Are you torn between paying off your smallest debt first or tackling that high-interest credit card balance? Both strategies can help you become debt-free quickly, and the best choice depends on your situation.

The debt snowball method has proven to be effective. It focuses on your smallest balances first and provides quick wins that keep you motivated throughout your debt-free experience. The debt avalanche method targets high-interest debt first and saves you more money over time. These debt payoff strategies work even better when combined with the 50/30/20 budgeting rule. This approach allocates 50% of your income to necessities, 30% to wants, and 20% to debt repayment and savings – creating a solid plan for financial freedom.

We have put together 17 proven strategies that work for credit cards, loans, and other financial obligations. This detailed guide will show you the quickest path to becoming debt-free. You’ll learn about debt consolidation (which needs a 690+ credit score) and the importance of building a 3-6 month emergency fund.

Create a Smart Debt Payoff Strategy Using AI Tools

Image Source: Bankrate

AI tools have revolutionized debt management and made it simpler to create and follow budget-friendly payoff plans. These smart solutions analyze your financial data to create customized strategies that speed up your path to becoming debt-free.

AI-Powered Budgeting Apps

Smart AI budgeting apps link to your financial accounts and give you up-to-the-minute data analysis of your spending patterns. The apps sort your expenses into categories and suggest where you could spend less to put more money toward debt payments. These apps can boost collector output by up to 8x and cut debtor coverage costs by 70%85.

Debt Payoff Calculators

AI-driven calculators do more than simple math – they review your full financial picture to suggest the most efficient way to eliminate debt. These tools run multiple scenarios at once and compare methods like debt snowball and avalanche. The calculators can cut loan delinquencies by 25% and reduce bad debt by 20%85.

Automated Payment Optimization

Smart payment systems employ AI to find the best payment schedule based on your income and expenses. These tools can:

- Track payments as they happen

- Send custom reminders through email, SMS, or apps

- Change payment plans when your finances shift

- Get 10x better response rates through smart automation85

AI in debt management shows impressive results. The global debt collection software market should reach USD 7.40 billion by 202885. These tools look at more than 20 factors to review a borrower’s ability to repay2, giving a full picture of your financial situation.

AI-powered debt management tools automate routine tasks like scheduling and tracking payments. You can focus on bigger financial goals while these tools watch your progress. The system spots potential risks and suggests changes to keep your debt payoff plan working. This smart approach reduces missed payments and keeps you moving steadily toward a debt-free life.

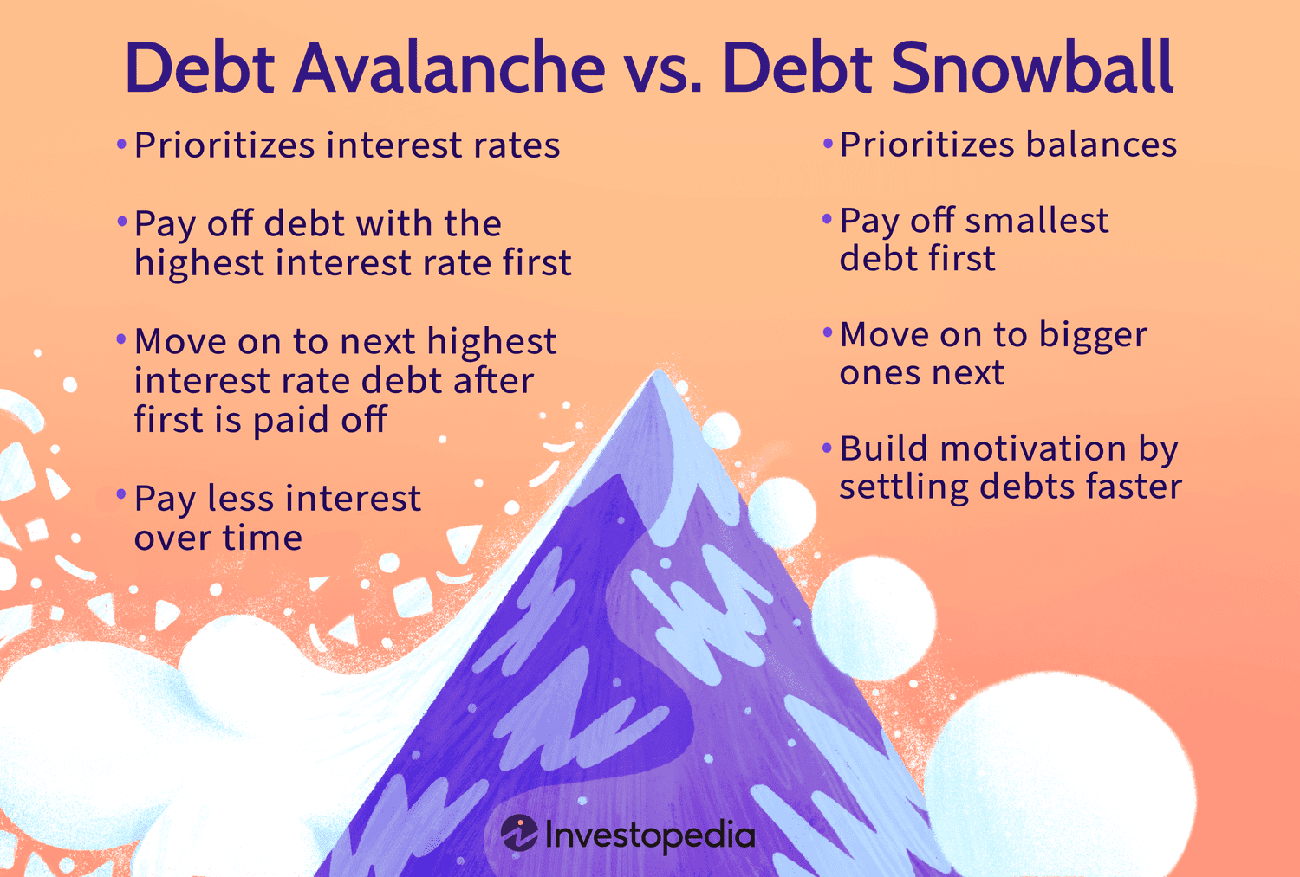

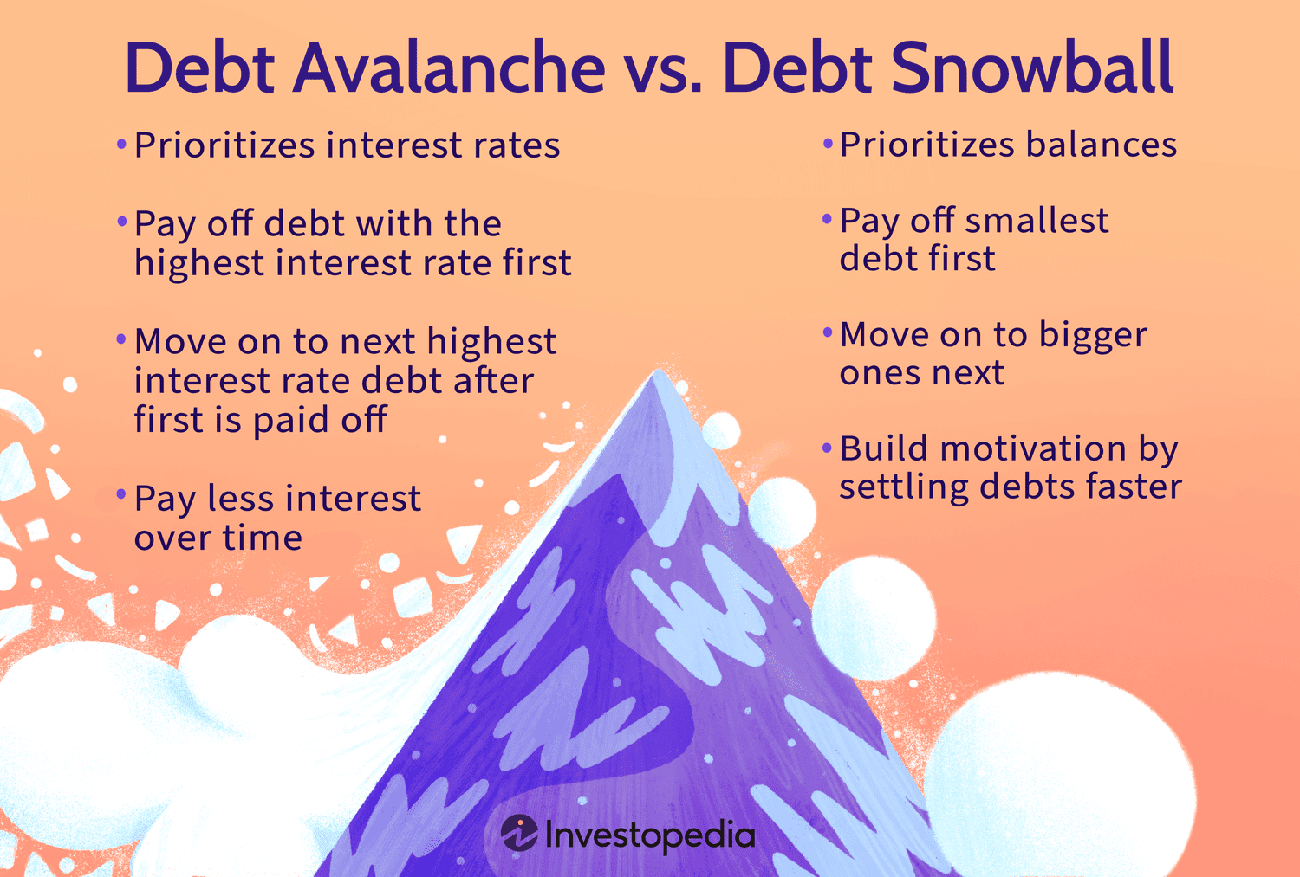

Implement the Debt Avalanche Method

Image Source: Investopedia

“The debt avalanche method targets your debt with the highest interest rate first. This route may help you save on accrued interest over your debt payoff journey.” — Annie Millerbernd, Personal Loans Writer at NerdWallet

The debt avalanche method proves to be a mathematically sound way to pay off multiple debts quickly. This strategy puts high-interest debts first and helps you save money on interest payments during your debt-free experience.

Understanding Debt Avalanche

You’ll want to eliminate debts with the highest interest rates first with the debt avalanche method, whatever the balance size might be. Targeting high-interest debts from the start minimizes your total interest paid over time86. To name just one example, see what happens with a credit card balance of $10,000 at 26% APR – making minimum payments of $250 monthly could result in paying $13,500 in interest alone over seven-and-a-half years87.

Step-by-Step Implementation Guide

- List all debts from highest to lowest interest rate

- Calculate minimum payments for each debt

- Allocate extra funds toward the highest-interest debt

- Continue minimum payments on other debts

- Roll over payments to the next highest-interest debt once the first is paid

Here’s a practical example: You have $650 monthly available for debt repayment spread across multiple debts. The quickest way would be focusing on a credit card debt of $4,200 at 22.24% APR first, which would take approximately 15 months to clear88. The smart move is to roll that amount into the next highest-interest debt payment once paid.

Tools for Tracking Progress

Digital tools help you monitor your debt avalanche progress:

- Debt payoff calculators that compare different strategies

- Online spreadsheets for tracking payment schedules

- Apps that visualize your debt-free timeline89

These tools work best when you have multiple high-interest debts and stay confident about keeping up with consistent payments86. Careful tracking might help you save by a lot – some people pay off debt 21 months faster than with minimum payments alone90.

The debt avalanche method needs patience and discipline, especially when your highest-interest debt carries the largest balance91. Notwithstanding that, focusing on interest rates instead of balance sizes often leads to substantial interest savings over time92.

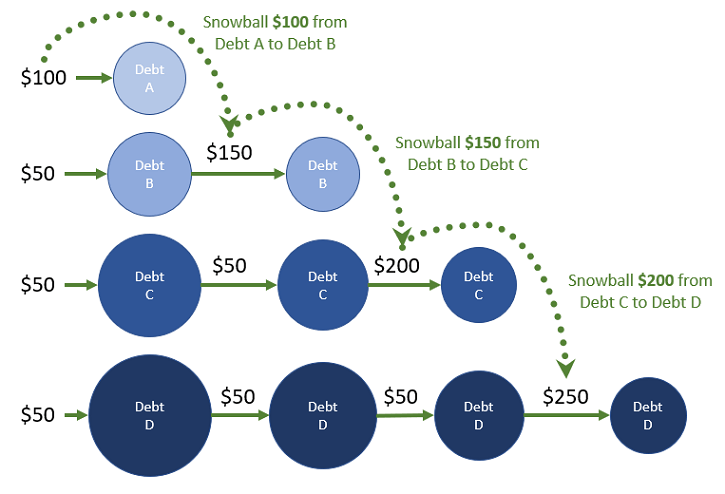

Use the Debt Snowball Technique

Image Source: Moolanomy

“With debt snowball, you make payments on all of your debts while putting extra money toward the account with the smallest balance.” — Bev O’Shea, Personal Finance Writer at NerdWallet

Dave Ramsey’s debt snowball method provides a psychologically rewarding way to become debt-free. This strategy differs from others by focusing on quick wins that build momentum toward your financial goals.

Debt Snowball Basics

The debt snowball method makes you pay off debts from smallest to largest balance, whatever the interest rates93. You start by listing all debts in ascending order. The next step requires minimum payments on all but one of these debts – the smallest one. Any extra money goes toward the smallest debt until it’s gone. The payment amount then rolls into the next smallest debt when paid off, which creates a “snowball” effect94.

Psychology Behind the Method

A Kellogg School of Management study of 6,000 consumers’ debt payment patterns showed that people who followed the “small victories” strategy were more likely to clear their entire debt balance95. People get psychological benefits when they close individual debts completely. This reduces monitoring costs and the chance of missed payments96.

Success Stories

One couple wiped out USD 130,000 in debt within four years using the snowball method97. Jennifer Bailey cleared USD 36,000 by targeting her smallest balances first98. Taryn Williams eliminated five smaller loans totaling USD 16,000 in less than two years99.

The method works well because:

- Quick wins boost confidence and motivation93

- You can see progress as debts disappear one by one94

- The snowballing payment amount speeds up debt elimination100

This approach might cost more in interest than other methods. Yet studies show that people using the debt snowball technique often stay committed to their debt-free experience100. The average household using this method pays off USD 5,300 in the first 90 days93. Research indicates that putting the most money toward the smallest account specifically boosts people’s motivation to repay debt later101.

Consolidate High-Interest Debts

Image Source: Investopedia

Merging several high-interest debts into one payment makes your financial experience simpler and helps save money on interest charges. Many borrowers I’ve worked with have reduced their monthly payments through smart consolidation. This approach has helped them become debt-free faster.

Debt Consolidation Options

A debt consolidation loan comes with interest rates between 6% to 36%, based on your credit profile102. Borrowers with good credit scores (690+) have a chance to get rates as low as 7%103. This method works best when you get a lower interest rate than your existing debts and can keep up with monthly payments104.

Interest Rate Negotiation

Your first step should be reaching out to credit card companies to ask for lower rates. Card issuers often adjust rates for customers who have:

- Paid bills on time consistently

- Maintained good credit scores

- Stayed loyal to their accounts37

Don’t give up if one representative says no. The HUCA (hang up, call again) method works because different staff members may give different answers105. Remember to mention other offers you’ve received during these talks – it helps your case.

Balance Transfer Strategies

Balance transfer cards are a great way to get debt under control. They usually come with 0% APR for 15 to 21 months23. Moving a $5,000 balance from a card with 16.28% APR to a 0% card saves about $956 in interest64. Here’s what you need to think about:

- Transfer fees usually run 3% to 5% of your balance

- You’ll need good to excellent credit (690+)

- Zero interest only lasts through the intro period

- Some cards won’t let you transfer from the same company106

The quickest way to benefit from balance transfers is paying off everything before the promotional rate ends107. Any remaining balance after that will face the card’s regular APR, which could be higher than your original rates108.

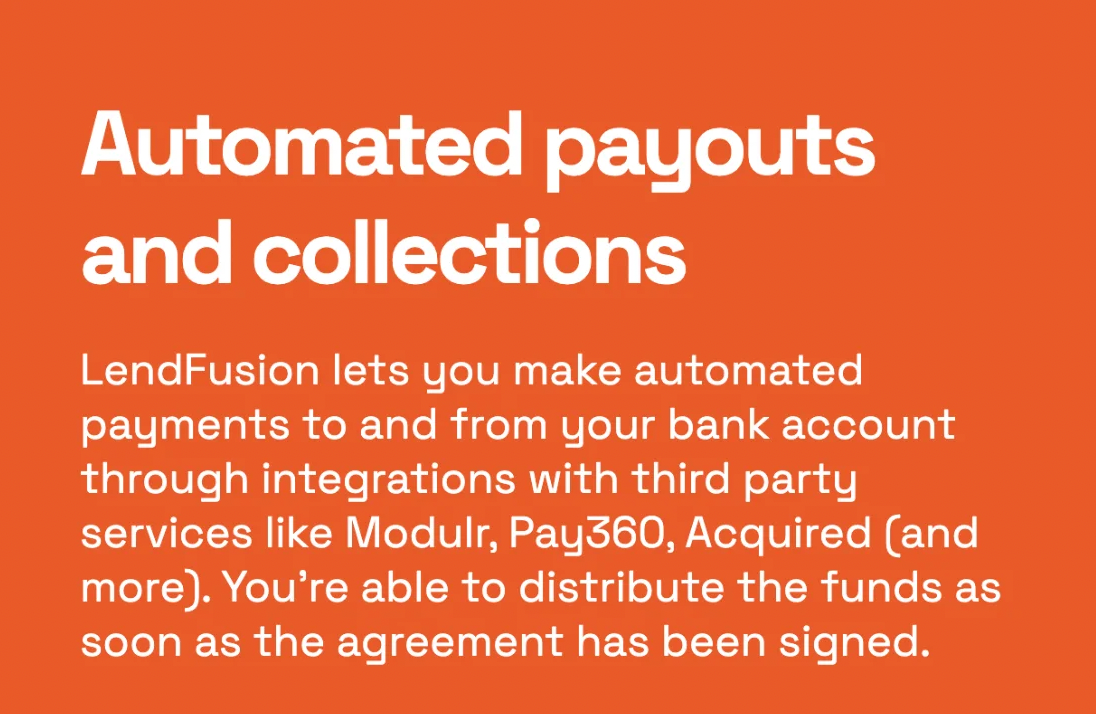

Automate Your Debt Payments

Image Source: LendFusion

Automatic payments can speed up your path to becoming debt-free. You can avoid late fees and make steady progress toward your financial goals with automated systems.

Setting Up Auto-Payments

Automatic payments connect your bank account directly to creditors and let you schedule transfers for bills and regular payments27. Here’s how to set it up:

- Connect your checking account or debit card

- Pick your payment amount (minimum, full balance, or fixed sum)

- Select payment dates that line up with when you get paid

A well-laid-out automatic payment system helps you track due dates, interest rates, and payment amounts for all your debts28. Modern financial platforms now offer smart automation that sends you reminders and updates right on time.

Payment Scheduling Tips

The right timing is vital for automatic payments to work well. You should schedule transfers several days before due dates to avoid any processing delays1. This extra time helps you avoid late fees, which can reach USD 28.00 on your first offense1.

Smart scheduling practices you should follow:

- Keep enough money in your account for scheduled payments

- Look over your statements even with automation

- Update your payment details quickly when things change

Avoiding Missed Payments

Missed payments can start a domino effect of financial problems. Your credit scores might take a hit when payments are late by more than 30 days because credit bureaus get notified1. You can protect yourself by:

Payment alerts should come through multiple channels – email, text messages, or app notifications28. Your payment schedule should sync with digital calendars to give you complete oversight28. You should also keep extra money in your account to avoid overdraft fees, which average USD 34.00 each time1.

Automated systems work amazingly well for managing debt. Research shows this approach can make collectors 8 times more productive and cut debtor coverage costs by 70%29. Automated debt recovery also speeds up cash flow, reduces mistakes, and keeps everything following the rules29.

Generate Extra Income Through Side Hustles

Image Source: Ditto Transcripts

Side hustles are a great way to speed up your debt payoff with extra income streams. You can make substantial extra cash for your financial goals by picking the right chances.

Online Freelancing

Freelancing is one of the most flexible ways to earn extra money. Platforms like Upwork and Fiverr connect freelancers with clients who need specific services30. Skills like writing, graphic design, and programming can bring in good money. New freelancers typically earn between USD 15.00-20.00 per hour, while experienced professionals can make upward of USD 100.00 per hour31.

Gig Economy Opportunities

The gig economy lets you start making money with little upfront cost. Popular options include:

- Ride-sharing through Uber or Lyft

- Food delivery via DoorDash or Postmates

- Task completion through platforms like TaskRabbit and Handy32

These jobs fit around your existing schedule, which makes them perfect for paying off debt. Virtual assistance has become another profitable option. Rates start at USD 15.00-25.00 per hour for simple tasks and go up to USD 30.00+ for specialized skills31.

Passive Income Streams

Passive income takes work upfront but can pay off long-term. You can earn ongoing income from stock photography through platforms like Shutterstock and Adobe Stock30. Digital products like courses, e-books, and printables can bring in USD 100.00 to USD 5000.00 monthly9.

Income Tracking Tools

Good financial management is key to side hustle success. Tools like FreshBooks or QuickBooks help you track:

- Income comprehensively

- Expense categories

- Tax preparation help

- Invoice management

Keeping separate bank accounts for side hustle money works best8. This makes financial records clear and tax reporting simple. A spreadsheet can work well for simple tracking before you buy dedicated accounting software8.

Negotiate Lower Interest Rates

Image Source: LinkedIn

You can pay off debt faster by negotiating lower interest rates with your credit card company. Many card issuers will reduce rates when customers ask, which could save you thousands in interest payments.

Script for Negotiation

Here’s a proven way to start your negotiation call: “I have [card name] with a [X]% interest rate. I received another offer from [competitor] for [lower rate]%, yet I prefer staying with your company”33. When you reach a representative, highlight:

- Your loyalty and payment history

- Recent credit score improvements

- Competitive offers received

The representative might say no at first. Ask to speak with a supervisor and say: “We both know that if I transfer my balance today, next week your bank will send me an offer to return at an even lower rate. Why not save the bank’s marketing costs by reducing my rate now?”33

Best Times to Negotiate

Your chances of success improve with good timing. The best times to ask for a rate reduction are after:

- You’ve shown consistent on-time payments

- Your credit score climbs above 70034

- You’ve built a solid relationship with the issuer

- Other lenders send you competitive offers

Alternative Lenders

When traditional lenders turn you down, these options can help:

- Balance transfer cards that offer 0% APR for 15-21 months35

- Personal loans with rates between 6.99% and 35.99%36

- Credit unions with rates lower than traditional banks

- Debt management programs through credit counseling agencies

Note that you should write down all conversations, including representative names and promised rate reductions33. Smart negotiation often leads to rate cuts of several percentage points37. A temporary rate reduction can help you save money – some issuers cut rates by 1-3 percentage points for one year7.

Use Cash Windfalls Strategically

Image Source: Bankrate

Surprise financial windfalls give you a great chance to speed up your debt payoff. Smart allocation of these funds can put you on a faster path to financial freedom.

Tax Refunds

Your tax refund can help reduce your debt load substantially. The average tax refund in 2024 stands at USD 3,13838. This isn’t extra money – it’s your pre-paid funds that can make an immediate dent in your debt. Research shows 52% of Americans will use their tax refunds to pay down debt39.

Here’s how to get the most from your refund:

- Target high-interest credit cards first

- Build or strengthen your emergency fund

- Split the refund between multiple financial goals

Bonuses

Your year-end or performance bonus needs smart planning. Many experts suggest splitting your bonus three ways: savings, investments, and debt payoff40. Before you decide what to do with your bonus, remember that most bonuses get taxed at a flat 22% rate41.

Inheritance Planning

Smart inheritance management needs time and strategy. Give yourself 6-12 months to cool off before making big money moves42. Keep the inherited money in high-yield savings accounts that pay at least 4% interest during this time42.

Smart ways to allocate your inheritance:

- Wipe out high-interest debt right away

- Build an emergency fund for 6-12 months of expenses

- Put money in retirement accounts if you’re debt-free

Statistics show 70% of windfall recipients lose their money within a few years3. You can avoid this trap by focusing on debt reduction while staying balanced. To cite an instance, setting aside 5-10% of your windfall for personal enjoyment helps maintain long-term financial discipline42.

Make sure to update your estate planning documents after getting large windfalls42. A financial professional can help you understand tax implications and create the best debt reduction strategy6. With proper planning and discipline, these windfalls can put you on a faster track to becoming debt-free.

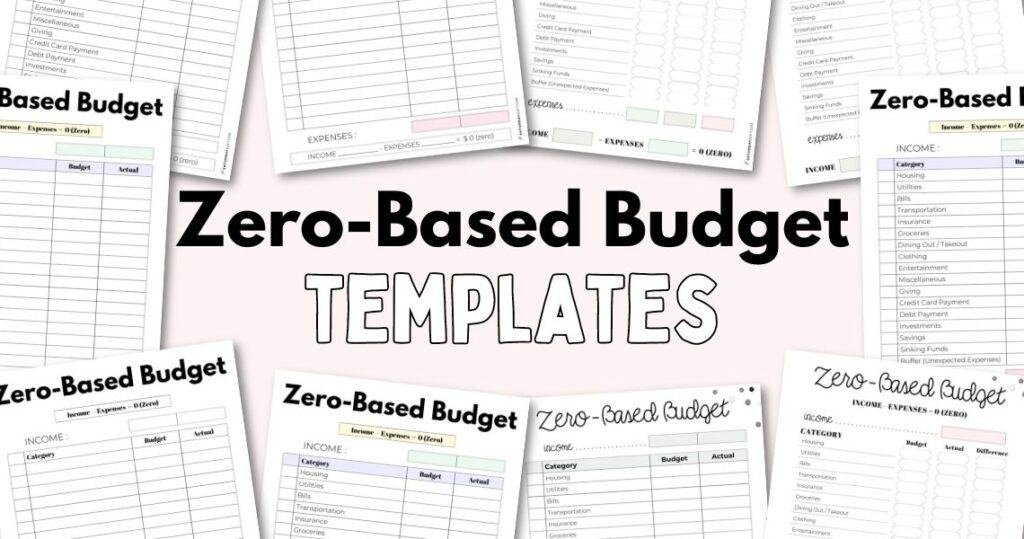

Create a Zero-Based Budget

Image Source: Saturday Gift

Zero-based budgeting puts every dollar of your income to work with a specific purpose. You gain complete control over your finances. This approach works best to speed up debt payoff because it helps you spot and redirect unnecessary expenses toward reducing your debt.

Budget Setup Guide

Start by adding up your total monthly income from regular paychecks and extra earnings43. Your expenses should fall into these categories:

- Essential needs (Four Walls: food, utilities, shelter, transportation)

- Financial goals (savings, debt payments)

- Non-essential spending (entertainment, dining out)

- Month-specific costs (holidays, celebrations)

Put your money toward necessities before wants. Your goal is to make your income minus expenses equal zero44. To cite an instance, if you have USD 5,000 monthly income, give every dollar a job, from rent payments to retirement savings45.

Expense Tracking

Accurate records make zero-based budgeting successful. You need to track each transaction during the month to avoid overspending43. Modern budgeting apps make this task easier by:

- Connecting directly to bank accounts

- Automatically categorizing expenses

- Providing live spending alerts

- Generating detailed financial reports

Monthly Adjustments

Look over and tweak your budget before each new month starts46. Core expenses stay mostly stable, but variable costs need regular updates. Here are some smart adjustment strategies:

- Assess last month’s spending patterns

- Plan for upcoming expenses or income changes

- Move extra funds toward debt reduction

- Cut back in areas where you overspend

People with irregular income should base their budget on their lowest-earning months47. Extra income can go straight to debt payments or savings goals. Research shows zero-based budgeting especially benefits people who struggle with debt repayment or work toward specific financial goals45.

Note that keeping a miscellaneous category helps with unexpected expenses43. This buffer keeps your budget on track when surprise costs pop up. Regular monitoring and adjustments help align your spending with debt payoff goals while keeping your finances stable.

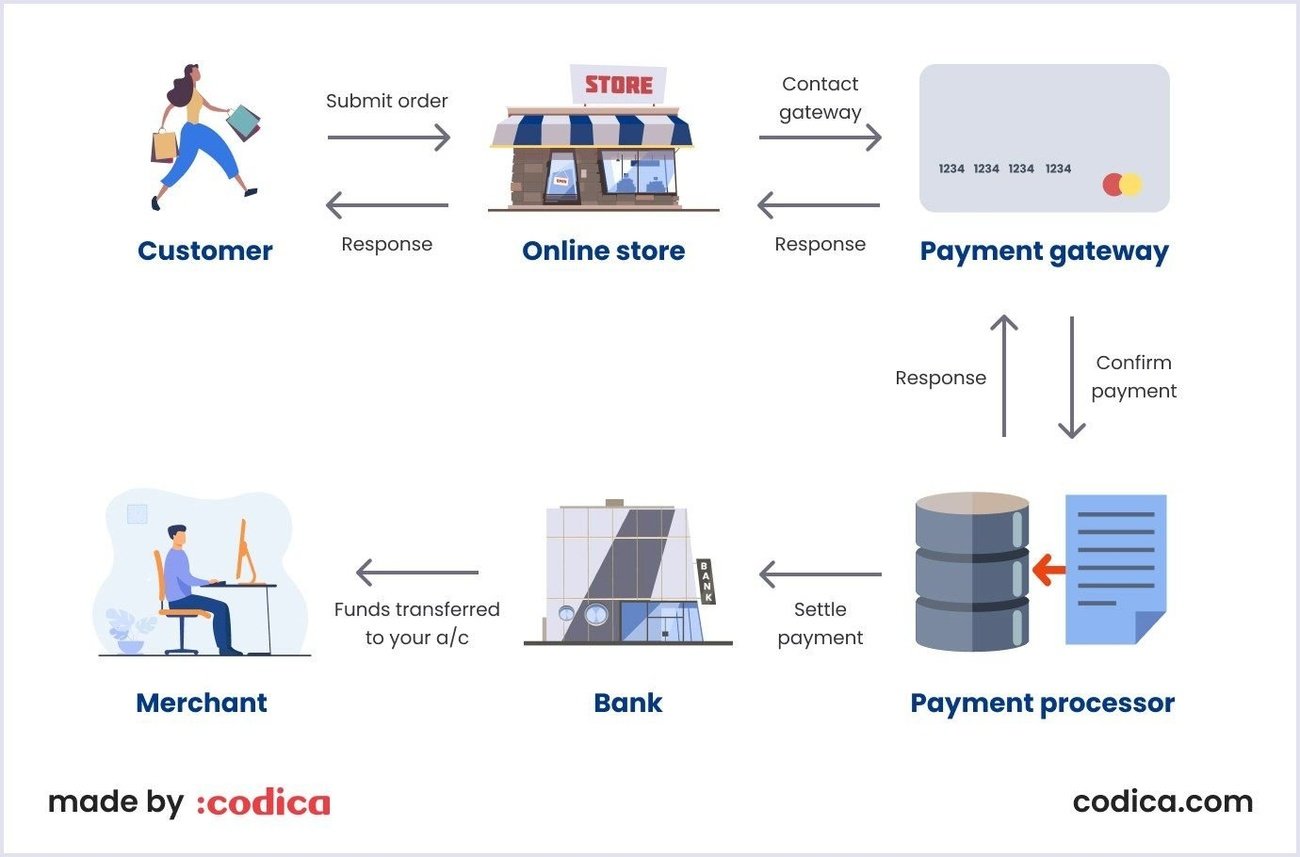

Sell Unused Items Online

Image Source: Codica

You can turn your unused items into cash and use that money to pay off debt. The right selling platform and smart selling tactics will help your forgotten items bring in substantial money toward your financial goals.

Best Selling Platforms

Facebook Marketplace leads the pack for local sales without listing fees5. Designer items sell well on The RealReal, which pays between 20% to 85% of the selling price48. Poshmark takes USD 2.95 for sales under USD 15.00 and 20% for higher amounts49. Bonanza gives you an economical option with just USD 0.25 plus 3.5% of the final value49.

Pricing Strategies

The right price tag makes all the difference in your sales success. Here’s what you should think about when pricing:

- Current market demand

- Item condition

- Original retail price

- Seasonal timing

Your prices should change based on market competition and what buyers want5. Vintage or collectible items often sell better with premium prices because collectors value them more5. Looking at your competition helps – price your items slightly lower than similar listings to catch buyers’ attention50.

Shipping Tips

Good shipping practices keep buyers happy and protect your profits. Start by getting exact shipping costs with package measurements and weight4. Pick the right packaging – light poly mailers work great for clothes while sturdy boxes protect fragile items4.

Smart shipping tactics include:

- Free shipping above certain price points

- Using free carrier packaging when available

- Getting insurance for valuable items

- Adding tracking numbers to all packages

Most platforms connect with major carriers and give you cheaper shipping rates4. Automated shipping tools help reduce mistakes and speed up the process4. Clear shipping information at checkout builds trust and helps more buyers complete their purchase4.

Optimize Your Credit Score

Image Source: Welch State Bank

A good credit score helps you get better interest rates and pay off debt faster. You can make strategic improvements to your score that will save you money by understanding what affects it.

Credit Score Factors

Your credit score depends on five main elements. Payment history makes up the biggest chunk at 35%51. Your credit utilization takes up 30% of your score – that’s how much of your available credit you actually use51. The rest comes from how long you’ve had credit (15%), the types of credit you have (10%), and new credit applications (10%)51. Lenders like to see you using less than 30% of your credit limit. The highest scores usually go to people who keep their usage under 10%52.

Improvement Strategies

Start by getting your credit reports from Equifax, TransUnion, and Experian51. Take care of any negative items by paying old debts and making payments on time. Remember that late payments stick around on your report for seven years51. Your older credit cards help your score, so keep them active with small purchases11.

Here are some proven ways to boost your score:

- Pay your credit card before the statement closes

- Try to get higher credit limits to lower your usage

- Get added as an authorized user on a reliable person’s card52

- See if your utility companies will report when you pay on time51

Monitoring Tools

Credit monitoring services watch all your credit reports and let you know about new accounts, payment updates, and possible fraud18. These services usually give you:

- Instant alerts when someone applies for credit

- Updates when your score changes

- Protection against identity theft

- Fresh credit report information53

Most monitoring services show your VantageScore, but banks usually look at FICO scores when they make lending decisions54. Your credit score usually updates within 30-45 days after you make positive changes55. Better scores lead to lower interest rates and faster debt payoff, so it’s worth keeping your credit in good shape.

Consider Debt Settlement

Image Source: InCharge Debt Solutions

Debt settlement stands as a last resort before bankruptcy that can provide relief to people drowning in debt. Creditors might accept less than what borrowers owe, which creates a way out of overwhelming financial obligations.

When to Consider Settlement

These specific situations make debt settlement a viable choice:

- Severe financial hardship makes full debt repayment impossible

- Other debt relief options no longer work

- Bankruptcy looks like the next step

- Debts are already delinquent by 90-180 days56

Negotiation Process

The settlement journey usually takes three to four years57. The process starts when you stop regular payments and save money in a dedicated account instead. Creditors might accept 50% to 80% of the original debt once you have enough funds saved58.

A successful negotiation requires you to:

- Verify debt amounts and ownership

- Keep records of all creditor communications

- Get agreements in writing

- Time it right – creditors often prefer to settle older debts59

Risks and Benefits

Settlement companies take 15% to 25% of the settled amount as fees12. This approach comes with notable drawbacks.

Benefits:

- You might pay less than what you owe

- This works better than bankruptcy

- Collection calls stop after reaching agreements13

Risks:

- Your credit score takes a hit that lasts seven years16

- The IRS taxes forgiven amounts over $60057

- Late fees and interest pile up during negotiations60

- Creditors might reject your offers61

- You could face lawsuits while settling60

Your financial situation should guide the decision to pursue debt settlement. Creditors have no obligation to accept settlement offers62. This strategy works best for people who face serious financial problems and have nowhere else to turn56.

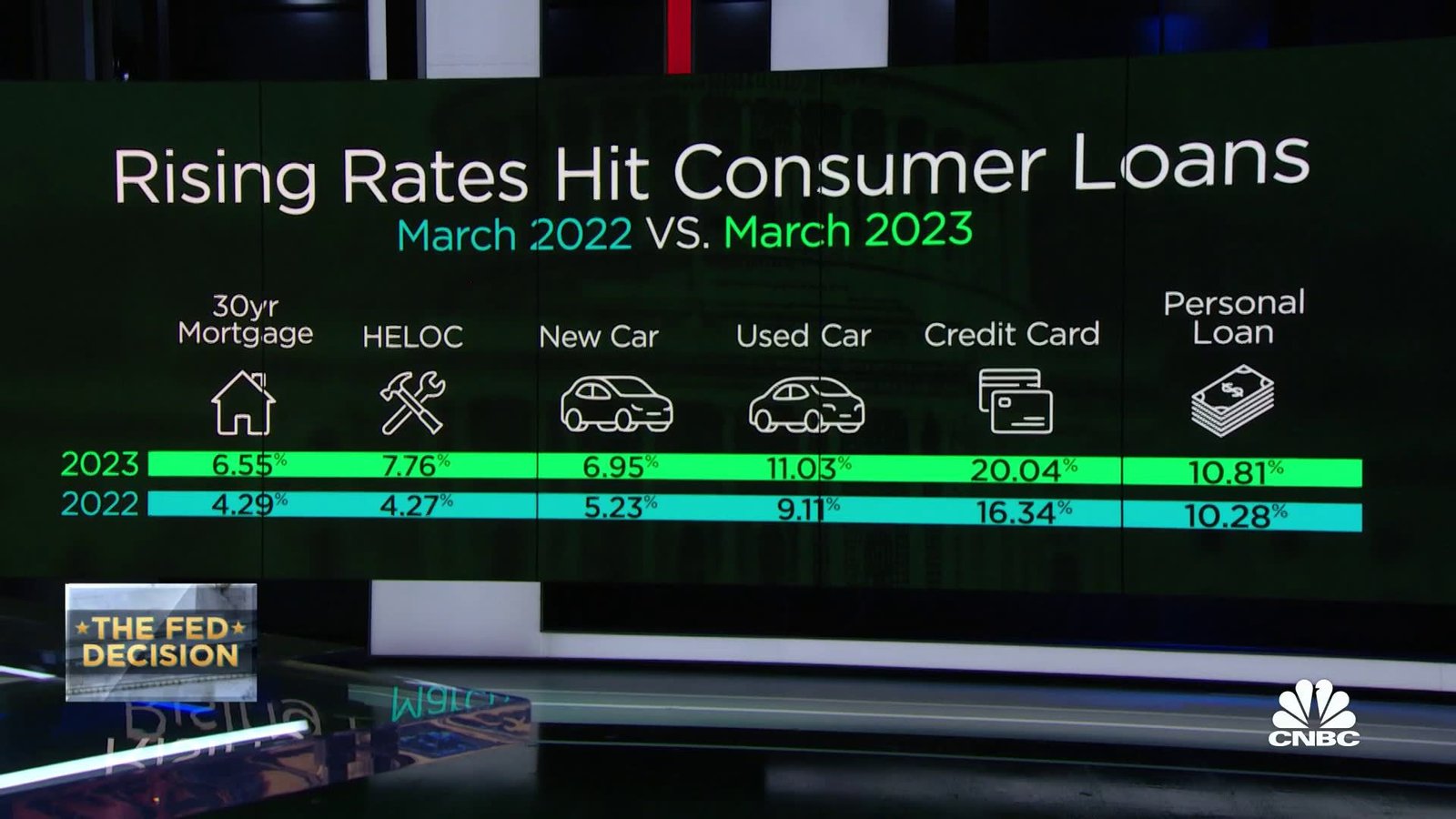

Use Balance Transfer Cards

Image Source: CNBC

Balance transfer credit cards are powerful tools that speed up debt payoff. These cards come with 0% APR introductory periods that can save you a lot of money on interest. The right card helps you combine and clear high-interest debt quickly.

Top Balance Transfer Offers

The best balance transfer cards give you promotional periods ranging from 15 to 21 months with 0% APR63. The Wells Fargo Reflect® Card, Citi Simplicity® Card, and Citi® Diamond Preferred® Card lead the pack with their long 0% APR periods14. To name just one example, moving a $5,000 balance from a card with 16.28% APR to a 0% card saves about $956 in interest. This helps you clear the debt five months faster64.

Transfer Strategy

Your first step should be calculating the total debt you want to transfer. Credit limits often cap how much you can move15. Card issuers won’t let you transfer balances between their own cards65. You’ll need to act fast after approval because most cards need transfers completed within 60-120 days of opening the account65.

Essential steps for successful transfers:

- Review current card balances and interest rates

- Compare promotional periods across multiple offers

- Calculate monthly payments needed to clear debt before promotion ends

- Maintain existing card payments until transfers complete63

Fee Considerations

Transfer fees usually run between 3% to 5% of what you move66. Moving $10,000 in debt costs $300 to $500 in fees66. The good news is that interest savings are often much higher than these fees10. Credit unions might offer no-fee transfer cards if you have an excellent credit score10.

Note that any missed payments can trigger penalty APRs and cancel your promotional rate65. Cards might also charge different APRs for new purchases and transferred balances65. Smart planning and regular payments make balance transfer cards excellent tools to break free from debt sooner.

Cut Unnecessary Expenses

Image Source: Investopedia

A full expense audit reveals hidden opportunities to speed up your debt payoff trip. You can redirect substantial funds toward eliminating financial obligations through systematic review and smart cuts.

Expense Audit Guide

Start by categorizing all expenses into essential and discretionary spending. Studies show Americans underestimate their monthly subscription costs by USD 133.0067. You need to distinguish core expenses like rent, mortgage, and utilities from discretionary items such as dining out or personal shopping67. Get into each category for potential reductions and focus first on non-essential costs.

Subscription Management

The average American spends USD 219.00 monthly on subscriptions68. List all recurring charges in entertainment, software, health, and news categories69. Review each subscription by asking:

- Current usage frequency

- Alternative free versions available

- Necessity in daily life

- Cost versus benefit ratio

Many services make cancelation difficult by requiring multiple steps or phone calls70. Subscription tracking apps help identify forgotten charges and set renewal reminders69. You might want to downgrade premium services to basic versions and potentially maintain benefits while reducing costs69.

Cost-Cutting Tools

Modern expense tracking applications make it easier to monitor spending patterns. These tools offer:

- Automatic transaction categorization

- Up-to-the-minute spending alerts

- Customizable budget limits

- Detailed financial reports71

Most personal finance apps link directly with bank accounts to provide complete oversight of your spending habits17. Platforms like Rocket Money help identify and cancel unwanted subscriptions while monitoring your credit score17. Regular expense reviews and smart cuts help you spot areas where your financial health needs improvement72.

Note that you should implement spending policies, such as waiting 24 hours before making purchases and creating strict shopping lists67. You should also shop around for better rates on essential services like internet, cable, phone, and insurance73.

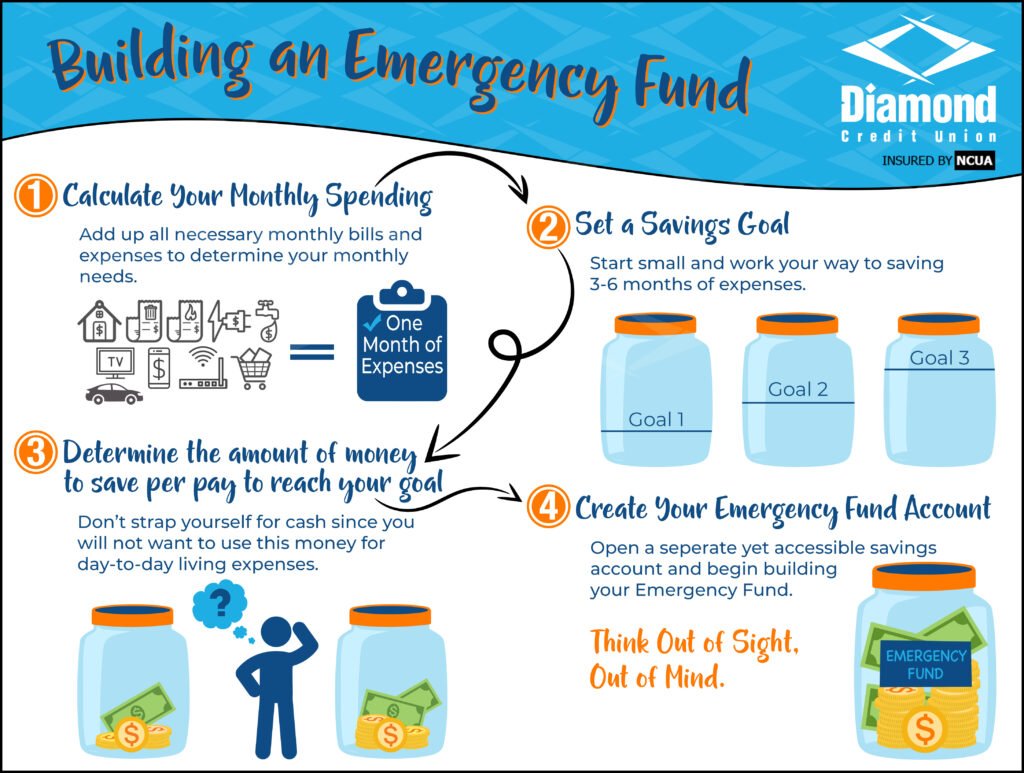

Build an Emergency Fund

Image Source: Diamond Credit Union

A reliable emergency fund and debt repayment plan create a vital financial safety net. Studies show that more than half of Americans don’t have emergency savings. This often leads them to use high-interest credit cards when unexpected expenses come up74.

Fund Size Guidelines

Financial experts suggest keeping six months of living expenses in a federally insured account75. Your personal situation determines the right amount to save. If you have self-employment or you’re the only provider, you’ll want nine to twelve months of expenses saved19. You can start small – even USD 500 helps prevent more debt20. Build your savings toward the recommended amount as your financial situation gets better.

High-Yield Savings Options

High-yield savings accounts now give annual percentage yields above 4%76. These accounts come with:

- FDIC insurance up to USD 250,000 per depositor76

- Easy access when you need money

- Better interest rates than regular savings accounts

- Protection from market ups and downs77

You’ll find higher yields and lower fees at online banks compared to traditional ones19. Money market accounts could work well for emergency funds since they offer competitive rates and let you write checks78.

Automated Savings

Regular contributions help build emergency funds quickly. You can set up automatic transfers from checking to savings on your payday75. To cite an instance, saving USD 20 every two weeks adds up to USD 520 per year, plus interest75. On top of that, you can try these automated methods:

- Split your direct deposit between checking and savings20

- Use apps that round up purchases and save the difference77

- Time your recurring transfers with when you get paid20

Research shows that 70% of people who get unexpected money lose it within years74. This is why disciplined, automated savings work better. Make sure to top up your fund after you use it79. With systematic saving and smart account choices, your emergency fund protects you from surprise expenses and keeps you from taking on more debt.

Seek Professional Debt Counseling

Image Source: Greenpath Financial Wellness

Credit counseling from professionals helps you take control of overwhelming debt. Certified counselors create individual-specific strategies and provide educational resources that put you back in charge of your finances.

Finding a Counselor

Your search should begin with trusted organizations like the National Foundation for Credit Counseling or Financial Counseling Association of America22. These groups ensure their counselors meet strict certification standards. Make sure to check potential agencies with your state’s attorney general and consumer protection agency80. Reputable organizations will share their service information freely without asking for your personal details22.

What to Expect

The original counseling session runs about 60 minutes and comes at no cost22. Counselors will get a full picture of your finances and assess your income, expenses, and outstanding debts80. They’ll create solutions specific to your situation, which could include:

- Budget creation and management techniques

- Debt management plans (DMPs)

- Educational resources and workshops

- Ongoing financial guidance

Counselors working on a DMP negotiate with creditors to lower your interest rates and monthly payments22. Your multiple payments unite into one monthly amount, which goes to your creditors22. Most people clear their debt through credit counseling organizations in three to five years81.

Cost Considerations

Nonprofit credit counseling agencies won’t charge for your first consultation25. DMP fees vary by state but stay regulated. You’ll pay between USD 0 to USD 79 monthly, with most people paying around USD 4025. California keeps monthly fees at 8% of creditor payments or USD 35, plus a USD 50 education fee24.

Stay away from organizations that want upfront payments or push DMPs without looking at your finances carefully26. Good agencies give you written agreements that spell out all costs and stay open about their fees80. The right research and careful choice of counseling service are a great way to get long-term financial stability.

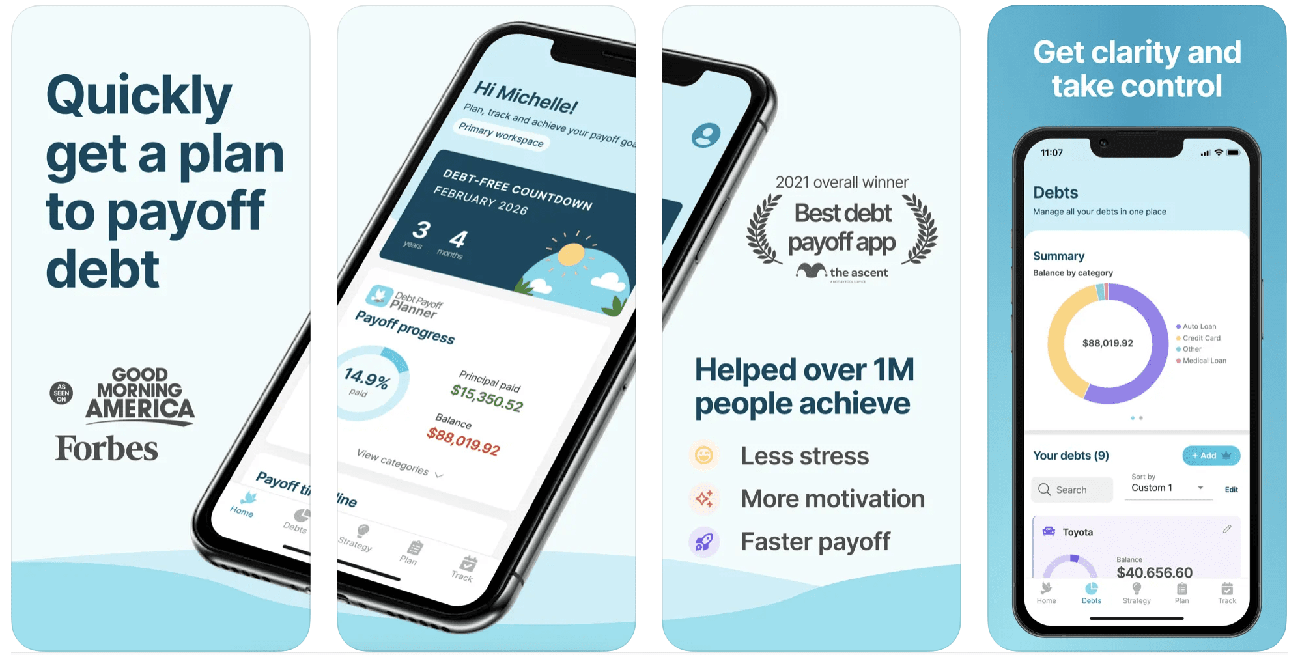

Track Progress with Debt Payoff Apps

Image Source: The Ways To Wealth

Debt payoff apps are changing how we manage money by giving us complete tools to track and eliminate debt. These digital tools offer custom repayment strategies and keep users motivated with visual progress trackers.

Top Debt Apps

A few apps stand out because of their reliable features and user-friendly design. Debt Payoff Planner gives users nine different payoff options to create personalized strategies82. Quicken remains the top debt tracker with a yearly cost of USD 35.9983. Tally helps users optimize credit card debt for USD 4.99 monthly83. Qoins finds extra money from purchases automatically to help pay off debt faster83.

Progress Monitoring

Today’s debt tracking platforms link to your financial accounts and show up-to-the-minute updates on balances and payments21. These apps look at your current balances and interest rates to help you make smart choices about paying off debt21. Users can see all their debts in one place through complete dashboards that make tracking progress and managing payments easier21.

Goal Setting Features

The best debt payoff apps include tools to help set realistic timelines and milestones. These platforms look at your financial information and suggest the best ways to eliminate debt based on your income and spending habits84. Most apps let you choose from different repayment methods:

- Debt snowball for quick psychological wins

- Debt avalanche for interest savings

- Custom plans that fit your situation84

The top apps boost motivation with interactive charts and show when you’ll be debt-free21. They also give you a clear picture of your income and expenses to help you become better at managing money21. Users retain control through custom debt repayment plans while getting guidance and timely reminders21. These digital tools analyze what’s most economical and suggest options like debt consolidation or talking to creditors when it makes sense21.

Comparison Table

| Debt Payoff Method | Main Benefit | Time to Start | Results & Effects | What You Need | Cost |

|---|---|---|---|---|---|

| AI Tools | Smart strategy that works on its own | Right away | Makes collectors 8x more productive; Cuts costs by 70% | Internet and access to financial accounts | Depends on platform |

| Debt Avalanche | Saves most on interest | Varies with debt size | You can save thousands | Your debts ranked by interest rate | None |

| Debt Snowball | Quick wins to keep you going | About 90 days for first debt | Pays off $5,300 in first 90 days | Your debts ranked by amount owed | None |

| Debt Consolidation | One simple monthly payment | 15-21 months usually | Rates drop to 6-36% | Credit score above 690 | 3-5% fee to transfer |

| Automated Payments | Never miss a payment | Sets up right away | Stops late fees ($28-34) | Working bank account | Usually free |

| Side Hustles | Extra money coming in | Start now | Earn $15-100 per hour | Skills you can market | Platform fees vary |

| Interest Rate Negotiation | Lower interest rates | 1-3 days | Drops by several percentage points | Good history of payments | None |

| Zero-Based Budget | Full control of spending | Monthly setup | Not available | Track income regularly | None |

| Balance Transfer | No interest for a while | 15-21 months | Save $956 on $5,000 balance | Good to great credit | 3-5% transfer fee |

| Debt Settlement | Pay less than you owe | 3-4 years | 50-80% of original debt | Past-due debts | 15-25% of settled amount |

| Emergency Fund | Protects from new debt | 6-12 months | Stops you from taking new debt | Regular savings habit | None |

| Credit Counseling | Expert help and advice | 3-5 years for plan | Not available | Financial records | $0-79 monthly |

| Debt Payoff Apps | See your progress | Start now | Not available | Phone with internet | $0-35.99 yearly |

Ultimate point

Your path to becoming debt-free needs proven methods that match your financial situation. My research and experience show that people eliminate debt most successfully by picking the right approach. The debt snowball method gives quick psychological wins, while the avalanche method saves the most interest.

AI tools make remarkable progress possible. These tools make debt collection 8 times more efficient and cut costs by 70%. Automated payments and budgeting apps make the process easier, but you need an emergency fund to avoid taking on more debt.

You’ll get the best results by combining several approaches. A zero-based budget helps you find extra money to pay off debt. Lower interest rates and balance transfers for high-interest debts save you substantial money as time passes. Credit counseling services are a great way to get structured guidance that helps eliminate debt within 3-5 years.

Your success relies on taking consistent action and watching your progress. Expense audits, automated payments, and dedicated apps help you stay motivated throughout your trip to financial freedom. Note that each step brings you closer to your goal, and every strategic choice counts toward eliminating your debt completely.

To learn more visit:

17 Smart Ways to Save Money on Entertainment (Tested in 2025)

FAQs

Q1. What is the fastest method to pay off debt? The debt avalanche method is often considered the fastest way to pay off debt. This approach involves focusing on paying off the debt with the highest interest rate first while making minimum payments on other debts. By targeting high-interest debt, you can reduce the overall amount of interest you pay and potentially become debt-free more quickly.

Q2. How can I pay off $30,000 in debt within a year? To pay off $30,000 in debt within a year, you’ll need a strategic approach. Start by creating a strict budget and cutting unnecessary expenses. Consider increasing your income through side hustles or asking for a raise. Automate minimum payments on all debts and allocate any extra funds to the highest-interest debt. Evaluate your progress regularly and adjust your strategy as needed. You may also want to explore debt consolidation options or negotiate with creditors for lower interest rates.

Q3. Are there government debt relief programs available? While the U.S. government doesn’t offer direct debt relief programs for most types of consumer debt, there are some federal programs that can help in specific situations. For federal student loans, there are income-driven repayment plans and potential forgiveness options. The IRS offers payment plans and compromise options for tax debt. For other types of debt, government-approved credit counseling agencies can provide guidance and potential debt management plans.

Q4. How effective are AI tools in managing debt? AI tools can be highly effective in managing debt. These tools can analyze your financial data to create personalized debt payoff strategies, automate payments, and provide real-time insights into your spending habits. Some AI-powered debt management solutions have shown to increase collector productivity by up to 8 times and reduce debtor coverage costs by 70%. However, the effectiveness ultimately depends on how consistently you use the tools and follow their recommendations.

Q5. Should I build an emergency fund while paying off debt? Yes, it’s generally advisable to build an emergency fund even while paying off debt. A modest emergency fund of $500 to $1,000 can prevent you from accumulating more debt when unexpected expenses arise. Once you have this initial buffer, you can focus more aggressively on debt repayment while gradually increasing your emergency savings. Aim to eventually build up to 3-6 months of living expenses in your emergency fund for long-term financial stability.

References

[1] – https://www.nerdwallet.com/article/credit-cards/how-to-set-up-automatic-credit-card-payments

[2] – https://www.debtzero.ai/resources/introducing-debtzero%3A-the-ai-powered-solution-transforming-debt-relief

[3] – https://www.newyorklife.com/articles/what-is-a-financial-windfall

[4] – https://www.shopify.com/blog/shipping-and-fulfillment

[5] – https://www.shopify.com/blog/pricing-strategies

[6] – https://www.finra.org/investors/insights/managing-financial-windfall

[7] – https://www.experian.com/blogs/ask-experian/can-i-negotiate-a-lower-interest-rate-on-my-credit-card/

[8] – https://www.forbes.com/sites/chriscarosa/2023/02/19/how-do-you-keep-track-of-side-hustle-finances/

[9] – https://www.inc.com/hostinger/top-10-side-hustle-ideas-to-make-extra-money-in-2025/91070479

[10] – https://www.investopedia.com/terms/b/balance-transfer-fee.asp

[11] – https://bettermoneyhabits.bankofamerica.com/en/credit/how-to-improve-your-credit-score

[12] – https://www.nerdwallet.com/article/loans/personal-loans/is-debt-settlement-a-good-idea

[13] – https://www.incharge.org/debt-relief/debt-settlement/debt-settlement-pros-cons/

[14] – https://www.bankrate.com/credit-cards/balance-transfer/best-balance-transfer-cards/

[15] – https://www.experian.com/credit-cards/best-balance-transfer/

[16] – https://www.investopedia.com/ask/answers/110614/how-will-debt-settlement-affect-my-credit-score.asp

[17] – https://www.pcmag.com/picks/the-best-personal-finance-services

[18] – https://www.investopedia.com/the-best-credit-monitoring-services-8763926

[19] – https://www.bankrate.com/banking/savings/starting-an-emergency-fund/

[20] – https://www.nerdwallet.com/article/banking/emergency-fund-why-it-matters

[21] – https://www.achieve.com/learn/resolve-debt/debt-payoff-app

[22] – https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-credit-counseling-and-debt-settlement-debt-consolidation-or-credit-repair-en-1449/

[23] – https://www.nerdwallet.com/article/loans/personal-loans/what-is-debt-consolidation

[24] – https://www.experian.com/blogs/ask-experian/how-much-does-debt-counseling-cost/

[25] – https://www.consolidatedcredit.org/ask-the-experts/how-much-does-credit-counseling-cost/

[26] – https://www.incharge.org/debt-relief/debt-management/what-are-the-debt-management-program-fees/

[27] – https://www.consumerfinance.gov/ask-cfpb/how-do-automatic-debit-payments-from-my-bank-account-work-en-2021/

[28] – https://www.manifest.ly/use-cases/accounting/debt-management-checklist

[29] – https://www.cognizant.com/us/en/glossary/debt-recovery-automation

[30] – https://www.linkedin.com/pulse/24-side-hustles-pay-off-debt-faster-curadebt-debt-settlement-ryg2e

[31] – https://fourthwall.com/blog/earn-extra-cash-from-home-with-these-online-side-hustles

[32] – https://www.experian.com/blogs/ask-experian/side-hustles-to-pay-off-debt/

[33] – https://jeanchatzky.com/wp-content/uploads/2014/08/interest-rates-script.pdf

[34] – https://www.ombbank.com/blog/how-to-negotiate-a-lower-credit-card-rate

[35] – https://www.cnbc.com/select/how-to-lower-credit-card-interest-rate/

[36] – https://www.bankrate.com/loans/personal-loans/low-interest-rates/

[37] – https://www.cbsnews.com/news/how-to-get-a-lower-credit-card-interest-rate-this-fall/

[38] – https://www.nerdwallet.com/article/finance/should-you-use-your-tax-refund-to-pay-off-debt

[39] – https://money.usnews.com/money/personal-finance/articles/spend-a-windfall-wisely

[40] – https://www.synovus.com/personal/resource-center/managing-your-finances/5-smart-ways-to-use-your-year-end-bonus/

[41] – https://www.britannica.com/money/what-to-do-with-a-windfall

[42] – https://www.forbes.com/sites/nextavenue/2024/10/08/10-smart-ways-to-manage-a-financial-windfall/

[43] – https://www.ramseysolutions.com/budgeting/how-to-make-a-zero-based-budget?srsltid=AfmBOopE7BbzltJmyK3UV6cubxHLhhTW8IJlR9pJ009usgguA-ADQurS

[44] – https://www.ramseysolutions.com/budgeting/how-to-make-a-zero-based-budget?srsltid=AfmBOopvyvM6x7TVVwIF0yiFVgwTMAYI1whxxUmHzCwQqZAUf1FirV27

[45] – https://www.bankrate.com/banking/how-to-make-a-zero-based-budget/

[46] – https://www.intuit.com/blog/budgeting/zero-based-budgeting/

[47] – https://www.fidelity.com/learning-center/smart-money/zero-based-budgeting

[48] – https://www.cnbc.com/select/best-resale-apps-and-websites/

[49] – https://www.nerdwallet.com/article/finance/where-to-sell-stuff-online

[50] – https://sell.amazon.com/blog/amazon-pricing-strategies

[51] – https://www.equifax.com/personal/education/credit/score/articles/-/learn/how-to-improve-credit-score/

[52] – https://www.nerdwallet.com/article/finance/raise-credit-score-fast

[53] – https://www.nerdwallet.com/article/finance/credit-monitoring-identity-theft-monitoring

[54] – https://www.lendingtree.com/credit-repair/best-credit-monitoring-services/

[55] – https://www.equifax.com/personal/education/credit/score/articles/-/learn/raise-credit-scores-fast/

[56] – https://www.bankrate.com/personal-finance/debt/alternatives-to-debt-relief/

[57] – https://www.nerdwallet.com/article/loans/personal-loans/debt-settlement-negotiations

[58] – https://www.experian.com/blogs/ask-experian/debt-settlement-risks/

[59] – https://www.consumerfinance.gov/ask-cfpb/how-do-i-negotiate-a-settlement-with-a-debt-collector-en-1447/

[60] – https://www.nerdwallet.com/article/finance/find-debt-relief

[61] – https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-relief-program-and-how-do-i-know-if-i-should-use-one-en-1457/

[62] – https://sadeklaw.com/2024/08/28/debt-settlement-pros-and-cons/

[63] – https://www.experian.com/blogs/ask-experian/pros-cons-balance-transfer-credit-cards/

[64] – https://www.cnbc.com/select/using-balance-transfers-to-pay-off-credit-card-debt/

[65] – https://www.nerdwallet.com/article/credit-cards/choose-balance-transfer-credit-card

[66] – https://www.bankrate.com/credit-cards/balance-transfer/what-is-a-balance-transfer-fee/

[67] – https://money.usnews.com/money/blogs/my-money/articles/how-to-audit-your-budget-and-prioritize-important-expenses

[68] – https://www.consumerreports.org/consumer-awareness/how-to-find-and-cancel-unwanted-online-subscriptions-a3454561625/

[69] – https://www.paypal.com/us/money-hub/article/how-to-cancel-recurring-subscriptions

[70] – https://www.nerdwallet.com/article/finance/subscriptions-are-hard-to-cancel-and-easy-to-forget-by-design

[71] – https://money.usnews.com/money/personal-finance/saving-and-budgeting/articles/best-expense-tracker-apps

[72] – https://www.makingcentsmatter.com/how-to-audit-your-personal-finances/

[73] – https://www.psecu.com/learn/financial-tips-for-every-stage-in-life/2021/08/12/how-to-perform-a-personal-finance-audit

[74] – https://www.discover.com/personal-loans/resources/consolidate-debt/successfully-payoff-debt-build-emergency-fund/

[75] – https://www.fdic.gov/consumer-resource-center/2025-01/saving-unexpected-and-your-future

[76] – https://finance.yahoo.com/personal-finance/banking/article/best-high-yield-savings-account-203140689.html

[77] – https://www.newyorklife.com/articles/importance-of-emergency-fund

[78] – https://www.usnews.com/banking/articles/whats-the-best-account-for-an-emergency-fund

[79] – https://www.equifax.com/personal/education/debt-management/articles/-/learn/build-emergency-fund/

[80] – https://www.consumerfinance.gov/ask-cfpb/what-is-credit-counseling-en-1451/

[81] – https://www.experian.com/blogs/ask-experian/how-does-debt-counseling-work/

[82] – https://www.experian.com/blogs/ask-experian/best-apps-for-paying-off-debt/

[83] – https://www.creditninja.com/blog/debt-payoff-tracker-best-software-template-ideas/

[84] – https://alleviatefinancial.com/debt-settlement/how-to-choose-a-debt-payoff-app-for-debt-relief/

[85] – https://www.scnsoft.com/lending/artificial-intelligence/debt-collection

[86] – https://www.credello.com/debt/debt-avalanche-calculator/

[87] – https://www.debt.org/advice/debt-avalanche/

[88] – https://www.cnbc.com/select/debt-snowball-vs-debt-avalanche/

[89] – https://www.debtpayoffplanner.com/

[90] – https://www.lendingclub.com/resource-center/personal-finance/what-is-the-debt-avalanche-method-and-how-does-it-work

[91] – https://www.nerdwallet.com/article/finance/what-is-a-debt-avalanche

[92] – https://www.investopedia.com/terms/d/debt-avalanche.asp

[93] – https://www.ramseysolutions.com/debt/how-the-debt-snowball-method-works?srsltid=AfmBOopSJwrHyyIFFlXUkonuF-8lCTwQoCFL6QtuWhgatXz9Q2CMR8x4

[94] – https://www.nerdwallet.com/article/finance/what-is-a-debt-snowball

[95] – https://www.hustleescape.com/psychology-of-reducing-debts/

[96] – https://www.psychologytoday.com/us/blog/retail-therapy/201304/debt-snowball-fight

[97] – https://www.nbcnews.com/better/lifestyle/couple-used-debt-snowball-method-pay-130-000-four-years-ncna1059086

[98] – https://www.cnbc.com/2018/01/18/how-this-blogger-used-the-debt-snowball-method-to-pay-off-36000.html

[99] – https://myoccu.org/learn/paying-down-debt-why-snowball-method-works/2021-10-21-0

[100] – https://www.experian.com/blogs/ask-experian/avalanche-vs-snowball-which-repayment-strategy-is-best/

[101] – https://www.debt.org/advice/debt-snowball-method-how-it-works/

[102] – https://www.bankrate.com/loans/personal-loans/debt-consolidation-loans/

[103] – https://www.experian.com/loans/debt-consolidation/

[104] – https://www.bankrate.com/personal-finance/debt/pros-and-cons-of-debt-consolidation/

[105] – https://www.bankrate.com/credit-cards/zero-interest/how-to-lower-credit-card-interest-rate/

[106] – https://www.nerdwallet.com/article/credit-cards/what-is-a-balance-transfer

[107] – https://www.experian.com/blogs/ask-experian/5-ways-to-make-the-most-of-your-balance-transfer-card/

[108] – https://www.nerdwallet.com/article/loans/personal-loans/pros-and-cons-debt-consolidation

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com