The average student loan debt hits $37,852.80 in 2024 according to [link_1]. You’re definitely not alone. Most college graduates now handle multiple loans, which makes financial freedom seem like navigating through a maze.

The SAVE plan and income-driven repayment programs offer some relief, but choosing the right strategy can feel overwhelming. We’ve tested 17 proven approaches that work effectively in 2025. These range from simple steps like getting a 0.25% interest rate cut with auto-payments to maximizing your employer’s assistance programs.

You might want to unite your federal loans or focus on high-interest debt first. We’ll guide you through creating a repayment plan that matches your financial situation perfectly. No complicated terms – just straightforward solutions to help you manage your student loan experience better.

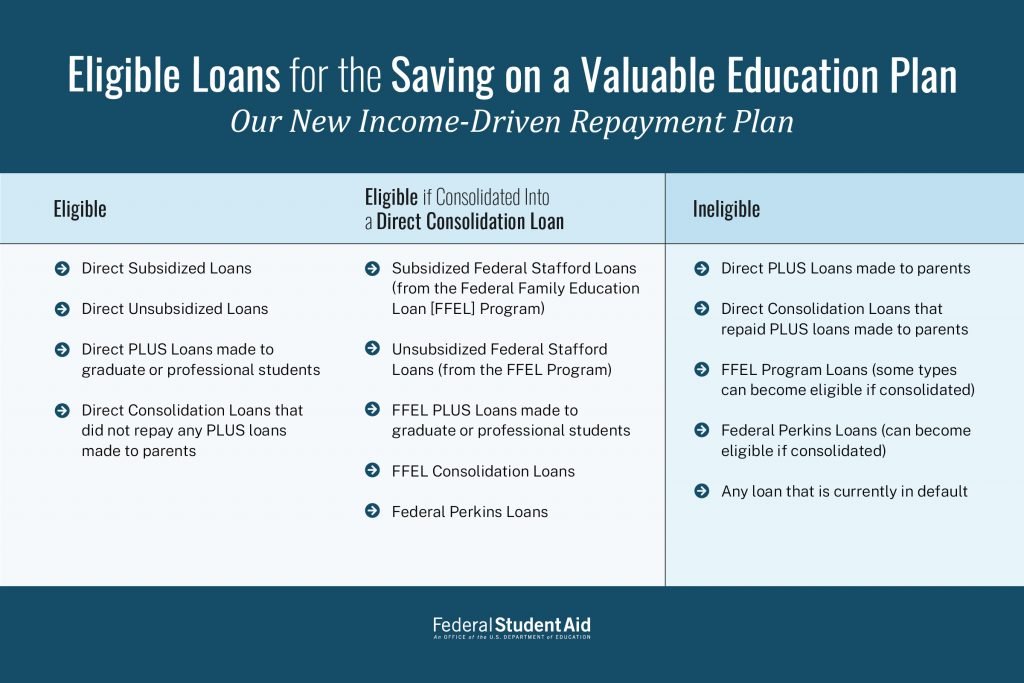

Enroll in the SAVE Income-Driven Repayment Plan

Image Source: Federal Student Aid

“With an income-driven repayment (IDR) plan, you can make lower monthly payments on your federal student loans based on your income and family size.” — Consumer Financial Protection Bureau, U.S. Government Agency

The SAVE (Saving on a Valuable Education) Plan is the most generous income-driven repayment option you can get for federal student loans. [Borrowers who earn less than $15.00 per hour can qualify for $0 monthly payments](https://www.cnbc.com/2023/07/31/how-to-apply-for-bidens-new-save-student-loan-repayment-plan.html)52.

Understanding SAVE Benefits

Your undergraduate loan payments drop to 5% of discretionary income, which is half of the previous 10% under REPAYE52. The plan protects you from accumulating unpaid interest when you make scheduled payments53. Your loan balance stays the same over time, even if your monthly payment doesn’t cover all the interest.

Eligibility Requirements

Direct Loans that qualify for SAVE include:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Graduate PLUS loans

- Direct Consolidation Loans (excluding Parent PLUS loans)54

How to Apply

You can complete your SAVE application in about 10 minutes on StudentAid.gov52. The process becomes easier when you allow automatic income updates from the IRS, which eliminates the need for yearly reapplication53.

Payment Calculation

Your monthly payments depend on your discretionary income and family size. Individual borrowers can qualify for $0 payments if they earn $32,800 or less annually54. A family of four can also get $0 monthly payments with an annual income of $67,500 or less55. The plan makes payments more affordable than previous options by using 225% of the Federal Poverty Level to calculate discretionary income53.

Leverage Employer Student Loan Benefits

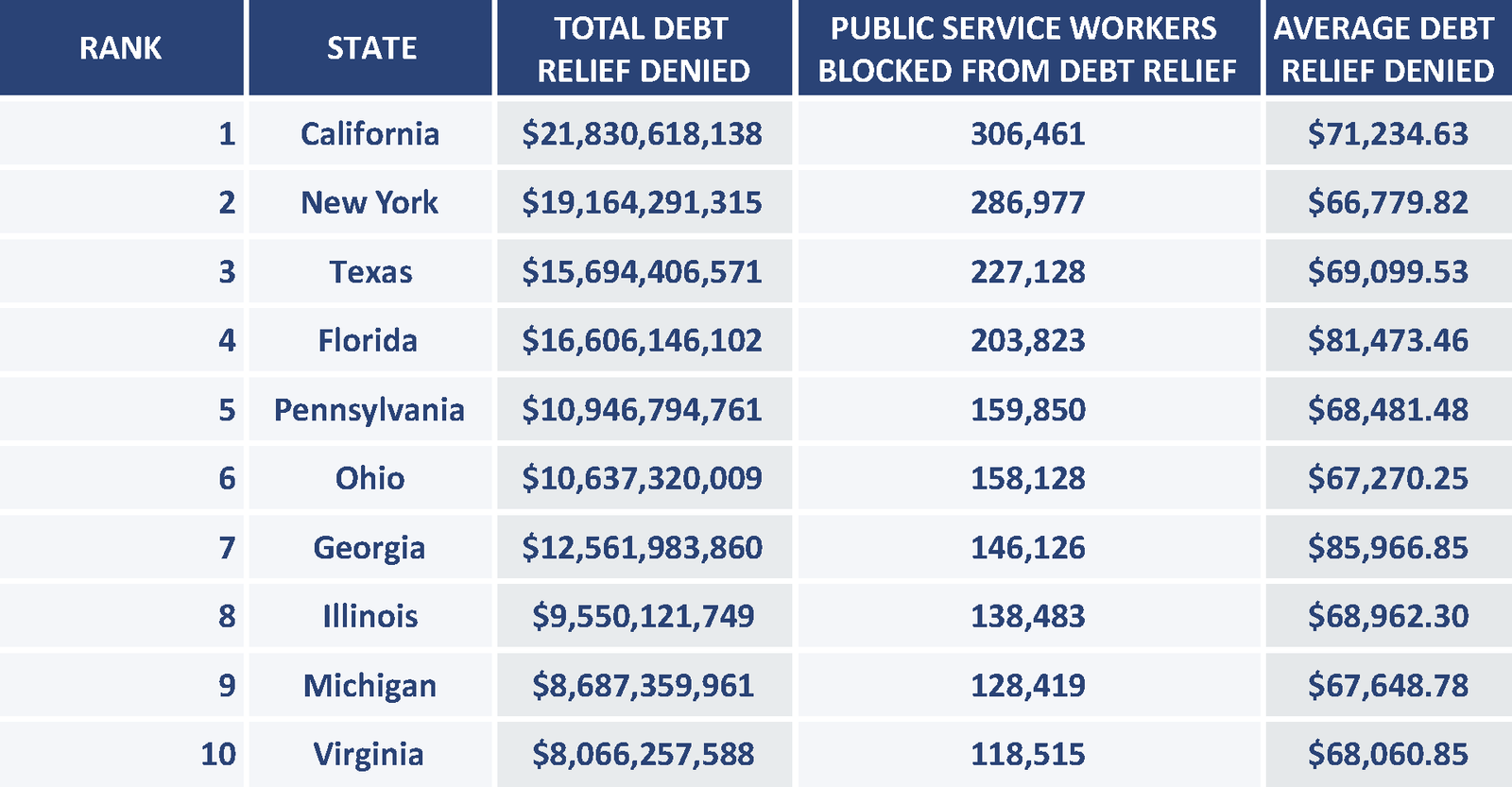

Image Source: Student Borrower Protection Center

Companies are stepping up to help with student loans. The numbers show this trend – workplace participation jumped from 17% in 2021 to 34% by October 202356. This benefit really works to attract talent. Research shows that 86% of workers would stay at a job for five years if they got help with their student loans56.

Types of Employer Assistance Programs

Companies offer different ways to help employees pay back their loans:

- Monthly payments that go straight to loan balances, usually $50-$10057

- Programs that let you turn unused vacation days into loan payments

- Contribution matching that works just like 401(k) plans

- New hire bonuses that go toward loans

How to Request Benefits

You’ll need to check when you can start getting these benefits, as companies usually want you to work there for a while first. The next step is to talk to HR about what programs they have and how to sign up. These programs need proper documentation and can’t just favor high-paid employees58.

Tax Implications

The tax rules are pretty straightforward through December 31, 2025. Your employer can give you up to $5,250 each year without you paying taxes on it58. This works whether they pay your lender directly or give the money to you58. Any amount over $5,250 counts as taxable income57. The program helps with both your loan’s principal and interest payments. This saves employees money and gives employers tax benefits too56.

Optimize Auto-Payment Discounts

Image Source: Federal Student Aid

Automatic payments for student loans will give a quick financial advantage. We reduced the interest rate by 0.25% on federal direct loans and most private loans59.

Interest Rate Reduction Benefits

Students with $28,950 in loans at 5% APR can lower their rate to 4.75% through auto-pay. This saves about $423 over a standard 10-year repayment period60. Graduate students with $71,000 in median debt can save significantly more60.

Setting Up Auto-Pay

You need to complete these steps:

- Link your bank account for automatic withdrawals

- Review the Auto-Pay Authorization Agreement

- Keep enough money in your account to avoid payment returns59

Your auto-pay benefits stop after three consecutive insufficient fund returns59. Keeping adequate money in your account is a vital step to maintain the discount.

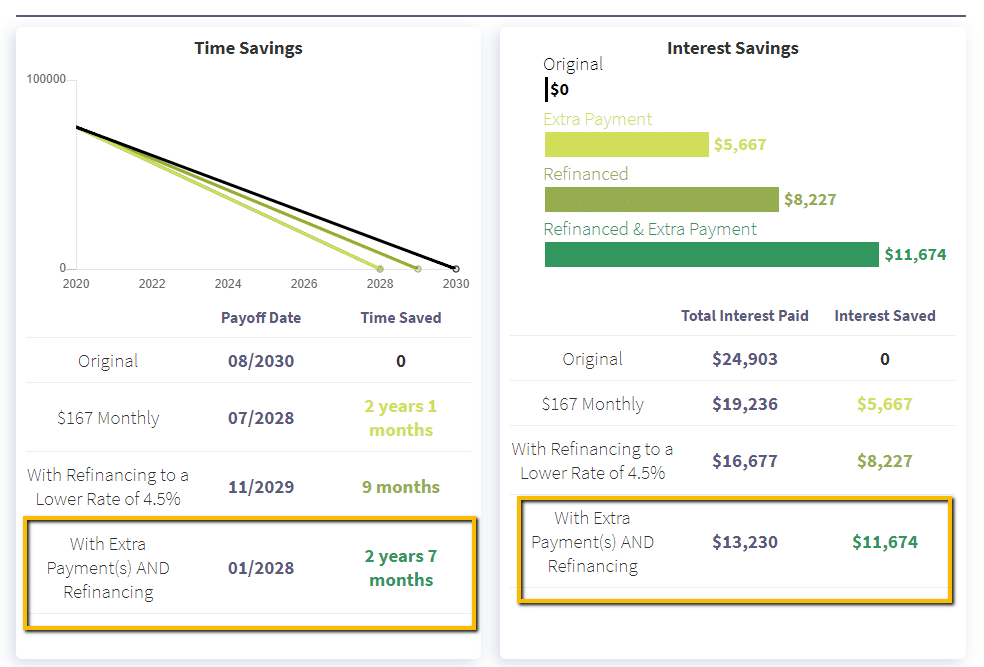

Payment Timing Strategies

Auto-pay withdrawals happen on the same date each month. You can make extra payments without disrupting your scheduled auto-pay amount61. The best time to make additional payments is right after your monthly payment. This happens when accrued interest is $062. Extra payments then reduce your principal balance directly.

The discount stops during deferment or forbearance but starts again automatically with regular payments59. Your benefits continue as long as you stay in the program and meet the requirements.

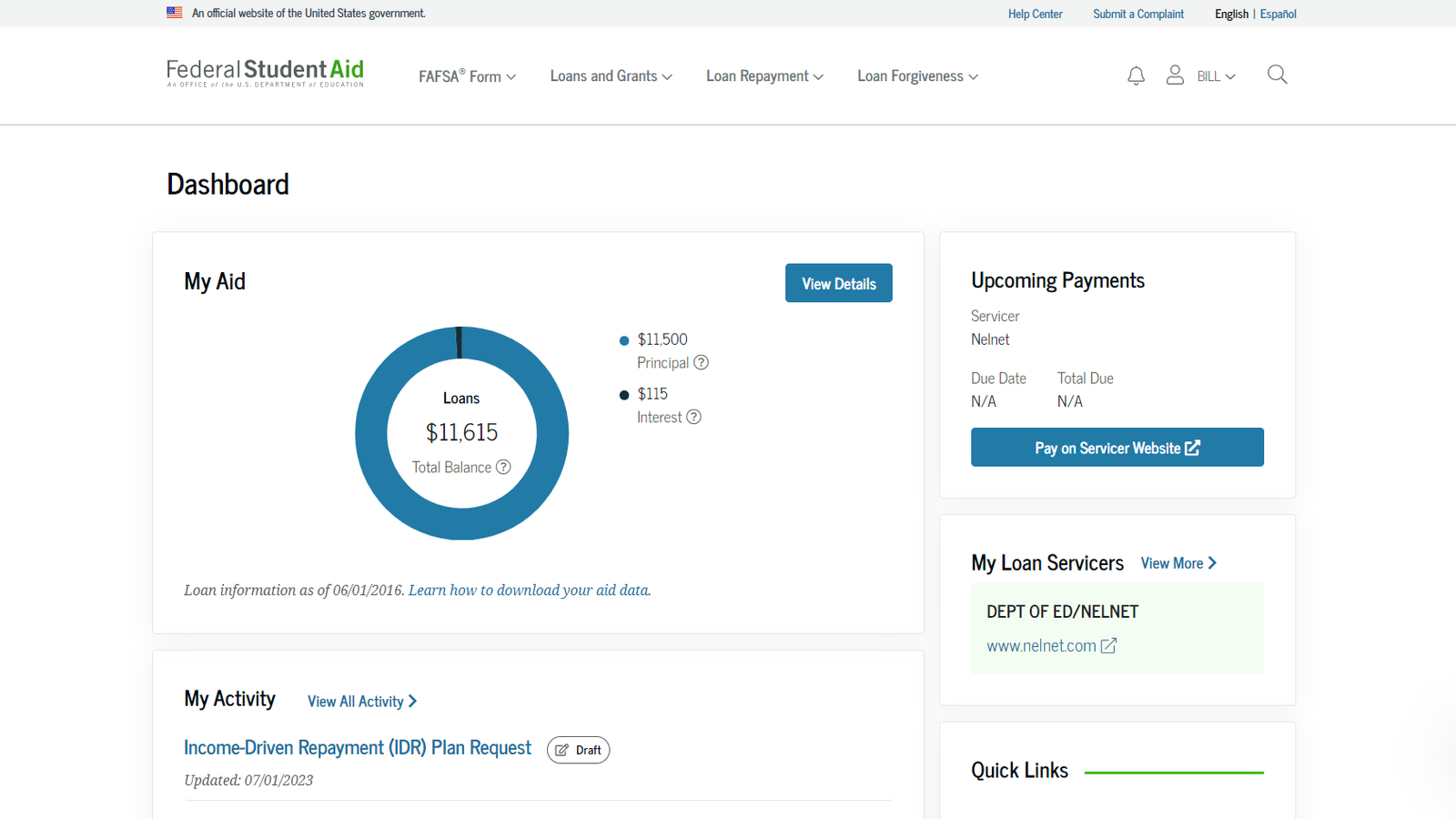

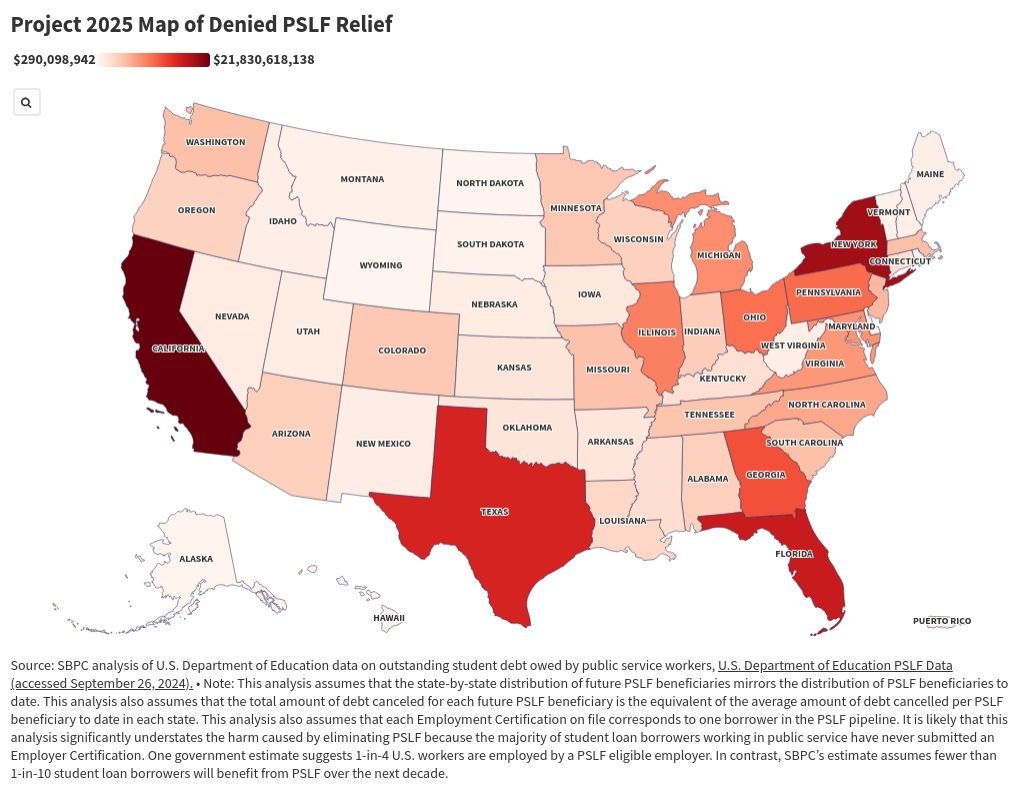

Pursue Public Service Loan Forgiveness

Image Source: Federal Student Aid

The Public Service Loan Forgiveness (PSLF) program offers complete federal student loan forgiveness after 120 qualifying monthly payments63.

PSLF Requirements

Borrowers must have Direct Loans or unite other federal loans into a Direct Consolidation Loan63. You need to make monthly payments under an income-driven repayment plan. The 10-Year Standard Repayment Plan qualifies but leaves no balance to forgive64.

Qualifying Employment

You must work full-time (minimum 30 hours weekly) with qualifying employers65. These employers include:

- Federal, state, local, or tribal government organizations

- 501(c)(3) tax-exempt nonprofits

- AmeriCorps or Peace Corps positions

- Public service organizations that provide essential services65

Application Process

StudentAid.gov’s PSLF Help Tool makes the application process easier66. You should submit the Employment Certification Form (ECF) each year or after changing employers63. In spite of that, most applications get reviewed within weeks as processing times have improved substantially67.

Common Mistakes to Avoid

Keep proper documentation and watch out for these pitfalls. Your forgiveness could be delayed if you make payments under non-qualifying repayment plans or miss annual income recertification deadlines63. COVID-19 periods aside, deferment or forbearance time doesn’t count toward your required 120 payments63. Remember – you’ll permanently lose PSLF eligibility if you refinance federal loans through private lenders66.

Refinance Private Student Loans

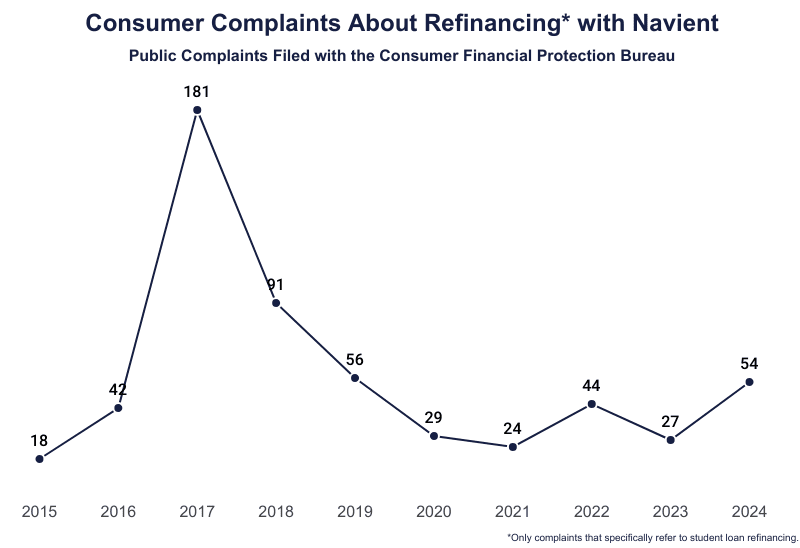

Image Source: Education Data Initiative

Student loan refinancing helps you get lower interest rates and better loan terms. We found this strategy works best if you have a good credit score and steady income.

When to Refinance

You should refinance if you can get interest rates lower than what you’re paying now68. The right moment comes after your credit score goes up and you land a stable job69. The Federal Reserve plans to keep cutting rates through 2025, which means private student loan rates will stay low70.

How to Compare Lenders

Look at several lenders’ offers within a 14 to 45-day window to keep credit checks minimal4. Most lenders let you check your rates without hurting your credit score71. Think about these important factors:

- Minimum loan requirements

- Fixed versus variable rates

- Repayment term options

- Cosigner release availability

Credit Score Impact

Your credit score will dip briefly from hard credit checks and opening a new account4. The score usually drops 5 to 10 points68. Regular payments on your new loan will boost your credit profile as time passes4. Credit scoring models treat multiple refinancing applications as one check if you submit them within the timeframe4.

Keep paying your current loans until you know the old ones are paid off71. This step will give a smooth transition that protects your credit score and avoids late fees.

Use Tax Deductions and Credits

Image Source: IRS

Tax benefits are a great way to get significant savings if you have student loans. The IRS lets you reduce your tax burden in several ways while you manage your education debt.

Student Loan Interest Deduction

You can deduct up to $2,500 of paid student loan interest each year13. We used this deduction when your modified adjusted gross income (MAGI) stays under $80,000 for single filers or $160,000 for joint returns13. This deduction helps lower your taxable income without itemizing deductions13.

Education Credits

Two major education credits help cut your higher education costs. The American Opportunity Tax Credit (AOTC) gives you up to $2,500 per eligible student14. Yes, it is worth noting that 40% of the remaining credit (up to $1,000) becomes refundable if it exceeds your tax liability14. The Lifetime Learning Credit gives you up to $2,000 per tax return2.

State Tax Benefits

Many states follow federal deductions for student loan interest. To name just one example, some states give additional tax credits or deductions beyond federal benefits. Here’s how to maximize these benefits:

- Keep accurate records of loan payments

- Look up state-specific education credits

- Document qualified education expenses

Note that you need to file Form 8863 for education credits2. Your loan servicers will send Form 1098-E, which shows annual interest payments over $60015.

Make Bi-weekly Payments

Image Source: Student Loan Planner

Making bi-weekly student loan payments instead of monthly ones creates a smart repayment strategy. This approach leads to 26 half-payments each year rather than 12 full payments16.

Payment Scheduling

The strategy works by splitting your monthly payment in half and paying that amount every two weeks. A $392 monthly payment becomes $196 bi-weekly16. Here’s how you can make this strategy work:

- Ask your loan servicer about bi-weekly payment options

- Set up automated payments when possible

- Make sure both payments arrive before the monthly due date

- Ask for proper principal application on extra payments

Interest Savings

Bi-weekly payments will save you about $1,000 in interest throughout your loan term16. You save money because you make one extra full payment each year. The frequent principal reduction also slows down interest accumulation17. Your principal decreases every two weeks instead of carrying the full balance for 30 days.

Budget Planning

Bi-weekly student loan payments that line up with your paychecks make budget management easier18. Start by checking if your loan servicer offers automated bi-weekly payments. Next, pick payment dates matching your pay schedule. Keep enough funds in your account since three consecutive insufficient funds could cancel your payment arrangement16.

Note that your loan servicer should apply the extra amount to your principal balance instead of future payments18. This will give you maximum interest savings and help you pay off your loan faster.

Apply for State-Specific Forgiveness Programs

Image Source: Student Borrower Protection Center

Forty-seven states, plus D.C. and Puerto Rico now have special student loan forgiveness programs19. These state programs give students more options beyond what federal programs can offer.

Available State Programs

We focused on healthcare and education sectors in most states. Minnesota runs ten different programs19, while New York has nine distinct forgiveness options19. The money you can get varies by a lot – ranging from USD 5,000 for aviation programs to USD 300,000 for healthcare professionals in California20.

Eligibility Criteria

These programs just need you to meet employment rules and:

- Have a professional license in the state

- Work full-time in underserved areas

- Have qualifying education loans to pay off

- Be a U.S. citizen or eligible non-citizen21

Healthcare professionals should work in Health Professional Shortage Areas (HPSAs)22. Teachers should work in areas that need them most or teach specific subjects23.

Application Steps

You should follow these steps carefully. Check if your state has the program you want. Get your employment and loan papers ready. Send in your application when the time is right – many programs open once a year, like New York’s Licensed Social Worker program that starts in July 202521. States usually review applications within 45-60 days and send money straight to loan servicers.

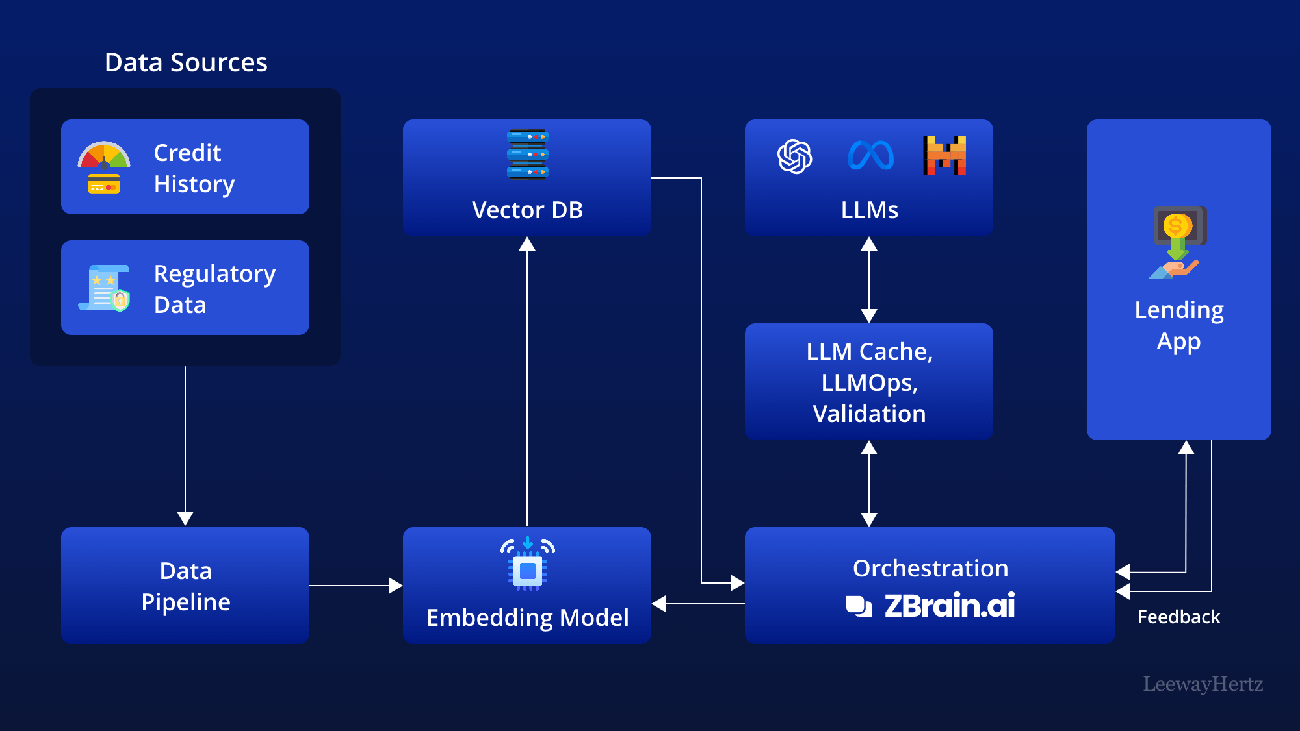

Utilize AI-Powered Repayment Tools

Image Source: LeewayHertz

AI now drives sophisticated tools that make student loan management easier through automated analysis and tailored recommendations. These digital tools help borrowers make better repayment choices and cut down on mistakes5.

Smart Payment Optimization

AI algorithms look at your income and expenses to build custom repayment plans24. These tools predict monthly expenses and find ways to save money through predictive analysis25. They watch cash flow patterns and send alerts about upcoming payments or possible account shortages5.

Debt Analysis Tools

Smart AI platforms look at loan portfolios to suggest the best repayment strategies26. They keep track of credit scores and overall financial health to help borrowers stay debt-free26. Platforms like Lever use AI algorithms to study individual financial situations and create custom plans that change with policy updates26.

Budget Tracking Apps

AI-powered apps make loan management simple:

- Wally: Sorts expenses on its own and gives personal savings tips through WallyGPT25

- Cleo: Has a chatbot that gives immediate feedback about spending choices25

- Rocket Money: Spots unnecessary expenses and moves money into savings25

These apps process big amounts of financial data to spot trends and savings chances25. Their best feature is how they keep learning – more data means better recommendations25. This tailored approach helps borrowers make smart choices about their student loan strategy5.

Consider Income Share Agreements

Image Source: FasterCapital

Income Share Agreements (ISAs) offer a fresh approach to education financing. Students pay a percentage of their future income rather than fixed payments. These agreements help students who have used up their federal loan options1.

ISA Benefits

We focused on eliminating upfront education costs through ISAs that offer flexible repayment based on post-graduation earnings6. Students get funding and pay back a fixed percentage of their income over a set period, similar to an investment1. Most ISAs now include minimum income thresholds. Payments stop automatically if earnings drop below certain levels6.

Terms and Conditions

Students typically share 2% to 10% of their gross income6. The core contract elements include:

- Salary floor (typically $30,000 to $40,000 annually)

- Payment cap limiting total repayment

- Fixed repayment timeline (2-10 years)

- Income percentage requirements6

Provider Comparison

Educational institutions and private lenders represent the two main types of ISA providers27. School-based ISAs control 31.8% of the market27 and generally offer better terms with lower income shares and extended repayment periods27. Private providers dominate 67.9% of the market27 and set higher income shares with shorter repayment terms.

ISAs ended up working best for students who enter fields with moderate salary growth potential or cannot qualify for traditional private loans7. The Consumer Financial Protection Bureau now classifies ISAs as student loans6, which could bring more consumer protections soon.

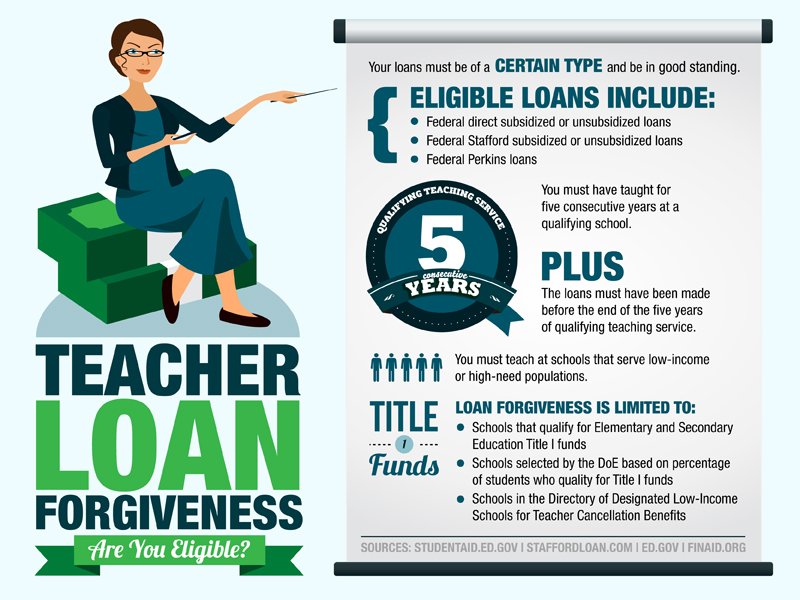

Explore Teacher Loan Forgiveness

Image Source: OnlineCollege.org

The Teacher Loan Forgiveness Program helps educators pay off their debt if they work in low-income schools. Teachers who qualify can get up to $17,500 in federal student loan forgiveness28.

Program Requirements

Teachers need to work full-time for five consecutive academic years29. Math, science, and special education teachers can receive the maximum $17,500, while other educators qualify for up to $5,00030. The program covers loans taken after October 1, 199828.

Eligible Schools

Schools must meet these requirements to qualify:

- Located in a Title I-eligible district

- Serve over 30% low-income students

- Listed in the Teacher Cancelation Low Income Directory30

A school’s eligibility at the start of employment ensures teachers remain qualified even if the school’s status changes later9.

Application Process

Teachers can apply after completing their five-year teaching requirement10. They need to submit the Teacher Loan Forgiveness Application to their loan servicer, and the school’s chief administrative officer must complete the certification section30. Multiple school administrators need to certify employment separately if a teacher worked at different locations during the qualifying period28.

The program accepts only Direct Subsidized and Unsubsidized Loans10. Teachers can participate in other federal programs while pursuing this forgiveness, but they can’t use the same service period for multiple benefits31.

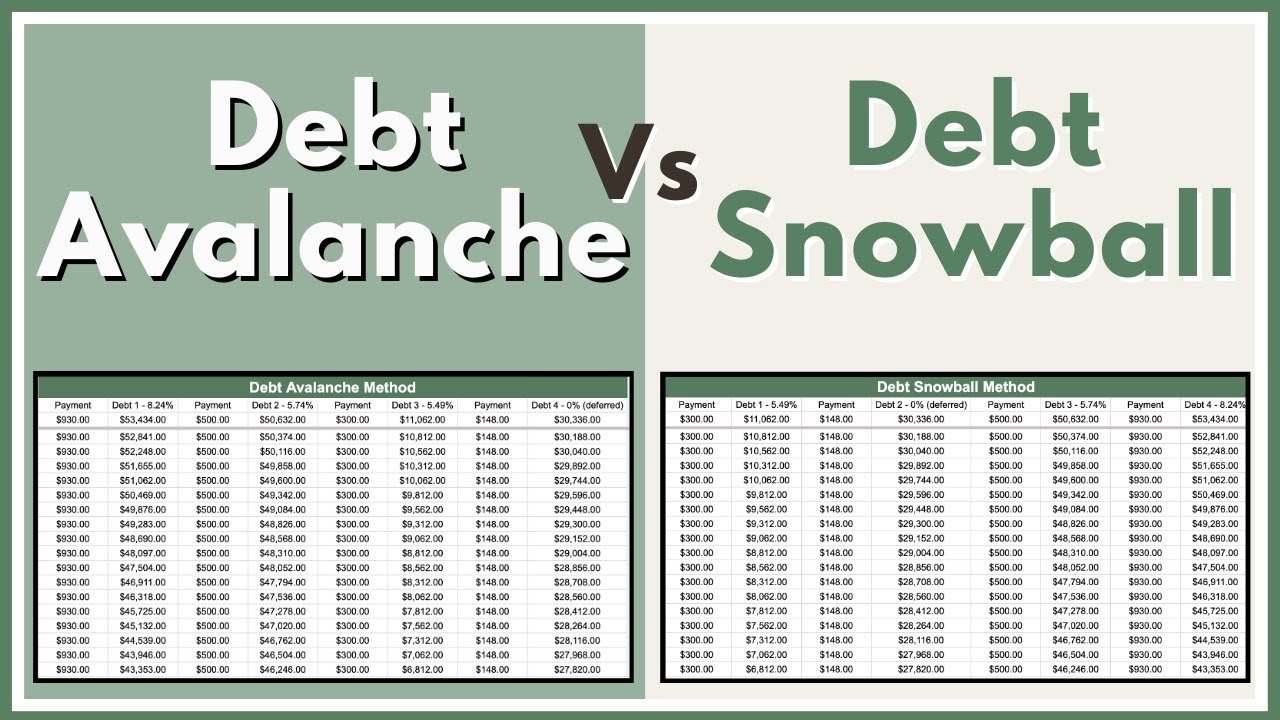

Use the Debt Avalanche Method

Image Source: YouTube

The debt avalanche method targets your highest-interest student loans first. This makes it the best mathematical approach to minimize interest costs. You can save money by allocating extra payments toward loans with the highest interest rates while paying minimums on other debts32.

Strategy Overview

You need to make minimum payments on all loans and direct additional funds toward the highest-interest debt33. This method reduces your total interest paid and shortens the repayment timeline34. The strategy works best when you have strong self-discipline and focus on long-term savings32.

Implementation Steps

- List all student loans by interest rate (highest to lowest)

- Calculate total minimum payments required

- Determine extra monthly payment amount

- Apply extra payments to highest-interest loan

- Roll payments to next highest-rate loan after payoff33

Interest Savings Calculation

The debt avalanche method shows impressive savings. Let’s look at an example with $500 available monthly for debt repayment and three loans – a credit card at 26% APR ($1,000), personal loan at 12% APR ($1,250), and line of credit at 8% ($5,000). This method saves $4,074 in total interest3. Your repayment time drops from 61 months to 40 months3.

The debt avalanche strategy needs patience because high-interest balances take time to eliminate32. Your success depends on consistent extra payments and avoiding new debt during the repayment period3.

Take Advantage of Military Benefits

Image Source: Money Management International

Military service members can get exclusive student loan benefits that substantially reduce their debt burden. The Department of Defense has loan repayment assistance programs for service members of all branches.

Service-Related Programs

The Army and Navy give up to $65,000 in student loan repayment35 through the Student Loan Repayment Program (SLRP). The Coast Guard provides up to $30,000, and the National Guard helps with up to $50,00035. These payments go directly to loan servicers each year. Members receive either one-third of their remaining balance or $1,500, whichever amount is higher35.

Interest Rate Caps

The Servicemembers Civil Relief Act (SCRA) keeps interest rates at or below 6% on loans taken before active duty36. This benefit covers federal and private student loans, auto loans, mortgages, and credit cards36. Service members have 180 days after leaving active duty to ask for this reduction36.

Deployment Benefits

Direct Loans made after October 1, 2008 qualify for 0% interest when service members deploy to hostile areas. This benefit lasts up to 60 months37. Federal Perkins Loan holders serving in hostile fire areas can get their entire loan canceled38. The Department of Education automatically applies these interest reductions for federal loans. Service members must specifically request benefits for private loans37.

Join a Student Loan Repayment Assistance Program

Image Source: UC Berkeley Law

Loan Repayment Assistance Programs (LRAPs) help you manage education debt through direct financial support. These programs stand apart from income-driven repayment plans by funding your loan payments directly.

Program Types

You can access LRAPs through several organizations:

- School-based programs that support public interest careers

- State-administered initiatives for specific professions

- Federal agency programs that offer up to $10,000 each year39

- Healthcare sector programs with up to $50,000 for two-year commitments40

Application Process

Most applications take three weeks to process41. You must submit:

- Proof of U.S. citizenship or eligible non-citizen status

- Complete loan documentation in PDF format

- Employment verification from qualifying organizations

- Credit report access that helps with verification

Benefit Maximization

LRAPs work best when combined with other forgiveness programs. Healthcare professionals can earn up to $80,000 through full-time service41. Language proficiency bonuses can add $5,000 to your total awards41. Federal employees need to complete a three-year service commitment to keep their benefits39.

Your LRAP benefits improve when you keep detailed payment records and submit annual recertification documents promptly. Most approved applicants receive their notification by September 30th each year41. Note that LRAP funds can cover private educational loans that rarely qualify for other relief programs39.

Consolidate Federal Loans Strategically

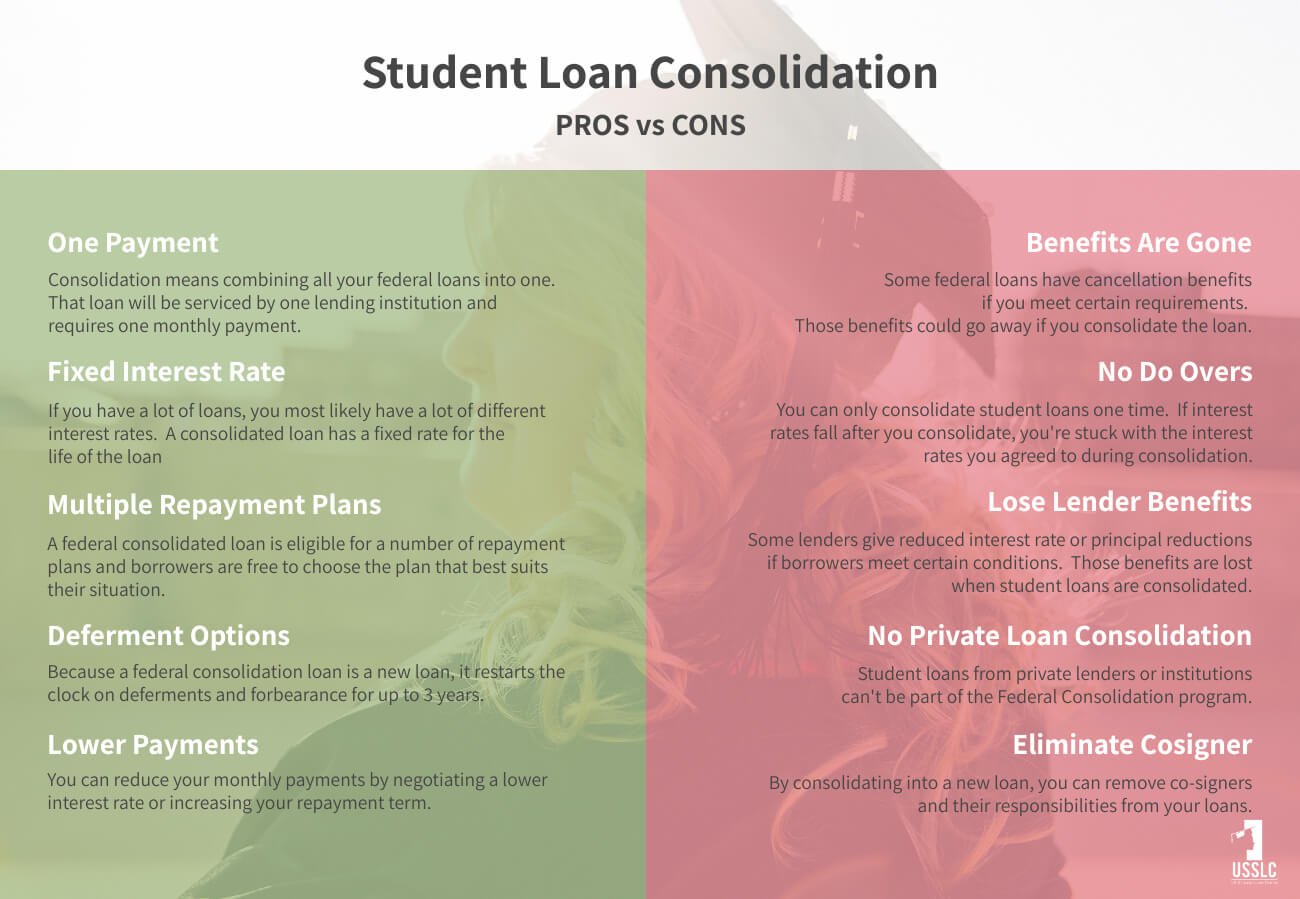

Image Source: US Student Loan Center

Federal loan consolidation lets you combine multiple federal student loans into a single Direct Consolidation Loan. This streamlined approach to debt management gives borrowers a single monthly payment and might lower their payments through extended terms8.

Pros and Cons

We combined multiple payments into one to make loan management easier. The process gives you access to more income-driven repayment plans and forgiveness options42. Your monthly payments could decrease when you extend repayment terms up to 30 years8. The longer term means you’ll pay more interest over time. The new interest rate equals your existing loans’ weighted average, rounded up to the nearest one-eighth percent43.

Timing Considerations

Recent changes have made timing a vital part of consolidation. You must consolidate by June 30, 2024 to get the most from the IDR Account Adjustment43. The whole process takes 30-45 business days44. You should think carefully about consolidating during grace periods because it cancels any remaining grace time45.

Impact on Forgiveness

Different forgiveness programs react differently to consolidation. Public Service Loan Forgiveness (PSLF) requires you to consolidate non-Direct loans43. The IDR Account Adjustment helps borrowers with multiple Direct loans keep their longest payment history after consolidation43. Parent PLUS loans need separate consolidation because combining them with other federal loans limits your repayment options43.

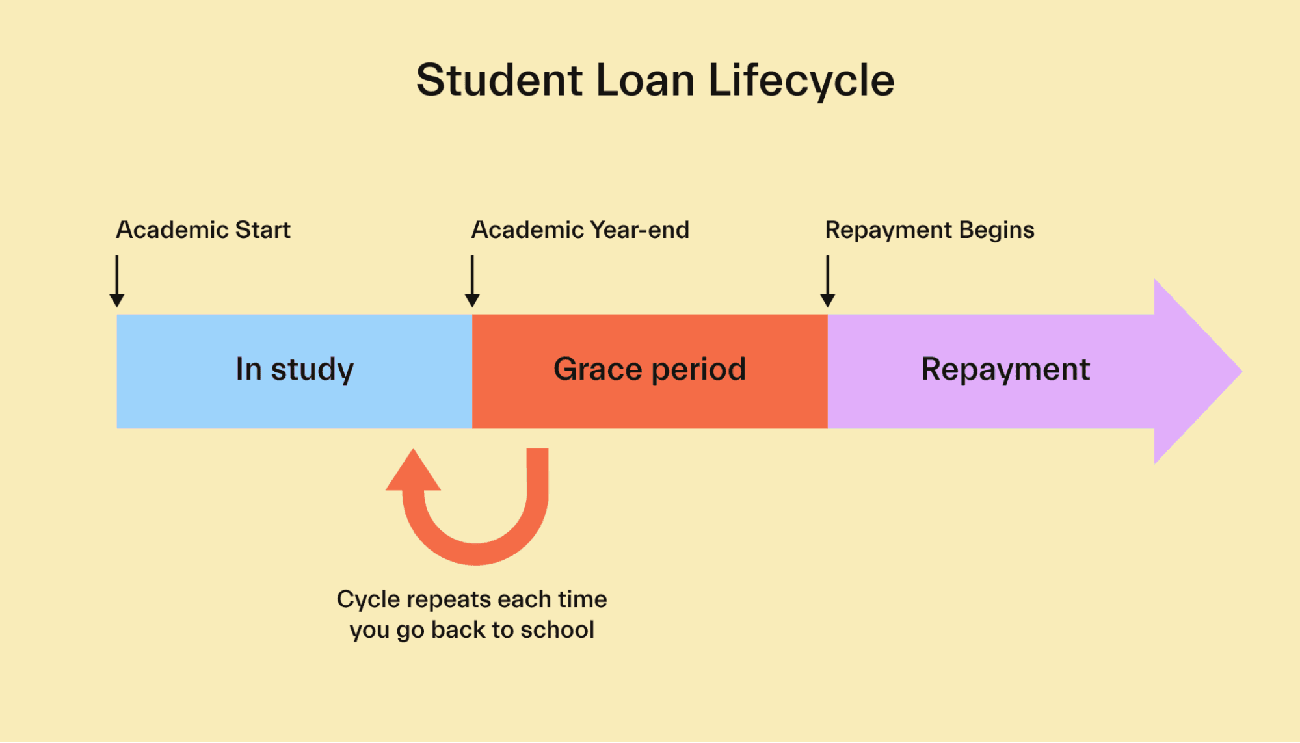

Maximize Grace Period Benefits

Image Source: Mos

Federal student loans give students a helpful six-month grace period after graduation or when enrollment drops below half-time12. This window provides significant time to build financial stability before payments start.

Smart Planning

The grace period gives students a chance to find jobs and get their finances in order. Students who have Direct Subsidized or Unsubsidized Loans start repayment after their six-month grace period ends12. Parent PLUS and Consolidation Loans need immediate payments right after the final loan disbursement12.

Interest Management

Interest keeps adding up during the grace period for most loans. Students can prevent balance growth through capitalization by making interest-only payments46. A borrower’s unsubsidized loans can save them thousands when they tackle interest before it adds to the principal47. Students can figure out potential savings with a grace period payment calculator based on what they can afford46.

Repayment Preparation

Students need these proactive steps to manage their loans successfully:

- Make a detailed loan inventory with servicer details

- Check repayment plan options through exit counseling

- Set up automatic payments before grace period ends

- Look for first billing statement that arrives three weeks before payment due date48

Students who already have jobs can reduce their overall loan costs by making early grace period payments46. Borrowers get their payment schedule about 45 days before payments must start12. This schedule helps them adjust their budget and plan their finances for future success.

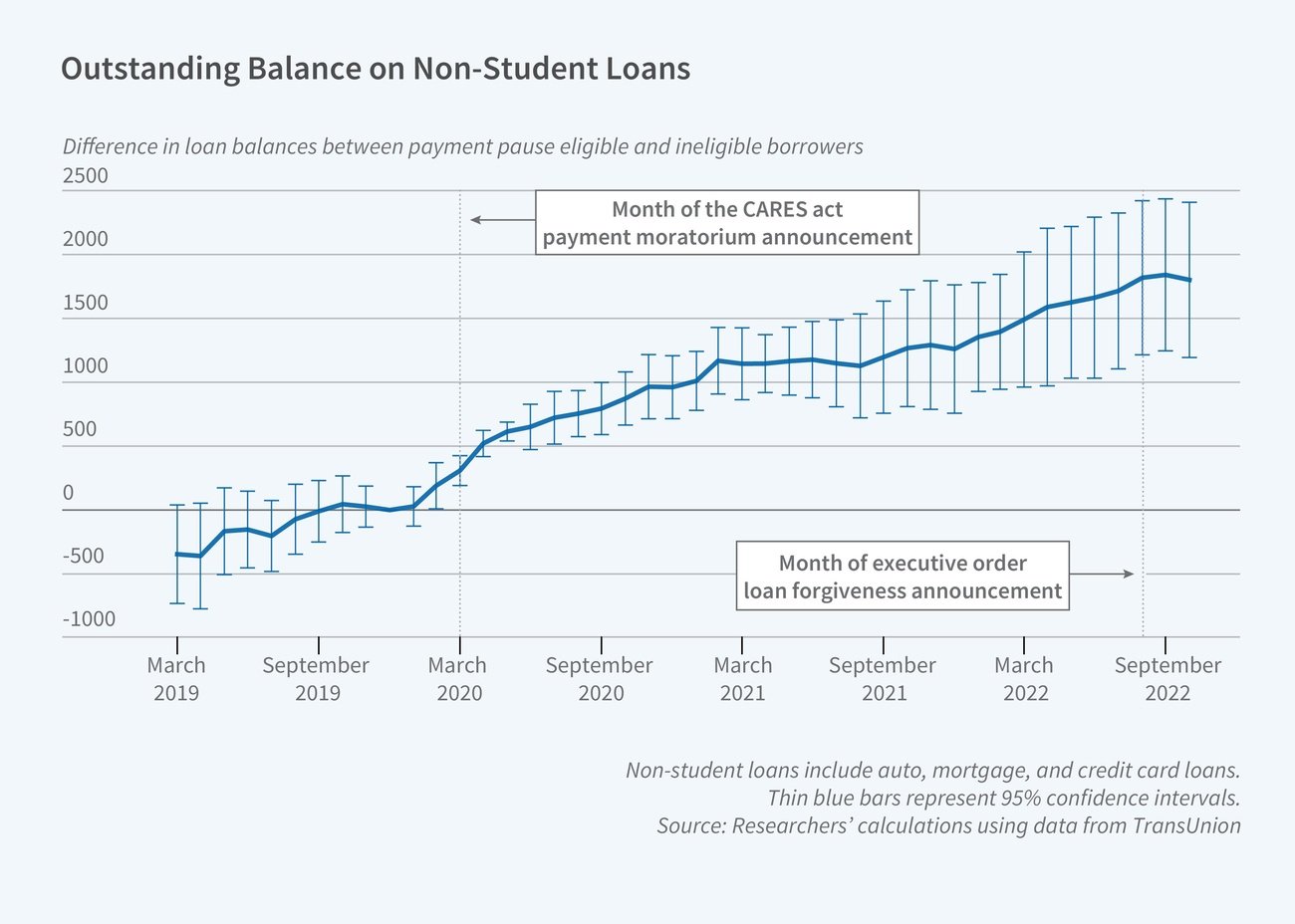

Create an Emergency Fund First

Image Source: National Bureau of Economic Research

A solid emergency fund creates the foundation you need to manage student loans effectively. Your financial safety net must be ready before you focus completely on loan repayment to prevent any payment disruptions.

Savings Goals

Your emergency fund should cover three to six months of living expenses49. Someone who needs USD 5,000 for three months of expenses can reach this goal through systematic savings methods11. The best approach directs a fixed portion of each paycheck into a dedicated high-yield savings account or money market account11.

Risk Management

Emergency savings shield you from unexpected financial shocks that could derail your loan repayment plans. This financial buffer helps you avoid high-interest credit cards or loans during emergencies50. Studies show that people without enough savings find it harder to bounce back from financial setbacks, which often leads to long-term debt problems50.

Balance Priorities

We divided funds between emergency savings and loan payments strategically. You might want to create a separate emergency fund just for three to six months of student loan payments51. Setting up automatic transfers from checking to savings accounts helps maintain this balance effectively51. Your tax refunds can go toward building emergency savings faster while keeping regular loan payments on track51.

A dedicated emergency fund lets you concentrate on long-term loan repayment strategies without worrying about unexpected expenses. One borrower’s story proves this value – their established fund covered an USD 1,800 emergency fence repair without affecting their loan payment schedule11.

Comparison Table

| Strategy | Maximum Benefit Amount | Eligibility Requirements | Key Features/Benefits | Implementation Timeline |

|---|---|---|---|---|

| SAVE Income-Driven Repayment | $0 payments when income falls under $32,800 (individual) | Direct Loans only with income-based qualification | 5% limit on undergraduate loan payments without interest accumulation | Application takes 10 minutes |

| Employer Student Loan Benefits | Tax-free benefits up to $5,250 yearly | Requirements vary by employer with specific employment periods | Benefits remain tax-free through 2025 with direct lender payments | Depends on employer program |

| Auto-Payment Discounts | Interest rates reduced by 0.25% | Active bank account with sufficient balance | Payments process automatically with reduced interest rates | Benefits start after setup |

| Public Service Loan Forgiveness | Complete loan forgiveness | Must complete 120 qualifying payments with eligible employer | Federal loans forgiven completely without tax impact | Requires 10 years of payments |

| Private Loan Refinancing | Amount varies by lender | Strong credit score with stable income proof | Better interest rates with improved terms | Process takes 14-45 days |

| Tax Deductions | Annual deduction up to $2,500 | MAGI must stay below $80,000 (single) or $160,000 (joint) | Lower taxable income without itemization | Submit with yearly taxes |

| Bi-weekly Payments | Save roughly $1,000 in interest | No specific qualifications needed | Extra payment yearly with faster loan payoff | Setup happens immediately |

| State Forgiveness Programs | Healthcare professionals in CA can receive up to $300,000 | Qualifications differ by state and profession | Benefits vary by state with multiple options | Processing takes 45-60 days |

| Teacher Loan Forgiveness | Benefits up to $17,500 | Must teach 5 consecutive years at qualifying school | Benefits vary by subject area | Complete 5 years of service |

| Military Benefits | Army/Navy members receive up to $65,000 | Must serve in active military | Interest capped at 6% with service benefits | Timeline varies by program |

| Loan Consolidation | Not applicable | Multiple federal loans required | Single monthly payment with extended terms | Takes 30-45 business days |

| Emergency Fund First | Cover 3-6 months of expenses | Anyone can qualify | Protects finances and prevents missed payments | Depends on savings target |

Last words

Student loan repayment just needs a personalized approach based on your financial situation. These 17 strategies can reduce your debt by a lot while keeping your finances stable.

Smart borrowers begin with federal programs like SAVE and PSLF. These programs are a great way to get benefits without extra costs. Your repayment plan works best when you mix different strategies – from employer assistance programs to state-specific forgiveness options.

Military service members, teachers, and public service workers should focus on their profession’s specific benefits. These benefits can give you up to $65,000 in loan forgiveness. On top of that, simple steps like auto-payments and bi-weekly payments can save you thousands in interest over your loan term.

Solid financial planning remains the key to successful repayment. You can create a strong safety net that supports long-term success by building an emergency fund, using tax benefits, and timing your loan consolidation well. These proven methods give you practical ways to control your student loan debt and reach financial freedom.

To learn more:

17 Proven Ways to Save Money on Travel in 2025 (Without Missing Out)

FAQs

Q1. Is student loan forgiveness still possible in 2025? While broad student loan forgiveness was blocked in 2023, borrowers enrolled in the SAVE plan may benefit from an interest-free payment pause until December 2025. The Education Department continues to explore targeted relief options for specific groups of borrowers.

Q2. How can I prevent wage garnishment for defaulted student loans in 2025? To avoid wage garnishment, explore options like loan rehabilitation, Direct loan consolidation, or income-driven repayment plans. Contact your loan servicer immediately if you’re struggling with payments to discuss alternatives and prevent default.

Q3. Why might my student loan payments increase in 2025? Payment increases may occur due to required income recertifications for income-driven repayment plans. As your income changes, your payment amount may be adjusted. Additionally, transitions between repayment plans or the end of temporary payment reductions can lead to higher monthly payments.

Q4. What’s the most effective strategy for repaying student loans? The most effective strategy often involves choosing the lowest monthly payment plan and applying extra payments to the highest-interest loans first (debt avalanche method). Consider income-driven repayment plans like REPAYE or SAVE, which can significantly reduce your monthly payments based on your income.

Q5. How can I take advantage of employer student loan benefits? Many employers now offer student loan repayment assistance as a workplace benefit. Check with your HR department about available programs, which may include direct monthly payments towards your loans, matching contributions, or one-time bonuses. These benefits can be tax-free up to $5,250 annually through 2025.

References

[1] – https://www.mdrc.org/work/projects/income-share-agreements-and-related-programs-finance-college-or-career-training

[2] – https://www.nerdwallet.com/article/loans/student-loans/education-tax-credits

[3] – https://www.lendingclub.com/resource-center/personal-finance/what-is-the-debt-avalanche-method-and-how-does-it-work

[4] – https://www.experian.com/blogs/ask-experian/heres-how-refinancing-affects-your-credit/

[5] – https://www.sofi.com/learn/content/ai-budgeting-tools/

[6] – https://www.nerdwallet.com/article/loans/student-loans/income-share-agreements-what-students-should-know-before-borrowing

[7] – https://www.bankrate.com/loans/student-loans/income-share-agreement/

[8] – https://studentaid.gov/articles/5-things-before-consolidating-student-loans/

[9] – https://www.readysetrepay.org/repaying/tlf.html

[10] – https://studentaid.gov/articles/teacher-loan-forgiveness-options/

[11] – https://www.salliemae.com/blog/pay-off-debt-and-start-emergency-fund/

[12] – https://aidvantage.studentaid.gov/getting-started/in-your-grace-period

[13] – https://www.irs.gov/newsroom/tax-benefits-for-education-information-center

[14] – https://www.irs.gov/credits-deductions/individuals/aotc

[15] – https://www.irs.gov/taxtopics/tc456

[16] – https://www.bankrate.com/loans/student-loans/biweekly-payments-vs-monthly/

[17] – https://www.experian.com/blogs/ask-experian/why-paying-your-mortgage-twice-a-month-can-save-you-serious-money/

[18] – https://www.nerdwallet.com/article/loans/student-loans/biweekly-student-loan-payments

[19] – https://thecollegeinvestor.com/student-loan-forgiveness-programs-by-state/?srsltid=AfmBOorw6_D7AyG3-9Rf__X_7Go7d4oImACis28MV_Cuy63Zn1FR7Vrr

[20] – https://educationdata.org/student-loan-forgiveness-programs

[21] – https://www.hesc.ny.gov/find-aid-you-need/new-york-state-loan-forgiveness-programs/nys-licensed-social-worker-loan

[22] – https://nhsc.hrsa.gov/loan-repayment/state-loan-repayment-program

[23] – https://www.house.mn.gov/hrd/pubs/stloanfrg.pdf

[24] – https://web.meetcleo.com/budget

[25] – https://www.bankrate.com/banking/savings/ai-apps-to-help-you-save-money/

[26] – https://www.globenewswire.com/news-release/2024/12/03/2990743/0/en/AI-Unlimited-s-Lever-App-Introduces-AI-Powered-Student-Loan-Management-Amid-Anticipated-Policy-Shifts.html

[27] – https://www.jff.org/what-we-know-about-the-income-share-agreement-market/

[28] – https://www.studentloanplanner.com/teacher-loan-forgiveness-application/

[29] – https://studentaid.gov/manage-loans/forgiveness-cancellation/teacher

[30] – https://tea.texas.gov/texas-educators/educator-initiatives-and-performance/federal-teacher-loan-forgiveness-program

[31] – https://www.alleducationschools.com/financial-aid/student-loan-forgiveness/

[32] – https://www.elfi.com/student-loan-payoff-debt-snowball-vs-debt-avalanche/

[33] – https://www.investopedia.com/terms/d/debt-avalanche.asp

[34] – https://www.investopedia.com/articles/personal-finance/080716/debt-avalanche-vs-debt-snowball-which-best-you.asp

[35] – https://www.military.com/education/money-for-school/student-loan-repayment.html

[36] – https://www.consumerfinance.gov/ask-cfpb/im-in-the-military-are-there-limits-on-how-much-i-can-be-charged-for-a-loan-en-893/

[37] – https://pueblo.gpo.gov/CFPBPubs/pdfs/CFPB262.pdf

[38] – https://myarmybenefits.us.army.mil/Benefit-Library/Federal-Benefits/Cancellation-of-Federal-Student-Loans

[39] – https://www.equaljusticeworks.org/law-students/student-debt-resources/resources/loan-repayment-assistance-programs/

[40] – https://studentaid.gov/articles/student-loan-forgiveness/

[41] – https://nhsc.hrsa.gov/loan-repayment/nhsc-loan-repayment-program

[42] – https://www.bankrate.com/loans/student-loans/pros-cons-student-loan-consolidation/

[43] – https://www.edcapny.org/resources-for-borrowers/consolidation-guide/

[44] – https://www.studentloanplanner.com/student-loan-consolidation-timeline/

[45] – https://law.pepperdine.edu/admissions/financial-aid/domestic-applicants/loans/federal-loan-consolidation.htm

[46] – https://www.collegexpress.com/articles-and-advice/financial-aid/articles/scholarships-grants-loans/smart-ways-to-plan-before-your-student-loan-grace-period-ends/

[47] – https://www.lendingtree.com/student/pay-student-loans-during-grace-period/

[48] – https://nelnet.studentaid.gov/content/ingrace

[49] – https://mai.capital/resources/financial-planning-with-student-loan-debt/

[50] – https://www.consumerfinance.gov/an-essential-guide-to-building-an-emergency-fund/

[51] – https://www.citizensbank.com/learning/manage-student-loans-economic-downturn.aspx

[52] – https://www.cnbc.com/2023/07/31/how-to-apply-for-bidens-new-save-student-loan-repayment-plan.html

[53] – https://fsapartners.ed.gov/knowledge-center/library/electronic-announcements/2023-08-22/loan-servicing-information-availability-saving-valuable-education-save-plan-and-updates-income-driven-repayment-plans

[54] – https://www.credible.com/refinance-student-loans/save-repayment-plan

[55] – https://www.creditkarma.com/news/i/student-loans-save-plan

[56] – https://www.paycor.com/resource-center/articles/employer-student-loan-repayment-program-5-tips/

[57] – https://www.uschamber.com/co/run/human-resources/offering-student-loan-assistance-employee-benefit

[58] – https://www.irs.gov/newsroom/reminder-to-employers-and-employees-educational-assistance-programs-can-be-used-to-help-pay-workers-student-loans-free-irs-webinar-will-offer-details

[59] – https://mohela.studentaid.gov/DL/resourceCenter/AutoPayInterestRateReduction.aspx

[60] – https://www.nerdwallet.com/article/loans/student-loans/auto-pay-student-loans

[61] – https://www.salliemae.com/student-loans/manage-your-private-student-loan/prepare-to-pay-your-student-loans/ways-to-make-student-loan-payments/

[62] – https://blog.massmutual.com/planning/student-loan-early-repay

[63] – https://www.studentloanplanner.com/biggest-pslf-mistakes/

[64] – https://www.passhe.edu/hr/benefits/pslf.html

[65] – https://www.laurelroad.com/public-service-loan-forgiveness/what-jobs-qualify-for-pslf/

[66] – https://www.forbes.com/sites/adamminsky/2023/11/22/5-student-loan-forgiveness-mistakes-to-avoid-according-to-an-attorney/

[67] – https://www.studentloanplanner.com/pslf-borrowers-prepare/

[68] – https://www.cnbc.com/select/best-student-loan-refinance-companies/

[69] – https://www.cnbc.com/select/the-best-time-to-refinance-student-loans/

[70] – https://www.bankrate.com/loans/student-loans/should-you-refinance-private-student-loans/

[71] – https://www.nerdwallet.com/article/loans/student-loans/refinance-private-student-loans

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com