Most self-made millionaires started with almost nothing. Some built their wealth right after high school. Others left college with just $50 in their checking accounts. These same people now have an average net worth between $6 to $8 million.

My 13 years as a financial advisor taught me that wealth creation doesn’t happen overnight. Smart, consistent decisions make all the difference. Self-made millionaires keep emergency funds that cover six to nine months of expenses. This amount is much higher than the usual three-month recommendation. They stay away from unnecessary debt and put their money into strategic investments that grow over time.

You can build financial wealth in 2025 with these 13 proven strategies from self-made millionaires. Let’s explore the methods that work, supported by real results and years of professional experience.

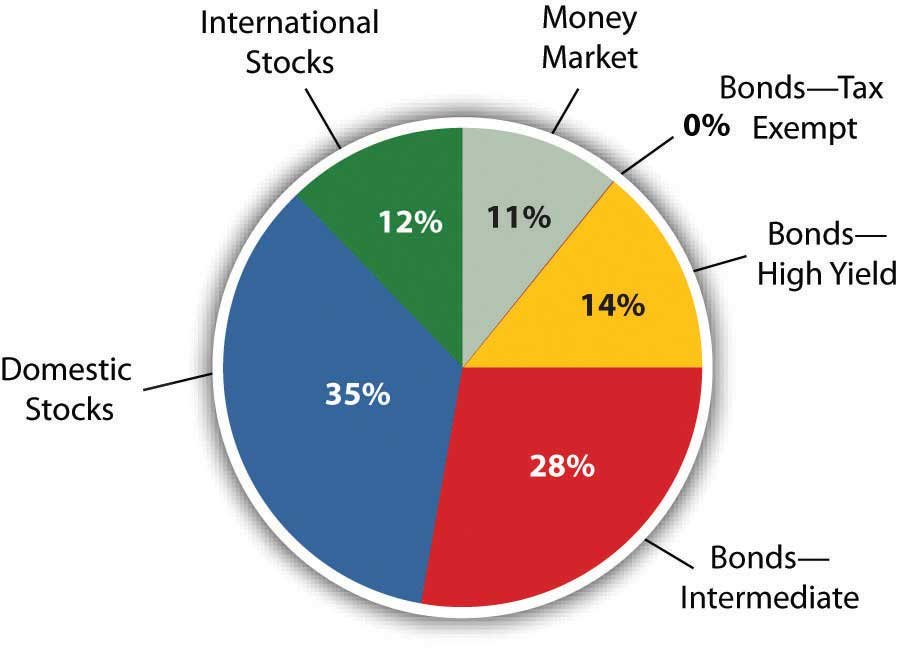

Strategic Investment Portfolio Diversification

Image Source: Lumen Learning

“We think diversification is only a surrogate, and usually a poor surrogate, for knowledge, control, and price consciousness.” — Charlie Munger, Vice Chairman of Berkshire Hathaway, business partner of Warren Buffett

Portfolio diversification is the life-blood of wealth building. This rings especially true in today’s market where the top 10 stocks account for nearly 40% of the S&P 500’s total market capitalization1. My years of advising clients have shown how smart diversification protects wealth during uncertain markets.

Portfolio Asset Allocation

The S&P 500 should deliver a modest 7% return in 20251. This makes spreading investments in assets of all types a significant priority. Traditional stocks aren’t your only option. Fixed income markets’ credit and spread products could generate total returns approaching 8%-10% with current yields of 5%-7%1. Your portfolio becomes more balanced when you add Japanese and emerging markets to U.S. stocks, along with global brands in Europe.

Risk Management Strategies

Stocks and bonds have started moving together lately. This shows why we need to look beyond conventional asset classes1. Master-limited partnerships (MLPs), residential REITs, select hedge fund strategies, and preferred securities can boost your portfolio’s resilience. Real assets are a vital component that protect you when traditional safe havens become scarce.

Investment Rebalancing Schedule

Your portfolio needs annual rebalancing to stay healthy. A portfolio adjustment happens when an asset class shifts 5%-10% from its target allocation54. This method takes emotion out of decisions and keeps your risk profile steady. Portfolio cash flows from dividends and interest are great ways to rebalance underweighted asset classes54.

Tax-Efficient Investing

Tax-efficient investing shapes your wealth-building trip significantly. Smart placement of investments in the right accounts minimizes tax implications. Tax-managed funds and ETFs work well since they keep capital gains distributions low55. Municipal bonds offer another smart option – their interest income usually stays free from federal taxes, and sometimes state and local taxes too55.

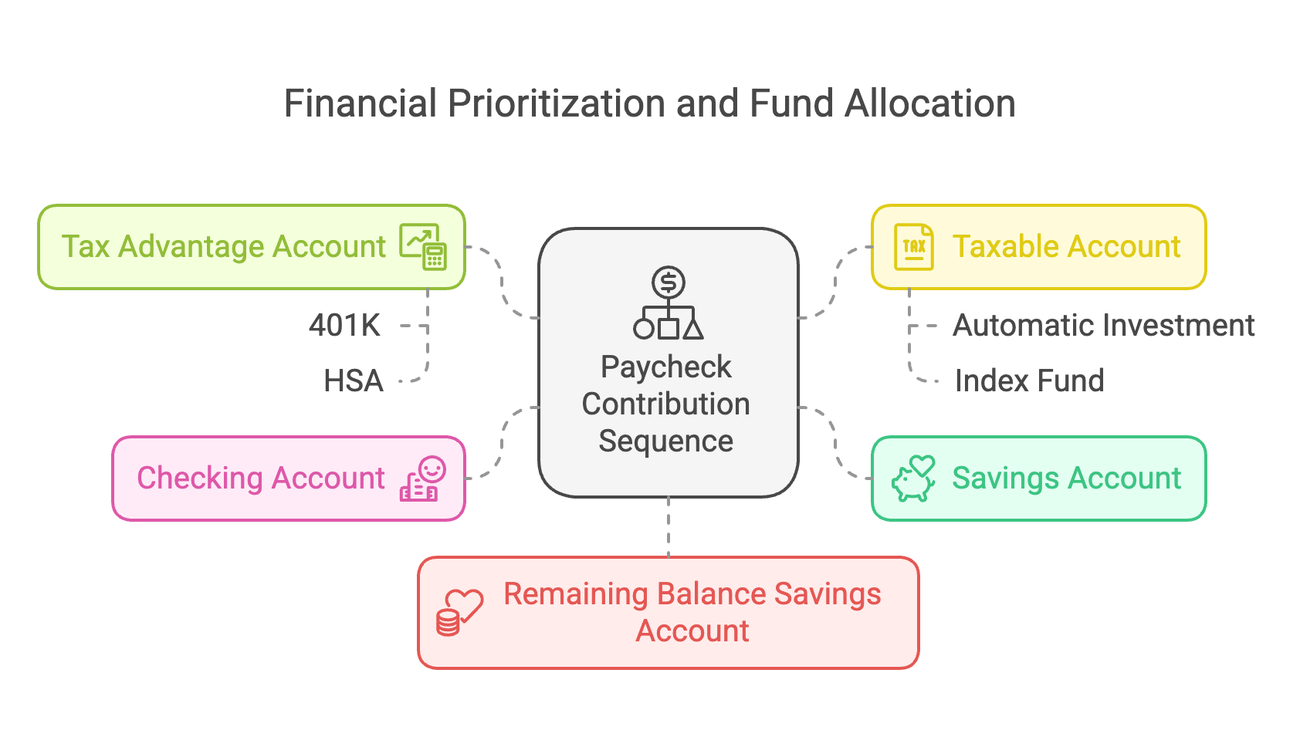

Automated Wealth Systems Implementation

Image Source: Substack

Switching from manual financial management to systematic growth through automated wealth-building will transform your financial future. My experience with client advising shows that automated systems reduce decision fatigue and help maintain steady progress toward financial goals.

Income Automation Setup

Your paycheck should automatically transfer into investment accounts to eliminate spending temptation before saving. Companies that provide automated payroll deductions for retirement accounts have seen their employee participation rates increase by 30-50%56. The best results come from automating contributions to match your employer’s maximum 401(k), then directing extra money toward IRAs or taxable investment accounts.

Expense Automation

AI-powered tools have revolutionized modern expense management systems. These platforms can categorize expenses, identify policy violations, and process reimbursements with 99% accuracy57. Your team can save 4,000 hours yearly by implementing automated expense tracking57. Automated systems also help maintain a six-month emergency fund. Successful wealth builders in my network typically keep USD 36,000 in reserves, based on USD 6,000 monthly expenses58.

Investment Auto-Scheduling

Smart wealth building removes emotional decisions through automated investment scheduling. Regular, automated contributions help spread investment purchases across market conditions through dollar-cost averaging59. Your automation should:

- Match transfers with paydays

- Set dividends and capital gains to reinvest automatically

- Boost contribution percentages when you get a raise

Automation shines through its consistency. Research shows automated investment platforms can boost tax efficiency by 15-25% using smart harvesting algorithms56. Mezzi’s platform combines accounts from over 50 institutions, which gives you complete portfolio management and cuts oversight time by 30-50%56.

Automated wealth systems create a financial foundation that runs without daily input. This complete approach helps you steadily build wealth without constant monitoring or intervention.

Tax Optimization Strategies

Image Source: Shakespeare Wealth Management

Tax optimization plays a vital role in building lasting wealth. My years of advising high-net-worth clients have taught me that smart tax planning helps preserve and grow wealth over time.

Tax-Loss Harvesting

You can offset capital gains through tax-loss harvesting. This strategy lets investors sell investments at a loss to reduce their tax burden while keeping their portfolio balanced. When capital losses are more than gains, you can deduct up to $3,000 from ordinary income each year60. Just remember to wait 30 days before buying back similar securities to avoid wash sales.

Strategic Tax Planning

Long-term investments come with better tax rates – 0% to 20% compared to short-term rates that can reach 37%60. That’s why I tell my clients to use tax-deferred accounts like Health Savings Accounts (HSAs). These accounts give you three big advantages: you can deduct contributions, grow money tax-free, and withdraw funds tax-free for qualified medical expenses61.

Investment Tax Efficiency

Municipal bonds are a great way to invest tax-efficiently because they provide interest income that’s free from federal taxes55. Tax-managed funds and ETFs also help by limiting capital gains distributions, which lowers your tax burden55. The best approach puts tax-efficient investments in taxable accounts and keeps less tax-efficient ones in tax-advantaged accounts.

Real Estate Tax Benefits

Real estate investing comes with major tax perks. Property owners can write off expenses like mortgage interest, property taxes, insurance, and maintenance costs62. They also get depreciation benefits spread across 27.5 years for residential properties and 39 years for commercial ones63. The best part? Using a 1031 exchange lets investors put off capital gains taxes by reinvesting into similar properties63.

These strategies work best when you keep good records and review them regularly. This can help you lower your tax bill by a lot. The tax laws are complex though, so working with qualified tax professionals is key to getting the most from these benefits.

Multiple Income Stream Development

Image Source: Wealth Factory

“If you do nothing else, INVEST in an ETF stock like $VTI, $VOO, or $QQQ. I found it more beneficial for people to be in the game versus waiting for the right time to jump in.” — Lawrence Gonzalez, Founder of The Neighborhood Finance Guy

Research shows that 65% of self-made millionaires have at least three income streams12. This demonstrates why you need to broaden your revenue sources. My experience as a financial advisor has helped many clients build multiple channels of wealth that complement each other.

Active Income Optimization

Successful wealth builders look beyond their day jobs to maximize their main source of income. The original springboard comes from high-paying careers or entrepreneurial ventures13. The secret lies in smart reinvestment of earned income to create more revenue streams. This sets strong foundations for exponential wealth growth.

Passive Income Sources

The year 2025 has made passive income opportunities more available thanks to technology14. You can now earn more than 4% annual percentage yield15 from high-yield savings accounts. Dividend stocks give you regular quarterly payouts plus potential capital appreciation16. Real estate investments shine especially when you have both recurring rental income and property value growth3.

Business Ventures

A focused business approach works better than scattered side hustles17. Start by mastering one venture that can run without your constant attention. To cite an instance, property market deal sourcing can bring thousands per deal. This transforms into passive income once the core team handles daily operations17.

Investment Income

A well-laid-out investment portfolio creates steady returns through multiple channels. Prominent companies’ dividend stocks provide regular payouts14. REITs give you real estate market exposure without direct property management3. P2P lending platforms are a great way to get higher interest rates compared to traditional savings accounts3.

Your income streams can work better when you:

- Put earnings from one stream into developing others

- Use automation tools to simplify processes18

- Choose flexible ventures that grow without eating up more time

- Keep emergency funds for 6-9 months of expenses12

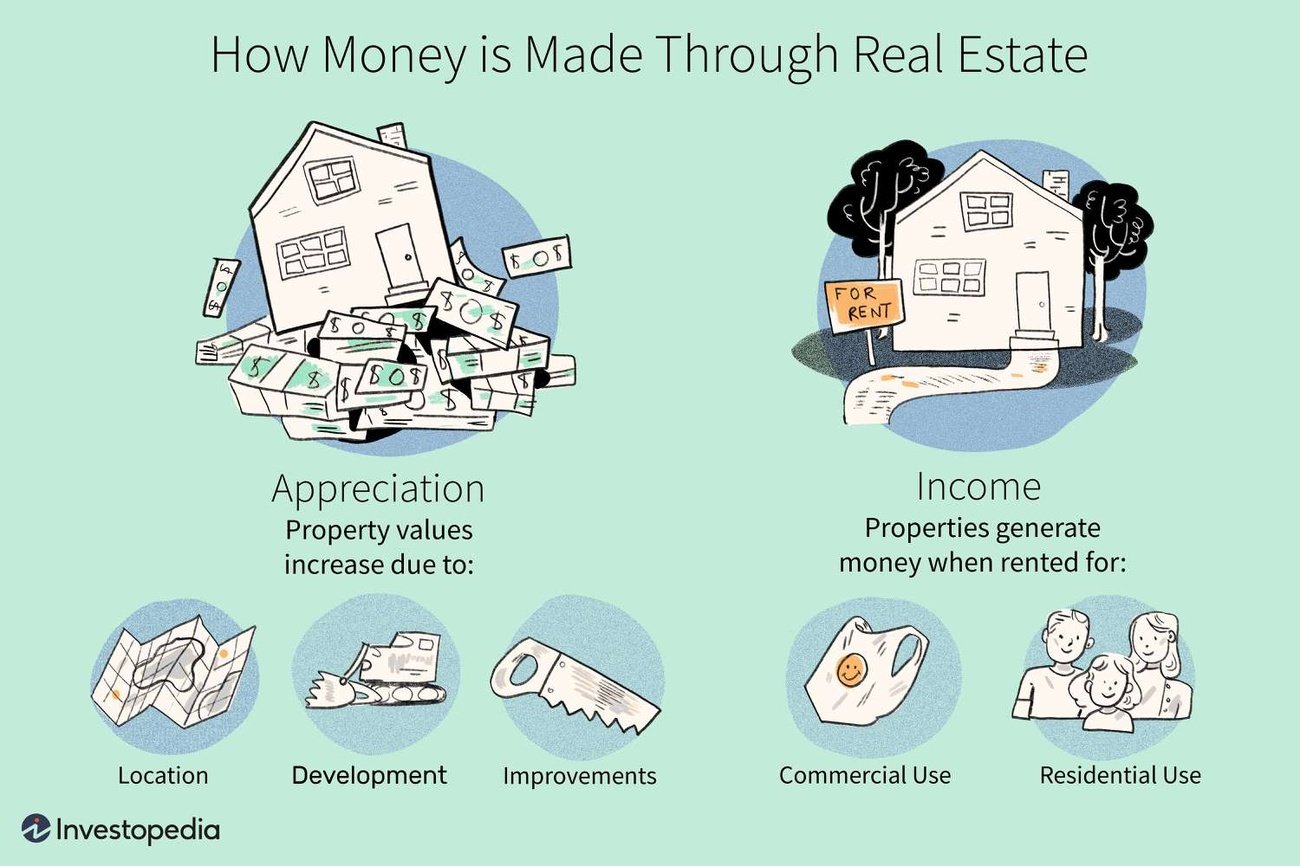

Real Estate Investment Mastery

Image Source: Investopedia

Real estate portfolio management stands out as a smart way to build wealth. It needs skills similar to running a successful corporation19. My years of advisory experience have helped many clients become skilled at this profitable investment approach.

Property Investment Strategies

Smart real estate investing needs careful property analysis to spot profitable deals. Properties that generate positive cash flow are the life-blood of wealth creation. This happens when yearly rent exceeds total expenses after tax deductions20. Multifamily properties now present great opportunities. They showed average annual returns of 9.5% between 2000 and 201821.

Real Estate Portfolio Management

Success in real estate portfolio management comes from understanding property basics and market movements19. Portfolio managers must create value through smart asset choices and allocation. They should ensure proper risk-adjusted returns through diversification19. Good management includes:

- Using specialized asset management for property-level strategies

- Analyzing markets carefully for strategic buying

- Setting up quick property management systems

Rental Income Optimization

Property owners should focus on strategic upgrades and tenant management to maximize rental returns. Professional property managers say smart improvements can substantially boost rental yields22. Key strategies to optimize returns include:

- Setting market-based competitive rental rates

- Keeping high occupancy through careful tenant screening

- Keeping utilities separate from rent to boost income20

- Using preventive maintenance to cut long-term costs22

Current real estate trends show increased spending on both existing and new properties. There’s also growing interest in renovation projects23. Green and energy-efficient properties are becoming popular. Investors who add eco-friendly features early might benefit from higher demand and better property values23. Without doubt, success in real estate investment comes from balancing property selection, management efficiency, and income optimization strategies.

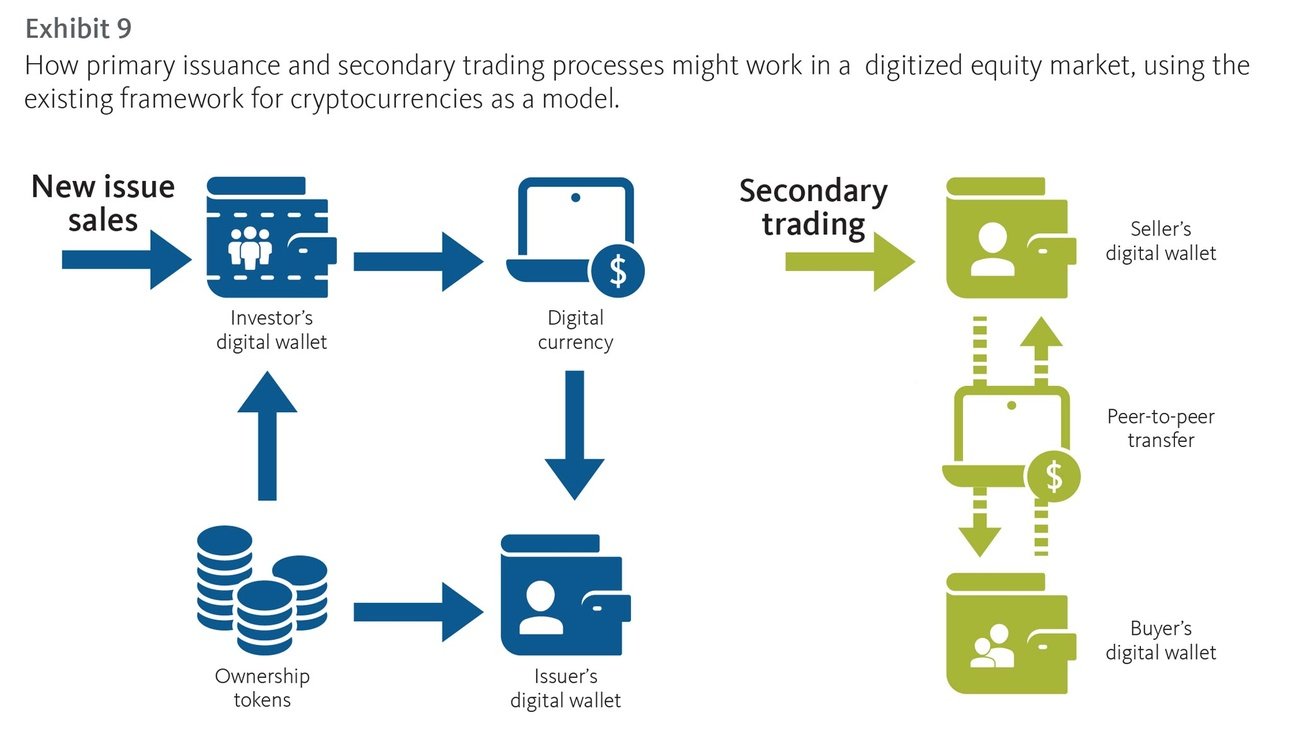

Digital Asset Accumulation

Image Source: Broadridge

Digital assets have become a vital part of modern wealth-building portfolios. 94% of institutions now see their long-term value24. My experience as a financial advisor shows a clear change toward digital investments. Traditional hedge funds now put more than 5% of their portfolios into this sector.

Cryptocurrency Investment Strategy

The digital world just needs a strategic approach that focuses on risk management and market analysis. Bitcoin’s projected value points to $150,000 by year-end25, with some forecasts aiming even higher. You can get optimal returns by:

- Using dollar-cost averaging to reduce market volatility effects

- Keeping a varied crypto portfolio with different assets

- Creating clear investment goals and rebalancing schedules

NFT Portfolio Management

Smart NFT portfolio management needs careful asset selection and trend watching. A complete strategy should track holdings in detail and do thorough research24. Key management practices should:

- Keep assets safe in reliable digital wallets

- Spread investments across NFT categories to reduce risk

- Keep an eye on market trends and new opportunities

Digital Business Assets

Asset tokenization opens up new doors, with 50% of investors looking at tokenized funds and securities26. More institutions jump in every day – 38% already put 1-5% of their funds into digital assets26. The number of stablecoin projects has grown to include 202 different options6. These projects boost payment efficiency and give strategic benefits.

Your digital assets can work better when you:

- Pick quality investments that last

- Use smart tools to track your portfolio

- Keep up with rules and market changes

Good management of digital assets can create steady income streams. Of course, staking and yield farming are a great way to get returns without selling26. Remember that digital assets need special knowledge and strong security measures. Multi-factor authentication and secure platforms27 help protect your investments.

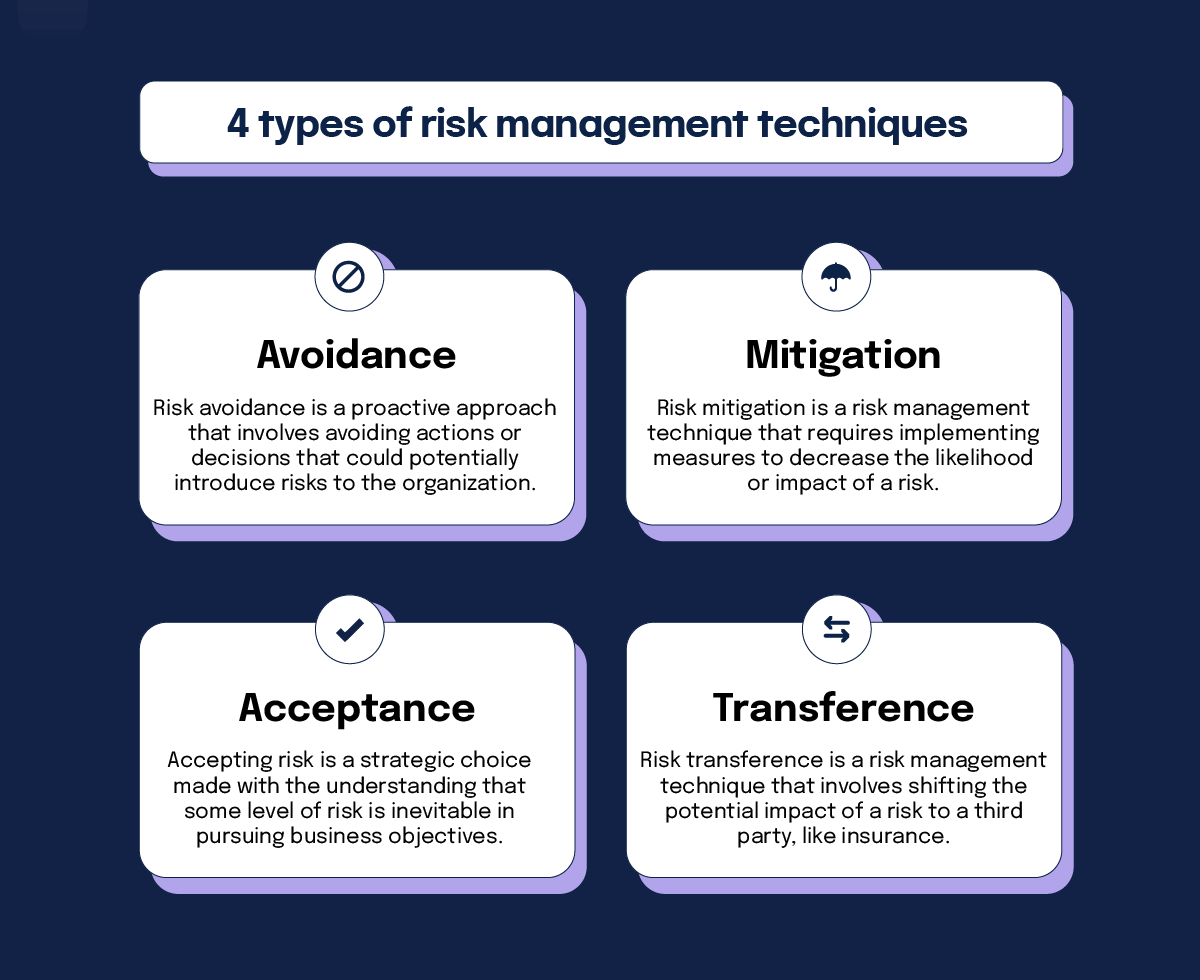

Risk Management and Insurance

Image Source: Hyperproof

Wealthy individuals need sophisticated strategies and complete insurance coverage to protect their assets. My experience in advising high-net-worth clients shows that a strong risk management framework is vital to long-term financial security.

Wealth Protection Strategies

Multiple layers of defense make wealth protection work well. Recent data shows only 31% of high-net-worth families accept greater financial risk to lower insurance costs, down from 39% in 202328. You should think about setting up family limited partnerships (FLPs) or limited liability companies (LLCs) through strategic asset allocation to shield assets from claims. A good emergency fund combined with structured protection mechanisms will give you financial resilience against unexpected challenges.

Insurance Coverage Optimization

Smart insurance planning goes beyond simple coverage. High-net-worth individuals should get specialized policies that address unique risks. Umbrella insurance plays a key role by providing coverage beyond standard policy limits29. Key insurance components include:

- Professional liability coverage for business interests

- Complete property insurance for high-value assets

- Malpractice insurance for specialized professions

- Personal liability protection against potential claims

Asset Protection Planning

Smart asset protection planning helps preserve wealth. Protection strategies must be in place before potential claims arise, as last-minute defensive moves often face legal challenges30. Here’s what works best:

Start by setting up irrevocable trusts to protect assets from creditor actions. These legal structures, both domestic and international, provide better protection levels5. Married couples should look into tenancy by entirety that offers shared ownership benefits and survivorship advantages30.

Insurance companies now help with disaster preparedness, send real-time risk alerts, and connect you with recovery vendors28. Rising litigation costs due to social inflation make strong liability protection necessary, not optional28.

Regular reviews with qualified risk advisers will help spot coverage gaps28. This organized approach ensures complete protection and access to specialized services that preserve wealth over time.

Business Ownership and Scaling

Image Source: Forbes

A successful business needs careful focus on model selection and scalability. My years of advisory experience show that 80% of growth comes from maximizing core business value31.

Business Model Selection

The right business model is vital to create lasting wealth. Research shows companies with recurring revenue models can predict their growth better32. Successful businesses focus on three main pillars:

- Products that work and fit the market

- Brands that connect emotionally

- A mission that matches customer values33

Growth Strategy Implementation

Growth needs a careful balance between new ideas and operational control. Companies growing in multiple directions over ten years are twice as likely to outperform their competitors31. The core strategies should:

Start with customer-focused operations that predict changing needs and behaviors. Next, build digital capabilities because businesses that don’t use AI risk falling behind33. Finally, maintain excellent operations through smart investments and clear business metrics.

Results improve when companies move their resources flexibly and direct both money and talent toward areas that show growth31. Right now, businesses that use automation systems save 4,000 hours yearly on manual data entry31.

Exit Planning

Exit planning is significant because 50% of business exits happen due to unexpected events like death, divorce, disability, disagreement, or distress34. A detailed exit strategy should:

- Build business value through better operations

- Control timing and handle unexpected offers well

- Reduce tax impact through proper structure34

Expert advisors suggest early exit planning because most successful businesses end up selling during the owner’s lifetime34. Companies that take a systematic approach to exit planning get better valuations and smoother transitions35.

These strategies combined with regular performance checks help businesses create lasting wealth while running smoothly. Success comes from balancing growth with risk management through strategic planning and systematic execution.

Strategic Debt Leverage

Image Source: The Institute of Financial Wellness

Strategic debt utilization is a powerful tool to build wealth when it lines up with clear financial goals. My years of advisory experience show that understanding the difference between productive and counterproductive debt is significant for long-term success.

Good Debt vs Bad Debt

Good debt acts as an investment in future wealth creation and typically carries lower interest rates under 6%36. Mortgages illustrate good debt and offer potential equity building with tax advantages37. Bad debt, often tied to high-interest credit cards averaging $6,500 per American household36, drains financial resources without creating value.

Debt Optimization

A healthy cash flow and clear repayment strategies make debt optimization work effectively. The average American adult has approximately $104,000 in total debt36, which makes strategic management vital. You can achieve optimal results by:

- Getting favorable financing terms with lower interest rates

- Combining high-interest debts into lower-rate options

- Following systematic repayment schedules

Leverage for Wealth Creation

Smart debt utilization multiplies investment returns with proper management38. Business owners can get capital through bank loans or bond issuance and keep their ownership intact38. Non-consumer debt works especially well now for:

- Real estate investments that generate positive cash flow

- Business expansion that drives increased profits

- Equipment acquisition that enhances operational efficiency

Smart debt management needs careful review of risk-return tradeoffs. Higher debt levels can increase returns through tax advantages and leverage effects39. Appropriate debt levels remain significant because excessive leverage might trigger financial distress39. Investors can use debt’s wealth-building potential and minimize risks by implementing these strategies and monitoring regularly.

Note that successful debt utilization requires sufficient liquidity reserves. Lenders look at available resources before approving funding40. A resilient cash flow becomes essential to implement debt-based wealth strategies successfully.

High-Value Skill Development

Image Source: WsCube Tech

Rich people invest in valuable skills that increase their wealth-building potential. My advisory experience shows how the right skill development creates exponential returns on investment.

Industry Expertise Building

Successful wealth builders master skills that generate substantial income. Technology ownership and breakthroughs are now the main drivers of wealth creation4. Strategic thinking and problem-solving abilities set top performers apart. Simply completing tasks isn’t enough in 2025’s competitive world41. Building expertise needs:

- Regular investment in education and skill improvement

- Keeping up with trends

- You retain control of competitive advantages through continuous learning

Professional Network Growth

Strong professional connections are vital to create lasting wealth. Research shows that networking through industry groups and local business communities creates valuable partnership opportunities7. Professional networks give you:

- Access to experienced mentors and supportive peers

- Chances for strategic collaborations

- Resources to overcome business challenges

The best networking results come from building rapport through shared interests and experiences42. Your connections with both senior-level professionals and industry peers will expand your opportunities42.

Personal Brand Development

A powerful personal brand becomes an irreplaceable asset for wealth creation43. A successful brand needs a unique value proposition that you communicate consistently across platforms. Wealthy individuals use personal branding to:

- Fight negativity and protect their reputation44

- Create beneficial partnerships and ventures44

- Make philanthropic efforts more effective44

Start building your personal brand by determining your core expertise and desired recognition43. Then create content that shows your knowledge while staying authentic in your presentation43.

These strategies combined with regular skill assessment create multiple paths for financial growth. An emergency fund covering six to nine months of expenses45 gives you stability to keep developing skills and expanding your network.

Wealth Mindset Cultivation

Image Source: North Star Resource Group

Financial education is the foundation of lasting wealth creation. My years of advisory work show that successful wealth builders spend at least one hour each day learning. This adds up to 250 hours of focused education every year46.

Financial Education Investment

Better financial literacy is vital to make smart investment choices. Studies show people with higher financial knowledge are more likely to keep emergency funds and start retirement accounts47. Regular education helps wealth builders gain:

- Detailed knowledge of banking basics

- Smart ways to budget and save

- Skills in managing debt and maximizing credit

Goal Setting Framework

The SMART framework makes reaching goals more likely. Research shows writing down financial goals has two benefits: you remember goals better and track deadlines more accurately48. Your financial targets should have specific dollar amounts and clear deadlines48. This method lets you check your progress and make needed changes to reach your goals.

Success Habit Formation

Learning and repetition create lasting habits. Duke University research shows habits make up about 40% of what we do each day49. Successful wealth builders develop good money habits through:

Small, manageable changes reduce mental resistance. New money habits should connect to daily routines, which triggers wealth-building actions naturally8. Regular timing and consistent settings strengthen these connections, according to research8.

Missing one day won’t hurt your long-term progress49. Building habits takes patience – typically 66 days to stick9. Using these methods and checking your progress regularly creates lasting patterns that support long-term financial success.

Legacy Planning and Preservation

Image Source: TBH Advisors

Wealth preservation for future generations just needs careful planning and structured implementation. My experience as a financial advisor has taught me how proper estate structuring protects generational wealth transfer while guiding many families through legacy planning.

Estate Planning Strategy

Estate planning goes beyond simple asset distribution. The lifetime estate and gift tax exclusion reaches $13.61 million if you have individual status and $27.22 million for married couples in 202450. Married couples can reduce their taxable estate by over $1 million over 30 years when they use the annual gift exclusion of $36,00050. The key planning elements include:

- Establishing revocable living trusts to avoid probate

- Creating structured asset distribution plans

- Keeping detailed records of holdings and intentions

Generational Wealth Transfer

Successful wealth transfer balances immediate needs with long-term preservation goals. Research shows that families lose 70% of their assets between generations51. You can prevent this trend by:

Getting family members to participate in open discussions about estate plans and future wishes10. Teaching financial education to younger generations helps ensure responsible asset management10. Regular family meetings build unity around shared objectives through transparency10.

Trust Establishment

Trusts are powerful tools that preserve and transfer wealth. Irrevocable trusts give enhanced protection by removing assets from taxable estates50. Smart trust options include:

- Charitable remainder trusts that provide annual income streams

- Qualified personal residence trusts for property transfer

- Spendthrift trusts that protect inheritances from creditors

Selecting professional trustees plays a vital role in complex estates50. Corporate trustees who specialize in settling intricate estates show higher success rates in wealth preservation50. Working with skilled professionals like wealth strategists, portfolio managers, and trust advisors will give a complete estate plan that matches wealth-building objectives50.

Global Investment Opportunities

Image Source: Investopedia

Smart investors look beyond their home markets to build wealth. Global markets offer great opportunities for better returns and lower risks. Many investors now put much of their money in international assets.

International Market Access

Developed markets create exciting possibilities. About 42% of investors have increased their stakes in these equities52. Family offices show strong interest in manufacturing, life sciences, consumer technologies, and natural resources53. Billionaires from different regions have varied real estate priorities:

- Americas: 33% increasing exposure

- Asia-Pacific: 27% expanding investments

- Europe, Middle East, and Africa: 10% boosting allocation52

Currency Diversification

A smart currency strategy helps portfolios stay strong. Each currency behaves differently – some gain value during market stress, while others follow global growth cycles11. Here’s what you should know to protect your investments:

Keeping all investments in one currency limits your long-term growth potential11. The currencies of resource-rich nations like Australia, Canada, and Russia are closely tied to global commodity markets11. Countries that raise interest rates early often see their currencies perform well11.

Cross-Border Investments

The 2025 digital world needs sophisticated approaches to cross-border investments. Success comes from understanding complex geopolitical relationships and adapting to increased government involvement2. Investors must:

- See how acquisitions fit government industrial policies

- Watch competition from government-backed rivals

- Know the rules across different jurisdictions2

Wealthy investors now prefer direct private investments over traditional funds. Family offices put an average of 7.7% of their assets in direct private investments53. This move shows growing interest in co-investment opportunities with private-equity managers that offer better visibility into businesses53. These global strategies combined with proper research help investors find great opportunities while managing risks well.

Comparison Table

| Strategy | Key Components | Implementation Methods | Expected Benefits | Risk Considerations |

|---|---|---|---|---|

| Strategic Investment Portfolio Diversification | – Asset class allocation – Risk management – Tax-efficient investing | – Annual rebalancing schedule – 5-10% deviation triggers – Portfolio cash flow management | – 7% S&P 500 returns – 8-10% fixed income returns – Better portfolio resilience | – Stocks and bonds moving together – Market concentration risk |

| Automated Wealth Systems Implementation | – Income automation – Expense automation – Investment auto-scheduling | – Payroll deductions – AI-powered expense tracking – Dollar-cost averaging | – 30-50% increase in participation rates – 15-25% tax efficiency improvement – 4,000 hours saved yearly | – System dependency – Regular monitoring needs |

| Tax Optimization Strategies | – Tax-loss harvesting – Strategic planning – Real estate tax benefits | – $3,000 annual loss deduction – HSA utilization – 1031 exchanges | – Federal tax exemption – Lower tax liability – Property depreciation benefits | – Wash sale limits – Complex tax laws – Documentation needs |

| Multiple Income Stream Development | – Active income – Passive income – Business ventures | – High-yield savings (4%+ APY) – Dividend investments – Rental properties | – 65% of millionaires have 3+ streams – Regular quarterly payouts – Property appreciation | – Starting capital needs – Market volatility – Management overhead |

| Real Estate Investment Success | – Property investment – Portfolio management – Rental optimization | – Market analysis – Property management systems – Strategic improvements | – 9.5% average annual returns – Positive cash flow – Tax advantages | – Property upkeep costs – Tenant management – Market shifts |

| Digital Asset Growth | – Cryptocurrency – NFTs – Digital business assets | – Dollar-cost averaging – Portfolio diversification – Security measures | – Bitcoin projected at $150,000 – Growing institutional adoption – Multiple income streams | – Market volatility – Security risks – Regulatory uncertainty |

| Risk Management and Insurance | – Wealth protection – Insurance coverage – Asset protection | – FLPs/LLCs setup – Umbrella insurance – Irrevocable trusts | – Full protection – Liability coverage – Asset preservation | – Premium costs – Coverage gaps – Legal complexities |

| Business Ownership and Growth | – Business model selection – Growth strategy – Exit planning | – Customer-focused operations – Digital capabilities – Resource allocation | – 80% growth from core business – 4,000 hours saved yearly – Higher valuations | – Market competition – Operational challenges – Exit timing |

| Smart Debt Management | – Good vs. bad debt – Debt optimization – Debt management | – Low-interest financing – Debt consolidation – Systematic repayment | – Tax advantages – Better returns – Business expansion | – Interest rate risk – Cash flow needs – Financial stress risk |

| High-Value Skill Building | – Industry expertise – Network growth – Personal branding | – Ongoing learning – Professional networking – Content development | – Income generation – Partnership opportunities – Better reputation | – Time investment – Market relevance – Competition |

| Wealth Mindset Growth | – Financial education – Goal setting – Habit formation | – Daily learning (250 hrs/year) – SMART framework – Regular routines | – Better decision-making – Clear goal achievement – Lasting patterns | – Time commitment – 66-day habit formation – Change resistance |

| Legacy Planning and Protection | – Estate planning – Wealth transfer – Trust setup | – Living trusts – Family meetings – Professional trustees | – $13.61M individual exclusion – Asset protection – Tax efficiency | – 70% wealth loss between generations – Family conflicts – Complex regulations |

| Global Investment Growth | – International markets – Currency diversification – Cross-border investments | – Market allocation – Direct private investments – Co-investment opportunities | – Better returns – Risk reduction – Portfolio strength | – Political risks – Currency changes – Regulatory compliance |

Last words

My clients’ success over the past 13 years has taught me that building wealth needs smart planning and steady action. These 13 strategies complement each other naturally – a diverse portfolio brings stability and automated systems keep investments regular. Smart tax planning protects wealth while multiple streams keep generating it. Physical real estate assets balance well with opportunities in digital investments.

You’ll see better results when you implement these strategies step by step rather than all at once. The basics come first – build an emergency fund that covers 6-9 months of expenses. Your next steps should focus on setting up automated investment systems and creating multiple income sources. This foundation lets you expand into advanced areas like real estate, digital assets, and global investments.

Numbers tell the story clearly. Most self-made millionaires run 3 or more income streams and spend over 250 hours each year learning about finance. Their investment mix across traditional and new asset types typically yields 7-10% returns.

Building wealth needs both financial know-how and the right mindset. Good money habits, valuable skills, and a long-term outlook are the foundations of lasting wealth. Smart tax planning and careful estate structure help preserve wealth across generations.

These approaches have helped my clients build lasting wealth for decades. Want to learn more? Email us at support@trendnovaworld.com and we can discuss how these proven strategies fit your situation. Financial success takes work, but these tested methods make your experience smoother and more rewarding.

Learn more here

15 Proven Ways to Cut Your Insurance Costs in 2025 (Expert Tips)

FAQs

Q1. What are some proven strategies for building wealth in 2025? Key strategies include diversifying your investment portfolio, automating your wealth systems, optimizing tax strategies, developing multiple income streams, and mastering real estate investments. It’s also important to cultivate a wealth mindset, continuously develop high-value skills, and implement strategic debt leverage when appropriate.

Q2. How important is real estate in wealth creation? Real estate is a crucial component of wealth building. It offers multiple benefits including potential appreciation, rental income, tax advantages, and leverage opportunities. Successful real estate investors focus on property investment strategies, portfolio management, and rental income optimization to maximize returns.

Q3. What role do digital assets play in modern wealth building? Digital assets have become increasingly important in wealth building portfolios. This includes strategic investments in cryptocurrencies, NFTs, and digital business assets. While these investments can offer high returns, they also require careful management of risks and a thorough understanding of the rapidly evolving digital landscape.

Q4. How can I protect and preserve my wealth for future generations? Legacy planning and preservation are crucial for long-term wealth management. This involves developing comprehensive estate planning strategies, implementing effective generational wealth transfer methods, and establishing trusts. It’s also important to engage family members in financial education and maintain open communication about wealth management goals.

Q5. Why is developing multiple income streams important for wealth building? Developing multiple income streams is a key strategy used by many self-made millionaires. It provides financial stability, increases earning potential, and accelerates wealth accumulation. This can include a combination of active income (like a primary job or business), passive income (such as dividends or rental income), and portfolio income from various investments.

References

[1] – https://www.morganstanley.com/ideas/2025-market-outlook-portfolio-diversification

[2] – https://www2.deloitte.com/content/dam/insights/us/articles/money-and-borders-cross-border-investments-in-a-changing-global-marketplace/US_deloittereview_Money_and_Borders_Jan10.pdf

[3] – https://finance.yahoo.com/news/7-best-passive-income-investments-160047690.html

[4] – https://iilife.live/academy/core-pillars/wealth-building-strategies/

[5] – https://blakeharrislaw.com/asset-protection/asset-protection-strategies

[6] – https://www.galaxy.com/insights/perspectives/2025-investment-outlook-gam/

[7] – https://www.forbes.com/sites/melissahouston/2024/02/19/unlocking-the-secrets-to-building-wealth-through-your-business/

[8] – https://unfilteredonline.com/5-essential-strategies-for-forming-new-positive-habits/

[9] – https://www.betterup.com/blog/millionaire-mindset

[10] – https://brentonmcwilliams.com/estate-planning-strategies-for-high-net-worth-individuals/

[11] – http://www.citibank.com/ipb/europe/pdfs/Currency_Diversification.pdf

[12] – https://finance.yahoo.com/news/average-millionaire-7-streams-income-160022858.html

[13] – https://www.newtraderu.com/2024/07/10/the-7-income-streams-of-the-rich-how-the-rich-make-money/

[14] – https://www.forbes.com/sites/melissahouston/2024/12/27/passive-income-ideas-for-financial-security-in-2025/

[15] – https://www.shopify.com/blog/passive-income-ideas

[16] – https://www.nerdwallet.com/article/investing/what-is-passive-income-and-how-do-i-earn-it

[17] – https://www.entrepreneur.com/growing-a-business/want-to-be-a-millionaire-here-are-3-ways-to-generate/436621

[18] – https://www.forbes.com/sites/melissahouston/2025/01/03/7-passive-income-business-ideas-to-build-wealth-and-financial-freedom/

[19] – https://www.investopedia.com/articles/financialcareers/09/real-estate-portfolio-management.asp

[20] – https://www.forbes.com/councils/forbesrealestatecouncil/2020/01/06/six-strategies-for-maximizing-income-through-your-rental-property-investment/

[21] – https://www.entrepreneur.com/starting-a-business/the-entrepreneurs-guide-to-building-wealth-through-real/456179

[22] – https://www.mdregroup.com/15-ways-to-maximize-rental-income/

[23] – https://www.forbes.com/councils/forbesbusinesscouncil/2025/01/10/19-real-estate-investment-trends-to-watch-in-2025/

[24] – https://ethereum-age.com/how-to-manage-your-nft-portfolio/

[25] – https://www.fool.com/investing/2025/02/19/cryptocurrencies-that-could-soar-in-2025/

[26] – https://nayaone.com/blog/what-is-digital-assets-income-ways-to-earn-grow-it/

[27] – https://investmentguruindia.com/newsdetail/the-role-of-digital-assets-in-modern-wealth-creation549757

[28] – https://www.thestreet.com/retirement-daily/your-money/high-net-worth-risk-management

[29] – https://creativeplanning.com/insights/risk-management/asset-protection-strategies/

[30] – https://smartasset.com/estate-planning/asset-protection-planning

[31] – https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/six-strategies-for-growth-outperformance

[32] – https://sbo.financial/blog/wealth-creation/is-your-business-model-making-you-wealthy/

[33] – https://www.ey.com/en_us/private-business/how-to-scale-your-growing-business-profitably

[34] – https://www.bernstein.com/who-we-advise/wealth-management-for-business-owners/business-exit-planning.html

[35] – https://www.edwardjones.com/us-en/market-news-insights/personal-finance/business-owners-entrepreneurs/planning-business-exit-strategy

[36] – https://www.fidelity.com/learning-center/smart-money/good-debt-vs-bad-debt

[37] – https://www.investopedia.com/articles/pf/12/good-debt-bad-debt.asp

[38] – https://www.investopedia.com/financial-edge/0710/5-ways-debt-can-make-you-money.aspx

[39] – https://www.vareto.com/post/best-practices-for-optimizing-capital-structure

[40] – https://www.americanexpress.com/en-us/credit-cards/credit-intel/debt-investment/

[41] – https://en.tempo.co/read/1977861/master-these-10-high-income-skills-in-2025-and-secure-your-future

[42] – https://wowledge.com/blog/professional-networking-strategies

[43] – https://www.forbes.com/councils/forbesagencycouncil/2023/03/31/from-influence-to-income-how-to-start-building-your-personal-brand/

[44] – https://www.legendarylabs.com/blog/personal-branding-for-the-wealthy-tailoring-reputation-management-strategies-for-high-net-worth-individuals?utm_campaign=social&utm_source=linkedin&utm_medium=social

[45] – https://www.forbes.com/sites/melissahouston/2025/02/02/the-millionaire-mindset-shift-you-need-to-make-more-money-in-2025/

[46] – https://www.linkedin.com/pulse/developing-millionaire-mindset-7-habits-success-mark-victor-hansen

[47] – https://www.investopedia.com/guide-to-financial-literacy-4800530

[48] – https://www.wolterskluwer.com/en/expert-insights/build-wealth-by-setting-goals-and-implementing-a-plan

[49] – https://jamesclear.com/habit-guide

[50] – https://ascent.usbank.com/private-capital-management/ascent-resources-and-insights/personal-legacy-planning/uhnw-family-estate-planning-strategies.html

[51] – https://www.1834.com/insights/4-commonly-used-wealth-transfer-strategies/

[52] – https://finance.yahoo.com/news/billionaires-plan-invest-three-areas-065800613.html

[53] – https://www.barrons.com/articles/ultra-rich-love-tech-stocks-upbeat-2025-private-equity-f314e6d9

[54] – https://investor.vanguard.com/investor-resources-education/portfolio-management/rebalancing-your-portfolio

[55] – https://www.investopedia.com/articles/stocks/11/intro-tax-efficient-investing.asp

[56] – https://www.mezzi.com/blog/top-6-wealth-building-strategies-for-tech-savvy-investors

[57] – https://www.brex.com/spend-trends/expense-management/expense-management-automation

[58] – https://boulevardwealth.com/blog/the-overlooked-secret-to-building-wealth-automate-your-savings

[59] – https://libertygroupllc.com/blog/building-financial-habits-that-stick-long-term-wealth-strategies-for-2025/

[60] – https://insight2wealth.com/blog/strategies-for-tax-efficient-wealth-accumulation-and-preservation/

[61] – https://avior.com/insights/wealth-management/tax-planning/maximizing-wealth-advanced-tax-strategies/

[62] – https://www.irs.gov/businesses/small-businesses-self-employed/tips-on-rental-real-estate-income-deductions-and-recordkeeping

[63] – https://www.theentrustgroup.com/blog/tax-benefits-real-estate-investing

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com