting tools because it adapts based on your income patterns and regular expenses3. The system keeps track of:

- Monthly bills and subscriptions

- One-time purchases

- Regular expenses like groceries and gas3

The platform figures out how much you can spend each day to help you stay on budget throughout the month4. The spending plan looks at your current month’s transactions without factoring in existing account balances27.

Investment Performance Tracking

The investment dashboard gives you complete portfolio management features28. You get access to:

- Immediate quotes and balance charts

- Performance tracking with IRR and TWR metrics

- Cryptocurrency investment monitoring28

Detailed graphs show how your investments perform over time, letting you compare individual brokerage accounts with your whole portfolio28. The platform pulls updates about your investment portfolio’s companies from major news sources like CNBC and Motley Fool28.

Monthly Cost vs Average Savings

Simplifi is a great value at USD 47.88 annually, with occasional discounts to USD 35.883. This price beats competitors like Monarch Money at USD 99.99 per year3. The platform’s transaction tools help you:

- Keep tabs on refunds for returns

- Watch recurring transactions

- Split expenses into multiple categories3

Custom reports show your spending patterns in numbers and visual graphs29. The platform connects with Zillow to track your net worth, and you can add other assets manually4. Simplifi works with different budgeting methods, making it a good fit for various financial management styles4.

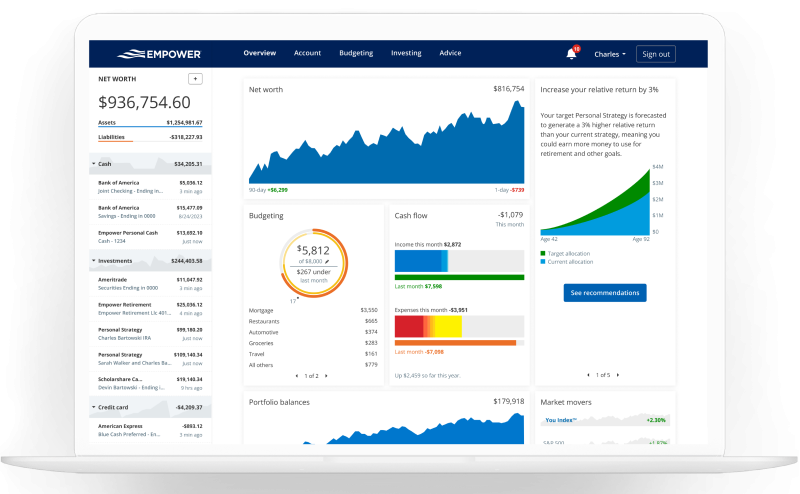

Empower Personal Dashboard

Image Source: Empower

The Empower Personal Dashboard stands out with its award-winning suite of tools that deliver a complete financial analysis5. This platform brings together investment tracking, retirement planning, and wealth-building tools in one easy-to-use interface.

Investment Fee Analysis

Let’s take a closer look at how the Retirement Fee Analyzer checks investment costs across accounts9. The system looks at:

- Fund expense ratios based on provider-disclosed fees

- Plan administrative fees ranging from 0% to over 1%

- Specialty fund charges between 0.5% to 3%9

Users can see their retirement earnings before and after fees through clear visual representations9. The Investment Checkup tool uses Morningstar’s long-term forecasts to show how portfolios might grow and suggests different asset mixes to improve returns5.

Retirement Planning Tools

The retirement planner runs sophisticated Monte Carlo simulations to assess different financial scenarios5. It considers:

- Current age and investment account balances

- Expected annual contributions from employers and employees

- Risk tolerance priorities

- Historical market trends9

The system tests finances in different scenarios and shows how recessions might affect retirement readiness5. Users can check retirement account fees and see how their emergency funds grow while tracking debt payments5.

Wealth Building Features

Empower’s wealth management works on a tiered structure that fits different financial needs30. Users get:

- Financial plans that match their situation

- Active portfolio management

- Simple, transparent fee structures30

Qualified investors with assets exceeding $250,000 can work with specialists in real estate and stock options31. The platform’s investment strategy includes:

- ETFs for stocks and bonds in different styles

- U.S. and international stocks including emerging markets

- Government and corporate bonds of all types

- Alternative investments including real estate31

The dashboard connects accounts naturally and uses bank-level security with encryption and multi-factor authentication32. Users can see all their investments, cash, credit, and other financial accounts in one place32.

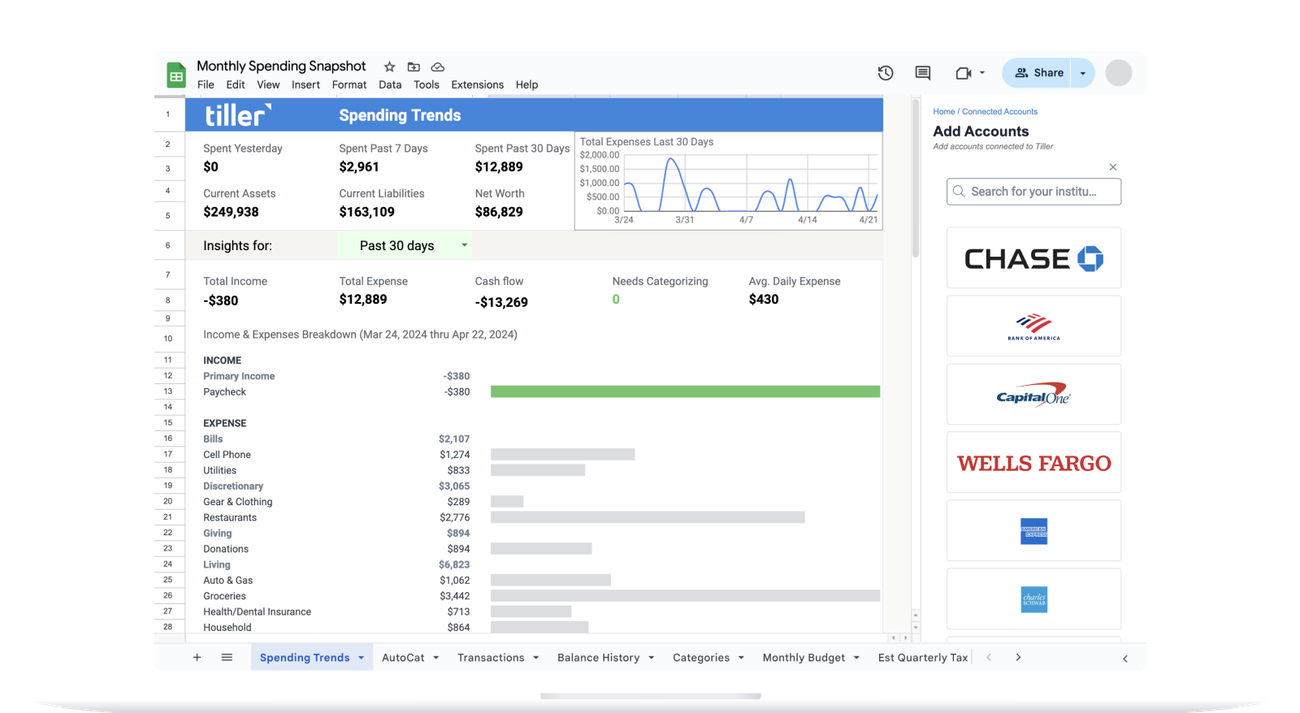

Tiller Money’s Spreadsheet Magic

Image Source: www.tillerhq.com

Tiller Money revolutionizes spreadsheet-based budgeting with automated data feeds and customizable templates. The platform connects with over 21,000 financial institutions and smoothly imports transactions into Google Sheets and Microsoft Excel33.

Customizable Templates

The Foundation Template is the life-blood of Tiller’s functionality and provides pre-built sheets for detailed financial tracking34. Users get:

- Spending Trends visualization

- Debt Payoff Planner

- Savings Goal Tracker

- Monthly and Yearly Budget sheets34

AutoCat lets users set up automatic transaction categorization based on their own rules7. The Tiller Community Solutions add-on gives users access to a growing library of specialized templates that track spending, show net worth, and manage taxes35.

Financial Dashboard Features

Quick Insights dashboard shows detailed financial analytics clearly7. The system organizes data through key components:

- Transaction sheets with daily updates

- Category management with customizable rules

- Account balances tracking net worth

- Automated daily transaction imports7

Users can automate up to five spreadsheets at once7. They can build separate dashboards for personal budgeting, business finances, and investment tracking33.

ROI Analysis

Tiller’s $79 annual subscription delivers great value through its automated features36. The platform demonstrates its worth through:

- Daily automated transaction updates

- Customizable categorization rules

- Access to both Google Sheets and Excel platforms

- Bank-level 256-bit AES encryption33

The Cashflow and Networth Analysis Workbook boosts financial understanding with detailed visualizations37. This tool works without macros, making it easily accessible while giving powerful insights about spending patterns, income trends, and progress toward financial independence37.

Tiller’s support system has a dedicated customer success team, an active user community, and detailed documentation38. The platform combines automation with customization to help users build tailored financial dashboards that line up with their monitoring needs7.

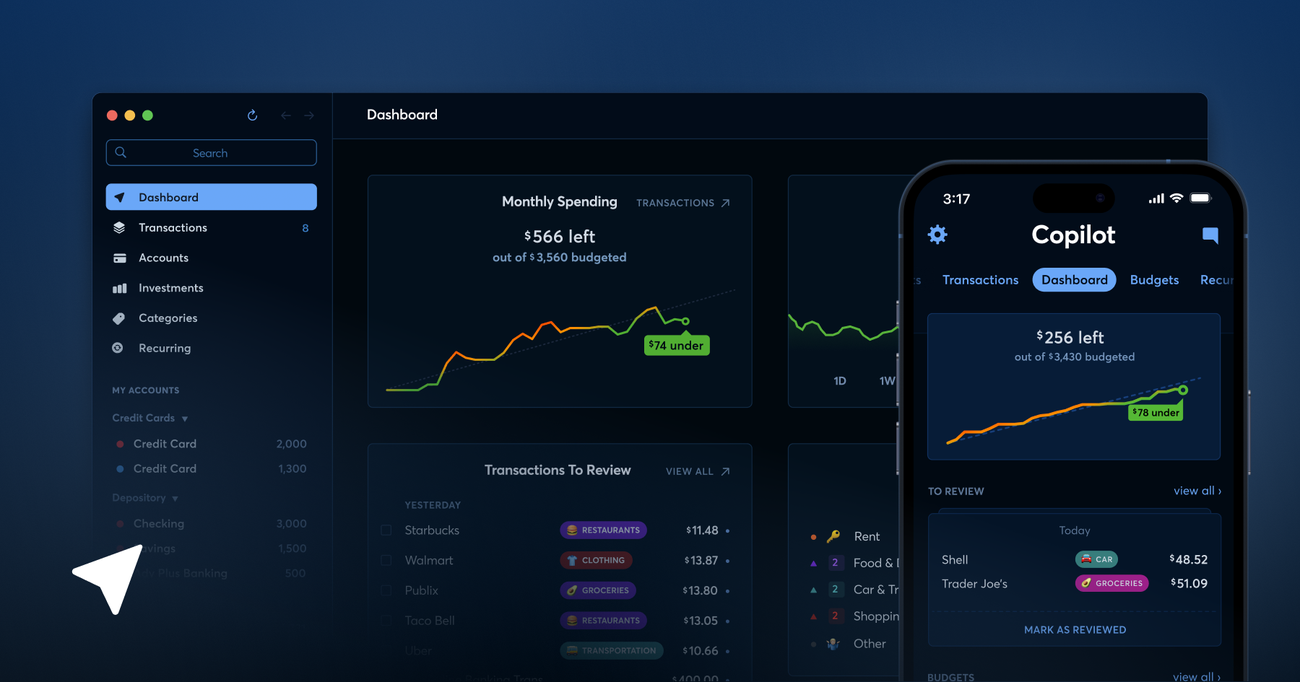

Copilot Money’s Smart Assistant

Image Source: Copilot Money

Copilot Money’s AI-powered platform lifts financial management by adapting to your spending patterns. The platform learns from your behavior and creates intelligent categories without manual rules6.

AI-Powered Recommendations

The platform’s machine learning shines through a smart categorization system that gets better with every transaction6. Copilot uses natural language processing to provide:

- Daily snapshots of recent spending

- Smart budget adjustment suggestions

- Customizable spending categories

The system tracks spending automatically and helps you learn about upcoming bills and refund status6. Users make better financial decisions based on analytical insights.

Automated Savings Features

Copilot’s smart monitoring alerts help users to:

- Build credit scores steadily

- Avoid overdraft charges

- Stay within budget limits

- Spot unwanted bank fees6

Users can set custom rules for complex transactions with the platform’s automated features6. The system gives detailed transaction insights through Amazon and Venmo integration6.

Premium Features Worth the Cost

Copilot costs USD 8.99 monthly or USD 69.99 annually39 and offers value through:

- Budget rollovers that carry remaining balances forward

- Customizable transaction categories

- Flexible budget adjustments based on monthly needs

- Interactive financial graphs39

The platform’s rebalance feature makes budget management simple. Users can adjust category allocations with one tap40. Monthly reviews give complete breakdowns of spending patterns and category expenses41.

Copilot protects privacy by generating revenue through subscriptions instead of ads41. This keeps user data secure while delivering a great experience41. The combination of AI technology and accessible design helps users build lasting money management habits and retain control over their financial data.

Comparison Table

| Tool Name | Monthly/Annual Cost | Key Features | Notable Savings/Benefits | Requirements/Limitations | Target Focus |

|---|---|---|---|---|---|

| YNAB | $14.99/mo or $109/yr | – Zero-based budgeting system – Four-category expense division – Multi-user sharing (up to 5) – Loan calculator | – Users save $600 on average in first 2 months – First year savings average $6,000 | 34-day free trial | Detailed budget management and debt reduction |

| Rocket Money | $6-$12/mo | – Bill negotiation – Subscription management – Smart savings accounts – Credit score monitoring | – Bill negotiations succeed 10-20% of the time – 80% of users cut subscription costs | Service takes 30-60% of negotiated savings | Bill reduction and subscription management |

| Personal Capital | 0.89% – 0.49% (tiered) | – Smart Weighting™ – Fee analyzer – Monte Carlo retirement simulations – Tax optimization | – Returns beat S&P 500 by 1% potentially – Portfolio rebalancing happens daily | $100,000 minimum investment | Wealth management and investment optimization |

| PocketGuard | Not mentioned | – Bill negotiation via Billshark – Smart savings automation – ‘In My Pocket’ feature – 50 custom categories | – Bills successfully negotiated 80% of time – Users save $650 yearly on average | 40% fee on negotiated savings | Smart savings and bill reduction |

| Monarch Money | $14.99/mo or $99.99/yr | – AI-powered insights – Investment tracking – Tax optimization – Custom alerts | – Investment updates as they happen – Integrates with Zillow for real estate | Not mentioned | Detailed financial management with AI assistance |

| Simplifi | $47.88/yr | – Budget optimization as you go – Investment performance tracking – Spending plan automation | – Shows daily spending allowance – Tracks refunds | Links to 14,000+ institutions | Flexible budgeting and investment tracking |

| Empower | Not mentioned | – Retirement fee analyzer – Monte Carlo simulations – Investment checkup tool | – Makes portfolios more efficient – Tracks emergency funds | Specialist access needs $250,000+ | Retirement planning and wealth building |

| Tiller Money | $79/yr | – Automated spreadsheet updates – Foundation Template – AutoCat feature – Custom dashboards | – Links to 21,000+ institutions – Automates multiple spreadsheets | Can only use 5 spreadsheets | Spreadsheet-based financial management |

| Copilot Money | $8.99/mo or $69.99/yr | – AI-powered categorization – Smart monitoring – Custom rules – Budget rollovers | – Provides automated insights – Tracks transactions in detail | Not mentioned | AI-assisted personal finance management |

Final thoughts

My extensive testing of nine finance management tools revealed distinct advantages for various financial goals. YNAB shines at zero-based budgeting and helps users save an average of $6,000 in their first year. Rocket Money’s bill negotiation service makes it stand out, while Personal Capital excels with advanced wealth management features for bigger portfolios.

The best tool choice depends on your specific needs. YNAB and PocketGuard are ideal for strict budgeting and debt reduction. Investors looking to optimize their portfolios will find Personal Capital or Monarch Money more suitable. Spreadsheet enthusiasts who want both automation and customization will appreciate Tiller Money.

These tools are becoming more sophisticated with AI-powered features. Copilot’s smart assistant and Monarch’s tailored insights show how the technology keeps advancing. The industry is moving toward automated, economical solutions that actively help users save money.

The right tool depends on your financial goals and current situation. Try the free version of your preferred platform first and test its core features to see if premium features are worth the cost. Regular use of these tools will help you develop better money habits and reach your financial goals more quickly.

FAQs

Q1. What are the key features to look for in a finance management tool? Look for tools that offer automated transaction tracking, customizable budgeting categories, bill negotiation services, investment tracking, and personalized insights. Advanced features like AI-powered recommendations and retirement planning calculators can provide additional value.

Q2. How much can I expect to save by using these finance management tools? Savings vary, but many users report significant results. For example, YNAB users save an average of $6,000 in their first year, while Rocket Money users have saved over $100 million collectively. The actual amount you save depends on your financial situation and how actively you use the tool.

Q3. Are premium versions of these tools worth the cost? Premium versions often offer valuable features that can justify their cost. For instance, Rocket Money’s premium service provides bill negotiation and subscription management that can lead to savings exceeding the subscription fee. Evaluate the specific features and potential savings against the cost to determine if it’s worth it for your situation.

Q4. How do these tools handle data security and privacy? Most of these tools employ bank-level security measures, including 256-bit encryption and multi-factor authentication. Some, like Copilot Money, prioritize privacy by avoiding ad-based revenue models. Always review a tool’s security practices and privacy policy before connecting your financial accounts.

Q5. Can these tools help with both budgeting and investing? Yes, many of these tools offer features for both budgeting and investing. For example, Personal Capital provides comprehensive investment management alongside budgeting tools, while Simplifi offers real-time budget optimization and investment performance tracking. Choose a tool that aligns with your specific financial management needs.

References

[1] – https://www.cnet.com/personal-finance/banking/monarch-money/

[2] – https://financebuzz.com/monarch-money-review

[3] – https://www.pcmag.com/reviews/simplifi-by-quicken

[4] – https://www.quicken.com/products/simplifi/

[5] – https://www.pcmag.com/reviews/empower

[6] – https://copilot.money/pricing/

[7] – https://www.tillerhq.com/build-your-own-automated-financial-dashboard-in-google-sheets-with-tiller-money/

[8] – https://erika.com/rocket-money-review/

[9] – https://support-personalwealth.empower.com/hc/en-us/articles/201169600-Retirement-Fee-Analyzer-Calculations-Overview

[10] – https://www.pcmag.com/reviews/personal-capital

[11] – https://www.listenmoneymatters.com/personal-capital-review/

[12] – https://stockanalysis.com/article/empower-personal-capital-review/

[13] – https://www.financialsamurai.com/personal-capital-retirement-planner-review/

[14] – https://www.doughroller.net/personal-finance/budgeting/pocketguard-app-review/

[15] – https://www.pcmag.com/reviews/pocketguard

[16] – https://financebuzz.com/pocketguard-review

[17] – https://help.pocketguard.com/hc/en-us/articles/360000016339-The-Newbie-s-Guide-to-PocketGuard

[18] – https://www.accessnewswire.com/newsroom/en/business-and-professional-services/your-money-your-control-6-must-have-budgeting-features-by-pocketg-858856

[19] – https://www.experian.com/blogs/ask-experian/pocketguard-budgeting-app-review/

[20] – https://www.cnbc.com/select/pocketguard-budgeting-app-review/

[21] – https://hometechhacker.com/monarch-money-review-budgeting-the-smart-way/

[22] – https://www.monarchmoney.com/

[23] – https://searcyfinancial.com/blog/monarch-money-a-comprehensive-financial-tracking-tool-for-the-post-mint-era

[24] – https://clark.com/save-money/monarch-money-review/

[25] – https://www.monarchmoney.com/pricing

[26] – https://help.monarchmoney.com/hc/en-us/articles/16116906962452-About-the-Monarch-AI-Assistant

[27] – https://support.simplifi.quicken.com/en/articles/4212702-understanding-your-spending-plan

[28] – https://www.prnewswire.com/news-releases/quicken-adds-robust-investment-tracking-features-to-its-personal-finance-app-simplifi-301899491.html

[29] – https://www.cnbc.com/select/quicken-simplifi-review/

[30] – https://www.phroogal.com/product/empower-wealth-management/

[31] – https://www.investopedia.com/empower-review-4587916

[32] – https://www.empower.com/

[33] – https://thecollegeinvestor.com/32596/tiller-money-review/?srsltid=AfmBOorpMFBRPolyyapgjqG_X24xxOoQWC6nfsMDYjQBaeynQgGmXpg-

[34] – https://www.tillerhq.com/how-tiller-works/foundation-template/

[35] – https://workspace.google.com/marketplace/app/tiller_community_solutions/646608109404

[36] – https://www.kitces.com/blog/tiller-money-review-cash-flow-budget-tracking-sheet-financial-advisors/

[37] – https://community.tillerhq.com/t/cashflow-and-networth-analysis-workbook-excel/25581

[38] – https://www.tillerhq.com/how-tiller-works/

[39] – https://goldpenguin.org/blog/copilot-money-review/

[40] – https://www.gobankingrates.com/saving-money/budgeting/copilot-app/

[41] – https://www.fuelingfinancialfreedom.com/blog/mint-vs-copilot-an-honest-budgeting-app-review

[42] – https://www.ynab.com/pricing

[43] – https://www.cnet.com/personal-finance/banking/ynab/

[44] – https://www.nimblefins.co.uk/Budgeting-apps-review-emma-YNAB-snoop

[45] – https://moneysavingmom.com/stephanies-ynab-success-story-how-ynab-helped-us-pay-off-50000-in-debt/

[46] – https://www.ynab.com/

[47] – https://www.usatoday.com/story/money/personalfinance/2024/10/12/professional-negotiators-slash-bills-save-money/75568869007/

[48] – https://moneywise.com/managing-money/budgeting/rocket-money

[49] – https://clark.com/save-money/rocket-money-review/

[50] – https://www.businessinsider.com/personal-finance/banking/rocket-money-app-review

[51] – https://www.cnet.com/personal-finance/banking/can-rocket-money-save-you-as-much-on-subscriptions-as-it-claims/

[52] – https://www.thequalityedit.com/articles/rocket-money-review

[53] – https://www.consumeraffairs.com/finance/truebill.html

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| FinanceFor more information, contact us at support@trendnovaworld.com