The U.S. Department of Agriculture reports a staggering $233,610 cost to raise a child until age 17. My 13 years as a financial advisor have shown me how families wrestle with money management, particularly with household debt reaching $17.5 trillion by late 2023.

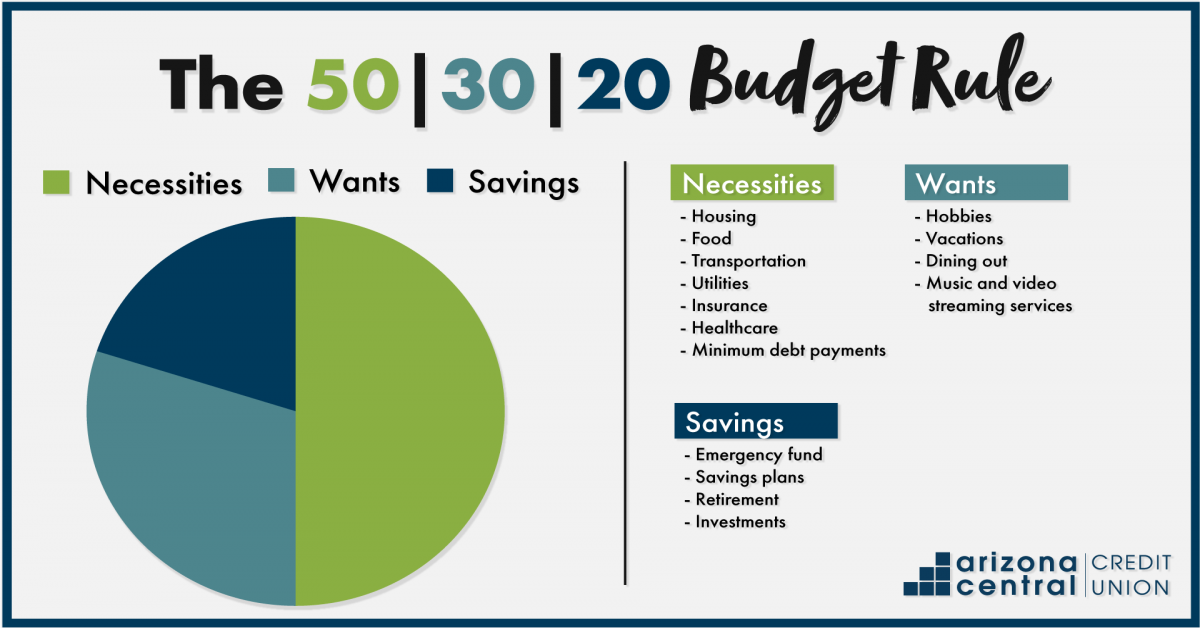

These numbers might seem daunting, but families can succeed with proven money management strategies that deliver results. Successful approaches include the time-tested 50/30/20 rule, which allocates 50% for needs, 30% for wants, and 20% for savings. Zero-based budgeting gives every dollar a specific purpose and helps families take control of their finances.

My collection of 15 practical money management tips extends beyond simple budgeting advice. These strategies will strengthen your family’s financial foundation in 2025 through emergency fund building, tax benefit optimization, and children’s financial education.

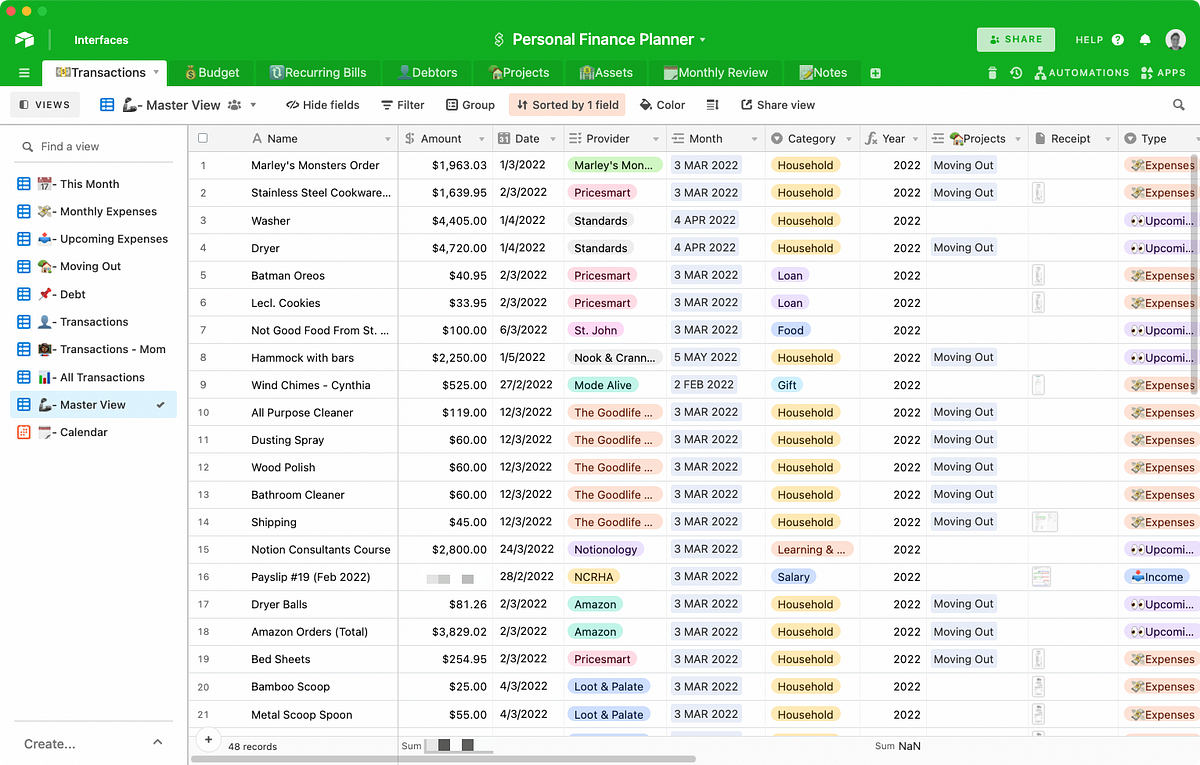

Create a Digital Family Budget Dashboard

Image Source: YouTube

My years as a financial advisor have shown how digital budget dashboards reshape the way families handle their money. A well-laid-out dashboard brings all financial tasks together – from expense tracking to goal setting – in one place.

Setting up automated tracking tools

The foundations of a working family budget dashboard begin when you connect your bank accounts and credit cards to a secure budgeting platform. Modern tracking tools automatically import and categorize transactions, which eliminates manual data entry67. These tools calculate the differences between projected and actual costs and help families improve their budgeting skills over time.

Best budgeting apps for families

Honeydue stands out for couples who manage shared expenses. It lets partners view joint accounts, credit cards, and investments in one place68. Monarch Money offers a customizable dashboard that helps families track spending, analyze recurring expenses, and monitor financial goals as a team69.

YNAB (You Need A Budget) uses a zero-based budgeting system that gives every dollar a purpose70. The app gives educational resources and immediate updates that make it perfect for families new to budgeting. It also combines budgeting features with investment tracking and retirement planning tools68.

Real-time expense monitoring strategies

These proven strategies will help you maintain an effective digital dashboard:

- Set up automated alerts for approaching budget limits and irregular expenses71

- Use AI-powered visual reports to share financial status with family members71

- Monitor recurring bills and subscriptions to avoid unnecessary charges72

Successful family budget management depends on choosing tools with strong security features. Look for apps that provide encryption, two-factor authentication, and secure login processes72. Many platforms now include fraud alerts and identity theft protection that give you peace of mind.

These digital dashboard strategies help families streamline their budgeting process and stay focused on their financial goals. The immediate insights and automated tracking features keep everyone informed and accountable for household spending decisions.

Implement the 50-30-20 Rule for Modern Families

Image Source: Arizona Central Credit Union

“The price of anything is the amount of life you exchange for it.” — Henry David Thoreau, 19th century American philosopher, poet and academic

The 50-30-20 rule is a simple way to handle family budgeting that has worked well throughout my advisory career. This budget splits your monthly after-tax income into three main categories and helps families stay financially stable.

Essential expenses breakdown

This rule directs 50% of your after-tax income to necessities – expenses your family can’t avoid73. These include:

- Housing costs and utilities

- Groceries and basic household items

- Transportation expenses

- Minimum debt payments

- Insurance premiums

A family earning $3,000 monthly after taxes should put $1,500 toward these core expenses74. Families in high-cost areas might need different percentages since housing can take much of their income73.

Lifestyle spending guidelines

30% of your income goes to lifestyle choices and extra spending73. My experience as a financial advisor suggests families use this money for:

- Entertainment and dining out

- Non-essential clothing and accessories

- Streaming services and subscriptions

- Family activities and hobbies

- Personal care items

This category gives you room to adjust while keeping your finances in check. These expenses are choices that boost your lifestyle, not survival needs73.

Future-focused savings allocation

Your family’s financial future needs the final 20%75. My experience shows this money should go toward:

- Emergency fund covering 3-6 months of expenses

- Retirement account contributions

- Debt payments beyond minimums

- Long-term financial goals

- Investment opportunities

Making this easier starts with automation. You might set up direct deposits where 80% goes to checking for needs and wants, while savings and retirement accounts automatically get 20%73.

This system’s strength lies in its flexibility. The percentages serve as a guide, and families can adjust them based on their unique situation and goals73. People with irregular incomes or specific money challenges might need to modify these numbers to create a budget that works76.

Build a Six-Month Emergency Fund

Image Source: SoFi

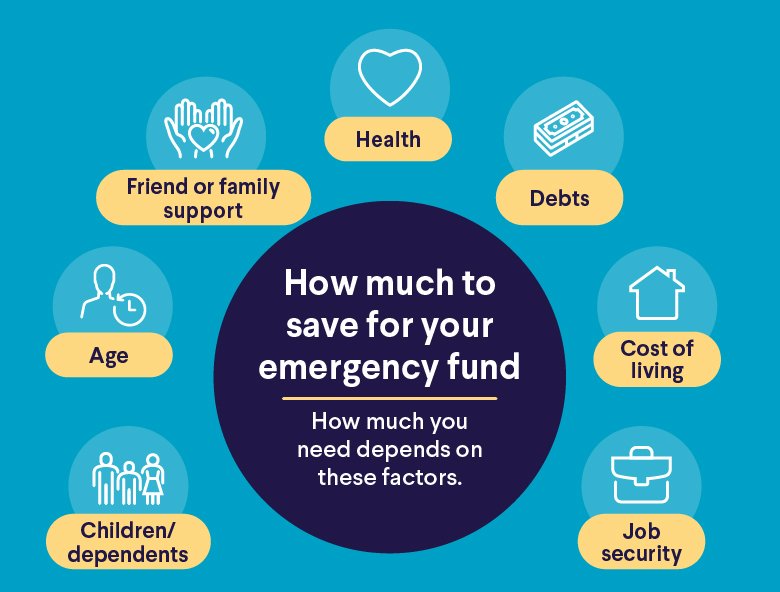

Your family’s financial future depends on building a resilient emergency fund. My years of advisory experience suggest saving six months of expenses, especially when you have a single income or are self-employed77.

Emergency fund calculator

Living expenses for the average household reach about $6,440 monthly78. Your target savings should be six times your monthly expenses. To cite an instance, a family of four that spends $9,200 monthly needs $55,200 in emergency savings77. Online calculators help you factor in your specific needs like mortgage payments, utilities, groceries, and insurance premiums.

High-yield savings options

Your emergency fund needs accounts that are secure and can grow. High-yield savings accounts now earn around 4% APY, which beats traditional savings accounts that pay just 0.41% by a lot79. A $10,000 balance in a high-yield account earning 4% APY gets more and thus encourages more earnings at $400 yearly, while a standard account earns only $4079.

Monthly saving milestones

The 1-3-6 method creates achievable targets on your path to a six-month fund80. Your original goal should be saving $500-$1,000 for unexpected bills81. Next, build up to three months of expenses before reaching your six-month target.

Your savings will grow faster if you:

- Set up automatic transfers from your paycheck to a separate emergency account

- Put portions of tax refunds and bonuses into emergency savings

- Pick FDIC-insured accounts that protect up to $250,00082

Note that emergencies like job loss, medical bills, or major repairs can drain savings quickly83. You should make it a priority to replenish your fund after withdrawals. Since 63% of Americans think about six months of expenses as their minimum for financial security80, this cushion gives you essential protection against unexpected money challenges.

Use AI-Powered Financial Planning Tools

Image Source: Renée De Four – Medium

AI-powered financial tools have transformed how families manage their money through individual-specific insights and automated features. My experience as a financial advisor shows how these tools help families make smarter money decisions.

Best AI budgeting assistants

Wally leads the pack of AI budgeting tools with automatic tracking of spending patterns and cash flow from linked accounts12. WallyGPT gives custom suggestions about how much to save and when. Cleo’s chatbot looks at your finances and answers specific questions about saving for vacations12.

PocketGuard uses AI to track spending patterns and shows disposable income after bills and savings goals84. YNAB creates detailed budgets with AI and shows live updates of spending habits84.

Automated savings features

Smart saving algorithms look at your financial activity and find the best times to move money without affecting cash flow14. Rocket Money’s Smart Savings predicts potential savings every few days and moves funds automatically to savings accounts12. The app finds and cancels subscriptions you don’t need12.

GridRewards combines sustainability with money-saving benefits. The platform tells you the best times to cut back on energy use during peak hours, which leads to cash rewards12.

Investment recommendations

AI-powered robo-advisors look at your financial details, investment goals, and risk tolerance to build custom investment strategies15. These tools analyze market conditions and client data continuously to adjust portfolios in real time16.

BlackRock uses machine learning to spot market patterns, geopolitical events, and social media sentiment that human analysts might miss16. Goldman Sachs expects over $1 trillion in capital investment toward generative AI infrastructure17.

These tools work best when you:

- Review automated reports regularly

- Take time monthly to adjust based on income changes

- Use AI-generated insights for long-term financial planning

The global AI market should grow from $638.23 billion in 2024 to $3680.47 billion by 2034, at a CAGR of 19.1%17. These numbers show how AI helps more families reach their financial goals through sophisticated yet available tools.

Practice Smart Grocery Shopping

Image Source: texasroadhousefamilymeals.info

“He who buys what he does not need, steals from himself.” — Swedish Proverb, Traditional wisdom

Smart grocery shopping remains one of the quickest ways to manage your family’s finances. My experience in advising families shows that smart food purchasing can reduce household expenses by a lot.

Meal planning strategies

Weekly meal plans are the life-blood of smart grocery shopping. Families who plan their menus ahead avoid impulse purchases and extra store visits1. Start small with two or three meals each week before adding more1. Theme nights like soup night or sheet-pan dinners make planning much easier. Without doubt, big weekend meals give you chances to use leftovers during the week1.

Bulk buying benefits

Smart bulk buying saves money. Families who shop at wholesale clubs like Costco spend nowhere near as much on pantry basics18. The biggest problem is to assess whether bulk items line up with what your family eats. Dried beans, lentils, oats, and rice give great value in larger amounts19. Buy only what your family will eat before the food expires20.

Digital coupon maximization

Technology has reshaped the scene of grocery savings. Digital coupons beat paper ones with bigger discounts because they cost less to process21. Big stores like Stop & Shop and Publix run two-tier loyalty programs that mix weekly deals with digital savings21. To name just one example, Club Publix members get $5 off when they spend $20 or more21.

To maximize your grocery savings:

- Check weekly store ads before planning meals

- Link store loyalty accounts to rebate apps for extra cashback

- Shop during seasonal sales

Of course, watching prices over time helps you spot real deals. Your store receipts are a great way to get insights – some families report saving up to $581.63 yearly through smart shopping and digital coupons21. These strategies help families eat well while spending less on groceries.

Automate Bill Payments and Savings

Image Source: Forbes

Automated financial tasks are the life-blood of good family money management. My experience as an advisor shows how automation takes away the stress of paying bills manually and helps develop better savings habits.

Setting up automatic transfers

Banks make it easy to schedule regular transfers between accounts. You can line up your checking account with savings and set up transfers that match your payday schedule4. To name just one example, splitting your paycheck between accounts with direct deposit will give a steady boost to your emergency fund7.

Bill payment scheduling

Automation works best with fixed-rate bills like car payments, insurance premiums, and mortgage payments22. Here are some proven ways to manage your cash flow better:

- Time your payments a few days after your paycheck arrives

- Unite all due dates to one or two days each month

- Check your automated transactions monthly to spot any errors or expired cards

Service providers reward autopay enrollment with discounts. Cell phone companies usually give $5 off monthly. Student loan providers cut interest rates by 0.25%23.

Avoiding late fees

Credit card companies charge penalty fees and raise interest rates for late payments24. Families can avoid these extra costs with automation. Yes, it is possible to set up automatic payments with credit card companies for:

- Current balance

- Last statement balance

- Minimum payment

- Custom amount

Set up balance alerts to protect against overdraft fees. These notifications tell you when your account drops below certain levels25. Most banks now offer online bill pay systems that put all your monthly payments in one secure place25.

Setting up automation takes time at first. Once it’s ready, the system runs naturally and keeps your bills paid while growing your savings26. These strategies help families build strong credit scores and create financial security through regular, automated savings22.

Teach Kids Financial Literacy

Image Source: Investopedia

A child’s future money management skills depend on their financial literacy foundation. Research shows that money habits typically develop between ages 6 and 1227. Early education plays a vital role in long-term financial success.

Age-appropriate money lessons

Parents shape their children’s financial learning more than literacy courses, peers, jobs, and media combined28. Young children learn better with physical money that helps their cognitive development28. Clear jars or piggy banks with three slots for giving, saving, and spending work well28. Children can learn about comparison shopping and budgeting through ground experiences as they grow older.

Digital allowance systems

New allowance platforms provide sophisticated tools that teach financial responsibility. FamZoo lets parents set up weekly allowances based on fixed amounts or age-based calculations29. Children who use these systems can:

- Create virtual savings jars for specific goals

- Track chore completion and earnings

- Learn budgeting through dedicated subaccounts

- See their transactions immediately

The Homey app blends chore management with financial education. Children can earn preset allowances by completing their assigned tasks29. These automated systems show children how work connects to earnings.

Investment basics for children

The next step comes after children learn simple money concepts. Parents can open a custodial Roth IRA when their children start earning income28. Hands-on learning happens when children buy shares in familiar companies like Disney or Apple30. The Stock Market Game platform gives children a safe space to practice investment strategies30.

Khan Academy’s Financial Literacy courses and the Million Bazillion podcast explain complex financial ideas in child-friendly terms31. These resources help reinforce the lessons. Apps like Goalsetter include financial literacy quizzes that children must complete before purchases32. This approach ensures they learn through real-life application.

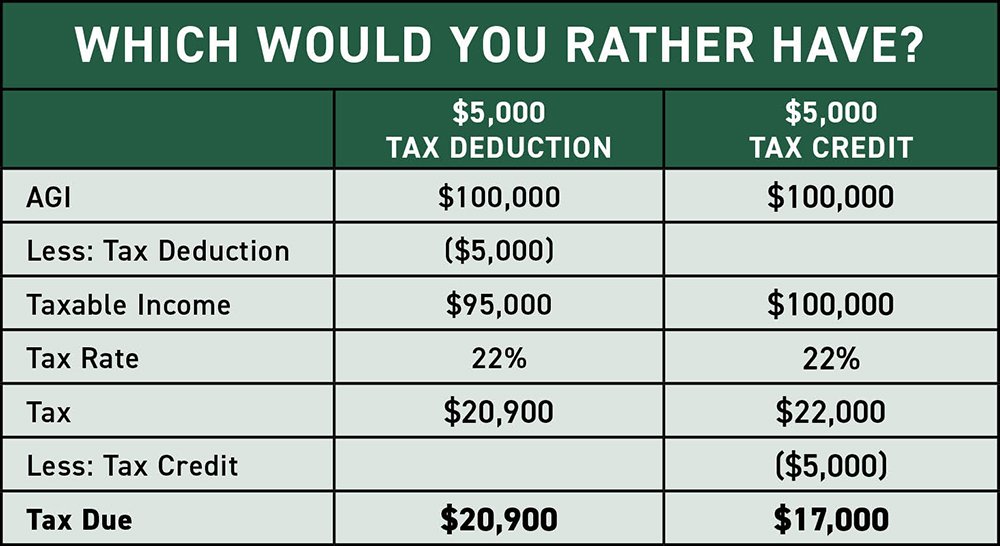

Maximize Tax Benefits for Families

Image Source: Conner Ash P.C.

Tax benefits help families reduce their expenses significantly. My experience as a financial advisor shows that families often miss out on tax-saving chances simply because they don’t know about them.

Available tax credits

The Child Tax Credit gives up to $2,000 per qualifying child under 17 years old33. Families with three or more eligible children can get substantial relief through the Earned Income Tax Credit when they earn less than $59,899 (Single/Head of Household) or $66,819 (Married Filing Jointly)33. Working parents should know about the Child and Dependent Care Credit that covers up to $3,000 for one child or $6,000 for two children under 1333.

Deduction opportunities

Smart planning helps families tap into the full potential of several deductions. The American Opportunity Credit provides up to $2,500 for college tuition and related expenses for each eligible student33. Parents who adopt can claim eligible expenses through the Adoption Tax Credit34.

Tax-advantaged accounts

529 plans are a great way to save for education. These state-sponsored programs let your money grow tax-free and you can withdraw it tax-free for qualified education expenses35. HSAs work even better with triple tax advantages – you can deduct contributions, grow your money tax-free, and withdraw it tax-free for medical expenses36.

Here’s how to make the most of these benefits:

- Set up automatic contributions to tax-advantaged accounts

- Track qualified expenses meticulously

- Look into state-specific tax credits and deductions

The year 2025 brings important changes for families. The Child Tax Credit will have a refundable portion up to $1,70037. New York residents can get up to $1,000 per child under age four and $500 per child from ages four through sixteen38.

Families who understand and use these tax benefits wisely can save money for other priorities like savings or debt reduction. Tax laws change often, so regular reviews of available credits and deductions help maximize your savings.

Create Multiple Income Streams

Image Source: Z.com Research

Broadening your family’s income streams works like planting seeds in a financial garden – they all grow at different rates39. My experience as a financial advisor has helped many families build multiple revenue channels that work alongside their main income.

Side hustle opportunities

The digital world has created new ways for families to earn extra money. Creative families can turn their children’s artwork into money-making products through print-on-demand services, earning $300 to $2,000 each month40. Pet sitting lets you earn flexibly with rates from $15 to $40 per hour, which could add up to $1,000 monthly40. Writers can make between $0.10 and $1.00 per word through freelancing40.

Passive income ideas

You’ll need some work upfront with passive income, but it pays off with minimal upkeep later. High-yield savings accounts now give about 4% APY, which beats regular accounts that only offer 0.41%39. Your photography skills could earn money through Shutterstock and Getty Images41. Digital products like online courses or printables keep bringing in money long after you create them39.

Family business ventures

A family-owned business lets everyone use their best skills. Print-on-demand businesses don’t need much money to start but can grow substantially42. Here are some proven ideas:

- Custom lighting businesses that mix creativity with what people want

- Vintage clothing stores that appeal to different age groups

- Family apiaries that sell honey and beeswax products

One family turned their beekeeping hobby into a thriving business. They started at farmers’ markets and grew into a full operation42. The most successful family ventures need clear roles and good planning to keep everyone working well together6.

Multiple income streams help families stay strong when money gets tight. Take this example: a family that combines rental income, digital product sales, and smart investments builds a reliable financial safety net that holds up when the economy shifts39. The secret is simple – start small, grow step by step, and pick opportunities that match your family’s talents and schedule39.

Implement Energy-Saving Measures

Image Source: EnergySage

Using energy-saving measures gives families a chance to cut their monthly expenses. Smart technology upgrades and strategic home improvements help households save money on utilities while supporting environmental sustainability.

Smart home technologies

Smart home systems make energy use more efficient through automated controls. Smart thermostats cut heating and cooling costs by up to 15%5. These devices adapt to your family’s schedule and let you control settings from your phone. Smart power strips help too by stopping electronics from drawing power in standby mode, which makes up 10% of home electricity use43.

Utility cost reduction

The average U.S. household pays $2,200 each year for utilities43. Targeted improvements can cut these costs by a lot. LED bulbs use 90% less energy than traditional ones44 and can save you $225 yearly44. Simple fixes like sealing gaps around doors and windows reduce heating and cooling costs by 10-25%43.

Green energy savings

ENERGY STAR certified appliances use 20% less energy than standard models45. To cite an instance, ENERGY STAR dryers use 20% less energy45. Their washing machines cut energy use by 25% and water consumption by 33% compared to regular units45.

These proven strategies help maximize your savings:

- Set smart thermostats to 68°F for heating and 78°F for cooling

- Use motion sensors and dimmer switches to control lights automatically

- Get regular energy audits to find ways to save more

The Inflation Reduction Act provides great incentives for energy improvements. You can get tax credits up to 30% of costs, with a $1,200 yearly maximum46. This includes $600 for windows, central air units, and electrical panels46. Heat pump installations qualify for bigger credits up to $2,000 per year46.

Families who use these measures often save hundreds on yearly energy costs47. Good attic insulation alone cuts heating bills by 10-50%45. Smart investments in energy efficiency clearly pay off over time.

Use Cashback and Rewards Programs

Image Source: Credit Sesame

Smart reward programs can help families cut down expenses through smart spending. My years of helping families have shown how the right credit cards and reward systems can boost their returns.

Best family reward cards

The Blue Cash Preferred Card from American Express is a great pick for families. It gives 6% cashback at U.S. supermarkets (up to $6,000 yearly) and 6% on streaming services48. The Chase Freedom Flex changes its 5% cashback categories with the seasons to match what families need48. The Capital One VentureOne Rewards Credit Card gives 1.25 miles per dollar on everything you buy, which makes it perfect for families who love to travel48.

Maximizing points

My experience shows these strategies work well. The Citi Double Cash Card gives you 1% cashback when you buy and another 1% when you pay48. Families using Bank of America’s Customized Cash Rewards Card can earn 3% in their favorite category, 2% at grocery stores, and 1% everywhere else48.

Strategic spending

You need a good plan to get the most from your rewards. The Chase Sapphire Preferred Card rewards families with 5x points on travel booked through Chase. You also get 3x points on dining, streaming services, and online grocery purchases49. This is a big deal as it means that families spending more than $31 weekly at grocery stores get enough Blue Cash Preferred Card rewards to make up for the annual fee49.

To get the best benefits:

- Put your regular bills on cards that give higher rewards for those types of purchases

- Plan big purchases when you can get bonus rewards

- Think about pooling points with other family members

Right now, many family-friendly cards skip the annual fee but still give great rewards. The Chase Freedom Flex gives you a $200 bonus just for signing up, with no annual fee48. On top of that, the Discover It Cash Back matches all your cashback earnings in your first year48. When you pick the right cards and use them wisely, you can put those savings toward your family’s financial goals.

Plan Cost-Effective Family Activities

Image Source: The Stay-at-Home-Mom Survival Guide

Creating memorable family entertainment doesn’t need a big budget. Smart planning and local resources help families build enriching experiences affordably.

Free entertainment options

Local parks give families endless chances to bond through nature walks, hiking trails, and outdoor activities50. Public libraries host many free events that include puppet shows, storytelling sessions, and arts and crafts workshops2. Summer brings free community events like outdoor concerts, movies in the park, and cultural festivals10.

Budget-friendly vacations

North Carolina’s coast features uncrowded beaches with low entry fees51. Gatlinburg makes a great wallet-friendly destination and charges only small parking fees to access Great Smoky Mountains National Park51. Hot Springs, Arkansas combines national park experiences with budget-friendly accommodations for adventure-seeking families51.

Educational experiences

Museums often have free or discounted admission days during the week2. Public libraries’ culture passes give families free access to educational venues52. Here are some enriching activities:

- Farmers’ markets teach kids about local agriculture while they enjoy live entertainment50

- Community centers run practical skill workshops at minimal costs2

- Science museums host free stargazing nights that create unique learning experiences53

Your area’s seasonal activities can boost entertainment value. Spring flower shows, summer berry picking, and holiday light festivals bring low-cost family fun2. YMCAs provide fully padded rooms and bounce houses for toddlers, along with year-round family gym access2.

Smart planning and community resources help families build lasting memories within their budget. The $80 annual National Park pass opens doors to 2,000 federal recreation sites, and children under 15 enter free54. Local events and educational programs combine to create family traditions that strengthen relationships and expand knowledge.

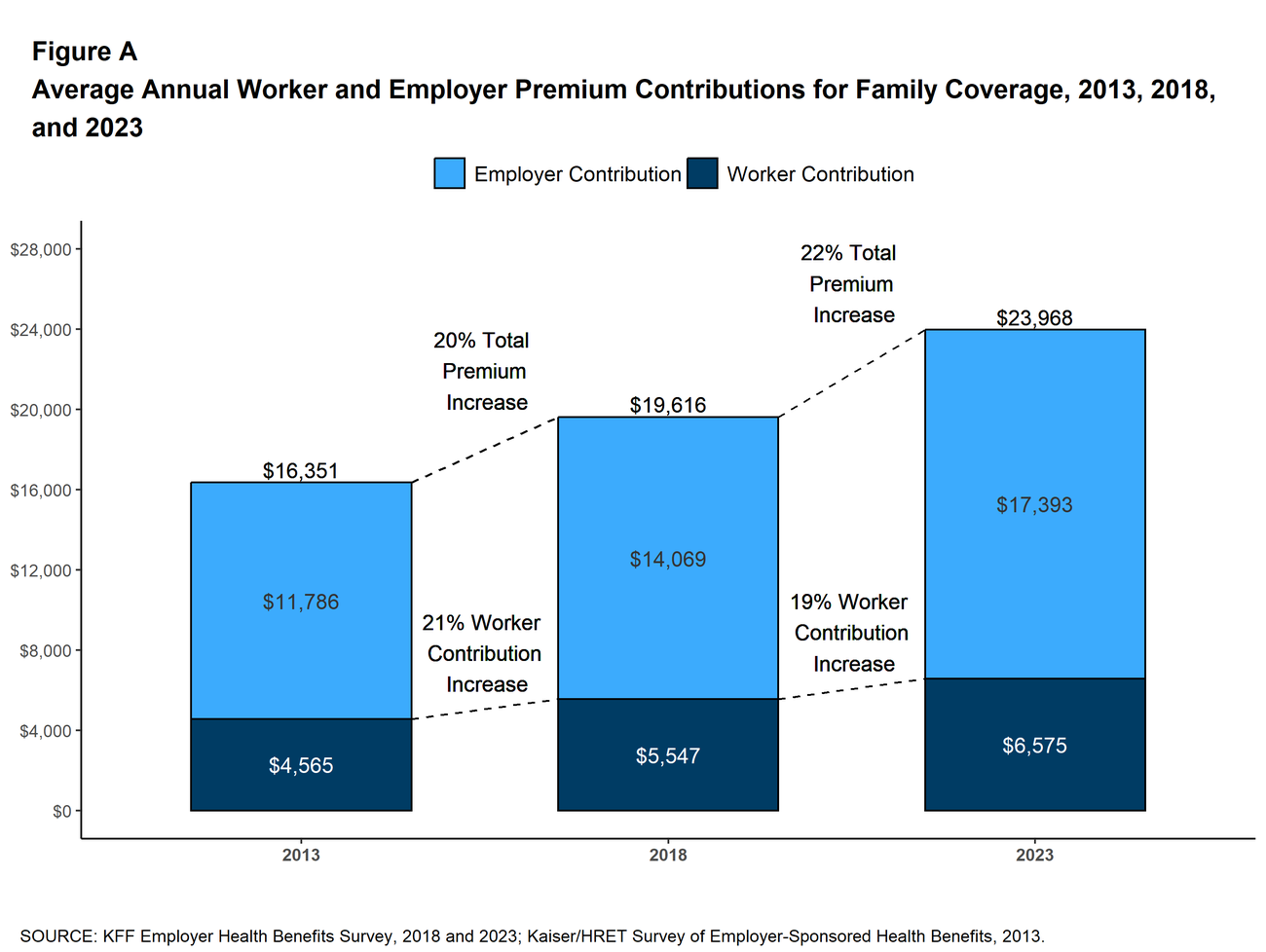

Optimize Insurance Coverage

Image Source: KFF

Your family’s financial future needs a complete insurance strategy. My experience advising families shows that finding the right coverage at the best price means taking a good look at all insurance choices.

Family insurance needs

A good insurance portfolio must cover multiple risks. Family health insurance through employers reached $23,968 yearly in 20233. This makes it crucial to look at other options. ACA Marketplace plans cost $13,824 annually for families3, which saves you quite a bit of money.

Cost-saving strategies

You can cut insurance costs while staying protected with these tested methods. High-deductible health plans with Health Savings Accounts (HSAs) give you lower premiums and tax benefits3. HSA-qualified plans in 2024 must have minimum deductibles of $1,600 for individuals and $3,200 for families3.

Section 125 cafeteria plans let employees pay premiums before taxes, which reduces their taxable income3. Health Insurance Marketplace premium tax credits ensure families pay no more than 8.5% of household income through 20253.

Coverage comparison

The best insurance options balance both coverage and cost. Employer health plans often pay much of employee premiums but might charge extra for family members3. ACA Marketplace individual policies must include essential health benefits like preventive care, prescription drugs, and mental health services3.

Getting complete protection means you might want to bundle different types of insurance. Group Personal Accident policies usually cost less than individual ones55. Umbrella liability policies start at $300 yearly and protect you beyond regular auto and homeowner limits56.

Smart insurance planning helps families get resilient coverage at good prices. Regular reviews help your coverage line up with your changing family needs, especially when life changes happen – like having children or buying property57.

Start College Savings Early

Image Source: Florida Prepaid

College costs will likely double by 2040, which makes early education savings crucial for your family’s financial future. Students at public in-state schools paid about $101,948 for tuition, fees, room, and board in 2022. Today’s toddlers will need $261,277 for the same education11.

529 plan benefits

State-sponsored accounts are a great way to get tax advantages for education savings. Your contributions aren’t federally tax-deductible, but earnings grow tax-free. Withdrawals stay untaxed when used for qualified education expenses8. More than 30 states give tax deductions or credits for 529 contributions8. Starting 2024, you can roll over up to $35,000 to a Roth IRA if you’ve kept the 529 for at least 15 years9.

Investment strategies

Age-based portfolios automatically adjust your investments as your child gets closer to college. Your portfolio changes from aggressive stocks to conservative bonds and cash investments gradually58. To name just one example, mixing age-based and static portfolios helps families boost growth potential while controlling risk58. Some 529 plans now deliver average returns up to 7% annually59.

Monthly contribution goals

Parents of newborns should save about $300 monthly for in-state public college, $500 for out-of-state public college, and $650 for private schools60. The math works like this: a $200 original deposit plus $50 monthly contributions through age 18, with 5% returns, builds $18,025 in savings61. Waiting just four years means you’ll need almost $100 more monthly to hit the same targets62.

Ways to boost your college savings:

- Use state tax benefits where available

- Think about superfunding options that allow up to $90,000 contribution across five years59

- Review and adjust investment strategies as your child grows

529 plans let you contribute high amounts, often above $350,000 per beneficiary11. These accounts also work better for financial aid – they affect aid eligibility by only 5.64% compared to 20% for standard savings accounts9.

Review and Adjust Financial Goals

Image Source: ORDNUR

Financial reviews act as key checkpoints in your family’s path to financial wellness. A financial advisor’s role includes helping you schedule time to check your monetary progress, similar to yearly medical checkups that give us a full picture of our health13.

Monthly financial check-ins

Monthly reviews help you see spending patterns and spot areas that need changes. Families can find unused subscriptions and ways to reduce monthly bills during these sessions63. Schedule your check-ins on the last Sunday of each month to get the best results63. Look at:

- iTunes and similar recurring charges

- Credit score updates from all three bureaus

- Progress toward emergency fund goals

Progress tracking

The start of January works best to map out big expenses for the year ahead64. Tax document organization follows in February, and March gives you time for catch-up retirement account contributions64. Your family can stay focused on big-picture financial plans through step-by-step tracking64.

Goal adjustment strategies

Life changes mean you need flexible financial planning. Your plans must adapt to marriage, childbirth, career moves, and retirement preparation65. Get the best results with these detailed reviews:

- Annual Insurance Assessment

- Schedule yearly meetings with insurance agents

- Review medical coverage during open enrollment

- Check if policies meet your family’s needs13

- Debt Management Review

- Look at current loan terms

- See if refinancing makes sense

- Look into early payment options13

- Education Funding

- Check college savings progress

- Change contribution amounts

- Start 529 plans if needed13

Regular monitoring and adjustments help maintain your family’s financial health over time13. Smart financial management needs regular checks and flexibility to change strategies as circumstances shift65. Yearly meetings with financial advisors ensure your plans match current goals and help find new ways to improve66.

Comparison Table

| Money Management Tip | Main Benefit | Implementation Cost | Key Statistics | Tools/Resources | Time Investment |

|---|---|---|---|---|---|

| Create Digital Budget Dashboard | Immediate expense tracking | Free to Low | N/A | Honeydue, YNAB, Monarch Money | Setup time |

| Implement 50-30-20 Rule | Well-laid-out spending control | Free | 50% needs, 30% wants, 20% savings | Automated transfers | Monthly monitoring |

| Build Six-Month Emergency Fund | Financial security | Variable | $6,440 avg. monthly expenses | High-yield savings accounts (4% APY) | Extended commitment |

| Use AI-Powered Tools | Automated insights | Low to Medium | $638.23B global AI market (2024) | Wally, Cleo, PocketGuard | Minimal |

| Practice Smart Grocery Shopping | Lower food expenses | Free | $581.63 annual savings | Digital coupons, store apps | Weekly planning |

| Automate Bill Payments | No late fees | Free | $5 monthly carrier savings | Bank autopay systems | Setup time |

| Teach Kids Financial Literacy | Lifelong money skills | Free to Low | Ages 6-12 vital learning period | FamZoo, Homey app | Continuous effort |

| Maximize Tax Benefits | Lower tax liability | Free | Up to $2,000 per child credit | Tax-advantaged accounts | Yearly review |

| Create Multiple Income Streams | Money diversification | Variable | $300-$2,000 monthly potential | Print-on-demand, freelancing | Substantial |

| Implement Energy Savings | Lower utility costs | Medium | 15% savings on heating/cooling | Smart thermostats, LED bulbs | Moderate |

| Use Cashback Programs | Returns on spending | Free | 6% grocery cashback | Various credit cards | Monthly tracking |

| Plan Economical Activities | Family bonding | Low | $80 annual park pass | Community resources, libraries | Regular planning |

| Optimize Insurance Coverage | Risk protection | Variable | $23,968 avg. family premium | HSAs, Section 125 plans | Yearly review |

| Start College Savings Early | Education funding | Variable | $261,277 projected 2040 costs | 529 plans | Extended commitment |

| Review Financial Goals | Track progress | Free | N/A | Monthly check-ins, annual reviews | Monthly/Annual reviews |

Epilogue

My 13 years as a financial advisor have shown me 15 money management strategies that revolutionize families’ financial futures. Your family’s goals can receive thousands of additional dollars each year through smart digital tools, automated savings, and strategic spending cuts.

Families achieve the best results when they implement these strategies systematically. Your first step should focus on creating a digital budget dashboard and setting up automated transfers based on the 50/30/20 rule. Building your six-month emergency fund comes next, while you maximize cashback rewards and tax benefits. Strong foundations will allow you to expand into multiple income streams and create long-term plans for college savings.

Note that successful family finance management needs regular review and adjustments. Your monthly check-ins help track progress and implement necessary changes. A family’s financial goals naturally evolve with changing needs – from new children to their college education planning.

These strategies prove effective because they tackle both immediate needs and long-term security. Families can build substantial savings through careful planning and consistent execution. This approach also teaches children valuable money management skills that last a lifetime. We can discuss customized strategies for your family’s unique financial situation – reach out to us at support@trendnovaworld.com.

To learn more

15 Clever Money Saving Tips That Won’t Change Your Lifestyle (2025 Guide)

FAQs

Q1. What is the 50/30/20 budgeting rule and how can it help families manage money?

The 50/30/20 rule is a simple budgeting guideline that allocates 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. This approach helps families prioritize essential expenses, allow for some discretionary spending, and ensure consistent savings for financial goals and emergencies.

Q2. How can families start building an emergency fund?

To build an emergency fund, start by setting a goal of saving 3-6 months of expenses. Open a high-yield savings account and set up automatic transfers from your paycheck. Begin with small, consistent contributions and gradually increase the amount. Prioritize this fund before discretionary spending to create a financial safety net.

Q3. What are some effective ways to teach children about financial literacy?

Teach children about money through age-appropriate methods like using clear jars for saving, spending, and giving. Introduce concepts like budgeting and comparison shopping through real-world experiences. Use digital allowance systems to help kids track earnings and expenses. For older children, consider opening a custodial investment account to teach basic investing principles.

Q4. How can families reduce their grocery expenses without sacrificing quality?

Families can reduce grocery expenses by meal planning, using digital coupons, and buying in bulk when appropriate. Compare prices across stores, consider store brands, and shop seasonally for produce. Use cashback apps and loyalty programs to maximize savings. Cook larger meals on weekends to repurpose leftovers throughout the week, reducing the temptation for expensive takeout.

Q5. What strategies can families use to create multiple income streams?

Families can diversify their income by exploring side hustles like freelancing, selling handmade items, or offering services in their community. Consider passive income options such as creating digital products, investing in dividend-paying stocks, or renting out a spare room. Start small with projects that align with your skills and available time, then scale up successful ventures gradually.

References

[1] – https://extension.okstate.edu/articles/2022/meal_planning.html

[2] – https://www.nationwidechildrens.org/family-resources-education/family-resources-library/family-fun-on-a-budget

[3] – https://www.peoplekeep.com/blog/seven-ways-to-save-on-health-insurance

[4] – https://www.bankrate.com/banking/savings/grow-your-savings-with-automatic-transfers/

[5] – https://saveonenergy.ca/en/For-Your-Home/Advice-and-Tips/12-ways-to-make-your-home-more-energy-efficient

[6] – https://greenlight.com/learning-center/earning/family-business-ideas

[7] – https://www.theverge.com/23608794/personal-finance-automation-how-to

[8] – https://www.theeducationplan.com/using-a-529-plan-for-your-childs-early-education

[9] – https://www.fidelity.com/learning-center/smart-money/how-to-save-money-for-kids

[10] – https://www.scu.org/20-budget-friendly-summer-activities-for-families/

[11] – https://www.collegeaccess529.com/articles/with-college-costs-on-the-rise-families-need-to-start-saving-early

[12] – https://www.bankrate.com/banking/savings/ai-apps-to-help-you-save-money/

[13] – https://www.nationwide.com/lc/resources/personal-finance/articles/family-financial-checkup-guide

[14] – https://www.banklandmark.com/blog/using-ai-and-apps-for-personal-finance-automation/

[15] – https://www.leewayhertz.com/ai-in-financial-planning/

[16] – https://www.coforge.com/what-we-know/blog/the-future-of-wealth-management-ai-powered-personalized-financial-planning

[17] – https://www.finextra.com/blogposting/27562/the-family-office-guide-to-more-effective-ai-investing

[18] – https://www.heavenlyhomemakers.com/how-i-keep-our-big-family-grocery-budget-low

[19] – https://nourishedbynic.com/guide-to-a-budget-friendly-healthy-grocery-haul/

[20] – https://www.bbc.com/future/article/20240528-buying-groceries-in-bulk-is-better-for-the-planet

[21] – https://www.consumerreports.org/money/coupons/how-to-save-big-with-digital-coupons-a1632035239/

[22] – https://www.cbsnews.com/news/autopay-credit-card-bills/

[23] – https://www.nerdwallet.com/article/finance/spring-clean-your-finances-with-some-automation

[24] – https://www.huntington.com/learn/saving/automate-savings-and-paying-bills

[25] – https://www.ally.com/stories/budget/how-to-automate-your-finances/

[26] – https://www.cohnreznick.com/insights/10-benefits-automating-finance-function

[27] – https://www.ramseysolutions.com/relationships/how-to-teach-kids-about-money?srsltid=AfmBOoo9d74JsoCd0abC4Dim8Xe447ke0OBTageKFpinevryEE5Sqfhb

[28] – https://marriott.byu.edu/magazine/feature/money-talks-teaching-kids-financial-fluency

[29] – https://hireandfireyourkids.com/blog/automated-allowance/

[30] – https://joinprisma.com/blog/how-to-teach-your-child-about-investing

[31] – https://www.readbrightly.com/8-great-resources-for-teaching-kids-financial-literacy/

[32] – https://www.bringingupmoney.com/blog/allowance-cash-or-digital

[33] – https://turbotax.intuit.com/tax-tips/family/sweet-child-of-mine-tax-credits-for-parents/L1DqxZ9mh

[34] – https://www.irs.gov/newsroom/tax-help-for-new-parents

[35] – https://taxpolicycenter.org/briefing-book/what-tax-incentives-exist-help-families-save-education-expenses

[36] – https://listerhill.com/blog/2024/04/tax-advantaged-accounts

[37] – https://blog.massmutual.com/planning/tax-breaks-parents

[38] – https://www.governor.ny.gov/news/money-your-pockets-governor-hochul-proposes-sweeping-expansion-child-tax-credit-deliver-1000

[39] – https://www.forbes.com/sites/melissahouston/2024/04/17/why-diversifying-your-income-streams-is-essential-in-todays-economy/

[40] – https://www.knockedupmoney.com/blog/best-side-hustles-for-families

[41] – https://www.whattoexpect.com/family/finances/passive-income-ideas-for-parents

[42] – https://www.shopify.com/blog/family-business-ideas

[43] – https://www.quorumfcu.org/learn/money-management/9-strategies-to-reduce-your-monthly-utility-bills/

[44] – https://www.forbes.com/sites/enochomololu/article/how-to-save-on-utility-bill/

[45] – https://saveonenergy.ca/en/For-Your-Home/Advice-and-Tips/Cost-effective-home-improvements

[46] – https://www.kiplinger.com/real-estate/save-big-by-going-green-at-home

[47] – https://www.iea.org/reports/multiple-benefits-of-energy-efficiency-2019/household-savings

[48] – https://fangwallet.com/2025/01/17/top-credit-cards-every-family-should-consider-in-2025/

[49] – https://www.nerdwallet.com/article/credit-cards/credit-card-families

[50] – https://www.lovetoknow.com/parenting/parenthood/frugal-fun-family

[51] – https://travel.usnews.com/rankings/best-affordable-family-vacations/

[52] – https://www.happysimplemom.com/20-free-activities-to-do/

[53] – https://thebeehiveconnection.com/free-family-activities-in-your-local-community/

[54] – https://www.visitsaltlake.com/articles/post/50-affordable-family-vacation-ideas-to-explore-on-a-budget/

[55] – https://www.loophealth.com/post/why-is-having-a-comprehensive-health-insurance-plan-important

[56] – https://www.sunflowerbank.com/about-us/resource-articles/insurance-essentials-protecting-your-family-rsquo;s-financial-future/

[57] – https://www.uhone.com/resources/articles/learn-about-insurance/save-health-insurance

[58] – https://blog.massmutual.com/planning/types-of-529-investment-strategies-explained

[59] – https://www.savingforcollege.com/intro-to-529s/name-the-top-7-benefits-of-529-plans

[60] – https://www.forbes.com/sites/markkantrowitz/2022/11/23/updated-rules-of-thumb-for-saving-for-college/

[61] – https://www.nerdwallet.com/article/investing/how-to-start-saving-for-your-kids-college

[62] – https://www.mefa.org/article/5-reasons-it-pays-to-start-saving-for-college-early/

[63] – https://thehumblehome.uk/posts/easy-guide-to-monthly-budgeting

[64] – https://www.wealthspire.com/blog/financial-check-ups-monthly-activities-financial-journey/

[65] – https://www.westernsouthern.com/personal-finance/family-financial-planning

[66] – https://www.investopedia.com/guide-to-family-financial-planning-8418295

[67] – https://support.microsoft.com/en-us/office/manage-your-household-budget-in-excel-6b30a89b-b5ff-4cfe-944f-a389a40c3174

[68] – https://www.nasdaq.com/articles/10-best-budgeting-apps-2025-stay-control-your-finances

[69] – https://familymoneyadventure.com/best-family-budgeting-apps/

[70] – https://www.nerdwallet.com/article/finance/best-budget-apps

[71] – https://www.thebricks.com/resources/how-to-do-a-family-budget-spreadsheet-using-ai

[72] – https://albert.com/blog/family-budget-app

[73] – https://www.citizensbank.com/learning/50-30-20-budget.aspx

[74] – https://www.nerdwallet.com/article/finance/nerdwallet-budget-calculator

[75] – https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

[76] – https://www.johnhancock.com/ideas-insights/debunking-50-30-20-budgeting-rule.html

[77] – https://www.ramseysolutions.com/saving/quick-guide-to-your-emergency-fund?srsltid=AfmBOoo7XKlm0GJ3LQzL9_vdxMK0HdLwJI2i_qLQjQgTlRMJWbmBiJ4z

[78] – https://www.bankrate.com/banking/savings/starting-an-emergency-fund/

[79] – https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

[80] – https://www.oldnational.com/resources/insights/saving-for-your-emergency-fund-as-easy-as-1-3-6/

[81] – https://legacy.bank/2025/02/01/the-importance-of-building-an-emergency-fund-legacy-bank/

[82] – https://www.synchrony.com/blog/bank/high-yield-savings-emergency-funds

[83] – https://www.consumerfinance.gov/an-essential-guide-to-building-an-emergency-fund/

[84] – https://www.aiixx.ai/blog/top-ai-budgeting-tools-to-manage-your-finances

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com