Did you know singles spend 12.8% of their income on food, while married couples spend just 12.3%? This small difference emphasizes a larger reality about financial planning for singles – managing money alone brings unique challenges.

My 13 years as a financial advisor have shown me the distinct financial obstacles singles face. The average U.S. household spends over $3,000 each year on dining out. This money could boost savings or retirement accounts significantly. Singles now have powerful tools to build wealth, from automated bill payments to alternative housing options.

You might be a twenty-something learning budget fundamentals or a thirty-something focused on growing wealth. I’ve gathered 17 proven strategies that will help you control your finances better. These actionable tips show you exactly how to protect your assets and manage money effectively in 2025.

Leverage AI-Powered Budgeting Apps

Image Source: Forbes

AI-powered budgeting apps have changed how singles manage their finances. My experience guiding clients through digital financial tools has shown me how these apps make money management easier with smart algorithms that give tailored insights.

Best AI Finance Apps for Singles

My analysis of many options leads me to recommend Simplifi for its complete financial overview and AI-powered transaction categorization72. On top of that, Copilot Money excels with its proactive budgeting approach that automatically sorts transactions and gives tailored recommendations2. NerdWallet delivers great value with minimal ads, which makes budgeting much easier2.

How AI Optimizes Your Spending

Modern AI budgeting tools shine in four key areas:

- Up-to-the-minute data analysis across connected accounts

- Automated expense categorization

- Tailored spending insights

- Predictive analysis for future expenses72

Singles can make smarter financial decisions with these features. AI studies your past spending patterns to predict monthly cash flow72. The technology also matches your spending habits against others in similar situations to find ways you could save money72.

Cost Comparison of Popular Apps

Popular AI budgeting apps and their costs break down like this:

| App Name | Monthly Cost | Annual Cost |

|---|---|---|

| YNAB | $14.99 | $109.0073 |

| Simplifi | $2.99 | $35.8873 |

| PocketGuard | $12.99 | $74.9973 |

| Goodbudget Plus | $10.00 | $80.0073 |

| Monarch Money | $14.99 | $99.9973 |

Many apps come with free versions that include simple features. NerdWallet gives you complete budgeting tools at no cost74. PocketGuard includes a free version along with its premium features73.

The right AI budgeting app needs both good features and security. Most apps use reliable security measures like encryption and two-factor authentication75. These tools help singles develop better money habits through automatic tracking and custom recommendations.

Master the Digital Envelope System

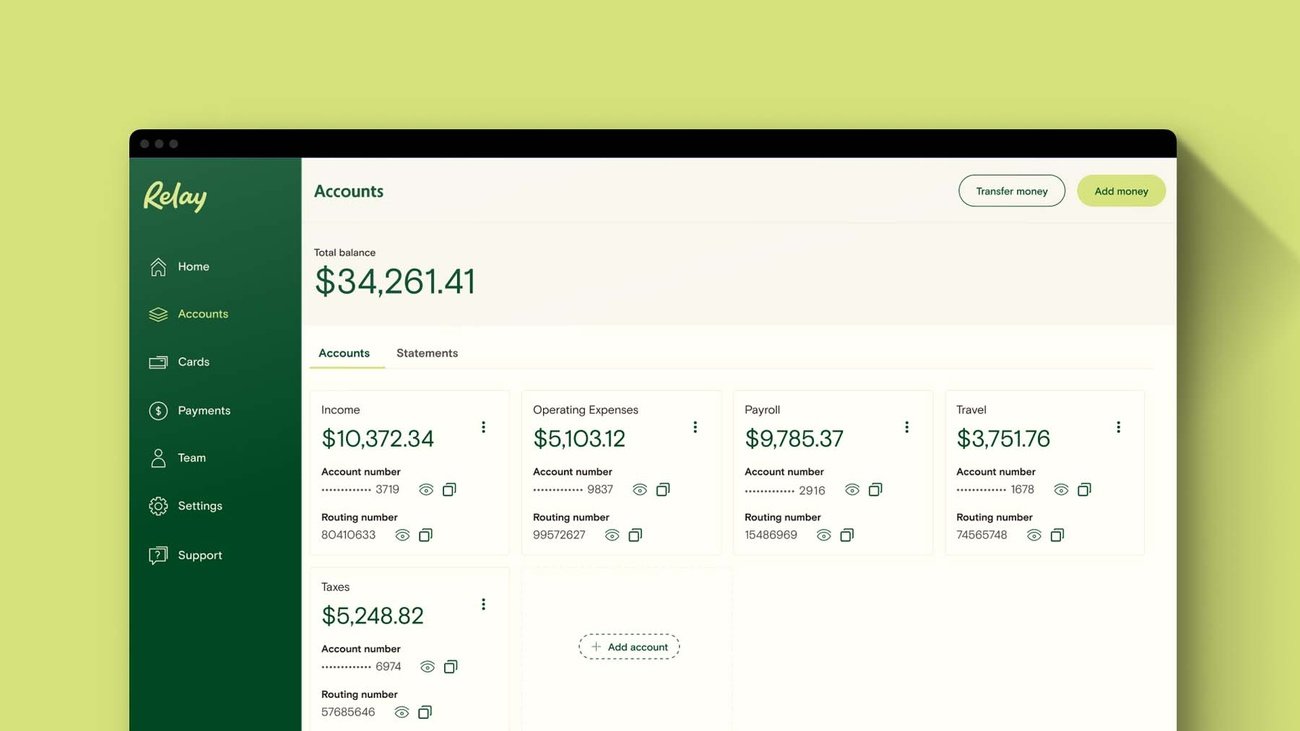

Image Source: Relay

Digital envelope systems bring traditional cash budgeting into our cashless world. My experience advising singles on financial planning shows this method helps control spending and build savings.

Setting Up Digital Envelopes

Your first step should be analyzing past bank statements to spot spending categories76. You don’t need envelopes for every expense – focus on areas where you tend to overspend. Research shows 5-7 envelopes work best for things like groceries, entertainment, and personal care77.

You have several options to implement this system:

- Sub-accounts at your bank

- Dedicated budgeting apps

- Multiple checking accounts

- Digital spreadsheets78

Automation Tips

Digital envelopes work best with consistent automation. Your pay cycle should determine automatic transfers that fund each envelope79. Money will move to designated categories right after payday when you “set it and forget it.”

Here’s what works best:

- Pull in your existing transaction data to see spending patterns80

- Daily reminders help you track and categorize expenses

- Regular budget data exports serve as backups

- Two-factor authentication keeps everything secure80

Common Pitfalls to Avoid

My career guiding singles through financial planning has revealed several challenges with digital envelope systems. Notwithstanding that, these problems have simple solutions:

Security concerns: Weekly or bi-weekly transfers work better than monthly envelope filling. A weekly grocery budget of USD 125 is safer than carrying USD 500 monthly77.

Shared responsibilities: Couples with joint expenses should either pick one person for shared envelopes or split them between partners. A USD 500 monthly grocery budget becomes two USD 250 envelopes77.

Online purchases: A dedicated envelope for online shopping helps track digital spending. Just move money from category envelopes to this account when buying online77.

Note that credit card rewards look tempting, but studies show people spend more with cards than those who stick to envelope limits77. Debit transactions with your digital envelopes will give you better spending control.

Optimize Your Living Situation

Image Source: Single Moms Society

A person’s budget takes the biggest hit from housing costs. My years of client advisory work show how smart living choices can substantially affect your financial well-being.

Co-living vs Solo Living Costs

Co-living spaces give you better value for money than traditional rentals. These fully furnished places cost 20-50% less than private apartments in the same neighborhood81. You’ll get utilities, internet, and amenities bundled into one monthly payment, which means no surprise bills81. Co-living residents save money through:

- Split utility costs

- Lower security deposits

- Ready-to-move furnished spaces

- Month-to-month lease flexibility

Modern Housing Alternatives

New housing options have popped up to help with affordability issues. Many urban areas now allow micro units and efficiency apartments that are budget-friendly for solo living82. Manufactured homes also help you save big, with new two-bedroom units starting at USD 45,00083.

Your wallet-friendly options include:

- Tiny homes (starting at USD 10,000)83

- Container homes (base units from USD 1,400)83

- Modular homes (beginning at USD 53,000)83

Location Optimization Strategies

Smart location choices balance cost and convenience. My housing market research suggests you should think over:

- Urban Growth Areas: Cities now welcome co-living housing in multifamily zones82

- Community Land Trusts: These programs keep housing affordable long-term84

- Alternative Neighborhoods: Areas with good public transport often give you better value84

Singles who want affordability and community will love modern housing alternatives like co-living spaces. These setups cut costs and create natural social connections. Studies show that 80% of co-living residents feel more connected to their community than traditional renters85.

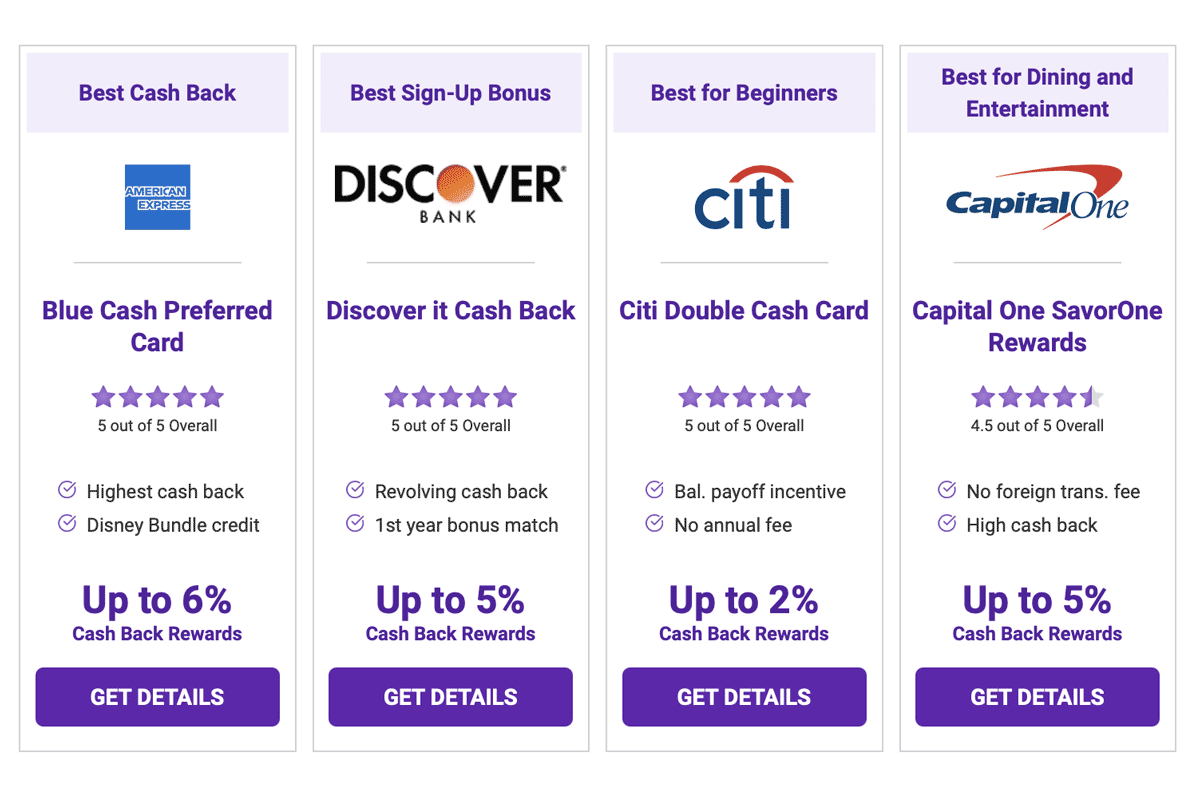

Maximize Cashback Rewards

Image Source: Reddit

Smart financial moves begin with getting the most rewards from everyday purchases. My years of advising singles on money management have helped me find effective ways to boost cashback earnings without changing spending habits.

Top Cashback Apps for Singles

Rakuten guides the pack and offers up to 40% cashback at select stores with quarterly PayPal payments86. Ibotta users earn between USD 10 to USD 20 monthly, while active users reach USD 300 per month86. Dosh stands out by providing instant cashback on purchases and eliminates waiting periods for rewards86.

Strategic Card Usage

Smart credit card choices are the foundations of effective cashback strategies. The Blue Cash Preferred® Card from American Express yields 6% cashback at U.S. supermarkets (up to USD 6,000 yearly, then 1%)86. So, try these proven approaches:

- Link cards to household bills without processing fees

- Schedule automatic payments to avoid interest charges

- Review quarterly bonus categories regularly

- Export budget data as backup safeguards

Stacking Rewards Programs

Your savings potential grows when you combine multiple reward streams. Rakuten’s browser extension works well with store-specific programs to increase earnings87. These stacking techniques work best:

- Layer cashback apps with credit card rewards

- Use shopping portals before making purchases

- Combine store loyalty programs with cashback offers

Statement credits give better value than merchandise when you redeem rewards. Chase rewards redeemed for Amazon purchases are worth 0.8 cents per point, compared to 1 cent for statement credits87. So, paying for purchases directly and applying rewards as statement credits later maximizes value.

Singles can build substantial savings without increasing expenses through these strategies. Active users who combine multiple reward streams earn between USD 2,000 to USD 2,300 yearly through smart cashback optimization88.

Build a Side Hustle Portfolio

Image Source: Shopify

Singles can build financial security by creating multiple income streams. My experience with clients shows that a well-laid-out side hustle portfolio can bring in extra money without affecting your main job.

Trending Gig Economy Opportunities

The gig economy keeps growing, with approximately 36% of U.S. adults making extra money through side hustles89. Content creation now guides the market, among social media management and virtual assistance90. Millennials make up 48% of gig workers, while Generation Z accounts for 30%91.

Remote opportunities have grown rapidly since 2025, particularly in:

- Marketing and web development

- Content creation and design

- Customer service and virtual assistance

- Technical consulting and advisory roles

Time Management for Side Hustles

A balanced schedule is a vital part of side hustle success. The data shows 72% of successful gig workers blend side work with their main jobs effectively91. Here’s how you can stay productive:

- Map out your project deadlines on a calendar

- Break work into 45-minute focused blocks

- Pick specific days for side hustle work

- Set firm boundaries with family and friends

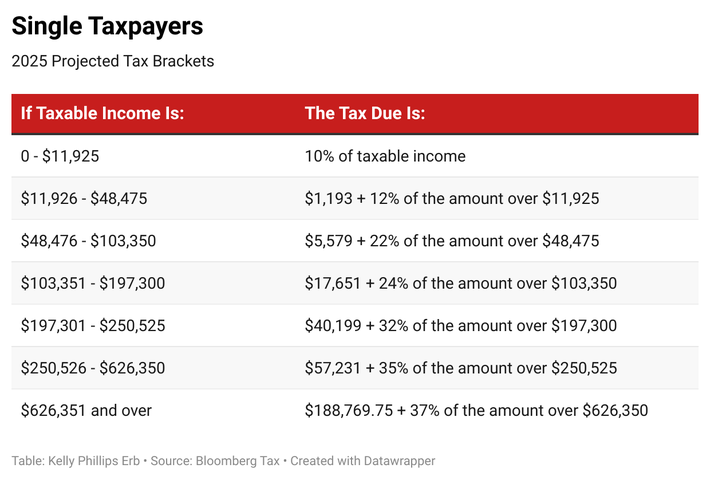

Tax Implications

Your side hustle success depends on understanding tax requirements. You must file taxes if your net gig earnings go over USD 40092. Here’s what you need to know:

- Tax payments are due quarterly: April 15, June 15, September 15, and January 1592

- Self-employment tax takes 15.3% of your earnings93

- Income tax ranges from 10% to 37% based on what you make93

Good record-keeping of business expenses helps optimize your tax situation. You can deduct business mileage, equipment costs, and home office expenses94. Smart planning means setting aside 25% of your side income for taxes93.

These strategies help singles build substantial extra income streams. The numbers back this up – active gig workers earn USD 24,000 on average each year91, making side hustles a powerful part of your financial plan.

Automate Your Investment Strategy

Image Source: Investopedia

Singles can now grow their wealth more easily with modern investment platforms. My research of automated investment options reveals strategies that combine convenience with the best possible returns.

Robo-Advisor Comparisons

Robo-advisors give you professional portfolio management at a fraction of what traditional services cost. Wealthfront and Betterment stand out with their detailed services95. The management fees range from 0.25% to 0.50% per year96. A USD 10,000 investment costs you USD 25 to USD 50 yearly96.

Key features you should think about:

- Automatic portfolio rebalancing

- Tax-loss harvesting capabilities

- High-yield savings options

- Goal tracking tools

Micro-investing Apps

Singles can start building wealth with minimal capital through micro-investing platforms. Acorns guides automated portfolio creation based on risk tolerance97. Robinhood gives you commission-free trading with a USD 1.00 minimum for fractional shares97.

Most micro-investing apps give you:

- Automated recurring deposits

- Round-up investment features

- Pre-built diversified portfolios

- Environmental, Social, and Governance (ESG) options97

Portfolio Diversification Tips

Long-term success depends on proper diversification. My experience shows spreading investments across multiple assets reduces risk while maintaining growth potential. Here’s what makes diversification work:

- Asset Class Distribution: Mix stocks, bonds, and other investments based on your risk tolerance98

- Geographic Variation: Include both U.S. and international investments98

- Sector Balance: Invest in different industries to minimize sector-specific risks98

- Regular Rebalancing: Review annually and adjust when allocations drift 5-10% from targets98

Mutual funds and ETFs provide straightforward diversification options98. Digital platforms now automatically build and manage diversified portfolios that line up with your goals and risk profile98. This automated approach helps singles maintain optimal asset allocation without constant portfolio monitoring.

Create a Singles Emergency Fund

Image Source: Bankrate

Your emergency fund works like a financial first-aid kit that helps you handle unexpected expenses without disrupting your long-term goals. I’ve helped many singles as a financial advisor to build strong safety nets that protect them when life throws curveballs.

Calculating Your Safety Net

Your lifestyle and income stability determine how much you need in your emergency fund. Singles with stable jobs need three months of expenses saved17. If you’re self-employed or have irregular income, you should save enough for six to nine months18.

Here’s how to figure out your target amount:

- Calculate monthly essential expenses (rent, utilities, groceries)

- Multiply by your risk factor (3-9 months)

- Add potential emergency costs (medical, car repairs)

Singles spend an average of USD 4,300 per month18. This means a three-month fund would need USD 12,90018. You can start with USD 500 – enough to handle common emergencies without going into debt19.

High-Yield Savings Options

The best high-yield savings accounts now offer APYs over 4%20. This is a big deal as it means that they beat traditional savings accounts that average 0.41%20. Your USD 10,000 balance can earn about USD 400 each year at these rates20.

Look for these features:

- FDIC insurance protection up to USD 250,00020

- No monthly maintenance fees

- Quick access to funds

- Automated deposit capabilities

You’ll find it easier to avoid impulse spending when you keep emergency funds separate from regular accounts21. High-yield accounts give you better returns while keeping your money accessible22. Even USD 10 weekly deposits add up to more than USD 500 per year19. The size of your first deposit matters less than saving consistently.

Keep in mind that an emergency fund isn’t optional – you really need one17. Singles can build financial security and earn good returns on their safety net with smart planning and the right account choice.

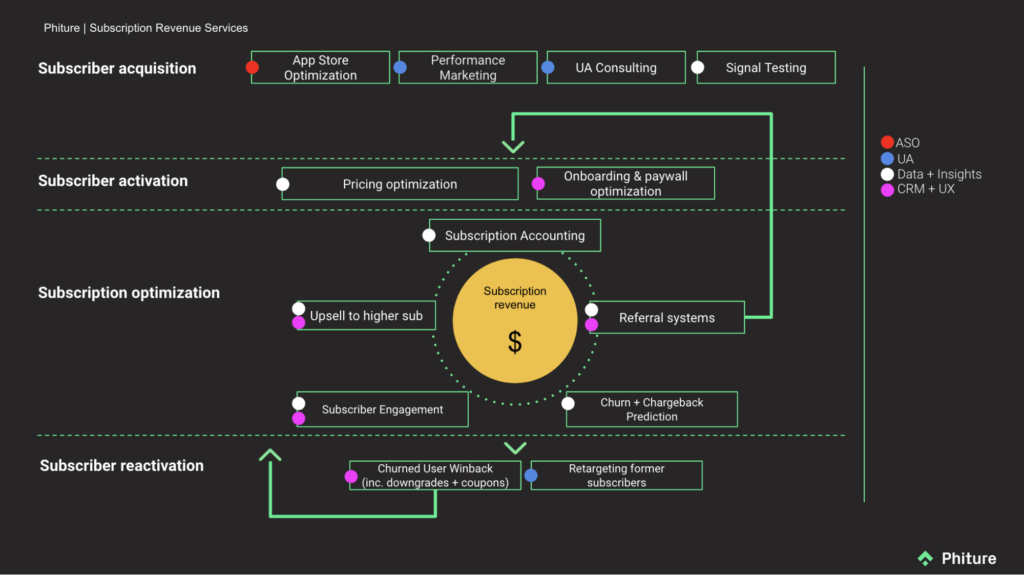

Optimize Subscription Services

Image Source: RevenueCat

Singles often underestimate their subscription costs, and 90% of consumers miss hundreds of dollars in subscription spending23. My years as a financial advisor have taught me several ways to cut these recurring costs.

Subscription Audit Strategy

The first step is to download your credit card statements from the past year23. This complete review reveals both monthly and yearly subscriptions you might miss. My latest audit showed USD 60 in monthly subscriptions I wasn’t using23.

A good audit should:

- Check all your payment methods

- List each subscription’s cost and renewal date

- Check how often you use each service

- Stop paying for services you don’t use right away

Sharing Economy Benefits

Subscription sharing can save you money in the sharing economy. This market could reach USD 827.10 billion by 20329. The platforms include insurance in their service fees11, which gives you protection and peace of mind.

The main benefits are:

- You save up to 44% on services11

- You get more choices11

- The environment benefits24

- You can access premium services as needed24

Negotiation Scripts

Smart negotiation can cut your subscription costs. Start by saying: “I’ve been reviewing my expenses and want to discuss ways to lower my bill or get more value”25. Then mention competitor prices you’ve researched and ask about current deals25.

December and January are the best months to contact providers because they launch new promotions25. Yearly subscriptions often cost less than paying monthly26. Make sure you get confirmation numbers and write down service agent names for all cancelations26.

These strategies help singles put subscription savings toward their money goals. Apps like Bobby or Hiatus help track regular payments27, but watch out for their fees that might eat into your savings27.

Master Meal Planning Technology

Image Source: U.S. Chamber of Commerce

Technology has transformed how single people plan their meals. Modern tools help them cut food costs and eat healthy at the same time. My experience as a financial advisor shows that clients who use AI-driven meal planning save 20-30% on their monthly grocery bills.

AI Meal Planning Tools

Modern AI systems create individual-specific meal plans that match your priorities, health needs, and diet restrictions28. These platforms look at over 176,000 meal choices to balance nutrition and cost28. MealMate AI creates weekly plans that work with your budget and schedule29. The system learns from your feedback and fine-tunes future suggestions29.

Grocery Savings Apps

Smart use of grocery apps leads to big savings. Flipp lets you compare prices at 2,000 stores to find the best deals30. Ibotta users earn between USD 10 to USD 20 monthly, while power users make up to USD 30031. Here’s what works best:

- Link store loyalty cards to save automatically

- Mix cashback offers with store sales

- Send shopping lists to delivery services

- Watch price histories of items you buy often

Bulk Buying Strategies

Smart bulk buying cuts costs by 56% on natural and organic products5. Success depends on good planning. Start by checking your storage space and how much you use32. Then pick non-perishable basics that last long33.

Check unit prices carefully before buying in bulk – bigger packages don’t always save money33. Wholesale clubs offer great deals, but you have options if you don’t want to pay membership fees33. You can also split bulk purchases with friends to save more without waste5.

These methods help singles make the most of their food budget while keeping quality and variety. AI meal planning users love how their systems balance dietary needs with cost savings – showing 100% satisfaction28.

Leverage Singles Travel Hacks

Image Source: Vacation Countdown App

Smart travel planning helps singles get the most from their vacation money. My years as a financial advisor have taught me proven ways to combine rewards programs with smart timing that cut costs.

Solo Travel Rewards Programs

Alaska Airlines Mileage Plan rewards miles based on distance flown instead of spending34. World of Hyatt delivers great value through points and elite benefits34. To get the best results, look for flexible points programs that let you move points between airlines and hotels35.

Group Travel Savings

Singles can cut costs with group travel packages. Right now, about 60% of tour participants travel solo10. Tour companies now match roommates to help solo travelers avoid single supplements36. Small groups of around 11 people give you both new friends and better prices10.

Timing Your Bookings

The right timing can save you big money on travel. Research shows:

- Book international flights 61-99 days before departure for best rates1

- Domestic flights are cheapest 3-6 weeks ahead1

- Flying Tuesday and Wednesday costs 20% less than weekends37

- Booking at 5 AM gets you better deals1

Money-saving tips that work:

- Book directly with airlines since prices are the same across search sites1

- Check nearby airports38

- Travel during off-peak times from June to August12

- Spring and fall trips mean fewer crowds and lower prices12

These strategies help singles see more places without breaking the bank. Changing your departure airport can save you money without affecting your plans much1. Many cities also offer free walking tours and samples at farmers’ markets that add value to your trip38.

Build Your Credit Score Strategically

Image Source: Self

Your credit score opens doors to better financial opportunities. My experience helping singles build credit shows that the right tools combined with consistent habits create amazing results.

Credit Building Apps

New apps make improving your credit score easier. StellarFi handles your bill payments and reports them to credit bureaus while you pay back through your bank account39. MoneyLion’s Credit Builder gives loans up to USD 1,000 and reports each payment to build your credit history39. SeedFi helps you build credit step by step with interest-free loans starting at USD 1040.

Secured Card Options

Secured credit cards help build credit effectively. These cards need a refundable security deposit that sets your credit limit41. Many secured cards now come with great features:

- Zero annual fees

- Free credit score monitoring

- Regular reviews to upgrade to unsecured cards

- Deposit returns when you use the card responsibly41

Most secured cards require deposits between USD 200 to USD 30042. Some card companies now offer lower deposits to make credit building easier for everyone42.

Score Monitoring Tools

Credit Karma stands out among free monitoring services with daily updates from two major credit bureaus6. MyFICO provides detailed scores from all three bureaus6. Experian Boost helps raise your scores by adding payments from:

- Streaming services

- Phone bills

- Utility payments

- Eligible rent payments43

Your credit score can improve when you become an authorized user on someone else’s credit card – even without using it44. Rent-reporting services add your on-time payments to credit reports, though some scoring models might not use this information43.

Singles can build strong credit profiles with these strategies. Regular on-time payments and keeping credit use under 30% will improve your scores steadily45.

Maximize Tax Benefits for Singles

Image Source: Forbes

Smart tax filing gives singles a chance to save money. My years as a financial advisor have taught me how to help clients pay less tax through careful planning and smart deductions.

Single Filer Advantages

Singles can tap into specific tax advantages that joint filers can’t access. The standard deduction for single filers is USD 14,60046. High-earning singles might land in a lower tax bracket than married couples. The 37% tax rate kicks in at USD 609,351 for singles, compared to USD 731,201 for joint filers47.

Deduction Opportunities

Singles can claim these tax breaks beyond the standard deduction:

- Educational credits like the American Opportunity Tax Credit (AOTC), worth up to USD 2,500 for qualified expenses47

- Capital loss deductions up to USD 3,000 yearly against income47

- Student loan interest deductions up to USD 2,50048

- Retirement savings contributions credit worth up to USD 1,00048

Singles who itemize can deduct:

- Mortgage interest and points46

- Charitable contributions up to 60% of adjusted gross income49

- Medical expenses exceeding 7.5% of adjusted gross income46

- State and local taxes up to USD 10,00048

Tax Planning Tools

The IRS gives you tools to make tax planning easier:

- Tax Withholding Estimator helps set the right W-4 settings50

- Interactive Tax Assistant helps you pick the right filing status13

- Sales Tax Deduction Calculator shows what you can deduct50

- EITC Assistant checks if you qualify for earned income credits50

Good record-keeping throughout the year makes tax preparation easier46. Quarterly reviews help you spot potential deductions and credits13. Smart tax planning helps singles keep more of their money while following IRS rules.

Create Passive Income Streams

Image Source: Stash

Singles can achieve financial freedom through passive income streams. My years of advisory experience have helped many clients create reliable revenue sources that need minimal effort to maintain.

Digital Product Creation

Digital products bring in steady income without high overhead costs. Successful creators now earn around USD 5,000 monthly from their digital offerings51. E-books priced between USD 20-40 make great starting points51. The digital media market will reach USD 560 billion by 202452. This growth creates amazing opportunities for creators.

Key digital products include:

- Online courses (USD 97-297 price range)51

- Templates and design assets53

- Educational PDFs and guides53

- Pre-made calculation sheets53

Rental Income Strategies

Smart property management leads to steady investment returns. Single-family rental rates have jumped 12.6% compared to last year14. The best results come from:

- Property location optimization14

- Regular market rent adjustments8

- Mutually beneficial alliances with property managers14

- Alternative rental approaches like room sharing8

Property owners see better cash flow over time because mortgage payments stay fixed while rents go up8. House hacking and room rentals help cut living costs. Monthly savings range from USD 275 to USD 1,595 based on location54.

Investment Dividends

Dividend investing creates reliable passive income streams. Dividends made up 40% of total S&P 500 returns from 1960 to 202155. Dividend aristocrats now offer yields between 1% and 6%54.

These strategies maximize dividend returns:

- Reinvest dividends to compound growth56

- Pick companies that raise dividends regularly56

- Watch payout ratios to ensure sustainability56

- Add dividend ETFs to spread risk54

A USD 10,000 investment in dividend ETFs generates USD 500 yearly54. REIT investments with 3.68% yields bring in about USD 373 annually54. Singles can build reliable financial security by combining several passive income streams.

Optimize Healthcare Costs

Image Source: Harvard Business Review

Healthcare costs can hit your financial stability hard. My years as a financial advisor in healthcare planning have shown me how smart choices can save you money.

HSA Optimization

Health Savings Accounts (HSAs) pack powerful tax benefits. Singles can put away up to USD 4,300 in 202557. People 55 and older get an extra USD 1,000 to contribute57. Your HSA contributions cut your taxable income, grow without taxes, and stay tax-free when you spend them on qualified medical expenses57.

To get the most from your HSA:

- Put in as much as you can

- Keep your money invested to grow

- Save your medical receipts

- Look for employer matching

Preventive Care Savings

Preventive care is the life-blood of affordable healthcare. Early problem detection through regular checkups can slash your future medical bills58. You pay no copays for these basic services:

- Annual wellness visits

- Cancer screenings

- Dental cleanings

- Immunizations

Research shows that people who stick to preventive care stay healthier and visit emergency rooms less often4. Regular checkups also help doctors manage chronic conditions better4.

Insurance Comparison Tools

The Health Insurance Marketplace lets you stack up different health plans side by side59. Look at these key factors:

- Plan deductibles (at least USD 1,650 for singles in 2025)57

- Out-of-pocket limits (capped at USD 8,050 for singles)57

- Prescription drug coverage

- Provider networks

The right plan needs a good match between your health needs and budget. Many tools help you crunch the numbers for different scenarios3. Your employer might chip in HSA money too – that’s free cash for healthcare57.

Smart planning and the right tools can build a resilient healthcare money strategy. HSAs work best when you pair them with preventive care and pick your insurance carefully to manage healthcare costs.

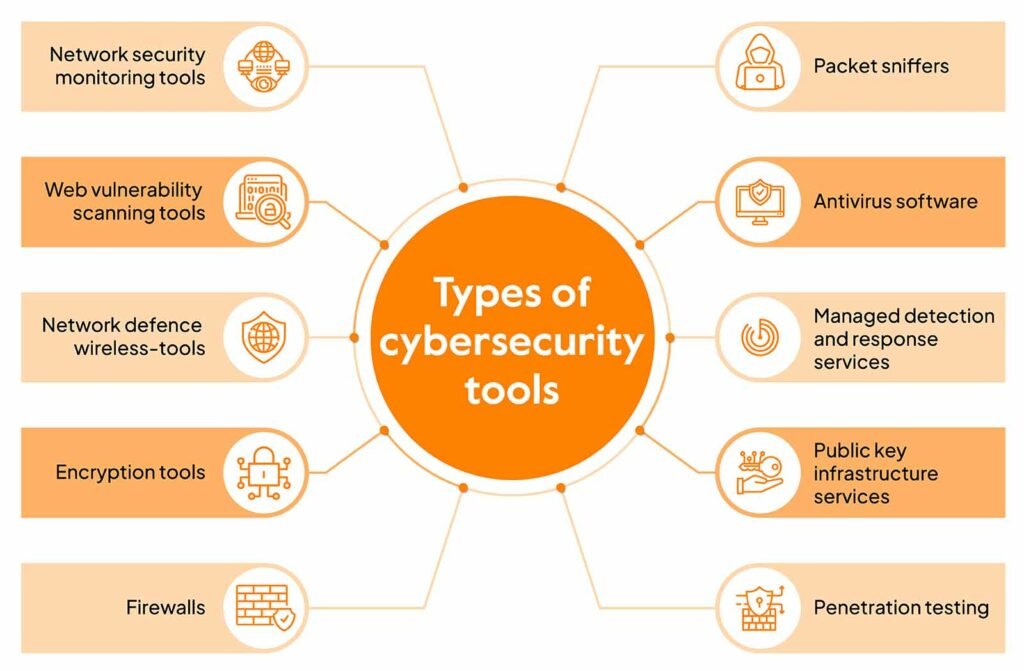

Build a Digital Security Net

Image Source: Sprinto

A complete security strategy protects your digital assets effectively. My experience with client financial security shows that strong digital protection safeguards your financial future.

Identity Theft Protection

Identity theft protection services watch your personal information and credit files to catch fraud early. Top services give you insurance coverage up to USD 1 million60. These platforms come with:

- Credit monitoring across major bureaus

- Dark web surveillance for stolen data

- Public records monitoring

- Expert case management support

Monthly costs range from USD 14 to USD 16 if you have individual needs, while family plans cost USD 20 to USD 3060. These services help limit damage from hacking attempts and help restore your identity if theft occurs.

Password Management

Password managers work like digital vaults for your credentials. Modern tools generate unique, lengthy passwords that are more than 20 characters61. These tools pack essential features like:

- Secure password generation

- Encrypted storage systems

- Multi-factor authentication options

- Automatic form filling capabilities

Premium password managers give you advanced features like secure password sharing and digital inheritance planning61. Many tools now include dark web monitoring to alert you when your credentials appear in data breaches.

Insurance Needs

Singles have different life insurance needs. People without dependents might skip life insurance unless special circumstances exist62. You should think over coverage if you have:

- Co-signed debts or mortgages

- Aging parents requiring support

- Business partnerships

- Desire to leave a legacy

Early coverage often means lower premiums62. Some policies build cash value that you can use during your lifetime63. The right digital security measures create strong protection for your financial assets while you retain control of your accounts.

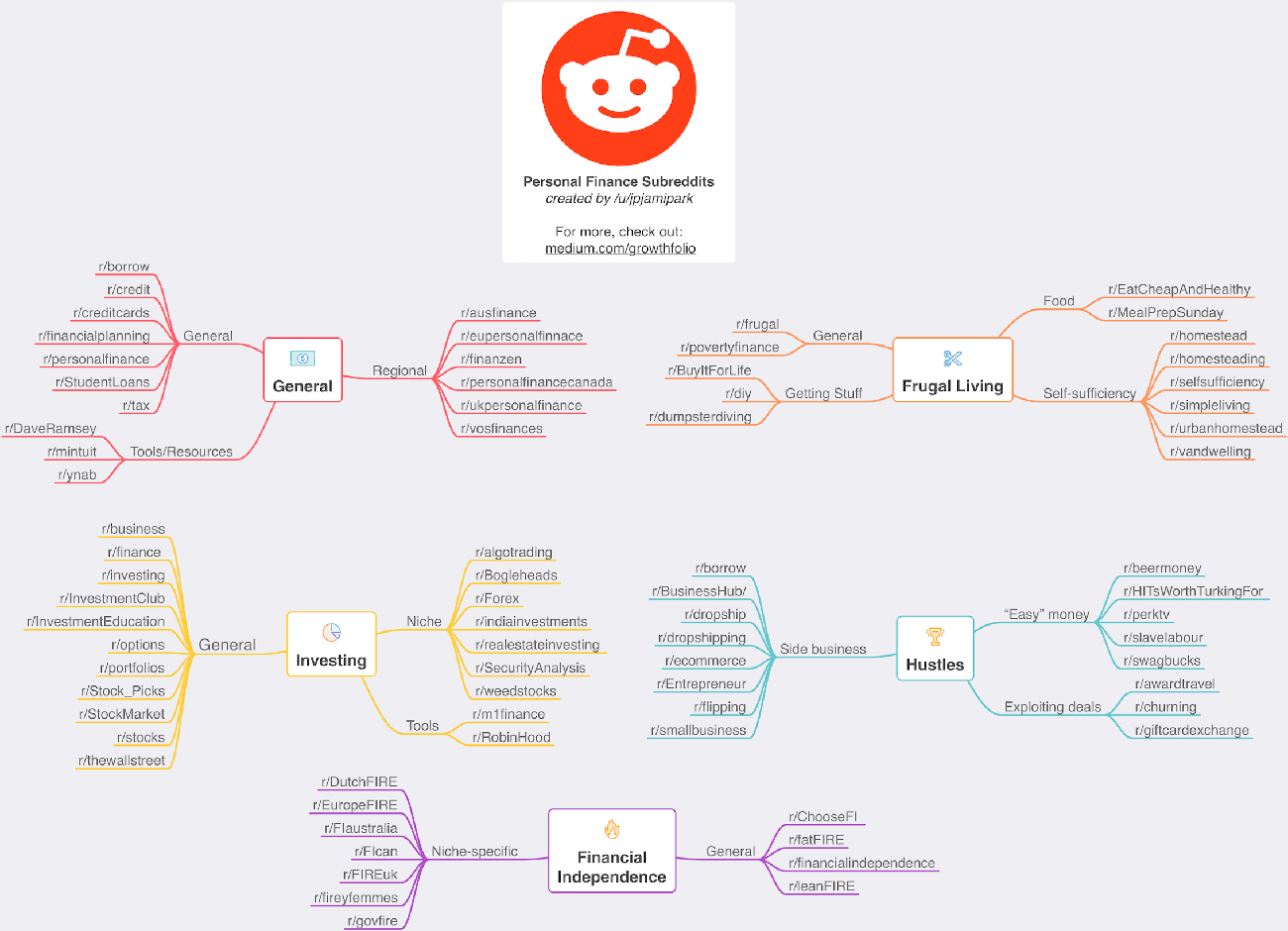

Join Money-Saving Communities

Image Source: Reddit

Singles can now manage and grow their money better through community-based savings groups. My years as a financial advisor have shown that these groups offer both money management benefits and social networks that help build long-term wealth.

Online Savings Groups

Digital savings platforms have changed traditional community banking methods. Members can save small, flexible amounts regularly and get loans from pooled funds64. Most platforms now work with mobile money, which removes the need to handle physical cash64. The number of people in savings groups worldwide has reached over 500 million65.

Through specialized platforms, members can:

- Request loans and make payments digitally

- Track contributions automatically

- Access emergency insurance funds

- Receive quarterly share distributions

Local Frugal Networks

Local savings communities show amazing results. Active groups manage pooled funds that exceed USD 12,000 within 18 months16. These networks usually have 20-30 members who get detailed training16. Women make up 80% of participants, which helps promote both financial growth and gender equality65.

Resource Sharing Platforms

Resource sharing goes beyond traditional savings groups. ReShare, a community-driven platform, helps collaboration through document delivery and digital lending66. These platforms use peer-to-peer principles that let members:

- Find affordable ways to share resources

- Access materials they can’t find locally

- Join multiple communities

- Learn from shared expertise

Savings groups work as vital training platforms that include messages about nutrition and personal well-being65. These communities build social capital and create safe spaces where members support each other and develop leadership skills65. Members contribute to savings and social funds during weekly meetings to create microinsurance protection for emergencies16.

Members find their collective power through community participation16. The interest earned from internal lending goes to members’ accounts instead of outside institutions16. Digital platforms now let entire savings groups work through shared smartphones, which speeds up communication and resource distribution67.

Plan for Solo Retirement

Image Source: Investopedia

Singles face unique challenges when planning for retirement. My years of helping solo retirees have shown that careful calculations and smart investments will create strong financial security.

Single Person Retirement Calculations

A single person’s retirement needs differ substantially, with most needing 70-90% of their pre-retirement income68. Social Security benefits replace only 40% of pre-retirement income68. Your target savings should include:

- Calculate annual retirement expenses (average USD 37,700)69

- Multiply by expected retirement years (plan until age 95)70

- Factor in inflation and healthcare costs

- Subtract projected Social Security benefits

Singles need USD 548 monthly in retirement savings to maintain their lifestyle69. A well-planned retirement strategy that starts early can grow to USD 3.8 million by retirement age70.

Investment Strategies

Self-employed singles can get powerful retirement benefits through Solo 401(k)s. The contribution limits now reach USD 66,000 annually and increase to USD 73,500 for those over 5015. These accounts give you:

- Pre-tax or Roth contribution options15

- Investment flexibility including real estate

- Loan provisions up to USD 50,00015

- Protection from creditors

Legacy Planning

Singles without default heirs need careful estate planning. Simple requirements include:

- Durable power of attorney for financial decisions71

- Healthcare power of attorney for medical choices71

- Revocable living trust for asset management71

- Detailed will specifying asset distribution71

We recommend choosing trusted individuals a generation younger as decision-makers7. Charitable trusts work well for long-term giving71. Your advance directives will ensure medical staff honor your healthcare wishes7.

Support systems matter beyond traditional planning. Naturally occurring retirement communities (NORCs) or village-to-village networks provide built-in support7. These communities give both practical help and social connections that singles need as they age7.

Comparison Table

| Strategy | Main Benefit | Cost Range | Average Savings | Key Features | Implementation Difficulty |

|---|---|---|---|---|---|

| AI-Powered Budgeting Apps | Automated money tracking | $2.99-$14.99/month | Not mentioned | Immediate tracking, automated sorting, future predictions | Easy |

| Digital Envelope System | Better spending control | Free-$10/month | Not mentioned | Smart transfers, budget categories, digital monitoring | Moderate |

| Living Situation Optimization | Lower housing expenses | 20-50% less than standard rentals | Not mentioned | Shared living spaces, split utilities, flexible lease terms | Complex |

| Cashback Rewards | Money back on purchases | Free-$95/year | $2,000-$2,300/year | Multiple reward types, bonus periods, auto redemption | Easy |

| Side Hustle Portfolio | Extra income sources | Varies by activity | $24,000/year | Work from home options, flexible hours, varied income | Complex |

| Automated Investment Strategy | Expert portfolio handling | 0.25-0.50% annually | Not mentioned | Smart rebalancing, tax benefits, goal monitoring | Moderate |

| Singles Emergency Fund | Money safety net | Free with high-yield accounts | 4% APY on savings | FDIC insurance, easy access, scheduled deposits | Easy |

| Subscription Services | Lower monthly bills | Varies | $60/month potential savings | Service reviews, shared accounts, better rates | Easy |

| Meal Planning Technology | Cheaper food costs | Varies | 20-30% on groceries | Smart meal suggestions, savings tools, bulk buying tips | Moderate |

| Singles Travel Hacks | Cheaper trips | Varies | 20% on flights | Points systems, group deals, best booking times | Moderate |

| Credit Building | Better money options | $200-$300 deposit | Not mentioned | Score tracking, secured cards, payment history | Moderate |

| Tax Benefits | Lower taxes owed | Free-$500 for software | Up to $2,500 in credits | Basic deduction, school credits, investment write-offs | Complex |

| Passive Income Streams | Regular extra money | Varies | $500-5,000/month | Online products, rental earnings, stock dividends | Complex |

| Healthcare Cost Optimization | Lower medical bills | $14-30/month | Up to $4,300 HSA contribution | HSA perks, preventive care, insurance options | Moderate |

| Digital Security Net | Protect your assets | $14-16/month | Up to $1M insurance coverage | ID protection, password tools, insurance plans | Easy |

| Money-Saving Communities | Shared resources | Free-Varies | $12,000 pooled funds/18 months | Web groups, local networks, resource pools | Easy |

| Solo Retirement Planning | Future money security | Varies | $3.8M potential by retirement | Investment plans, estate planning, group support | Complex |

Closure

My 13 years as a financial advisor have shown that these 17 money-saving strategies help singles build substantial wealth. AI-powered tools, smart housing choices, and automated investments are the foundations of financial success.

Singles who use these methods save 20-30% on daily expenses while creating multiple income streams. My clients earn $24,000 yearly through side hustles. They redirect subscription savings to investments and maximize tax benefits with careful planning.

The path to success begins with small steps that scale up gradually. You can start with two or three strategies that line up with your situation. AI budgeting apps and automated investments make excellent starting points. Additional techniques can be added as your confidence grows and results become visible.

Financial independence needs both knowledge and consistent action. Singles who blend these strategies with daily habits build impressive wealth steadily. To learn about customized approaches that match your financial goals, reach out to us at support@trendnovaworld.com.

A single step launches your path to financial freedom. These proven strategies, backed by real-life results, show the way forward for singles ready to take charge of their financial future.

To learn more visit:

15 Simple Family Budget Tips That Actually Save Money in 2025

FAQs

Q1. How can singles effectively manage their finances in 2025? Singles can leverage AI-powered budgeting apps, optimize their living situation through co-living or modern housing alternatives, and build multiple income streams through side hustles and passive income strategies. Additionally, maximizing cashback rewards and strategically planning for taxes can lead to significant savings.

Q2. What are some innovative ways for singles to save money on everyday expenses? Singles can use AI meal planning tools to reduce grocery costs, optimize subscription services through regular audits, and join money-saving communities for resource sharing. Utilizing cashback apps and strategic credit card usage can also provide substantial savings on daily purchases.

Q3. How can singles build a strong financial foundation for the future? Singles should focus on creating an emergency fund, automating their investment strategy through robo-advisors or micro-investing apps, and planning for solo retirement. Building a good credit score and considering passive income streams like digital product creation or rental income can also contribute to long-term financial stability.

Q4. What are some effective strategies for singles to reduce healthcare costs? Singles can optimize healthcare costs by maximizing HSA contributions, focusing on preventive care, and using insurance comparison tools to find the best coverage. Additionally, joining health-sharing communities or exploring telemedicine options can lead to further savings.

Q5. How can singles protect their finances and personal information in the digital age? Singles should build a digital security net by using identity theft protection services, implementing robust password management systems, and considering appropriate insurance coverage. Staying informed about the latest cybersecurity practices and regularly monitoring credit reports can also help safeguard personal and financial information.

References

[1] – https://www.flashpack.com/us/solo/travel/travel-tips/fairs-fare-the-best-days-and-months-to-book-airline-tickets-your-ultimate-guide/

[2] – https://softwarehouse.au/blog/7-best-personal-finance-apps-in-2025/

[3] – https://www.nerdwallet.com/a/health/health-insurance

[4] – https://www.nebraskamed.com/health/conditions-and-services/primary-care/how-preventive-care-can-lower-your-health-care-costs

[5] – https://www.greenamerica.org/your-green-life/how-buy-bulk

[6] – https://www.investopedia.com/the-best-credit-monitoring-services-8763926

[7] – https://www.nytimes.com/2024/09/21/business/retirement-single-alone-plan.html

[8] – https://www.biggerpockets.com/blog/rookie-490

[9] – https://www.investopedia.com/terms/s/sharing-economy.asp

[10] – https://www.exploreworldwide.com/experiences/holidays-for-solo-travellers

[11] – https://www.progressive.com/resources/insights/new-face-of-sharing-economy/

[12] – https://www.girlabouttheglobe.com/best-time-of-year-to-travel-solo/

[13] – https://www.irs.gov/newsroom/year-round-tax-planning-pointers-for-taxpayers

[14] – https://www.forbes.com/councils/forbesbusinesscouncil/2022/05/03/five-tips-for-successful-single-family-rental-investing/

[15] – https://www.forusall.com/401k-blog/solo401k-guide

[16] – https://rlo.acton.org/archives/114890-savings-groups-for-global-transformation.html

[17] – https://fcaa.org/2023/06/19/building-your-safety-net/

[18] – https://www.ramseysolutions.com/saving/quick-guide-to-your-emergency-fund?srsltid=AfmBOorKEdtyaBr1WPX4VZ_isFHL_W6G4PmKhCYh3v2NLtjKN0Re9X0C

[19] – https://www.nerdwallet.com/article/banking/emergency-fund-calculator

[20] – https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

[21] – https://www.discover.com/online-banking/banking-topics/where-to-keep-emergency-fund/

[22] – https://www.synchrony.com/blog/bank/high-yield-savings-emergency-funds

[23] – https://www.cnbc.com/2022/03/28/subscription-audit-can-save-you-hundreds-of-dollarshow-to-do-it.html

[24] – https://www.twicecommerce.com/blog/what-is-the-sharing-economy

[25] – https://www.nerdwallet.com/article/finance/use-this-script-to-lower-your-cable-and-internet-bills

[26] – https://www.apartmenttherapy.com/subscription-audit-tips-36991895

[27] – https://www.nerdwallet.com/ca/personal-finance/how-subscription-audit-helps-save-money

[28] – https://pmc.ncbi.nlm.nih.gov/articles/PMC10436119/

[29] – https://theresanaiforthat.com/ai/mealmate/

[30] – https://www.ramseysolutions.com/budgeting/best-coupon-apps?srsltid=AfmBOopDuCDH3L9h_VRw7cx-_JAR6SeYK_2dE9hMgX7LG4L5gsMFR40L

[31] – https://www.bankrate.com/personal-finance/apps-that-will-help-you-save-money-on-food/

[32] – https://updater.com/moving-tips/how-to-buy-in-bulk/

[33] – https://www.nerdwallet.com/article/finance/buy-in-bulk

[34] – https://www.nerdwallet.com/article/travel/travel-loyalty-program-reviews

[35] – https://www.afar.com/magazine/the-best-airline-loyalty-programs-to-consider-in-2025

[36] – https://www.gct.com/ways-to-save/solo-traveler

[37] – https://wowfare.com/blog/mastering-the-timing-for-your-solo-travel-adventures-with-the-complete-guide-to-booking-flights/

[38] – https://ordinarytraveler.com/best-travel-hacks-save-money

[39] – https://www.bankrate.com/personal-finance/credit/credit-building-apps/

[40] – https://www.edvisors.com/money-management/credit/best-credit-building-apps/

[41] – https://money.usnews.com/credit-cards/secured

[42] – https://www.nerdwallet.com/best/credit-cards/secured

[43] – https://www.nerdwallet.com/article/finance/raise-credit-score-fast

[44] – https://www.forbes.com/sites/truetamplin/2024/11/28/how-to-improve-your-credit-score–8-simple-rules-and-strategies/

[45] – https://concenturewealth.com/5-easy-ways-to-improve-your-credit-score/

[46] – https://www.irs.gov/credits-and-deductions-for-individuals

[47] – https://blog.taxact.com/4-tax-advantages-for-solo-filers/

[48] – https://www.kiplinger.com/taxes/602075/most-overlooked-tax-breaks-and-deductions

[49] – https://www.schwab.com/learn/story/year-end-portfolio-checkup-5-tax-smart-tips

[50] – https://www.irs.gov/help/tools

[51] – https://www.businessinsider.com/how-to-make-money-online-passive-income-digital-product-ideas-2022-12

[52] – https://www.theleap.co/blog/sell-digital-products-passive-income/

[53] – https://www.paigebrunton.com/blog/passive-income-ideas-digital-products

[54] – https://www.nerdwallet.com/article/investing/what-is-passive-income-and-how-do-i-earn-it

[55] – https://www.lenoxadvisors.com/insights/dividend-growth-investing-as-a-long-term-strategy/

[56] – https://www.dividend.com/dividend-education/the-ten-commandments-of-dividend-investing/

[57] – https://www.investopedia.com/maximize-your-hsa-8599495

[58] – https://www.cdc.gov/chronic-disease/prevention/preventive-care.html

[59] – https://finder.healthcare.gov/

[60] – https://www.security.org/identity-theft/best/

[61] – https://www.pcmag.com/picks/the-best-password-managers

[62] – https://www.chubb.com/nz-en/articles/personal/no-dependents-no-worries-life-insurance-for-single-people.html

[63] – https://www.cbsnews.com/news/do-i-need-life-insurance-if-im-single/

[64] – https://bfaglobal.com/insights/digital-savings-groups/

[65] – https://stories.globalcommunities.org/crisis-to-resilience/technology-innovation/women-saving-for-resilience-transforming-lives-through-savings-groups/index.html

[66] – https://www.indexdata.com/reshare/

[67] – https://www.wvi.org/livelihoods/savings-transformation

[68] – https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/dol-top-10-ways-to-prepare-for-retirement-booklet-2023.pdf

[69] – https://smartasset.com/retirement/retirement-calculator

[70] – https://www.bankrate.com/retirement/retirement-plan-calculator/

[71] – https://creativeplanning.com/insights/estate-planning/estate-planning-unmarried/

[72] – https://www.sofi.com/learn/content/ai-budgeting-tools/

[73] – https://www.ramseysolutions.com/budgeting/budgeting-apps-comparison?srsltid=AfmBOoqnx_B-SC55GcAlm6-8GKybZKgB9Tqb0RKW5UPXm1IyoDK2-bu0

[74] – https://www.nerdwallet.com/article/finance/best-budget-apps

[75] – https://www.pcmag.com/picks/the-best-personal-finance-services

[76] – https://www.quorumfcu.org/learn/money-management/the-digital-envelope-budgeting-system/

[77] – https://www.fundingcloudnine.com/cash-envelope-system-problems/

[78] – https://www.penfed.org/learn/how-to-set-up-an-envelope-budget-with-or-without-cash

[79] – https://www.planeasy.ca/managing-cash-flow-using-the-digital-envelope-budget-system/

[80] – https://m1.com/knowledge-bank/digital-envelope-system/

[81] – https://university.heavnn.io/coliving-vs-traditional-accommodation-a-cost-comparison/

[82] – https://mrsc.org/explore-topics/housing-homelessness/housing/types-of-affordable-housing

[83] – https://www.buildwithrise.com/stories/guide-to-the-most-affordable-types-of-homes

[84] – https://www.habitat.org/costofhome/optimizing-land-use-affordable-homes

[85] – https://rentremote.com/blog/coliving-vs-renting-cost-breakdown

[86] – https://www.cnbc.com/select/best-cash-back-apps/

[87] – https://www.bankrate.com/credit-cards/cash-back/maximize-cash-back-strategy/

[88] – https://www.kiplinger.com/personal-finance/rewards-credit-cards/how-to-maximize-your-credit-card-rewards

[89] – https://fundo.com/the-future-of-the-gig-economy/

[90] – https://bigteam.ai/blog/top-gig-economy-jobs-2025-succeed

[91] – https://www.getwhizz.com/blog/for-delivery/gig-economy-and-delivery-statistics?srsltid=AfmBOoqRGmnRavC-a7BRcpImQm5yuphPFig8at0JYLzdiGXmdxrqCNzm

[92] – https://www.irs.gov/businesses/small-businesses-self-employed/manage-taxes-for-your-gig-work

[93] – https://smartasset.com/taxes/how-to-avoid-paying-taxes-on-side-jobs

[94] – https://turbotax.intuit.com/tax-tips/self-employment-taxes/side-giggers-tax-tips-for-side-jobs/L6025l8Uh

[95] – https://www.nerdwallet.com/best/investing/investment-apps

[96] – https://www.bankrate.com/investing/best-robo-advisors/

[97] – https://financebuzz.com/best-micro-investing-apps

[98] – https://investor.vanguard.com/investor-resources-education/portfolio-management/diversifying-your-portfolio

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com