The uncertain economic climate and rising cost of living make smart frugal habits a vital part of financial survival.

My experience shows that simple daily spending adjustments create substantial savings. Switching to store brands alone can cut your grocery bills by 40%. Smart commuting choices save over $5,725 each year. These money-saving habits don’t require extreme sacrifices – they help you make smarter financial decisions.

Small but consistent changes in spending habits could save you over $12,000 yearly – enough money to build an emergency fund or save for a house deposit. This piece shares 15 proven frugal living tips that help you save $500 or more monthly, starting today.

Create a Zero-Based Digital Budget

Image Source: CNET

“Zero-based budgeting can help them figure out how to balance increased cost of living with income.” — Lorna Sabbia, Head of Retirement and Personal Wealth Solutions at Bank of America

Zero-based budgeting changes how people manage their money by giving every dollar a job. This digital way of being frugal means all money gets factored in your monthly budget.

Understanding Zero-Based Budgeting

Each month starts fresh with zero-based budgeting that needs proof for every expense1. This method helps cut costs by stopping automatic increases to previous budgets1. Money management works by matching all income to expenses until they equal zero57.

Best Budgeting Apps for 2025

You Need A Budget (YNAB) leads the pack with complete zero-based budgeting features, costing $14.99 monthly or $99 annually58. YNAB gives users a 34-day free trial and students can try it free for a year58. PocketGuard comes with three ways to budget: envelope, zero-based, and 50/30/20 allocation58. Simplifi by Quicken shines with its easy-to-use design and connects multiple financial accounts smoothly58.

Setting Up Automated Tracking

Bank accounts link directly to automated budget tracking for smoother money management59. Your CRM and contracts feed important data into the system automatically60. This automation cuts down office work and gives up-to-the-minute financial insights60.

Monthly Savings: $100+

Users who switch to zero-based digital budgeting save $100 or more monthly by watching expenses better and cutting unnecessary spending. Smart alerts stop budget overruns60, while the system spots possible budget problems before they happen60.

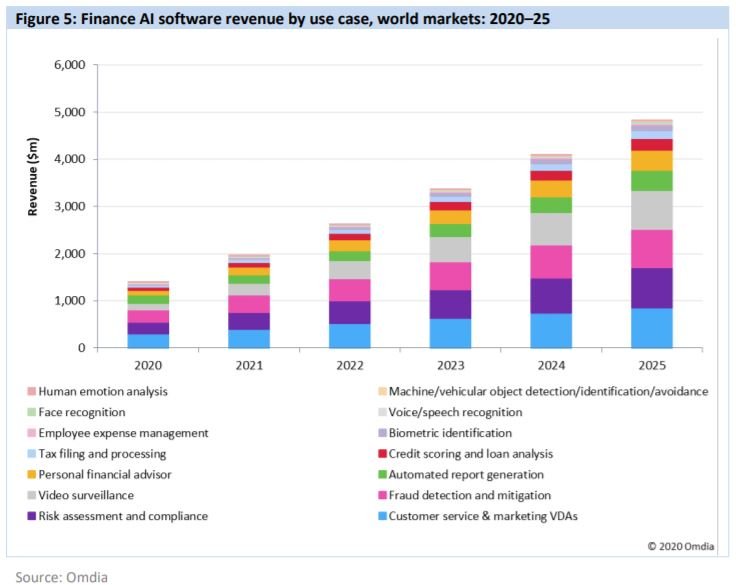

Automate Bill Negotiations with AI Tools

Image Source: Omdia – Informa

AI-powered bill negotiation apps offer a smart way to save money without dealing with manual negotiations. These services automatically reduce monthly bills through conversations with service providers.

Top Bill Negotiation Apps

BillShark guides the market with a 90% success rate and potential savings of up to 25% on monthly bills61. Trim’s customers save an average of $213 annually61 on their recurring expenses. BillCutterz excels at negotiating household bills61 and offers a specialized Medical Cost Advocate service that reduces unpaid medical bills by 20-50%61.

How AI Reduces Your Bills

Smart negotiation tools analyze your billing patterns and service usage to find savings opportunities. The system spots pricing discrepancies and manages denial appeals automatically62. These advanced tools create negotiation scripts that adapt based on each situation62. To name just one example, see DoNotPay’s AI chatbot that secured a $120 annual reduction in an internet bill by analyzing service outages and making compelling arguments63.

Success Rate Statistics

The numbers prove how well these services work. BillShark maintains a 90% success rate61, and BillAdvisor’s customers save $830 on average61. Beta testing showed users saved an average of $300 per year64.

Monthly Savings: $50+

Each negotiated bill typically saves users $300-$500 annually65. Multiple service negotiations increase savings potential, though companies take 30-60% of first year’s savings as their fee66. The net savings make this money-saving approach worthwhile for most households despite the fees.

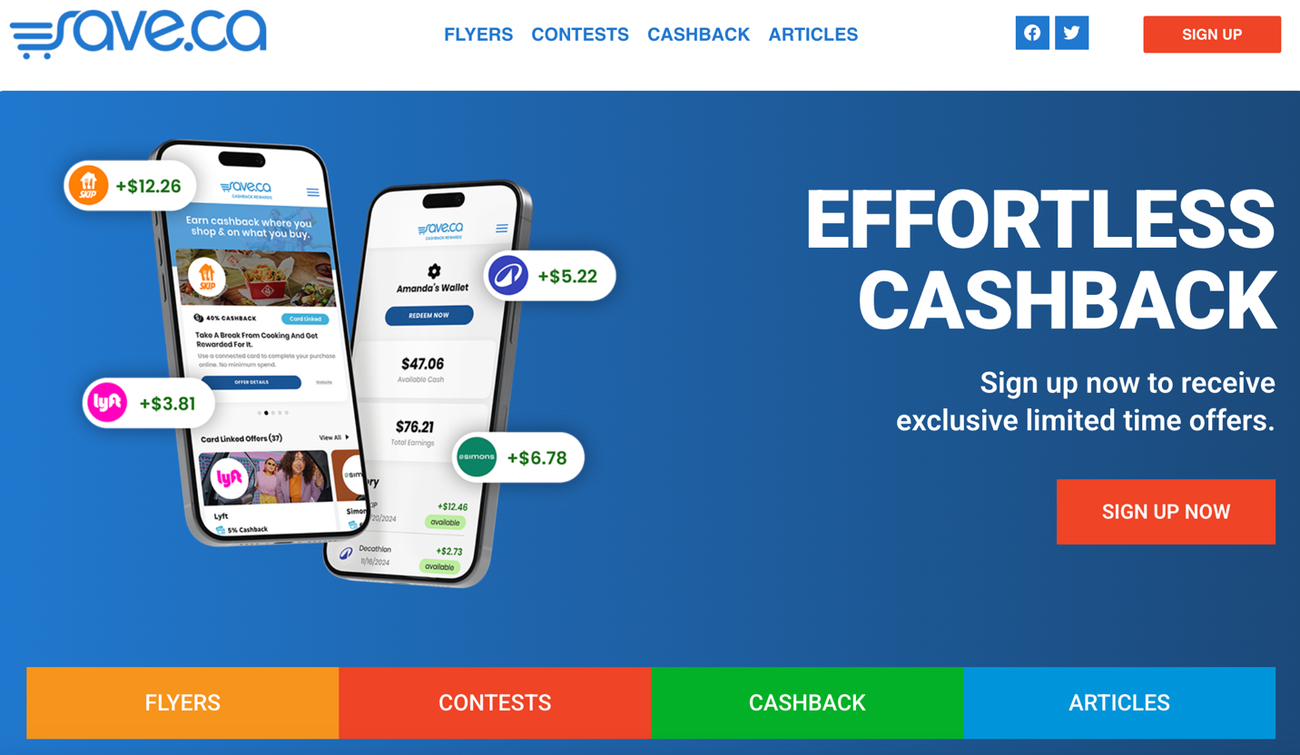

Use Cashback Stacking Strategy

Image Source: GlobeNewswire

Savvy shoppers discover the potential of cashback stacking as a money-saving habit that combines multiple reward programs to maximize savings on everyday purchases. The strategy lets users layer different cashback opportunities to earn multiple rewards from a single transaction.

Best Cashback Apps 2025

Rakuten guides the market with cashback rates ranging from 1% to 40% at more than 3,500 retailers67. TopCashback delivers higher rates consistently and passes 100% of their affiliate commission to users with up to 45% cashback at over 4,500 stores68. Ibotta focuses on grocery shopping by providing item-specific offers and store loyalty card integration69.

Combining Multiple Rewards Programs

Smart stacking requires strategic combinations of rewards programs. A $100 purchase could earn 2% from your credit card plus 3% from a cashback app, which reduces the cost to $9567. Credit card rewards combined with shopping portals and store loyalty programs boost returns substantially. Shoppers can amplify their savings by timing purchases during seasonal promotions and special offers67.

Monthly Savings: $75+

Dedicated reward stackers save between $300-$500 annually in each spending category70. Success comes from combining store loyalty programs with cashback credit cards and receipt scanning apps71. A shopper saved $30 on a single grocery trip by using loyalty card discounts with cashback offers71.

Implement the 24-Hour Purchase Rule

Image Source: FasterCapital

Research shows that 40-80% of all buying decisions happen on impulse72. The 24-hour purchase rule helps curb these unplanned expenses and builds better spending habits.

Psychology Behind Impulse Buying

We buy things on impulse because of emotional triggers, not logical thinking. Store environments, life satisfaction, and our emotional state play a huge role in spontaneous purchases72. The numbers tell an interesting story – 40% of consumers spend more in physical stores while only 25% do so in online shopping73. These quick decisions come from our need for instant gratification and often lead to buyer’s remorse73.

Setting Up Digital Purchase Barriers

The 24-hour rule works best with these digital safeguards:

- Clear all saved credit card details from your devices

- Build a “waiting list” for items you want

- Open a separate account for planned purchases

- Remove shopping apps from your phone

The rule works best when you take a full day to review any purchase above 1% of your yearly income14. This cooling-off period helps you think clearly about needs versus wants.

Monthly Savings: $200+

The typical consumer drops $5,400 annually on impulse buys – from food to clothes to household items15. People who follow the 24-hour rule save $200 or more monthly by avoiding unplanned purchases72. These savings grow even more with automated tracking and digital barriers.

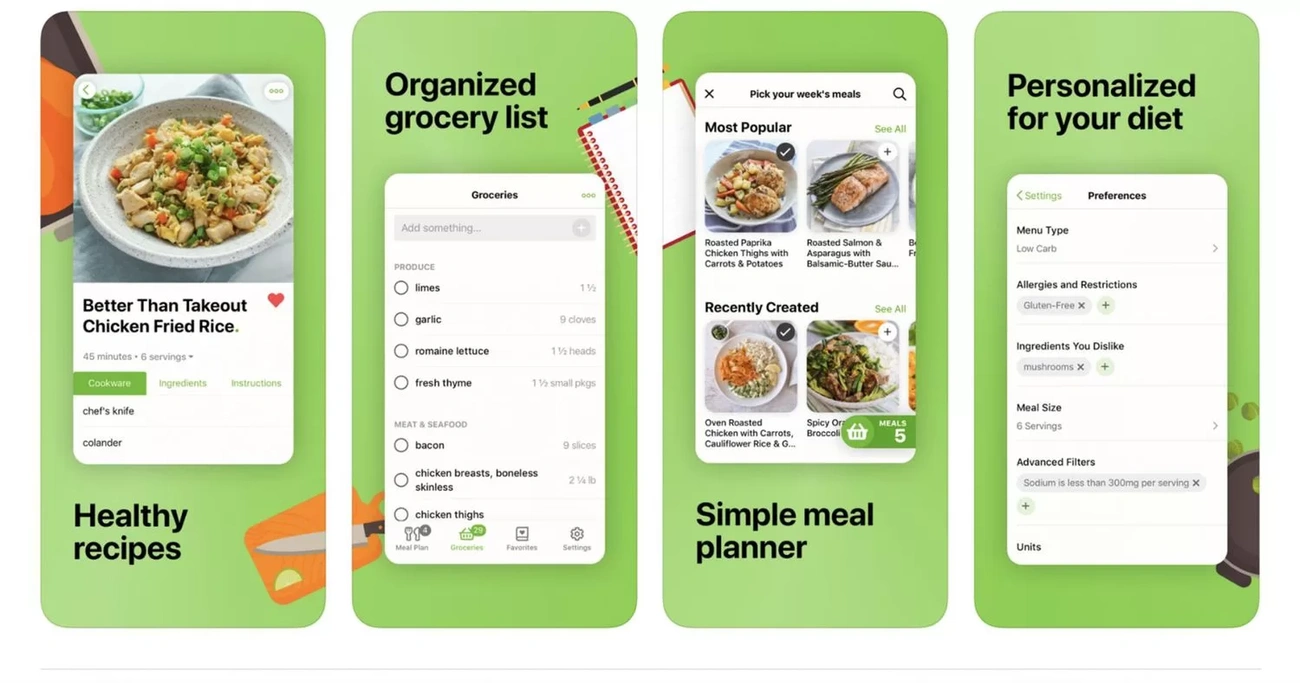

Master Meal Planning Technology

Image Source: Easy Meal Prep Recipes

Meal planning is the life-blood of saving money, and we used technology to make grocery shopping and food prep easier.

Meal Planning Apps

New meal planning apps help you save on groceries and reduce food waste. Mealime creates customized meal plans with automated grocery lists that help prevent wasted food through smart recipe suggestions16. Eat This Much Premium lets you set calorie and nutrient targets based on your goals and creates grocery lists automatically3. Plan to Eat combines your meal plans with shopping lists and cuts planning time to just 30 minutes each week4.

Digital Grocery List Optimization

A complete grocery list is the quickest way to shop efficiently. Items organized by store sections help you save time and avoid impulse buys17. Digital list apps give you:

- Live budget tracking

- Store layout optimization

- Automated category sorting

- Shared family access

Bulk Cooking Strategies

Batch cooking cuts food costs by 20-30% when you buy and prepare in bulk18. You can cook several meals at once and store portions in the freezer19. This method saves money and time by using seasonal produce and bulk ingredients18.

Monthly Savings: $300+

Households save $2,275 annually by using meal planning apps and batch cooking to reduce waste20. The savings come from fewer impulse purchases, better ingredient use, and less takeout3. Smart bulk cooking alone helps save $500-$700 monthly on groceries21.

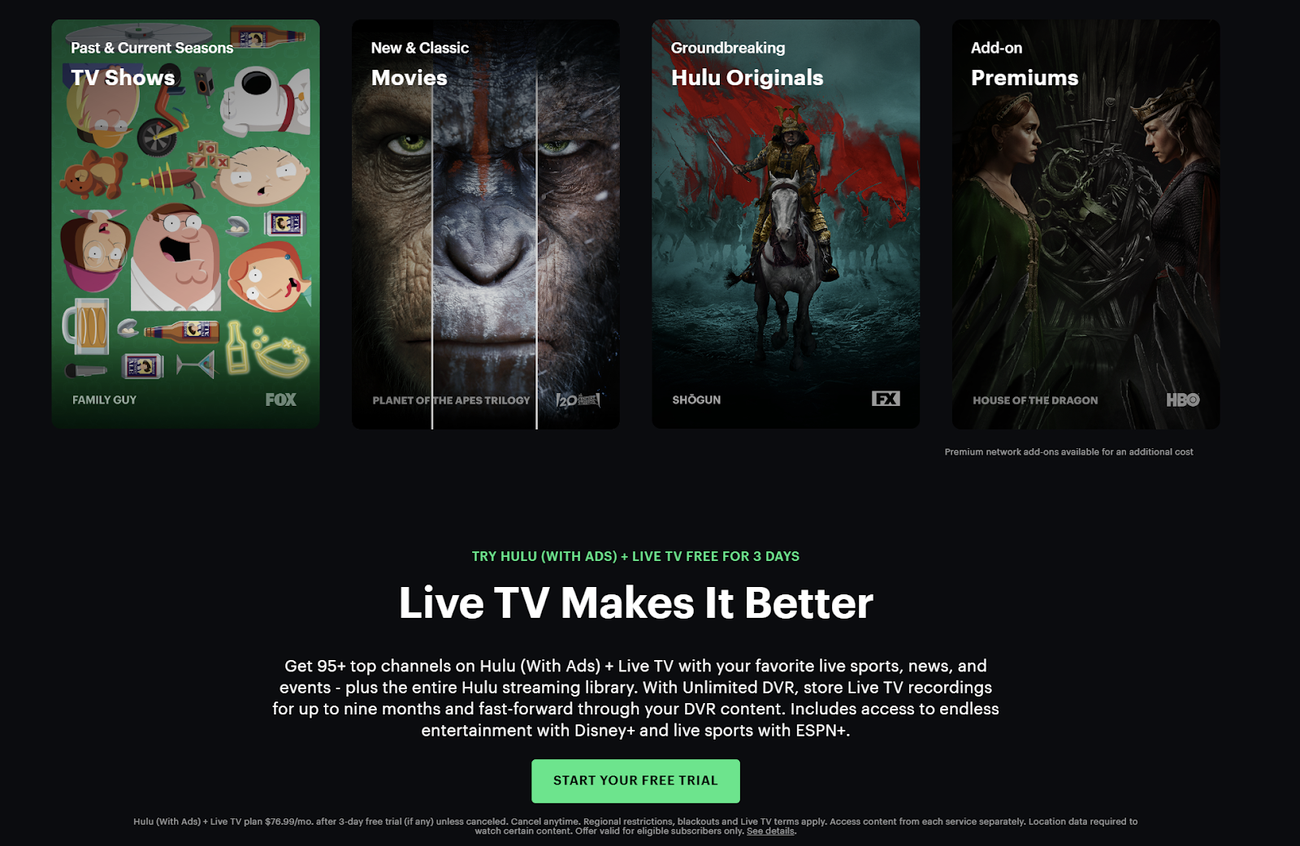

Optimize Streaming Services

Image Source: Encharge.io

Smart management of streaming subscriptions helps reduce entertainment costs. The average U.S. household spends $61 monthly on streaming services22. Budget-conscious consumers need to optimize these expenses.

Rotating Subscriptions Strategy

Service rotation, also called “churn,” helps users get more content at lower costs. Statistics show 25% of streaming subscribers have canceled three or more services in the last two years23. Here’s how to make rotation work:

- Use apps like JustWatch to track show releases

- Add calendar alerts for billing cycles

- Stop services between seasons

- Start again when favorite shows come back

Family Plan Optimization

Household plans save money through multiple profiles and simultaneous streams. Netflix’s Premium plan costs $22.99 monthly and lets you add two users at $7.99 each24. Disney+ allows up to six simultaneous streams on family accounts25. Sharing costs among household members cuts per-person expenses.

Ad-Supported vs Premium

Ad-supported options save money on many platforms. Netflix has an ad-supported plan at $8 monthly23, and Disney+ offers ad-supported viewing for $10 monthly26. Users can also choose bundles like Disney+, Hulu, and ESPN+ with ads at $15 monthly23. These packages give better value to multi-service users.

Monthly Savings: $30+

Households save $20-$40 monthly27 by rotating services and choosing ad-supported plans. Annual subscriptions provide extra discounts. Max’s ad-supported yearly plan costs $99.99, which saves $20 yearly26 compared to monthly payments.

Use Smart Home Energy Management

Image Source: Moyer Indoor | Outdoor

Home automation has become a money-saving habit that uses smart technology to cut energy costs through intelligent monitoring and control. Smart home energy management systems automatically take specific actions to reduce energy consumption6.

Smart Thermostat Programming

Smart thermostats are the most powerful energy-saving technology available today. We discovered that heating and cooling make up the biggest chunk of household energy costs6. These clever devices learn your household’s patterns and adjust temperatures on their own. The result? You can save up to 20% on heating bills5. Your thermostat’s geofencing feature detects empty homes and adjusts temperatures to save money6.

Key smart thermostat capabilities:

- Control temperature from your smartphone

- Schedule changes based on when people are home

- Monitor energy use immediately

- Adjust temperature based on weather conditions

Energy Monitoring Apps

Energy monitoring applications work among smart thermostats to show exactly how you use power. Apps like Emporia Energy help manage power use and adjust consumption at the time rates peak28. WatchWire and Energy Elephant platforms track immediate usage and give you applicable information to save money29.

Monthly Savings: $50+

American households spend $900 annually to heat and cool their homes6. Smart thermostats help users save 10-12% on heating and 15% on cooling costs. This adds up to yearly savings between $131-$14530. Smart appliances cut energy costs by an additional 2-9%30. These numbers show how home automation contributes significantly to monthly savings.

Practice Digital Couponing

Image Source: www.joinhoney.com

Digital coupons have changed how we save money, and 94% of consumers now look for deals online8. Smart shoppers turn their everyday purchases into chances to save big.

Browser Extensions for Savings

The best browser extensions now do all the work of finding deals. PayPal Honey connects with 30,000+ merchants and helps users save $126 every year7. Capital One Shopping and Rakuten check multiple discount codes at once to find the biggest savings at checkout. These tools also watch price changes and let you know when better deals pop up at other stores.

Smart Deal Finding

The old way of searching for coupons used to take more than two hours each week31. Today, just 17% of online shoppers use these automatic coupon tools8, but they find discounts for 40% of all online purchases8. The best features you’ll get:

- Instant code testing

- Price drop alerts

- Automatic cashback tracking

- Deals for every season

Monthly Savings: $100+

People who use digital coupons save $1,465 each year with these automatic tools8. The typical discount comes to $30 per purchase, which means 17.2% savings8. Browser extensions help you save money consistently without spending hours clipping coupons.

Leverage Buy-Nothing Groups

Image Source: WIRED

Buy Nothing groups offer a smart way to save money and connect with neighbors at the same time. These neighborhood-based groups now exist in 128,000 communities worldwide32. Members can give away items they don’t need and pick up things they want – all for free.

Finding Local Groups

The Buy Nothing Project app makes it easy to find groups near you. Facebook has plenty of options too, with over 500 groups that have 500-3,000 members each33. Just search for “Buy Nothing” and add your neighborhood name32. These groups stick to small local areas so pickup is convenient and neighbors can build real connections.

Best Practices for Free Items

Your success in Buy Nothing groups depends on some simple guidelines:

- Take time to read the group rules first

- Write clear item descriptions

- Answer messages quickly

- Show up when you say you will

- Make sure items are clean and work well

Monthly Savings: $75+

Members save big on everyday stuff. A free set of weights saves you $5034, while car seats that normally cost $100 or more34 come at no cost. You’ll skip the sales tax too, which runs up to 9.55% in some states32. Active members can easily save more than $75 each month on household items, furniture and clothes.

Implement No-Spend Weekends

Image Source: Printabulls

No-spend weekends are a powerful way to reset your spending habits and boost monthly savings. These dedicated times without extra spending give you chances to find creative entertainment and bond with family.

Planning Free Activities

You need engaging alternatives to paid entertainment to make no-spend weekends work. We focused on outdoor activities that offer free recreation through nature walks, hiking trails, and community parks35. Your indoor options include:

- Creating family game tournaments with existing board games

- Building blanket forts for movie marathons using streaming services

- Organizing neighborhood potlucks with shared resources

- Learning about free community events and museum admission days36

Tracking Success

Digital tools make it easy to monitor your progress during no-spend weekends. Modern apps help you track spending patterns and highlight success rates37. A digital journal of activities and savings helps build positive habits. Many families feel more motivated when they document their no-spend experience through photos and activity logs10.

Monthly Savings: $200+

No-spend weekends help you save $200 or more each month38. The average family spends $5,400 annually on weekend impulse purchases39. This budget-friendly habit works well, especially when you have meal planning and free community activities10. You can end up with substantial yearly savings by sticking to this routine.

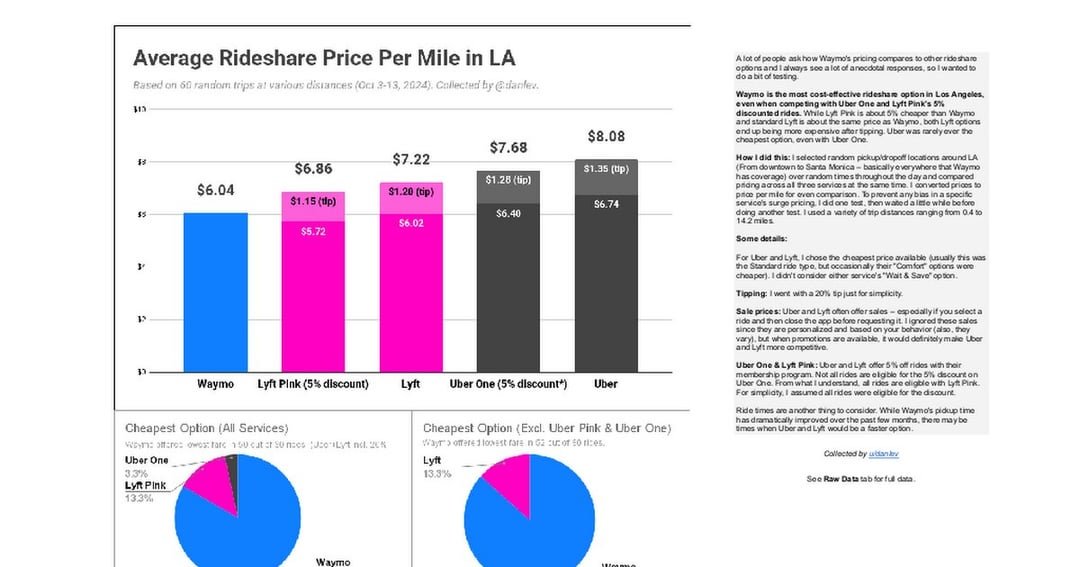

Use Transportation Apps Smartly

Image Source: Reddit

Transportation apps turn daily commuting into a money-saving habit with smart price comparisons and live updates.

Comparing Ride Costs

RideGuru stands out by comparing fares from 50+ supported rideshare companies in thousands of cities40. The app breaks down costs between driver earnings and company fees40. Additionally, Obi reports savings of $20-$50 on airport rides and $5-$10 on regular trips41. The app includes 99% of all drivers in major cities like New York and delivers average savings of 20% per ride41.

Public Transit Apps

Google Maps excels at providing live traffic updates and suggests alternative routes9. Citymapper combines data for busses, trains, and other transport modes to give clear directions that help avoid delays9. Moovit’s AI-powered route optimization has cut average commute times by 18% through crowdsourced updates9.

Monthly Savings: $150+

Smart transportation app usage saves $5,725 annually on commuting costs42. Users can maximize savings by:

- Comparing multiple service providers before booking

- Setting price alerts for regular routes

- Using off-peak travel discounts

- Combining public transit with ride-sharing options

These apps ended up helping users cut unnecessary transportation expenses through smarter decisions and live price optimization43.

Automate Savings with Microsaving Apps

Image Source: The College Investor

Microsavings apps are breakthrough tools that automate the savings process through small, regular transfers. These digital tools help users build wealth without thinking about saving money.

Top Apps for 2025

Oportun guides the digital world of microsavings by analyzing spending patterns and determining safe amounts to transfer automatically44. Qapital’s customizable savings rules let users save money with specific purchases44. Among other features, Chime provides automatic savings transfers and competitive interest rates that move a percentage of each paycheck to savings44.

Setting Up Round-Ups

Round-up features are the life-blood of microsavings success. The key capabilities include:

- Transaction rounding to nearest dollar

- Daily transfer of accumulated spare change

- Automated deposit scheduling

- Multiple savings goals tracking

Users save $2,200 annually with simple plans45. Some apps analyze spending habits and withdraw small amounts several times weekly to avoid overdraft fees45.

Monthly Savings: $100+

The Financial Health Network shows that automated savings tools help users save $217 more per month compared to manual methods2. The success rate jumps dramatically as these tools blend with regular payroll. Participation rates have risen from 1.3% to 52.6%2. These microsavings apps help establish consistent saving habits and build financial confidence through small, regular wins46.

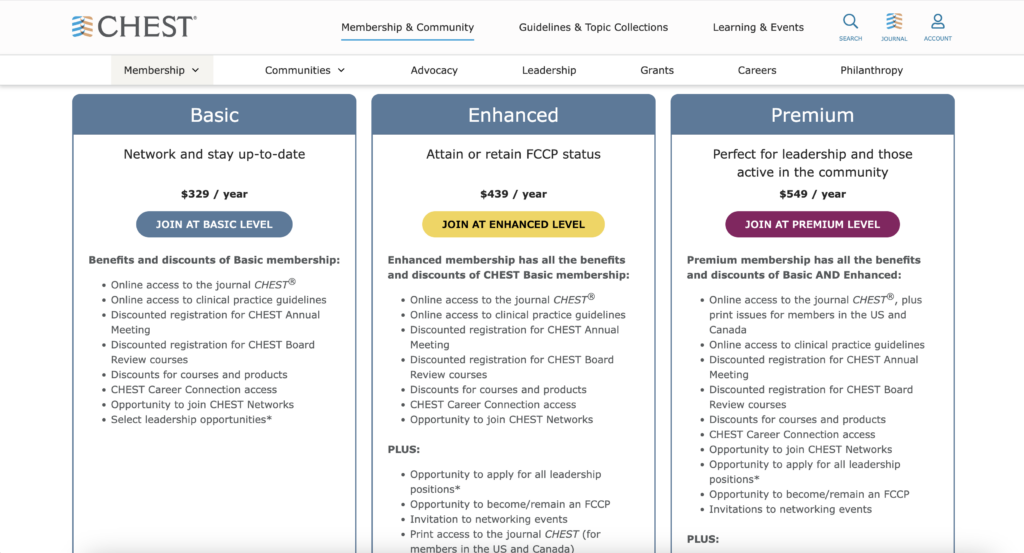

Join Members-Only Discount Programs

Image Source: MemberClicks

Membership discount programs are a smart money-saving habit that gives you exclusive access to the most important savings in multiple categories. These programs blend retail discounts, travel perks, and special services to give you the best value for your money.

Best Programs for 2025

Costco guides the market with 50 million members11 and offers three membership tiers. The options range from Gold Star at $55 annually to Executive at $110 annually with 2% cashback11. Sam’s Club memberships start at $45 and give you $10 cashback per $500 spent11. Amazon Prime brings value through free shipping, streaming services, and special discounts. Students can get Prime at half price11.

Maximizing Membership Benefits

Smart members combine multiple benefits to get the most value. You get exclusive access to:

- Store discounts from 10-50% off47

- First access to sales and limited collections48

- Customized deals based on your shopping habits48

- Special in-store savings at over 1 million locations worldwide47

Monthly Savings: $50+

Members save 35-40% per transaction47 when they use programs smartly. Warehouse club members save enough to cover their membership costs within three months11. Company alliances give you an extra 10-20% off on travel and stays49. These membership programs are a great way to get more savings in your budget strategy.

Create a Home Maintenance Schedule

Image Source: Reddit

Smart home maintenance is a vital frugal habit. Scheduling maintenance strategically saves homeowners money on repairs and replacements. Professional contractors ask for $70 to $130 per hour50, which makes planned maintenance essential to control costs.

DIY vs Professional Services

Several factors help you decide between DIY and professional services. Safety comes first – tasks with electricity, gas, or potential hazards need professional expertise50. Simple projects like building fences or varnishing tables work well as DIY projects50. Professional plumbers charge $45 to $200 per hour50, and their specialized equipment can get pricey at $3,000 for certain tools50.

Preventive Maintenance Apps

Digital tools make home maintenance scheduling easier. UptimePM gives you the complete tracking system for machine hours and inspection schedules12. Limble CMMS now includes:

- Automated maintenance scheduling

- Live task tracking

- Mobile inspection capabilities

- Detailed maintenance history logs12

Monthly Savings: $100+

Regular maintenance saves 1-4% of your home’s value each year13. A $200,000 home owner saves $2,000-$8,000 yearly13. HVAC maintenance needs $500-$1,000 annually to avoid emergency repairs51. Early problem detection and longer equipment life make preventive maintenance a money-saver in the long run52.

Use Price Tracking Tools

Image Source: Competitors App

Price tracking tools are valuable allies that help smart shoppers turn random deals into regular savings through automated monitoring and alerts.

Best Price Alert Apps

CamelCamelCamel guides the market in Amazon price tracking and gives users complete historical data and email notifications53. The platform shows price changes from both Amazon direct sales and third-party sellers53. Capital One Shopping compares prices from multiple retailers and alerts users about better deals53. Honey’s Droplist feature tracks items in many stores and notifies shoppers about price drops while it tests multiple discount codes at once53.

Seasonal Buying Guide

Smart shoppers can save more by knowing seasonal pricing patterns. Black Friday and Cyber Monday offer the lowest prices for electronics54. Furniture deals peak twice a year – when winter ends and summer turns to fall55. The best prices for outdoor equipment and lawn care items appear in spring54. Holiday weekends consistently bring the best value for mattresses55.

Monthly Savings: $75+

Price tracking tools deliver substantial returns when used strategically. Amazon shoppers save 20-30% on purchases through better timing56. Automated price monitoring saves the average person $126 annually56. Price alerts combined with seasonal shopping ended up reducing yearly expenses by $900 or more56. These tools are essential for anyone wanting to develop money-saving habits.

Comparison Table

| Frugal Habit | Monthly Savings | Key Tools/Apps | Main Benefits | Implementation Complexity |

|---|---|---|---|---|

| Zero-Based Digital Budget | $100+ | YNAB, PocketGuard, Simplifi | Better expense tracking, live insights | Medium |

| AI Bill Negotiations | $50+ | BillShark, Trim, BillCutterz | 90% success rate, handles multiple services | Low |

| Cashback Stacking | $75+ | Rakuten, TopCashback, Ibotta | Multiple rewards on single purchase, up to 40% cashback | Low |

| 24-Hour Purchase Rule | $200+ | Digital waiting lists, separate savings accounts | Fewer impulse purchases, smarter buying decisions | Low |

| Meal Planning Technology | $300+ | Mealime, Eat This Much, Plan to Eat | Everything gets used, smarter grocery shopping | Medium |

| Streaming Optimization | $30+ | JustWatch, streaming service bundles | Better content value at lower cost | Low |

| Smart Home Energy | $50+ | Smart thermostats, Emporia Energy, WatchWire | 10-12% heating savings, 15% cooling savings | High |

| Digital Couponing | $100+ | PayPal Honey, Capital One Shopping, Rakuten | Automatic deal finding, live code testing | Low |

| Buy-Nothing Groups | $75+ | Buy Nothing Project app, Facebook groups | Free items, stronger community bonds | Low |

| No-Spend Weekends | $200+ | Tracking apps, digital journals | Better spending habits, increased savings | Medium |

| Transportation Apps | $150+ | RideGuru, Citymapper, Moovit | Price comparison, live updates | Low |

| Microsaving Apps | $100+ | Oportun, Qapital, Chime | Automatic savings, round-up features | Low |

| Members-Only Discounts | $50+ | Costco, Sam’s Club, Amazon Prime | 35-40% savings per purchase | Medium |

| Home Maintenance Schedule | $100+ | UptimePM, Limble CMMS | Prevents repairs from getting pricey, longer equipment life | High |

| Price Tracking Tools | $75+ | CamelCamelCamel, Capital One Shopping, Honey | 20-30% savings on purchases, price alerts | Low |

Final thoughts

Research shows these 15 money-saving habits can help smart households save over $1,600 each month when put into practice properly. Quick wins come from simple changes like using digital coupons and stacking cashback rewards. Long-term savings flow from advanced approaches like smart home automation.

The habits that work best need little effort but make a big difference. You can save $75+ monthly by using price tracking tools to spot better deals. Families who try no-spend weekends cut back $200+ monthly on unnecessary purchases and build stronger bonds through creative activities.

Technology makes saving money easier than ever before. Modern apps help negotiate bills, watch prices, and get the best streaming deals. Digital tools transform small changes into big savings with features like automatic round-ups and instant price checks.

The best approach starts small. Choose 2-3 habits that fit your schedule and lifestyle naturally. Zero-based budgeting and the 24-hour purchase rule need minimal setup but save $300+ together each month. You can add more habits gradually as these changes become second nature.

These smart money strategies show you don’t need extreme sacrifices to save. Anyone can build substantial savings while enjoying life by making thoughtful choices and using digital tools effectively.

To Lear More Visit

How to Build a Bulletproof Budget: Ramit Sethi’s Proven Money Plan

FAQs

Q1. What are some key frugal habits of millionaires? Millionaires often live below their means, drive affordable cars, pay themselves first, avoid debt, and take advantage of employer benefits. They also invest outside their 401(k) and take ownership of their investments.

Q2. How can I implement the 30-day rule to save money? When you want to buy something, wait 30 days before making the purchase. During this period, consider if it’s a need or want. If you still want the item after 30 days, proceed with the purchase. This rule helps avoid impulse spending and develops healthier financial habits.

Q3. What’s an effective strategy for comparison shopping? Before making a purchase, take the time to compare prices across different retailers. Use price tracking tools and apps to monitor fluctuations and receive alerts for better deals. This approach can lead to significant savings, especially on larger purchases.

Q4. How can I start saving money if I’m on a tight budget? Start small with achievable short-term goals. For example, commit to saving $20 a week for six months. This approach is more attainable than setting an ambitious long-term goal and can help build the habit of saving regularly.

Q5. What role does technology play in modern frugal living? Technology plays a crucial role in frugal living today. Apps and digital tools can automate savings, negotiate bills, track prices, and optimize subscriptions. These technologies make it easier to implement money-saving habits and maximize your savings potential with minimal effort.

References

[1] – https://www.investopedia.com/terms/z/zbb.asp

[2] – https://www.adlittle.com/be-en/insights/report/micro-saving-big-impact

[3] – https://www.hurfpostbrasil.com/best-meal-planning-apps/

[4] – https://thissimplifiedhome.com/plan-to-eat-review/

[5] – https://www.meteorelectrical.com/blog/smart-home-energy-saving-statistics.html

[6] – https://www.energystar.gov/products/ask-the-experts/save-energy-smart-home-products

[7] – https://www.joinhoney.com/

[8] – https://capitaloneshopping.com/research/coupon-statistics/

[9] – https://softwarehouse.au/blog/3-best-public-transit-apps-to-navigate-your-city-efficiently-in-2025/

[10] – https://theeverygirl.com/no-spend-weekend/

[11] – https://www.supermoney.com/member-only-discount-deals

[12] – https://limblecmms.com/blog/best-preventive-maintenance-software/

[13] – https://www.statefarm.com/simple-insights/residence/how-to-budget-and-save-for-home-maintenance

[14] – https://www.cnbc.com/2022/04/12/are-you-an-impulse-shopper-try-the-1percent-rule-to-spend-less.html

[15] – https://www.clearoneadvantage.com/blog/the-power-of-delayed-spending

[16] – https://play.google.com/store/apps/details?id=com.mealime&hl=en_US

[17] – https://eatbobos.com/blogs/health-nutrition/grocery-list-ideas-health-focused-shopping-tips?srsltid=AfmBOopf2HPpHAV-5za7TbXGobjNbjGWrWuamv5X9qAtCz1utZbu1s9h

[18] – https://dontwastethecrumbs.com/how-to-save-time-money-batch-cooking/

[19] – https://www.bettycrocker.com/how-to/tipslibrary/cooking-tips/batch-cooking

[20] – https://blog.harvardfcu.org/save-money-by-meal-planning

[21] – https://foodess.com/article/ways-batch-cooking-can-save-you-money/

[22] – https://www.nerdwallet.com/p/best/finance/what-is-the-best-streaming-service-for-you-see-prices-and-plans

[23] – https://www.consumerreports.org/electronics-computers/streaming-media/how-to-save-money-on-streaming-services-a7950600930/

[24] – https://www.cnbc.com/select/how-to-save-on-streaming-services/

[25] – https://www.makeuseof.com/best-group-family-plans-streaming-subscriptions/

[26] – https://www.cnet.com/tech/services-and-software/streaming-with-ads-netflix-vs-disney-plus-vs-hulu-and-more/

[27] – https://money.com/save-money-netflix-disney-streaming/

[28] – https://www.saveonenergy.com/resources/apps-track-energy-use/

[29] – https://www.capterra.com/energy-management-software/s/android/

[30] – https://www.iot-now.com/2024/04/22/144080-smart-home-technology-saves-money-and-helps-protect-the-planet/

[31] – https://qples.com/blog-digital-coupon-revolution/

[32] – https://www.experian.com/blogs/ask-experian/how-to-save-money-with-buy-nothing-groups/

[33] – https://theconversation.com/exploring-the-extraordinary-potential-and-avoiding-the-pitfalls-of-your-local-buy-nothing-group-221986

[34] – https://www.chime.com/blog/how-to-use-a-buy-nothing-group-to-save-money/

[35] – https://www.ramseysolutions.com/budgeting/no-spend-month?srsltid=AfmBOopHmv3ZDQ6ysnCabsiw8CYY4bhIlkqk5G9lZlQWdrxkiViiKTyN

[36] – https://www.moneygeek.com/living/free-weekend-activities/

[37] – https://www.johnsonfinancialgroup.com/resources/blogs/your-financial-life/the-no-spend-month-challenge-the-ultimate-reset-for-your-finances/

[38] – https://lifeonthegobyanu.com/my-no-spend-weekend-experience-frugal-living/

[39] – https://www.elephantsapp.com/financial-goals/how-to-complete-the-no-spend-weekend-challenge

[40] – https://ride.guru/

[41] – https://apps.apple.com/us/app/obi-get-the-cheapest-ride/id1081008679

[42] – https://www.ramseysolutions.com/budgeting/save-on-transportation?srsltid=AfmBOooyQIyYMTJErxUM5mYflhmerOEwfO4lwUOz3XmyunLdZi_92Pbc

[43] – https://www.payactiv.com/financial-learning/10-ways-to-save-on-your-daily-commute/

[44] – https://www.bankrate.com/personal-finance/best-money-saving-apps/

[45] – https://www.forbes.com/sites/jimwang/2021/01/27/are-microsaving-apps-worth-it/

[46] – https://finmasters.com/microsavings-apps/

[47] – https://www.accessdevelopment.com/membership-discount-programs/

[48] – https://www.talon.one/blog/best-loyalty-programs-2025-what-makes-them-stand-out

[49] – https://www.ptk.org/benefits/member-savings/

[50] – https://www.bankrate.com/homeownership/diy-or-hire-a-pro/

[51] – https://www.moneyfit.org/essential-home-repair-savings-guide/

[52] – https://www.bosscathome.com/resources/home-maintenance-your-guide-to-cut-costs-and-save-big

[53] – https://lifehacker.com/best-price-tracking-tools

[54] – https://www.nerdwallet.com/article/finance/what-to-buy-every-month

[55] – https://money.usnews.com/money/personal-finance/saving-and-budgeting/articles/the-best-time-of-year-to-buy-everything

[56] – https://savingsgrove.com/blogs/guides/price-tracking-apps

[57] – https://www.bankrate.com/banking/how-to-make-a-zero-based-budget/

[58] – https://www.thepennyhoarder.com/budgeting/best-budgeting-apps/

[59] – https://www.cnbc.com/select/best-budgeting-apps/

[60] – https://www.psohub.com/blog/7-ways-to-automate-the-project-budget-management-process

[61] – https://www.doughroller.net/tools/best-bill-negotiation-apps

[62] – https://altumed.com/blog/about-the-revolutionary-ai-in-medical-billing-and-practice-management-and-bill-negotiation/

[63] – https://www.vice.com/en/article/chatgpt-can-negotiate-comcast-bills-down-for-you/

[64] – https://www.glamour.com/story/this-ai-app-will-slash-your-cable-bill-for-you

[65] – https://www.joinkudos.com/blog/best-services-for-bill-negotiation-save-money-without-the-hassle

[66] – https://www.cnet.com/personal-finance/banking/best-budgeting-apps-to-get-control-of-your-money-in-2025/

[67] – https://www.bankrate.com/personal-finance/combine-credit-cards-and-cash-back-apps/

[68] – https://savingsgrove.com/blogs/guides/cashback-website-comparison

[69] – https://thekrazycouponlady.com/tips/couponing/ultimate-comprehensive-guide-to-rebate-apps21608

[70] – https://financebuzz.com/stacking-rewards-beginners-guide

[71] – https://lukeleben.com/stacking-cashback-offers

[72] – https://pmc.ncbi.nlm.nih.gov/articles/PMC8206473/

[73] – https://www.forbes.com/sites/traversmark/2023/12/11/a-psychologist-offers-3-tips-to-tame-your-impulse-buying-habit/

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com