New parenthood brings overwhelming financial responsibilities. A baby’s first year costs over $21,000, based on NerdWallet’s research. Even with insurance, parents pay around $4,500 for childbirth. My 13 years as a financial advisor have shown me how families wrestle with these growing expenses.

Here’s the bright side – financial planning doesn’t need complex strategies. Parents face various costs from $70-80 monthly diaper expenses to the staggering $11,959 yearly infant care costs. Yet solutions exist. Through my work with hundreds of families, I’ve developed 13 practical money management tips that real parents have successfully used.

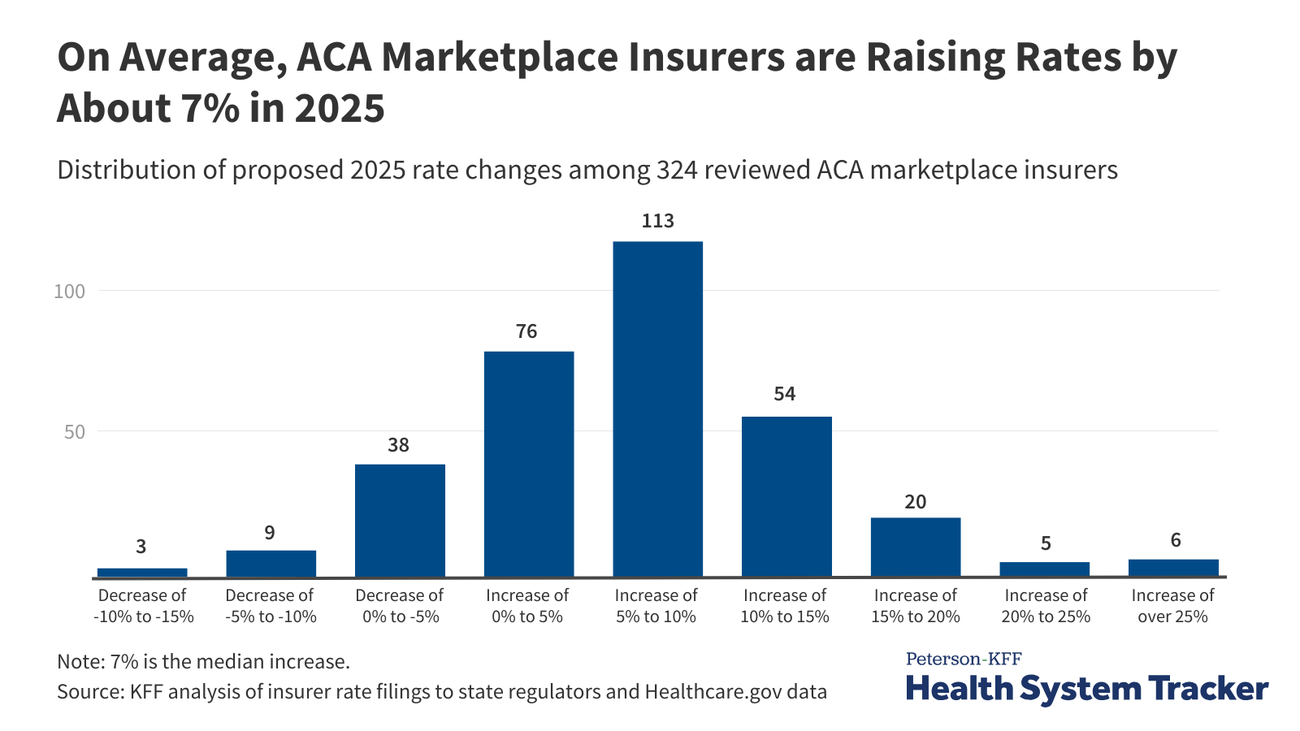

Smart Health Insurance Planning

Image Source: Peterson-KFF Health System Tracker

Health insurance decisions impact your family’s financial security. My experience as a financial advisor shows how the right insurance planning can save families thousands in medical expenses.

Understanding Family Health Plans

All marketplace and Medicaid plans cover pregnancy and childbirth. This includes services before and after your child’s birth67. You’ll receive coverage for at least 60 days after delivery if you qualify for Medicaid during pregnancy. Some states extend this to 12 months67. Your newborn automatically receives coverage for at least a year if you have Medicaid during birth67.

Comparing Insurance Options

Health plans come in three main categories with unique benefits:

- HMO (Health Maintenance Organization): Coverage through select in-network doctors and hospitals comes with lower premiums68

- PPO (Preferred Provider Organization): More flexibility with higher premiums and out-of-pocket costs68

- EPO (Exclusive Provider Organization): A mix of HMO and PPO features provides more flexibility than HMOs at a lower cost than PPOs68

HSA vs FSA Benefits

FSAs will allow contributions up to $3,300 per person in 202569. HSAs provide several advantages over FSAs:

- Your funds never expire

- You can invest your money for growth

- The account stays yours even after changing jobs70

HSA funds work like traditional retirement accounts after age 65. You won’t face penalties, but taxes apply for non-medical expenses70.

Digital Insurance Management Tools

Modern insurance platforms make healthcare management easier through:

- Immediate claims processing

- Automated authorization systems

- Integrated provider networks

- Self-service analytics and reporting tools71

These digital tools reduce costs and help manage your family’s healthcare needs better71. Many platforms now include mobile apps that give you quick access to benefits information and claims status.

New parents should know that while pregnancy doesn’t qualify for a Special Enrollment Period, having a baby does67. This lets you join a Marketplace health plan within 60 days of your child’s birth67. Look at both premium costs and out-of-pocket expenses like deductibles, copayments, and coinsurance when comparing plans72. Make sure your preferred healthcare providers are in the plan’s network to get the most from your benefits73.

Strategic Emergency Fund Building

Image Source: SoFi

A resilient emergency fund is the life-blood of financial stability for new parents. My experience as a financial advisor shows families with enough savings are nowhere near as stressed about unexpected costs.

Emergency Fund Calculators

New parents should aim to save three to six months of living expenses74. I suggest splitting this into two parts:

- $2,000 or half a month’s expenses as a spending shock fund74

- $15,000 to $30,000 as an income shock fund74

Your child’s emergencies need specific amounts:

- $10,000 for medical expenses

- $5,000 for baby essentials

- $10,000 as emergency reserve75

High-Yield Savings Options

High-yield savings accounts now give rates around 4% APY, which substantially beats the national average of 0.41%76. To cite an instance, a $10,000 emergency fund in a high-yield account at 4% APY gets more and thus encourages more savings with approximately $400 yearly76.

The best high-yield accounts should have:

- FDIC insurance up to $250,00076

- No monthly maintenance fees

- Easy access to funds

- Online banking capabilities

Many parents use a mixed strategy. They keep spending shock funds in high-yield savings accounts while placing income shock funds in money market accounts that offer check-writing and competitive rates77.

Automated Savings Apps

Today’s savings apps make building emergency funds easier with several features:

Set & Save Technology:

- Automatic withdrawals based on income and expenses

- Goal-specific savings allocation

- Regular contribution scheduling78

Smart Features:

- Round-up investments that turn spare change into savings

- Paycheck splitting capabilities

- Zero-based budgeting tools78

Your emergency fund will grow best when you:

- Split direct deposits between checking and savings

- Set up scheduled transfers on payday

- Use percentage-based automatic transfers79

Note that steady saving beats large amounts. Just $25 twice monthly adds up to $600 yearly79. You can boost your automated contributions as your income grows to build a stronger safety net.

My work with hundreds of families shows automated emergency fund building works best, especially when you have multiple money priorities. Success comes from picking the right tools and staying consistent with contributions, whatever the starting amount.

Digital-First Budget Management

Image Source: Cool Mom Tech

Digital tools make budget management easier for new parents. My experience as a financial advisor has shown me how families can change their money habits with the right technology.

Best Budgeting Apps for Parents

I tested many platforms and picked these apps that work best for families:

Monarch Money: This app tracks your spending, analyzes regular expenses, and helps you watch your financial goals80. Couples love how they can manage their money together with its partner-sharing features.

YNAB (You Need A Budget): Parents who want control over every dollar will find this zero-based budgeting system perfect81. The platform teaches you everything about budgeting through its learning resources.

FamZoo: Families with several children will find this private family banking system useful82. You can track each child’s account separately while keeping your household budget unified.

AI-Powered Expense Tracking

AI has changed how we handle expenses:

Smart Categorization: The AI sorts your transactions into categories automatically and shows you where your money goes83. It reads receipts and pulls out important details like store names, amounts, and dates.

Predictive Analysis: The system looks at your past spending to help predict future expenses and suggest budget changes84. This helps families prepare for upcoming costs and find ways to save.

Family Finance Dashboard Setup

Your financial command center needs good organization:

Essential Components:

- Income and expense tracking

- Savings progress monitoring

- Debt management tools

- Investment portfolio overview85

Dashboard Customization: You can create views that match your family’s financial priorities86. Your dashboard should show:

- Monthly budget progress

- Spending categories breakdown

- Savings goals tracking

- Bill payment schedules

Collaborative Features: Both parents can use these platforms to:

- Add transactions right away

- Look at financial goals together

- Share budget duties

- Watch joint accounts87

The three-bucket budgeting strategy works best with these platforms86. This method separates must-pay bills, long-term savings, and fun money, which helps you stay on track financially.

Regular checks of your dashboard will reveal spending patterns that need attention. Your family can spot unused subscriptions, see how close you are to savings goals, and make better money decisions88.

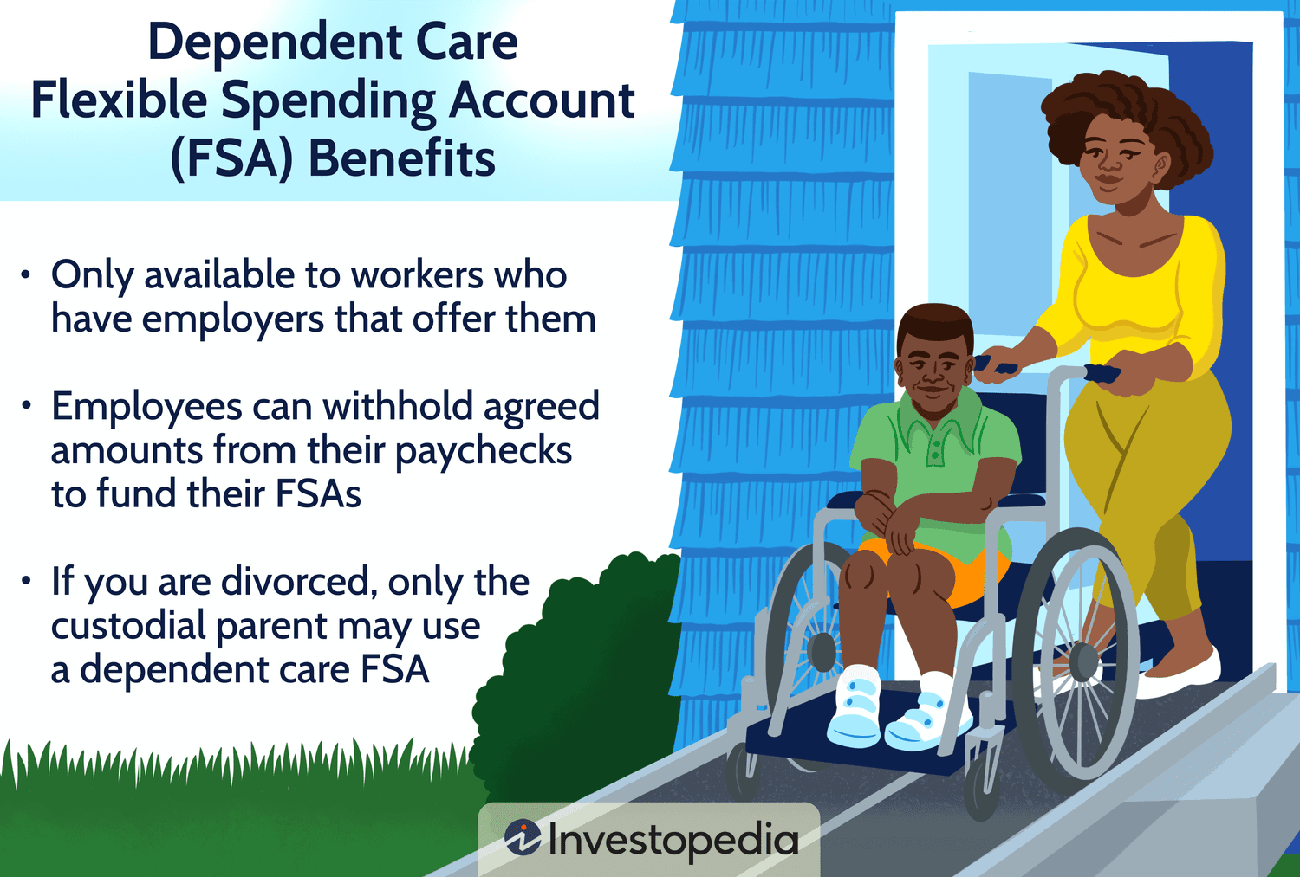

Tax-Efficient Childcare Planning

Image Source: Investopedia

Tax-smart planning helps new parents save money through various credits and benefits. I’ve helped countless families as a financial advisor to get the most from their childcare expenses through better tax strategies.

Childcare FSA Benefits

Dependent Care Flexible Spending Accounts (DCFSAs) are a great way to get tax advantages. Parents can contribute up to $5,000 per household or $2,500 if married filing separately in 202589. Your pre-tax contributions lower your overall tax burden and can save you up to 30% on dependent care services89.

Eligible Expenses Include:

- Preschool and nursery school costs

- Before and after-school care

- Summer day camps

- Qualified nanny services89

Tax Credits for Parents

Working parents can get substantial relief through the Child and Dependent Care Credit. Families can claim these amounts in 2025:

- Up to $3,000 in expenses for one child

- Up to $6,000 for two or more children17

Your income determines the credit percentage. It ranges from 35% for families earning under $15,000 to 20% for those making over $43,0004. The District of Columbia and fifteen states also offer their version of child tax credits4.

Employer Benefits Optimization

Companies of all sizes improve childcare support through different programs. Here are some notable options:

Direct Assistance Programs: The Employer-Provided Childcare Credit gives businesses tax incentives worth 25% of qualified childcare facility expenditures, plus 10% for resource and referral services3. Employees often see better childcare benefits because of this.

Strategic Combinations: You can tap into the full potential of benefits by combining FSAs with tax credits. Keep in mind that “double-dipping” isn’t allowed – using $5,000 from an FSA means only $1,000 of additional expenses would qualify for the credit2.

Your best results come from keeping detailed records of all childcare payments. Include provider names, addresses, and tax identification numbers2. You might want to think about prepaying expenses during lower-income years to get higher percentage credits2.

Modern Life Insurance Strategies

Image Source: Policybazaar

Life insurance protects your growing family’s financial future. My experience helping hundreds of new parents has shown me the best strategies for 2025.

Term vs Whole Life Analysis

Term life insurance covers you for a specific period, usually 10-30 years. This makes it perfect for young families. A 20-year, $500,000 term policy costs about $334 annually for men and $282 for women at age 4018. Whole life insurance gives you lifelong protection and includes a cash value component. The premiums are higher at $7,440 yearly for men and $6,512 for women for the same coverage18.

Key Considerations:

- Term policies protect specific financial commitments like mortgages or your children’s education

- Whole life builds cash value you can borrow from

- Convertible term policies let you upgrade to permanent coverage later

Digital Insurance Platforms

The insurance world has changed thanks to innovative features on modern platforms:

Advanced Capabilities:

- Automated underwriting systems

- Live claims processing

- Integrated provider networks

- Self-service analytics19

Platforms like Policygenius help you compare multiple providers easily20. Next Insurance makes applications simple with digital-first solutions20.

Coverage Calculator Tools

Your coverage needs depend on several factors:

- Annual salary multiplication until retirement

- Outstanding debts and mortgages

- College funding requirements

- Daily living expenses (usually 60-80% of post-tax income)21

Coverage calculators look at your family’s complete financial picture and include:

- Burial expenses

- Income replacement years

- Survivor’s net income

- Current investments and savings22

Each spouse should have separate policies instead of joint coverage23. You might want to add riders for specific needs like spouse term coverage or child protection23. Review your coverage every year as your family grows and changes.

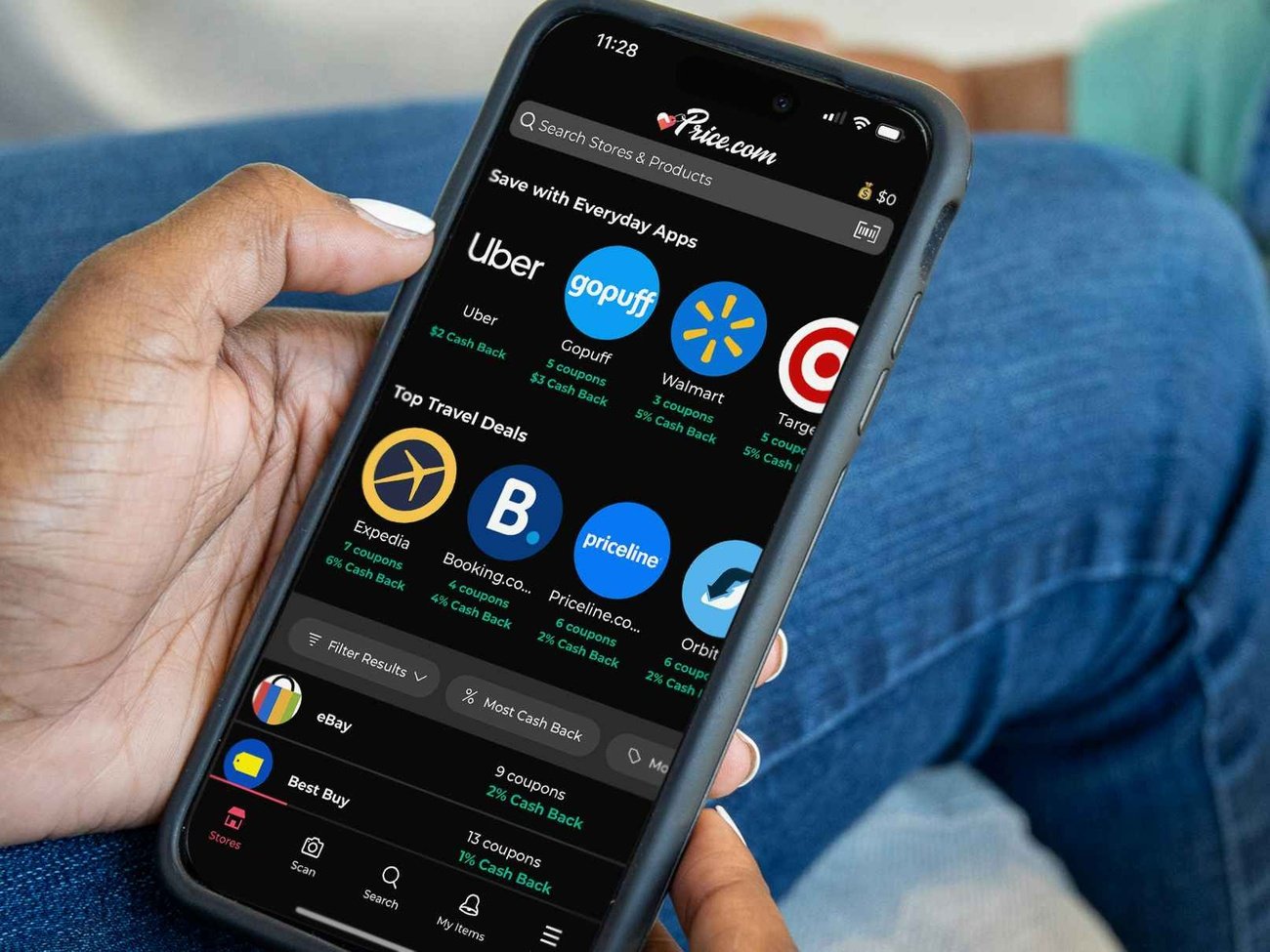

Smart Shopping Systems

Image Source: The Krazy Coupon Lady

Smart shopping tricks help new parents handle the big costs of raising a child. I’ve helped many families and found some great ways to save money on baby essentials.

Cashback Apps for Baby Items

Ibotta leads the pack as a top cashback app for baby-related purchases. Parents can get some nice rebates on must-have items:

- Up to $8.00 back on formula purchases24

- $5.00 cashback on training underwear25

- $2.00 returns on baby care products25

You’ll save even more money by using cashback apps with rewards credit cards26. Fetch Rewards gives you another way to save – just scan your receipts. This works great if you shop at Target, Kroger, and Walmart often27.

Price Comparison Tools

PriceReel makes it easy to compare prices across major stores. You can track prices on:

- Cribs and bedding

- Changing tables

- Feeding accessories

- Educational toys5

Google Shopping helps you compare prices right away to get the best deals on what you need. Buying smart items like convertible cribs that turn into toddler beds will save you money down the road8.

Subscription Service Optimization

Smart subscription choices can save you big bucks. To name just one example, buying diapers in bulk through wholesale clubs can save you about $170.00 each year8. Here’s how to get the most from your subscriptions:

Digital Subscription Management:

- Look over subscriptions once a year

- Put services together when you can

- Talk about better rates before you renew28

The average American spends about $1,000 on subscriptions yearly28. Using subscription tracking tools helps you spot what you don’t need. Many stores also mark down their prices weekly, which lets you time your purchases just right29.

Store loyalty programs at your regular shopping spots give you great perks:

- Store credit builds up

- Special discounts

- First crack at sales29

Parent groups on social media are gold mines for finding what you need at lower prices29. With some planning and these modern shopping tools, you can keep quality high while your costs stay low.

Estate Planning Essentials

Image Source: NerdWallet

Estate planning protects your child’s future through smart asset protection. My years of experience helping families has shown that good documentation will give you a smooth wealth transfer and fewer legal complications.

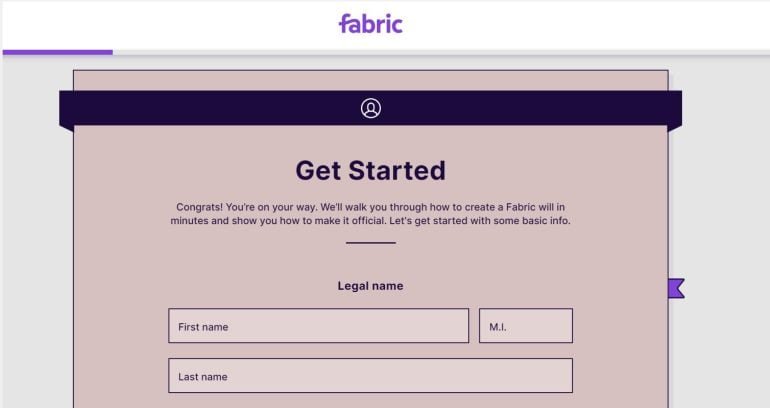

Digital Will Creation

Digital platforms make estate planning quick and simple with step-by-step guidance. Fabric by Gerber Life gives you free digital wills designed for families with young children30. These platforms include:

Essential Components:

- Guardian appointments for minor children

- Asset distribution instructions

- Executor selection

- Final arrangement specifications31

Trust Fund Setup

Trusts give you better control over asset distribution than traditional wills. You can modify a revocable living trust throughout your life9. Irrevocable trusts provide better asset protection from creditors32.

Trust Benefits:

- Skip probate court proceedings

- Keep estate details private

- Control fund distribution

- Shield assets from legal claims33

Trusts let you decide exactly when your children receive their inheritance. You can set specific milestones like age requirements or education completion10.

Beneficiary Designation

The right beneficiary designation keeps assets out of probate. Financial institutions need these specific details to set up beneficiaries:

- Full legal name

- Relationship to account holder

- Date of birth

- Social Security number or complete address34

You should set up custodial arrangements or trusts for accounts with minors since children under 18 can’t directly receive inherited assets35. Regular reviews of beneficiary designations become vital after major life events like marriage or childbirth35.

My experience advising families shows that digital estate planning tools cost substantially less than traditional methods. These platforms provide attorney support when needed to ensure legally valid documentation36. Store your digital copies safely and share access details with trusted people to make asset transition easier when needed10.

Debt Management Tactics

Image Source: Debt.org

Smart debt management becomes more significant when you add a new family member. My years of helping families with financial challenges have taught me proven ways to reduce debt and build a stable future.

Debt Consolidation Options

Debt consolidation turns multiple payments into one monthly bill. A debt management program through nonprofit credit counseling costs $50-$75 for setup and $32 monthly37. These programs give you great benefits:

Benefits of Nonprofit Consolidation:

- Lower interest rates through creditor negotiations

- Professional guidance from certified counselors

- One simple monthly payment

- Well-laid-out repayment plans37

Interest Rate Negotiation

Talking to creditors early can save you substantial money. A credit card interest rate reduction from 18% to 13% on a $5,000 balance saves about $1,100 in interest charges7. These negotiation tactics work well:

Effective Approaches:

- Check your payment history first

- Look at competitive offers from other lenders

- Ask to speak with supervisors when needed

- Keep communication respectful and professional38

Payment Prioritization Strategy

A smart payment plan speeds up debt elimination. Two methods stand out:

Debt Avalanche Method: Pay off high-interest debts first while making minimum payments on other accounts. This method saves money throughout repayment by minimizing total interest39.

Debt Snowball Method: Start with smallest balances first to build momentum through quick wins. This method might cost more in interest but gives psychological benefits through visible progress39.

High-yield savings accounts that earn around 4% APY38 work great with these strategies. Your emergency funds stay available while you tackle debt systematically.

Digital tools help track progress and automate payments. Modern platforms include payment reminders, interest calculators, and goal-tracking features37. Good records from these systems prevent missed payments and help you negotiate better with creditors.

Investment Account Setup

Image Source: Investopedia

Parents need solid investment plans to secure their child’s future. My work with numerous new parents has revealed the best ways to build lasting family wealth.

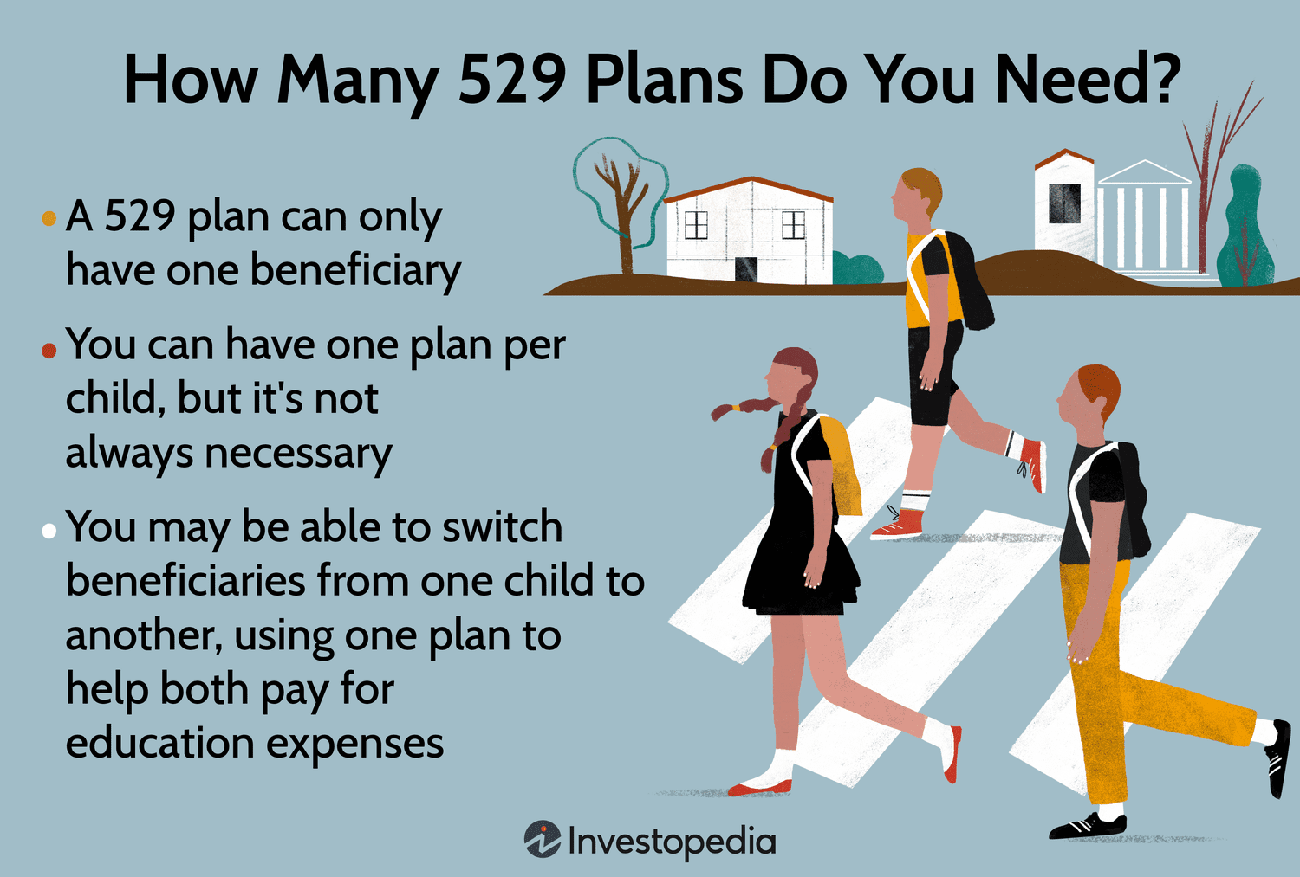

529 Plan Options

College savings plans give you great tax benefits for education costs. A child born today might need $276,000 for four years at a public university40. Parents who start with $500 monthly contributions at birth could build up $187,400 by age 18, based on 6.11% returns40.

You can choose from 529 plans in most states, and you’re not limited to your state’s options. These plans come with several benefits:

- Your earnings grow tax-free

- You pay no taxes on withdrawals for qualified expenses

- Many states offer tax benefits6

The good news is that unused 529 money can go into a Roth IRA—without taxes or penalties—up to $35,0006. Your funds also help pay for various education needs beyond college, like K-12 tuition and apprenticeship programs41.

Robo-Advisor Benefits

Smart algorithms help digital investment platforms manage portfolios efficiently. These platforms charge just 0.20% to 0.25% yearly42, much less than traditional advisors. New parents can start with small amounts since many platforms have low minimum investments43.

Key Advantages:

- Portfolios rebalance automatically

- Tax losses get harvested

- Investment strategies stay diverse

- Professional management costs less43

Long-term Investment Strategy

Smart wealth building combines education savings with broader investments. Here’s what works:

Start by opening separate checking accounts for your child’s investments44. When your children start earning money, look into custodial Roth IRAs. The contribution limit reaches $7,000 in 202444.

Putting just $50 monthly into diverse portfolios could grow to $73,000 in 23 years, assuming 8% yearly returns44. Regular contributions matter more than market timing43.

Age-based portfolios work best as they adjust risk levels automatically as college gets closer12. These investments start growth-focused and become more conservative as education expenses approach41.

Income Protection Planning

Image Source: Ward Law Group

Your income protection becomes vital when a new family member arrives. My experience as a financial advisor shows how unexpected income disruptions can put pressure on family finances. The good news is that proper planning helps alleviate these risks.

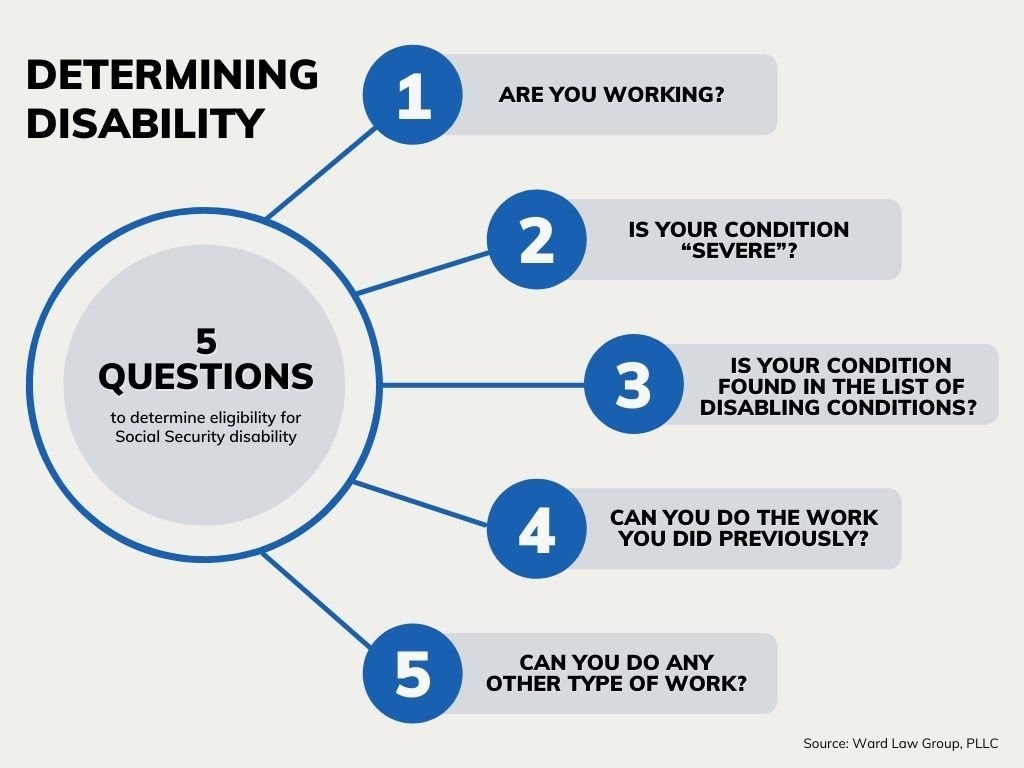

Disability Insurance Options

Short-term disability insurance puts back 50-70% of your income when you can’t work45. Benefits usually last 6-8 weeks after delivery for pregnancy-related conditions46. Employer-sponsored plans are a great way to get coverage without medical underwriting46.

Long-term disability insurance gives you significant protection against extended illnesses or injuries. Research shows 92% of employees worry about their financial readiness if primary wage earners can’t work45. Here are the key features you should know about:

- Coverage that stays with you beyond your employer

- Policies that match what you earn

- Protection options for business owners

Side Hustle Opportunities

The rise of remote work has created many more ways to earn. Freelance writers can make $0.10 per word for 1,500-word articles47. Virtual assistants earn $20-30 hourly, while remote bookkeepers pull in between $10,000 to $100,000 yearly47.

Popular Side Hustles:

- Online tutoring through platforms like Cambly

- Social media management for brands

- Proofreading services for businesses

- Transcription work for medical notes

Remote Work Benefits

New parents thrive with flexible work arrangements. Data shows 76% of employees have a better quality of life through remote work48. The numbers get better – 73% spend more time with their children48.

Parents who work remotely can:

- Cut out 30+ minutes of daily commute time48

- Strike a better work-life balance

- Lower their childcare expenses

- Handle family emergencies quickly

The impact on families speaks volumes – 91% of parents say remote work boosts their family’s well-being1. Remote workers also excel at creating wellness routines, with 75% successfully establishing healthy habits1. This leads to a more balanced approach to juggling parenting and career goals.

Healthcare Cost Management

Image Source: AllyHealth

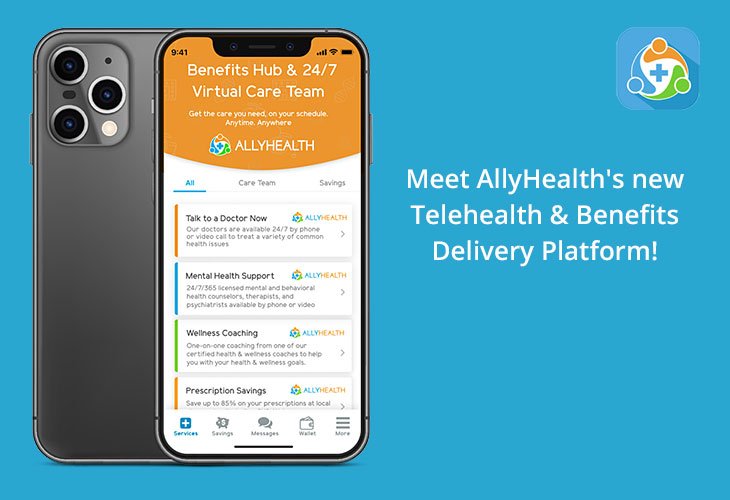

Healthcare costs can surprise new parents. I help families as a financial advisor to find better ways to manage their medical expenses through modern solutions that save money and make life easier.

Telemedicine Benefits

Virtual healthcare has changed how busy parents get medical care. Studies show telemedicine provides care that matches or beats traditional visits at lower costs49. Parents find virtual visits helpful, especially when they have:

Cost-Effective Care:

- Lower costs than urgent care visits

- No travel expenses

- Less time away from work50

Today’s telemedicine platforms support complete pediatric services and make it easy to connect with specialists for follow-up care51.

Prescription Savings Apps

You can save money on medications with digital prescription tools. The top apps show great results:

ScriptSave WellRx: Users save 65% on average for prescriptions, sometimes up to 80% at more than 65,000 pharmacies52.

SingleCare: Discounts reach up to 80% on over 10,000 medications at 35,000 pharmacies across the country53. You get extra savings on eligible refills53.

These apps let you compare prices between pharmacies to get the best deals on your regular prescriptions54.

Wellness Program Rewards

Health insurance companies now reward you for preventive care. UnitedHealthcare’s program shows how modern wellness benefits work:

- Gift cards when you complete health activities

- Money in your HSA for preventive care

- Cash back for reaching health goals55

Wellness programs work better when the whole family joins in. Research shows families achieve better health outcomes together13. Many employers now include family members in their wellness programs because healthy families help reduce healthcare costs13.

Smart use of these tools helps families get quality healthcare without breaking the bank. Using telemedicine, prescription savings apps, and wellness rewards together creates a solid plan to manage medical costs15.

Government Benefits Optimization

Image Source: Corrigan Krause

Government assistance programs give families the financial support they need to grow. My experience as a financial advisor has helped many parents get the most from these benefits.

Child Tax Credit Updates

The Child Tax Credit helps families with up to $2,000 for each qualifying child under 1756. Parents who earn less than $200,000 yearly ($400,000 for joint filers) can get the full credit56. Parents who don’t usually file tax returns might still be eligible for this benefit56.

Key Features:

- Up to $1,600 refundable per child57

- Credit gradually decreases at higher incomes57

- Extra $500 credit for dependents aged 17-2457

State-Specific Benefits

States offer their own support programs alongside federal benefits. California shows how complete assistance works through:

- Medical Therapy Program for children with physical limitations11

- Early Start Program that supports children under 311

- Regional Centers that deliver developmental services11

Federal Aid Programs

Federal assistance comes through several channels. The Women, Infants, and Children (WIC) program helps low-income pregnant women and young children up to age 558. TANF gives time-limited cash support to families who qualify58.

Additional Support Programs:

- SNAP for food assistance58

- LIHEAP that helps with home energy costs58

- Child Nutrition Support Programs that provide balanced meals58

The Supplemental Security Income (SSI) program helps children with physical or mental disabilities58. The Child and Adult Care Food Program helps childcare providers serve nutritious meals58.

The 2-1-1 helpline connects families with local resources for better results59. Many families can get multiple benefits at once – including WIC, SNAP, and healthcare through Medicaid14.

Good planning helps families access complete support systems. State programs work alongside federal benefits to create strong financial assistance networks60.

Financial Education Tools

Image Source: Yahoo

Financial literacy is the foundation of long-term success for growing families. My work with parents has revealed powerful educational tools that help build lasting money management skills.

Money Management Apps

Digital platforms have transformed financial education through interactive learning. Goalsetter’s innovative debit card automatically freezes when children skip their weekly financial literacy quiz61. The card reactivates after quiz completion, which helps children learn consistently.

Key Features:

- Interactive quizzes with engaging videos

- Moneylingo™ educational content about saving, investing, and credit management

- Progress tracking shows 83% mastery of financial concepts61

Family Finance Courses

MoneyEdu delivers complete financial education through programs you can customize. The platform gives you:

- Hundreds of money management topics

- Secure messaging for financial counseling

- Tools to create custom content62

Junior Wallstreeters teaches youth money management with color-coded envelope systems and 10-lesson curriculum plans63. Banzai’s interactive games cover core topics while meeting state learning standards64.

Resource Libraries

The FDIC’s Money Smart program gives you educational materials that teach:

- Financial planning fundamentals

- Income and expense tracking

- Credit management strategies

- Investment basics65

Young Americans Center boosts learning through:

- Virtual financial education programs

- Summer camps for grades 2-7

- Free “Money Matters” classes

- Girl Scout badge workshops66

Khan Academy provides well-laid-out courses about personal finance essentials16. McGill Personal Finance Essentials teaches universal money management principles that work in any region16.

Parents can mix and match these learning tools based on their family’s needs. Regular participation in these resources helps parents guide their children toward financial independence. Students who use these educational platforms show a 47% improvement in financial aptitude61.

Comparison Table

| Financial Tip | Main Benefits | Recommended Tools/Platforms | Cost Savings/Financial Effect | Timeline |

|---|---|---|---|---|

| Smart Health Insurance Planning | Pregnancy and childbirth coverage | HSA, FSA platforms | FSA contributions reach $3,300 (2025) | Immediate – 60 days after birth |

| Building Emergency Funds | Security against unexpected costs | High-yield savings accounts | $400 yearly earnings on $10,000 at 4% APY | 3-6 months of expenses |

| Budget Management with Digital Tools | Automated tracking and expense analysis | Monarch Money, YNAB, FamZoo | Not specified | Starts immediately |

| Childcare Tax Planning | Lower tax burden through pre-tax payments | Dependent Care FSA | 30% tax savings on $5,000 pre-tax contributions | Yearly planning |

| Life Insurance for Modern Families | Dependent financial safety | Policygenius, Next Insurance | $500K term policy costs: $334/year (men), $282/year (women) | Coverage starts immediately |

| Smart Shopping Methods | Baby essentials cost reduction | Ibotta, PriceReel, Fetch Rewards | Diaper savings reach $170 yearly | Continuous process |

| Estate Planning Basics | Wealth protection and transfer | Fabric by Gerber Life | Digital will creation at no cost | First year setup |

| Debt Control Strategies | Lower interest and simpler payments | Debt management programs | $5,000 balance saves $1,100 | Monthly review |

| Investment Account Creation | Education savings with tax benefits | 529 plans, Robo-advisors | Savings potential: $187,400 by age 18 | Begin at birth |

| Income Protection Strategy | Disability salary coverage | Remote work platforms | Replaces 50-70% of income | First 3 months |

| Healthcare Cost Reduction | Medical expense savings | ScriptSave WellRx, SingleCare | Prescription savings up to 80% | Quick setup |

| Government Benefit Planning | Assistance and tax credit maximization | WIC, SNAP, TANF | Child tax credit reaches $2,000 | Review yearly |

| Money Education Resources | Better financial knowledge | Goalsetter, MoneyEdu, Banzai | Students master 83% of financial concepts | Ongoing learning |

Closing remarks

My 13 years of guiding families as a financial advisor have shown me how these strategies turn overwhelming financial challenges into manageable steps. Smart planning begins with proper health insurance coverage and emergency funds. Digital budgeting tools that track every dollar support this foundation.

Parents who use these guidelines see major savings. They cut prescription costs by 80% and save $170 yearly on diapers alone. Their success stems from a combination of approaches: tax-efficient childcare planning, smart shopping systems, and government benefit optimization.

Life insurance and estate planning provide crucial protection. Investment accounts like 529 plans help families build substantial education savings. Parents who put in monthly $500 contributions from birth built college funds that exceeded $187,000 by their child’s 18th birthday.

These financial strategies deliver the best results when they match your family’s specific needs and goals. Start with one or two approaches that line up with your current priorities. You can expand your financial toolkit as time goes on. We can help you get personalized guidance tailored to your family’s situation – reach out to us at support@trendnovaworld.com.

Note that financial success doesn’t need perfection. Small steps taken consistently lead to major long-term results. Your steadfast dedication to these proven strategies today will help secure your family’s financial future tomorrow.

Learn more here

Proven Retirement Strategies That Keep Your Lifestyle Intact (2025 Guide)

FAQs

Q1. How can new parents save money on healthcare costs? New parents can save on healthcare costs by utilizing telemedicine services for routine consultations, using prescription savings apps to find discounts on medications, and participating in wellness programs offered by health insurers that provide rewards for preventive care activities.

Q2. What are some effective ways to build an emergency fund for a growing family? To build an emergency fund, consider using high-yield savings accounts offering around 4% APY, setting up automated savings transfers, and using apps that round up purchases to save spare change. Aim to save 3-6 months of living expenses over time.

Q3. How can parents start saving for their child’s education? Parents can start saving for their child’s education by opening a 529 college savings plan, which offers tax advantages. Consider setting up automatic monthly contributions and explore age-based portfolios that adjust risk as the child approaches college age.

Q4. What are some smart shopping strategies for new parents? New parents can save money by using cashback apps like Ibotta for baby items, utilizing price comparison tools like PriceReel, and optimizing subscription services for essentials like diapers. Joining store loyalty programs can also provide additional discounts.

Q5. How important is life insurance for new parents? Life insurance is crucial for new parents to protect their family’s financial future. Term life insurance often provides affordable coverage, with a 20-year, $500,000 policy costing around $334 annually for men and $282 for women at age 40. Consider coverage that accounts for income replacement, debts, and future expenses like education.

References

[1] – https://www.bairesdev.com/blog/remote-work-life-study/

[2] – https://www.taxextension.com/content/top-5-strategies-to-maximize-savings-with-the-childcare-tax-credit/

[3] – https://compt.io/blog/child-care-benefits-for-employees/

[4] – https://www.kiplinger.com/taxes/new-family-tax-credits-for-next-year

[5] – https://pricereel.com/children-baby

[6] – https://www.cnbc.com/select/best-529-plans/

[7] – https://www.takechargeamerica.org/dos-and-donts-for-negotiating-credit-card-interest-rates/

[8] – https://www.parents.com/parenting/money/family-finances/32-ways-to-save-money-when-you-have-a-baby/

[9] – https://askinlaw.com/5-important-estate-planning-documents-for-new-parents/

[10] – https://www.usbank.com/wealth-management/financial-perspectives/trust-and-estate-planning/how-to-set-up-a-trust.html

[11] – https://www.prudentinvestors.com/blog/special-needs-planning-breaking-down-californias-public-benefits/

[12] – https://www.plancorp.com/blog/best-investment-accounts-children

[13] – https://www.hni.com/blog/bid/77677/keep-it-in-the-family-including-spouses-kids-in-wellness-programs

[14] – https://www.usa.gov/early-childhood

[15] – https://pmc.ncbi.nlm.nih.gov/articles/PMC10476004/

[16] – https://money.usnews.com/money/personal-finance/family-finance/articles/worthwhile-online-personal-finance-courses

[17] – https://turbotax.intuit.com/tax-tips/family/birth-of-a-child/L26LBBTkd

[18] – https://www.bankrate.com/insurance/life-insurance/new-parents/

[19] – https://www.insurtechexpress.com/the-rise-of-digital-life-insurance-solutions-in-the-modern-era/

[20] – https://insurtechdigital.com/top10/top-10-insurtech-platforms

[21] – https://lifehappens.org/life-insurance-needs-calculator/

[22] – https://www.bankrate.com/insurance/life-insurance/life-insurance-calculator/

[23] – https://www.nerdwallet.com/article/insurance/family-life-insurance

[24] – https://home.ibotta.com/blog/lifestyle/how-to-save-money-with-a-new-baby

[25] – https://thesmartwallet.com/easy-ways-to-save-on-diapers-that-every-mom-should-know-about/?articleid=2638

[26] – https://www.nerdwallet.com/article/finance/cash-back-apps

[27] – https://thekrazycouponlady.com/tips/couponing/ultimate-comprehensive-guide-to-rebate-apps21608

[28] – https://www.finance-monthly.com/2024/11/optimizing-your-digital-subscriptions-a-guide-to-budget-friendly-entertainment/

[29] – https://www.upchoose.com/blog/how-to-save-money-when-having-a-baby

[30] – https://meetfabric.com/wills

[31] – https://www.whattoexpect.com/family/finances/best-online-will-makers

[32] – https://safeharborestatelaw.com/how-to-set-up-a-trust-fund-for-a-child/

[33] – https://www.legalzoom.com/personal/estate-planning/estate-planning-bundle.html

[34] – https://www.merrilledge.com/article/beneficiary-designation

[35] – https://www.securian.com/insights-tools/articles/naming-a-life-insurance-beneficiary.html

[36] – https://trustandwill.com/?srsltid=AfmBOoqJSI9_ACeJp6tYV3L2r0pGqQKzO0IENebHMz6rbs5n0wmIiRq-

[37] – https://www.incharge.org/debt-relief/debt-consolidation/free-debt-credit-consolidation/

[38] – https://www.greenpath.com/blog/credit/how-to-negotiate-a-lower-credit-card-interest-rate/

[39] – https://www.equifax.com/personal/education/debt-management/articles/-/learn/prioritize-debt-payments/

[40] – https://www.schwab.com/learn/story/6-financial-planning-tips-new-parents

[41] – https://www.fool.com/retirement/college-savings/529-plans/

[42] – https://investor.vanguard.com/advice/robo-advisor

[43] – https://www.investopedia.com/articles/personal-finance/010616/pros-cons-using-roboadvisor.asp

[44] – https://www.bankrate.com/investing/financial-advisors/investing-for-babies-cpa-parents/

[45] – https://www.guardianlife.com/insurance/income-protection-strategies

[46] – https://www.protective.com/learn/life-planning/parenting/short-term-disability-for-pregnancy-and-maternity-leave

[47] – https://marriagekidsandmoney.com/podcast/side-hustles-parents-can-do-from-home/

[48] – https://www.care.com/c/the-modern-workplace-report/

[49] – https://www.healthaffairs.org/doi/10.1377/hlthaff.2020.01560

[50] – https://kidshealth.org/en/parents/telemedicine.html

[51] – https://hellopediatrics.com/advantages-and-benefits-of-telehealth/

[52] – https://www.wellrx.com/family-prescription-savings/

[53] – https://play.google.com/store/apps/details?id=com.singlecare.scma&hl=en_US

[54] – https://financebuzz.com/money-saving-prescription-apps

[55] – https://www.uhc.com/member-resources/health-care-programs/wellness-and-rewards-programs

[56] – https://www.irs.gov/credits-deductions/individuals/child-tax-credit

[57] – https://taxpolicycenter.org/briefing-book/what-child-tax-credit

[58] – https://childcare.gov/consumer-education/financial-assistance-for-families

[59] – https://www.healthline.com/health/pregnancy/free-programs-for-new-parents-and-your-children

[60] – https://aphsa.org/resources/funding-programs-for-young-parents-families/

[61] – https://goalsetter.co/

[62] – https://www.moneyedu.org/

[63] – https://capitalbnews.org/financial-literacy-resources/

[64] – https://banzai.org/

[65] – https://www.fdic.gov/consumer-resource-center/money-smart-young-people

[66] – https://yacenter.org/financial-literacy-resources/families/

[67] – https://www.healthcare.gov/what-if-im-pregnant-or-plan-to-get-pregnant/

[68] – https://www.anthem.com/individual-and-family/insurance-basics/health-insurance/cost-of-family-health-insurance

[69] – https://fsastore.com/articles/learn-covid-19-baby-boom-is-coming-fsa.html?srsltid=AfmBOoqpinqkkv1J-gsALqgCbO4ppS8XVpNw8gmTqGlRvqNrxqwDh5Uu

[70] – https://www.fidelity.com/learning-center/smart-money/hsa-vs-fsa

[71] – https://www.iqvia.com/locations/emea/iqvia-connected-healthcare-platform/iqvia-health-insurance-management-platform

[72] – https://individual.carefirst.com/individuals-families/health-insurance-basics/choosing-plan/choose-a-family-health-insurance-plan.page

[73] – https://www.nerdwallet.com/article/health/choose-health-insurance

[74] – https://investor.vanguard.com/investor-resources-education/emergency-fund

[75] – https://finance.yahoo.com/news/much-savings-child-120012032.html

[76] – https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

[77] – https://www.bankrate.com/banking/savings/where-to-keep-emergency-fund/

[78] – https://www.usnews.com/banking/articles/automatic-money-saving-apps-for-the-forgetful

[79] – https://www.payactiv.com/financial-learning/using-automatic-savings-to-create-an-emergency-fund/

[80] – https://marriagekidsandmoney.com/best-budget-apps-for-families/

[81] – https://www.nerdwallet.com/article/finance/best-budget-apps

[82] – https://familymoneyadventure.com/best-family-budgeting-apps/

[83] – https://expenseai.app/

[84] – https://www.aiixx.ai/blog/top-ai-budgeting-tools-to-manage-your-finances

[85] – https://support.microsoft.com/en-us/office/manage-your-household-budget-in-excel-6b30a89b-b5ff-4cfe-944f-a389a40c3174

[86] – https://breakyourbudget.com/personal-finance-dashboard

[87] – https://www.moneypatrol.com/moneytalk/budgeting/family-budget-software/

[88] – https://ianbelcher.me/tech-blog/building-a-household-metrics-dashboard/

[89] – https://www.fsafeds.gov/explore/dcfsa

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com