American families spend about $310,605 to raise a child until age 17 – that’s before we even start planning for retirement. These numbers might seem daunting, but the right financial strategies can help you shape a secure future.

My 13 years as a financial advisor have taught me how smart money management transforms lives. This becomes even more crucial since only 52% of private-sector workers receive retirement benefits from their employers. That’s what drove me to create these 13 practical money-saving strategies. They offer a clear roadmap to financial fitness and long-term success.

These proven techniques range from getting the most out of your employer benefits to using smart AI tools. You’ll learn to build wealth while maintaining your lifestyle. My clients have already used these applicable steps by the thousands to reach their financial dreams.

Create a Smart Financial Fitness Plan

Image Source: Fullerton Markets

“A person either disciplines his finances or his finances discipline him.” — Orrin Woodward, Author and leadership expert

A well-laid-out financial fitness plan lays the groundwork for building a strong financial foundation. My experience as a financial advisor shows how a good plan turns monetary challenges into achievable milestones.

Financial Fitness Plan Components

Your financial fitness plan needs four key pillars: spending, saving, borrowing, and planning66. Each component requires active improvement to maintain financial wellness. Your monthly debt payments should be nowhere near 15% of your income, when you exclude mortgage and transportation loans66.

Your first line of defense against unexpected costs should be an emergency fund covering three to six months of living expenses2. This money keeps you from racking up high-interest credit card debt during financial emergencies.

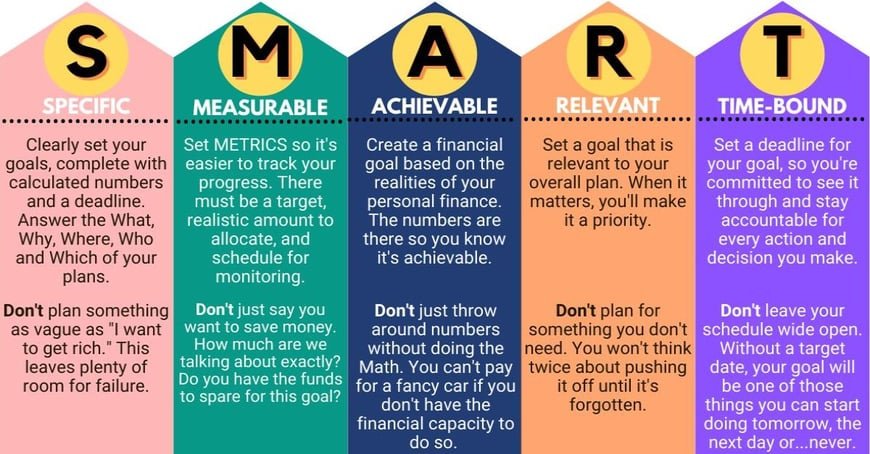

Setting SMART Financial Goals

SMART goals – Specific, Measurable, Achievable, Relevant, and Time-bound – are the life-blood of any successful financial plan. To cite an instance, instead of saying “I want to save more,” be specific: “I’ll automatically transfer $50 from each biweekly paycheck into a high-yield savings account”67.

Clear metrics help you learn about your progress. When you want to invest for retirement, define your contribution amount: “I’ll defer 15% of each paycheck into a Roth IRA”67. Your goals become achievable when you identify specific steps that bring them within reach.

Recent data reveals that 14 million people in the UK have less than £100 in savings68. Small savings can still create positive feelings of optimism and achievement. You can start with attainable targets like your first $1,000 and work toward larger objectives.

Tracking Progress

Your financial journey needs regular checks of key metrics, including net worth growth, income increases, and debt reduction69. Budgeting apps and financial management software make this easier by automating data collection and creating detailed reports70.

Your progress tracking should include:

- Regular credit report reviews to ensure accuracy and monitor bill payments

- Annual goal assessments that line up with changing circumstances

- Automated tools that track spending patterns and spot areas for improvement

Note that a financial plan needs ongoing attention. Financial experts suggest reviewing your plan yearly to make adjustments that line up with your evolving financial goals6. Regular monitoring and tweaking help maintain steady progress toward your financial objectives.

Master Your Budget with Digital Tools

Image Source: Eastern Peak

The digital world has made budget management easier with innovative financial tools. My experience guiding countless clients to financial success shows how these digital solutions help manage money and increase savings potential.

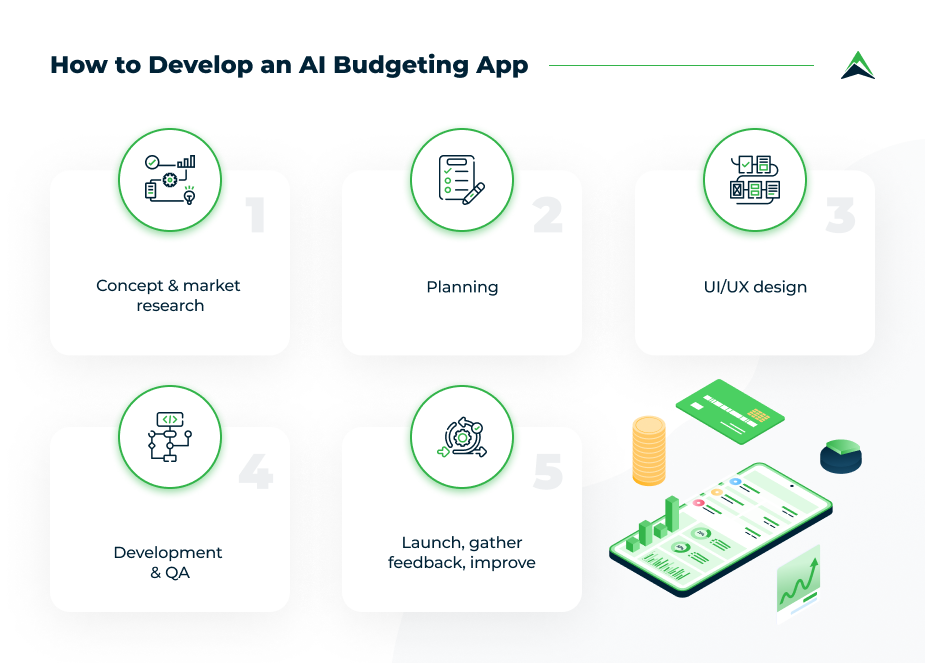

Best Budgeting Apps for 2025

Today’s budgeting apps come with features that work in a variety of financial situations. YNAB (You Need A Budget) shines with its zero-based budgeting approach. Users report saving an average of $600 in their first two months and $6,000 in their first year71. PocketGuard helps prevent overspending by alerting users when spending categories reach their limits8.

Couples who manage joint finances will find Honeydue useful with its selective account sharing and live expense tracking capabilities72. Rocket Money combines budgeting with subscription management and bill negotiation features73.

Automated Savings Features

Budget tools that work best now include automated saving capabilities that line up with your financial goals. Chime lets you automatically save portions of your paycheck73. Many apps also offer round-up features that move spare change from purchases straight into dedicated savings accounts.

These key features matter when picking an automated savings tool:

- Live account syncing

- Goal-based savings tracking

- Customizable transfer schedules

- High-yield savings options integration

AI-Powered Expense Tracking

Artificial intelligence has reshaped expense management through sophisticated algorithms that analyze spending patterns and give personalized insights. These AI-driven tools can automatically categorize expenses, spot potential savings opportunities, and flag unusual spending patterns74.

Latest AI features in expense tracking include:

- Smart receipt and document capture using optical character recognition

- Automated expense categorization based on spending patterns

- Predictive analytics for future expense forecasting

- Live policy compliance monitoring

Financial educator Michelle Taylor explains why choosing apps that match your specific needs matters: “This will help keep you on track and prevent you from feeling overwhelmed with choices”73. Certified financial planner Melissa Murphy Pavone adds that money-saving apps are “only as effective as your commitment to using them”73.

These digital tools can streamline your budgeting process and help you focus on achieving long-term financial fitness goals. Note that regular reviews and adjustments of your digital budget tools ensure they keep serving your changing financial needs.

Optimize Your Emergency Fund Strategy

Image Source: SoFi

A good emergency fund strategy is the first step to secure your financial future. My experience helping clients handle money problems shows that good emergency savings prevent debt from getting pricey and help you sleep better at night.

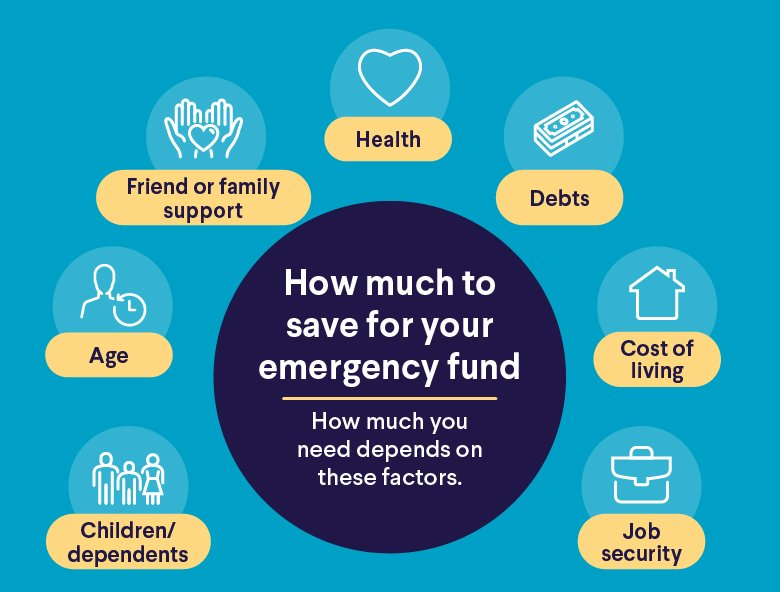

Emergency Fund Calculation

Your unique situation determines how much emergency money you need. You should save half a month’s expenses or $2,000 to handle spending shocks like sudden car repairs or medical bills, whichever is greater11. In spite of that, you need a fund that covers 3-6 months of essential expenses75 to protect against income shocks like job loss.

Here’s how to calculate your target amount:

- Add up monthly essential costs (housing, utilities, food, debt payments)

- Multiply by 3 for simple protection or 6 for better security

- Adjust based on job stability and family responsibilities

High-Yield Savings Options

Your emergency fund needs accounts that are both safe and easy to access. High-yield savings accounts earn around 4% APY right now76, which is substantially better than traditional savings accounts. These accounts also give you FDIC insurance up to $250,00077.

Look at these factors when picking an account:

- Zero maintenance fees

- No minimum balance requirements

- Quick access to funds without penalties

- Competitive interest rates to curb inflation

Fund Building Timeline

Starting small works better than waiting to save large amounts. You can build $1,040 yearly13 by saving just $20 weekly. Break down your target into manageable monthly goals.

Setting up automatic transfers from your paycheck to your emergency savings account makes sense4. Without doubt, this quickest way helps build your fund steadily without needing constant attention.

Recent data shows 62% of Americans feel behind on emergency savings78. Building this financial buffer through regular contributions should be your priority. Keep your growing fund strictly for unexpected expenses like medical bills, car repairs, or temporary income loss75.

Leverage Employer Benefits

Image Source: Lendtable

Your workplace benefits can boost your financial fitness by a lot. My experience advising clients shows how these overlooked benefits build substantial long-term wealth.

401(k) Matching Benefits

Most employers offer 401(k) matches, with the average contribution amounting to 4.6% of compensation15. The common formula gives $0.50 per dollar on the first 6% of compensation15. To name just one example, a $60,000 salary with a 100% match up to 3% could give you $1,800 in free retirement money each year15.

People 50 or older can contribute an extra $7,500 in 202415. Note that your employer’s contributions don’t count toward your personal limit of $23,00015.

Health Savings Accounts

HSAs give you excellent tax advantages through:

- Tax-free contributions

- Tax-free investment growth

- Tax-free withdrawals for qualified medical expenses16

You need a High Deductible Health Plan (HDHP) to qualify. The 2024 contribution limits are $4,150 for individuals and $8,300 for families3. Anyone 55 or older can add $1,000 as a catch-up contribution3.

HSA funds roll over indefinitely, unlike Flexible Spending Accounts16. The account stays yours even after job changes or retirement17.

Employee Stock Purchase Plans

ESPPs let you buy company stock at discounted prices, usually 15% below market value18. Your payroll deductions accumulate funds over 3-6 months before share purchases18.

Many plans include a “lookback” provision that lets you buy at the lower price between the start and end of the purchase period19. You can often sell right after purchase to lock in your discount profit19.

Your path to better financial fitness should include these approaches:

- Put in enough to get your full 401(k) match

- Max out HSA contributions for triple tax advantages

- Join ESPP programs when available, especially with lookback provisions

Automate Your Savings Game

Image Source: Acorns

Making your savings automatic is a vital step to reach financial fitness. My years of client advisory work show that automation helps overcome emotional hurdles that prevent regular saving.

Automatic Transfer Setup

You need to link your checking and savings accounts to set up automatic transfers. Most banks let you do this through their online platforms or mobile apps20. Here’s how to set up recurring transfers:

- Log into your online banking portal

- Go to the transfer section

- Select source and destination accounts

- Choose transfer amount and frequency

- Confirm setup details

Schedule your transfers right after payday to make sure you have enough funds21. Small weekly transfers of just $20 can add up to $1,040 in a year22.

Round-Up Savings Apps

Round-up apps have transformed micro-saving by investing your spare change automatically. Acorns users save more than $30 monthly just through round-ups23. These apps link to your bank accounts and round up purchases to the nearest dollar, moving the difference to savings or investments.

Chime gives you fee-free round-ups with automatic transfers to high-yield savings accounts24. Qapital lets you create custom rules, so you can save money based on your spending habits24.

Savings Acceleration Techniques

These proven strategies will help you save more automatically:

Split your direct deposit between checking and savings accounts22. This way, you save money before spending temptations kick in. You can also boost your round-ups by doubling or tripling the usual amount25.

Financial writer Melanie Lockert showed how powerful automation can be when she saved $100 weekly through automatic transfers. She built up thousands of dollars in just one year21. Freelancers and people with changing incomes often do better with quarterly transfers21.

Note that you should check your automated savings plan regularly. Bump up your automatic transfer amounts as your income grows26. You might want to keep your savings at a different bank than your main one. This creates a mental barrier that helps prevent impulse withdrawals21.

Minimize High-Interest Debt

Image Source: Lantern by SoFi

Your financial fitness takes a major hit from high-interest debt more than anything else. My experience as a financial advisor has helped many clients find debt reduction strategies that actually work.

Debt Consolidation Strategies

Multiple high-interest debts can become manageable through consolidation, which opens up possibilities for lower interest rates. The best consolidation terms often go to qualified borrowers who have credit scores above 680 and keep their debt-to-income ratios below 45%7. Our clients have cut their annual interest payments significantly from rates that used to exceed 20%7.

Here are your best consolidation options:

- Personal loans to simplify payments

- Home equity loans (if you own property with sufficient equity)

- Debt management plans through credit counseling firms

Balance Transfer Tactics

You can employ balance transfer cards as a powerful debt management tool. Right now, many cards come with 0% APR for 12-21 months7. Success depends on smart planning. The first step is calculating transfer fees that usually range from 3-5% of transferred amounts27. You must also make sure you can clear the balance before promotional rates end.

Let’s look at the numbers: A $20,000 balance with a 20% APR moved to a 0% card for 12 months costs $150 in transfer fees (3%) but saves you $98427. Keep paying your existing cards until transfers finish to avoid late fees27.

Debt Snowball Method

The debt snowball method targets your smallest debts first while you keep up minimum payments on larger ones. Your freed-up money goes toward the next smallest balance once you clear a small debt28. Quick wins make this approach particularly effective.

Here’s a real scenario: You have a $5,000 credit card debt at 20% APR, $1,000 personal loan at 10% APR, and $10,000 student loan at 8% APR. Adding just $100 extra monthly through the snowball method cuts your debt-free timeline from 50 months to 25 months. This saves you $2,251 in interest28.

Stay focused on becoming debt-free through systematic reduction approaches. The key is avoiding new debt while these strategies work their magic.

Maximize Cashback Rewards

Image Source: Kudos

Smart credit card choices and strategic reward planning can multiply your savings. My experience as a financial advisor has helped clients earn thousands in cashback rewards through smart spending strategies.

Best Cashback Cards 2025

The Wells Fargo Active Cash Card guides flat-rate rewards with 2% back on all purchases1. The Blue Cash Preferred Card from American Express rewards grocery shoppers with 3% back at U.S. supermarkets up to $6,000 spent annually29. The Chase Freedom Flex gives you 5% cash back on rotating quarterly categories up to $1,50030.

Food lovers will enjoy the Capital One Savor Cash Rewards Card that pays 3% back on dining, groceries, entertainment, and popular streaming services29. The Citi Custom Cash automatically adjusts to give you 5% back in your highest spending category each billing cycle29.

Reward Stacking Methods

You can boost your earnings through smart reward stacking. Shopping portals like Shop Through Chase, Capital One Shopping, and Barclays RewardsBoost are a great way to get extra rewards1. These combine well with cash back apps such as Upside, Dosh, and Rakuten for more savings1.

These stacking techniques work well:

- Link credit cards to issuer-specific shopping portals

- Activate quarterly bonus categories when required30

- Use card-linked offers from your credit card issuer1

Points Optimization

The right timing of redemptions helps maximize point values. Statement credits give you the most straightforward redemption option and reduce your card balance effectively1. You can also save rewards for planned purchases to stretch their value.

The best results come from pairing a flat-rate card earning 1.5-2% on all purchases with cards offering higher rates in specific categories1. Use bonus category cards for targeted spending and flat-rate cards for everything else. Smart card selection and strategic spending can help you earn substantial rewards without changing your regular spending habits.

Reduce Monthly Bills

Image Source: Idea Usher

You can save a lot of money on your monthly bills through smart negotiation and the right tools. My client consultations have helped me discover proven ways to cut recurring expenses while keeping all your important services.

Negotiation Scripts

Good bill negotiation needs proper preparation. Take time to check your payment history and current plan details10. Research what competitors are offering and look for questionable charges on your monthly statements before you make the call. Stay polite but firm when you talk to customer service representatives31.

This script works well: “I’ve been a loyal customer for [X] years with consistent on-time payments. Could you look at my account to find adjustments based on my usage patterns or unused features?”10. Then bring up your research: “I noticed [Competitor] offers similar services at lower rates. What options do we have to make my current plan more competitive?”31.

Service Auditing

You can find hidden savings by auditing your services regularly. Start by looking at your recurring subscriptions to spot any redundant services32. Companies that analyze their contracts systematically save 9.2% on total contract value32.

These areas need your attention:

- Utility bills and usage patterns

- Insurance policies and bundling options

- Subscription services and overlapping features

- Service contracts versus equipment replacement costs33

Bill Reduction Apps

Smart apps make bill management easier. Rocket Money’s premium features give you bill negotiation services where experts review your expenses and work to reduce them34. They’ve helped customers get refunds for overdraft fees and better rates on existing services35.

PocketGuard watches your subscription services and spots potential money-wasters8. It also suggests cheaper alternatives based on your spending habits. Couples can use Honeydue to manage bills together while retaining control over their privacy34.

My clients usually cut their monthly expenses by 10-15%9 with these strategies. Make sure you write down all negotiated changes and check that they show up on your next bills31.

Generate Passive Income

Image Source: Investopedia

“Savings without a mission is garbage. Your money needs to work for you, not lie around you.” — Dave Ramsey, Personal finance expert and author

Passive income streams can lead you to financial independence. My extensive client work has shown several proven strategies that bring consistent returns without much ongoing effort.

Dividend Investing

Dividend-paying stocks give you regular income through quarterly payments from company profits36. Companies with sustainable payout ratios under 60% tend to perform best37. ETFs give you a broader approach and better potential returns because they cost less than mutual funds36.

Dividend aristocrats have increased their dividends for 25+ consecutive years. These companies show strong business models and management’s dedication to shareholder returns38. A $150,000 portfolio that yields 8% can generate $1,000 monthly through careful selection and reinvestment38.

Real Estate Crowdfunding

Real estate crowdfunding platforms make property investment available to everyone with minimal capital. Fundrise manages $3 billion in assets from 350,000+ investors. They focus on single-family and multi-family rentals in the Sunbelt region39. These investments typically bring 3-22% annual returns40.

Arrived Homes lets non-accredited investors buy shares in carefully selected rental properties with 6-10% yearly returns40. However, most platforms have lock-up periods that limit quick access to your invested funds41.

Passive Income Platforms

Affiliate marketing is an available passive income source with 3-7% commissions on third-party product sales36. You need substantial traffic through content creation and audience involvement to succeed. Amazon, eBay, and ShareASale are popular platforms36.

Lending platforms help you earn interest through company investments42. This method gives steady cash flow with more predictable returns than traditional markets42. Fractional bonds let you start with smaller amounts while getting regular interest payments42.

Note that spreading your investments across multiple passive income streams helps because each has its own risks and potential returns. Strategic allocation and patient capital deployment can create substantial recurring income as time passes.

Optimize Tax Savings

Image Source: Investopedia

Tax planning is the life-blood of financial fitness and gives you great opportunities to preserve and grow your wealth. You can minimize tax liabilities and maximize investment returns with the right strategies.

Tax Deduction Strategies

Your ability to reduce taxable income depends on understanding available deductions. Tax-deductible contributions to traditional IRAs are possible if your income stays below certain thresholds. The deduction limits will start to decrease at $79,000 for single filers and $126,000 for joint filers in 202543.

These powerful deductions can help you save:

- HSA contributions up to $4,300 if you file individually and $8,550 for families44

- Flexible spending account contributions right from your paycheck45

- Charitable donations through qualified organizations46

Investment Tax Benefits

Municipal bonds give you exceptional tax advantages, and their interest stays exempt from federal taxes44. On top of that, retirement accounts offer major tax benefits. Your traditional 401(k) contributions lower current taxable income because the IRS doesn’t tax money that goes straight from your paycheck45.

Asset location strategies can boost your tax efficiency. You should place tax-efficient investments in taxable accounts and less tax-efficient ones in tax-advantaged accounts47. This approach will give a better after-tax return across your portfolio.

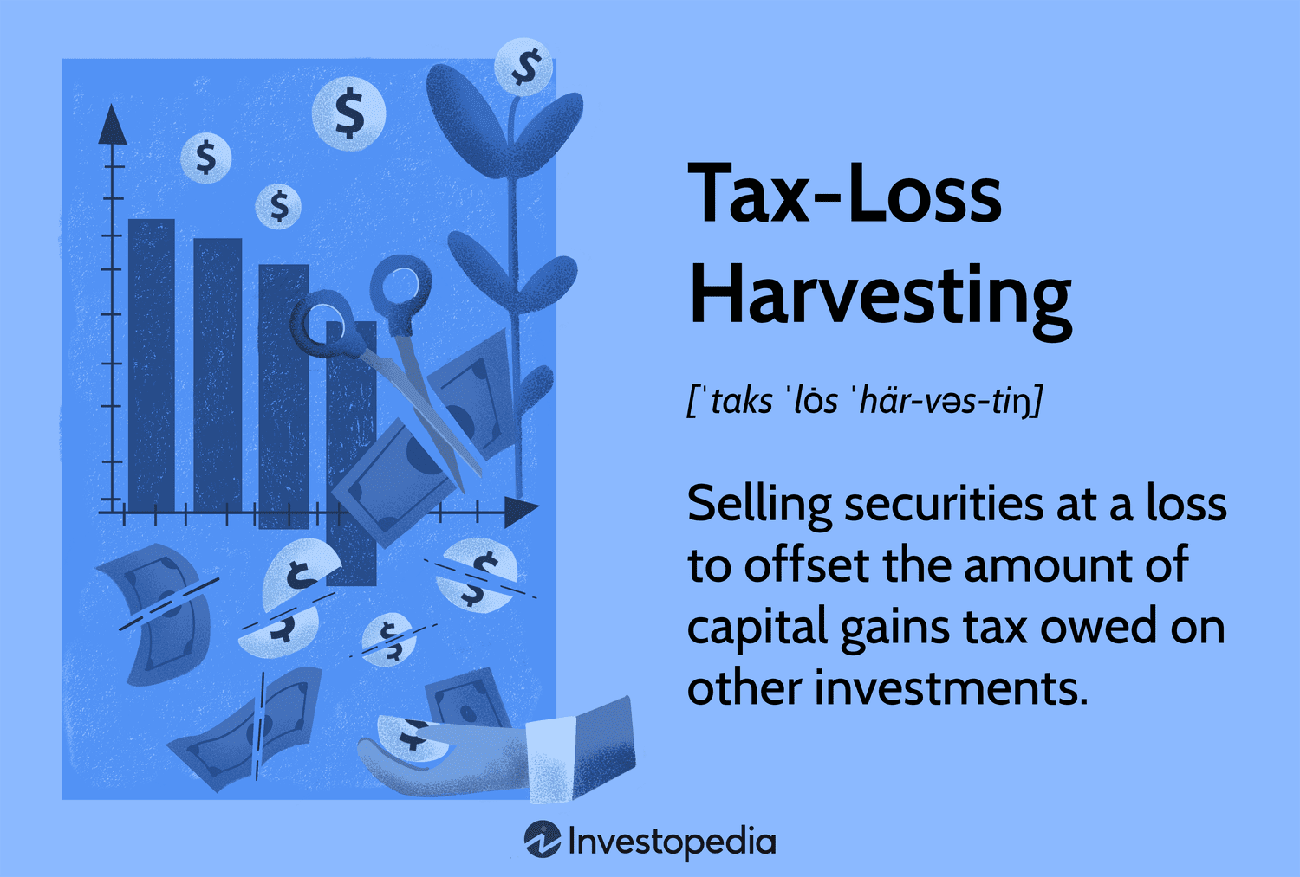

Tax-Loss Harvesting

Tax-loss harvesting is a sophisticated way to offset investment gains. This technique lets you use investment losses to reduce taxable gains dollar-for-dollar when done right48. You can even deduct up to $3,000 against ordinary income if your losses exceed gains49.

The wash-sale rule is something to watch out for. It won’t allow losses if you buy similar securities within 30 days before or after the sale50. Smart tax-loss harvesting can save up to $8,050 each year if you’re in higher tax brackets50.

“Bunching” deductions into specific years can optimize your tax savings. This strategy works especially well since recent tax law changes doubled the standard deduction51. Regular reviews of your tax strategy help you tap into the full potential of available opportunities while staying compliant with current regulations.

Build Multiple Income Streams

Image Source: Chime

Having multiple income streams is a vital strategy to achieve lasting financial fitness. My experience as a financial advisor shows how different revenue sources protect clients from economic uncertainty and help build wealth faster.

Side Hustle Options

Print-on-demand services are available to anyone who wants to start with minimal investment. Creators can earn passive income by designing custom merchandise through platforms like Redbubble or Printful52. Digital product creation can bring substantial returns, with online courses generating USD 100-5000 monthly5.

Artists and crafters can make USD 200-2500 monthly by selling their handmade items5. You can also make extra money by finding free items on Facebook Marketplace, restoring them, and selling them for profit53.

Freelance Opportunities

AI prompt engineering is a high-paying skill right now, with hourly rates between USD 87-12354. Data science consultants can charge USD 150-200 per hour once they gain experience54.

Content creation works well too. Freelance writers manage social media accounts and earn USD 300-3500 monthly5. Video production services bring in about USD 59.40 per hour54 as visual content grows more popular.

Online Business Ideas

Dropshipping ventures can earn USD 50-3000 monthly5. Of course, affiliate marketing offers flexible income potential, with successful marketers making USD 50-3000 monthly through smart product promotion5.

Digital courses can be highly profitable when you turn specialized knowledge into educational content. Virtual event planning has become a fresh opportunity as businesses look for outside expertise53.

Note that 75% of millionaires have multiple income streams55. Even part-time efforts can bring substantial returns and deepen your financial security when you vary your income sources strategically12.

Invest in Your Skills

Image Source: Chaos Genius

Your financial future depends on investing in professional development. You can boost your earning potential and career opportunities by improving your skills.

High-ROI Certifications

Professional certifications give you great returns on investment. Studies show that people with Master’s degrees earn about 20% more than those with Bachelor’s degrees. Doctorate holders make 25% more than Master’s graduates56. Financial certifications are a great way to earn more. Chartered Financial Analysts make USD 92,000 per year on average and can reach USD 120,000 with experience57.

Online Learning Platforms

Learning platforms offer budget-friendly ways to develop skills. Coursera stands out by offering university-level courses that are often free58. Skillshare helps you develop creative skills and focuses on practical business uses58. Udacity provides specialized technical training through Nanodegrees that target specific job skills58.

Career Development

You need systematic planning and continuous learning to advance your career. Regular professional development helps you stay current with industry trends and relevant certifications59. Here’s what you should think over:

- Set clear career goals that match market needs

- Get certifications your industry values

- Build both technical and soft skills

- Connect with mentors in your field

Investing in yourself pays off. Small investments in skill development can lead to big salary increases56. Today’s online accelerated learning programs help you grow professionally in months instead of years60.

Smart upskilling helps you get promotions, raises, and better job security. Regular skill checks help you find gaps in your expertise56. Taking charge of your professional growth shows ambition and self-motivation – qualities employers look for when promoting candidates59.

Use AI for Financial Planning

Image Source: Yieldstreet

AI is changing how we approach financial planning with smart tools that boost investment decisions and portfolio management. My experience as a financial advisor shows how AI solutions are making professional-grade financial services available to everyone.

AI Investment Tools

Today’s AI platforms can process huge amounts of market data to spot investment opportunities. These systems look at information from many sources, like earnings reports, market trends, and economic indicators14. Smart algorithms give analytical insights that help investors react quickly to market shifts61.

AI-powered investment platforms are great at:

- Live market analysis

- Finding patterns in stock movements

- Checking risks across asset types

- Suggesting portfolio adjustments

Robo-Advisor Benefits

Robo-advisors shine when it comes to cost – they charge just 0.25% to 0.50% per year62, which is way less than traditional advisors who charge 1-2%63. These platforms give unbiased advice based on statistics and proven investment principles62.

Modern robo-advisors offer:

- Automatic portfolio balancing

- Tax-loss harvesting features

- Investment strategies based on your goals

- Small minimum account sizes

This technology works really well for new investors – 98% of Gen Z adults and millennials say they love using it64. Note that while AI handles simple financial tasks well, complex money matters still need human expertise64.

Automated Financial Analysis

AI analysis tools streamline financial planning by processing data and providing useful insights. These platforms look at how you spend, find ways to save, and predict future expenses65. On top of that, they watch your investment portfolio in real-time to make sure it matches your financial goals62.

The best features include:

- Automatic expense sorting

- Future cost predictions

- Portfolio fine-tuning

- Non-stop market tracking

Smart use of AI tools helps investors make better financial decisions while they retain control over their strategy. Right now, 72% of companies use AI in at least one part of their business14, which shows growing trust in these technologies for managing money.

Comparison Table

| Financial Tip | Main Benefits | Essential Tools/Methods | Expected Returns/Savings | Implementation Difficulty |

|---|---|---|---|---|

| Design a Smart Financial Plan | Foundations for financial success | SMART goals, progress tracking, regular check-ins | Monthly debt payments ≤15% of income | Moderate |

| Become skilled at Budgeting with Digital Tools | Simplified money management | YNAB, PocketGuard, Honeydue | $600 in first 2 months (YNAB) | Easy |

| Build a Strong Emergency Fund | Financial security safety net | High-yield savings accounts, automated transfers | 4% APY on savings | Easy |

| Make the Most of Employer Benefits | Free money, tax advantages | 401(k), HSA, ESPP | 4.6% average 401(k) match | Easy |

| Set Up Automatic Savings | Build consistent saving habits | Direct deposit splitting, round-up apps | $1,040 annually ($20/week) | Easy |

| Reduce High-Interest Debt | Lower interest payments | Debt snowball, balance transfers, consolidation | 50% reduction in payoff time | Moderate |

| Get Maximum Cashback Rewards | Extra earnings on daily spending | Multiple card strategy, reward stacking | 2-5% on purchases | Moderate |

| Cut Monthly Bills | Reduce fixed expenses | Negotiation scripts, service audits, bill reduction apps | 10-15% monthly savings | Moderate |

| Create Passive Income | Multiple revenue streams | Dividend investing, real estate crowdfunding | 3-22% annual returns | Complex |

| Reduce Tax Burden | Lower tax liability | Tax-loss harvesting, deductions, strategic planning | Up to $8,050 annual savings | Complex |

| Create Multiple Income Streams | Income diversification | Freelancing, side hustles, online business | $100-5000 monthly | Complex |

| Grow Your Professional Skills | Career advancement potential | Certifications, online learning platforms | 20-25% salary increase | Moderate |

| Make Use of AI for Financial Planning | Informed decisions | Robo-advisors, AI analysis tools | 0.25-0.50% annual fees | Easy |

Last words

Financial fitness just needs a balanced approach that combines smart planning, consistent saving, and mutually beneficial investing. My 13 years of advising clients have shown these 13 strategies create remarkable results when people apply them systematically.

A solid financial plan sets your foundation. Automated savings and debt reduction speed up progress toward your goals. Smart use of employer benefits, cashback rewards, and tax optimization strategies helps maximize every dollar. Passive income streams and continuous skill development build lasting financial security.

These strategies deliver the best results when customized to your specific situation. My clients see most important improvements within 3-6 months after implementing these approaches. Note that financial fitness mirrors physical fitness – success flows from consistent daily actions rather than sporadic efforts.

You can reach us at support@trendnovaworld.com to learn how these strategies can work for your unique financial situation.

Small steps today create substantial results tomorrow. Start with one strategy, implement it fully, then add another. Your future financial security depends on the actions you take right now.

Access more info at

15 Smart Ways to Save Money on Your Wedding (Expert Tips for 2025)

FAQs

Q1. What are some effective strategies to save money in 2025? Make saving a priority by building an emergency fund covering 3-6 months of expenses. Automate your savings, take advantage of employer benefits like 401(k) matching, and use budgeting apps to track spending. Consider high-yield savings accounts and look for ways to reduce monthly bills through negotiation and service audits.

Q2. How can I set achievable financial goals for 2025? Use the SMART framework to set specific, measurable, achievable, relevant, and time-bound goals. For example, aim to save a specific amount for a down payment on a home by December 2025, pay off a certain amount of credit card debt by July 2025, or contribute 15% of your 2025 salary to a retirement account.

Q3. What is the 50/15/5 rule for managing personal finances? The 50/15/5 rule is a guideline for allocating your income: aim to spend no more than 50% of your take-home pay on essential expenses, save 15% of your pretax income for retirement, and set aside 5% of your take-home pay for short-term savings or emergency funds.

Q4. How can I save $10,000 in five years? To save $10,000 in five years, you need to set aside approximately $167 per month or $2,000 per year. Automate your savings, cut unnecessary expenses, and consider additional income streams like side hustles. Invest in high-yield savings accounts or low-risk investment options to potentially earn more interest on your savings.

Q5. What role can AI play in improving personal financial planning? AI-powered tools can enhance financial planning by providing data-driven insights, automated portfolio management, and personalized investment recommendations. Robo-advisors offer cost-effective investment services, while AI analysis tools can help with budgeting, expense tracking, and identifying savings opportunities. These technologies can complement traditional financial advice, especially for basic financial tasks and investment strategies.

References

[1] – https://www.bankrate.com/credit-cards/cash-back/maximize-cash-back-strategy/

[2] – https://epiccapital.com/basics-of-financial-fitness/

[3] – https://www.morganstanley.com/articles/health-savings-account-retirement-tax-advantages

[4] – https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/emergency-fund-tips

[5] – https://www.inc.com/hostinger/top-10-side-hustle-ideas-to-make-extra-money-in-2025/91070479

[6] – https://www.evansbank.com/personal-banking/investments/investment-resources/the-basics-of-financial-fitness/

[7] – https://www.cbsnews.com/news/will-a-debt-consolidation-loan-be-worth-opening-in-2025-experts-weigh-in/

[8] – https://www.cnet.com/personal-finance/banking/best-budgeting-apps-to-get-control-of-your-money-in-2025/

[9] – https://www.bill.com/blog/cut-monthly-business-expenses

[10] – https://www.nerdwallet.com/article/finance/use-this-script-to-lower-your-cable-and-internet-bills

[11] – https://investor.vanguard.com/investor-resources-education/emergency-fund

[12] – https://www.forbes.com/sites/melissahouston/2024/04/17/why-diversifying-your-income-streams-is-essential-in-todays-economy/

[13] – https://www.tiaa.org/public/learn/financial-education/building-an-emergency-fund

[14] – https://am.jpmorgan.com/se/en/asset-management/per/insights/market-insights/investment-outlook/ai-investment/

[15] – https://www.investopedia.com/articles/personal-finance/112315/how-401k-matching-works.asp

[16] – https://www.cms.gov/marketplace/outreach-and-education/health-savings-account.pdf

[17] – https://healthaccounts.bankofamerica.com/top-six-reasons.shtml

[18] – https://www.fidelity.com/learning-center/personal-finance/what-is-an-ESPP

[19] – https://www.investopedia.com/terms/e/espp.asp

[20] – https://www.investopedia.com/terms/a/automatic-transfer-of-funds.asp

[21] – https://www.synchrony.com/blog/banking/how-automatic-savings-can-help

[22] – https://www.bankrate.com/banking/savings/grow-your-savings-with-automatic-transfers/

[23] – https://www.nasdaq.com/articles/7-best-round-up-apps-for-saving-investing-money-instantly-0

[24] – https://www.bankrate.com/personal-finance/best-money-saving-apps/

[25] – https://moneywise.com/banking/banking-reviews/round-apps-savings-apps

[26] – https://www.experian.com/blogs/ask-experian/how-to-create-automatic-savings-plan/

[27] – https://www.forbes.com/sites/winniesun/2024/11/01/financial-advisors-guide-to-debt-transfers-reducing-credit-card-debt/

[28] – https://www.experian.com/blogs/ask-experian/avalanche-vs-snowball-which-repayment-strategy-is-best/

[29] – https://money.usnews.com/credit-cards/cash-back

[30] – https://www.nerdwallet.com/article/credit-cards/make-most-rewards-credit-cards

[31] – https://www.payactiv.com/financial-learning/negotiating-bills-scripts-for-lowering-your-monthly-expenses/

[32] – https://www.brex.com/spend-trends/expense-management/cost-reduction-strategies-for-reducing-business-expenses

[33] – https://www.regions.com/insights/small-business/article/how-to-self-audit-your-business-and-control-expenses

[34] – https://www.businessinsider.com/personal-finance/banking/best-budgeting-apps

[35] – https://www.investopedia.com/how-to-lower-your-monthly-bills-8759699

[36] – https://www.bankrate.com/investing/passive-income-ideas/

[37] – https://www.vaneck.com/us/en/blogs/income-investing/how-to-develop-a-dividend-investing-strategy-a-comprehensive-guide/

[38] – https://medium.com/the-investors-handbook/how-to-build-a-1000-month-dividend-portfolio-2025-guide-c0b63bdaaf88

[39] – https://www.financialsamurai.com/ranking-the-best-passive-income-investments/

[40] – https://www.benzinga.com/money/best-real-estate-crowdfunding-platforms

[41] – https://www.investopedia.com/the-best-real-estate-crowdfunding-sites-8761523

[42] – https://www.mintos.com/blog/create-multiple-streams-of-income/

[43] – https://smartasset.com/investing/tax-deductible-investments

[44] – https://www.gwadvisors.net/tax-strategies/

[45] – https://www.nerdwallet.com/article/taxes/tax-planning

[46] – https://anderscpa.com/top-year-end-tax-tips-2025-maximize-savings/?tag=fwep

[47] – https://www.fidelity.com/learning-center/wealth-management-insights/top-tax-tips

[48] – https://turbotax.intuit.com/tax-tips/tax-planning-and-checklists/top-8-year-end-tax-tips/L5szeuFnE

[49] – https://corporate.vanguard.com/content/dam/corp/research/pdf/tax_loss_harvesting_why_a_personalized_approach_is_important.pdf

[50] – https://www.schwab.com/learn/story/how-to-cut-your-tax-bill-with-tax-loss-harvesting

[51] – https://us.beyondbullsandbears.com/2025/02/12/key-planning-ideas-to-maximize-your-2025-tax-savings/

[52] – https://sell.amazon.com/learn/online-business-ideas

[53] – https://www.forbes.com/sites/melissahouston/2024/12/28/10-side-hustles-you-can-start-with-no-money-in-2025/

[54] – https://www.forbes.com/sites/rachelwells/2024/09/19/freelance-jobs-to-make-50-an-hour/

[55] – https://www.nasdaq.com/articles/the-6-biggest-mistakes-in-creating-multiple-income-streams

[56] – https://abacuswealth.com/your-greatest-asset-investing-in-yourself-for-career-and-financial-growth/

[57] – https://crushthefinancialanalystexam.com/financial-certifications-that-have-the-best-roi/

[58] – https://www.pcmag.com/picks/best-online-learning-services

[59] – https://online.uc.edu/blog/career-development-strategies/

[60] – https://beal.edu/invest-in-yourself-strategies-for-personal-growth-that-will-pay-dividends-in-your-career-and-finances/

[61] – https://www.levelfields.ai/news/ai-investing-tools

[62] – https://www.investopedia.com/are-robo-advisors-worth-it-7568057

[63] – https://www.experian.com/blogs/ask-experian/pros-and-cons-of-robo-advisors/

[64] – https://www.cnbc.com/2024/11/04/how-to-use-artificial-intelligence-for-personal-finance.html

[65] – https://www.workiva.com/solutions/financial-statement-automation

[66] – https://www.ourgrovecu.com/the-four-pillars-of-financial-health/

[67] – https://www.experian.com/blogs/ask-experian/how-to-set-smart-financial-goals/

[68] – https://www.the-independent.com/money/financial-resolutions-for-2025-b2670901.html

[69] – https://moneyning.com/better-yourself/measure-financial-progress/

[70] – https://www.townebank.com/personal/resource/credit/trouble/progress/

[71] – https://www.nerdwallet.com/article/finance/best-budget-apps

[72] – https://www.moneyfit.org/budgeting-tools-for-2025-success/

[73] – https://www.usnews.com/banking/articles/automatic-money-saving-apps-for-the-forgetful

[74] – https://www.concur.com/blog/article/expense-management-with-ai-comprehensive-guide

[75] – https://www.consumerfinance.gov/an-essential-guide-to-building-an-emergency-fund/

[76] – https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

[77] – https://www.bankrate.com/banking/savings/where-to-keep-emergency-fund/

[78] – https://www.veridiancu.org/news/advice/start-your-emergency-fund-in-2025

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com