The average American spends $219 monthly on subscriptions alone. Managing personal finances might seem overwhelming, but these small expenses often slip through the cracks unnoticed.

A simple 15-minute morning routine focused on your finances can turn basic actions into lasting habits. We’ve found that successful money management doesn’t need complex strategies – it relies on smart, consistent choices. The proven 50/30/20 rule recommends using 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment.

We’ve put together 15 straightforward, practical ways to improve your finances in 2025. These methods will help you take control of your money confidently, whether you’re new to financial planning or want to enhance your current strategy.

Create a Smart Digital Budget System

Image Source: Forbes

Your first step to control finances starts with a digital budget system. AI-powered tools have reshaped how we track and manage money, which makes budgeting more available and efficient today.

AI-Powered Budget Tools for 2025

AI budgeting assistants now give customized insights based on your spending patterns. Tools like YNAB and Mint sort transactions automatically and send up-to-the-minute alerts when you near spending limits1. These platforms also study your financial habits and suggest targeted budgeting tips and smart financial goals60.

Smart Budget Categories

The best digital budgets follow the 50/30/20 rule – 50% goes to essentials, 30% to wants, and 20% to savings and debt repayment61. Modern apps help you create custom categories that fit your lifestyle:

- Housing and utilities

- Transportation and groceries

- Entertainment and subscriptions

- Savings and investments

- Emergency fund allocation

Automated Expense Tracking

Digital expense tracking has grown beyond basic receipt scanning. Modern systems now offer automated receipt capture and processing, and AI technology detects duplicate transactions and checks exchange rates62. These tools merge with existing finance systems and give accurate, up-to-the-minute data about your spending patterns63.

Automation helps create detailed reports that reveal spending trends over time1. You can spot patterns, find areas to improve, and make smart choices about your financial future.

Build an AI-Enhanced Emergency Fund

Image Source: Bankrate

Your financial safety net comes from an emergency fund that protects you when unexpected expenses hit or income drops. Research shows that 57% of consumers feel uncomfortable with their emergency savings64. Building this vital financial buffer should be a priority.

Emergency Fund Calculator

You should save three to six months of living expenses, according to financial experts65. Modern AI-powered calculators help you find the right amount based on your monthly expenses, mortgage payments, utilities, and debt obligations66. These tools look at your spending patterns and suggest a savings target that fits your situation, taking into account your job stability and family size.

Automated Savings Rules

AI platforms now make it easy to build your emergency fund through smart automation. These systems can:

- Round up everyday purchases and transfer the difference to savings67

- Set up payroll deductions for automatic savings67

- Create micro-transfers based on spending patterns68

- Schedule recurring transfers on paydays69

High-Yield Digital Accounts

High-yield savings accounts offer APYs around 4%70. This is a big deal as it means that traditional savings accounts average only 0.41%70. These accounts give you easy access and help your emergency fund grow. They come with FDIC insurance up to $250,00071, so your safety net stays protected. The best accounts give you competitive rates without maintenance fees and minimum balance requirements71.

Automate Your Bill Payments and Savings

Image Source: Money Fit

Automating your financial routine is a substantial step toward better personal finance management. Modern payment systems now handle transactions almost instantly and eliminate manual tracking while reducing human error72.

Bill Payment Automation Tools

Automatic bill payment services have evolved substantially with secure ways to handle recurring expenses. These systems can process multiple payment types, including ACH transfers for next-day settlement and Fedwire for same-day transactions73. We developed overdraft protection and instant notification features that ensure your accounts maintain sufficient funds for scheduled payments74.

Smart Recurring Transfers

Recurring transfers help create a systematic savings approach. You can designate specific percentages of your paycheck for different savings goals75. These automated transfers work flexibly with your pay schedule – weekly, biweekly, or monthly75. You can set up dedicated transfers for emergency funds, investment accounts, or specific financial goals.

Payment Scheduling Strategies

Smart payment scheduling helps optimize cash flow and avoid late fees. Automatic payments make life easier, but you should remember to:

- Check transactions monthly to verify correct deductions76

- Set up payments a few days before due dates to allow processing time74

- Keep sufficient account balances to avoid overdraft fees74

- Track payment confirmations for accuracy77

Notwithstanding that, automation’s benefits go beyond convenience – it builds consistent saving habits and cuts the risk of missed payments75. Payment systems arranged with accounting software make shared financial tracking possible, which leads to better decision-making72.

Leverage Personal Finance Apps

Image Source: PCMag

Personal finance apps have evolved into powerful tools, and 88% of U.S. consumers now use them to manage their money13. The right app can make all the difference in reaching your financial goals.

Top Finance Apps for 2025

We tested several apps and found Simplifi stands out with its customizable reports and live spending plans3. YNAB shines with its zero-based budgeting approach that helps users save around $600 in their first two months3. Monarch delivers complete features at $8.33 monthly3 and works great to track both expenses and investments.

App Integration Tips

These finance apps naturally connect with over 17,000 financial institutions14. Here’s how to get the most from these integrations:

- Enable automatic transaction syncing

- Verify account connections monthly

- Set up customized spending categories

- Monitor live balance updates

Security Features

The best finance apps use bank-grade security protocols. These platforms employ 256-bit encryption for data protection15 and protect your personal information through multiple security layers. Two-factor authentication and biometric access add extra protection15, especially when you have sensitive financial data. The activity monitoring systems detect unusual transactions and send live alerts about potential fraud15.

The right personal finance app depends on your needs and security priorities. Premium apps cost between $1 to $15 monthly3, but they’re worth it for their complete features and robust security measures.

Implement the Digital Envelope System

Image Source: The Qube Money Blog

Digital envelope systems bring traditional cash budgeting into the modern age with virtual categories that help manage expenses. You can track your spending while keeping the psychological advantages of envelope budgeting16.

Virtual Envelope Categories

A well-laid-out digital envelope system starts with 12 primary categories. We focused on basic expenses like housing, transportation, and utilities16. You should create separate virtual envelopes to cover rent, insurance, childcare, and personal costs. The system becomes more effective when your categories match your spending habits, which makes it easier to stick to your financial goals.

Digital Cash Management

Digital envelopes are a great way to get better security and convenience compared to physical cash17. Several tools support this approach, including GoodBudget, Mint, and Simplifi16. These platforms let you:

- Create customized spending categories

- Track balance updates instantly

- Set up automated transfers

- Generate detailed spending reports

Spending Controls

Up-to-the-minute tracking gives you resilient spending controls18. You can check category balances right away to stop overspending before it happens. The system helps you spot spending patterns and adjust your budget19. Your success depends on regular monitoring and staying within the limits you set for each category16.

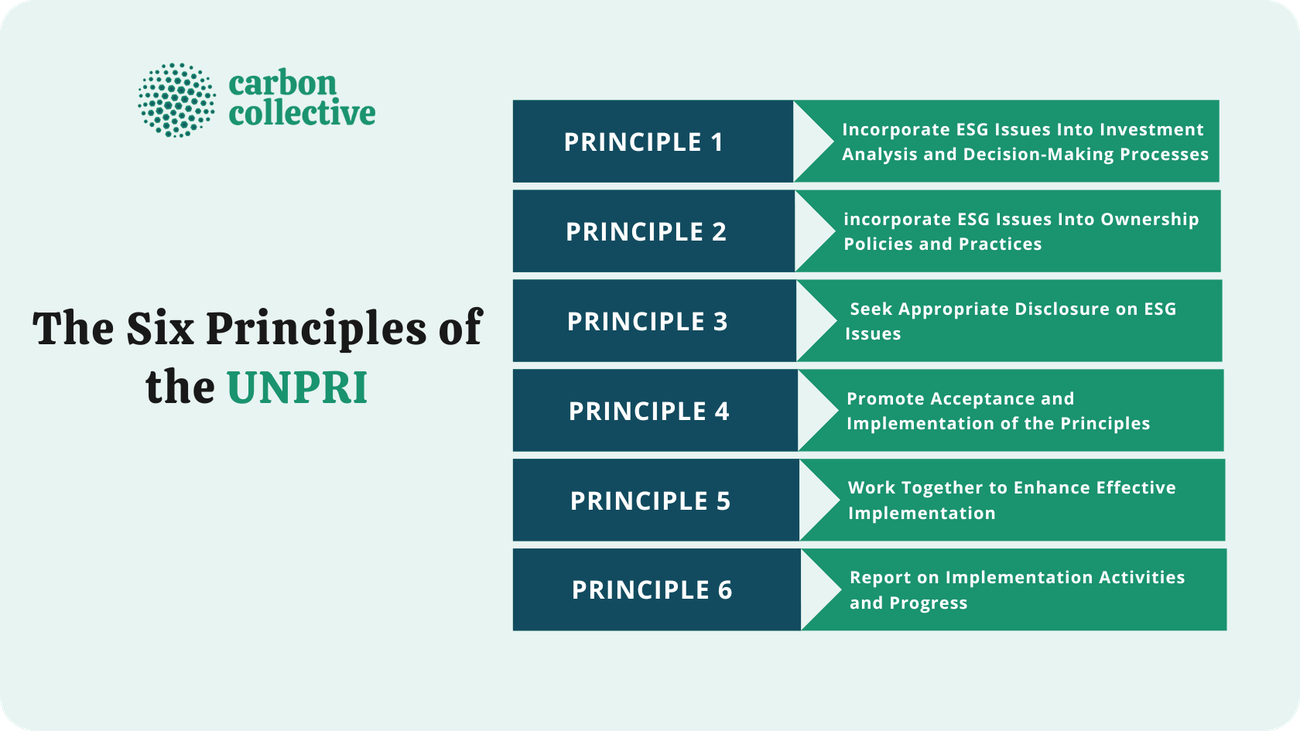

Master Sustainable Investing

Image Source: Carbon Collective

The global impact investing market is a big deal as it means that it has reached USD 1.57 trillion2. Investors now think over both environmental and social effects along with financial returns when they manage their personal finances.

ESG Investment Options

ESG investing gives you several ways to line up your financial goals with environmental values. The main strategies are:

- Positive/best-in-class screening for top performers

- ESG integration in investment analysis

- Impact investing for measurable outcomes

- Thematic investing in specific sectors20

Green Portfolio Building

Your green portfolio journey starts by setting asset allocation based on your goals and risk tolerance21. Green bonds are a great way to get steady returns while funding environmental projects. Issuers raised USD 492.30 billion in 2023 [link_2]21. Sustainable investors can pick from investment vehicles of all types, such as mutual funds, ETFs, and direct investments in companies that support sustainability.

Impact Tracking

Standard metrics that line up with UN Sustainable Development Goals help measure impact22. Tracking tools assess company performance in six impact themes and show portfolio-level environmental results22. These metrics let investors watch their investment’s social and environmental benefits while they focus on financial performance2.

Optimize Credit Score Management

Image Source: FasterCapital

Credit scores are vital for managing personal finances. FICO® scores range from 300 to 8507. Scores above 700 show very good credit management. A score between 680-699 means good credit, while 620-679 indicates acceptable credit standing23.

Credit Monitoring Tools

Today’s credit monitoring services automatically scan credit files to find ways you can improve24. These AI-powered tools create detailed analysis reports and can predict future scores by simulating changes24. Digital platforms keep track of activities at Equifax, Experian, and TransUnion. Most updates appear within 3-5 business days24.

Score Improvement Strategies

Regular payment habits will boost your credit score most effectively. Your score gets stronger when you have different types of credit accounts, like installment loans and credit cards7. Here’s what you need to do while building credit:

- Keep credit utilization low

- Pay bills by due dates

- Maintain older credit accounts

- Limit new credit applications

Credit Report Analysis

You need to look at several elements when examining credit reports. Your payment history makes up 35% of your FICO® Score25. You should dispute any errors with credit bureaus as soon as you spot them. Most resolutions take about 30 days25. Your score could take a hit if incorrect information stays on your report7.

A strong credit score needs regular monitoring and active management. The good news is that credit monitoring won’t affect your credit scores26. This makes it a safe option to track your financial progress.

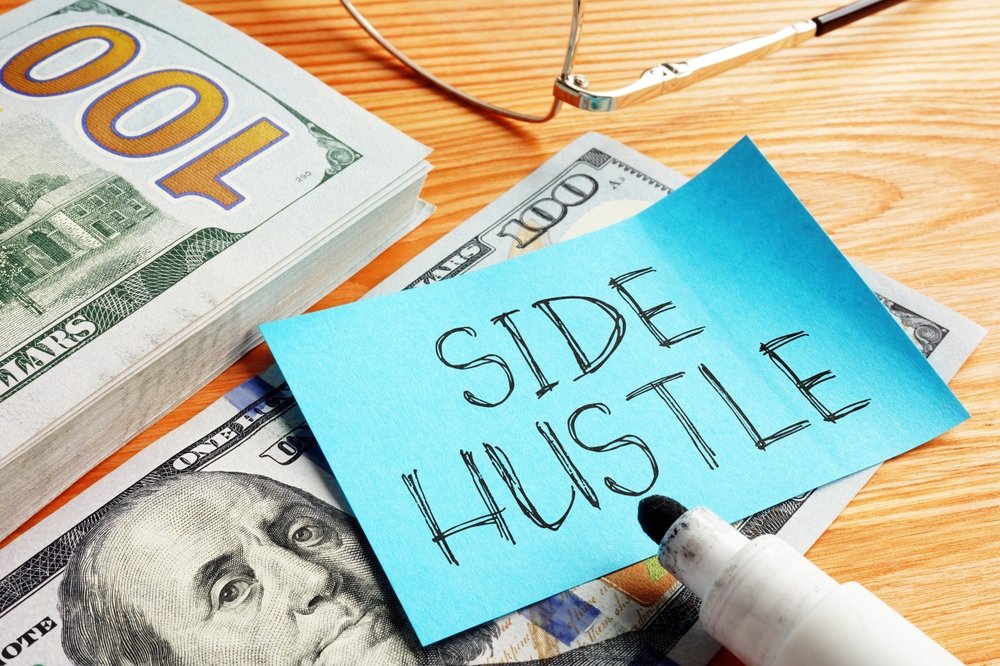

Create Multiple Income Streams Online

Image Source: Crypto Dispensers

“Never depend on single income. Make investments to create a second source.” — Warren Buffett, CEO of Berkshire Hathaway, legendary investor

Broadening income streams is vital for reliable financial management.Recent data shows [[39% of working Americans](https://www.houst.com/blog/mastering-income-diversification-guide) have a side hustle that brings in USD 810.00 monthly]27.

Digital Side Hustles

Digital products can help you earn between [USD 100.00 to USD 5000.00 per month]28. Here are some profitable options:

- Create online courses and educational content

- Develop digital templates and printables

- Offer consulting services

- Build subscription-based newsletters

- Design print-on-demand products

Passive Income Platforms

Passive income platforms let you earn money without constant hands-on work. Digital product sellers typically [earn USD 2000.00 monthly]29. Course creators report that [courses generate 75% of their income]9. YouTube offers another path through passive advertising revenue, with [some creators reaching CPMs of USD 222.75]9.

Income Diversification Strategy

Your success in income diversification depends on smart implementation. Starting small and growing step by step works best30. The best results come from balancing active and passive income sources while delivering quality in every project. This approach strengthens your financial position and helps you tap into the potential of your existing skills to create multiple revenue streams30.

Plan for Digital Retirement

Image Source: Crypto Tax Calculator

Digital assets have caught everyone’s attention as retirement planning moves beyond traditional investment vehicles. The numbers tell an interesting story – 94% of state pension plans now include cryptocurrency investments10.

Crypto Retirement Options

The landscape of crypto retirement options has grown with self-directed IRAs and specialized retirement plans. Investors can choose between two main paths: they can get indirect exposure through spot Bitcoin ETFs or buy cryptocurrencies directly31. The iShares Bitcoin Trust ETF’s growth speaks volumes, reaching over USD 50.00 billion in total assets10. This shows how institutional investors are warming up to crypto.

Traditional vs Digital Assets

Cryptocurrency and other alternative investments can help diversify portfolios because they don’t follow traditional market patterns10. The experts suggest keeping crypto investments between 2% to 8% of an investment portfolio10. Smart retirement planning takes these factors into account:

- Bitcoin’s volatility runs five times higher than U.S. stocks10

- Cold storage options provide better security31

- Retirement account structures offer tax benefits31

- The Department of Labor oversees regulatory compliance10

Retirement Calculator Tools

Modern retirement calculators have evolved to embrace digital assets. These tools look at both traditional and crypto investments to create complete retirement projections31. Users can access advanced features like Monte Carlo simulations that calculate success probability. The tools even send automatic alerts when crypto holdings go beyond recommended levels31.

Practice Mindful Digital Spending

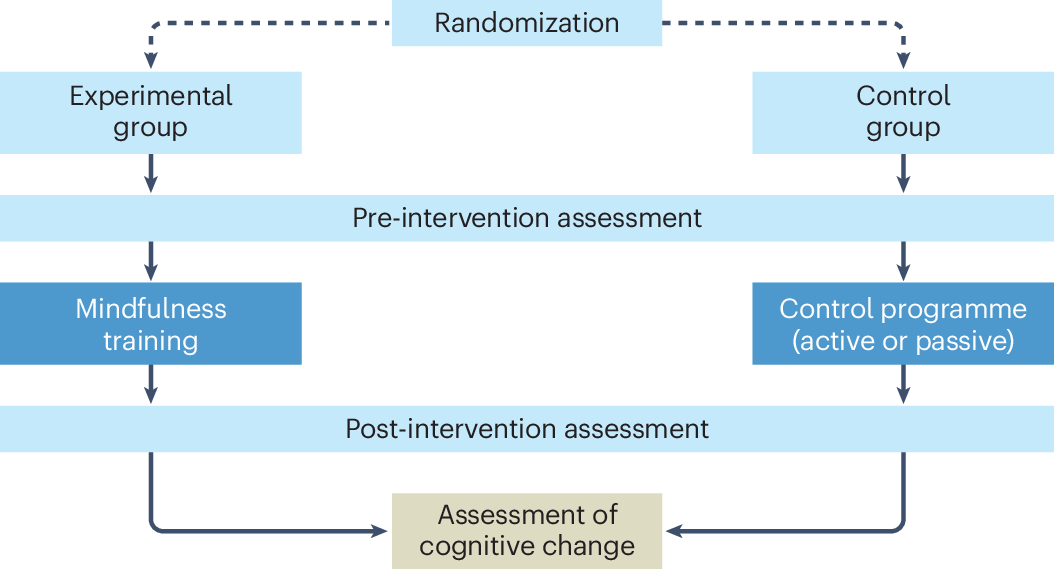

Image Source: Nature

Studies show that 89.4% of Americans involve themselves in emotional spending and spend an average of USD 62.55 on impulse purchases8. Understanding what triggers our spending habits helps us manage our money better.

Spending Tracking Apps

Today’s tracking apps do much more than simple expense monitoring. We used these platforms to get up-to-the-minute alerts and spending pattern analysis3. These apps now merge with financial institutions to track transactions and create custom reports that show where you can save money32.

Psychological Spending Triggers

Several psychological factors drive emotional spending. Research shows that 58.8% of individuals experience anxiety and 45.1% face depression because of money worries8. Common triggers include:

- Stress and anxiety responses

- Social media influence and FOMO

- Decision fatigue in later hours

- Seeking instant gratification

- Emotional state management

Mindful Purchase Framework

Mindful spending means making conscious decisions about your purchases33. The framework suggests a 24-48 hour waiting period before buying non-essential items8. This approach helps you assess if purchases match your financial goals or just respond to emotions34.

This mindful framework puts quality before quantity and focuses on purchases that improve your life8. This method reduces impulse buying and promotes smart financial decisions that match your long-term goals35.

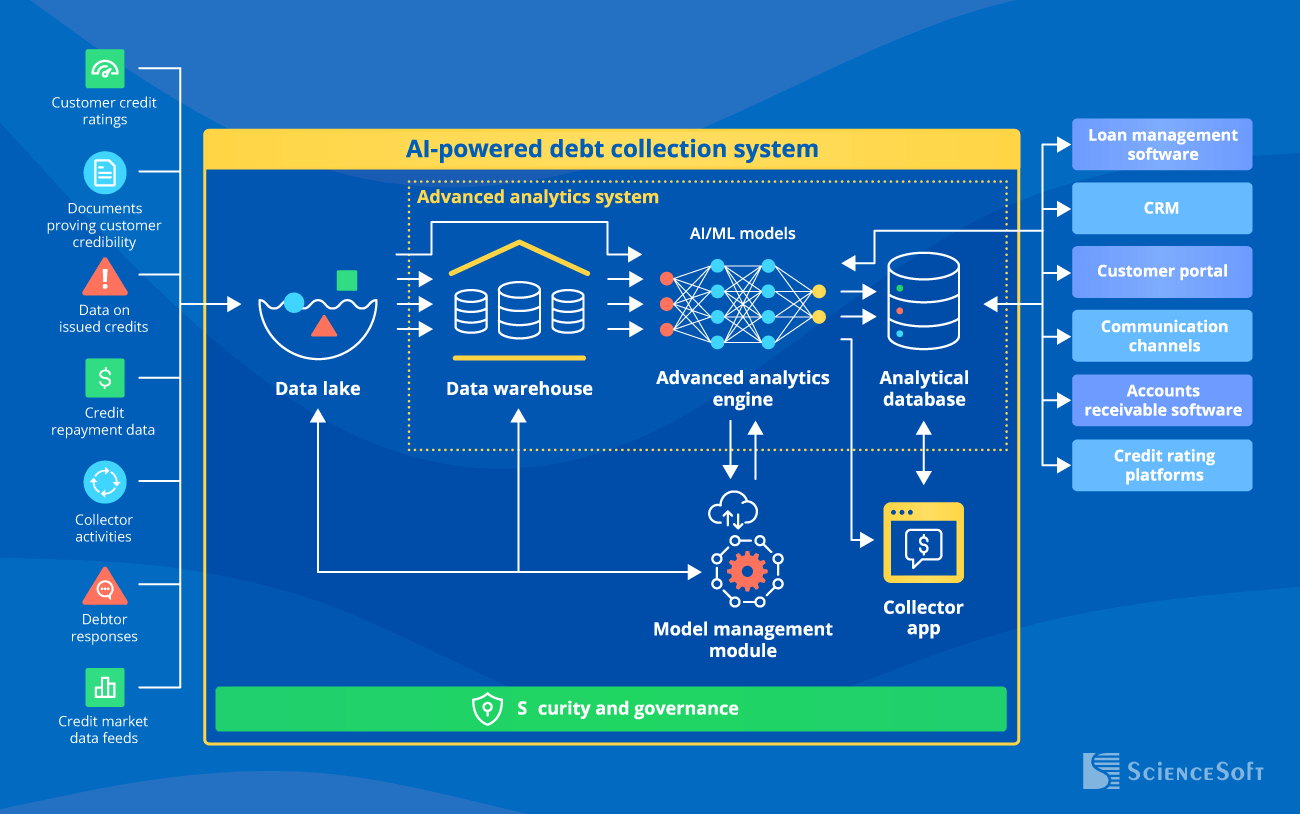

Utilize AI for Debt Management

Image Source: ScienceSoft

AI technology has revolutionized debt management. Automated systems have increased collector’s productivity by 2-4 times and reduced operational costs by 30-50%6.

Debt Reduction AI Tools

Modern AI platforms can analyze a borrower’s financial situation and predict repayment capabilities using more than 20 different factors6. These systems generate unique debt relief scores to assess repayment capacity and maximize returns on outstanding debts6. The key benefits include:

- Automated application processing

- Live payment tracking

- Customized repayment plans

- Reduced collection costs

Interest Rate Optimization

AI algorithms use historical data to determine the best interest rates and payment terms6. These systems can forecast optimal return rates for debts that cannot be fully settled6. AI systems often recommend the avalanche method, which prioritizes high-interest debt payments to minimize overall interest costs36.

Payment Prioritization

AI tools now process applications and qualify borrowers automatically, which reduces losses by 30-50%6. The systems analyze multiple factors to create individual-specific payment plans that help avoid credit score drops while keeping payments manageable6. The snowball method offers an alternative approach by focusing on smaller debts first, which creates psychological momentum in debt reduction36.

AI has revolutionized debt collection, and automated systems now process millions of calls weekly37. The tools send proactive alerts about upcoming payments and potential account shortfalls38. This helps maintain steady debt reduction progress and prevents missed payments.

Build a Digital Financial Safety Net

Image Source: Trust & Will

“A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.” — Suze Orman, Financial advisor, author, and television personality

Digital asset protection plays a vital role in personal finance management today. Each year, millions of people lose billions of dollars to identity theft39.

Insurance Tech Solutions

Insurance companies have built sophisticated digital platforms that connect multiple service providers40. These systems improve core insurance processes through up-to-the-minute data exchange. They cut operational costs by using multi-layered security architectures40. The market just needs specialized cyber insurance products that offer detailed coverage against digital threats40.

Digital Estate Planning

You must document all your online assets and accounts to manage them properly after death41. The process has two key steps – creating a digital account inventory and storing passwords in a separate location42. Laws and service providers have adapted to handle digital assets through the Revised Uniform Fiduciary Access to Digital Assets Act. This act sets up three tiers to access digital assets41.

Identity Protection

Identity thieves target personal information in many ways, from phishing emails to social engineering attempts43. Here’s how you can boost your financial safety:

- Enable multifactor authentication on all financial accounts43

- Use unique, complex passwords for each account43

- Monitor credit reports weekly through annualcreditreport.com4

- Review account statements as soon as you receive them43

- Secure home WiFi networks with strong encryption43

Password managers can give you extra security4. Your digital financial safety depends on regular monitoring and quick action against new threats43.

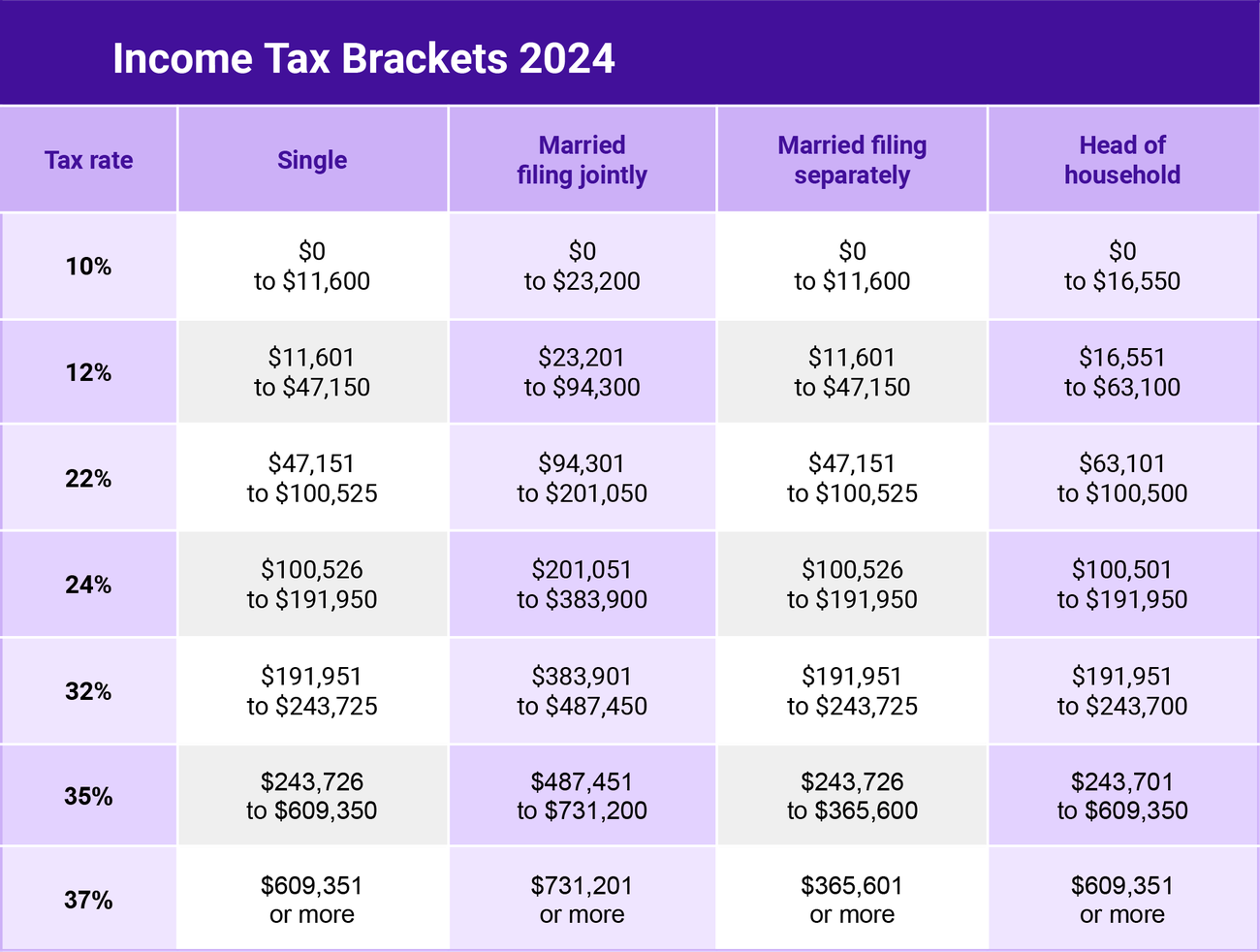

Master Tax Planning Tools

Image Source: People Managing People

Users save an average of USD 1,000 each year on tax returns with modern tax planning software44. These digital tools simplify tax preparation and help users find more deductions.

Tax Software Solutions

TurboTax and H&R Block’s platforms provide complete features to manage personal finances45. These systems cut processing time by 30-50% with up-to-the-minute tax calculations and automated form filling46. Advanced platforms merge with existing financial systems to reduce manual entry errors and transfer data smoothly47.

Deduction Tracking Apps

Keeper Tax distinguishes itself from other deduction tracking apps by creating custom profiles based on income sources and job types44. The platform includes:

- AI-powered expense categorization

- Automated receipt scanning

- Custom rules for recurring expenses

- Up-to-the-minute tax savings estimates

Tax Saving Strategies

Smart tax planning needs attention throughout the year. Businesses that use automated tax tracking save 25% monthly in reimbursements12. Modern AI systems analyze past data to find potential deductions, which reduces processing costs by 30-50%47.

Predictive analytics helps users plan taxes better by finding savings opportunities before filing season48. Cloud-based solutions keep tax regulations current and help users maximize their deductions46.

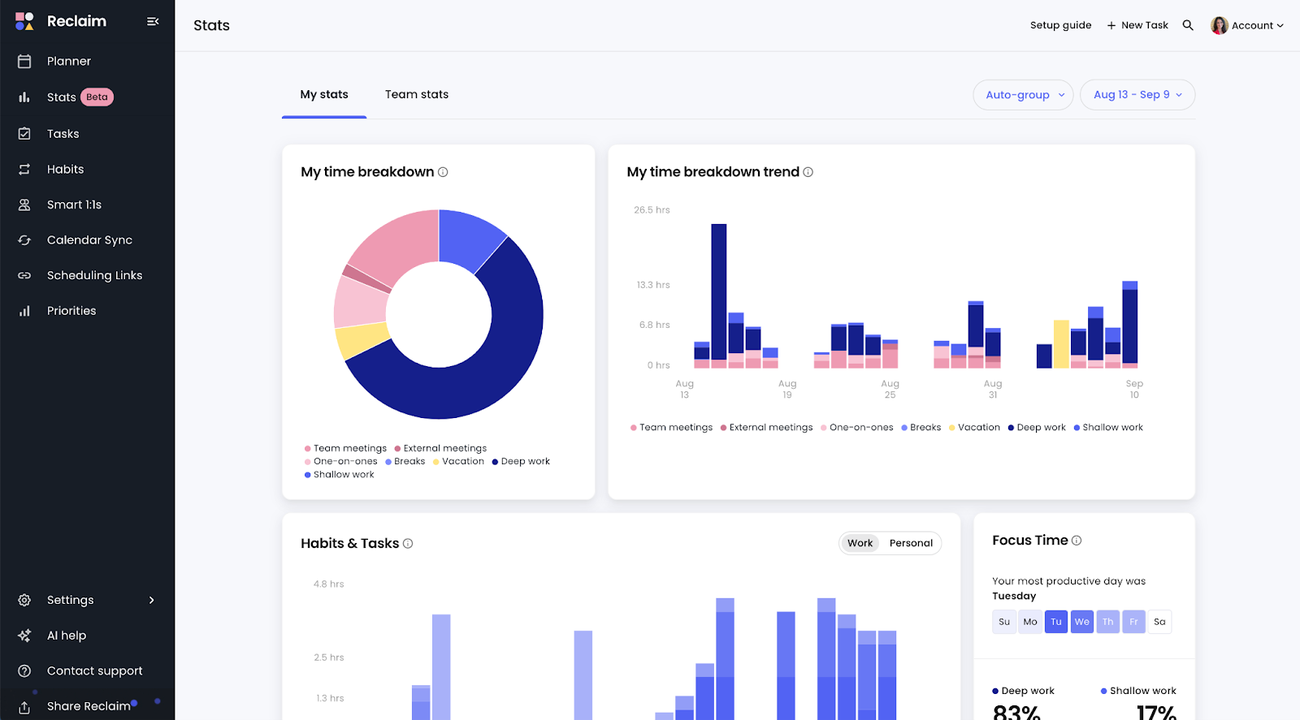

Implement Smart Financial Goals

Image Source: Reclaim AI

Clear financial goals are the life-blood of successful money management. Research proves that people who set specific money targets succeed more at every income level49.

Goal Setting Framework

The SMART framework gives you a well-laid-out way to handle your personal finances. Your money goals should be:

- Specific: Define exact amounts and purposes

- Measurable: Track progress through numbers

- Achievable: Set realistic targets within reach

- Relevant: Line up with your financial priorities

- Time-bound: Establish clear deadlines

Deep connections between goals and personal motivations boost commitment levels49. To name just one example, saving for a home connects to your family’s security, which makes the goal more meaningful and easier to achieve.

Progress Tracking Tools

Digital goal-tracking platforms like GoalsOnTrack help you build multi-level structures that monitor your financial progress50. These tools are a great way to get detailed metrics and vision boards that keep goals SMART-compliant50. We tracked success through:

- Quarterly progress reviews49

- Live data monitoring through AI-powered apps51

- Automated goal adjustments based on changing circumstances52

Milestone Rewards

Celebrating your financial wins reinforces good habits without derailing progress5. A 5-10% allocation of major financial gains for celebrations keeps you motivated while maintaining financial discipline5. You might also think over investing in personal development or career growth as rewards that can generate extra returns5.

Your financial goals need regular updates as life changes49. This framework and modern tracking tools help you build a resilient system to manage your personal finances well.

Monitor Financial Wellness

Image Source: Smartsheet

Research shows two-thirds of employees experience increased financial stress11. This stress substantially affects their personal and professional lives. Employees become four times more likely to miss monthly expenses11.

Financial Health Metrics

Financial wellness tracking measures vital indicators like income-to-expenditure ratios and emergency savings levels53. Today’s financial wellness platforms give users detailed assessment tools that calculate wellness scores based on their current financial status54. These tools look at spending patterns, savings habits, and debt management strategies to create customized action plans.

Stress Management

Several indicators demonstrate financial stress that needs attention:

- 34% of employees say their mental health takes a severe hit55

- 72% of full-time workers deal with moderate to extreme financial stress56

- 80% of employees feel constant financial pressure57

Good stress management depends on financial wellness software that gives customized guidance and support58. These platforms help maintain financial stability through educational resources and live monitoring.

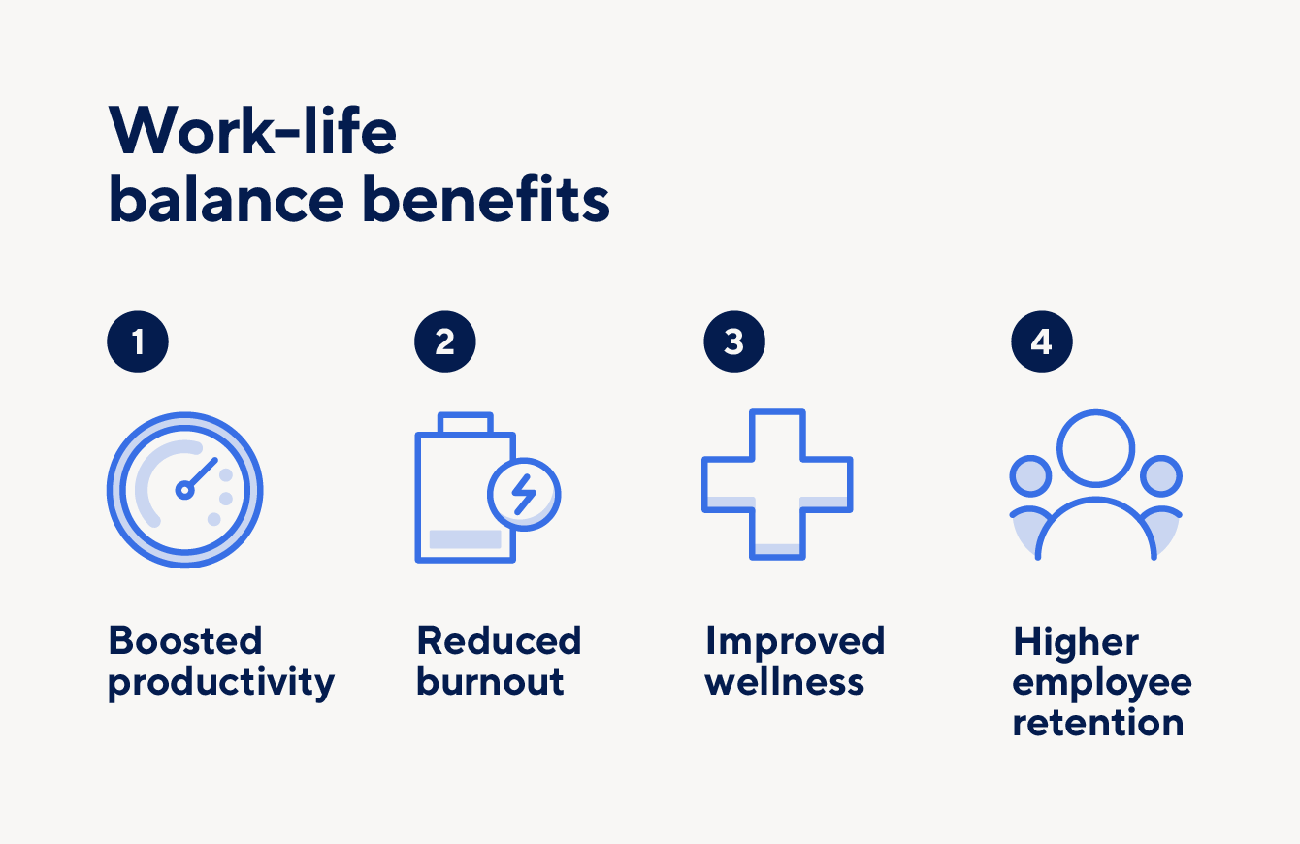

Work-Life Balance

Work-life balance shapes financial wellness through job satisfaction and productivity59. Life quality elements like family time and stress levels affect financial decisions substantially59. A healthy financial life needs a balance between money goals and personal well-being to ensure long-term financial health54.

Comparison Table

| Financial Management Method | Main Goal | Key Features | Tools/Platforms | Notable Statistics | Implementation Tips |

|---|---|---|---|---|---|

| Create a Smart Digital Budget System | Track and manage daily expenses | AI-powered grouping, automated tracking, custom categories | YNAB, Mint | Follows 50/30/20 rule (50% essentials, 30% wants, 20% savings) | Set up automatic expense tracking and create detailed spending groups |

| Build an AI-Improved Emergency Fund | Create financial safety net | Automated savings rules, tailored calculators, high-yield accounts | AI-powered calculators | 57% of people feel uneasy about emergency savings; APYs around 4% | Save 3-6 months of living costs; use high-yield savings accounts |

| Automate Bill Payments and Savings | Make financial routine easier | Payment scheduling, recurring transfers, overdraft protection | ACH transfers, Fedwire | Handles transactions almost instantly | Schedule payments before due dates; keep sufficient balances |

| Use Personal Finance Apps | Complete money management | Immediate tracking, custom reports, bank integration | Simplifi, YNAB, Monarch | 88% of U.S. consumers use finance apps | Turn on automatic transaction syncing; check account links monthly |

| Apply Digital Envelope System | Sort expenses by category | Custom spending groups, immediate tracking | GoodBudget, Mint, Simplifi | 12 main spending categories recommended | Make separate virtual envelopes for each expense type |

| Become Skilled at Green Investing | Match investments with values | ESG screening, impact measurement, portfolio building | Green bonds, ESG funds | Global impact investing market exceeds $1.57 trillion | Find balance between environmental impact and financial returns |

| Improve Credit Score Management | Build better creditworthiness | Credit monitoring, score simulation, report analysis | Credit bureau services | FICO scores range 300-850; 700+ shows very good credit | Keep credit use low; pay bills on time |

| Create Multiple Online Income Sources | Vary income streams | Digital products, passive income platforms | Online courses, YouTube | 39% of working Americans run side jobs averaging $810 monthly | Begin small and grow steadily; mix active and passive income |

| Plan for Digital Retirement | Secure future finances | Crypto options, traditional investments | Bitcoin ETFs, self-directed IRAs | 94% of state pension plans include crypto investments | Keep crypto at 2-8% of portfolio |

| Practice Mindful Digital Spending | Manage emotional spending | Spending pattern analysis, trigger identification | Tracking apps | 89.4% of Americans make emotional purchases | Wait 24-48 hours for non-essential buys |

| Employ AI for Debt Management | Make debt repayment better | Automated processing, payment tracking, custom plans | AI debt collection platforms | Boosts collector output 2-4x; cuts costs 30-50% | Choose avalanche or snowball method to reduce debt |

| Build Digital Financial Safety Net | Guard digital assets | Insurance tech, identity protection, estate planning | Password managers, cyber insurance | Millions face identity theft yearly | Use two-factor authentication; create unique passwords |

| Become Skilled at Tax Planning Tools | Improve tax efficiency | Automated calculations, deduction tracking | TurboTax, H&R Block, Keeper Tax | Saves $1,000 on average yearly on tax returns | Track taxes throughout the year |

| Set Smart Financial Goals | Create achievable targets | SMART framework, progress tracking | GoalsOnTrack | Not mentioned | Create specific, measurable, achievable, relevant, time-bound goals |

| Monitor Financial Wellness | Check financial health | Stress management, wellness metrics | Financial wellness platforms | 66% of employees feel financial stress | Check income-to-spending ratios regularly |

Epilogue

Smart digital tools and consistent habits make personal finance management simpler than complex strategies. Research shows that successful money management comes from automated systems that handle daily tasks. This lets us focus on strategic decisions. Smart budgeting tools based on the 50/30/20 rule create a solid structure. AI-powered apps help us avoid emotional spending traps that affect 89.4% of Americans.

Emergency funds and diversified investments create strong financial safety nets. Modern high-yield accounts with 4% APY make your emergency savings work harder. Environmentally responsible investing options help you match your money with your values. Side hustlers earn an average of $810 monthly through multiple income streams, which adds financial security through active and passive revenue.

Financial wellness needs a balance of automation and mindful decisions. AI-powered tools track your progress toward goals and help maintain healthy spending habits. You can build lasting wealth through proven digital methods when tax planning and debt management systems reduce your stress.

Note that financial success grows from small, consistent actions over time. You can get ahead of most people who use outdated money management approaches by starting with just one of these 15 methods today.

To learn more:

17 Smart Ways to Save Money on Entertainment (Tested in 2025)

FAQs

Q1. What are some key strategies for financial success in 2025? Review your wealth plan, organize accounts, maximize tax efficiency, and renew your portfolio’s resilience. Also consider holding sufficient cash reserves, planning charitable giving, and completing annual financial “to-dos” to stay on track.

Q2. How can I implement the 50/30/20 rule in my budget? Allocate 50% of your income for necessities like housing and food, 30% for discretionary spending or wants, and 20% for savings and debt repayment. This balanced approach helps prioritize financial goals while allowing for some flexibility in spending.

Q3. What are some examples of SMART financial goals for 2025? Set specific targets like saving for a home down payment by December 2025, paying off a certain amount of credit card debt by July 2025, or contributing 15% of your 2025 salary to a retirement account. Ensure goals are measurable, achievable, relevant, and time-bound.

Q4. How can I diversify my income streams in 2025? Consider creating digital products, offering online courses, or leveraging passive income platforms. Start small with side hustles and gradually scale up, aiming to balance active and passive income sources for greater financial stability.

Q5. What role does AI play in personal finance management for 2025? AI-powered tools can enhance budgeting, automate bill payments, optimize debt management, and provide personalized investment advice. These technologies increase efficiency in tracking expenses, identifying saving opportunities, and making data-driven financial decisions.

References

[1] – https://www.aiixx.ai/blog/top-ai-budgeting-tools-to-manage-your-finances

[2] – https://thegiin.org/publication/post/about-impact-investing/

[3] – https://www.cnbc.com/select/best-budgeting-apps/

[4] – https://www.equifax.com/personal/education/identity-theft/articles/-/learn/apps-cybersecurity-tips/

[5] – https://richburgenterprisesllc.com/celebrating-milestones-how-to-reward-yourself-without-derailing-your-goals/

[6] – https://www.debtzero.ai/resources/introducing-debtzero%3A-the-ai-powered-solution-transforming-debt-relief

[7] – https://www.federalreserve.gov/pubs/creditscore/creditscoretips_2.pdf

[8] – https://medium.com/prosperpulse/the-psychology-of-spending-mastering-emotional-triggers-and-cultivating-financial-balance-458c846c4c20

[9] – https://www.paigebrunton.com/blog/multiple-online-business-income-streams

[10] – https://www.cnbc.com/2025/01/08/crypto-options-in-401k-plans-heres-what-you-need-to-know.html

[11] – https://www.payactiv.com/holistic-financial-wellness-platform/

[12] – https://www.everlance.com/

[13] – https://leobit.com/blog/how-to-build-a-budgeting-app-opportunities-challenges-and-practical-tips/

[14] – https://mint.intuit.com/

[15] – https://www.wisdomtreeprime.com/blog/5-security-features-you-should-look-for-when-choosing-a-financial-app/

[16] – https://www.quorumfcu.org/learn/money-management/the-digital-envelope-budgeting-system/

[17] – https://www.firstcitizensbank.com/services-tools/tools/education-center/detail.html?cId=57645&title=envelope-budgeting-cash-vs-digital

[18] – https://www.clevergirlfinance.com/digital-envelope-system/

[19] – https://relayfi.com/blog/digital-envelope-system

[20] – https://am.jpmorgan.com/lu/en/asset-management/per/investment-themes/esg/what-are-the-different-approaches-to-sustainable-investing/

[21] – https://coloradocap.com/blog/building-a-green-portfolio-how-to-get-started/

[22] – https://www.sustainalytics.com/impact-reporting

[23] – https://www.universalclass.com/articles/business/finance/analyzing-the-credit-report.htm

[24] – https://xactus.com/score-optimization/

[25] – https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/improve-credit-score/

[26] – https://www.experian.com/credit/credit-monitoring/

[27] – https://www.houst.com/blog/mastering-income-diversification-guide

[28] – https://www.inc.com/hostinger/top-10-side-hustle-ideas-to-make-extra-money-in-2025/91070479

[29] – https://www.hostinger.com/tutorials/make-money-online/

[30] – https://www.forbes.com/sites/melissahouston/2024/04/17/why-diversifying-your-income-streams-is-essential-in-todays-economy/

[31] – https://www.kiplinger.com/retirement/crypto-in-your-retirement-account

[32] – https://www.pcmag.com/picks/the-best-personal-finance-services

[33] – https://sustain.ubc.ca/resources/mindful-consumption-guide

[34] – https://www.nasdaq.com/articles/ramit-sethi:-how-to-create-a-conscious-spending-plan

[35] – https://www.valley.com/personal/insights/managing-your-money/create-a-conscious-spending-plan-with-these-4-steps

[36] – https://www.bankrate.com/credit-cards/news/i-asked-chat-gpt-for-a-debt-repayment-plan/

[37] – https://ibsintelligence.com/ibsi-news/3-platforms-leveraging-generative-ai-to-eliminate-debt-in-usa/

[38] – https://ksltv.com/ksl-investigates/get-gephardt/using-ai-to-tackle-your-debt/622459/

[39] – https://www.morganstanley.com/articles/personal-cybersecurity

[40] – https://www.nusummit.com/top-technology-trends-in-the-insurance-industry-for-2025/

[41] – https://www.usbank.com/wealth-management/financial-perspectives/trust-and-estate-planning/digital-estate-plan.html

[42] – https://www.ml.com/articles/digital-assets-estate-planning.html

[43] – https://www.finra.org/investors/insights/cyber-safe-financial-accounts

[44] – https://www.keepertax.com/posts/best-app-to-track-receipts-for-taxes

[45] – https://www.cnbc.com/select/best-tax-software/

[46] – https://www.wolterskluwer.com/en/know/artificial-intelligence-tax-accounting

[47] – https://tax.thomsonreuters.com/en/tax-accounting/tax-research-guidance/research-powered-by-ai

[48] – https://www.primeglobal.net/news/ai-powered-tax-planning-eurofast

[49] – https://www.usbank.com/wealth-management/financial-perspectives/financial-planning/how-to-set-financial-goals.html

[50] – https://clickup.com/blog/goal-tracking-apps/

[51] – https://www.bankrate.com/investing/artificial-intelligence-as-financial-tool/

[52] – https://hexaware.com/blogs/generative-ai-in-financial-services-transforming-goal-based-financial-planning/

[53] – https://www.useorigin.com/resources/blog/the-4-pillars-of-holistic-financial-wellness

[54] – https://business.bofa.com/en-us/content/workplace-benefits/solutions-and-services/financial-wellness-for-employees.html

[55] – https://www.pwc.com/us/en/products/financial-wellness.html

[56] – https://www.paycom.com/resources/blog/employee-financial-wellness/

[57] – https://hbr.org/2024/01/its-time-to-prioritize-employees-financial-health

[58] – https://www.gartner.com/reviews/market/financial-wellness-software

[59] – https://miranna.com/blog/non-traditional-metrics-of-financial-well-being-a-holistic-approach-to-financial-health

[60] – https://www.maly.ai/ai-financial-assistant

[61] – https://www.bediasbank.com/post/mastering-your-finances-in-2025-practical-budgeting-tips-to-reach-your-financial-goals

[62] – https://use.expensify.com/expense-management

[63] – https://www.concur.com/en-us/expense-management

[64] – https://www.bankrate.com/banking/savings/ai-apps-to-help-you-save-money/

[65] – https://www.fdic.gov/consumer-resource-center/2025-01/saving-unexpected-and-your-future

[66] – https://www.moneylion.com/learn/emergency-fund-calculator/

[67] – https://www.planadviser.com/candidly-launches-emergency-savings-solution/

[68] – https://era.app/blog/the-emergency-fund-challenge-building-your-safety-net-while-optimizing-your-finances

[69] – https://www.payactiv.com/financial-learning/using-automatic-savings-to-create-an-emergency-fund/

[70] – https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

[71] – https://www.usnews.com/banking/articles/whats-the-best-account-for-an-emergency-fund

[72] – https://stripe.com/au/resources/more/automated-payment-systems-explained

[73] – https://www.asap.gov/ASAPGovHelp_508Project/payments/create_payment_schedule/tips___tricks_create_payment_schedule.htm

[74] – https://www.paystand.com/blog/automatic-bill-payment

[75] – https://www.bankrate.com/banking/savings/grow-your-savings-with-automatic-transfers/

[76] – https://www.huntington.com/learn/saving/automate-savings-and-paying-bills

[77] – https://www.avidxchange.com/glossary/automatic-bill-payment/

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com