My 13 years as a financial advisor have shown me a surprising fact – only about half of people stick to a budget that works long-term.

Making and following a budget doesn’t have to be complicated. The right strategy makes it simple and straightforward. The 50/30/20 rule has helped my clients reach their financial goals consistently. This proven approach allocates 50% for needs, 30% for wants, and 20% for savings. Anyone can use these tested budgeting strategies to save $300 monthly or build a 3-6 month emergency fund.

My experience with thousands of successful clients has led me to develop 12 practical budget tips. These aren’t just theories – they’re proven methods that work in real-life situations. The tips are particularly helpful for people who struggle to stick to their budget and save money effectively.

Start with Zero-Based Budgeting

Image Source: ORBA Cloud CFO Services

“Zero-based budgeting starts with the premise that your income minus your expenses each month should equal zero.” — First Federal Lakewood, Financial institution

Zero-based budgeting is the quickest way I’ve helped my clients manage their money. This method makes every dollar work by giving it a specific purpose and creates a clear financial roadmap.

What is Zero-Based Budgeting

Zero-based budgeting follows one simple rule: your income minus expenses should equal zero52. This doesn’t mean spending everything you have. Each dollar gets a specific job, which includes savings and investments. Traditional budgeting looks at past spending patterns, but zero-based budgeting gives you a fresh start each month53.

Setting Up Your First Zero-Based Budget

Your zero-based budget needs these key steps:

- List your monthly income, including regular paychecks and side hustle earnings52

- Categorize your expenses:

- Giving (10% of income)

- Savings

- Four Walls (food, utilities, shelter, transportation)

- Essential expenses (insurance, debt, childcare)

- Discretionary spending

- Month-specific costs52

The next step is simple – subtract all expenses from your income until you hit zero. Your expenses might be more than your income. You’ll need to cut back on spending or find ways to earn more money.

Tools for Zero-Based Budgeting

Modern apps make zero-based budgeting much easier. EveryDollar, priced at USD 17.99 monthly or USD 79.99 annually for premium features54, comes with complete tools like:

- Automatic transaction streaming

- Custom budget reports

- Bill due date reminders

- Net worth calculations

- Paycheck planning features

Common Pitfalls to Avoid

My years as an advisor have shown me what trips people up with zero-based budgeting. The biggest problem is that people see it as just a way to cut costs rather than an all-encompassing approach to manage money55. Dealing with irregular income can be tough – I tell my clients to use their lowest monthly income from recent months as a starting point52.

Here’s what you should avoid to succeed:

- Treating it as a temporary fix instead of a lifestyle change

- Not tracking expenses regularly

- Skipping monthly budget adjustments

- Forgetting to set money aside for surprises

Monthly reviews and adjustments of your budget categories are crucial. Tracking every transaction carefully will help you stick to your budget and reach your financial goals.

Automate Your Savings with AI Tools

Image Source: Eastern Peak

AI has reshaped the scene of money management, especially when you have automated savings tools that make budgeting simple. My experience helping clients optimize their finances shows that AI-powered solutions deliver better results than traditional methods.

Top AI Budgeting Apps for 2025

The financial technology world of 2025 features several groundbreaking apps. Piere stands at the forefront with its complete features. It offers AI-powered insights for saving and spending plus immediate account syncing56. Cleo brings a fresh approach as an AI chatbot that guides comprehensive money management through an engaging chat interface57.

Honeydue works best for couples who need to manage joint finances while keeping their privacy56. Empower blends daily budgeting with future financial planning56. PocketGuard makes budgeting easier by showing available spending money after bills and essentials56.

Setting Up Automated Transfers

Automated savings plans work as your financial partner. They move preset amounts from checking to savings accounts on schedule58. Here’s how to create an effective automated savings system:

- Determine transfer frequency (weekly, biweekly, or monthly)

- Choose between account transfers or direct deposits

- Set specific savings thresholds with immediate alerts

- Link accounts for smooth transfers

My advisory practice shows that clients who automate their savings reach their financial goals. Most employers now let you split your direct deposit to automatically move part of your paycheck into savings59.

AI-Powered Spending Analysis

Today’s AI tools look at spending patterns and give personalized insights and recommendations. These platforms check your transaction history to find:

- Ways to save money

- Strange spending patterns

- Upcoming bills and expenses

- Investment opportunities based on cash flow

The technology learns from your money habits and becomes more precise over time60. Recent data shows that 70% of financial industry professionals believe AI technology will change how employees work at their firms61.

These AI tools use predictive analytics and immediate coaching to help maintain a workable budget. They anticipate needs and improve investment strategies based on individual financial behavior62. Albert can study your income and spending habits to set aside affordable amounts automatically. It moves money to specific accounts based on your priorities62.

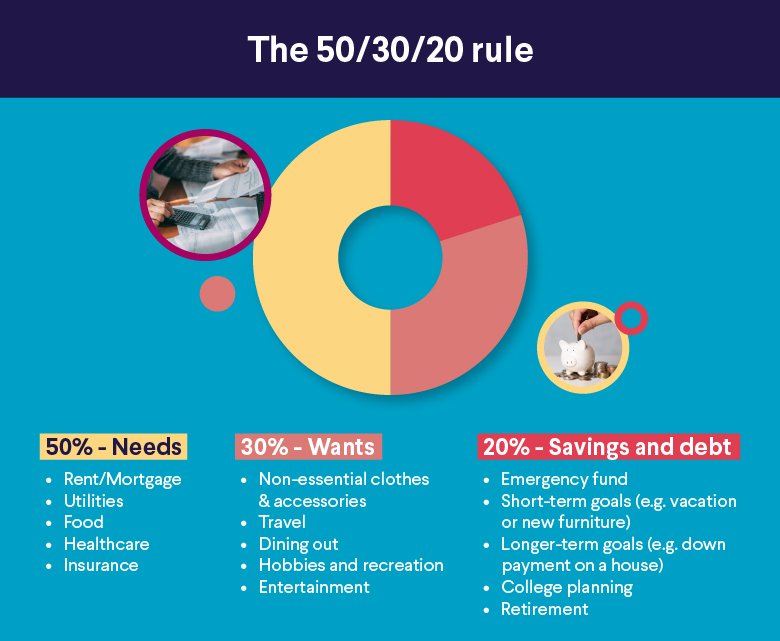

Implement the 50/30/20 Rule

Image Source: SoFi

The 50/30/20 rule stands out as a simple yet powerful way to create a green budget that balances today’s needs with tomorrow’s goals. This method has helped my clients develop healthy money habits without feeling restricted throughout my advisory career.

Understanding the Rule

The rule splits your after-tax income into three main categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment12. Your needs cover basic expenses like housing, utilities, groceries, and minimum debt payments63. Wants include extras such as entertainment, dining out, and streaming services. The final 20% builds emergency funds, retirement savings, and extra debt payments beyond minimums.

Calculating Your Ratios

To name just one example, see how a monthly after-tax income of $5,000 breaks down:

- $2,500 (50%) for necessities

- $1,500 (30%) for lifestyle choices

- $1,000 (20%) for savings and debt reduction14

The quickest way to put this into action:

- Calculate your net income after taxes

- Review recent bank statements

- Categorize each expense

- Track spending against target percentages

- Adjust allocations as needed

Adjusting Percentages for Your Lifestyle

The rule offers an excellent framework, but flexibility is vital. My clients in high-cost areas often need to modify these percentages. Statistics show most households spend approximately $4,500 monthly on basic needs alone14. So some people might need to allocate more than 50% toward necessities.

These factors will shape your ratio adjustments:

- Geographic location and cost of living

- Income level

- Family size

- Debt obligations

- Long-term financial goals

You’ll get the best results if you treat the 50% and 30% as maximum limits and the 20% savings as a minimum threshold15. This approach will give a priority to financial security while keeping your lifestyle balanced. Note that budgets don’t fit everyone the same way14.

My clients have built emergency funds, prepared for retirement, and achieved debt freedom by sticking to this method. Success comes from regular reviews and adjustments of these percentages to match your changing financial situation and goals12.

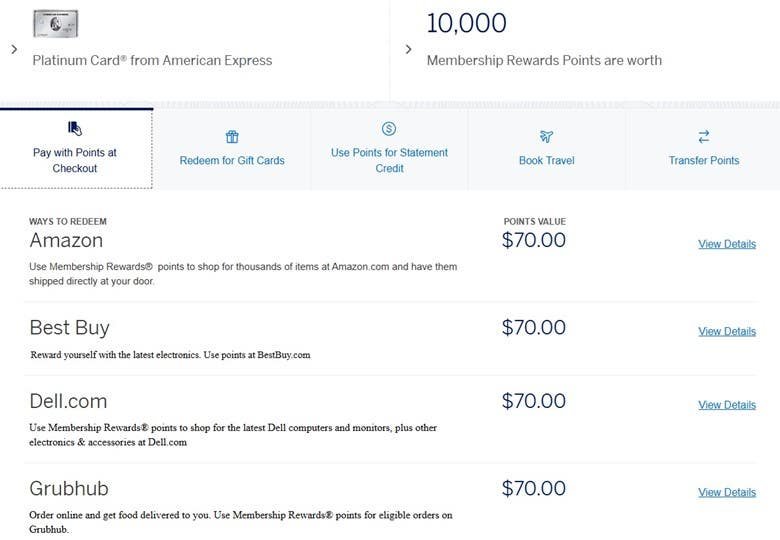

Use Cashback and Rewards Strategically

Image Source: Bankrate

Smart use of cashback and rewards programs helps you maintain a budget that works. My years of client advisory work show that getting the most from these benefits takes smart planning.

Best Cashback Programs 2025

The digital world of cashback programs has changed a lot. The Blue Cash Preferred® Card from American Express guides with 6% cashback on up to $6,000 yearly at U.S. supermarkets16. Capital One Savor Cash Rewards Credit Card rewards dining fans with 3% back on dining and entertainment purchases16.

The Wells Fargo Active Cash® Card gives you a steady 2% return on everything you buy, which makes it perfect for daily expenses16. These programs work best with your main budget plan and create extra savings without much effort.

Maximizing Credit Card Rewards

Your credit card rewards work better when you:

- Pick cards that match how you spend

- Grocery cards for supermarket runs

- Travel cards when you’re on the move

- Basic cards for everything else

The timing of your card use matters a lot. My clients learn to use specific cards when they give the highest rewards17. Some cards offer 5% cash back on different categories each quarter, but you must activate these benefits17.

Avoiding Reward-Chasing Traps

Rewards look great, but watch out for hidden problems. Interest rates are usually higher than any rewards you earn, so carrying a balance wipes out your gains18. My advice? Pay your full balance monthly.

Watch out for these common mistakes:

- Spending too much to get bonuses

- Missing category activation deadlines

- Keeping balances that eat up rewards

- Picking cards that don’t fit your spending

Your rewards strategy will work better if you:

- Stick to planned purchases with reward cards

- Set up automatic payments to skip interest fees

- Check reward programs every three months

- Know what sign-up bonuses are worth before you apply

Cashback and rewards programs are great tools to help you save money. Pick programs that fit how you already spend instead of changing your habits to chase rewards16. These guidelines will help you get the most value while staying financially smart.

Create Multiple Income Streams

Image Source: YouTube

Multiple income streams are the life-blood of financial stability in today’s digital world. My experience as a financial advisor shows that varying your income sources builds financial security and helps grow wealth faster.

Side Hustle Ideas for 2025

Digital products lead the pack as the most profitable side hustles, bringing in USD 100 to USD 5,000 monthly19. You can sell online courses, e-books, and digital art with little upfront cost and get substantial returns. A social-first management approach opens up great opportunities, with earnings potential of USD 300 to USD 3,500 per month19.

Traditional side hustles still work well among other ventures. Print-on-demand businesses can make USD 50 to USD 2,500 monthly19, while handmade crafts bring in USD 200 to USD 2,50019. Virtual assistance pays well too, with monthly income between USD 300 and USD 1,70019.

Passive Income Opportunities

Real estate investments stand out as a top passive income source. REITs let investors join real estate markets with as little as USD 1020. These investments deliver steady returns – the Dow Jones Equity All REIT Index hit an 11.3% return in 202320.

Other passive income streams include:

- Dividend stocks and ETFs to get steady returns

- Online businesses that run on autopilot

- High-yield savings accounts if you want less risk

- Licensing and royalties from intellectual property21

Managing Multiple Income Sources

You just need strategic organization to handle various income streams well. Start by keeping business and personal finances in separate accounts1. Then set up automated systems that track earnings and expenses from each source.

A monthly financial review helps you:

- See how each income stream performs

- Find ways to improve

- Change your allocation strategy

- Keep track of tax impacts1

The key is to start small and grow step by step. Each new income stream might not seem like much at first, but with time and smart planning, it can become a major part of your financial portfolio2. It’s worth mentioning that successful income diversification needs careful planning, good organization, and regular checkups to keep growing while staying within your budget goals.

Track Expenses with Smart Technology

Image Source: Moon Invoice

“Budget 2025 presents an opportunity to make tax filing more accessible and transparent for everyone. Leveraging AI-based income tax systems” — Business Micro, Business news platform

Smart technology has changed how we track expenses and made budget management easier than ever. My work with clients shows how digital tools can turn financial management from a chore into a natural habit.

Best Expense Tracking Apps

Today’s expense tracking apps give you detailed solutions to keep your finances in check. Simplifi, priced at USD 5.99 monthly or USD 3.59 annually22, leads the pack with its multi-category tracking features. The app builds custom spending plans based on your past transactions and lets you watch specific expenses22.

Center gives businesses free expense management tools built for corporate credit card users23. Shoeboxed, which costs between USD 29.00 and USD 89.00 monthly, specializes in paper receipt management23.

Smart Receipt Management

Digital receipts have changed the game in expense tracking. Smart receipts, or e-receipts, come with several benefits:

- Advanced search and filtering capabilities

- Environmental sustainability

- Permanent digital archiving

- Personalized retailer discounts22

Optical Character Recognition (OCR) technology can now pull data from receipts and figure out handwritten notes and unusual formats24. This technology merges with expense management systems to sort transactions and update budgets immediately3.

Real-Time Budget Monitoring

AI-powered budget monitoring gives you immediate insights into your spending patterns. These systems flag unusual transactions, catch duplicates, and spot potential fraud3. They also offer:

- Automated expense categorization

- Policy compliance verification

- Instant budget updates

- Predictive spending analysis3

Cloud technology lets users check their financial data from anywhere, which ensures constant budget oversight3. AI algorithms study past data and spending patterns to forecast future expenses, which helps you manage your budget proactively24.

Smart technologies make budget management much easier. Automated tracking, smart receipt management, and immediate monitoring create a strong system to help you reach your financial goals.

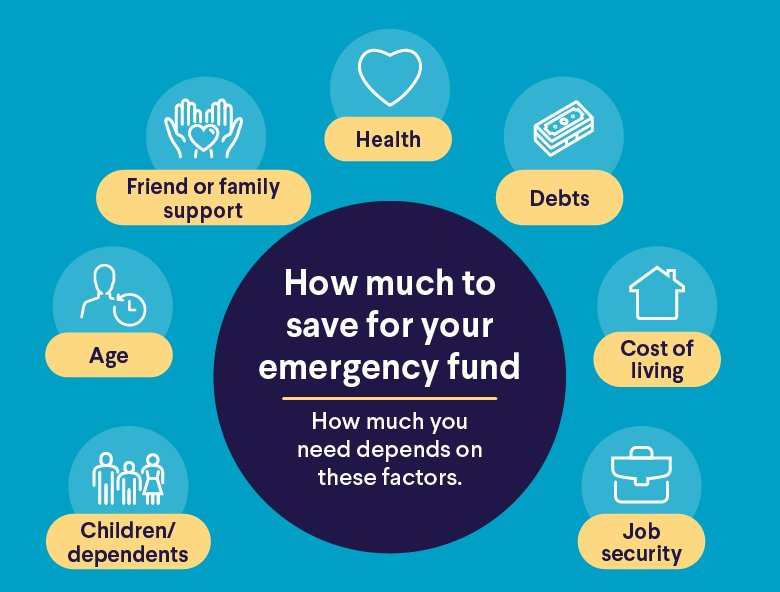

Build an Emergency Fund First

Image Source: SoFi

A solid emergency fund is the foundation of an eco-friendly budget that protects you from unexpected financial challenges. My experience with thousands of clients shows that you should build this safety net before pursuing other financial goals.

Calculating Your Emergency Fund Need

Your ideal emergency fund size depends on your personal situation. You need to save half a month’s expenses or $2,000, whichever is greater25 to protect against spending shocks. Having three to six months of living expenses26 helps shield you from income disruptions. To name just one example, if your monthly expenses are $5,000, you should target $2,500 at first and ended up building $15,000 to $30,00025.

High-Yield Savings Options

High-yield savings accounts keep your emergency funds safe and accessible. These accounts now earn approximately 4% APY, and this is a big deal as it means that traditional savings accounts that average 0.41%27. A $10,000 balance would earn you $400 in yearly interest27.

Key features to look for in an account:

- Federal insurance protection up to $250,0004

- No monthly maintenance fees

- Easy access through mobile banking

- Competitive interest rates

Emergency Fund Milestones

You can build your safety net step by step. A starter goal of $500-$1,000 helps handle immediate emergencies26. After reaching this original milestone, grow your fund through:

- Automated transfers from each paycheck

- Banking unexpected windfalls

- Regular monthly contributions

- Reinvesting earned interest

Your emergency fund should only cover genuine emergencies like medical bills, essential car repairs, or job loss26. Make sure to rebuild the fund quickly after using it to maintain your financial safety net28.

Building an emergency fund is doable even with a tight budget if you save consistently and choose the right account. Note that even $10 weekly contributions add up to over $500 yearly29, giving you vital protection against unexpected expenses.

Practice Mindful Spending

Image Source: Zinnia Wealth Management

The psychology behind spending habits can turn budgeting from a restrictive practice into a mindful experience. My years as a financial advisor have shown how emotional triggers shape our financial decisions and affect our knowledge of maintaining a workable budget.

Psychology of Spending

Money stress shows up differently in each person, yet nearly three-quarters of Americans experience money-related anxiety at some point30. Our perception of wealth matters more than our actual financial status. A salary of $70,000 might feel good until you learn your coworker makes $80,000, which triggers stress and anxiety30. This personal view of wealth substantially influences how we spend and feel about money.

Implementing Waiting Periods

A well-laid-out waiting period plays a vital role to curb impulse purchases. Research shows that credit card users typically bid twice as much as cash buyers31. You can overcome this by waiting 24-48 hours before buying non-essential items32. This break lets your emotional response fade and helps you make better decisions.

Mindful Shopping Techniques

Better spending habits need a systematic approach. Companies keep improving their marketing strategies to make you spend more30. Here’s what you can do:

- Watch your emotions before, during, and after purchases to spot spending triggers32

- Set up automatic financial decisions so you worry less about money30

- Match payment dates with your paycheck schedule for better control30

Your mindful spending goes beyond personal choices. Product manufacturing uses lots of water and energy33. Choosing quality items over quantity and thinking about environmental effects leads to more responsible financial decisions. These techniques help you see budgeting as a choice rather than a restriction that matches your long-term money goals.

Optimize Fixed Expenses

Image Source: Self

Monthly budgets typically get eaten up by fixed expenses, so optimizing them is vital for long-term financial health. A close look at these recurring costs and some smart negotiating can lead to big savings.

Negotiating Bills

Companies want to keep their customers and will often cut you a deal rather than lose your business. Your negotiating power grows when you mention what competitors charge and how long you’ve been a customer. To name just one example, asking someone to look over your current plan might reveal better deals that aren’t on their website34. The best time to negotiate is right before your plan renews35.

To get the best deals:

- Contact retention departments directly

- Reference competitor offers specifically

- Document all conversations with representatives

- Request manager review to get extra discounts36

Finding Better Rates

Your insurance costs offer great chances to save money. Bundling multiple policies usually saves you quite a bit9. You can also lower your monthly car insurance payments by choosing higher deductibles9. People who rarely need medical care might benefit from high-deductible health plans with lower premiums9.

Smart ways to get better rates:

- Review insurance policies annually

- Compare rates across multiple providers

- Review bundling opportunities

- Look into higher deductible options9

Reducing Monthly Commitments

Start with a list of all fixed costs, putting your basic needs first34. Take a good look at your subscriptions – you might be paying monthly for features you barely use5. Your housing costs probably take the biggest bite out of your budget. Moving to a cheaper area or a smaller place can really cut down your monthly bills9.

My experience advising clients shows that automatic payments help dodge late fees and sometimes get you extra discounts6. A regular check of your fixed costs helps spot services you’re paying for but not using37. To name just one example, cutting $85 from your monthly rent adds up to $1,020 in savings each year37.

Keep in mind that cutting fixed expenses creates automatic monthly savings without much change to your lifestyle37. These changes will help build a budget that works better for you and frees up money for other financial goals.

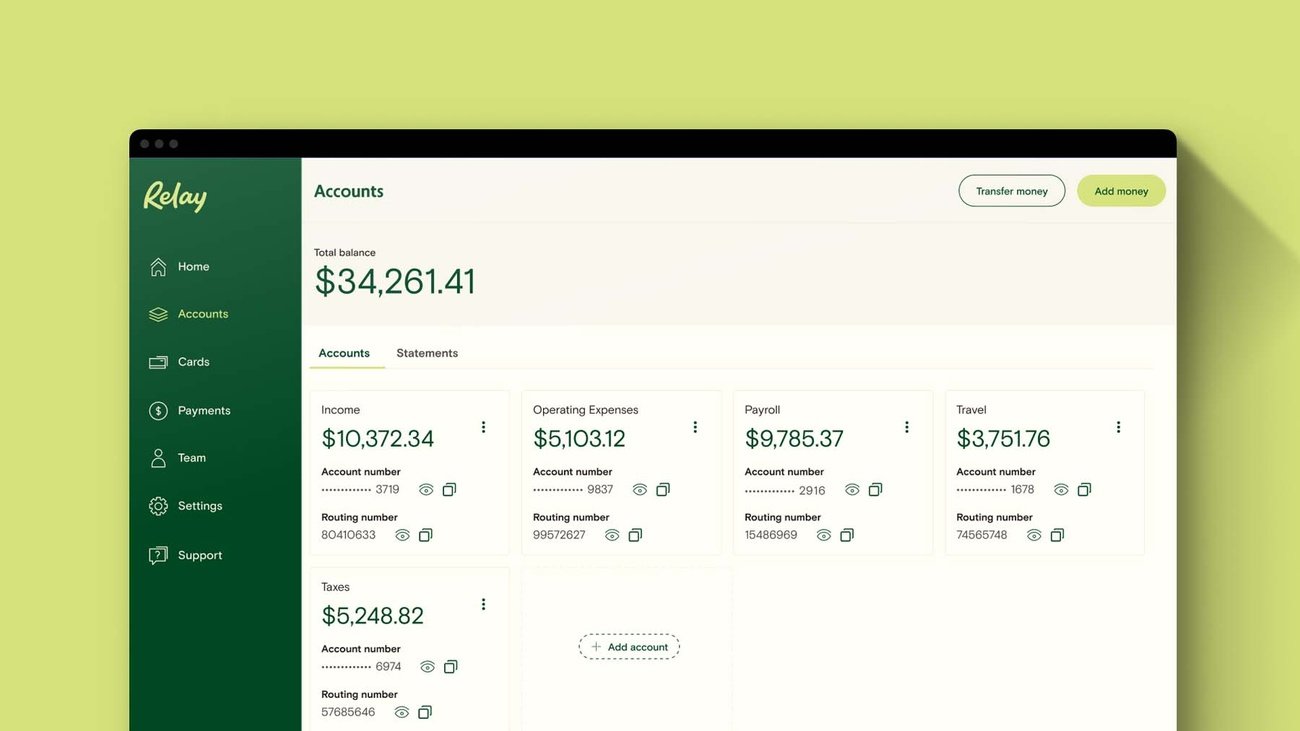

Use the Envelope System Digitally

Image Source: Relay

Digital tools have given the traditional envelope budgeting system a modern twist that lets you stay in control while making things easier. My experience as a financial advisor has helped many clients switch from physical cash envelopes to digital options that keep the same spending discipline intact.

Digital Envelope Apps

A few apps really shine when it comes to digital envelope budgeting. Goodbudget has a free version that works with one account and some envelopes, while its premium version gives you unlimited envelopes and accounts on five devices38. Mvelopes comes with budget-friendly monthly plans packed with different features – perfect if you want to go digital with cash-based budgeting39. Qube Money’s mobile banking app lets users put money into digital purses called ‘qubes’ based on spending categories40.

Setting Category Limits

Digital envelope systems are great at keeping spending in check. Users can:

- Put monthly income into specific spending categories

- Get alerts when nearing limits

- See category balances right away

- Change limits as needed

Digital envelopes make you check your budget before spending money. This keeps your cash safe and helps you make smarter purchases7. People who use this system save around USD 500.00 each month from day one7.

Managing Digital Envelopes

These tried-and-tested strategies will help you get the best results:

- Set up different savings accounts for each envelope category8

- Give accounts clear names to track deposits easily

- Move purchase amounts from savings to checking right away

- Let automated tracking watch your envelope balances

Digital envelopes come with a nice bonus – you earn interest on your envelope balances8. Success depends on your steadfast dedication to tracking withdrawals and smart spending habits. These digital tools make it easier to build and stick to an eco-friendly budget when you use them regularly.

Review and Adjust Monthly

Image Source: Refined Rooms

Regular financial reviews are the life-blood of a sustainable budget. We can spot errors, anomalies, and compliance risks that could derail financial goals through systematic monitoring41.

Monthly Review Checklist

A complete monthly review needs focus on specific areas:

- Track income versus expenses to spot unusual spending patterns42

- Assess cash flow health and remaining balances43

- Review automated transfers and recurring charges44

- Check progress toward savings goals and emergency fund targets44

Your net total (income minus expenses) shows your overall financial health44. This analysis helps you spot areas that need quick fixes or adjustments.

Adjustment Strategies

When you find discrepancies, make these targeted adjustments:

- Move funds between categories based on real spending patterns44

- Change sinking fund contributions to match upcoming expenses44

- Update debt repayment plans when extra funds show up44

- Reset savings targets when financial circumstances change44

The right timing is vital to make budget management work. The best time to review is at month-end when all transactions are in45. Keep detailed records of any changes you make to ensure clear financial decisions41.

Progress Tracking Methods

You need systematic approaches to track progress effectively:

- Record corrections and adjustments right away42

- Watch key performance indicators that match financial goals46

- Check milestone achievements against set targets46

- Look for patterns in spending and saving11

People who stick to these methods consistently hit their financial targets within planned timeframes about 70% of the time11. Quick detection of potential issues lets you solve problems before they become major headaches41.

Set aside 30-60 minutes each month to review your finances thoroughly10. This disciplined approach builds a strong foundation for long-term financial success and keeps your budget in sync with your changing goals and circumstances11.

Leverage Micro-Saving Techniques

Image Source: The Ways To Wealth

Micro-saving techniques are a great way to build wealth through small, consistent actions. My experience as a financial advisor shows amazing results when clients welcome these methods among their main budgeting strategies.

Round-Up Savings Apps

Modern round-up apps work like digital coin jars that save your spare change from everyday purchases automatically. These apps round your transactions to the nearest dollar and transfer the difference to your savings accounts. A $3.50 purchase becomes $4.00, with $0.50 going straight to savings47. Chime’s Save When You Spend feature puts these round-ups right into high-yield savings accounts48.

Micro-Investment Platforms

Micro-investing platforms make wealth building possible for everyone with minimal starting capital. Acorns leads the pack with its detailed approach that creates automated portfolios based on your risk tolerance and financial goals47. The platform invests your round-ups once they hit $5.0047. It also offers Environmental, Social, and Governance portfolios if you care about sustainability47.

Daily Saving Challenges

Saving challenges turn budgeting into an exciting game. The nickel challenge starts with a 5-cent deposit that grows each day, leading to significant savings13. No-spend challenges help you look at non-essential purchases and redirect that money into savings49.

My advisory practice shows clients get the best results by mixing different micro-saving approaches. Using round-up features with automated monthly transfers helps maximize savings47. The best part? These platforms usually need just $1.00 to start50.

Note that micro-saving works best when you stick with it. Round-ups automatically go into investment accounts once they reach $5.0051, creating a smooth wealth-building system. Many platforms now sweeten the deal with bonus investments, some matching up to 50% of your contributions47, which really speeds up your savings growth.

Comparison Table

| Budget Tip | Main Purpose/Benefit | Key Tools/Methods | Implementation Difficulty | Notable Statistics/Data |

|---|---|---|---|---|

| Zero-Based Budgeting | Each dollar serves a specific purpose | EveryDollar app ($17.99/month or $79.99/year) | High | Needs monthly review and adjustment |

| Automate Savings with AI | Simple savings through smart tech | Piere, Cleo, Honeydue, Empower | Low | 70% of financial experts recognize AI’s effect |

| 50/30/20 Rule | Balances today’s needs with future goals | 50% needs, 30% wants, 20% savings | Medium | Average household spends $4,500 monthly on necessities |

| Cashback and Rewards | Get returns on planned spending | Blue Cash Preferred® (6% grocery), Capital One Savor, Wells Fargo Active Cash | Low | Up to 6% cashback on select categories |

| Multiple Income Streams | Better financial security | Digital products, social media management, print-on-demand | High | Digital products can earn $100-$5,000 monthly |

| Track Expenses with Smart Tech | Smart expense tracking | Simplifi ($5.99/month), Center, Shoeboxed ($29-89/month) | Low | Not mentioned |

| Emergency Fund First | Shield against surprise costs | High-yield savings accounts | Medium | 4% APY vs 0.41% traditional savings rate |

| Mindful Spending | Manage spending triggers | 24-48 hour cooling period | Medium | 75% of Americans feel money-related anxiety |

| Optimize Fixed Expenses | Cut regular costs | Bill negotiation, insurance bundling | Medium | $85 less in rent monthly saves $1,020 yearly |

| Digital Envelope System | Control spending by category | Goodbudget, Mvelopes, Qube Money | Medium | People save $500 monthly on average |

| Monthly Review and Adjust | Keep budget on track | Monthly review checklist | Medium | 70% reach financial goals with regular checks |

| Micro-Saving Techniques | Grow wealth through small steps | Round-up apps, micro-investment platforms | Low | Round-ups start at $5 |

Closing remarks

My 13 years as a financial advisor have helped me refine these 12 budget tips into proven strategies. Each approach, from zero-based budgeting to micro-saving techniques, provides practical ways to build lasting financial stability. My clients reach their financial goals by combining multiple strategies. They start with emergency funds, use AI tools to automate savings, and review their budgets regularly.

You succeed by picking the right mix of these methods for your situation. The 50/30/20 rule works great for some clients, while others prefer digital envelope systems. A smart approach starts with 2-3 methods that line up with your lifestyle. You can always add more strategies later.

My experience guiding thousands of clients shows that good budgeting needs both effective tools and the right mindset. Technology makes tracking simple, but mindful spending creates lasting change. A good budget makes you feel capable rather than restricted. It serves as your roadmap to financial success.

Need help putting these strategies to work? Email us at support@trendnovaworld.com. Note that budgeting isn’t about perfection. It’s about making consistent, intentional choices that line up with your long-term financial goals.

Read more at

15 Proven Ways to Save Money on Online Shopping in 2025

FAQs

Q1. What are some effective budgeting strategies for 2025? Some effective budgeting strategies include using zero-based budgeting to allocate every dollar, automating savings with AI tools, implementing the 50/30/20 rule (50% needs, 30% wants, 20% savings), and leveraging cashback rewards strategically on planned purchases.

Q2. How can I create multiple income streams in 2025? You can create multiple income streams by exploring side hustles like selling digital products or offering social media management services, investing in passive income opportunities like real estate investment trusts (REITs), and automating savings from your primary income source.

Q3. What are some smart ways to track expenses in 2025? Smart expense tracking methods include using AI-powered apps that automatically categorize transactions, implementing digital receipt management with OCR technology, and setting up real-time budget monitoring systems that flag irregularities and provide instant insights into spending patterns.

Q4. How much should I save for an emergency fund in 2025? For protection against spending shocks, aim to save half a month’s expenses or $2,000, whichever is greater. To shield against income disruptions, maintain three to six months of living expenses in a high-yield savings account earning around 4% APY.

Q5. What are some tips for practicing mindful spending in 2025? To practice mindful spending, implement a 24-48 hour cooling-off period before non-essential purchases, track emotions related to spending to identify triggers, set up automated financial decisions to minimize constant financial rumination, and consider the environmental impact of purchases.

References

[1] – https://www.bankrate.com/banking/savings/manage-multiple-income-streams/

[2] – https://www.forbes.com/sites/melissahouston/2024/04/17/why-diversifying-your-income-streams-is-essential-in-todays-economy/

[3] – https://www.concur.com/blog/article/expense-management-with-ai-comprehensive-guide

[4] – https://www.investopedia.com/best-high-yield-savings-accounts-4770633

[5] – https://www.bill.com/blog/reduce-fixed-costs

[6] – https://www.dncu.com/blog/top-10-tips-to-reduce-monthly-spending/

[7] – https://qubemoney.com/

[8] – https://www.quorumfcu.org/learn/money-management/the-digital-envelope-budgeting-system/

[9] – https://www.incharge.org/financial-literacy/budgeting-saving/how-to-cut-your-expenses/

[10] – https://fellow.app/meeting-templates/monthly-budget-review-meeting-template/

[11] – https://www.townebank.com/personal/resource/credit/trouble/progress/

[12] – https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

[13] – https://www.collegedata.com/resources/money-matters/money-saving-challenges-that-are-fun

[14] – https://www.ramseysolutions.com/budgeting/50-20-30-budget-rule?srsltid=AfmBOor3CC80VrdbtyGjJjSa61XB1NWpBCbVYi34XS8TkxfOxlxbU79Y

[15] – https://www.opploans.com/oppu/financial-literacy/50-30-20-budget/

[16] – https://www.nerdwallet.com/article/credit-cards/cash-back-vs-travel-how-to-choose-your-credit-card-rewards

[17] – https://www.nerdwallet.com/article/credit-cards/make-most-rewards-credit-cards

[18] – https://www.cnbc.com/select/best-ways-to-maximize-credit-card-rewards/

[19] – https://www.inc.com/hostinger/top-10-side-hustle-ideas-to-make-extra-money-in-2025/91070479

[20] – https://finance.yahoo.com/news/6-passive-income-streams-build-150109057.html

[21] – https://www.forbes.com/sites/melissahouston/2024/12/27/passive-income-ideas-for-financial-security-in-2025/

[22] – https://www.paypal.com/us/money-hub/article/beginners-guide-smart-receipts

[23] – https://tnj.com/top-daily-expense-tracker-apps/

[24] – https://www.medius.com/blog/10-ai-advancements-in-expense-management/

[25] – https://investor.vanguard.com/investor-resources-education/emergency-fund

[26] – https://www.consumerfinance.gov/an-essential-guide-to-building-an-emergency-fund/

[27] – https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

[28] – https://www.morganstanley.com/articles/how-to-build-an-emergency-fund

[29] – https://www.nerdwallet.com/article/banking/emergency-fund-calculator

[30] – https://www.apa.org/monitor/2023/06/psychology-of-spending

[31] – https://betterworld.mit.edu/spectrum/issues/winter-1999/the-psychology-of-spending/

[32] – https://www.elevationfinancial.com/psychology-behind-overspending

[33] – https://www.fleurishcollective.com/mindful-shopping-guide/

[34] – https://finances.extension.wisc.edu/articles/cutting-expenses-and-increasing-income/

[35] – https://www.nerdwallet.com/article/finance/how-to-negotiate-your-bills

[36] – https://time.com/6993692/how-to-negotiate-lower-bills/

[37] – https://smartasset.com/financial-advisor/fixed-expenses

[38] – https://www.nerdwallet.com/article/finance/best-budget-apps

[39] – https://smartasset.com/financial-advisor/best-budgeting-apps

[40] – https://www.galileo-ft.com/blog/how-qube-money-is-enabling-the-future-of-envelope-budgeting/

[41] – https://finance.princeton.edu/budgeting-financial-management/financial-management/financial-review-and-monitoring

[42] – https://icahn.mssm.edu/files/ISMMS/Assets/About%20the%20School/For%20Faculty/Finance/ISMMS%20Monthly%20Expenditure%20Review%20Checklist.pdf

[43] – https://www.westernsouthern.com/personal-finance/personal-financial-planning-regularly

[44] – https://theoldenchapters.com/monthly-budget-review/

[45] – https://www.business.com/articles/financial-tracking-101/

[46] – https://www.cassandra.app/resources/maximizing-impact-strategies-for-budget-allocation-efficiency-eae41

[47] – https://financebuzz.com/best-micro-investing-apps

[48] – https://www.nasdaq.com/articles/7-best-round-up-apps-for-saving-investing-money-instantly-0

[49] – https://www.pnc.com/insights/personal-finance/save/money-saving-challenges.html

[50] – https://www.finder.com/investments/micro-investing

[51] – https://brokerchooser.com/best-brokers/best-micro-investing-apps

[52] – https://www.ramseysolutions.com/budgeting/how-to-make-a-zero-based-budget?srsltid=AfmBOopI8HCXzUmKP7WoYse9-k_MjNJji_EeBZv7H6sxHZZWnhWf75SC

[53] – https://www.bankrate.com/banking/how-to-make-a-zero-based-budget/

[54] – https://www.ramseysolutions.com/budgeting/budgeting-apps-comparison?srsltid=AfmBOoqrKVoRvUrQ3H94NH9GzmAiro2ES7pIwB7-ZPQs1IGfuDWPEH2c

[55] – https://www.bain.com/contentassets/65ee5fffc87443599468a2340c027249/bain_brief_why_zero-based_budgeting_goes-wrong.pdf

[56] – https://www.moneyfit.org/budgeting-tools-for-2025-success/

[57] – https://www.joinkudos.com/blog/cleo-budgeting-app-review-your-ai-financial-assistant-in-2025

[58] – https://www.synchrony.com/blog/banking/how-automatic-savings-can-help

[59] – https://www.experian.com/blogs/ask-experian/how-to-create-automatic-savings-plan/

[60] – https://www.nasdaq.com/articles/10-best-budgeting-apps-2025-stay-control-your-finances

[61] – https://www.financial-planning.com/list/favorite-ai-tools-in-wealth-management

[62] – https://www.forbes.com/sites/jaimecatmull/2024/11/05/how-to-grow-your-money-heading-into-2025/

[63] – https://www.unfcu.org/financial-wellness/50-30-20-rule/

Discover more at:

Zyntra | Trend Nova World | News| Tech| Free Tools| Finance

For more information, contact us at support@trendnovaworld.com