The dream of financial wellness feels far away as 1 in 10 Americans struggle with medical debt that adds up to $200 billion across the nation.

But achieving better financial health is simpler than you might expect. Your monthly savings of $100 could grow into $1.2 million by retirement. The proof exists – research reveals that 8 out of 10 millionaires created their wealth through basic approaches like investing in their company’s 401(k) plans.

We gathered these 15 tested methods to boost your finances, supported by actual data and success stories. These strategies help you succeed in today’s economic world, whether you need to tackle debt or build wealth that lasts. You can start changing your financial future today.

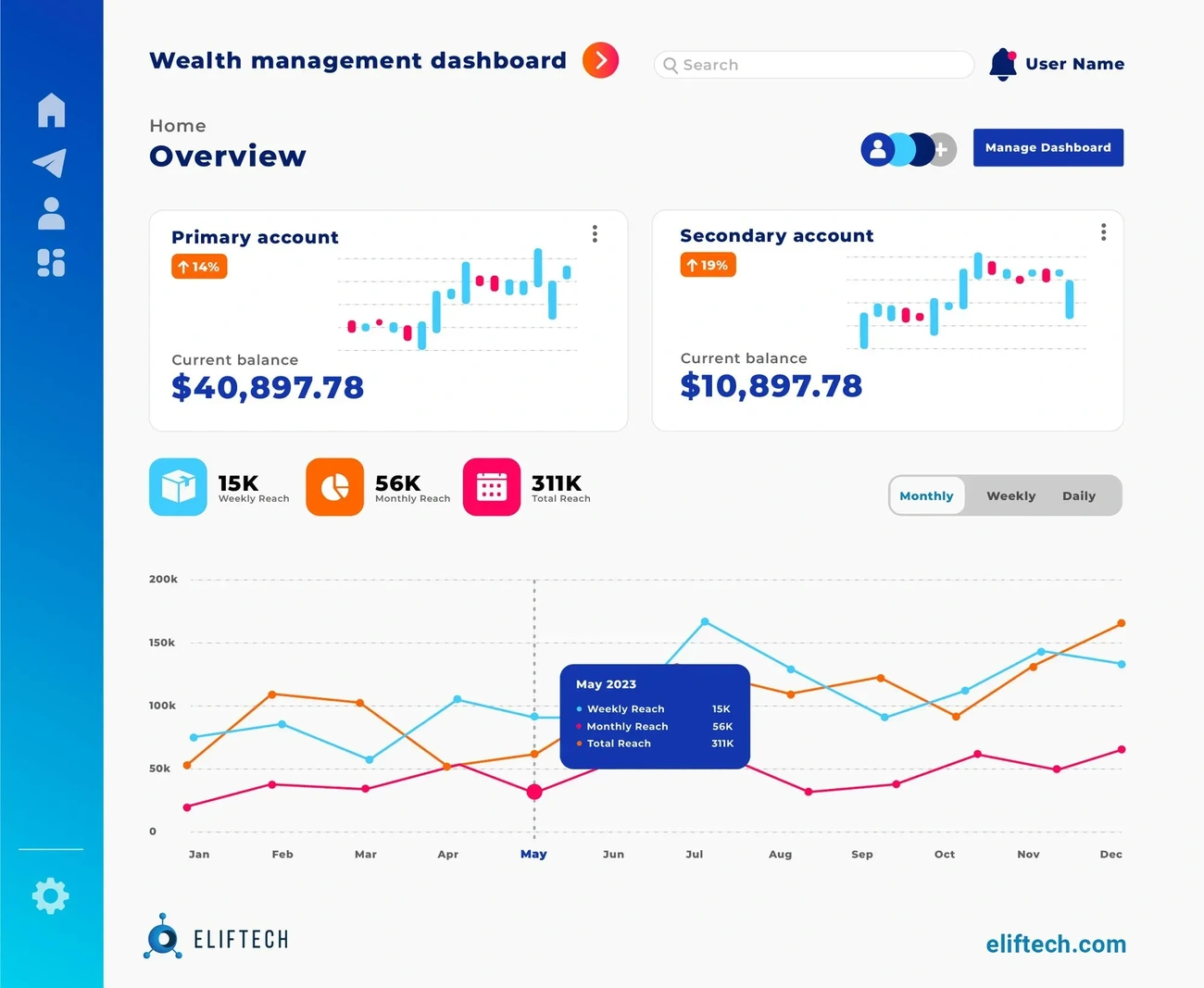

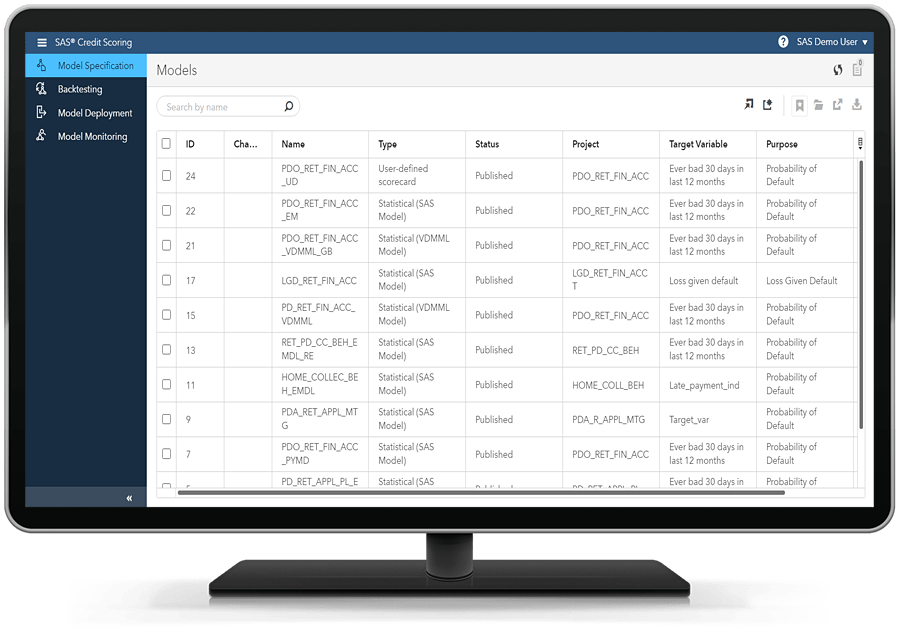

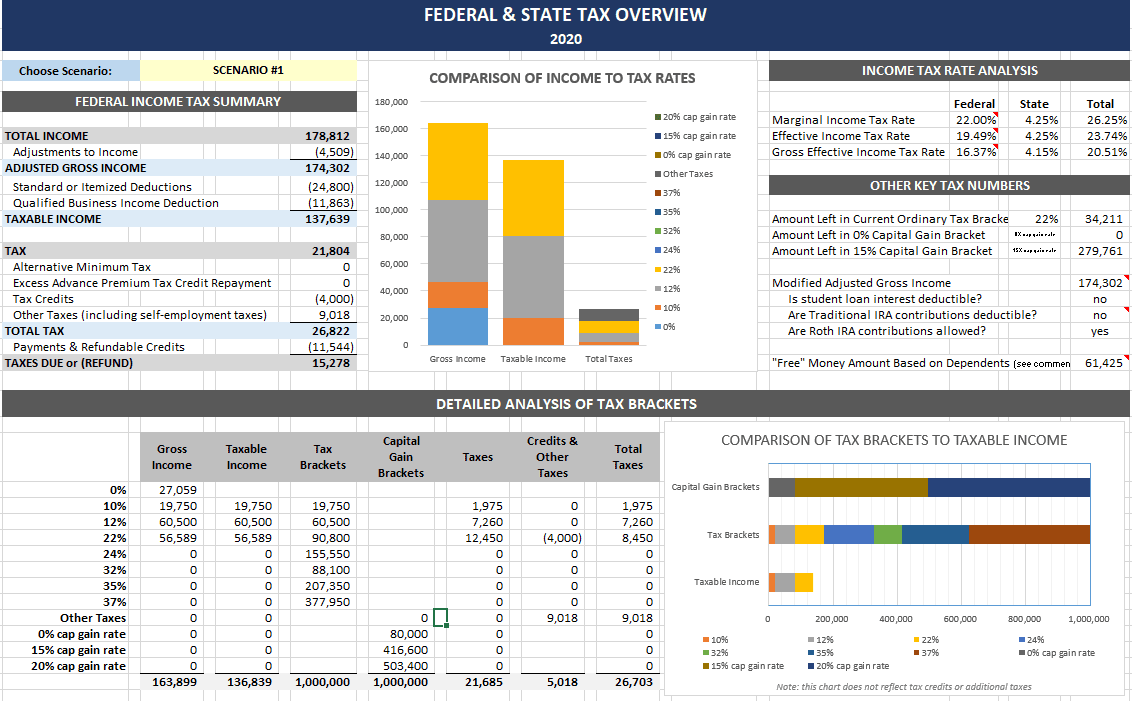

Create a Tech-Powered Financial Dashboard

Image Source: ElifTech

“The future of finance is digital.” — Ginni Rometty, Former CEO of IBM

Building a tech-powered financial dashboard helps you take control of your finances.Modern financial dashboards combine your accounts, track expenses, and monitor your net worth in one place65.

Personal Finance Apps Integration

Your financial dashboard becomes powerful when you connect your financial accounts. Leading personal finance apps now support integration with thousands of financial institutions worldwide66. These apps sync your bank accounts, credit cards, investments, and loans automatically to give you a complete picture of your finances67.

Automated Expense Tracking

Smart expense tracking saves you time by scanning receipts and categorizing expenses automatically. Modern tracking systems catch duplicate transactions and check exchange rates on their own68. These systems study your spending patterns and predict budgets to boost your financial health69.

Real-time Net Worth Monitoring

Your dashboard needs to track assets and liabilities as they change. Advanced platforms let you monitor traditional investments, crypto assets, and real estate values in one view66. These tools update property values automatically by getting data from popular real estate websites66.

Financial Analytics Setup

Analytics turn raw financial data into useful insights. Modern dashboards come with charts and reports you can customize to show how your assets spread out and track your financial goals67. You can see your cash flow patterns, spot spending trends, and make better decisions about your financial future70.

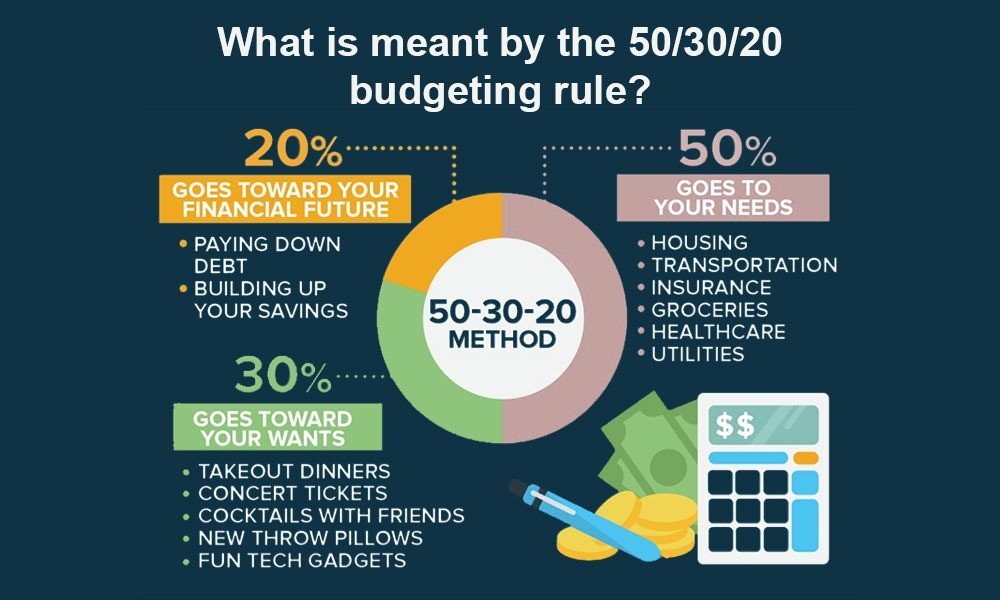

Implement the 50-30-20 Rule for Modern Budgeting

Image Source: LinkedIn

The 50-30-20 rule is the life-blood of modern budgeting that works because it’s simple and effective. This quickest way helps you divide your after-tax income into three clear categories instead of dealing with complex spreadsheets71.

Understanding the Rule

50% of your income goes to necessities such as housing, utilities, and groceries. You can spend 30% on discretionary items or “wants,” and the final 20% should go to savings and debt repayment72. To cite an instance, a monthly after-tax income of $3,000 would break down like this:

| Category | Percentage | Amount |

|---|---|---|

| Needs | 50% | $1,500 |

| Wants | 30% | $900 |

| Savings | 20% | $600 |

Customizing Percentages

This system’s strength comes from its flexibility. You can adjust these percentages by cutting back on “wants” to boost your savings if that’s your goal71. People living in expensive areas might need to put more than 50% toward necessities73.

Digital Tools for Tracking

Budget apps and personal finance software have made this rule easier to follow71. These tools sort your expenses, watch your spending patterns, and notify you about category limits. The platforms give you live updates about your budget allocation instead of making you calculate everything by hand74.

Build Multiple Income Streams

Image Source: WiserStep

Multiple income streams are the life-blood of reliable financial wellness. Recent data shows that dividend-paying stocks alone distributed a record $588 billion to shareholders in 20239.

Passive Income Sources

Dividend stocks remain the gold standard for passive income and offer regular payouts with potential capital appreciation75. REITs are another attractive option that provides steady income through property appreciation without direct management responsibilities75. High-yield savings accounts and CDs offer modest but reliable returns in the current high-interest environment75.

Side Hustle Opportunities

Digital products have become a lucrative side hustle. Creators sell e-books, templates, and online courses that generate income repeatedly with minimal ongoing effort75. Rental properties continue to deliver reliable returns, and some landlords report substantial profits through both monthly rent and property appreciation75.

Investment Income

A diversified investment approach has:

- Index funds and ETFs offering broad market exposure with low expense ratios

- Peer-to-peer lending platforms yielding higher returns than traditional savings accounts

- Bond investments providing steady interest payments with lower risk75

Freelancing Platforms

Upwork guides the marketplace, where freelancers earned over $2 billion in 20193. Platforms like Toptal cater to top-tier talent and offer rates between $100 and $250 per hour10. PeoplePerHour connects professionals with clients worldwide, enabling earnings of $30 to $100+ per hour based on expertise10.

| Platform | Hourly Rate Range | Specialization |

|---|---|---|

| Toptal | $100-$250 | Tech & Design |

| Upwork | $50-$150 | Various |

| PeoplePerHour | $30-$100+ | Creative & Marketing |

Master Behavioral Money Psychology

Image Source: Amazon.com

Psychology is a vital part of how we make financial decisions. Research shows that 52% of Americans report money has a negative effect on their mental health11.

Understanding Money Triggers

Money triggers are psychological and emotional cues that drive our spending behavior. Shopping malls and online stores are environmental triggers that lead to impulse buying12. Social pressures and emotional states also shape our financial choices. Studies reveal that almost half of Americans make emotional purchases they cannot afford13.

Developing Healthy Money Habits

Children start forming their financial habits in middle childhood and these habits evolve through their teenage years14. So building positive money management practices involves:

| Habit Type | Action Steps | Expected Outcome |

|---|---|---|

| Planning | Create budgets, track expenses | Better spending control |

| Saving | Set automated transfers | Increased savings |

| Decision-making | Compare costs, resist impulses | Improved choices |

Overcoming Financial Anxiety

Financial stress often shows up as insomnia, depression, and relationship problems15. Notwithstanding that, you can take practical steps to handle this anxiety. The most effective strategies include spotting specific money stressors, building emergency funds, and keeping 3-6 months of living expenses saved16. Yes, it is helpful to work with financial counselors certified by the Association for Financial Counseling & Planning Education who can offer individual-specific guidance to boost your financial wellness6.

Leverage AI for Financial Planning

Image Source: Investopedia

“The major winners will be financial services companies that embrace technology.” — Alexander Peh, PayPal and Braintree

AI has become a game-changer in personal finance management. Financial services companies have embraced this technology, with 91% either using or evaluating AI in their operations17.

AI-Powered Budgeting Tools

Today’s AI budgeting tools can automatically sort expenses and give you tailored financial insights18. These platforms track your spending patterns and warn you about possible overspending or overdraft risks18. We used them to automate routine tasks like data entry and expense sorting, which saves time and improves accuracy18.

Robo-Advisors

Robo-advisors have revolutionized investment management through automated portfolio handling. Here’s what they typically cost:

| Service Type | Management Fee | Fund Expenses |

|---|---|---|

| Basic Service | 0.25-0.50% | 0.05-0.25% |

| Premium Service | 0.40-0.89% | 0.10-0.35% |

The fees might look small but they help you save money compared to traditional financial advisors19. These platforms now offer features like automatic rebalancing and tax-loss harvesting that make sophisticated investment strategies available to everyone20.

Smart Investment Algorithms

Advanced algorithms can analyze big market data sets to optimize investment portfolios21. These systems excel at spotting trends and predicting market movements with remarkable precision22. AI-driven portfolio optimization uses machine learning to create tailored investment strategies based on your financial goals and risk tolerance22.

Optimize Credit Score Using Modern Tools

Image Source: SAS Institute

Credit monitoring tools have transformed the way we track and improve credit scores. Today’s credit monitoring apps are a great way to get protection against fraud and help build better credit profiles1.

Credit Monitoring Apps

Modern monitoring systems keep track of changes from all three major credit bureaus – Experian, Equifax, and TransUnion. Users get instant alerts when suspicious activities or credit file changes occur1. Premium services go beyond simple monitoring to include AI-powered fraud detection and up to $5 million in identity theft insurance coverage1.

Score Improvement Strategies

Your payment history and credit utilization are the biggest factors affecting credit scores. They make up 35% and 30% respectively23. The most effective improvement strategies target:

| Factor | Impact on Score | Recommended Action |

|---|---|---|

| Payment History | 35% | Set up automatic payments |

| Credit Utilization | 30% | Keep below 30% |

| Credit Mix | 10% | Maintain diverse accounts |

| Credit Age | 15% | Keep old accounts active |

Credit Building Programs

New credit building options now send regular bill payment information to credit bureaus. The National Foundation for Credit Counseling has launched programs that count on-time household bill payments toward credit building. This helps consumers improve their credit through everyday expenses24. Modern secured credit cards and credit builder loans also provide paths to establish credit without needing previous credit history25.

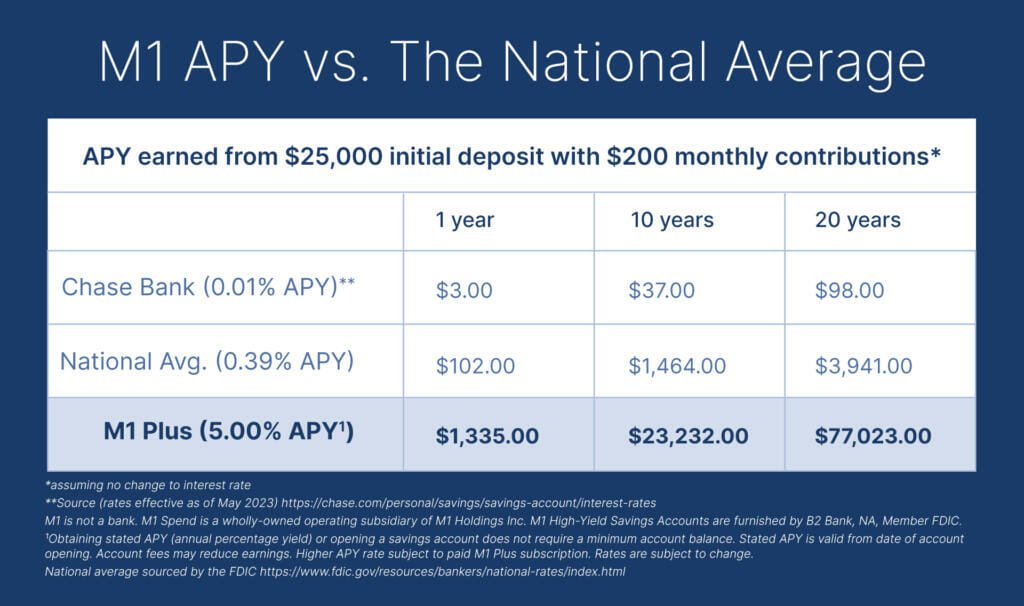

Create a Digital Emergency Fund Strategy

Image Source: M1 Finance

High-yield savings accounts are changing how we think about emergency funds by offering rates up to 4% APY. These rates are almost ten times higher than what traditional savings accounts offer26.

High-Yield Savings Options

These accounts come with FDIC insurance protection up to $250,00026. You can earn around $400 yearly with a $10,000 balance in a high-yield account at 4% APY26. Here’s what to look for in an account:

| Feature | Benefit |

|---|---|

| Interest Rate | Up to 4% APY |

| Monthly Fees | Often $0 |

| Access Type | Easy withdrawal |

| Insurance | FDIC protected |

Emergency Fund Calculator

We used emergency savings calculators to figure out the right fund size based on monthly expenses27. These tools help you plan by looking at:

- Your regular monthly bills

- Your family’s size and needs

- How stable your income is

- Any surprise expenses that might pop up

Most experts say you should have three to six months of expenses saved up28. A starter emergency fund of $500 can help you avoid going into debt from unexpected costs29.

Automated Savings Plans

Setting up automatic transfers is the best way to build your emergency savings30. Money moves straight from your paycheck to savings without you lifting a finger31. Smart automation services track spending patterns and save money automatically if you have irregular income32.

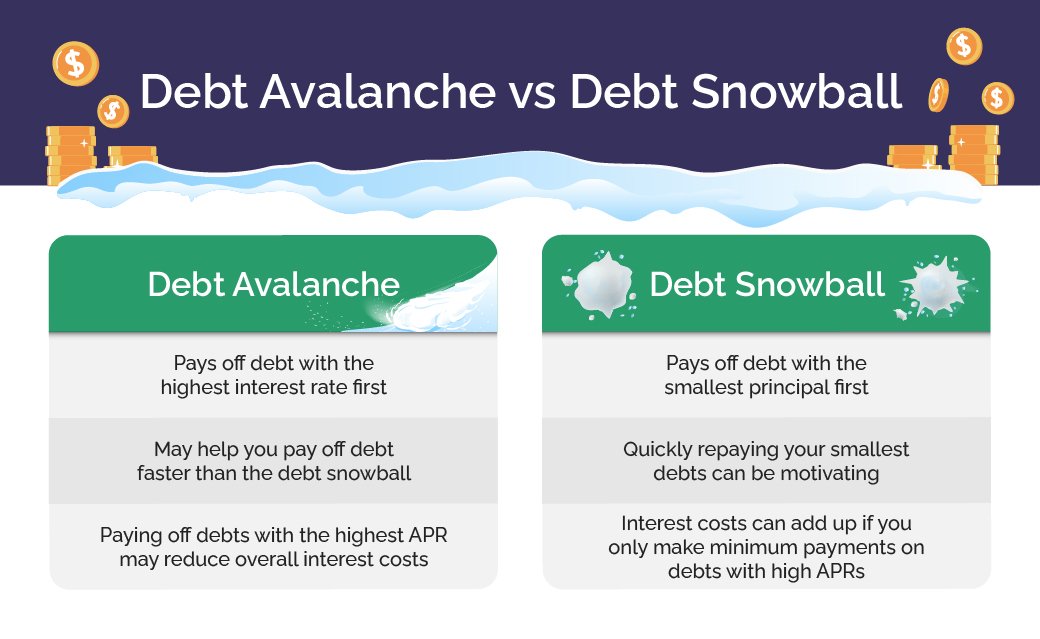

Implement Smart Debt Reduction Methods

Image Source: Lantern by SoFi

Smart ways to cut debt are the foundations of long-term financial health. The debt avalanche and debt snowball methods have altered the map of debt reduction strategies.

Debt Avalanche vs Snowball

The debt avalanche method targets high-interest debt first and we focused on cutting interest costs33. The debt snowball method takes a different path by tackling smaller debts first, which helps build momentum through quick wins. Here’s a clear comparison:

| Method | Focus | Best For | Savings |

|---|---|---|---|

| Avalanche | Highest Interest | Budget-oriented people | Maximum interest savings |

| Snowball | Smallest Balance | Motivation-driven | Quick psychological wins |

Debt Consolidation Apps

Today’s debt consolidation apps make repayment easier with automated tracking and payment systems34. These tools analyze your spending patterns, find ways to save money, and build custom debt payoff plans. The best apps include payment reminders, immediate updates, and bank account sync features35.

Interest Rate Negotiation

Lower interest rates can save you significant money. To name just one example, a drop in credit card interest from 18% to 13% on a $5,000 balance saves about $1,100 in interest36. Your success in negotiation often depends on:

- A strong payment history

- Knowledge of competitive rates

- Talking to supervisors who can change rates more easily36

Design a Sustainable Investment Portfolio

Image Source: Sustainable Review

Sustainable investing plays a crucial role in improving financial wellness. ESG-related assets will likely reach USD 40 trillion by 20307.

ESG Investing

Environmental, Social, and Governance (ESG) investing blends traditional financial analysis with sustainability factors. Investors review companies based on:

| ESG Component | Key Evaluation Criteria |

|---|---|

| Environmental | Climate policies, waste management |

| Social | Employee relations, community effects |

| Governance | Board diversity, shareholder rights |

Green Bonds

Green bonds are a chance to support environmental projects while earning returns. The World Bank’s Green Bond program supports renewable energy and climate-resilient growth37. This market keeps growing, and annual issuance will likely exceed USD 1 trillion by 20245.

Impact Investment Options

Impact investing has grown by a lot and now manages USD 1.57 trillion in assets38. We focused investment on:

- Better healthcare access

- Affordable housing development

- Eco-friendly agriculture support

- Ocean and land regeneration39

Sustainable portfolios now mix public and private capital to improve returns through blended finance40. Europe’s leading impact investors report a 20% compound annual growth rate, which shows the sector’s strong performance40.

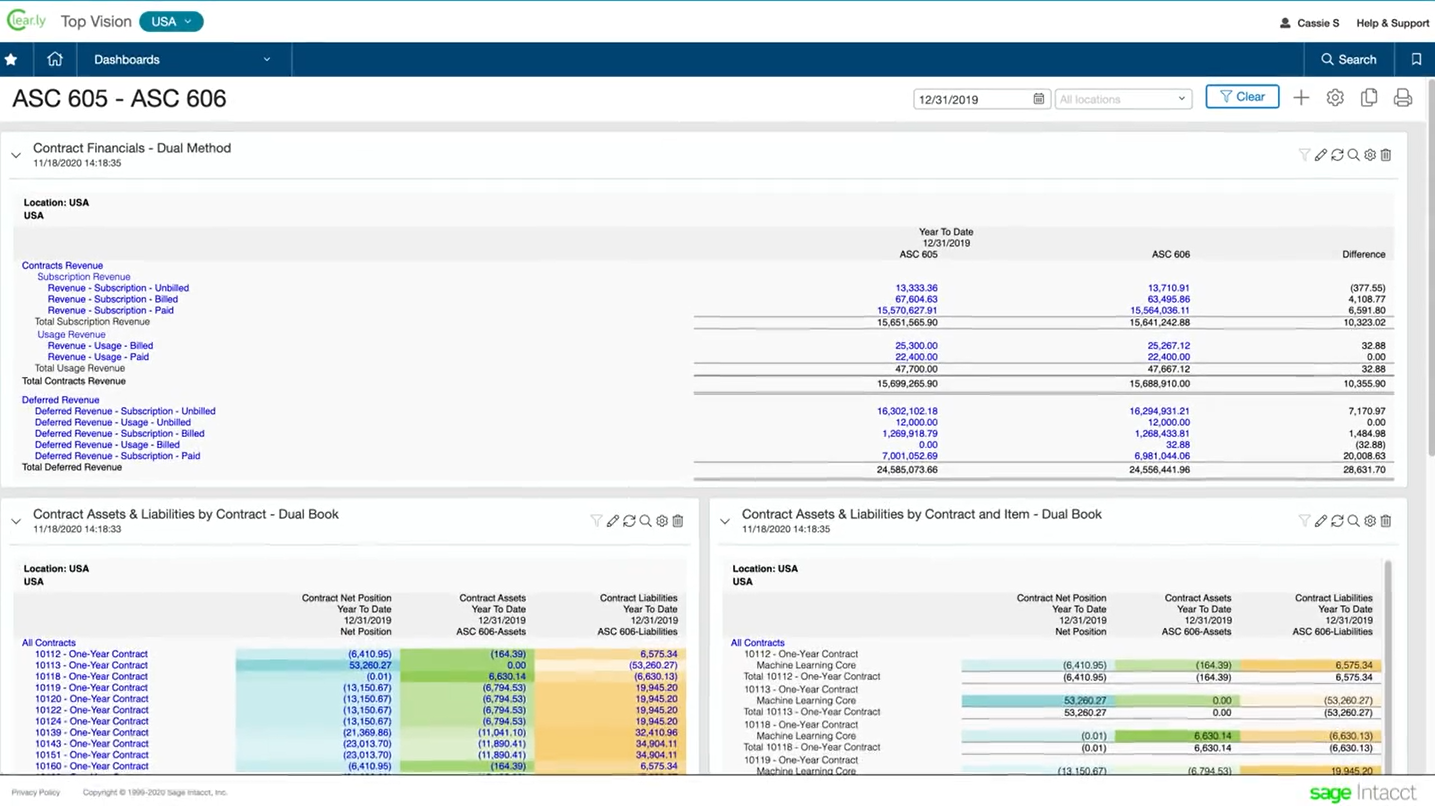

Automate Bill Payments and Savings

Image Source: Sage

Financial automation is a significant step toward lasting financial wellness. Studies show automated bill payments can reduce late fees and improve credit scores by ensuring consistent, timely payments41.

Smart Payment Systems

Digital automation simplifies financial operations through modern payment systems. The setup of automatic bill payments requires:

| Setup Step | Purpose |

|---|---|

| Link Payment Source | Connect bank account/card |

| Add Payees | Connect service providers |

| Schedule Payments | Set frequency and dates |

| Authorize | Verify identity |

Recurring Investment Setup

Automated investing helps investors avoid market timing mistakes through dollar-cost averaging42. Leading investment platforms now provide recurring investment options that start at $25 and enable systematic portfolio building4. Investors can schedule regular contributions to mutual funds, ETFs, or stock portfolios automatically43.

Cash Flow Optimization

Cash flow optimization focuses on simplifying both inflows and outflows44. Businesses can improve cash retention by delaying payments until the due date through electronic systems45. Automated systems capture and confirm transactions that reduce processing time by 62%46.

Regular reviews of automated systems are vital to get the best results. Financial experts suggest monthly or quarterly checks of automated transactions to ensure they match financial goals41. This “set and monitor” approach helps maintain control while maximizing automation’s benefits.

Develop a Digital Estate Plan

Image Source: Western & Southern Financial Group

Digital assets have become crucial to financial well-being. Recent studies show that 90% of Americans have digital assets that need protection47.

Digital Asset Inventory

Your digital asset inventory has financial accounts, social media profiles, and digital property. Here’s a well-laid-out breakdown of everything in your digital assets:

| Asset Category | Examples | Protection Level |

|---|---|---|

| Financial | Banking, investments, crypto | High security |

| Personal | Photos, emails, documents | Medium security |

| Social | Social media, blogs | Simple security |

| Business | Websites, digital products | High security |

Online Will Creation

Online will-making platforms are a great way to get legally binding documents48. You can complete the process in under 20 minutes48. This has changed how we handle estate planning. The best platforms give you:

- State-specific documentation

- Free document updates

- Secure storage solutions

- Expert legal guidance

Legacy Planning Tools

Digital legacy planning tools help you organize and secure access to your online presence. These platforms ended up helping you pick legacy contacts and create backup plans49. The Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA) makes digital asset transfer legally clear8. Your digital legacy stays protected this way.

You should keep digital estate plans in secure locations and give access instructions only to designated executors47. Remember to review and update your digital inventory when life changes happen or you get new digital assets49.

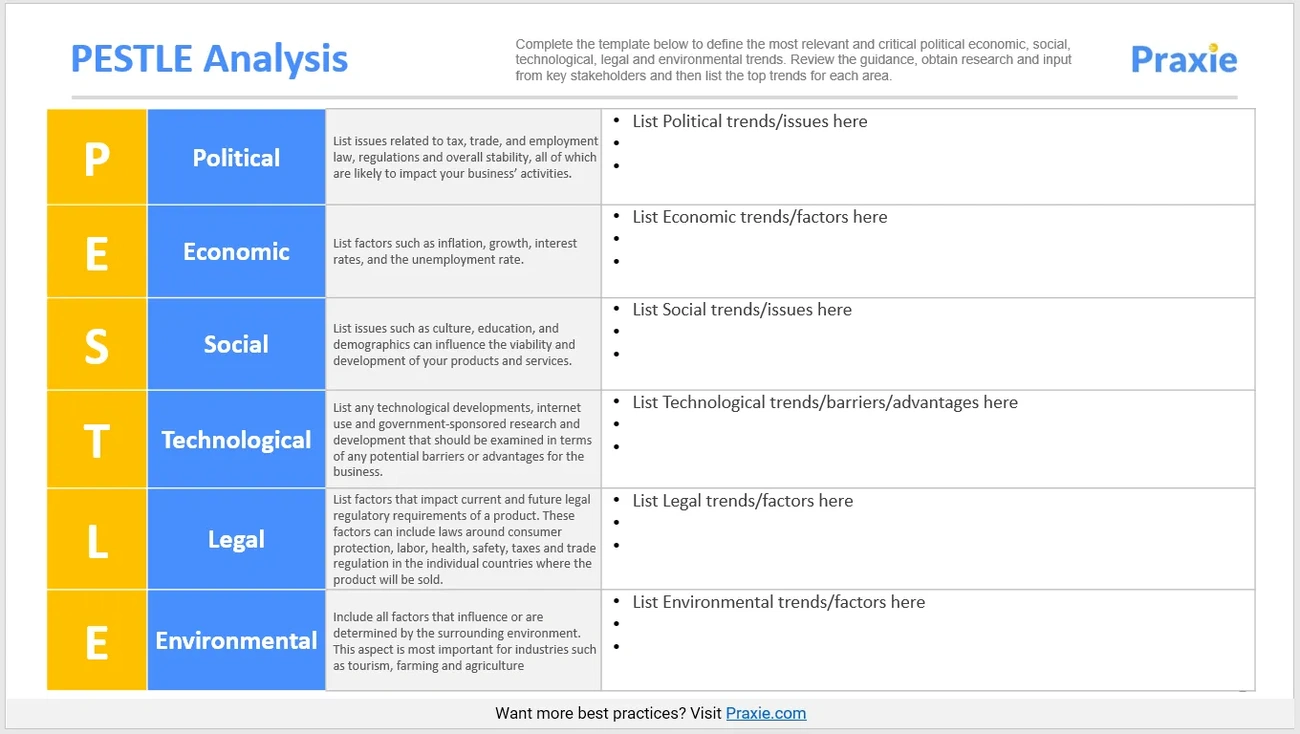

Maximize Tax Efficiency

Image Source: Physician on FIRE

Tax efficiency shapes your long-term financial health. Smart tax planning can save you thousands each year. Tax software has changed how we handle our tax obligations and provides accuracy guarantees with maximum refund assurance50.

Tax Planning Software

Modern tax preparation platforms update tax laws automatically. You don’t need to track complex changes by hand anymore50. These systems search extensively for deductions and help maximize your refund through detailed analysis50. The leading platforms now use accessible interfaces that convert tax terminology into simple language. This makes even complex returns easier to handle51.

Deduction Tracking

We focused on proper expense categorization to track deductions effectively. Here’s a breakdown of common tax-deductible expenses:

| Expense Category | Deduction Potential |

|---|---|

| Office Supplies | Full deduction52 |

| Travel Expenses | Business-related52 |

| Professional Services | 100% deductible52 |

| Home Office | Based on square footage52 |

Investment Tax Strategies

Asset placement is key to smart tax management. Of course, you can minimize your current tax exposure by putting taxable investments like dividend stocks in tax-deferred accounts2. Municipal bonds give you tax advantages and are typically exempt from federal taxes. Many are also free from state and local taxes2. Tax-loss harvesting is another useful strategy. You can offset up to $3,000 of ordinary income each year through investment losses2.

Create a Financial Learning System

Image Source: Money Management International

Education plays a vital role in achieving financial wellness. Studies show that learning about finances has a positive effect on financial knowledge and how people handle money53.

Online Courses

Top platforms give complete financial education programs. McGill Personal Finance Essentials lets students take free courses with weekly videos and quizzes54. Udemy’s Personal Finance 101 teaches over three hours of content in 50+ short videos. The course covers everything from credit basics to education financing54.

| Platform | Duration | Key Features |

|---|---|---|

| McGill | 6-8 weeks | Canadian-focused, quiz-based |

| Udemy | 3+ hours | Video-based, beginner-friendly |

| Khan Academy | Self-paced | Interactive exercises |

Financial Podcasts

“We Study Billionaires” has become the world’s largest stock investing podcast with over 180 million downloads55. “The Long View” features talks with influential leaders about investing trends and money management strategies56.

Expert Webinars

Financial Experts Network runs more than 120 live webinars each year with 90+ subject matter experts57. These programs teach significant topics like tax planning, estate management, and investment strategies. The webinars ended up giving continuing education credits to CFP® professionals and Investment Adviser Representatives57.

Build a Financial Support Network

Image Source: Experian

A strong support network makes a real difference in your financial wellness. Studies show people who have an accountability partner reach their goals 95% of the time58.

Professional Advisors

Finding the right financial advisor starts with checking their credentials and expertise. Right now, registered investment advisors must act as fiduciaries and put their client’s interests first59. Here’s what to review when picking an advisor:

| Criteria | Importance |

|---|---|

| Credentials | Check CFP® certification |

| Experience | Review specialization areas |

| Fee Structure | Compare AUM vs fixed fees |

| Disciplinary History | Verify through FINRA |

Money Accountability Partners

Money accountability partnerships are the foundations of reaching your goals. The best partnerships need regular check-ins and clear goals60. Your partner helps you stay on track through:

- Monthly progress tracking

- Bi-weekly financial discussions

- Constructive feedback on decisions

Financial Communities

Online financial communities are a great way to get support and share knowledge. The Financial Common Cents group has 82,000 members who focus on credit improvement and debt reduction61. Reddit’s finance forums ended up becoming specialized discussion spaces for financial topics, from investing to budgeting61. These communities give expert explanations while connecting you with people who share your money goals.

Implement Regular Financial Reviews

Image Source: Fyle

Regular reviews are the life-blood of successful financial management. Studies show that systematic evaluations lead to better financial outcomes62.

Monthly Metrics

We focused on tracking key performance indicators in monthly financial reviews. A well-laid-out approach has:

| Review Area | Key Metrics | Frequency |

|---|---|---|

| Budget | Income vs Expenses | Monthly |

| Savings | Progress to Goals | Monthly |

| Investments | Portfolio Balance | Monthly |

| Debt | Reduction Progress | Monthly |

Quarterly Goals Assessment

Quarterly evaluations shape your path to long-term success. You should get into your progress toward financial objectives set at the year’s start63. The assessment should cover:

- Average monthly income trends

- Fixed and variable expense patterns

- Financial priorities arrangement

- Emergency fund adequacy

Annual Strategy Updates

Yearly reviews just need a detailed look at your financial world. Research shows that connecting with financial advisors by February 1st substantially improves goal achievement rates62. The focus areas are:

- Reviewing asset allocation strategies

- Updating estate planning documents

- Assessing insurance coverage adequacy

- Evaluating tax efficiency opportunities

The best results come from keeping detailed records of each review session and documenting strategy adjustments64. This systematic approach helps spot potential issues early and enables proactive financial management that improves financial wellness.

Comparison Table

| Strategy | Main Goal | Essential Tools/Methods | Recommended Frequency | Important Numbers | Advantages |

|---|---|---|---|---|---|

| Tech-Powered Financial Dashboard | Account consolidation | Personal finance apps, automated tracking | Live monitoring | Integrates with thousands of financial institutions | Unified view of finances, automated expense tracking |

| 50-30-20 Rule | Budget allocation | Digital budgeting apps | Monthly tracking | 50% needs, 30% wants, 20% savings | Simple to use, flexible allocation |

| Multiple Income Streams | Income diversification | Dividend stocks, REITs, freelancing | Ongoing | $588B dividend distributions in 2023 | Lower financial risk, steady income |

| Behavioral Money Psychology | Emotional spending control | Money trigger tracking, habit building | Regular monitoring | 52% Americans say money affects mental health | Better spending control, less anxiety |

| AI for Financial Planning | Automated management | Robo-advisors, smart algorithms | Continuous | 91% financial companies use/assess AI | Lower fees (0.25-0.50%), automated optimization |

| Credit Score Optimization | Credit improvement | Monitoring apps, payment automation | Monthly | 35% impact from payment history | Fraud protection, better credit terms |

| Digital Emergency Fund | Financial safety net | High-yield savings accounts | Monthly contributions | Up to 4% APY on savings | FDIC protection, automated saving |

| Smart Debt Reduction | Debt elimination | Avalanche/snowball methods, consolidation apps | Monthly tracking | 5% interest reduction saves $1,100 on $5,000 | Lower interest costs, systematic payoff |

| Sustainable Investment Portfolio | ESG investing | Green bonds, impact investments | Quarterly rebalancing | $40T in ESG assets by 2030 | Environmental impact, competitive returns |

| Bill Payment Automation | Payment efficiency | Digital payment systems | Monthly review | 62% reduction in processing time | Lower late fees, improved credit |

| Digital Estate Plan | Asset protection | Online will platforms, legacy tools | Annual updates | 90% Americans have digital assets | Secure asset transfer, legal compliance |

| Tax Efficiency | Tax optimization | Tax planning software, deduction tracking | Annual planning | $3,000 annual tax loss harvest limit | Maximum refunds, lower tax liability |

| Financial Learning System | Continuous education | Online courses, podcasts, webinars | Weekly/Monthly | 180M+ podcast downloads | Better financial knowledge |

| Financial Support Network | Accountability | Professional advisors, community groups | Monthly check-ins | 95% goal achievement with partners | Better decision-making |

| Regular Financial Reviews | Progress tracking | Performance metrics, goal assessment | Monthly/Quarterly | February 1st advisor meeting recommended | Quick issue detection |

Final thoughts

Financial wellness needs more than simple budgeting and saving. It takes a strategic mix of technology, automation, and ongoing learning. AI-powered tools, green investing, and automated systems are a great way to get practical improvements in your financial health.

You should begin with a tech-powered financial dashboard and the 50-30-20 rule instead of trying everything at once. This foundation lets you add other methods systematically, like building multiple income streams and reducing debt smartly.

Technology and sustainability now shape how we build wealth. ESG investing, digital estate planning, and AI-driven financial tools show what a world of wealth building looks like.

Your financial success grows when you apply these strategies consistently and review your finances regularly. A well-laid-out approach, along with a strong support network and continuous learning, builds lasting financial wellness. Note that every small step toward better financial habits adds up over time and reshapes your financial future substantially.

Discover more a

[2025] 10 Simple Ways to Automate Personal Finances (Step-by-Step Guide)

FAQs

Q1. How can I create a comprehensive financial dashboard? A comprehensive financial dashboard can be created by integrating personal finance apps, setting up automated expense tracking, monitoring your net worth in real-time, and establishing financial analytics. This provides a unified view of your finances and helps in making informed decisions.

Q2. What is the 50-30-20 rule and how can it improve my budgeting? The 50-30-20 rule is a simple budgeting method where you allocate 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment. It improves budgeting by providing a clear structure and flexibility, allowing you to adjust percentages based on your financial priorities.

Q3. How can AI tools enhance my financial planning? AI tools can enhance financial planning through AI-powered budgeting tools that categorize expenses and provide personalized insights, robo-advisors that offer automated portfolio management at lower fees, and smart investment algorithms that optimize portfolios based on market data and individual goals.

Q4. What are some effective strategies for reducing debt? Effective debt reduction strategies include the debt avalanche method (focusing on high-interest debt first), the debt snowball method (tackling smallest debts first), using debt consolidation apps for streamlined repayment, and negotiating interest rates with creditors to potentially save on interest payments.

Q5. How often should I review my finances and what should I focus on? It’s recommended to conduct monthly reviews of key metrics like budget adherence and savings progress, quarterly assessments of financial goals, and annual strategy updates. Focus on tracking income and expense trends, evaluating progress towards financial objectives, and adjusting strategies as needed to improve overall financial wellness.

References

[1] – https://www.aura.com/learn/credit-monitoring-app

[2] – https://www.morganstanley.com/articles/tax-efficient-investments-keeping-your-return

[3] – https://crowdsourcingweek.com/blog/top-10-freelancing-platforms/

[4] – https://us.etrade.com/knowledge/library/getting-started/how-automatic-investing-works

[5] – https://www.robeco.com/en-int/glossary/green-social-and-sustainability-gss-bonds

[6] – https://organizations.headspace.com/blog/5-tips-for-taming-financial-anxiety

[7] – https://www.cfainstitute.org/insights/articles/gaining-broader-perspective-guide-to-esg-investment-approaches

[8] – https://www.scclegal.com/a-comprehensive-guide-to-digital-estate-planning/

[9] – https://www.schwabassetmanagement.com/strategies-investors-seeking-income

[10] – https://www.landaclub.com/post/the-10-best-freelance-websites-to-find-high-paying-gigs-in-2025

[11] – https://humantold.com/blog/why-is-money-so-triggering/

[12] – https://getremynt.com/blog/money-triggers/

[13] – https://www.debt.com/how-to-cope-with-financial-stress/the-psychology-of-spending-money/

[14] – https://www.consumerfinance.gov/consumer-tools/educator-tools/youth-financial-education/learn/financial-habits-norms/

[15] – https://www.helpguide.org/mental-health/stress/coping-with-financial-stress

[16] – https://creativeplanning.com/insights/financial-planning/overcoming-financial-anxiety/

[17] – https://www.investopedia.com/how-can-ai-help-financial-advisors-8385520

[18] – https://learn.wymarfcu.com/money-management/budgeting/article/ai-powered-budgeting-tools

[19] – https://www.nerdwallet.com/best/investing/robo-advisors

[20] – https://www.cnbc.com/select/best-robo-advisors/

[21] – https://www.investopedia.com/articles/active-trading/101014/basics-algorithmic-trading-concepts-and-examples.asp

[22] – https://keymakr.com/blog/the-algorithmic-advantage-how-ai-is-optimizing-investment-strategies/

[23] – https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/improve-credit-score/

[24] – https://www.nfcc.org/press_release/nfcc-pilots-innovative-credit-building-program-with-pebble/

[25] – https://www.investopedia.com/the-best-credit-builder-loans-8764460

[26] – https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

[27] – https://www.navyfederal.org/makingcents/tools/emergency-fund-calculator.html

[28] – https://www.morganstanley.com/articles/how-to-build-an-emergency-fund

[29] – https://www.nerdwallet.com/article/banking/emergency-fund-calculator

[30] – https://www.cnbc.com/2024/08/29/how-to-build-an-emergency-fund-with-automated-savings.html

[31] – https://www.payactiv.com/financial-learning/using-automatic-savings-to-create-an-emergency-fund/

[32] – https://www.asppa-net.org/news/2019/11/automated-emergency-savings-plans-next-big-thing/

[33] – https://www.investopedia.com/articles/personal-finance/080716/debt-avalanche-vs-debt-snowball-which-best-you.asp

[34] – https://www.credello.com/financial-resources/personal-finance/best-financial-apps-for-debt-relief/

[35] – https://savingsgrove.com/blogs/guides/debt-payoff-tracker

[36] – https://www.takechargeamerica.org/dos-and-donts-for-negotiating-credit-card-interest-rates/

[37] – https://treasury.worldbank.org/en/about/unit/treasury/ibrd/ibrd-green-bonds

[38] – https://impactalpha.com/holiday-list-no-8-shining-a-spotlighting-on-seven-impact-investing-trends-for-2025/

[39] – https://thegiin.org/publication/opinion/seven-things-to-watch-in-impact-investing-in-2025/

[40] – https://impact-investor.com/2025-outlook-whats-ahead-for-impact-investing/

[41] – https://www.paypal.com/us/money-hub/article/automate-personal-finances

[42] – https://www.fidelity.com/trading/recurring-investments

[43] – https://www.schwab.com/content/how-to-automatically-invest-mutual-funds

[44] – https://www.infosysbpm.com/blogs/finance-accounting/cash-flow-optimization-techniques.html

[45] – https://www.investopedia.com/articles/personal-finance/061215/10-ways-improve-cash-flow.asp

[46] – https://www.paystand.com/blog/payment-automation

[47] – https://www.usbank.com/wealth-management/financial-perspectives/trust-and-estate-planning/digital-estate-plan.html

[48] – https://www.freewill.com/

[49] – https://www.dglegacy.com/digital-legacy-4/

[50] – https://www.pcmag.com/picks/the-best-tax-software

[51] – https://www.cnet.com/personal-finance/taxes/best-tax-software/

[52] – https://www.expensein.com/blog/business-expenses/business-expense-tracking

[53] – https://www.councilforeconed.org/wp-content/uploads/2021/10/2021-National-Standards-for-Personal-Financial-Education.pdf

[54] – https://money.usnews.com/money/personal-finance/family-finance/articles/worthwhile-online-personal-finance-courses

[55] – https://www.theinvestorspodcast.com/podcasts/best-finance-podcasts/

[56] – https://www.morningstar.com/personal-finance/best-investing-podcasts-beginners

[57] – https://www.financialexpertsnetwork.com/

[58] – https://www.clevergirlfinance.com/accountability-partner/

[59] – https://www.nerdwallet.com/article/investing/how-to-choose-a-financial-advisor

[60] – https://www.usbank.com/financialiq/manage-your-household/personal-finance/Working-with-accountability-partner-help-reach-goals.html

[61] – https://www.cnbc.com/select/best-personal-finance-communities/

[62] – https://www.morganstanley.com/articles/financial-planning-new-year-financial-resolutions

[63] – https://www.securian.com/insights-tools/articles/year-end-financial-checklist.html

[64] – https://www.dartmouth.edu/finance/forms-policies-systems/training_guidance/guidance_best_practices/account_review_guidelines.php

[65] – https://www.knack.com/blog/financial-reporting-dashboard-no-code/

[66] – https://www.kubera.com/

[67] – https://wealthtender.com/insights/money-management/wealth-tracker-apps-and-websites-know-your-net-worth/

[68] – https://www.expensify.com/

[69] – https://ramp.com/expense-management

[70] – https://noreastcapital.com/how-to-use-personal-finance-software/

[71] – https://www.nerdwallet.com/article/finance/nerdwallet-budget-calculator

[72] – https://www.unfcu.org/financial-wellness/50-30-20-rule/

[73] – https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

[74] – https://fasnycu.com/financial-wellness-blog/how-to-budget-effectively-in-2025-tools-and-tips

[75] – https://www.nasdaq.com/articles/7-best-passive-income-investments-build-your-wealth-2025

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com