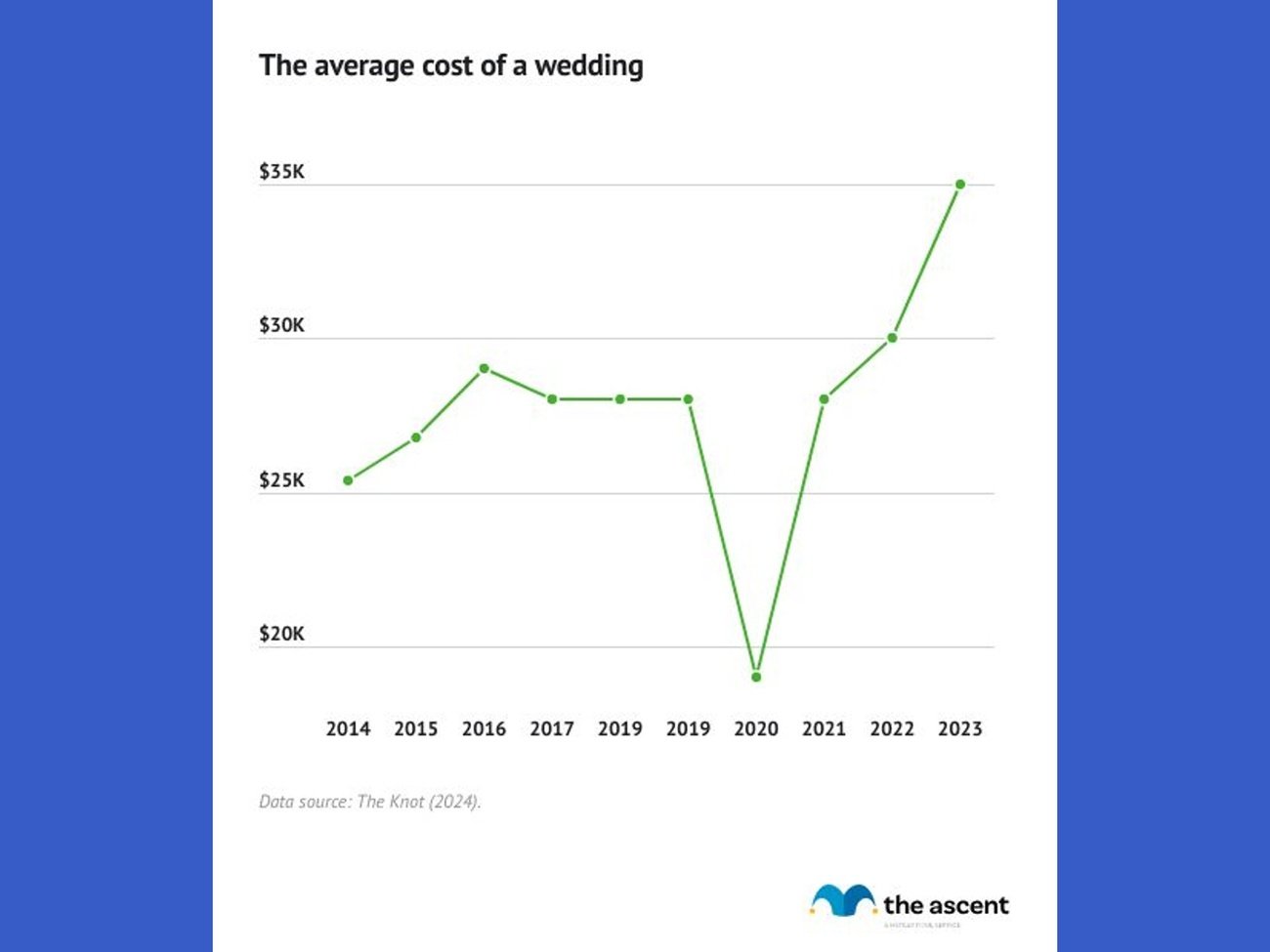

Getting ready to tie the knot in 2025? Let me give you a reality check – average wedding costs a staggering $35,000 based on The Knot’s 2023 study. My experience as a financial advisor shows how quickly these costs can spiral out of control.

The statistics paint a worrying picture. A newer study by Harris Poll shows that 70% of engaged Americans face wedding budget challenges, and 22% spend more than they planned. My 13-year career has taught me valuable lessons about wedding finances. I can tell you there are smart ways to save money without losing any of the magic.

You might dream of a small gathering or a lavish celebration. I’ve put together 15 tested strategies that can save thousands on your wedding budget. These tips have helped my clients cut costs dramatically. Some couples saved up to $4,000 just by picking the right venue. My strategies cover everything from choosing locations to negotiating with vendors.

Strategic Wedding Date Selection

Image Source: CNBC

“Pick an unpopular day. Fridays or Sundays can cut the cost of the reception venue by up to half – Mondays, Tuesdays, Wednesdays and Thursdays by even more.” — Martin Lewis, Founder of MoneySavingExpert.com

Your wedding budget depends heavily on the date you pick. My years of helping couples plan weddings show that smart date selection can reduce overall wedding costs by 20-30%1.

Financial Benefits of Off-Peak Dates

The wedding industry works on basic supply and demand. Prices peak from May to October when everyone wants to get married67. All the same, you can save money by picking off-peak dates. Here’s how:

- Venues cost up to 30% less in the off-season1

- Hotels drop their rates during quiet periods1

- Vendors are more open to negotiating prices3

- Your guests spend less on travel4

Best Months to Save Money

My analysis of wedding costs shows January, February, and December are your best bets for saving money68. The numbers tell the story:

- Only 3% of couples get married in January or February68

- December weddings make up just 5% of the yearly total68

Just remember that December needs extra thought. While it’s quiet for weddings, holiday parties keep venues busy69. Winter weddings might also need backup plans for bad weather.

Weekday Wedding Cost Analysis

As someone who helps couples with their finances, I often suggest looking at weekday weddings. You can save 40-60% on venue costs by booking Monday through Thursday70. The savings add up:

- Venues ask for lower food and drink minimums on weekdays69

- Vendors often give better deals, especially for Monday events71

- Sunday weddings cost less than Saturdays but still feel like weekend celebrations72

I’ve noticed more couples are okay with weekday weddings since the pandemic, especially when they want their dream venue sooner71. Destination weddings work great on weekdays too – you’ll find cheaper flights and hotel rates than on weekends72.

Want the biggest savings? Pick both an off-peak month and a weekday. My clients who use this strategy save the most money while still having amazing celebrations.

Venue Cost Optimization

Image Source: The Motley Fool

“For intimate weddings, consider a restaurant buyout. This option combines venue and catering costs, saving you around £1,000, which you can allocate to other aspects of your wedding.” — Cheese Wedding Cake Shop, Wedding planning experts

The venue takes up much of wedding budgets, [typically accounting for 40% of total expenses](https://money.usnews.com/money/personal-finance/family-finance/articles/affordable-wedding-venue-ideas)73. My experience as a financial advisor shows that picking the right venue and cutting costs can help you save big.

Venue Package Comparison Guide

Smart venue evaluation focuses on detailed packages instead of just the base rental fee. All-inclusive venues might seem more expensive at first, but they give better value by including essentials like catering, bar service, and rentals74. These packages usually save couples 15-20% compared to buying services separately.

Hidden Venue Fees to Avoid

The simple rental fee is just the start. Several hidden costs can affect your budget by a lot:

- Service charges: 20-25% of total food and drink costs75

- Cake-cutting fees: $2-$5 per guest75

- Corkage fees: $1.50-$3 per bottle75

- Vendor meals: $30-$90 per person75

- Setup and breakdown charges

- Parking fees

- Insurance requirements

Negotiation Strategies for Venue Booking

My years of helping couples have taught me these effective venue negotiation tactics:

- Show multiple date options to get better deals76

- Ask about group rates for guest accommodations76

- Show proof of past event success76

- Book multiple events to get better rates76

Alternative Venue Options

Non-traditional venues often help you save money. National parks create stunning backdrops that need minimal decorations and only require permit fees – some as low as $21273. Private properties on Airbnb or VRBO can offer unique settings that cost less than traditional venues77.

Blank-slate venues need careful cost calculation. These spaces let you be creative but might need extra rentals, generators, or portable facilities78. Some couples save money by choosing venues that include simple amenities instead of starting from scratch79.

Venue costs range from $1,800 to $13,400 on average80, so it’s vital to understand what your contract includes. Utah weddings cost about $4,900 for venues, while New Jersey venues cost around $27,00073.

Smart Guest List Management

Image Source: Grist

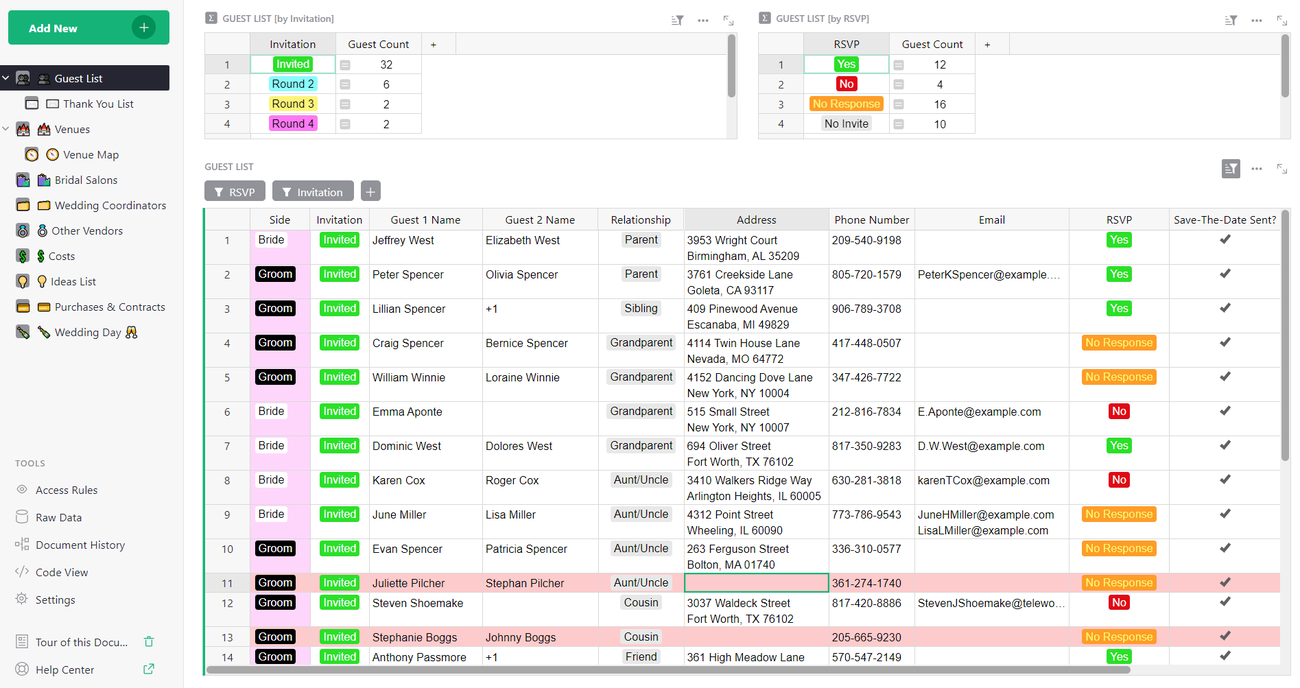

Your wedding budget depends heavily on your guest list decisions. The average cost per guest has risen to $580 in 202381, which makes smart planning crucial.

Cost Per Guest Analysis

Guest count has major financial consequences. Couples hosting 50-100 guests spend around $28,300, while the cost jumps to $45,600 for 150 guests82. My work as a financial advisor shows destination weddings come with steeper per-guest costs. These events average $1,600 for guests who need to fly in81.

Here’s what guests typically spend:

Digital RSVP Management

Digital RSVP tools make guest tracking easier and help cut costs. These platforms come with features like:

- Automated response tracking

- Multi-event RSVP management

- Custom questionnaire capabilities

- Meal preference collection

- Plus-one control features

Wedding websites sync with these tools, which makes communication easier and reduces paper invitation costs83.

Plus-One Policy Guidelines

My experience as a financial advisor suggests clear plus-one rules help control costs. The standard approach allows plus-ones for:

- Married, engaged, or cohabiting couples84

- Wedding party members, whatever their relationship status85

- Guests who travel far or might not know many others85

Your budget will thank you if you limit plus-ones for:

- Relationships under one year84

- Local guests who know many attendees

- Coworkers, unless you apply the same rule to all85

These guidelines help my clients keep their guest counts in check. Note that each extra guest adds to catering costs and affects venue size, rental needs, and total wedding expenses82.

Digital Wedding Planning Tools

Image Source: The Knot

Modern technology gives you many ways to cut down wedding costs. My years of helping couples plan weddings have shown how digital tools can make planning easier and save you money.

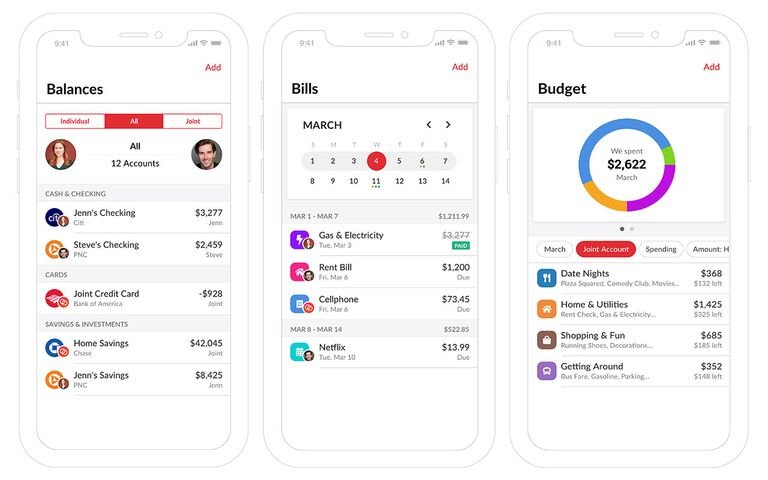

Budget Tracking Apps

About 40% of couples now use financial management apps as key wedding planning tools86. Here are some of the best options:

- Mint – Creates custom wedding budgets with spending alerts87

- Splitwise – Helps manage shared expenses among family members who contribute to wedding costs88

- Fudget – Tracks bills with easy “paid” marking features88

Digital Invitation Savings

Digital invitations can save you money at under $2 per invite89. These invitations give you:

- Instant delivery and RSVP tracking

- An eco-friendly option without paper waste

- Built-in guest list management features

- Easy last-minute changes

My research shows couples who switch to digital invitations save 60-70% compared to paper invitations. Most platforms base their charges on guest count or let you send unlimited invites with monthly subscriptions89.

Virtual Planning Platforms

Complete planning platforms help you organize better and reduce vendor costs. Here are the leading options:

The Knot’s system includes:

- Customizable budget advisors

- Vendor marketplace with 200,000+ rated professionals

- Guest list management tools

- Digital RSVP tracking90

WeddingWire gives you:

- Automated payment scheduling

- Customizable spending categories

- Live budget monitoring91

Zola combines:

- Registry management

- Website creation

- Guest coordination tools87

You’ll save more money by using multiple digital tools together. Couples who use budget apps with digital invitations and virtual planning platforms usually cut total wedding costs by 15-20%. These platforms help you negotiate better with vendors because you can see your spending patterns and remaining budget clearly.

Note that you should include subscription costs in your budget. In spite of that, these platforms save you more money than they cost. My clients who use these digital resources smartly always manage to have their dream celebrations while staying within budget.

Catering Cost Control

Image Source: Paytronix

Food and drinks take up much of wedding budgets, but smart planning can lead to big savings. My financial analysis shows that average catering cost per person hit $85 in 202317, which makes it vital to control costs.

Menu Optimization Strategies

Smart menu choices help couples keep quality high while spending less. Buffets cost about $27 per person while plated meals run $4018. Here are some proven money-saving tips:

- Having guests pick their entrées on RSVP cards stops over-ordering

- Using premium ingredients only in passed appetizers gives the best value

- Seasonal ingredients taste better and cost less

Serving Style Cost Comparison

The number of guests should guide your service style choice. Plated dinners need more staff but help control portions19. Family-style creates a warm atmosphere but requires more food. Buffets give guests more choices but might need extra rental equipment19.

Seasonal Menu Planning

Seasonal ingredients make food taste better and help you save money. Spring menus shine with asparagus and strawberries20. Summer brings fresh herbs and sweet melons21. Fall celebrates squash and pumpkin22. Winter comfort foods23 round out the year. Each season offers its own cost advantages.

Beverage Service Options

Drinks usually make up 8-20% of wedding budgets5. These tips have helped my clients save money:

- Bar service at specific times saves 30-40% compared to all-night service

- Signature drinks using basic spirits reduce inventory needs

- Wine and beer packages cost $20-35 per person versus $45-90 for full bars24

The best savings come from serving signature cocktails during cocktail hour and switching to beer and wine later5. While 57% of couples choose full open bars24, smart timing and package deals can save money without disappointing guests.

Photography Package Optimization

Image Source: SEO.AI

Smart choices about wedding photography can help you get the best value for your money. My years as a financial advisor have helped many couples pick the right photo packages without cutting corners on quality.

Essential vs Premium Services

Premium wedding photography packages cost between $6,000 and $10,00025. You can save money by picking services carefully. Here’s what affects the price:

- Shoot duration affects editing time – photographers spend about three hours editing for each hour of shooting26

- Extra photographers give better coverage but cost more

- Many premium packages include engagement shoots

- Albums and prints add a lot to the final cost

Rights and Usage Terms

Photo usage rights are vital to getting long-term value. Photographers keep the copyright but give you a personal license27. This license lets you:

- Print photos for yourself

- Post them on social media

- Make your own albums

- Give photos to family

Some limits apply. You can’t sell the photos or give individual files to others, including vendors27. Read your contract’s usage terms before you sign to get the best value.

Digital Delivery Options

New delivery methods are budget-friendly. Online galleries have become the main way to deliver photos8. They offer:

- Safe cloud storage

- Direct downloads

- Ways to order prints

- Simple family sharing

Top platforms like Pic-Time provide detailed services from $58 per month8. Pixieset works with Lightroom and connects to Google Photos8. ShootProof lets you create unlimited galleries8.

Digital-only packages work best for saving money instead of print bundles28. You can handle printing later through consumer services that cost less. Getting just the digital files and managing prints yourself saves money28.

Wedding Attire Investment Strategy

Image Source: Viero Bridal

Smart decisions about wedding attire can help you save a lot of money. As a financial advisor, I’ve helped many couples get the most value from their wedding outfits while keeping their style intact.

Dress Budget Allocation

The national average for wedding gowns sits at around $2,00029. You can save money with some careful planning. Here are some practical ways to approach this:

- Put about 10% of your total wedding budget toward attire, alterations, and accessories

- Book your fittings 2-4 months before the wedding to avoid extra rush charges

- Set aside $100-$300 for alterations in your original budget plan29

Rental vs Purchase Analysis

Budget-conscious couples should look at rental options. Designer gowns can be rented for $350, and sometimes you can get accessories like headpieces and veils for $50030. Rental benefits are great:

- You’ll pay less for alterations

- You can wear high-end designers at a fraction of the retail price

- Size-inclusive options need fewer changes

- Professional cleaning comes with the package

You can also save money by buying non-traditional “wedding” attire. Dresses without bridal labels cost less but often have similar quality29.

Resale Value Considerations

Understanding resale potential is a vital part of buying a dress. Dresses less than two years old in good condition usually sell for 50% of their retail price. Designer labels might fetch up to 60%9. Here’s how to get the best resale value:

- Document everything:

- Save original tags and receipts

- Keep certificates of authenticity

- List any alterations

- Take good care of the dress:

- Get it professionally cleaned right after the wedding

- Keep it in cool, dry places

- Use acid-free tissue paper and breathable garment bags

The best time to sell matches planning seasons, usually January through March31. You’ll likely get better prices on specialized bridal websites than local consignment shops31. Money saved from smart attire choices can help with other goals, like house down payments or dream honeymoons30.

Decor Budget Management

Image Source: Reddit

Wedding decorations create the ambiance of your celebration. Good planning will give you ways to stay within budget. Recent data shows couples spend between $2,000 to $10,000 on average for wedding decorations32.

High-Impact Elements

The right decorative elements will maximize visual appeal. These key elements work best:

- Lighting arrangements create unique experiences through chandeliers, candelabras, plus fairy lights33

- Table settings with luxurious linens plus sophisticated silverware improve the guest experience33

- Taller centerpieces add drama to reception tables33

Of course, ceremony spaces need minimal investment since guests spend least time there6. You should put more resources into reception areas where guests stay longest.

DIY Cost Analysis

DIY projects need careful evaluation of time plus material costs. My financial analysis shows these DIY approaches work well:

- Cutting machines for personalized signage

- Custom table runners from wholesale fabrics

- Unique bunting with simple materials11

Professional help is often more budget-friendly for complex installations or time-sensitive setups34. Look at vendor experience plus setup fees when comparing DIY versus professional services.

Rental vs Purchase Decision Matrix

Rental options give better value for single-use items35. Key factors to think about cover:

- Future Usage Potential:

- Buy items you’ll reuse after the wedding

- Rent specialty pieces needed just for celebration36

- Storage Requirements:

- Space limitations matter

- Cleaning plus maintenance costs add up35

- Setup Services:

- Rental companies handle delivery plus arrangement

- Professional setup removes day-of stress35

Indoor receptions typically cost between $500 to $5,000 for decorations32. Outdoor celebrations might need $200 to $3,000 for ceremony décor plus $1,000 to $15,000 for reception arrangements32. Focusing decoration budgets where guests spend most time will give maximum value for every dollar spent6.

Music and Entertainment Value

Image Source: The Knot

Your celebration’s atmosphere and budget depend heavily on entertainment choices. My experience as a financial advisor shows that smart planning for music and entertainment leads to great savings.

DJ vs Band Cost Analysis

Your choice between a DJ and live band affects costs by a lot. DJs usually charge $1,500 to $2,00037 and give you versatility with huge music libraries. Live bands cost more, with average fees of $4,30038. These costs change based on how many members are in the band and how long they play.

Full bands with 4-5 members ask for $900-$1,500 per hour12. Smaller groups of 2-3 members charge between $300-$500 hourly12. Solo performers are your most economical choice and still deliver professional quality.

Equipment Requirements

Professional entertainment setups just need specific equipment:

- Sound systems with powered speakers

- Mixing boards for audio control

- Microphones for announcements

- Lighting equipment for ambiance

- Backup equipment for emergencies

Your venue’s power supply needs careful checking, especially in rural areas39. Larger entertainment setups might need extra generators at some venues39.

Timing Optimization

Smart timeline management helps you get the most value from entertainment. A 6-hour wedding timeline works well40 and includes:

- Setup time of 2 hours before guests arrive40

- Background music during cocktail hour

- Ambient sounds for dinner service

- Dance sessions afterward

You can save money by booking entertainment at specific times. Most bands offer 7-hour packages with a “mini teaser” dance set40. This creates an energetic atmosphere while keeping costs in check.

Smart timing and equipment planning help couples save money without losing quality entertainment. Booking during weekdays, Monday through Thursday, usually gets you better rates41. Local musicians often charge less since there’s no travel costs or hotel stays to worry about42.

Transportation Cost Reduction

Image Source: The Knot

Wedding transportation costs often surprise couples during their budget planning. My years as a financial advisor helping couples optimize their wedding budgets have taught me that smart transportation planning leads to big savings.

Shuttle Service Analysis

Wedding shuttles make guest transportation smoother and help save money. The average transportation cost ranges from $750 to $1,50043. Smart planning cuts these costs down. Large groups benefit from shuttle busses that provide the quickest way to move between venues and hotels.

The best ways to maximize value include picking venues near guest hotels. Smart scheduling of pickup times helps avoid extra waiting fees. You can also plan multiple trips with fewer vehicles to keep costs down.

Group Booking Discounts

Early bookings help realize the full potential of group rate savings. Couples should book 5-6 months before the wedding44 to lock in better rates and ensure they get the vehicles they want. Many transportation companies now offer wedding packages that include:

- Dedicated coordinators to handle logistics

- Free perks for wedding parties

- Discounts up to 25% for group bookings2

Timing Optimization

The right timing helps cut transportation costs. A well-planned schedule should:

- Set aside 30-45 minutes to load and unload guests13

- Account for possible traffic delays

- Have vehicles arrive 15 minutes early13

- Follow detailed transportation timelines

Uber Vouchers offer a budget-friendly option where couples pay only for rides their guests actually use45. This eliminates expensive waiting charges and works great for late-night departures.

These strategies typically save couples 20-30% on transportation. Booking during off-peak times, especially Monday through Thursday, unlocks even more discounts46. All-inclusive venues that provide shuttle services in their package47 are another great way to get reliable transportation while keeping guest comfort in mind.

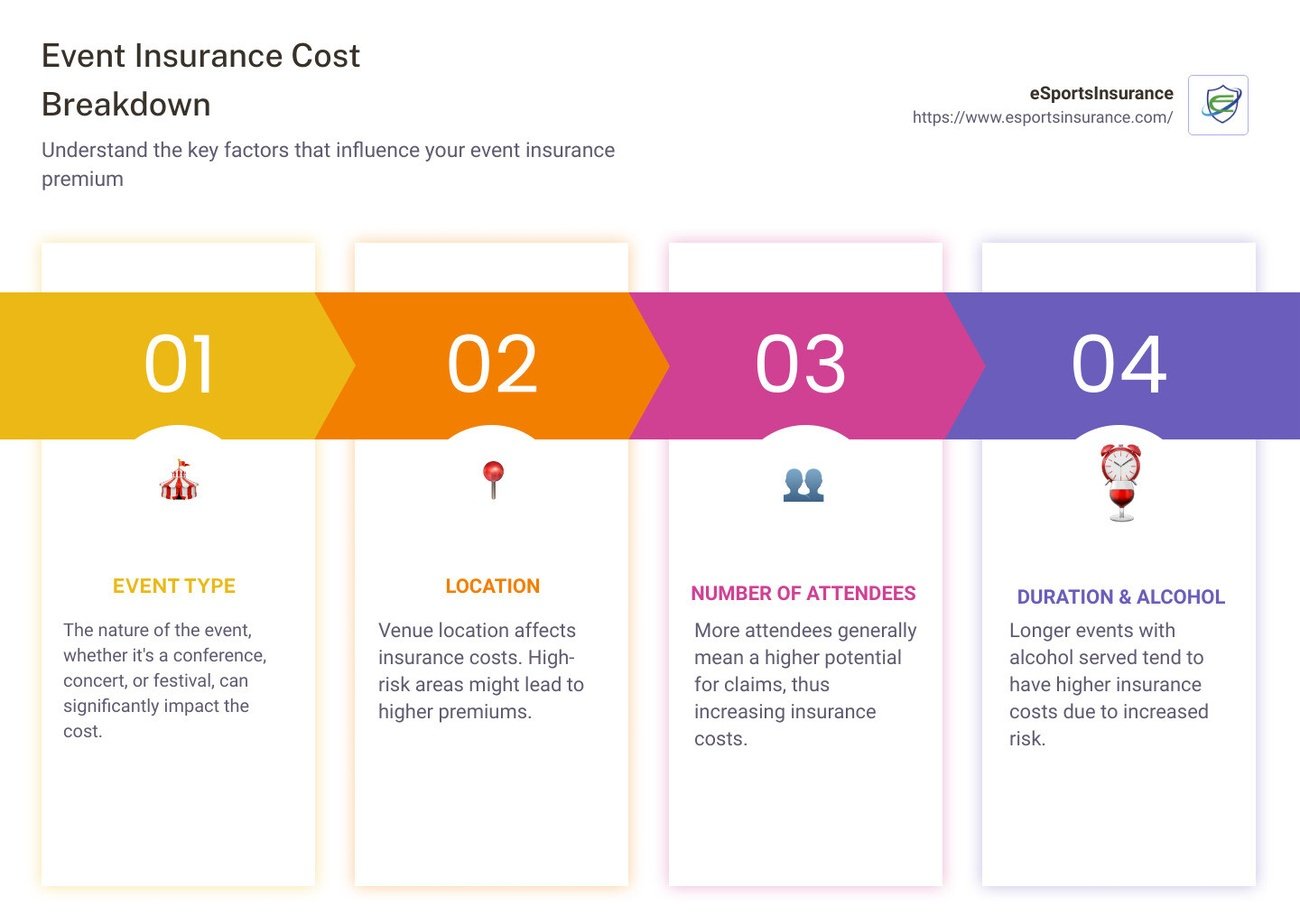

Wedding Insurance Selection

Image Source: eSports Insurance

Wedding insurance is a vital financial decision to protect your special day. My years of helping couples plan their weddings have shown how this protection can save celebrations from unexpected problems.

Coverage Types

Wedding insurance covers two main categories:

Liability Coverage: This protection covers property damage and guest injuries at your event. Most venues require liability coverage that typically protects up to $2 million for accidents48. The coverage includes:

- Property damage from guests or vendors

- Medical expenses for injuries

- Host liquor liability protection

- Rehearsal dinner coverage

Cancelation Coverage: You’ll get your money back for expenses you can’t recover if you need to postpone due to circumstances beyond your control. The protection includes:

- Vendor bankruptcy or no-shows

- Severe weather events

- Military deployment changes

- Lost deposits

- Damaged wedding attire

- Stolen gifts

Cost-Benefit Analysis

Your insurance costs will depend on coverage levels and event details. Simple liability policies start at $155 for $1 million in coverage49. Cancelation insurance costs between $50 for $5,000 coverage and higher rates for detailed protection50.

These factors affect your premiums:

- Wedding size

- Venue location

- Coverage limits

- Policy deductibles

- Additional riders needed

Provider Comparison

Top insurance companies offer different benefits:

eWed Insurance: Zero-deductible policies that cover multiple events start at $11951

Travelers: Detailed plans with no deductibles begin at $16051

WedSafe: Quick coverage is available, but weather protection needs 15-day advance booking51

Wedsure: Stands out by offering ‘change of heart’ coverage as an optional add-on48

The best time to get coverage is right after you pick your date or pay your first vendors, usually 12-18 months before the wedding49. Picking the right provider and coverage levels helps couples protect their investment from various risks.

Vendor Contract Optimization

Image Source: YouTube

Smart vendor contract negotiations can help you cut wedding costs. My years as a financial advisor have taught me reliable ways to get better deals while keeping service quality high.

Payment Terms Negotiation

The right payment timing can lead to big discounts. Vendors often cut their rates by 10-15% for upfront payments52. Here’s what works best:

- Ask about military or first responder discounts

- Learn about early payment benefits

- Talk about flexible payment plans

Most vendors will adjust their prices based on when you pay53. Just make sure every deal ends up in your written contract to avoid confusion later.

Service Bundle Savings

You’ll save money by booking multiple services with one vendor. All-in-one packages usually cost 15-20% less overall54. Smart bundles include:

- Combined photo and video services cost less

- DJs who bring their own lighting give better rates

- Catering packages with rentals save you money

Bigger companies tend to offer deeper discounts when you book more services14. It also makes your planning easier and cuts down on paperwork.

Early Booking Discounts

Book your vendors well ahead and watch the savings add up. You’ll typically save 20-30% by booking 12-18 months before your big day53. Vendors love early bookings because they:

- Lock in their calendar

- Get better cash flow

- Spend less on marketing

Early birds often get prime dates at better prices52. Many vendors throw in extras like free upgrades or longer service hours when you book ahead53.

Note that good deals come from clear talks and realistic goals15. Put everything in writing – services, timelines, and payment plans. Smart vendor negotiations help couples save big without giving up their dream wedding vision.

Registry and Gift Management

Image Source: The Budget Savvy Bride

Gift registries have evolved substantially over the years. They now offer innovative ways to encourage engagement to maximize value and simplify the process. My experience as a financial advisor has helped many couples optimize their registry strategies to get the most benefit.

Cash Registry Benefits

Cash registries today offer compelling advantages for couples. Data shows that 70% of couples now register for cash55, which is a 10% increase from previous years. Cash registries let you:

- Allocate funds flexibly toward specific goals

- Pay lower processing fees through specialized platforms

- Track gifts transparently

- Give guests multiple payment options

Many couples combine traditional registries with cash funds to create versatile options for guests. Popular cash registry allocations include home down payments, honeymoon experiences, and charitable contributions16.

Group Gift Coordination

Group gifting makes collecting larger contributions easier. Dedicated platforms allow guests to:

- Contribute any amount toward premium items

- Track collective progress

- Include personalized messages

- Combine efforts without direct communication

Specialized group gifting platforms handle logistics automatically and deliver optimal results56. These services process contributions instantly, which eliminates manual coordination needs.

Thank You Note Cost Reduction

Smart thank-you note management reduces costs and time investment. Key guidelines include:

- Send personalized notes to everyone who attended and those sending gifts57

- Write notes in batches and schedule dedicated time daily58

- Let partners divide responsibility based on guest relationships

- Send individual cards to group gift contributors58

Digital tools make tracking and organization natural. Most registry platforms’ integrated thank-you management systems let couples:

- Monitor gift receipt dates

- Track note completion status

- Maintain personalized message records

- Generate customized templates

It’s worth mentioning that proper etiquette suggests mentioning specific uses for cash gifts in thank-you messages59. This personal touch helps guests understand their contribution’s effect while maintaining professional courtesy.

Honeymoon Integration Strategy

Image Source: Destination I Do

A clever combination of honeymoon and wedding planning can help you save money. My financial background shows that couples save more when they plan both events together. The right timing and smart use of rewards programs make this possible.

Combined Wedding-Honeymoon Packages

All-inclusive resorts provide attractive wedding-honeymoon combinations with personal wedding experts who take care of everything60. These packages usually include:

- Venue and catering services

- Custom ceremony arrangements

- Luxury rooms with premium amenities

- Free upgrades for newlyweds

- Personal concierge help

Resorts make these packages special with extras like breakfast in bed, couples massages, and private beach dinners61. These destination packages cost less than separate celebrations and cut down on travel expenses.

Travel Rewards Optimization

Smart credit card use during wedding planning results in big travel rewards. Most couples earn over 300,000 points in six months when they spend wisely10. Here’s how to get the most benefits:

- Pay for all wedding expenses with rewards cards

- Get sign-up bonuses when spending is high

- Move points to airline partners at the right time

- Keep track of point values across programs

Travel experts can get better deals through their industry connections and help you get more value from your points10.

Timing Flexibility Benefits

Taking your honeymoon after the wedding has clear advantages. Couples who wait can enjoy:

- More time to plan longer trips62

- Extra money from wedding gifts62

- Better rates in off-peak seasons

- Less stress and more fun62

- More destination choices62

Delayed honeymoons let couples make better use of their vacation days62 and get better seasonal prices. Travel experts suggest booking 8-12 months early to get discounts and the best rooms63.

These strategies help couples save 20-30% on their combined wedding and honeymoon costs. Good planning, smart use of rewards, and flexible timing let couples enjoy premium experiences without breaking their budget.

Post-Wedding Financial Planning

Image Source: Her First $100K

The wedding celebrations are over, and now it’s time to build a strong financial foundation. My 13 years as a financial advisor have shown me how smart money moves right after marriage can shape a couple’s financial future.

Debt Avoidance Strategies

Wedding debt needs quick attention. Home buyers typically put down 13%64, so clearing wedding expenses fast helps you get ready for homeownership. Here are some proven ways to tackle debt:

- Use wedding gift money to reduce debt

- Set up realistic payment plans with clear deadlines

- Keep contributing to retirement while paying off debt65

Investment Opportunities

Your wedding funds can grow into long-term wealth. Here’s where to put that money:

- Home Renovations: Kitchens and bathrooms give you the best return on investment64

- Emergency Fund: Start small and grow it as you can64

- Business Ventures: Wedding gifts make great startup capital without bank loans64

- Educational Growth: Career development pays off for years64

Future Financial Goals

Shared money goals make partnerships stronger. Recent numbers show couples should save 15% of their income for retirement66. Here are the key targets:

- Six months of expenses in emergency savings66

- Life insurance – buy early for better rates66

- 529 plans for education savings with tax benefits7

- Max out your 401(k) – the limit is $23,500 for 20257

Monthly money talks work best. These “money dates” let you check budgets, track investments, and celebrate wins7. A financial advisor can help guide tough talks and create your roadmap7.

Joining finances needs open talks about what matters – homes, kids, travel, and retirement7. Clear money goals and regular chats help build a strong foundation for your future together.

Comparison Table

| Strategy | Potential Savings | Key Benefits/Features | Implementation Timeline | Important Considerations |

|---|---|---|---|---|

| Smart Wedding Date Selection | 20-30% off total costs | – Off-peak months (Jan, Feb, Dec) – Weekday discounts 40-60% on venues | 12-18 months before | Weather risks during winter dates |

| Venue Cost Efficiency | 15-20% with all-inclusive packages | – Bundled services – Standard amenities included | 12+ months before | Hidden fees (20-25% service charges) |

| Guest List Optimization | $580 per guest reduction | – Digital RSVP tracking – Plus-one policy control | 6-8 months before | Higher costs for destination weddings ($1,600/guest) |

| Digital Planning Tools | 60-70% on invitation costs | – Budget tracking apps – Digital invitations – Guest list management | Throughout planning | Platform subscription fees |

| Food and Beverage Management | $13-18 per person (buffet vs plated) | – Seasonal menu options – Limited bar service (30-40% savings) | 6-8 months before | Staff and rental equipment needs |

| Photography Service Options | Varies by package ($6,000-$10,000 range) | – Digital delivery options – Usage rights included | 8-12 months before | Time needed for post-production |

| Wedding Attire Strategy | Up to 50% through resale | – Rental options ($350 average) – Resale potential | 6-8 months before | Alteration costs ($100-$300) |

| Decor Planning | $500-$5,000 range | – High-impact elements – Rental vs. purchase options | 4-6 months before | Setup and teardown costs |

| Entertainment Solutions | $2,300+ (DJ vs. Band) | – Flexible timing options – Equipment included | 6-8 months before | Power requirements |

| Travel Cost Management | 20-30% with advance booking | – Group booking discounts – Shuttle services | 5-6 months before | Extra time allowance |

| Insurance Coverage | Starts at $155 | – Liability coverage – Cancelation protection | 12-18 months before | Venue requirements |

| Vendor Agreement Planning | 10-15% with early payment | – Bundle discounts – Early booking savings | 12-18 months before | Contract term review |

| Gift Registry Management | Varies by platform | – Cash registry options – Group gift coordination | 6-8 months before | Platform fees |

| Honeymoon Planning | 20-30% on combined packages | – Resort packages – Travel rewards | 8-12 months before | Schedule flexibility |

| Future Financial Planning | 15% recommended savings rate | – Debt management – Investment opportunities | Immediately after wedding | Emergency savings priority |

Final thoughts

Smart wedding planning just needs careful attention to financial details. I’ve guided many couples through wedding budgeting and found that combining multiple cost-saving strategies leads to amazing results. Couples who use these recommendations typically save 30-40% on their total wedding expenses while keeping their desired celebration quality.

Smart timing is the life-blood of wedding cost reduction. You can create substantial savings when you select off-peak dates, book vendors early, and negotiate payment terms. Digital tools also streamline planning processes and reduce traditional expenses like paper invitations and RSVP tracking.

These strategies help couples start their marriage on solid financial ground. Newlyweds can direct funds toward important goals like emergency reserves, home down payments, or retirement investments instead of depleting savings or accumulating debt. My clients who use these approaches often enter marriage with $10,000 or more in preserved savings.

The biggest challenge lies in balancing emotional desires with practical financial decisions. My 13 years as a financial advisor have shown how thoughtful planning can make dream weddings real without compromising future financial stability. To learn more about tailored strategies for your celebration, contact us at support@trendnovaworld.com.

Your wedding marks just one day – albeit special – in your life together. Smart financial planning will give your celebration the power to become a foundation for lasting prosperity rather than a source of financial stress.

To learn more

13 Money-Saving Financial Fitness Tips That Actually Work in 2025

FAQs

Q1. How much should I expect to spend on a wedding in 2025? Wedding costs can vary widely, but the average is around $35,000. Your total budget will depend on factors like guest count, location, venue type, and catering choices. Creating a detailed budget and prioritizing your must-haves is essential for managing expenses.

Q2. What are some effective ways to save money on a wedding? Some smart ways to save include choosing an off-peak date, optimizing your guest list, using digital planning tools, negotiating with vendors, and considering alternative venue options. Focusing on high-impact elements while cutting back on less essential items can help reduce costs without sacrificing the overall experience.

Q3. How far in advance should I start saving for my wedding? It’s best to start saving as soon as possible, ideally 12-18 months before your planned wedding date. This allows time to accumulate funds for deposits and gives you a realistic picture of what you can afford. Having a longer engagement can provide more flexibility in budgeting and planning.

Q4. Should I have my entire wedding budget saved before I start planning? While having the full budget saved is ideal, it’s not always necessary. Many couples start planning with enough for initial deposits and continue saving throughout the engagement. The key is to have a realistic savings plan and avoid going into debt for the wedding.

Q5. What are some creative ways to fund a wedding? Consider options like cash registry funds for specific wedding expenses, group gifting for larger items, and allocating any work bonuses or tax returns towards your wedding budget. Some couples also take on part-time work or freelance gigs to boost their savings. Remember to prioritize your financial health and avoid compromising long-term goals for wedding expenses.

References

[1] – https://tisoh.edu/blog/advantages-of-planning-an-off-season-wedding/

[2] – https://vamosrentacar.com/wedding-group-discounts/

[3] – https://clarkslandingweddings.com/off-season-weddings-why-they-are-worth-considering/

[4] – https://www.lakebridemagazine.com/blog/the-perks-of-planning-off-peak/

[5] – https://www.brides.com/save-money-wedding-alcohol-7105506

[6] – https://www.brides.com/wedding-decor-checklist-5076408

[7] – https://www.bankrate.com/investing/investing-decisions-to-consider-after-marriage/

[8] – https://photobugcommunity.com/business-advice/how-deliver-wedding-photos-to-clients/

[9] – https://www.theknot.com/content/used-wedding-dresses-buy-sell-online

[10] – https://money.usnews.com/money/personal-finance/saving-and-budgeting/articles/honeymoon-saving-tips

[11] – https://bridebook.com/uk/article/saving-tips-wedding-decorations

[12] – https://www.gigsalad.com/blog/wedding-performers-for-any-budget/

[13] – https://www.bride-advisor.com/wedding-transport-guide/

[14] – https://completewedo.com/rapid-city/blog/how-to-save-money-bundling-wedding-services/

[15] – https://www.theknot.com/content/can-you-negotiate-with-wedding-vendors

[16] – https://www.zola.com/expert-advice/wedding-cash-registry-101

[17] – https://www.theknot.com/content/average-cost-wedding-catering

[18] – https://www.weddingwire.com/cost/wedding-catering

[19] – https://gatheringsforgood.com/blog/cost-comparison-wedding-buffet-vs-plated-meal

[20] – https://www.fftcaters.com/blog/how-to-optimize-your-spring-wedding-catering-menu/

[21] – https://www.brides.com/story/menu-ideas-for-a-summer-wedding

[22] – https://mbmcatering.com/seasonal-wedding-catering-ideas/

[23] – https://mansiononmainstreet.com/wedding-menu-ideas-by-season/

[24] – https://www.theknot.com/content/types-wedding-bar

[25] – https://kendralauck.com/2024/03/16/the-importance-of-hiring-a-premium-wedding-photographer/

[26] – https://weddingphotographyandfilms.com/wedding-blog/the-ultimate-wedding-money-savings-guide

[27] – https://melissamullenphotography.com/copyright-personal-usage-rights/

[28] – https://blog.kellywilliamsphotographer.com/how-to-save-money-on-wedding-photography/

[29] – https://www.fidelity.com/learning-center/smart-money/how-to-save-money-on-a-wedding

[30] – https://money.usnews.com/money/personal-finance/spending/articles/say-yes-to-the-different-dress

[31] – https://www.kleinfeldbridal.com/maximizing-your-return-a-comprehensive-guide-to-selling-your-wedding-dress/

[32] – https://www.zola.com/expert-advice/average-cost-of-wedding-decorations

[33] – https://www.tbdsandiego.com/luxury-wedding-decor/

[34] – https://www.brides.com/average-cost-of-wedding-decorations-8419095

[35] – https://www.janeraeevents.com/blogs-portfolios/rent-vs-buy-wedding-decor

[36] – https://onceuponatime.events/wedding-decor-renting-vs-buying/

[37] – https://www.theknot.com/content/save-money-on-wedding-music

[38] – https://www.theknot.com/content/average-cost-wedding-band-dj

[39] – https://marbellabride.com/the-wedding-blog/dont-forget-technical-needs

[40] – https://www.bostoncommonband.com/wedding-timeline-planning

[41] – https://www.entertainment-nation.co.uk/blog/budget-wedding-entertainment-ideas/

[42] – https://encoremusicians.com/blog/affordable-wedding-entertainers-uk/

[43] – https://national-parking.com/about/resources/2023/11/wedding-shuttle-service-cost/

[44] – https://www.theknot.com/content/wedding-transportation-costs-tips-trends

[45] – https://www.uber.com/us/en/about/vouchers/weddings/

[46] – https://www.theknot.com/content/wedding-transportation-tips

[47] – https://www.zionsprings.com/blog/wedding-transportation/

[48] – https://www.cnbc.com/select/best-wedding-insurance/

[49] – https://smartasset.com/insurance/wedding-insurance

[50] – https://www.experian.com/blogs/ask-experian/is-wedding-insurance-worth-it/

[51] – https://www.theknot.com/content/wedding-insurance-101

[52] – https://www.abelldjcompany.com/blog/can-you-negotiate-wedding-venue-prices/

[53] – https://www.getwedpro.com/incentivising-commitment/

[54] – https://blackdiamondep.com/benefits-of-bundling-wedding-vendors/

[55] – https://money.usnews.com/money/personal-finance/family-finance/articles/are-cash-wedding-registries-worth-it

[56] – https://www.weddingshop.com/wedding-planning/wedding-registry-group-gifting

[57] – https://www.abrideonabudget.com/2015/01/the-ultimate-guide-to-wedding-thank-you.html

[58] – https://www.brides.com/story/how-to-write-wedding-thank-you-notes-wording

[59] – https://www.theknot.com/content/a-complete-guide-to-sending-thank-you-notes

[60] – https://all-inclusive.marriott.com/weddings-honeymoons

[61] – https://www.hyattinclusivecollection.com/en/weddings-honeymoons/

[62] – https://www.bridestoday.in/food-travel/story/is-it-necessary-to-go-on-a-honeymoon-straight-after-your-wedding-988801-2024-05-02

[63] – https://erosandpsyche.travel/when-to-book-your-honeymoon/

[64] – https://drsmusic.com/6-of-the-best-investments-you-can-make-after-getting-married/

[65] – https://www.newyorklife.com/articles/post-wedding-financial-strategies

[66] – https://www.newyorklife.com/articles/financial-milestones-marriage

[67] – https://www.theknot.com/content/picking-the-perfect-wedding-date

[68] – https://www.theknot.com/content/less-expensive-days-for-weddings

[69] – https://www.cnbc.com/2018/03/22/picking-an-off-peak-wedding-date-can-be-a-risky-way-to-save.html

[70] – https://www.reddit.com/r/Weddingsunder10k/comments/1gr9wmy/weekday_vs_weekend_weddings_a_complete/

[71] – https://bridalmusings.com/184308/weekday-wedding-planning-guide/

[72] – https://www.wedding-spot.com/blog/weekday-wedding

[73] – https://money.usnews.com/money/personal-finance/family-finance/articles/affordable-wedding-venue-ideas

[74] – https://www.herecomestheguide.com/wedding-ideas/how-to-save-money-on-your-wedding-venue

[75] – https://www.theknot.com/content/hidden-wedding-costs

[76] – https://blog.planningpod.com/2014/09/11/strategies-for-negotiating-with-venues-and-hotels-part-1/

[77] – https://www.minted.com/wedding-ideas/affordable-wedding-venues

[78] – https://www.herecomestheguide.com/wedding-ideas/hidden-wedding-costs

[79] – https://www.nerdwallet.com/article/finance/cheap-wedding-venue-ideas

[80] – https://www.wedding-spot.com/blog/compare-wedding-venues

[81] – https://www.theknot.com/content/wedding-guest-cost

[82] – https://www.theknot.com/content/average-wedding-cost

[83] – https://rsvpify.com/weddings/

[84] – https://www.theknot.com/content/plus-one-etiquette-guide

[85] – https://www.brides.com/wedding-plus-one-etiquette-8719700

[86] – https://www.theknot.com/content/budget-apps-for-couples

[87] – https://www.brides.com/story/top-apps-and-sites-for-brides

[88] – https://weddedwonderland.com/6-apps-to-help-you-stick-to-your-wedding-budget/

[89] – https://www.theknot.com/content/digital-invitation-options

[90] – https://www.theknot.com/content/our-top-wedding-planning-tools

[91] – https://www.weddingwire.com/wedding-planning/wedding-budget.html

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance