The average American family spends a whopping 24% of their income on childcare. This amount is nowhere near what the US government calls “affordable” – it’s actually triple that figure. My experience as a financial advisor shows that many families struggle to manage childcare expenses that end up costing more than their monthly mortgage.

The path to affordable childcare might look daunting, but solutions exist. Parents can save $1,200 each year through Dependent Care FSAs and tax benefits. Nanny shares offer another practical option. You’ll find many more choices available – from nonprofit daycare centers to employer-sponsored programs and government assistance programs.

My 13 years of guiding families through these options have yielded 17 tested strategies that can cut your childcare costs by a lot. These aren’t just ideas on paper – they’re ground solutions that have helped real parents, and they could make a difference for your family too.

Maximize Tax Benefits for Childcare

Image Source: FasterCapital

Tax benefits are one of the best ways to cut down childcare expenses. My experience as a financial advisor shows families can save thousands each year by making the most of these tax advantages.

Understanding Dependent Care FSA

A Dependent Care FSA lets you set aside pre-tax dollars for childcare expenses. You can contribute up to $5,000 if married filing jointly or $2,500 if married filing separately in 202561. This benefit lowers your overall tax burden because the money comes out before taxes61. Your eligible expenses can include preschool, summer day camps, and before/after school programs for children under 1361.

Child Care Tax Credit Optimization

Working parents can save even more with the Child and Dependent Care Tax Credit (CDCTC). Right now, you can claim between 20% to 35% of qualifying expenses, up to $3,000 for one child or $6,000 for two or more children62. Your family can claim CDCTC on the difference if child care expenses go beyond your FSA contribution63. To name just one example, with two children and $5,000 in FSA funds used, you could still claim $1,000 in expenses toward the CDCTC63.

State Tax Deductions

Federal benefits aren’t the only option – many states provide extra tax relief for childcare expenses. All but one of these states (78%) have created their own version of at least one childcare-related tax credit64. The Earned Income Tax Credit (EITC) and Child and Dependent Care Tax Credit lead the pack, available in 32 and 30 states respectively64.

These strategies will help maximize your benefits:

- Get the most value by coordinating FSA and CDCTC claims

- Keep records of all qualifying expenses year-round

- Check your state’s specific tax provisions each year

Note that FSA funds usually follow a “use it or lose it” policy61. Make sure to estimate your yearly childcare expenses carefully before setting your contribution amount. On top of that, it helps to mark your calendar for open enrollment periods since most employers need you to re-enroll in FSA programs annually65.

Leverage Employer-Sponsored Benefits

Image Source: Bizstim

Companies today offer great childcare benefits that can cut down your expenses. I work as a financial advisor and have watched families save thousands each year by making the most of their corporate programs.

Corporate Daycare Discounts

Big companies team up with childcare providers to help employees save money. CVS Health gives its employees discounts on childcare services66, while Microsoft’s employees get 20% tuition savings at programs across the country67. These strategic collaborations usually come with priority waitlist spots at popular centers, so your child can get in when you just need it.

Backup Care Programs

Backup care is crucial since 37% of working parents miss work because of childcare emergencies68. Your employer’s backup care programs let you access trusted in-center and in-home care providers at lower daily rates. Amazon works with Bright Horizons to give its employees backup childcare when schedules get disrupted66. These programs work well – companies see a 30% drop in employee absences69.

Work-from-Home Childcare Benefits

Working remotely is a chance to save on childcare costs. Studies show 75% of parents prefer remote work to balance their work and home life better70. Working from home helps families cut costs in several ways:

- Parents can adjust their schedules to share childcare duties

- No commute means more time to handle childcare

- Part-time childcare becomes an option instead of full-time care

Companies know that remote workers still just need childcare support since it affects how well they work. Organizations that provide childcare benefits end up saving around $75,000 each year from less lost work time71. Some companies even give remote work allowances that you can use for childcare costs66.

Take a good look at your company’s employee handbook to get the full picture. Set up time with HR to learn about all your options. Using multiple benefits together – like corporate discounts with backup care – helps you save the most money.

Explore Government Assistance Programs

Image Source: Wisconsin Examiner

Government assistance programs are a great way to get relief for families who need affordable childcare options. I’ve helped many clients save money on their childcare costs by carefully evaluating these programs.

Income-Based Subsidies

States get federal funding to help eligible families pay for childcare30. These programs, known as vouchers or subsidies, support parents who work or go to school72. Each state has different rules to qualify, but families who get public assistance through TANF, SSI, or SNAP qualify automatically72. Every state runs its own subsidy program, which helps them provide support that fits their community’s needs73.

Head Start Programs

Head Start gives detailed early childhood services free to families that qualify30. The program helps children from birth to age 5 through two main parts:

- Early Head Start: Helps children from birth to age 3 and supports expecting families23

- Traditional Head Start: Works with children ages 3-523

Head Start does more than just childcare. It provides many support services such as:

- Medical and dental screenings72

- Mental health services23

- Family support for housing and employment23

- Parenting guidance and educational resources23

Military Family Benefits

Service members can get specialized childcare help through several channels74. The Department of Defense provides:

- Military-run childcare programs with income-based sliding fee scales74

- Fee help for families who can’t access on-base facilities74

- A pilot program that pays for in-home childcare options74

Military families can also set aside up to $5,000 in pre-tax earnings through the Dependent Care Flexible Spending Account program74. Active component service members, active Guard Reserve on Title 10 orders, and DoD civilians can use this benefit74.

Military families who live far from bases might qualify for extra state-based assistance programs74. These benefits work well with existing military support to create a detailed childcare support system.

Consider Alternative Care Arrangements

Image Source: Is This Normal – Little Spoon

Budget-conscious families can save money with alternative childcare arrangements. My years as a financial advisor have shown me several options that give great value while keeping care quality high.

Family Daycare Cost Analysis

Licensed family daycares run from private homes give you an affordable option compared to traditional centers. These providers charge an average of $344 per week for one child12, which saves about 30% compared to center-based care49. Family daycares also give you:

- Hours that work around your schedule, including evenings and weekends

- Small groups of 10-12 children

- More one-on-one attention

Nanny Share Economics

Nanny sharing lets you get individual-specific care at lower costs. Current market rates show each family pays about $515 weekly in a share, compared to $827 for a private nanny12. This setup comes with great benefits.

The cost usually splits to 2/3 of regular nanny rates, which makes it cheaper than hiring alone75. Adding a second child bumps the hourly rate from $20 to $3076, but sharing the cost still saves you money.

Au Pair Program ROI

Au pair programs mix cultural exchange with affordable childcare. The yearly cost runs about $21,500, which covers:

- Program fees ($10,000)

- Weekly stipend ($215 minimum)

- Education allowance ($500)

- Room and board15

Au pairs give you great value through:

- Up to 45 hours of care weekly12

- Schedule flexibility

- Cultural learning chances

- Live-in help

My career has shown that different care setups often work better than traditional options. Your success depends on how well you match your family’s needs, schedule, and long-term money plans. You’ll need to look at both money and non-money factors to find what works best for your family’s specific needs.

Implement Schedule Optimization

Image Source: LinkedIn

Smart scheduling helps families cut down their childcare costs. Parents can find creative ways to spend more time with their children while keeping their careers on track.

Split-Shift Parenting

Parents who work different schedules can take turns watching their kids. This approach, known as tag-team parenting, works well for many families. Data shows that in one-third of two-income families with young children, parents choose opposite work shifts to handle childcare duties16. This setup offers several benefits:

- Lower costs for formal childcare

- Parents spend more time with their children

- Better balance between work and family life

Parents should think carefully about this choice. Research shows couples who work completely different shifts are up to six times more likely to face relationship problems16. Successful parents often choose schedules that overlap partly instead of working totally opposite hours.

Compressed Workweek Benefits

Working full-time hours in fewer days gives parents another way to reduce childcare expenses. Parents who pack their work hours into fewer days create extra family time. Research shows these compressed schedules lead to:

- Less money spent on childcare because fewer days are needed

- Savings on commuting costs and time

- Better work attendance rates17

Of course, changing work schedules needs careful planning. About 39% of women with children under 5 have changed their work hours to handle childcare needs18. Companies now see the value in flexible schedules, and many report better employee retention and involvement through these programs19.

Here’s how to make the most of schedule changes:

- Check what flexible work options your employer offers

- Figure out how much you’ll save on childcare with different schedules

- Think about how changes might affect your family

- Plan how to talk about these changes with your boss and caregivers

Families who plan their schedules carefully often find they can cut childcare costs while keeping their careers strong and their children well-cared for.

Utilize Community Resources

Image Source: Missouri Department of Elementary and Secondary Education – MO.gov

Community resources are a great way to get help in cutting down childcare costs. My experience as a financial advisor shows how families can find big savings through options many people overlook.

Non-Profit Daycare Centers

Non-profit childcare centers show clear advantages in service quality and affordability. These centers keep higher staff-to-child ratios3 and pay their staff better, which leads to a more stable environment3. These providers choose to set up their facilities in low-income areas3, making sure families who need budget-friendly care can access it.

Non-profit centers’ key advantages include:

- Tax-exempt status that helps lower operating costs20

- They can receive donations and grants20

- Better chances of staying in business than for-profit centers3

Religious Organization Programs

Religious organizations play a big role in making childcare more affordable. Their programs work in different ways, from running facilities directly to sharing space with independent providers21. These faith-based centers can get Child Care and Development Fund (CCDF) subsidies through certificates, even when they include religious teaching21.

Faith-based organizations now provide much of the community’s childcare services21. Their programs typically include:

- Payment plans that work for families

- Fees based on what parents earn

- Extra community support services

Community Center Options

Community centers act as vital spots for budget-friendly childcare. These places help parents connect with various childcare options through their networks22. Local partnerships allow community centers to offer several benefits.

They give complete support services beyond simple childcare23. Many centers connect families with free medical and dental services24. Parents control these programs through advisory boards, which keeps community needs at the vanguard of program growth3.

Families can find substantial savings while getting quality care by looking carefully at these community resources. The centers work closely with childcare resource and referral agencies, so parents can look at several options at once22.

Join Childcare Cooperatives

Image Source: Highs and Lows – PEPS

Childcare cooperatives are a chance to cut costs and create lasting community bonds. My years of helping families have shown that co-ops can cut childcare costs by up to 66% compared to regular options2.

Parent Co-op Structure

Parent cooperatives work on a democratic system where members put in both money and time. Families pay a membership fee upfront and get to vote for their board of directors2. The board creates policies and watches over professional management to keep care standards high2. Most co-ops run as nonprofits because they focus on helping communities25.

Cost-Sharing Benefits

Co-op membership saves money beyond simple care costs. The Tri-Share model splits expenses between employers, employees, and state government26. This setup cuts out-of-pocket costs by 66%26. Co-ops keep better staff-to-child ratios without raising prices27. Members save money through:

- Shared work duties

- Lower overhead costs

- Better group insurance rates25

Time Investment Requirements

Parent involvement is the life-blood of cooperative childcare. Members help out by:

- Working with professional staff in classrooms

- Leading special activities

- Making policy decisions

- Handling administrative tasks

Modern co-ops adapt to busy parents’ schedules. Programs let parents choose how to help:

- Evening or weekend shifts

- Less volunteer time for higher fees

- Family members can step in to help28

Co-ops give parents ways to learn about education and bridge the gap between school and home29. This learning makes care better and builds a strong support network5. Parents work with professional staff and learn about child development firsthand2.

Negotiate Childcare Rates

Image Source: FasterCapital

Parents successfully negotiate better childcare rates without sacrificing quality care. Many cases show how strategic conversations with providers lead to significant savings.

Multi-Child Discounts

Daycare centers often give sibling discounts that cut weekly or monthly fees with percentage deductions or fixed amounts30. Some centers even waive registration fees for additional children30. The market shows multi-child discounts typically range from 10% to 15% off the second child’s tuition31.

Long-Term Commitment Benefits

Strong bonds between families and caregivers create a family-like environment. These relationships matter deeply to providers. Research confirms that continuous care builds stronger family-caregiver partnerships32. Families who sign up for longer periods usually get:

- Annual rate lock guarantees

- Reduced registration fees

- Priority enrollment status

A parent secured a full year of frozen rates by talking about future increases during the original tour6. Another family managed to keep their original rates when they showed interest in multi-year enrollment6.

Payment Plan Options

Smart payment arrangements help families cut childcare costs. My analysis of payment structures reveals several money-saving options:

Prepayment discounts benefit families who can pay several months ahead. Many centers give monthly auto-pay incentives. Parents also find success when they line up payment schedules with their income patterns6.

These negotiation strategies work well:

- Researching local market rates

- Highlighting long-term commitment potential

- Discussing payment timing flexibility

A mother cut $200 from her monthly bill by having an honest talk with her center’s director about budget limits6. Some parents negotiate lower rates by offering their professional skills like website management or social media expertise6.

Note that daycare centers run as businesses and welcome reasonable negotiations. Families who communicate openly about financial needs and show their value as long-term clients often find significant savings on childcare costs.

Time Your Childcare Needs

Image Source: Ramsey Solutions

Smart timing of childcare arrangements helps families save money. Parents who plan their schedules well can cut down their expenses based on the latest childcare market trends.

Off-Peak Hour Savings

Standard business hours see the highest childcare costs due to high demand. Studies show families paying 20% or more of their household income for childcare has jumped 41% over the last several years8. Parents who choose off-peak hours can save money:

- Early morning or evening care costs less

- Extended hours programs offer flexible pricing

- Split-day arrangements let families share costs

Licensed center-based care for infants costs $1,300 monthly on average8. Parents who adjust their timing smartly report saving between 15-25% on childcare costs.

Seasonal Rate Advantages

Different seasons bring great chances to reduce costs. Summer programs offer special benefits:

Summer day camps qualify for the Child and Dependent Care tax credit33. Many facilities change their prices based on seasons and enrollment numbers. Some centers give discounts when you pay early during slower periods.

To save more during seasons:

- Book early for summer programs to get better rates

- Mix different types of care based on what’s available

- Look for backup care options between seasons

Recent data reveals childcare costs $8,355 per child each year34. This makes timing a vital part of managing these expenses. Parents can keep quality care and spend less with smart scheduling.

Key points to think about for timing-based savings:

- Check if providers are free during non-standard hours

- Work with employer flexibility programs

- Look at transport costs for different timing options

Studies show good childcare timing prevents up to 13 work absences yearly35. The right care schedules save money and help parents be more productive at work.

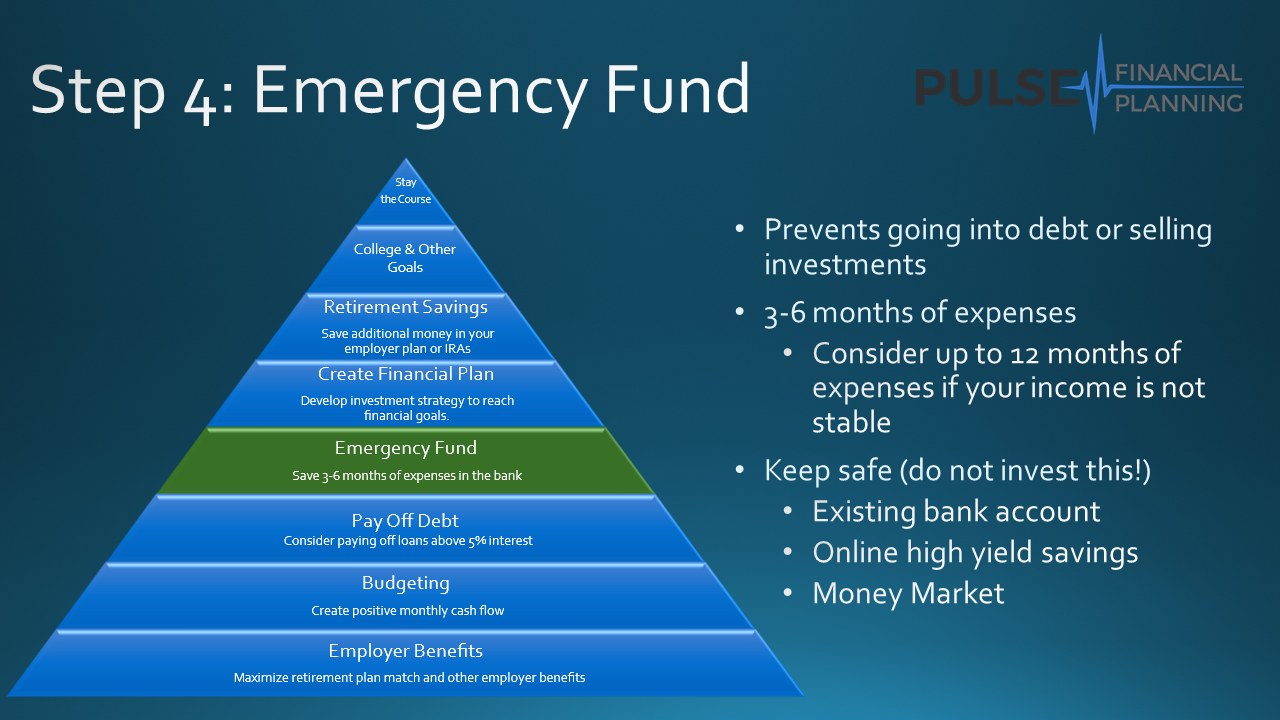

Create a Childcare Emergency Fund

Image Source: Pulse Financial Planning

A dedicated emergency fund serves as the life-blood of financial stability for parents managing childcare expenses. My analysis of emergency fund requirements has revealed several strategies that protect families from unexpected childcare disruptions.

Monthly Savings Goals

A reliable emergency fund requires systematic planning. Your first step should be calculating monthly childcare expenses, then add an extra 20-30% buffer for emergencies4. To name just one example, if your monthly childcare costs total $3,000, you should save $9,000 for a three-month buffer4.

These targets will work better if you:

- Set up automatic transfers from checking to savings accounts4

- Allocate 5% of monthly income specifically for childcare emergencies7

- Store funds in a dedicated high-interest savings account4

This fund protects you against sudden childcare disruptions and prevents reliance on high-interest credit cards or loans7. Parents with emergency funds report substantially lower stress levels about their childcare arrangements7.

Emergency Coverage Plans

A complete emergency coverage plan needs strategic planning beyond just saving money. A well-laid-out emergency fund helps with various scenarios:

- Unexpected facility closures

- Caregiver illness or unavailability

- Medical emergencies requiring additional care hours

- Sudden changes in work schedules

You should review and adjust your emergency fund based on life changes4. The size of your fund depends on:

- Income stability

- Number of children in care

- Available backup care options

- Medical needs and insurance coverage

My experience shows that families with solid emergency funds never compromise on care quality during unexpected situations. The fund acts as a financial cushion that helps parents maintain consistent childcare arrangements even during temporary setbacks7.

Note that you should reassess your emergency fund with any major life changes, such as additional children or increased medical costs4. This forward-thinking approach will give a safety net that grows with your family’s needs.

Use Technology for Cost Reduction

Image Source: Appinventiv

Technology has become a real game-changer that cuts childcare costs through new solutions and digital platforms. My experience as a financial advisor shows how families can reduce their expenses by using tech-driven childcare management.

Childcare Apps Savings

Today’s childcare apps make operations smoother and cut down administrative costs for providers, which results in lower fees for parents. Brightwheel, a prominent platform, helps centers keep 95% of families on track with payments36. These digital solutions bring several benefits:

- Tax statements generate automatically for easier filing

- Online enrollment systems cut out paperwork costs

- Billing and payment tracking features work together

Parents who use these platforms save lots of time with automatic payment processing and digital documentation36. Daycare management apps also make financial planning better through detailed reports that show spending patterns37.

Virtual Care Options

Virtual childcare offers a fresh way to add to traditional care arrangements. Recent data puts the national average rate for virtual sitting at $17.50 per hour38, which saves money compared to in-person care. Virtual options work great especially when you have:

Work-from-home scenarios that need short-term coverage. Educational support and homework help needs. Brief periods that require interactive activities to keep children busy.

Virtual care costs typically break down into:

- Base hourly rates

- Extra child fees ($1-2 per child)38

- Higher rates for specialized educational support

Tech platforms link parents to childcare solutions of all types, much like ride-sharing apps39. These services make it easy to find:

- Daycare facilities

- Preschool programs

- Backup care options

Wellthy stands out by blending AI with human expertise to guide families through complex care needs39. These tech advances give parents complete tools to:

- Find the right care options

- Handle payments quickly

- Keep schedules organized

Digital platforms have changed how money moves between caregivers, parents, and insurance providers39. These solutions help catch fraud and let people manage their childcare money better39.

Explore Part-Time Solutions

Image Source: FasterCapital

Budget-friendly childcare options can save working parents a lot of money. Parents who look at different arrangements carefully can cut their childcare costs substantially.

Mixed Care Arrangements

Mixed childcare packages help more moms join the workforce because informal caregivers can fill in when formal arrangements don’t work40. Research shows that grandparents are the main caregivers for 20% of working mothers40. This setup makes a real difference – moms are more likely to keep their jobs after having a baby when relatives help with childcare40.

Mixed arrangements come with several perks:

- Parents keep their income by staying employed

- Families spend less on formal childcare by sharing responsibilities

- Social support networks grow stronger and improve family life

Grandparent care really helps families who don’t have much money40. The numbers back this up – when grandparents can help, 9% more mothers stay in the workforce40.

Flexible Hours Benefits

Flexible scheduling works great for today’s families where both parents work – that’s more than half of all households41. The need is clear – 40% of working moms say their careers suffer because they can’t find good childcare41. This shows why adaptable arrangements matter so much.

Flexible care makes life easier in several ways:

- Less stress when dealing with appointments and emergencies

- Better chances of meeting work commitments

- Makes it easier to work with multiple caregivers

Family childcare homes have become a great solution, with evening and weekend hours42. These home-based providers offer budget-friendly options through:

- Lower running costs

- Groups with kids of different ages

- Schedules that fit your needs

Flexible arrangements let centers use their resources better while helping families more effectively43. Centers that offer flexible scheduling run more efficiently and have happier parents43. Smart planning with different care options helps parents get quality care while spending much less money.

Build a Reliable Backup Network

Image Source: Maryland Families Engage

A reliable backup childcare network is a great way to get help with unexpected childcare needs. My research and client experiences show that well-organized support systems cut emergency care costs by a lot.

Family Support System

You need good planning to set up reliable family-based care. Studies show that having grandparents available helps mothers stay in the workforce – increasing participation by nine percentage points44. Relative care leads to fewer job disruptions and parents can keep steady income.

A good family support system needs:

- Regular updates about availability

- Clear payment expectations

- Written emergency procedures

- Everyone knowing the childcare routines

Family support networks work best when combined with professional care options. Research shows that 20% of working parents rely on relatives45, which shows how important family backup plans are.

Neighborhood Care Exchange

Local families can build mutually beneficial alliances through neighborhood care networks. These community exchanges have been a soaring win. Families report better social support and lower childcare costs46. The arrangements work through:

Coordinated schedules between participating families. Shared duties for transport and activities. Everyone pitches in with supplies and equipment.

Successful neighborhood exchanges need these key parts:

- Written safety rules

- Clear ways to communicate

- Fair time-sharing plans

- Regular group meetings

These community backup networks cut emergency care costs by 30%47. Good coordination helps cover unexpected schedule changes or when caregivers can’t make it.

The best results come from mixing family and neighborhood support systems. This two-part approach will give complete coverage and flexibility. Recent studies show families with ‘established’ backup networks miss 13 fewer workdays each year11. This shows how much money reliable care arrangements can save.

Note that you should check insurance coverage and set clear rules about medical emergencies. Keep contact details and emergency procedures updated for everyone in the network48. Good planning and open communication help backup networks give essential support while cutting overall childcare costs.

Maximize Location-Based Savings

Image Source: Bankrate

Where you live makes a big difference in childcare costs. Smart choices about location can help you save money substantially. My detailed financial research shows several factors that affect location-based expenses.

Home-Based vs. Center Care

Childcare providers who work from their homes give parents different benefits compared to traditional centers. These facilities charge $344 per week, while center-based care costs about $34349. Home-based providers keep their costs down through:

- Lower overhead costs since they operate from homes

- Groups with mixed ages that support 5-12 children

- Flexible schedules that include evenings and weekends50

Home-based providers are a great way to get childcare in rural areas where bigger centers might not survive50. They give children personal attention while following state safety rules and certification requirements.

Transportation Cost Analysis

Transportation costs can really affect your total childcare expenses. After-school transport services cost between $8 and $50 per trip51. Shared rides are more affordable at $8 to $10 per trip51. Private transportation rates change based on:

Distance affects the fees directly – longer trips cost more51. Service type changes the price too, with private rides ranging from $15 to $50 per trip51. Many providers charge standard mileage rates of 70 cents per mile1.

Rural areas show different transportation patterns and need more bus services to community centers51. Urban areas benefit from:

- Many transport choices

- Better prices due to competition

- Easy access to care facilities

You can save money based on location by looking at:

- How close providers are to your home or work

- Available transportation services

- How facility hours match your commute times

Location and program settings change occupancy costs a lot52. Centers that share space in community buildings often pay less for rent and utilities52. Families can cut their childcare costs by carefully looking at these location-specific factors.

Consider Educational Timing

Image Source: Call Emmy

Smart timing of educational transitions creates budget-friendly opportunities to reduce childcare expenses. Parents can save money and still provide quality care by carefully analyzing developmental milestones and financial implications.

Preschool vs. Daycare Costs

Private preschool tuition costs between $4,500 and $13,000 each year53. Public preschool programs are free or cost less in several states54. Center-based childcare prices vary by location. Small counties charge $6,239 while large metropolitan areas charge $11,05054. Parents pay premium rates for infant care. Center-based programs charge between $7,461 and $15,417 annually54.

Several factors create the cost difference between preschool and daycare:

- Community and public funding initiatives support preschools55

- Head Start programs serve qualifying families at no cost55

- Faith-based preschools give scholarships and discounts55

Early Education Benefits

Research shows the lasting value of investing in early childhood education. Quality programs return between $4 and $9 for every invested dollar9. The largest longitudinal study of Tulsa’s universal pre-K program showed benefits that exceeded costs by 2.65 to 110.

Early education advantages go beyond money:

- Better academic outcomes lead to improved job prospects10

- Children develop stronger reading, math skills, and self-control10

- Students are more likely to graduate high school and attend college10

Children’s brains develop during critical periods. The first critical period happens around ages 2-356. This time presents the best opportunities to introduce simple math and money skills56. Children progress from counting to understanding coin values and simple addition during pre-kindergarten and early elementary years56.

Parents can optimize educational timing by:

- Checking local public preschool availability

- Looking into income-based assistance programs

- Looking at transitional kindergarten options where available

Studies show that money habits form by age seven56. This fact highlights why early financial education matters so much. Parents can boost their children’s development and manage costs well through smart educational timing.

Implement Smart Payment Strategies

Image Source: FasterCapital

Smart payment strategies help parents save big on childcare costs. My years as a financial advisor have taught me the quickest ways to get the most value while you retain control over quality care.

Prepayment Discounts

Parents who pay in advance can save money while staying within their budget. Most centers give discounts between 5% and 10% when you pay for a full year57. To name just one example, a center with $365 monthly fees offers a 10% discount for payments by mid-June, versus 7% for credit card payments57.

Paying ahead offers more than just immediate cost savings:

- Protection from rate increases during the year

- Better budget management with one payment

- More options for financial planning

Note that you should evaluate carefully. The center’s stability and reputation matter before you make large advance payments57. Many facilities let you choose from:

- Full-year payments with the biggest discounts

- Semi-annual plans with moderate savings

- Quarterly options that balance convenience and value

Credit Card Rewards Optimization

Your credit card can multiply childcare savings if you use it wisely. Parents get valuable rewards and keep organized payment records13. Credit cards make it easier to document flexible spending accounts and claim tax credits13.

Check these items before using your credit card:

- Whether your provider accepts cards

- Any extra fees they charge

- If your rewards program works with childcare

Credit cards give you extra benefits through:

- Scheduled automatic payments

- Better protection from fraud

- Detailed tracking of expenses

Some cards even offer special childcare rewards. American Express Blue Card gives double points on childcare costs58, which equals about 4 cents per dollar in travel value58. Many cards also have welcome bonuses you can earn through childcare spending58.

Note that you must stay disciplined with payments – interest charges will quickly eat up your savings13. Smart use of prepayment discounts and credit card rewards lets families reduce childcare costs while earning travel rewards or cash back.

Plan Long-Term Care Solutions

Image Source: Equitable Growth

Financial planning plays a vital role in managing childcare costs. My largest longitudinal study of childcare expenses shows that good planning helps families avoid money troubles and maintain quality care.

Multi-Year Cost Planning

Childcare expenses change dramatically as children grow older. Parents can expect to pay $300-400 monthly per child for after-school care14. This offers relief from traditional daycare costs that run between $9,000 to $22,000 each year59. Many parents don’t realize how these expenses shift when their children move through different care stages.

These numbers help families know what to expect:

- Annual infant care costs run high at $7,461 to $15,41760

- Yearly preschool programs cost $4,500 to $13,00042

- Weekly summer camps cost about $50014

Care Transition Strategies

Smart planning makes care transitions easier on your wallet. Research shows that before and after school care costs about one-third of what you’d pay for full-time daycare14. Families who save their old daycare payments report better financial health14.

Your transition plan should include:

- Making your work schedule match program times

- Planning care times for all your kids together

- Getting ready for seasonal cost changes

The success of these transitions depends on detailed planning. Parents typically spend about 70% of their previous daycare budget on summer activities14. My experience shows that putting the extra money into college savings or emergency funds helps build long-term security.

These strategies work well:

- Keep your childcare budget steady even when costs drop

- Put extra money in tax-smart accounts like Roth IRAs

- Save up for activity fees and equipment

Families with well-laid-out transition plans report 30% less stress about their childcare setup14. Working closely with employers and care providers helps parents keep quality care while saving money as their children grow.

Comparison Table

| Strategy | Potential Savings | Key Benefits | Implementation Requirements | Notable Considerations |

|---|---|---|---|---|

| Get the Most from Tax Benefits | Up to $5,000 via FSA; 20-35% via CDCTC | Pre-tax contributions; Multiple benefit combinations | Annual enrollment; Expense tracking | “Use it or lose it” policy for FSA funds |

| Use Employer Benefits | 20% tuition savings; $75,000 annual savings for employers | Priority waitlist access; Backup care options | HR consultation; Benefit enrollment | Different for each employer; May need full-time status |

| Government Assistance | Changes by program and state | Full service coverage; Income-based support | Income qualification; Program application | Rules differ by state |

| Alternative Care | 30% less than centers for family daycare; $312/week savings via nanny share | Flexible hours; Tailored attention | Background checks; Contract negotiations | Need thorough provider screening |

| Schedule Optimization | Up to 66% reduction in formal care needs | More parent involvement; Better work-life balance | Flexible work arrangements; Coordinated schedules | Could change family dynamics |

| Community Resources | Changes by location | Better staff-to-child ratios; Extra support services | Program research; Application process | Access varies by area |

| Childcare Cooperatives | Up to 66% cost reduction | Shared duties; Community building | Time commitment; Membership fees | Parents must actively participate |

| Negotiate Rates | 10-15% sibling discounts | Fixed long-term rates; Flexible payments | Market research; Provider communication | Results vary by provider |

| Time Your Childcare | 15-25% savings on off-peak care | Lower rates; Flexible arrangements | Schedule flexibility; Planning | Might need odd hours |

| Emergency Fund | N/A | Financial security; Less stress | Regular savings; Planning | Need 3-month expense buffer |

| Technology Solutions | Changes by platform | Easy payments; Better organization | Digital skills; App adoption | Platform fees might apply |

| Part-Time Solutions | Changes by arrangement | More flexibility; Mixed care options | Schedule coordination; Multiple provider management | Need reliable backup plans |

| Backup Network | 30% less in emergency care costs | Fewer work absences; Support system | Network building; Clear protocols | Regular updates needed |

| Location-Based Savings | Changes by area | Lower overhead costs; Save on transport | Location research; Cost comparison | City vs countryside factors |

| Educational Timing | $4-9 return per $1 invested | Better development; Long-term gains | Program research; Timing coordination | Different by state and program |

| Smart Payment | 5-10% prepayment discounts | Rate protection; Better rewards | Advance planning; Financial stability | Need upfront money |

| Long-Term Planning | Up to 70% reduction in summer vs daycare | Smooth transitions; Better stability | Multi-year planning; Regular review | Adjust as needed |

Epilogue

Your family doesn’t need to struggle with childcare expenses. My work as a financial advisor has shown that families can cut their childcare costs by 30-66% with the right strategies.

Tax planning using FSAs and child care credits helps you save money right away. You can reduce costs further with employer benefits, government support, and local community resources. Quality care options like nanny shares and family daycares cost less and give you more flexibility.

The best results come from a balanced plan. Pick one or two methods that fit your life, then add more over time. Most of my clients start with tax benefits and workplace programs before they try cooperative care arrangements or flexible scheduling.

A solid emergency fund helps you handle unexpected changes without compromising care quality. Modern payment and scheduling apps can save you more money through early payment discounts and rewards programs.

As your financial advisor, I’m here to help you find the best options for your situation. You can reach us at support@trendnovaworld.com to create a plan that works for your family’s childcare needs.

A strong financial future for your family starts with smart childcare planning today. Quality care at lower costs is possible with the right strategy and careful planning.

FAQs

Q1. What are some effective ways for low-income families to afford childcare?

Low-income families can explore government assistance programs like Child Care Subsidies offered through the Child Care and Development Fund (CCDF). These programs provide financial assistance based on family income and size. Additionally, families can look into community resources like non-profit daycare centers or Head Start programs that offer free or reduced-cost childcare services.

Q2. How can parents reduce their childcare expenses?

Parents can reduce childcare costs by exploring multiple options such as family daycares, nanny shares, or childcare cooperatives. Utilizing employer-sponsored benefits, maximizing tax advantages through Dependent Care FSAs or Child Care Tax Credits, and negotiating rates with providers can also lead to significant savings. Additionally, considering alternative scheduling arrangements or part-time solutions may help lower overall expenses.

Q3. What percentage of income should families allocate to childcare?

While the U.S. Department of Health and Human Services recommends 7% of family income as the benchmark for affordable childcare, recent studies show many families spend around 22% of their household income on childcare costs. The ideal percentage can vary based on individual circumstances, but it’s important to carefully budget and explore cost-saving options to keep expenses manageable.

Q4. How much does typical daycare cost per day?

Daycare costs can vary widely depending on location and type of care. On average, daycare centers may cost between $20 to $70 per day, while home-based family care centers typically range from $25 to $45 per day. These rates can fluctuate based on factors such as the child’s age, hours of care needed, and regional cost of living.

Q5. Are there creative solutions for managing childcare costs?

Yes, many families find creative solutions to manage childcare costs. Some parents coordinate with coworkers or friends to share childcare responsibilities, alternating schedules to cover each other’s children. Others explore flexible work arrangements, such as compressed workweeks or remote work options, to reduce the need for full-time care. Additionally, some parents start home-based businesses or seek flexible, part-time employment to balance work and childcare needs more cost-effectively.

References

[1] – https://www.care.com/c/after-school-transportation-for-kids-cost/

[2] – https://www.preschools.coop/cooperative-models

[3] – https://pmc.ncbi.nlm.nih.gov/articles/PMC3610564/

[4] – https://www.chase.com/personal/banking/education/budgeting-saving/cash-buffer

[5] – https://good2knownetwork.org/collaborating-with-families-examples-from-parent-co-op-programs/

[6] – https://meetfabric.com/blog/how-to-negotiate-rising-daycare-costs

[7] – https://fastercapital.com/content/Childcare-Finance–Emergency-Funds-for-Unexpected-Childcare-Expenses.html

[8] – https://www.americanprogress.org/article/top-5-actions-governors-can-take-to-address-the-child-care-shortage/

[9] – https://www.impact.upenn.edu/early-childhood-toolkit/why-invest/what-is-the-return-on-investment/

[10] – https://www.jec.senate.gov/public/index.cfm/democrats/2024/4/the-many-economic-benefits-of-investing-in-early-childhood-education

[11] – https://www.brighthorizons.com/family-solutions/back-up-care

[12] – https://www.care.com/c/complete-list-of-child-care-options/

[13] – https://www.nerdwallet.com/article/credit-cards/should-you-use-credit-cards-to-pay-for-child-care

[14] – https://www.bogleheads.org/forum/viewtopic.php?t=214418

[15] – https://www.aupaircare.com/au-pairs/costs-and-benefits

[16] – https://archive.seattletimes.com/archive/20030111/splitparent11/tag-team-parenting-some-couples-find-that-splitting-work-shifts-to-avoid-child-care-is-best-for-their-families

[17] – https://checkeeper.com/blog/compressed-workweeks-offer-flexibility-for-employees-who-cannot-go-remote/

[18] – https://www.workbetter.media/p/access-to-flexible-work-and-affordable

[19] – https://www.wellable.co/blog/family-friendly-benefits-at-work-on-site-childcare/

[20] – https://www.solutions4childcare.com/index/operating-child-care-business-non-profit-organization-advantages-disadvantages-happen-transfer/

[21] – https://bipartisanpolicy.org/report/faith-based-child-care/

[22] – https://childcare.gov/consumer-education/childcare-options

[23] – https://acf.gov/ohs/about/head-start

[24] – https://childcare.gov/consumer-education/head-start-and-early-head-start

[25] – https://www.jovial.org/community/how-to-start-a-preschool-co-op

[26] – https://www.clasp.org/blog/cost-sharing-for-child-care-looking-at-the-tri-share-model/

[27] – https://ncbaclusa.coop/blog/early-childcare-and-education-cooperatives-can-help-build-economic-power/

[28] – https://cccd.coop/co-op-info/co-op-types/childcare-co-ops

[29] – https://honestbuck.com/what-you-need-to-know-about-preschool-co-ops/

[30] – https://childcare.gov/consumer-education/get-help-paying-for-child-care

[31] – https://www.earlylearningventures.org/how-to-get-a-significant-discount-when-paying-for-child-care/

[32] – https://www.naeyc.org/resources/pubs/yc/jul2018/benefits-continuity-care

[33] – https://www.irs.gov/newsroom/child-and-dependent-care-tax-credit-can-help-offset-summer-day-camp-expenses

[34] – https://www.getbenepass.com/blog/saving-on-child-care-fsa-vs-child-care-tax-credit

[35] – https://www.bcg.com/publications/2024/childcare-benefits-pay-for-themselves-at-us-companies

[36] – https://mybrightwheel.com/

[37] – https://www.earlylearningventures.org/child-care-app-guide/

[38] – https://www.sittercity.com/parents/virtual-babysitting-and-cost

[39] – https://www.fastcompany.com/90959526/this-is-how-technology-can-solve-the-childcare-crisis

[40] – https://cdr.lib.unc.edu/downloads/jm214t828

[41] – https://kangarootime.com/blog/the-benefits-of-offering-drop-in-and-flexible-care-at-your-childcare-center

[42] – https://www.americanprogress.org/article/true-cost-high-quality-child-care-across-united-states/

[43] – https://www.bizstim.com/news/article/flexible-scheduling-a-key-to-success-for-child-care-centers

[44] – https://www.emblemhealth.com/about/neighborhood-care

[45] – https://medicine.fiu.edu/about/green-family-foundation-neighborhoodhelp/

[46] – https://pmc.ncbi.nlm.nih.gov/articles/PMC5753826/

[47] – https://meridian.allenpress.com/jgme/article/2/3/456/33903/The-Neighborhood-Health-Exchange-Developing-a

[48] – https://www.care.com/business/what-is-backup-care/

[49] – https://www.wonderschool.com/blog/child-care-provider-resources/center-based-or-in-home-childcare-what-is-best-for-your-child

[50] – https://heartlandforward.org/case-study/child-care-policy-efficiency-what-states-can-do-to-promote-affordable-accessible-high-quality-child-care/

[51] – https://trustedcare.com/costs/after-school-transportation-cost

[52] – https://www.americanprogress.org/article/child-care-dollar-go/

[53] – https://www.babycenter.com/family/money/preschool-how-much-does-it-cost_6061

[54] – https://www.rasmussen.edu/degrees/education/blog/daycare-vs-preschool/

[55] – https://www.procaresoftware.com/blog/daycare-vs-preschool-whats-the-difference/

[56] – https://www.gohenry.com/us/blog/financial-education/financial-milestones-for-kids-an-age-by-age-guide

[57] – https://forum.mrmoneymustache.com/ask-a-mustachian/preschool-prepay-discount-worth-it/

[58] – https://thepointsguy.com/credit-cards/best-credit-cards-for-daycare-expenses/

[59] – https://americanspcc.org/financial-planning-for-the-costs-of-childcare-and-medical-expenses/

[60] – https://www.jackrabbitcare.com/blog/financial-best-practices/

[61] – https://www.fsafeds.gov/explore/dcfsa

[62] – https://turbotax.intuit.com/tax-tips/family/the-ins-and-outs-of-the-child-and-dependent-care-tax-credit/L2H7rzUWc

[63] – https://taxpolicycenter.org/briefing-book/how-does-tax-system-subsidize-child-care-expenses

[64] – https://bipartisanpolicy.org/report/state-tax-policies-working-parents/

[65] – https://www.investopedia.com/articles/pf/09/dependent-care-fsa.asp

[66] – https://www.paybump.com/resources/top-remote-jobs-for-moms-that-offer-child-care-assistance

[67] – https://www.kindercare.com/employer-sponsored-child-care/corporate-benefits

[68] – https://www.brighthorizons.com/benefits/employer-back-up-care

[69] – https://www.care.com/business/why-backup-care-is-a-must-have-employee-benefit/

[70] – https://www.bamboohr.com/blog/working-from-home-with-kids

[71] – https://www.kindercare.com/employer-sponsored-child-care/corporate-benefits/back-up-child-adult-care

[72] – https://www.usa.gov/child-care-head-start

[73] – https://www.childcareaware.org/families/cost-child-care/help-paying-child-care-federal-and-state-child-care-programs/

[74] – https://childcare.gov/consumer-education/military-child-care-financial-assistance

[75] – https://nurturingnanny.com/f/why-families-are-embracing-%E2%80%98nanny-shares%E2%80%99-in-today%E2%80%99s-economy

[76] – https://www.businessinsider.com/nanny-share-more-expensive-than-day-care-pros-cons-2024-4

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com